Precious Metals

Review and Outlook

01/16 thru 01/27/2017

Gold, Silver, the U.S. Dollar, Platinum & Palladium

Originally Posted on 01/23/2017 @12:19am

Precious Metals Review & Outlook

Hello,

I hope that you and your family have been safe and well.

This week I'm skipping the intro and going straight to the charts…

The order of this week’s Charts & Analysis are as follows:

Gold, Silver, U.S. Dollar, Platinum & Palladium.

GOLD

Last week, gold briefly paused at the $1200 level on Monday then moved quickly to the $1215 level on Tuesday, before falling back to close the week at $1208.

By looking at the chart below, it looks like the price of gold will continue to consolidate around the $1200-$1220 level before it continues to rise.

I think it will rise because there is a lot of uncertainty in the markets and uncertainty is often called gold’s best friend, plus a pattern has formed on the silver chart (in the next section) that is giving gold and silver positive indications of a further move up, this week.

Note: Silver and Gold generally move together in their daily trading, but silver leads gold in its long-term trade.

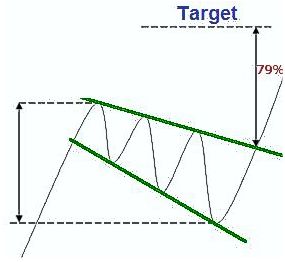

In addition, another bullish indicator on the gold and silver price charts is the 'Expanding Descending or Falling Wedge.'

Note: Click the chart above for Forex-Central's definition of the 'Falling Expanding Wedge' also known as a 'Descending Broadening Wedge.'

Gold's Price Resistance &

Support Levels

Gold's Resistance Level

$1250.00

$1220.00

Gold's Support Levels

$1200.00

$1180.00

SILVER

Silver started last week at the $16.80 level and ended the week above seventeen at $17.05.

It had been trading around the $16.80 level for almost a week before it broke above the $17 on Tuesday 1/17/2017.

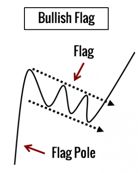

The price of silver has now formed a ‘Bull Flag’ while consolidating at this level, to the right you can see an example of a bull flag; click the chart for a definition.

The bull flag may continue to move sideways this week, or the price of silver could break above it, time will tell what silver does this week.

Charts provided courtesy of TradingView.com

Silver's Price Resistance and

Support Levels

Silver's Resistance Level

$17.50

$17.25

Silver's Support Level

$16.70

$16.50

US DOLLAR

The U.S. Dollar continued to move down last week falling below the $101 level on Friday.

In this week’s chart I’ve indicated that a ‘Descending Channel’ has formed in the U.S. Dollar chart.

Last week, I misjudged this pattern to be a falling wedge, but after last week’s trade, this technical pattern has made itself easier to identify.

For the U.S. Dollar’s immediate future, it looks like it will trade between the $101.00 - $100.00 levels, as the market looks to the Federal Reserve’s remarks at its meeting on Jan. 26-27th.

However, it is doubtful that we’ll see any earth shattering news after this meeting, so expect the U.S. dollar to continue to trade inside this channel.

(continued…)

Charts provided courtesy of TradingView.com

Furthermore, the expanding rising wedge in the U.S. dollar

chart continues to be a negative sign for the dollar, so more down movement is expected.

Note: Click the chart above for Forex-Central's definition of the Rising Expanding Wedge or 'Ascending Broadening Wedge.'

U.S. Dollar's Price Resistance and Support Levels

U.S. Dollar's Resistance Level

$103.50

$102.90

$101.00

U.S. Dollar's Support Level

$100.00

$99.75

Platinum

Last week I wrote that Platinum’s price could be affected by the news that the U.S. EPA was accusing Fiat/Chrysler that they were manipulating the software in diesel vehicles to pass emissions tests.

So far, I haven’t heard any additional news about this allegation, but that doesn’t mean anything, the news last week stated that an investigation was started by the EPA.

If the EPA’s charges are true; that will be when it may hurt platinum.

Link to 1/13/2017 artilce: E.P.A. Accuses Fiat Chrysler of Secretly

Violating Emissions Standards

In last week’s analysis of Platinum, I didn’t offer any commentary about the chart because honestly there wasn’t much to say about it.

Last week, the Platinum price chart reached its crest and started to fall until a report about platinum & palladium supply was released on Friday 1/20, see chart below.

The report stated that supply for PGMs (Platinum Group Metals) was down year over year, which gave strength to platinum and palladium prices.

In addition, the Chinese extended a tax break to its citizens to buy small vehicles, which gave Palladium more momentum in price gain.

For an analysis of the report that was released last week, read this article by MINING.com : Palladium price surges to 22-month high.

Palladium

Last week, I posted the chart below, and all can see that it was wrong after Friday’s move.

After reassessing Palladium’s chart, I can see a 'regular head and shoulders' topping pattern and an 'inverse head and shoulders' pattern; you probably can too.

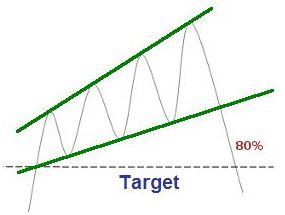

But, instead of posting a confusing chart with a bunch of H's and S's on it, I've identified a completely different bullish pattern in the Palladium chart, a 'Rising or Ascending Channel.'

Palladium has been trading in this Ascending Channel' for over a year, and it doesn’t look like it will be stopping anytime soon.

Music

Numerous times, this week, I heard this song, it originally came out in the early 90’s, and for the longest time I hadn’t heard it until lately.

Then while I was writing this post it came on again, I’m a fan of the song and it has a great beat and lyrics.

So here it is...'Back to Life' by Soul II Soul

Have a Great Week.

Thank you for your time & God Bless,

Steve

Thank You for Visiting the Free Bullion Investment Guide

This Guide gives 50% or more of what it earns to those who are Battling Cancer.

Please Help Us Give by Supporting our Affiliates.

(Every Advertisement on the Guide is from one of our Affiliates)

'Click Here' see all of the prior Blog posts,

Thank You for Your Time!

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

February 2026

All Articles were Originally Posted on the Homepage