Homepage / Buying Guides: Silver Guide

Last Edited on 01/26/2026

Silver Bullion Buying Guide

with a list of Reputable

Silver Bullion Dealers

This physical silver buying guide provides a thorough examination of the silver bullion market, presenting a compelling case for why silver is a prudent investment option. It highlights the metal's stability and its potential for profit, making it an attractive choice for investors.

Furthermore, the guide offers practical strategies on how individuals can effectively integrate silver into their investment portfolios, empowering readers to make well-informed decisions regarding this asset.

Silver: A Smart Investment

Silver is known as the "Poor Man's Gold", but for many of those who invest in physical silver bullion, consider Silver to be a "Smart Investment."

The reason behind silver's "Poor Man's" label is the simple truth that silver is less expensive than gold because it is more abundant in the earth's crust.

The label doesn't diminish silver's relationship with other precious metals to protect your savings and wealth, it states the obvious, that silver is more affordable.

Silver Facts

Silver ore exists in the Earth's crust in many forms; it's found in its "native silver" elemental form as nuggets or crystals of pure silver, and it often occurs alongside gold, copper, lead and zinc. Silver also occurs naturally as an alloy with gold, known as electrum.

Mexico is the leading producer of silver, followed by China, Peru, Chile, Poland, Australia, Bolivia, Russia, the United States, Kazakhstan, Argentina, and India (source).

Silver's atomic number is 47; its chemical symbol on the periodic chart is "Ag." The abbreviation stands for the Latin word for silver: "Argentum."

Silver is a brilliant whitish metal that can take a high polish luster; it is the most reflective element and is used in mirrors, telescopes, microscopes, and solar cells.

silver nugget

silver nuggetSilver is the best elemental conductor of electricity. Silver serves as the benchmark for measuring the conductivity of other conductors. On a scale from 0 to 100, silver scores a perfect 100 in electrical conductivity. By comparison, copper ranks 97, while gold ranks 76.

Silver is the best thermal conductor among all metals. For example, a silver paste is used in every computer; it is applied between the Central Processing Unit (CPU) and motherboard for its effectiveness as both an electrical and thermal conductor. In addition, only gold is more malleable than silver; one ounce of silver can be drawn into an 8,000-foot-long wire (source).

It is estimated that silver was first used by man around 5000 BC, it is one of the oldest forms of money. In fact, "silver" and "money" are the same in 14 different languages.

Demand for Silver in the Markets

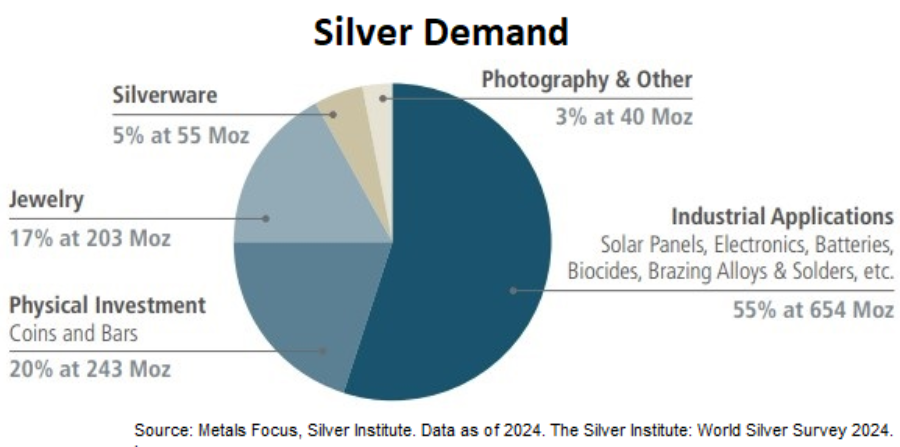

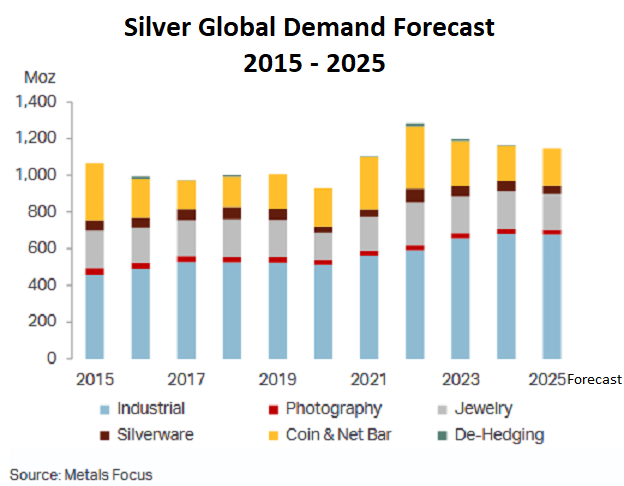

Silver has two major roles in the markets; its primary role, 55 percent, is as an industrial metal, which includes the solar industry, chemical catalysts, electronics, and other industries.

Its second role, accounting for 45 percent of its market, is as a monetary metal used in coins, bars, jewelry, and silverware due to its luster, durability, and intrinsic value.

Monetary metals like silver and gold are 'decentralized' forms of money; they have no liability to any individual or entity, and they will never be worth zero.

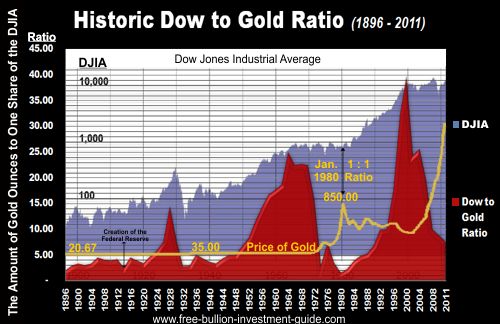

Silver's Pricing Dynamics

Silver's monetary and industrial markets make its price more dynamic than gold, which is considered solely a monetary metal because only 10% of gold's market is devoted to industry. Gold is primarily purchased as a store of wealth by individuals and central banks.

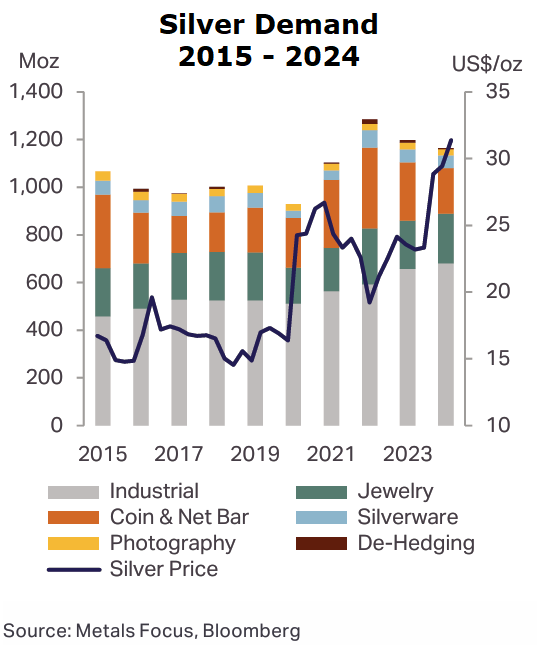

As noted earlier, 55% of silver's demand is industrial; the chart to the right indicates that silver's industrial demand has been rising consistently over the last 10 years and is expected to continue.

Solar Energy is one of the fastest-growing industries globally; currently it consumes more than 200 million ounces of silver annually and has been consistently growing more than 25% year over year since 2015.

Silver's industrial demand gives it a price floor, but it doesn't govern the movement of silver's price; its relationship with gold as a monetary metal governs its price.

Monetary metals are safe havens; they bring certainty and security to your savings or portfolio in uncertain times.

In a portfolio, monetary metals serve as a counterweight to what are considered riskier investments; they have no counterparty risk, no liability, and they will never be worth zero.

The primary driver of a monetary metal's price is uncertainty. In contrast, during periods of high certainty in the markets, such as the late 1990s, when investor confidence and stock market gains reduced the appeal of gold, monetary metals can be worth less than the cost to extract them from the ground. (Source: MINING.COM: How big miners are reliving the late 90’s bust: Steve Todoruk - Oct. 16,2014)

According to estimates, silver has moved 77% of the time in the same direction as gold over the last 50 years due to the monetary characteristics that both metals share. (source: BullionVault)

In the chart below, the monetary movement similarities between silver and gold are evident, as silver's price moves in a comparable direction with gold. However, silver is more volatile than gold because the size of silver's market is much smaller than many realize.

The silver market is approximately $95 billion annually (source), whereas the gold market is about $12 trillion annually (source). This significant difference means that silver's price tends to be more volatile than gold's, especially when large sums of capital are added to or withdrawn from its market.

Gold and Silver Performance Chart provided courtesy of MiningVisuals.com

Silver Protects Purchasing Power

As a hedge against inflation, owning silver or gold is essential because it preserves one's "Purchasing Power."

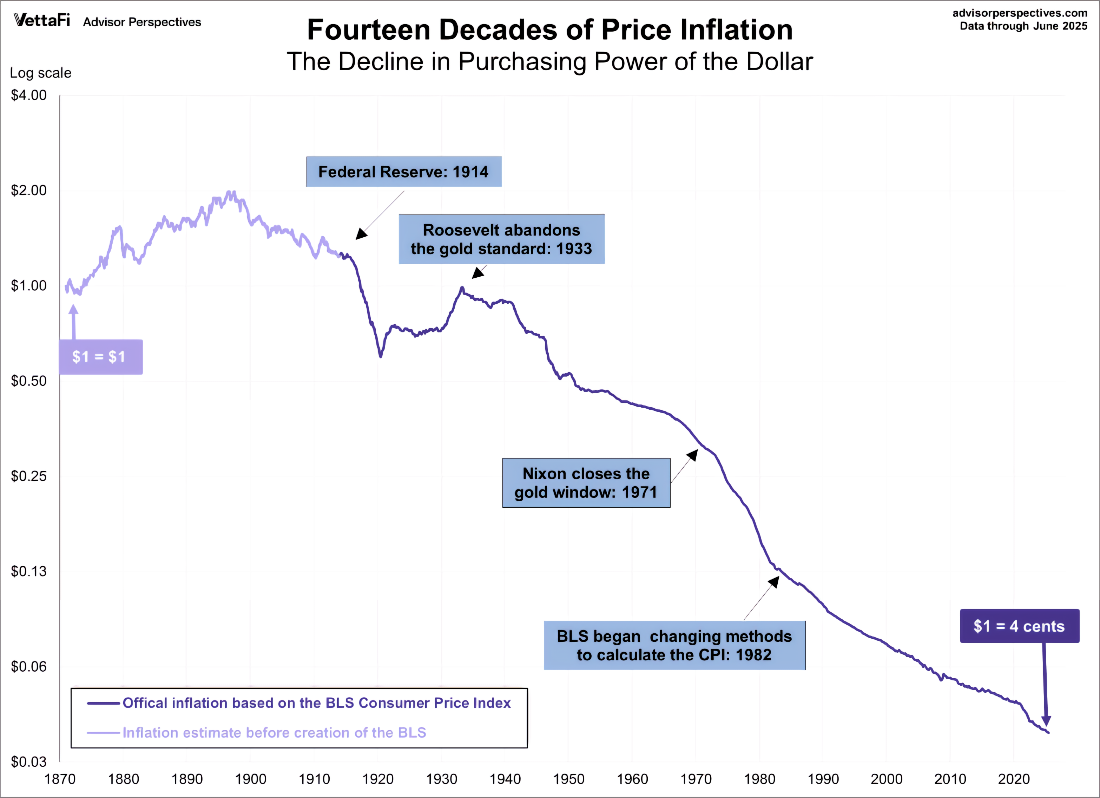

The chart above provides a glimpse into the impact of inflation on the purchasing power of the U.S. dollar, showing that $1.00 today has the same purchasing power as $0.04 had in 1872.

How did this happen?

Today, the U.S. dollar is the world's reserve currency, held by many governments for trade, savings, and investment purposes; it is also used by many countries to settle imports and stabilize their own currencies.

The U.S. dollar is a fiat currency, meaning it is not backed by a physical commodity like gold or silver. The value of the U.S. dollar comes from trust in the stability of the U.S. government and its ability to meet its debt obligations and maintain low inflation.

The chart above reveals that the majority of the value of the U.S. dollar was lost after it was no longer backed by gold and silver. The following paragraphs explain how that happened.

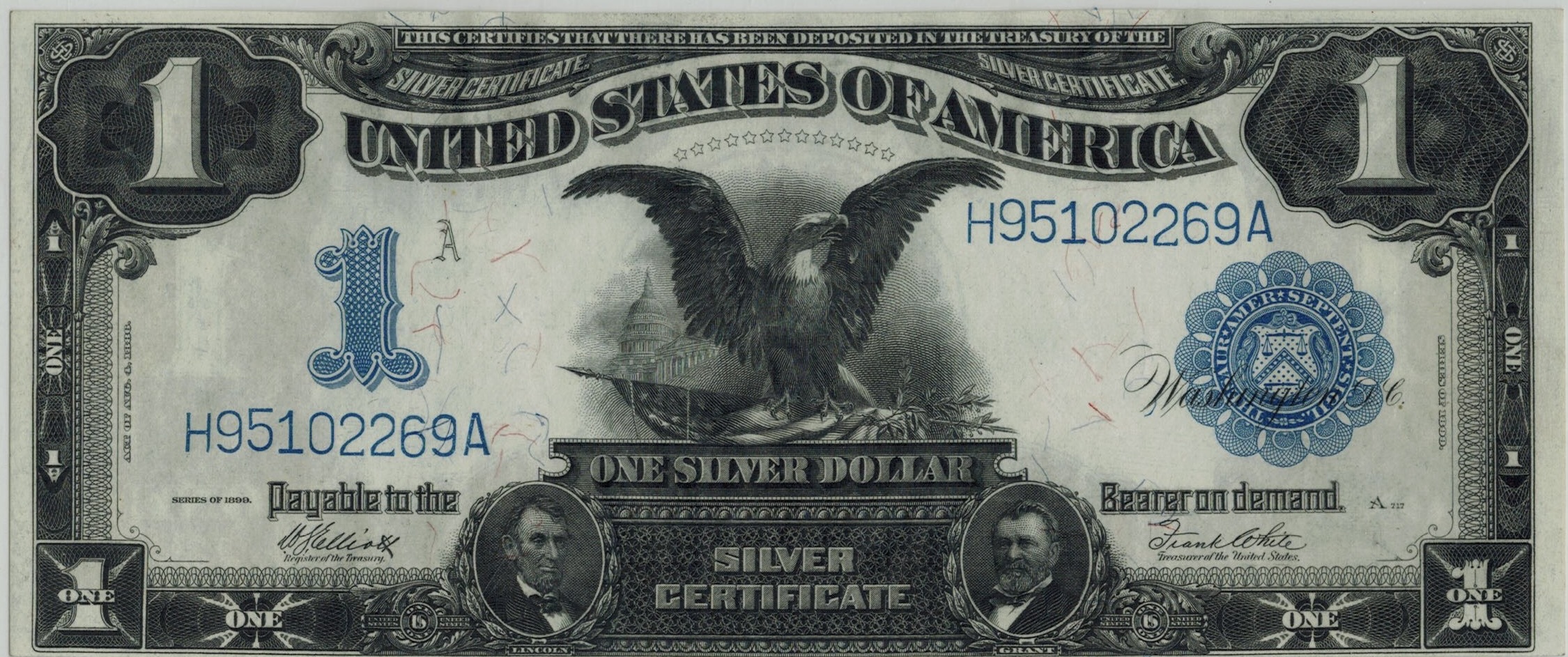

From the founding of the United States to 1933, gold and silver coins were the money in Americans' pockets and used for everyday exchange.

The cash in Americans' wallets was known as silver and gold certificates that were redeemable for the equivalently valued precious metal coins.

|

In 1933, Democrat President Franklin Delano Roosevelt abandoned the Gold Standard when he signed Executive Order 6102 into law. Executive Order 6102 made it illegal for U.S. Citizens to hold gold coins, gold bullion, or gold certificates. The gold that Americans owned was confiscated and stored in U.S. depositories like Fort Knox. In 1934, the Gold Reserve Act was passed, changing the statutory gold value of the U.S. dollar from $20.67 to $35.00. Under the act, the dollars in American's pockets were as good as gold, they just were no longer allowed to redeem their paper money for the physical metal. |

= |

The Gold Reserve Act reduced the purchasing power of the dollar by more than a third, and it enabled the Federal Reserve to expand the money supply.

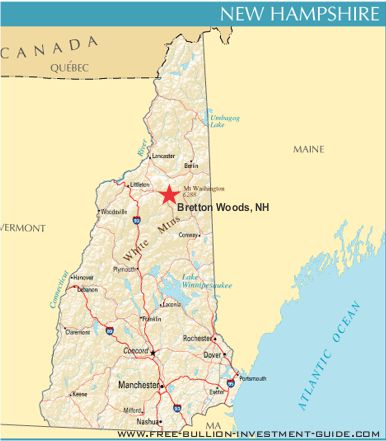

After World War II, 44 countries convened on Bretton Woods, NH, to create a de facto Gold Standard known as the Bretton Woods System of Monetary Management.

The Bretton Woods system kept gold valued at $35.00 a troy ounce, but the U.S. dollar was now considered as good as gold to the holder, who could no longer own gold; foreign countries were the only ones who could exchange U.S. dollars for gold bullion or gold bullion for U.S. dollars.

Citizens in countries of the Bretton Woods system were forbidden from holding gold coins, bullion, or certificates unless they were collectible and not exchanged as currency.

On the other hand, silver coins remained in circulation as part of the currency until the late 1960.

This Bretton Woods de facto gold standard worked well until the 60's, when there was a sizable increase in U.S. government spending caused by the Vietnam War and Democrat President Lyndon B. Johnson's "Great Society" programs of Medicare, Medicaid, and his "War on Poverty."

The spending policies increased the value of the U.S. dollar against gold, leading to significant imbalances in currency markets and resulting in a global currency crisis that caused many countries to abandon the Bretton Woods system.

On August 15, 1971, Republican President Richard Nixon took the United States off the Bretton Woods system and completely separated the U.S. dollar's convertibility to gold, which eroded the value of the U.S. dollar and has ever since.

Note: Executive Order 6102 was overturned on December 31, 1974, when U.S. Republican President Gerald R. Ford Jr. signed Executive Order 11825.

The order repealed Executive Order 6102, signed by President Franklin D. Roosevelt, which forbade U.S. citizens to own gold. On the same day Executive Order 11825 was signed into law, many precious metals refiners including Engelhard Industries began to provide gold bullion bars and rounds for the public to purchase.

In 1977, the U.S. Congress passed a law forbidding any U.S. President to confiscate gold from U.S. citizens except during a time of war.

The Purchasing Power of Silver

The Silver price chart below, provided by GoldBroker.com, illustrates how silver has retained its purchasing power since President Nixon took the United States off the Gold Standard and silver began to be priced and traded as a commodity.

Now that we've gone over silver's supply, demand, its pricing dynamics, and purchasing power, let's introduce you to one of the best barometers for determining when to buy or sell silver.

The Gold to Silver Ratio

a barometer for buying and selling

For those who want to invest in silver (or gold) and receive the greatest return, they should pay attention to the Gold to Silver Ratio.

Interpreting

the Gold to Silver Ratio

|

|

|

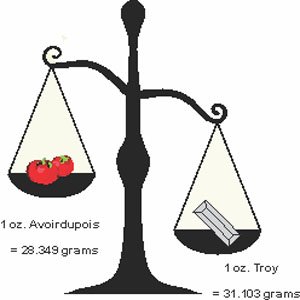

The "Gold to Silver Ratio" represents the number of silver ounces it takes to buy one ounce of gold.

The gold-to-silver ratio serves as a barometer to help you decide when to buy or sell gold and silver.

|

A high gold-to-silver ratio means that more silver ounces are needed to purchase one troy ounce of gold. This means that silver is in a buyer's market, and its prices are relatively low compared to gold prices. When the gold-to-silver ratio is low, it suggests that silver prices are high while gold is undervalued, indicating that gold is in a buyer's market as silver prices approach parity with gold. |

The Gold to Silver Ratio chart below (Click the Chart to Enlarge) indicates how the ratio moved between 2000 and 2025. It shows three Monthly Averages in the ratio:

- 2000 - 2025 = 68.96 avg. (green line)

- 1970 - 2025 = 60.24 avg. (red line)

- 1900 - 2025 = 52.16 avg (beige line)

Over the last 100 years, the gold-to-silver ratio has generally been above the average. Common wisdom among those who track this ratio suggests the following scenario to maximize returns in silver and gold.

To maximize returns on gold or silver:

- buy silver when the ratio is 10 or more points above 60

- buy gold when the ratio is near or below the 60

What you choose to do is entirely your decision; the average lines are there to act as an aid in judgment. Generally, those who bought silver at a high ratio relative to the averages in the chart achieved significant investment returns.

Chart provided courtesy of incrementum

Types of Physical Silver Bullion

There are many different forms of physical silver bullion that one can choose from; they include:

Silver Bullion Coins

|

American Eagle Silver 1986 - Present Purity: 99.90% Silver, Balance Copper |

|

Canadian Silver Maple Leaf 1988 - Present 1oz. Purity: 99.99% Silver |

|

Mexican Silver Libertad 1982 - Present Purity: 99.90% Silver, Balance Copper |

|

|

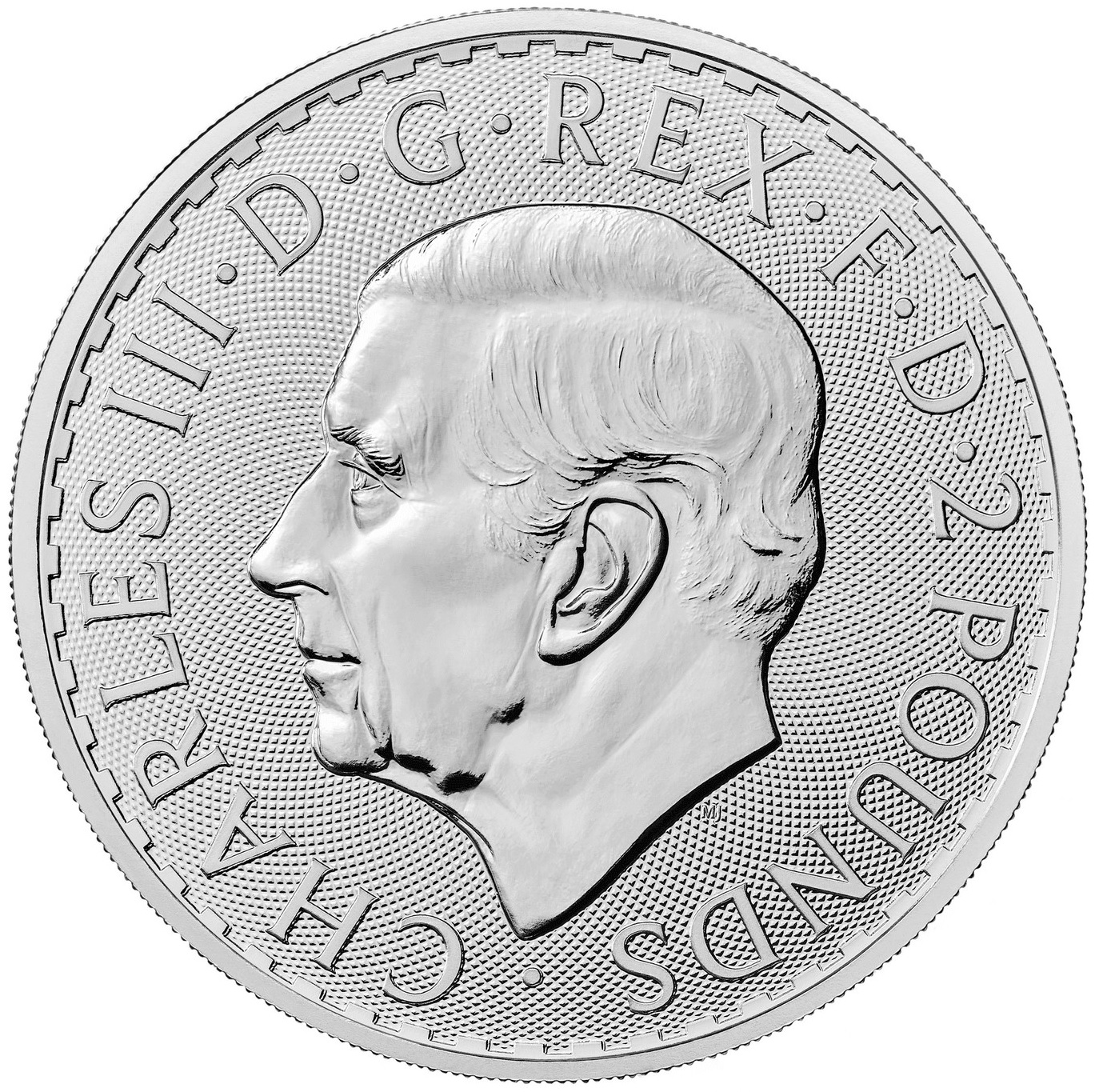

U.K. Britannia Silver 1997 - Present 1-kilo. | 10oz. | 1oz. | 1/2 oz. Purity: 1997 - 2012 95.80% Purity: 2013 - Present 99.90% |

|

|

Chinese Silver Panda 1989 - Present Purity: 99.90% Silver, Balance Copper |

|

Austrian Silver Vienna Philharmonic 2008 - Present Purity: 99.90% Silver, Balance Copper |

|

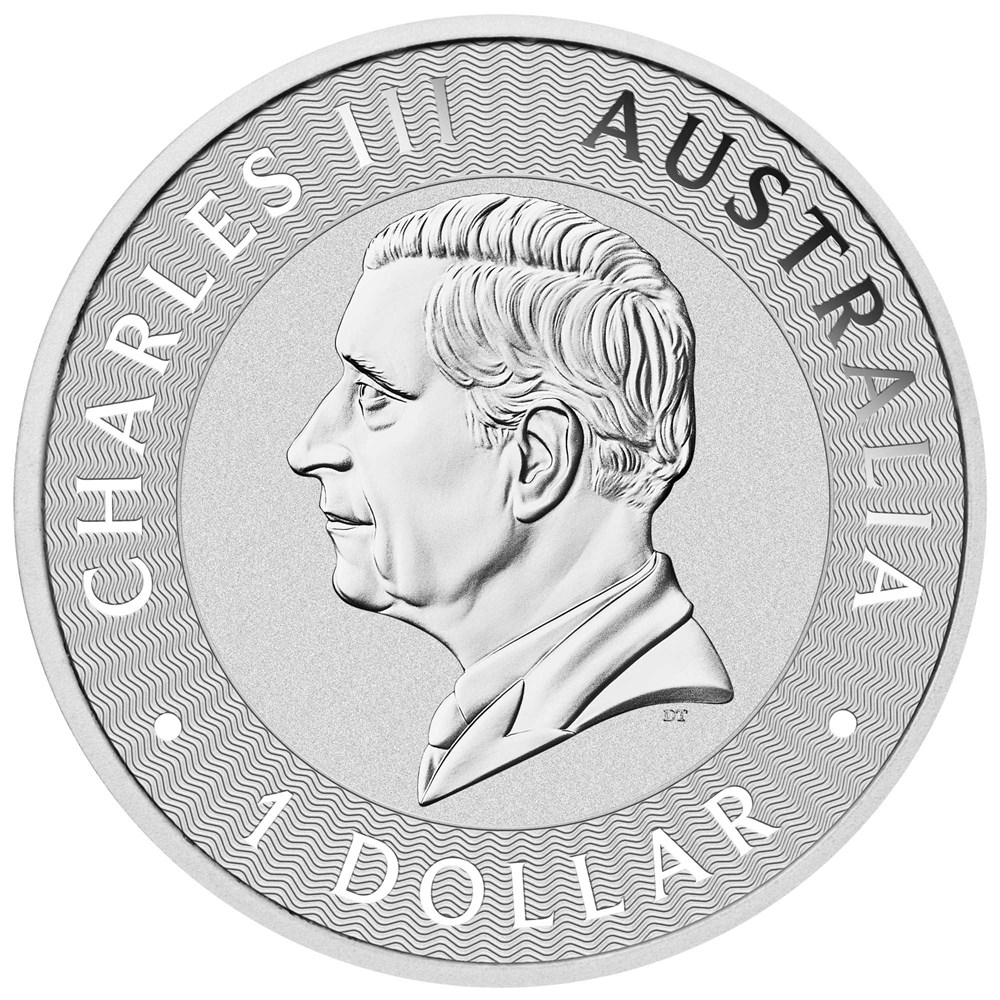

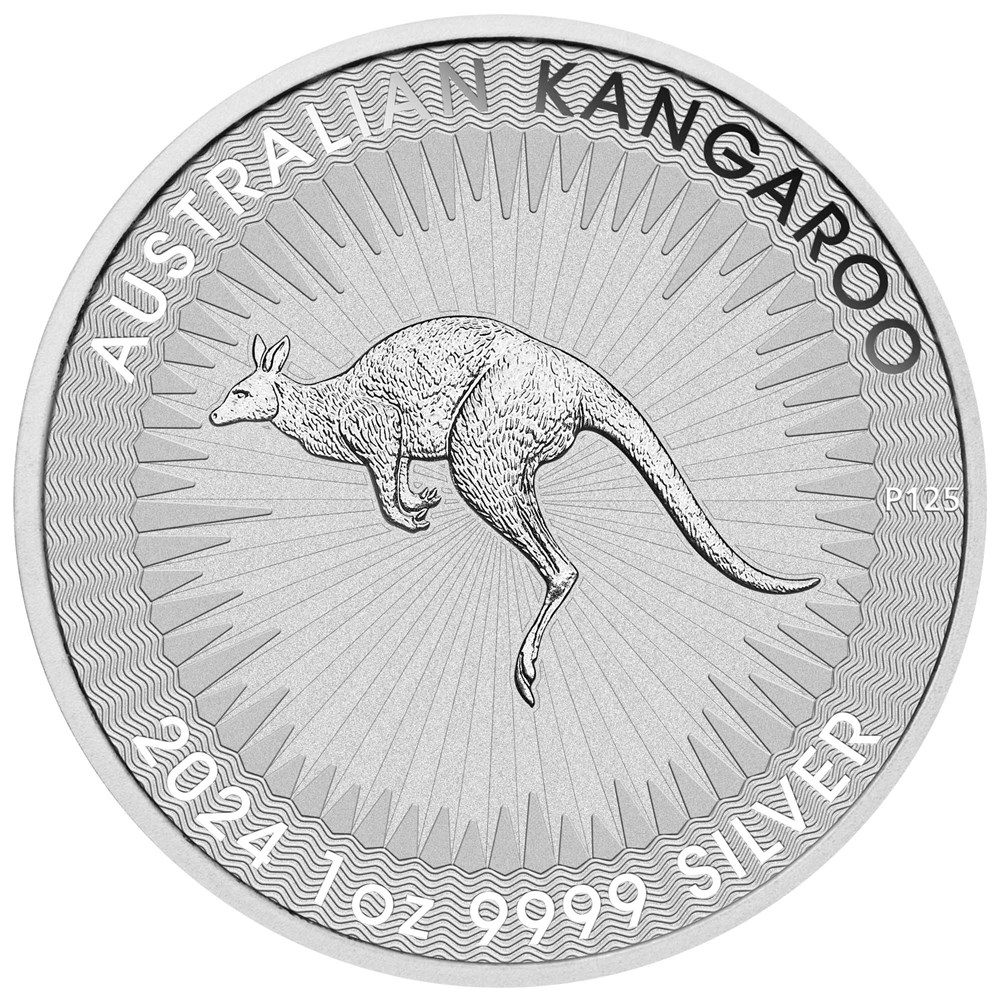

Australian Silver Kangaroo 2015 - Present Purity: 99.99% Silver |

|

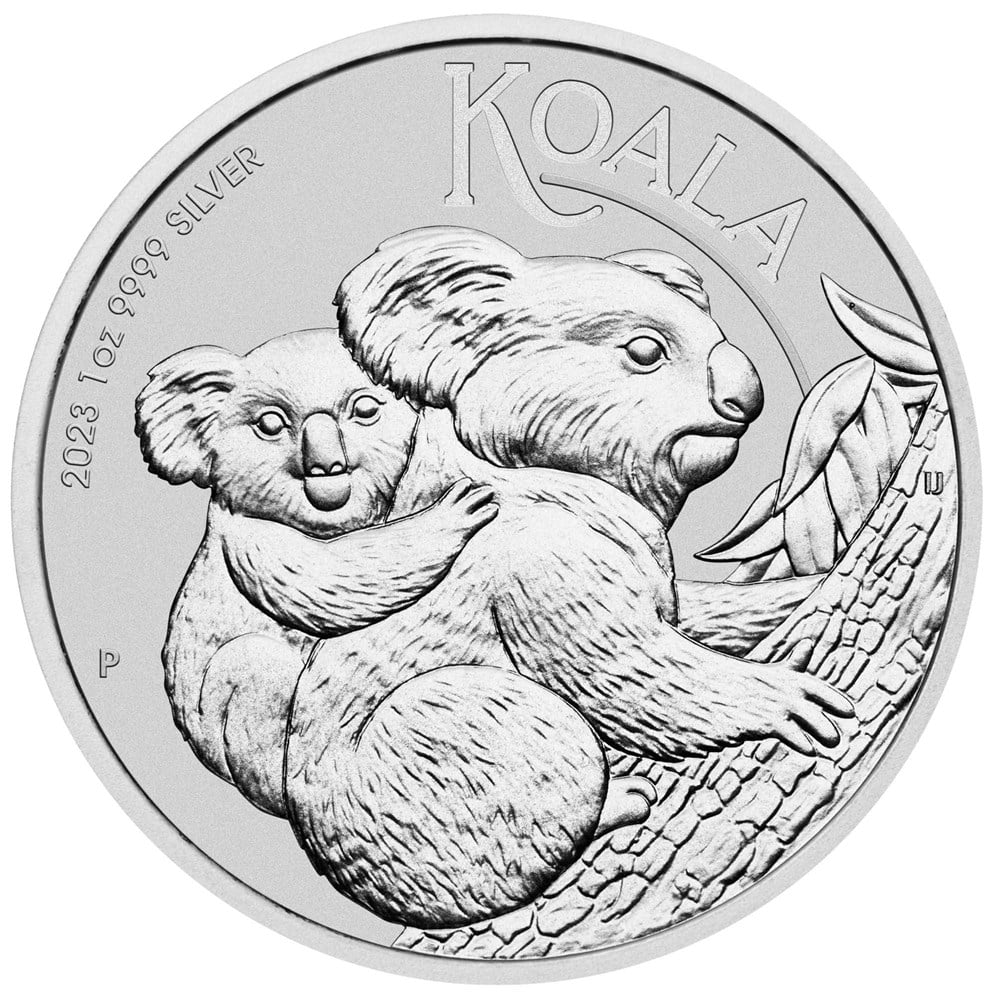

Australian Silver Lunar 1999 - Present Purity: 99.99% Silver |

|

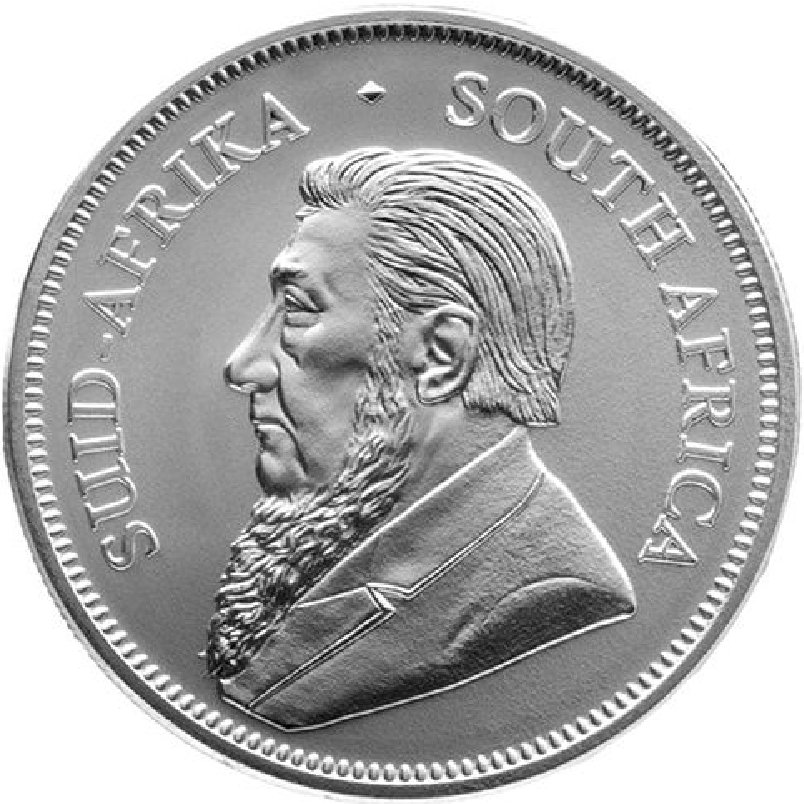

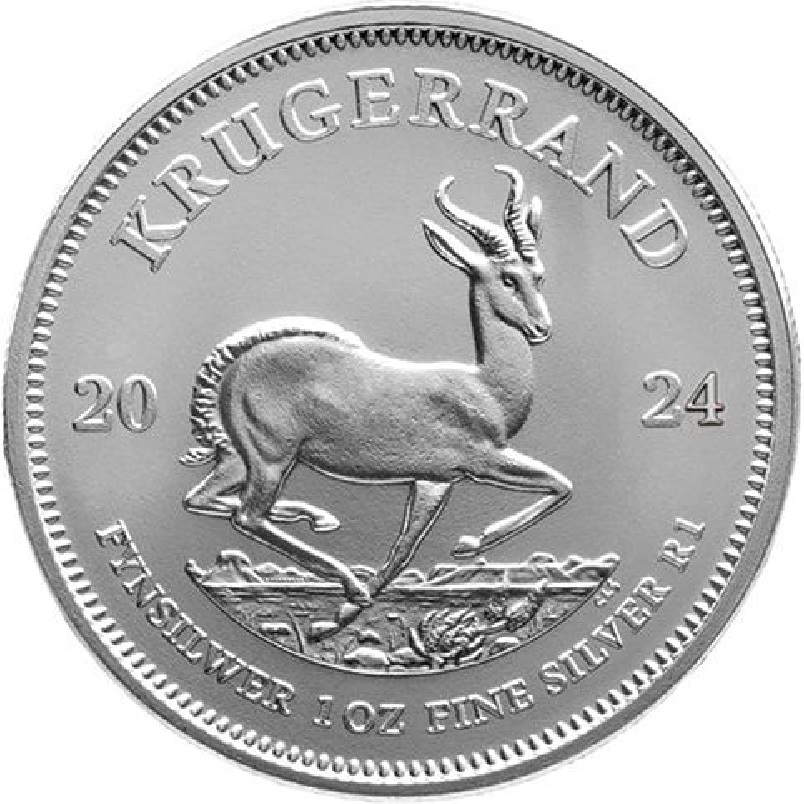

South African Silver Krugerrand 2017 - Present Purity: 99.90% Silver, Balance Copper |

|

Russian Saint George the Victorious 2009 - Present Purity: 99.90% Silver, Balance Copper |

Many of the silver bullion coins on the list above are the most popular; however, it is not a complete list of all the bullion coins available on the market.

Other forms of Silver Bullion include:

- Pre-1970 U.S. Mint "Junk Silver" Coins (see the Junk Silver Buying Guide for more in-depth information about these coins)

- Silver Rounds (made by numerous Private Mints & Refiners) See the Coins & Rounds buying guide for more info.

- Silver Bullion Bars ranging in size from 1 gram to 400 oz., by some of the following refiners: PAMP, Johnson Matthey, Engelhard, Heraeus, Sunshine Minting, Inc., etc.)

- Silver Bullion Jewelry, and Sterling Silver Jewelry & silverware

- Silver Bullets and Silver Statues made of 999 to 9999 fine silver

Listed below the next section is a list of Reputable Online Bullion Dealers that offer all of these types of silver.

Bullion Storage

The Free Bullion Investment Guide provides storage guides listed below for those who want to own precious metals but aren't sure which form of storage is best for them.

For those unfamiliar with the various options available for storing assets, including precious metals, our Vault Storage of Assets Buying Guide offers comprehensive information on numerous asset storage solutions.

If you want to learn more about storing precious metals at home, see our Home Safe Buying Guide.

or

If you want to own, store, and trade precious metals abroad, you will want to see our Vault Storage Brokerages Buying Guide.

Furthermore, below is a list of reputable dealers and brokers that offer silver bullion in its many different forms, and there are direct links to their storage services for those who provide it.

List of Reputable

Silver Bullion Dealers

Note: If you're considering purchasing bullion from any of the websites listed below, I highly recommend taking the time to thoroughly review each company's ordering instructions and shipping policies. Doing so will ensure a smooth and satisfying buying experience. These instructions can be found at the bottom of the dealer's website.

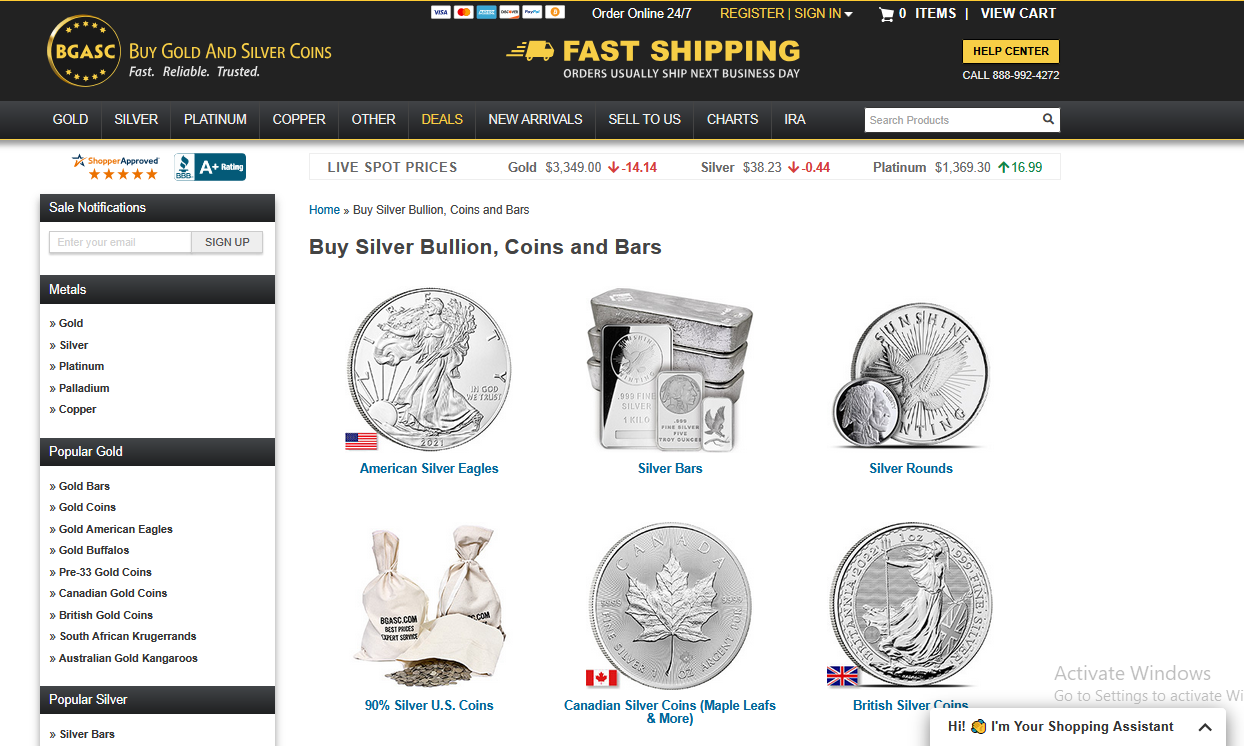

Free Shipping on Orders $199+

"BGASC" is an acronym for "Buy Gold And Silver Coins." The online precious metals bullion dealer is based in California.The company offers its customers one of the largest selections of silver coins, rounds, bars, and other forms of silver bullion available online.

BuyGoldAndSilverCoins.com's goal is to be the kind of dealer you've always wanted to trade with: to have the bullion you want in stock, have fair and reasonable prices, have fast shipping, and operate honestly and efficiently.

They are an official PCGS dealer, a member of the Certified Coin Exchange (CCE), an NGC Collector's Society member, and a bulk purchaser of United States Mint non-bullion coins.

Every single package they ship is sent fully insured for its time in transit. Customers all across the country have quickly come to recognize BGASC as one of the fastest and most trusted online precious metals suppliers in the U.S.

Free Shipping on Orders $199+

BBB - Customer Reviews

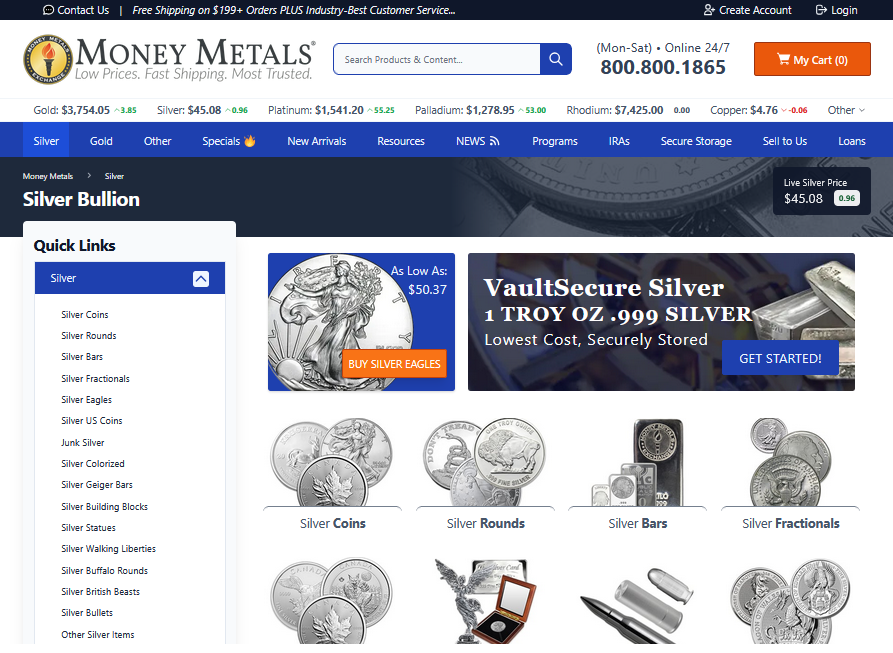

Stefan Gleason is president of the Money Metals Exchange, which is a national precious metals investment company and news service with over 75,000 customers and

500,000 readers.

Gleason founded the company in 2010 in direct response to the abusive methods of national advertisers of collectible and numismatic coins.

Money Metals Exchange offers a wide range of silver bullion, from coins, rounds, and bars to silver statues and silver bullets (non-lethal).

The online bullion dealers offers you physical precious metals bullion to protect you from financial turmoil and the devaluing dollar. They don't pass on to you costly middleman mark-ups or pressure you with bait-and-switch sales tactics.

Money Metals and Exchange is for self-reliant investors who are looking for a trustworthy resource for gold, silver, and platinum bullion.

Free Shipping on Orders $100+

(Canada & US) | RCM - Customer Reviews

The Royal Canadian Mint stands for excellence in bullion production worldwide.

The Royal Canadian Mint offers silver numismatic coins featuring stunning scenes of Canada's wildlife, historical events, and the iconic maple leaf.

The only Silver Maple Leaf Bullion Coins that are available through its website are its latest offering called "Premium Bullion."

The Royal Canadian Mint's Premium Bullion coins are sold in special packaging, whereas standard Canadian Bullion coins are not available directly from the mint. Instead, they are only available through pre-approved dealers in their raw form, without special packaging.

Three of these pre-approved bullion dealers are on this page; they include BGASC, SD Bullion, and SilverGoldBull.

The Royal Canadian Mint is one of the largest and most versatile mints in the world, offering a wide range of specialized, high-quality coinage and related services on an international scale.

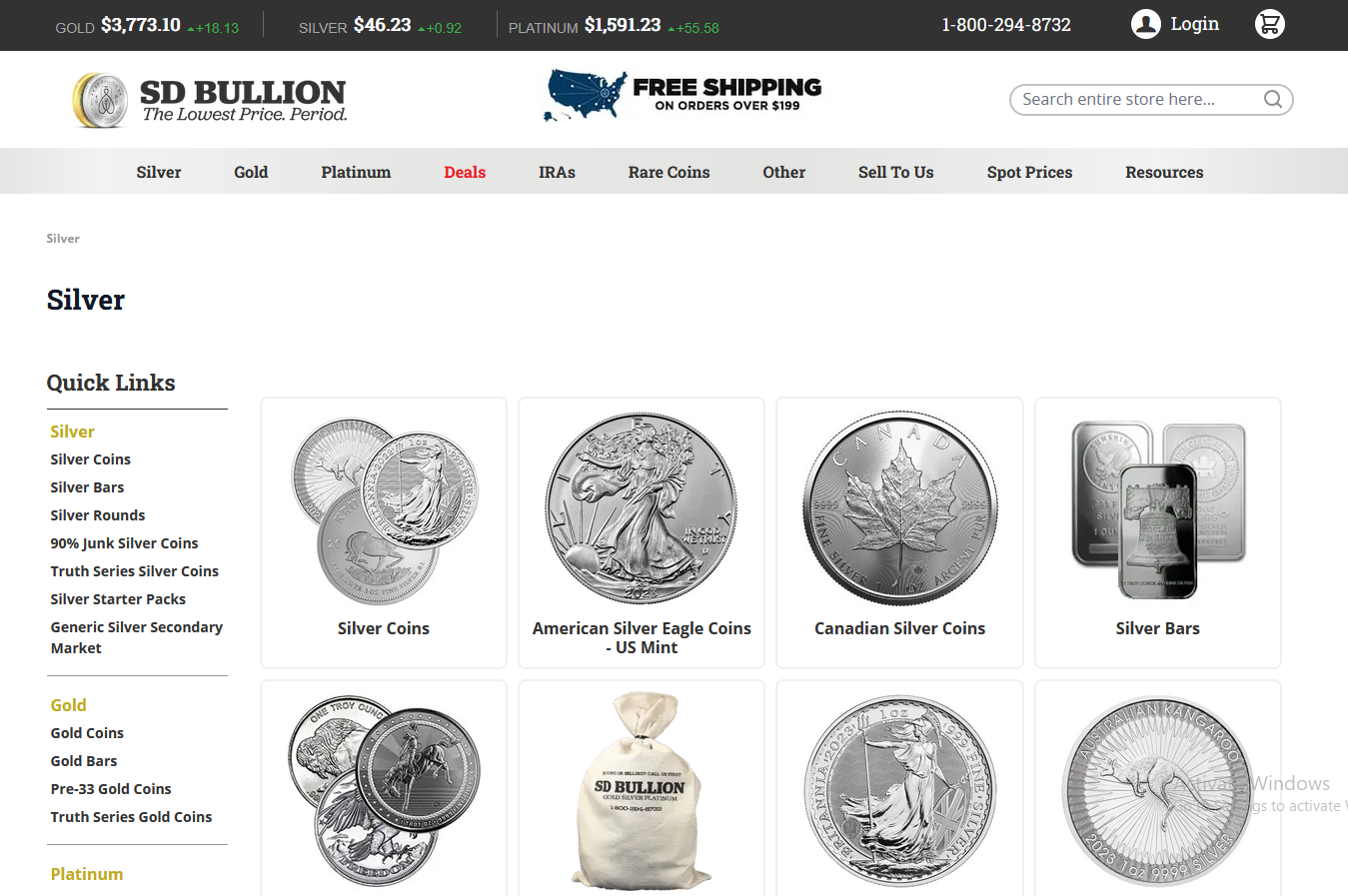

Free Shipping on Orders $199+

SD Bullion is a top precious metals bullion dealer, they offer a huge selection of silver bullion coins, rounds, and bars.

In 2011, two doctors started a highly popular Gold & Silver News website with one dream: To educate the masses on the value of hard assets and preparation.

The rapid success of that website gave way to the launch of SDBullion.com in March of 2012.

Since then, SD Bullion has executed more than $4 Billion in sales and hit Inc. Magazine's list of 5000 Fastest Growing Companies four times.

We did all this while staying true to our original mission of offering the absolute lowest prices on gold bullion and silver bullion in the industry, guaranteed.

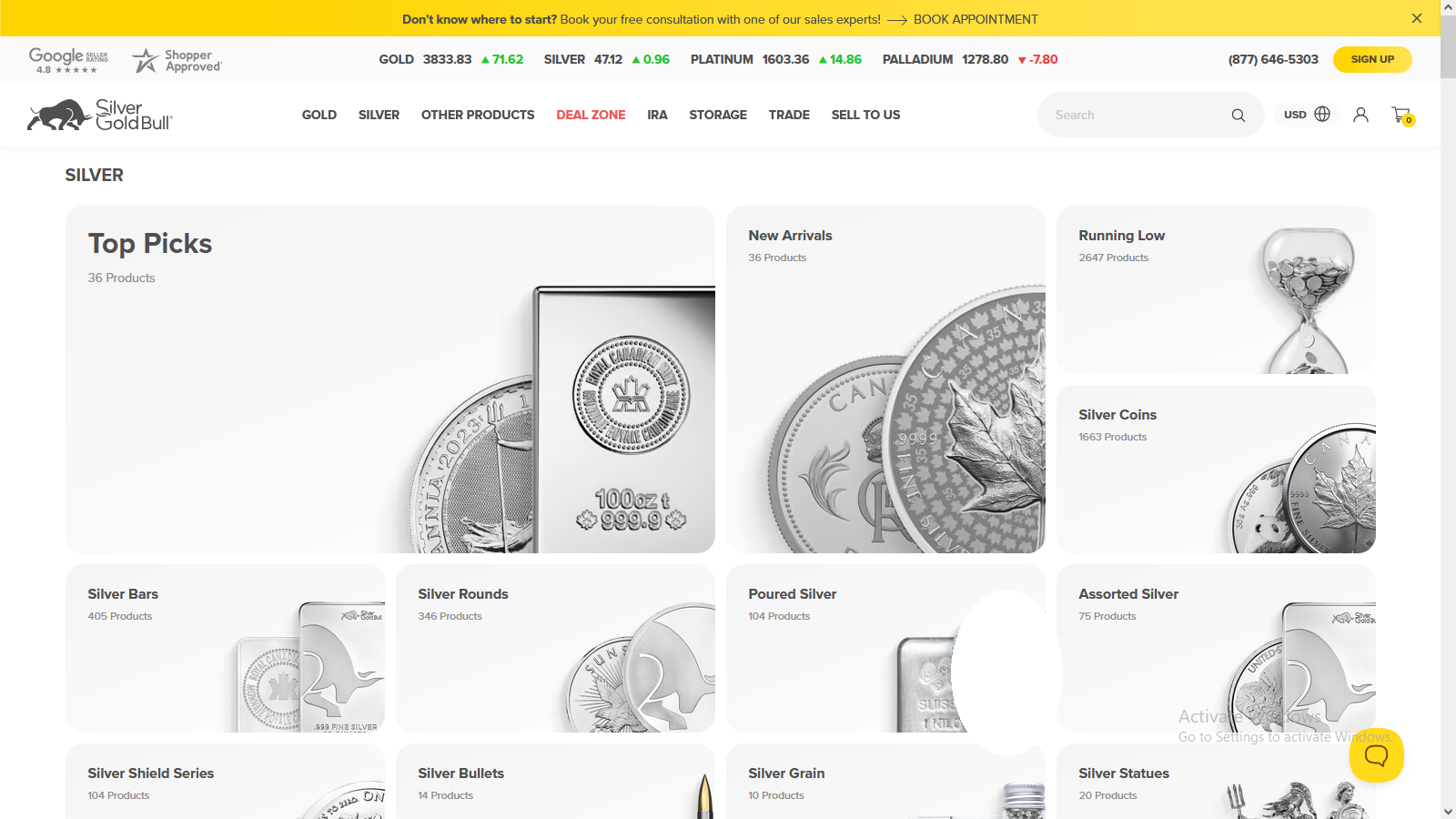

Free Shipping on Orders $199+

SilverGoldBull.com offers a wide variety of silver bullion. They provide you with competitive, up-to-the-minute pricing, and after you place an order, they make sure your precious metals are delivered to your door discreetly and fully insured.

SilverGold Bull's excellent in-house customer service representatives will work to ensure you are satisfied in a timely, friendly, and professional manner. Their number one priority is building good relationships with their customers.

SilverGoldBull has helped tens of thousands of satisfied customers take control of their financial futures by investing in gold and silver.

They are based in Canada and offer a wide variety of precious metals bullion for you to choose from; their commitment to you is to provide extraordinary service throughout your bullion buying experience.

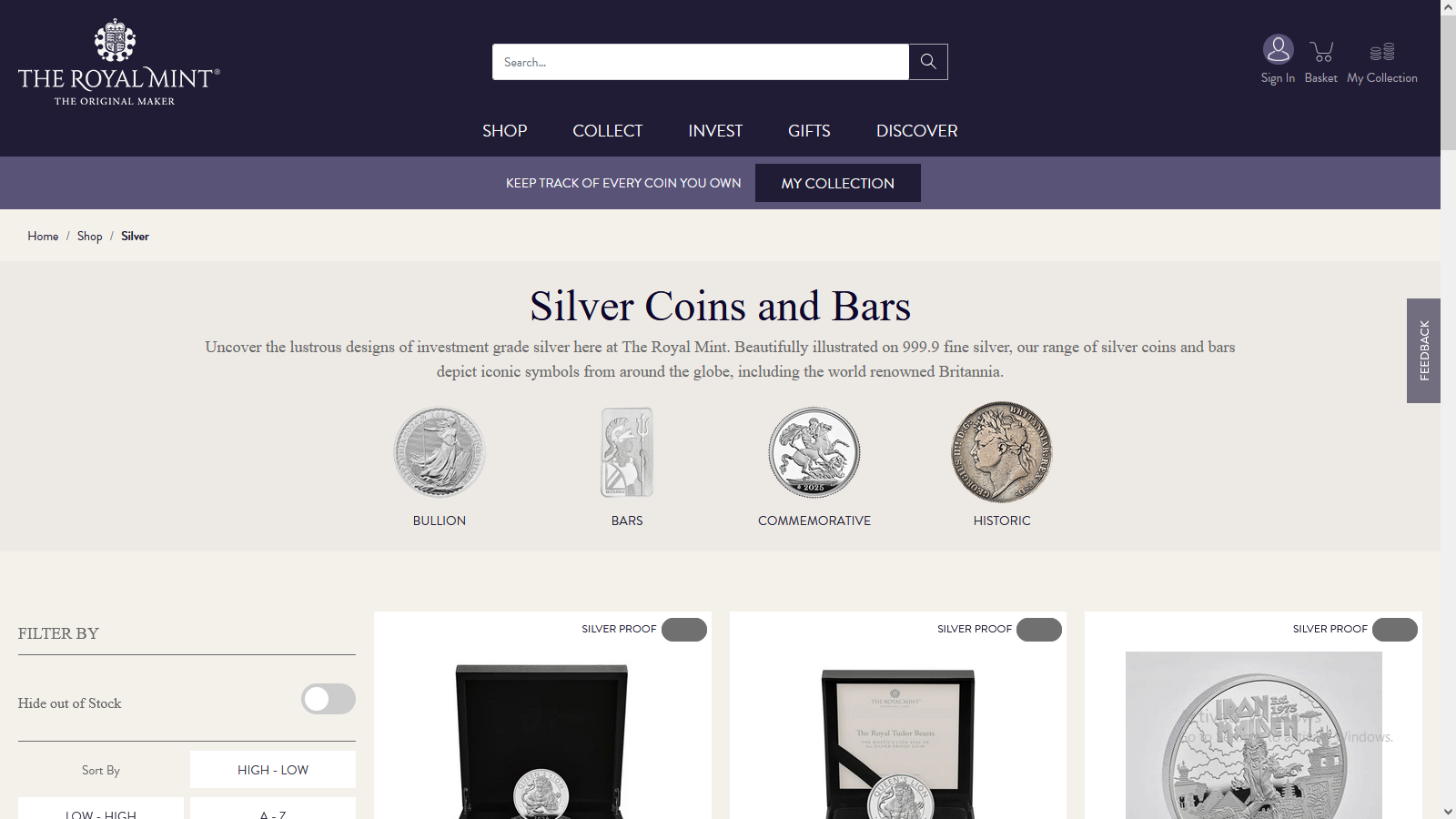

The Royal Mint (U.K.) Delivery Rates

The Royal Mint is known as "The Original Maker" and has over millennia of experience in minting coins globally recognized for its designs and craftsmanship.

The Royal Mint strives to make the customer their primary focus by consistently improving their minting practices to make their bullion more appealing while protecting it from counterfeiters.

Their bullion coins and bullion bars showcase the characteristics of British heritage, which is what makes them sought after by collectors and investors, worldwide. As the Original Maker, the Royal Mint is staying true to its roots while keeping its eyes on the horizon.

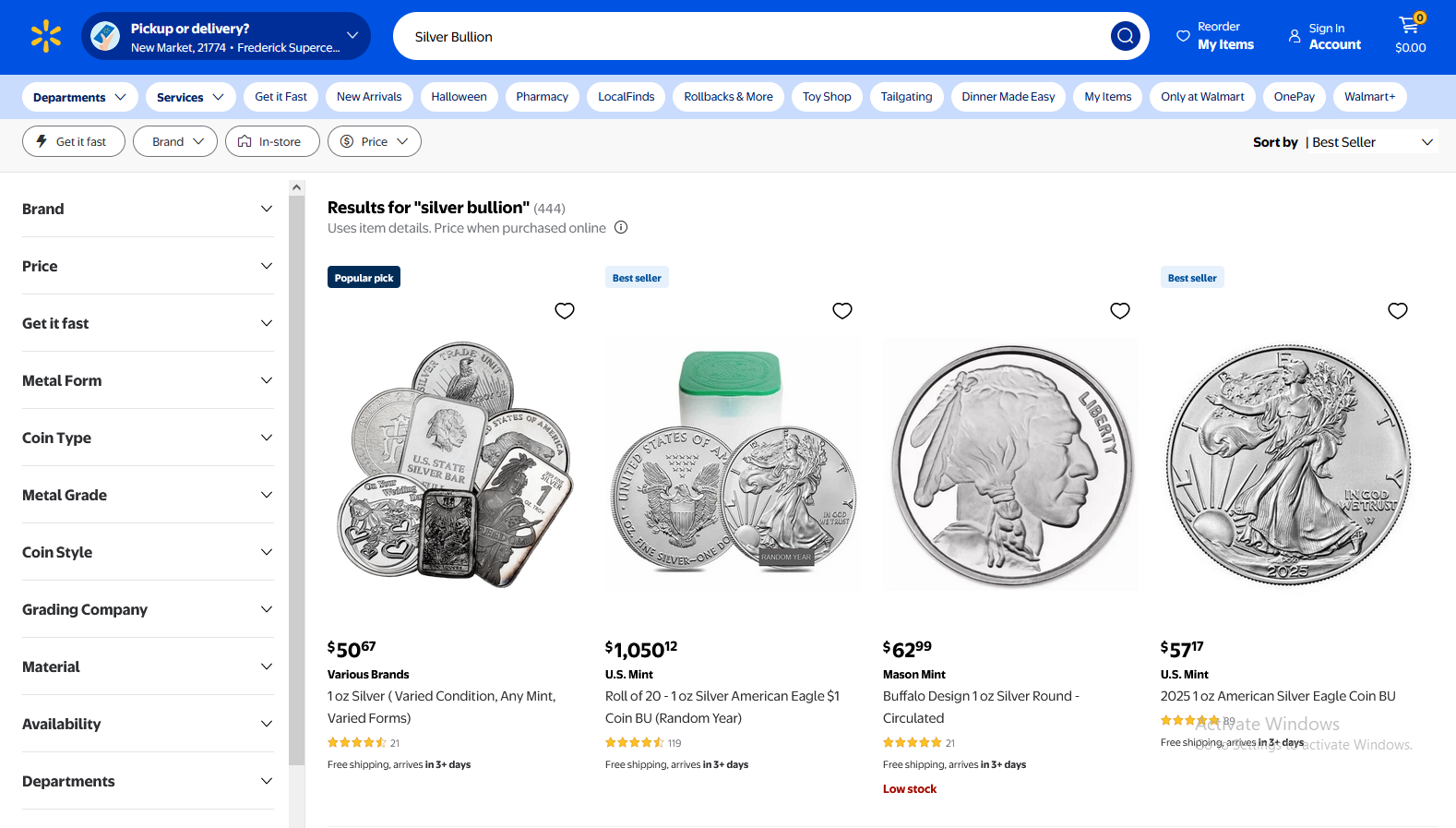

Walmart sells bullion from various reputable dealers; it is advised to avoid items without a specified seller or shipper.

Precious Metals from America's Superstore, offering deals from the Top Online Bullion Dealers in the Industry; including: SD Bullion, APMEX, Scottsdale Mint, and more.

Walmart Inc. is an American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores in the United States, headquartered in Bentonville, AR.

Walmart’s core purpose is summed up in its mission statement and slogan: "We save people money so they can live better.”

Sam Walton famously remarked upon receiving the Presidential Medal of Freedom award in 1992 that, “If we work together, we’ll lower the cost of living for everyone…we’ll give the world an opportunity to see what it’s like to save and have a better life.”

Throughout its 50+ years of history, Walmart has stayed true to its purpose and consistently striven to offer low everyday prices to its customers, and because of this, Walmart has built for itself a strong and loyal customer base.

Low-price leadership is primarily achieved through Walmart's extensive network of suppliers, which allows them to purchase merchandise in bulk at lower prices than competitors.

Silver, Gold, and Platinum

Bullion Brokers &

Storage

|

|

|

BullionVault is the world's largest online bullion investment service taking care of $7.0 billion of bullion and client assets under Mgmt, for more than 120,000 users. The bullion you own is held in vaults. Bars are stored in professional-market vaults in Zurich, London, Toronto, Singapore or New York. You choose where. Because of their size, you benefit from the low storage costs they've negotiated, which always include insurance. |

with Bullion Vault |

4.7 star - Customer Reviews

The video below goes into further detail about Bullion Vault's services.

4.8 star Customer Review

$100 Minimum to Open an Account

Click all the OneGold.com logo links to Learn more or Open an Account

OneGold gives you direct ownership of vaulted gold, silver, and platinum at an ultra-low cost. A free account will provide you with a platform that is easy to use and offers 24/7 access.

Quick Facts about OneGold

- U.S. based company

- Incorporated in 2018

- Trading 24/7 ~ 365 days a year

- Cash Withdraw after account is verified.

- Redemption in Physical Precious Metals is available.

- 3 Million oz (+) under Mgmt

- 4.8 star Customer Reviews

4.8 star Customer Reviews

Vaulted is a service provided by McAlvany Financial Group, the longest-running gold investment company in the United States.

Vaulted states states that buying gold and silver has never been more simple, affordable, or transparent using their service.

- Purchase Pure Gold and Silver and have it stored in the world's most secure vaults

or

- Take Delivery of Your Kilo Bar or smaller coins and bars, whatever you prefer

Buy and secure gold and silver with the tap of a finger Vaulted is a mobile platform for investing in physical precious metals. Store what you've purchased in international vault storage facilities or have it delivered.

Starting an Account with Vaulted is as easy as 1, 2, 3:

- Login to your Vaulted account

- Link a bank account and transfer funds

- Buy gold and silver with the tap of a finger!

Bullion Buying Guides

Other pages you may like...

|

|

|

|

|

|

SilverGoldBull - Customer Reviews - 5.0 stars

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

February 2026

All Articles were Originally Posted on the Homepage

4.9 Customer Reviews

ExpressGoldCash - 4.9 star Customer Reviews