Homepage / Bullion Market Basics: Inflation...explained

Last Updated on 01/26/2025

Inflation...explained

What is Inflation?

Inflation is the devaluation of a currency through the increase in the amount of money circulating in society, resulting in the eventual rise in the price of services and goods.

How does the government calculated the rate of inflation? By comparing the price of a good or service in the past with its current price.

If the inflation rate is 4% a quarter, then a $100.00 item bought at the beginning of the quarter will cost $104.00 by the end of the quarter, and by the end of the year, that item will cost $116.99.

The results of inflation are always the same: the value of goods and services increases as the value of money decreases.

Major Influences of Inflation

- Currency - a Unit of exchange; ex: US dollar, Yen, Pound, Peso, Rand, Ruble, or Yuan

- Bonds - A certificate of debt; or an IOU issued by a government or corporation; ex: a bond is the form of a loan to a government to pay for infrastructure to be paid back in a set period of time with interest.

- Government Debt - is the financial liabilities of the government sector

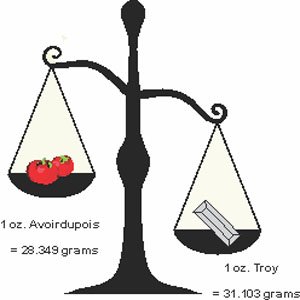

- Commodities - A transportable article of commerce or trade; ex: gold, silver, iron, oil, lumber, platinum, beef, corn, palladium, sugar, coffee, wheat, cotton, etc.

- Real Interest Rate - An interest rate that has been adjusted to remove the effects of inflation to reflect the real cost of funds to the borrower, and the real yield to the lender. The real interest rate is approximately the nominal interest rate minus the inflation rate.

- Stocks - a certificate of ownership; a contract between a corporation and the owner of the stock, which gives the owner an interest in the management of the corporation; ex: When you own a share of stock, you own a share of the business.

How do these Market Factors interact together in a Low Inflationary market compared to a High Inflationary Market?

Low Inflation Market

Stable Currency, Lower Commodity Prices, Normal Interest Rates

Good for Consumers

Good for ConsumersWhen a government's inflation rate is low, its currency's value is stable, interest rates on this government's bonds are low, and its bond prices are high. Also, government debt may or may not be high; how its debt affects inflation is determined by how well it is managed.

When a government's bonds sell at a higher price, it indicates market confidence, and it suggests that investors believe the government will repay the bond upon its expiration. Bonds issued by a government like this would be in high demand and considered a safe-haven investment.

A stable currency, or one that holds its value, keeps commodity prices low because it takes less money to buy the commodity.

Lower commodity prices help to make the services and manufactured goods less expensive, giving the citizens of the government in this scenario a low inflationary environment.

Free Shipping on Orders $199+

High Inflation Market

Falling Currency Value, Higher Commodity Prices, Higher Interest Rates

Bad for Consumers

Bad for ConsumersWhen a government prints, spends, and hands out excessive amounts of

money, the value of its currency falls due to the increase in the money

supply and debt. (Example: Covid-19 Stimulus of 2021)

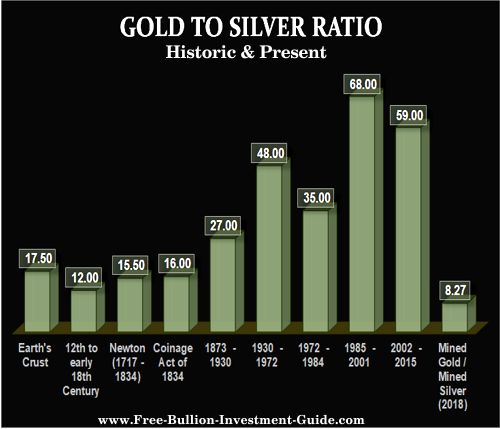

When you have inflated dollars in circulation, the cost of goods increases because commodities can't just be printed out of thin air, like dollars. Instead, commodities must be mined, grown, and drilled in one way or another, which requires time and money causing their raw value to increase.

Meanwhile, the government continues to print and spend more money, continually reducing the value of the currency. When the higher-priced commodities are manufactured and come to the marketplace, more dollars are chasing them, and prices rise as the product sells, causing supply shortages.

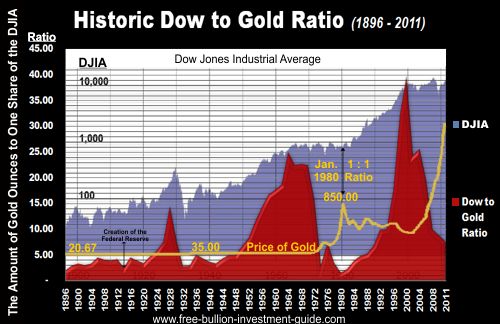

This is how the stock market begins to rise in an inflationary environment: prices in stores are higher, so when a company sells these inflated goods, it earns more money, increasing its earnings.

However, when the constant higher prices finally start to creep into consumer savings, it causes the consumer to retract and stop buying some goods to pay for others.

This is how high inflation hurts the stock market. When the product is a consumer staple (toilet paper, electricity, food), the consumer will buy it as they need resupply, but if the item isn't a consumer staple, in a high inflation economy, it will get overlooked, and the company that supplies that item will lose revenue.

This is why economists recommend investors who are in the stock market buy consumer staples when a market is in trouble because these companies do the best in inflationary environments and in hard times.

Furthermore, interest rates on bonds rise in this scenario; a government that is selling these bonds to fund its spending activities will be unable to sell its bonds at face value because nobody wants to buy them.

Higher interest rates on government bonds indicate to potential investors that this is a high-risk bond, commonly known as a "Junk Bond," and that they would be taking on significant risk by purchasing it.

In this scenario, the bonds will not sell without a high reward, namely through higher interest rates, and unless the government pays off its debts, it will not be able to pay the interest, its currency will lose value, and inflation will increase.

(Ex: Venezuela)

Governments should strive to keep their debt low because they must repay both the debt and the interest.

Videos about Inflation

ExpressGoldCash - 4.9 star - Customer Reviews

Other pages, on this Guide, that you

may like...

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

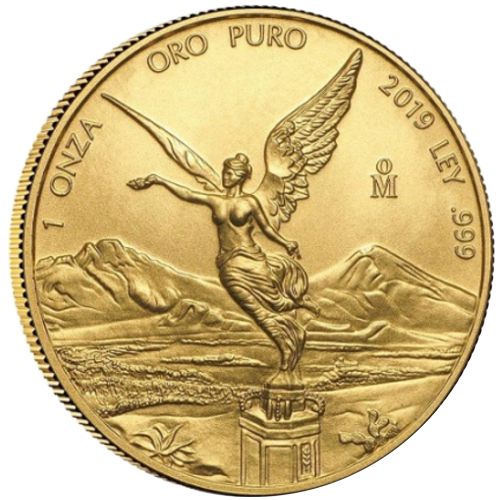

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage