Homepage / Bullion Coins: Australian Coins

Last Updated on 05/18/2025

The Perth Mint &

Australian Bullion Coins

History of

the Perth Mint

Situated on the Swan River, Perth serves as the capital city of Western Australia.

Perth has one of the most pleasing climates in the world; its average temperature in summer is 73℉ (23℃), while in winter the average temperature is 55℉ (13℃).

British colonization of Australia began in 1788; Admiral James Stirling, a British Naval Officer, founded Perth in 1829 by lobbying the British Government to establish a settlement there. In doing so, Perth became the first colony on Australia's west coast.

Gold in Western Australia drew many prospectors; the region's gold rush accelerated in the 1890s after two prospectors found gold in a town called Coolgardie, leading to the accelerated development of Perth.

The Perth Mint Began as a Branch of the British Royal Mint

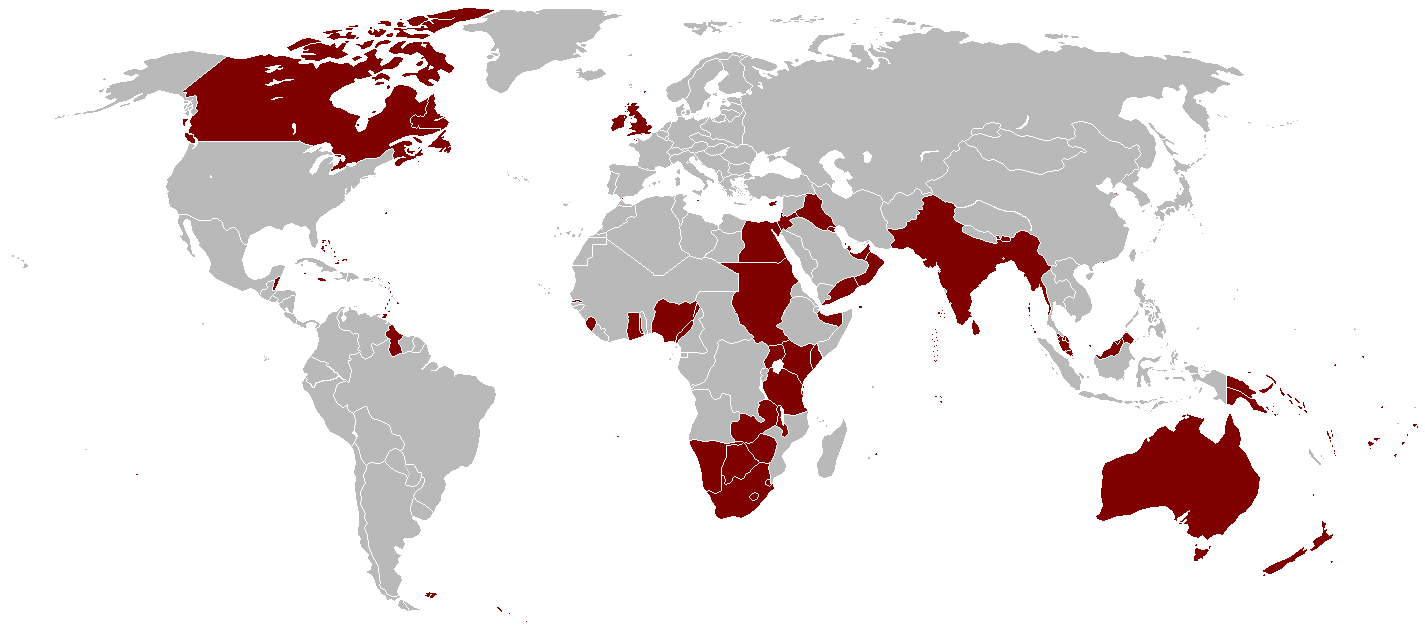

In the 1800s, the British Empire's global influence consistently grew, and in turn, the Royal Mint established satellite mints overseas to refine gold and silver ore to expand its currency and economic influence. (British Empire map provided courtesy of Vadac)

Australia received the first of three satellite mints: Sydney in 1855, Melbourne in 1872, and Perth in 1899; subsequently, the Sydney Mint closed in 1926, whereas the Melbourne Mint is today privately held.

In 1892, two prospectors set out on their own in Western Australia to look for gold; what William Ford and Arthur Bayley found was what ultimately led the British government to open a branch of the Royal Mint in Perth. (Statue photo below provided courtesy of Roo72)

The statue (right) stands in front of the Perth Mint; it is of the Western Australian prospector William Ford showing a gold nugget to fellow prospector Arthur Bayley. (photo above provided by Phil Whitehouse)

The plaque under the sculpture states:

The sculpture depicts the gold strike near Coolgardie, by Prospectors William Ford and Arthur Bayley in 1892 which unleashed the Gold Rushes that secured the future of the struggling colony of Western Australia. Established one of the State's most successful and enduring industries and led to the foundation of the Perth Mint in 1899.

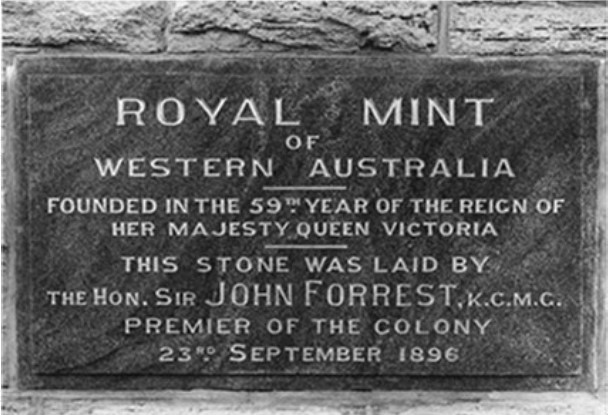

Shortly after the discovery of gold in Western Australia, Sir John Forrest, the colony's first premier, advocated for the British to establish a branch of the Royal Mint in Perth.

Premier Sir John Forrest laid the foundation stone of the Royal Mint in Perth on September 23rd, 1896, and construction on the mint was completed in 1899. (Foundation stone photo provided courtesy of The Perth Mint)

The Royal Mint in Perth originally had two functions: first, it struck coins for circulation in Western Australia (WA), and second, it purchased the majority of gold extracted in WA; miners sold their raw gold directly to the Mint, where it was minted into bullion bars and Gold Sovereigns.

In its first 32 years, the Royal Mint in Perth struck more than 106 million gold sovereigns and nearly 735,000 half-sovereigns for use as currency in Australia and throughout the British Empire.

Gold Sovereigns struck at the Royal Mint in Perth, Australia, were minted with the "P" mint mark from 1899 to 1931; the identifying "P" mint mark is on the ground on the coin's design, above the coin's "year of issue." (click images below to enlarge)

Gold Sovereigns struck at the Royal Mint branch in Sidney, Australia, had an "S" mint mark, and the Royal Mint branch in Melbourne had an "M" mint mark; the mint marks can be found in the same place as Perth's mint mark as shown in the example above.

The Royal Mint in Perth stopped making Gold Sovereigns when Britain abandoned the gold standard in 1931. Regardless, the refinery continued to refine gold bullion bars. Yet, it was not long before the Mint was back in the production of coins from base metals.

999.999 Gold

In 1957, the refinery of the Royal Mint in Perth set a historic milestone by achieving the purest gold ever recorded.

Refinery Officer Leo Hickey and Senior Craftsman Alexander Osborne produced a proof 'plate' with an unparalleled purity of almost six nines - 999.999 parts of gold per thousand, as verified by the Worshipful Company of Goldsmiths in London.

Recognizing this exceptional feat, the Royal Mint in London, England, ordered some of this gold to upgrade its standards.

999.999 gold is too soft and malleable to be made into jewelry, bullion coins, or bars, and it is very costly to duplicate, which is why it is unfit for sale.

Since 1987, the Perth mint has produced all their coins and bars in 999.9 fine gold. (999.999 gold plate photo provided courtesy of the Perth Mint)

The Gold Corporation

Between 1931 and 1964, the Royal Mint in Perth produced hundreds of millions of pennies and half pennies for the Australian Government.

In 1965, the Australian Government opened the Royal Australian Mint as Australia's primary mint for producing circulated coins.

Although the Royal Australian Mint was built to be the primary producer of circulated coins, it didn't do so immediately; the Royal Mint in Perth continued to produce circulated coins till the early 1970s, especially after Australia introduced decimal currency in 1966. It produced 829 million 2-cent coins and 26 million 1-cent coins.

The Royal Mint in Perth remained under the jurisdiction of Britain until July 1, 1970, when the Government of Western Australia took control of the Perth Mint and redirected its focus to producing precious metals bullion through its refinery.

The change came at a fortunate time.

In August 1971, President Richard Nixon created a new gold boom by ending the Bretton Woods currency system.

The system had pegged international currencies to the U.S. dollar, which in turn was pegged to the price of gold at $35.00 a troy ounce; this allowed gold to increase in value.

Today, the Perth Mint is owned by Gold Corporation, which is wholly owned by the Government of Western Australia.

In 1987, the Australian Government established the Gold Corporation through a State Act of Parliament to launch Australia's official bullion coin program to investors and collectors worldwide under a unique agreement with the Commonwealth of Australia's Department of the Treasury.

In 1987, the Perth Mint officially launched the Australian Nugget gold bullion coin.

After the Perth Mint released the Australian Nugget Gold Coin Series in April of 1987, the first day of trading resulted in the sale of 155,000 ounces of gold, worth $103 million, exceeding the sales target of 130,000 ounces by the end of June.

Gold Corporation owns two subsidiaries, Western Australian Mint and GoldCorp Australia, both trade as The Perth Mint.

Note: the Australian Nugget gold bullion coin is now known as the Australian Kangaroo gold bullion coin.

The Australian Kangaroo

One Tonne Gold Coin

On October 27th, 2011, the Perth Mint unveiled the largest legal tender bullion coin ever created, the One Tonne Gold Kangaroo.

The coin consists of one Tonne of 99.99% pure gold, measures almost 80 cm wide and 13 cm thick, has an Australian legal tender face value of $1,000,000.00, and is the biggest, heaviest, and intrinsically the most valuable gold bullion coin in the world.

Furthermore, in 2012, Guinness World Records awarded the Australian Kangaroo One Tonne Gold coin the title of "Largest Coin." (coin photo provided courtesy of wikimedia)

The video below is a look into how the Perth Mint designed, cast, and put the finishing touches on the Largest Gold Bullion Coin ever created.

The Making of the One Tonne Gold Kangaroo Bullion Coin

Perth Mint Expertise

Australia's Perth Mint operates one of the biggest refineries in the world; it refines more than 92% of Australia’s gold production, in addition to the gold mined from countries in the Asia-Pacific region.

The Perth Mint has a refining capacity of 800 tonnes of gold and 1,000 tonnes of silver each year; their refinery is one of the most established refining facilities in the world.

The Perth Mint is accredited by all five of the world’s major gold exchanges, which include the LBMA (London Bullion Market Association), the Chicago Mercantile Exchange (CME), the Shanghai Gold Exchange (SGE), the Osaka Exchange Ltd. (OSE), and the Dubai Multicommodities Centre (DMCC).

The Perth Mint is Australia’s largest fully integrated precious metals

refining, minting, and depository corporation, it produces a wide variety of gold, silver, and platinum coins and manufactures bullion bars for investors worldwide.

Today, The Perth Mint is a member of an elite group of world mints whose pure gold, silver, and platinum legal tender coins are trusted without question.

The Perth Mint's bullion coins come in an array of different sizes, allowing them to fit any investor's budget. Below, you'll find detailed pages about many of these bullion coins.

Face Value

The legal tender "Face Value" of a bullion coin does not represent the "Intrinsic Value" of a precious metal bullion coin.

In regards to a coin, a coin's intrinsic value is determined by what it consists of and how much it weighs.

Australian Bullion Coins are bought and sold based on the current market spot price of gold, silver, or platinum, plus a premium to cover minting, handling, distribution, and marketing costs.

The Perth Mint's bullion coins often carry a higher premium than that of other bullion coins due to their proof-like finish.

Furthermore, the lower the mintage of the bullion coin, the more a collector's premium will be attached to it.

Source: The Perth Mint

Silver Kangaroo

Australian Bullion Coin

2015 - Present

1 oz. Silver Australian Kangaroo Bullion Coin

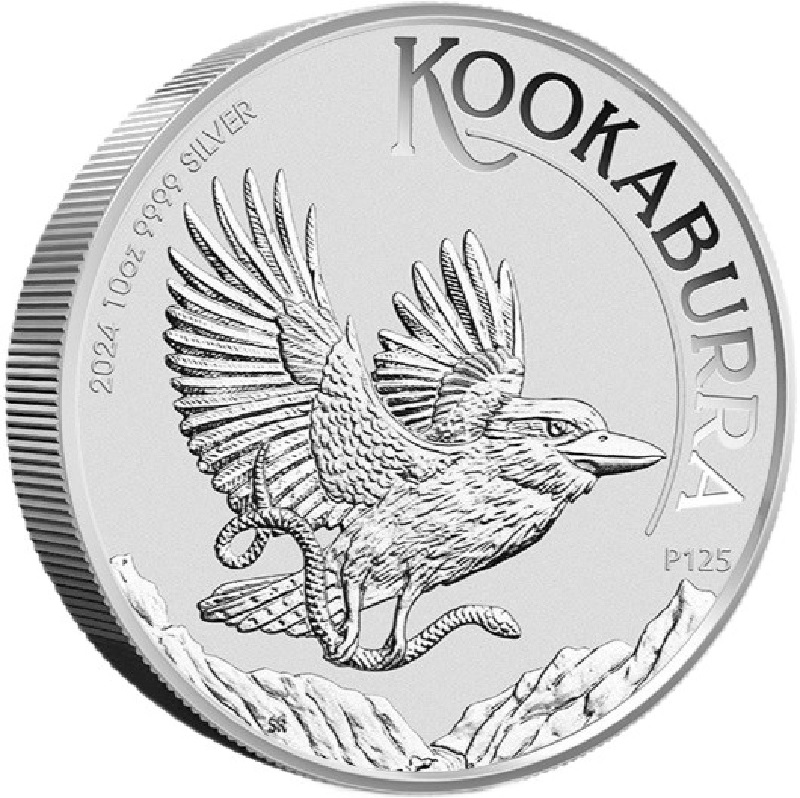

Silver Kookaburra

Australian Bullion Coins

1990 - Present

|

In Production |

Not In Production |

Silver Koala

Australian Bullion Coins

2007 - Present

|

In Production |

Not In Production |

Lunar Silver

Australian Bullion Coins

Series I, II, & III

1999 - Present

Series I, II, & III |

Series I & II |

Lunar Gold

Australian Bullion Coins

Series I, II, & III

1996 - Present

Series I, II, & III

|

Series I & II

|

Gold Kangaroo (Nugget)

Australian Bullion Coins

1987 - Present

|

In Production |

Not In Production |

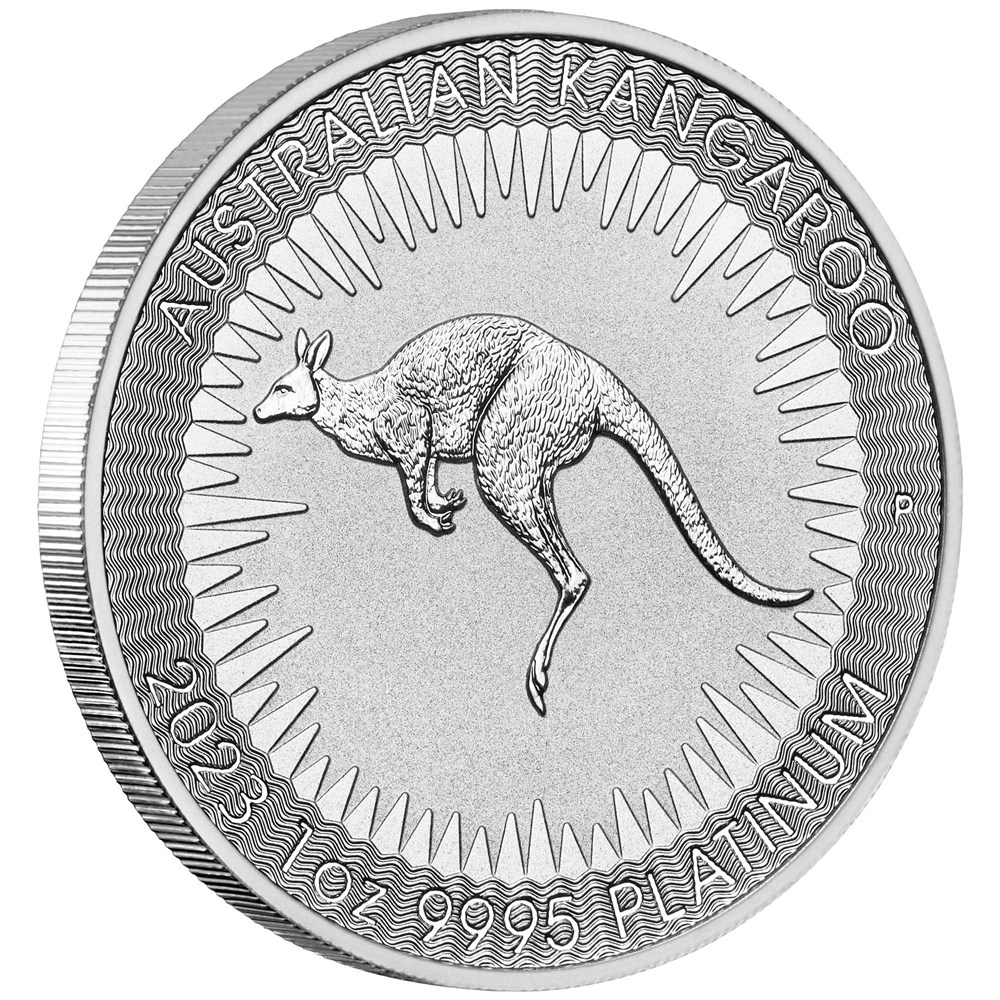

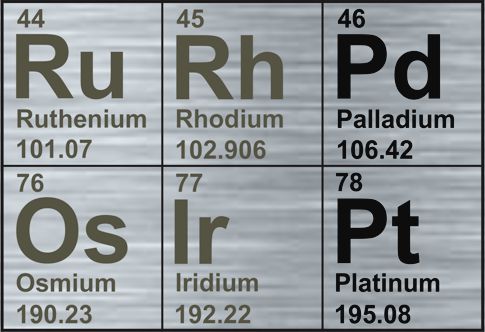

Platinum

Australian Bullion Coins

Other Pages you may like...

|

|

|

|

|

|

The Perth Mint and Australian Bullion Coins

For Bullion Market News....

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage