Homepage / Bullion Investment Basics: Bullion Glossary / B - Bretton Woods

ExpressGoldCash - 4.9 star - Customer Reviews

Last Updated 08/08/2025

Bretton Woods

System of Monetary Management

(a Gold Standard)

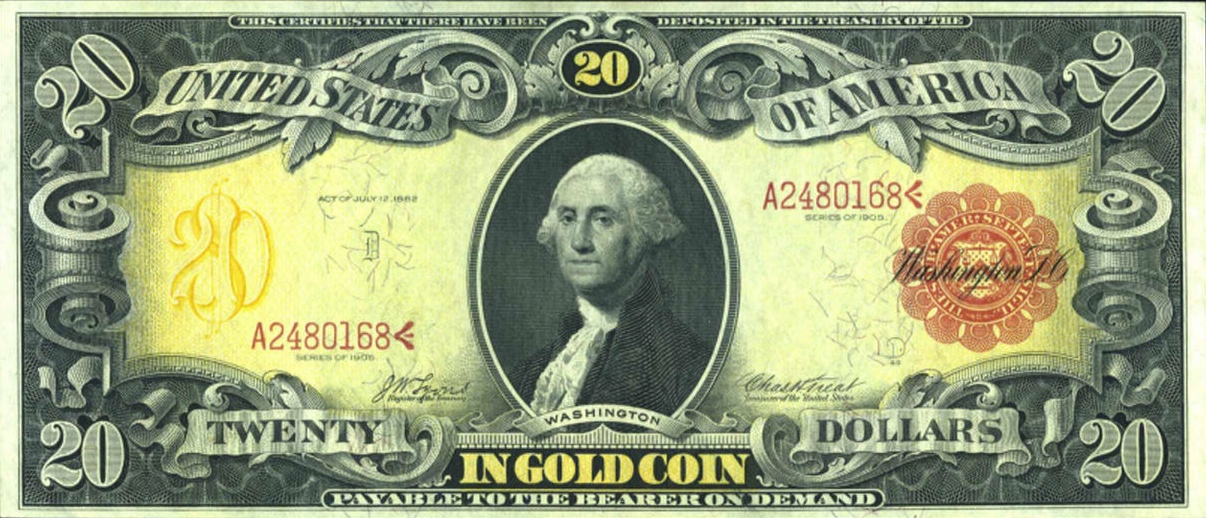

In 1933, President Franklin Delano Roosevelt abandoned the Gold Standard, when gold and silver was literally the money in American's pockets and used for everyday exchange. Americans also used silver and gold certificates that looked like cash and were redeemable for gold or silver coins.

President Roosevelt did this by signing Executive Order 6102, which forbade Americans from holding Gold Coins, Gold Bullion and Gold Certificates, and ended the Gold Standard under which the United States economy functioned.

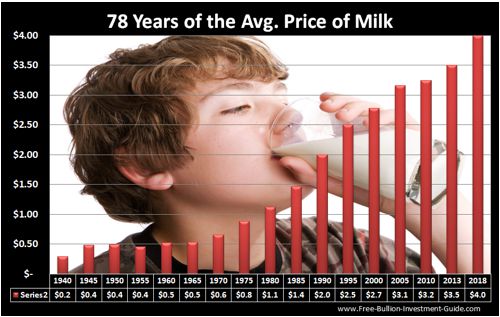

In 1934, the Gold Reserve Act was passed, changing the statutory gold value of the U.S. dollar from $20.67 to $35 an ounce. This reduced the purchasing power of the dollar by more than a third, and it enabled the Federal Reserve to expand the money supply.

After World War II, in July of 1944, forty-four countries convened on Bretton Woods, NH, to create a de facto gold standard known as the Bretton Woods System of Monetary Management.

The Bretton Woods system kept gold valued at $35.00 a troy ounce, but the U.S. dollar was now considered as good as gold to the holder, who could no longer own gold; foreign countries were the only ones who could exchange U.S. dollars for gold bullion or gold bullion for U.S. dollars.

The gathering in Bretton Woods, New Hampshire was called International Monetary Conference it consisted of 730 delegates from all 44 WWII Allied nations. The delegates deliberated from July 1st through the 22nd in 1944 and signed the Agreement on its final day.

The planners hoped to avoid a repeat of the debacle of the 1930s, when the United States, as a creditor nation, insisted on repayment of allied war debts from World War I.

Combined with the threat of isolationism, this led to a breakdown of the international financial system and a worldwide economic depression.

Governments of the 1930s used currency devaluation policies to increase the competitiveness of a country's exported goods.

They did this to reduce their growing deficits; instead, it worsened other nations' monetary systems, which caused plummeting national incomes, shrinking demand, mass unemployment, and an overall decline in world trade.

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the world's major industrial states after World War II.

The system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent nations.

Those attending the conference set up a system of rules, institutions, and procedures to regulate the international monetary system, establishing the International Monetary Fund (IMF) and the World Bank.

After ratification in 1945, these organizations became operational.

The chief feature of the system was an obligation for each country to adopt a monetary policy that maintained the exchange rate by tying its currency to the U.S. dollar's value to the price of gold.

The IMF was established to bridge temporary imbalances of payments.

For the first years after World War II, the Bretton Woods system worked well. Under the Marshall Plan, Japan and Europe were rebuilding from the war, and demand for American goods and dollars were high, and because the U.S. owned over half the world's official gold reserves—574 million ounces at the end of World War II—the system appeared secure.

Presiden Lyndon B. Johnson - Overspending Cartoon

Presiden Lyndon B. Johnson - Overspending Cartoon(every character is LBJ)

However, as Germany and Japan recovered from 1950 to late 1960s, the U.S. share of global economic output dropped from 35% to 27%.

Furthermore, a negative balance of payments, growing public debt incurred to fund U.S. involvement in the Vietnam War, and President Lyndon B. Johnson's "Great Society" programs of Medicare, Medicaid, and his "War on Poverty" created high monetary inflation, causing the dollar to become increasingly overvalued in the 1960s.

These policies increased inflated the value of the U.S. Dollar against gold, causing currency markets to become greatly unbalanced, and many countries began to leave the Bretton Woods monetary system.

ExpressGoldCash - 4.9 star - Customer Reviews

The End of the

Bretton Woods System

(Gold Standard)

On August 15, 1971, President Nixon unilaterally announced a temporary suspension on the convertibility of the dollar to gold.

An attempt to revive the fixed exchange rates failed, and by March 1973, the major currencies began to float against each other.

As a result, the Bretton Woods system officially ended, and the U.S. dollar became a 'fiat currency,' backed by nothing but the faith and trust in the United States government to live up to its obligations.

The 1971 event is known as the "Nixon shock" and the official end of the gold standard, which made the United States dollar the reserve currency for the member states.

Since the collapse of the Bretton Woods Monetary System, IMF members have been free to choose any form of exchange arrangement they wish except when governments peg their currency to gold.

This allows currencies to float freely, pegging one currency to another or a basket of currencies adopting the currency of another country participating in a currency bloc, or forming part of a monetary union.

Examples of the last sentence would be equal to the European Union and the future wishes of the BRICs economic union.

Sources: Bretton Woods System

Library of Economics & Liberty - AUDIO: Benn Steil on the Battle of Bretton Wood

Creation of the Bretton Woods System - Federal Reserve History

BullionVault - How Did Bretton Woods Work?

Daily Reckoning - The Dollar Will Die with a Whimper, Not a Bang

- by James Rickards

Other pages, on this Guide, that you

may like...

|

|

|

Bretton Woods

Visit the Bullion Glossary page

or

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are not meant to encourage you to invest or divest in any particular way.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

Ad Gloriam Dei

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

November 2025

All Articles were Originally Posted on the Homepage