Homepage / Bullion Coins: Chinese Bullion

Last Updated on 02/20/2025

Chinese Gold Coin Group Co.

& Chinese Bullion

The History

of Chinese Currency

Ancient Coinage

The first traces of China's monetary system dates back to the Shang Dynasty (c. 1600 BC – c. 1046 BC), where cowrie shells served as early currency.

Diverse metal currencies, like knife and spade coins, also emerged. In 2021, archeologists in China unearthed the oldest known mint (coin manufacturing site) dating from 640 and 550 B.C. and found clay molds for casting spade-shaped coins. Read more about what was found by the archeologists here: World’s Oldest Known Coin Mint Found in China

by Smithsonian Institute's Magazine.

Round coins were introduced around 350 B.C., first with a round hole in the center, then later a square hole in the center.

Chinese cash coins were introduced in 400 B.C. and used until the 20th century A.D., and they were minted in copper, iron, lead, gold, and silver.

Chinese Cash Coin's Design Characteristics:

- Symbolically: the round shape of cash coins represents heaven, while the square hole represents the earth.

- Functionally: the square hole in the center of the coin allowed them to be strung together.

- Manufacturing: the square hole allowed the coins to be stacked on a square rod to remove excess metal while casting the coins.

The Qin dynasty (221–206 B.C.), the first dynasty to unify China, witnessed the introduction of a standardized coinage for the whole Empire.

Modern Chinese Coins

The People's Bank of China authorizes all Chinese coins

One of the People's Bank of China's numerous responsibilities is to publish the issuance plan for precious metal commemorative coins through its direct affiliate, the Chinese Gold Coin Group Co. Ltd. (limited liability company).

The history of the People's Bank of China can be traced back to China's Second Civil Revolutionary War. The bank was established on December 1, 1948.

The People's Bank of China is the central bank of the People's Republic of China; however, for its first 31 years, it acted more as a single-tier banking system than a two-tier central banking system because it did very little to regulate the exchange rate of China's currency, the Yuan (Renminbi).

Between 1950 and 1978, the People's Bank of China was the sole bank in the People's Republic of China, with other banks in mainland China serving as either divisions of the PBoC or non-deposit-taking agencies.

In September 1983, the Chinese State Council decided that the People's Bank of China would exclusively function as a central bank and no longer undertake commercial banking activities.

In 1993, the People's Bank of China restructured its financial supervisory functions by officially designating its mandates as: "formulating and implementing monetary policy, safeguarding financial stability, and providing financial services. "

Chinese Gold Coin Group Co. Ltd.

China Gold Coin Group Co., Ltd. (CHNGC) was established in 1987; it is the sole company under the People's Bank of China that deals in precious metal commemorative coins, including the Panda bullion coins.

CHNGC is China's primary distributor of precious metal commemorative coins, which encompasses their project development, design, production, and sale. It serves as an extension of the central bank's currency issuance and the company is a crucial component of the currency issuance system.

The Chinese bullion and commemorative coin markets are being aggressively developed and expanded by the Chinese Gold Coin Group Company both domestically and internationally.

The Chinese Gold Coin Group Company is actively developing and expanding the Chinese bullion and commemorative coin markets, with large distribution centers in Asia, Europe, and the Americas, and it has established extensive cooperation with major coin dealers and banks worldwide.

Chinese Gold Coin Group Co. (CHNGC)

Minting Subsidiaries

Chinese Mints are located in Shanghai, Shenyang, Shenzhen, and Nanjing. The Shanghai Mint is the oldest and most important mint in China; it was founded in 1920 during the Beiyang era in China.

Shanghai, Shenyang, and Shenzhen primarily mint coins for circulation and precious metal commemorative coins. The Mint in Nanjing primarily prints fiat banknotes and also does coining in small quantities.

Chinese Gold Coin Group (CHNGC)

Distribution Subsidiaries

China Great Wall Coins & Investments Ltd., the first subsidiary of the Chinese Gold Coin Group Company, was established in 1988 and is based in Hong Kong.

Since its inception, China Great Wall Coins & Investments company has set up the distribution of Chinese coins through a network of international coin dealers and institutions.

This company also distributes ancient Chinese gold and silver medallions, circulated bank notes, and other commemorative coins.

The seven China Gold Coin Incorporation branch subsidiaries:

- China Great Wall Coins & Investment Co., Ltd.

- Shenzhen China Gold Coin Distribution Center

- Beijing Kaiyuan China Gold Coin Distribution Center Co., Ltd.

- Guobao Company (Shenzhen National Treasure Mint Co., Ltd.)

- Beijing Xinwen Times Gold Coin Cultural Communications Co., Ltd.

- Shanghai Gold Coin Investment Co., Ltd.

- Beijing Zhongjin Guoheng Collectible Coin Appraisal and Ration Co., Ltd.

Source: China Gold Coin Group Company, Ltd.

Note: This site is entirely in the Chinese language, check your internet browser for a language translation option.

Bullion Coins

Face Value vs. Intrinsic Value

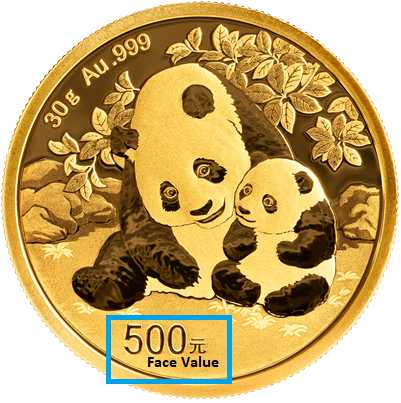

China's investment-grade bullion coins are officially named "Panda Gold and Silver Commemorative Coins."

The "Face Value" of a bullion coin does not represent the "Intrinsic Value" of the different precious metal bullion coins. A coin's intrinsic value is determined by what it consists of and how much it weighs.

The face value of a coin is the legal tender value inscribed on it, but it doesn't reflect its true worth; it's the amount the issuing government must provide if exchanged at a bank.

All bullion coins are bought and sold based on the current market spot price of gold or silver, plus a premium to cover minting, handling, distribution, and marketing costs. The spot price is the current price of an asset, such as a commodity, that can be bought or sold for immediate delivery.

Chinese gold and silver bullion coins often carry a higher premium than other bullion coins due to their low mintage and design. However, since 2011, the People's Bank of China has been authorizing the Chinese Gold Coin Group Company to increase the mintage figures of the "Panda Gold and Silver commemorative coins," which may affect the bullion value of these coins.

The best way to find Chinese Bullion Coins closest to their precious metals spot price is to buy the Gold or Silver Panda bullion coins in their current year.

Furthermore, Chinese bullion coins have been under increasing scrutiny in recent years due to forgeries. To minimize this risk, it is best to buy these bullion coins from a reputable bullion dealer.

Panda Silver

Chinese Bullion Coins

1989 - Present

30 gram & 1 oz. - Panda Silver Chinese Bullion Coin

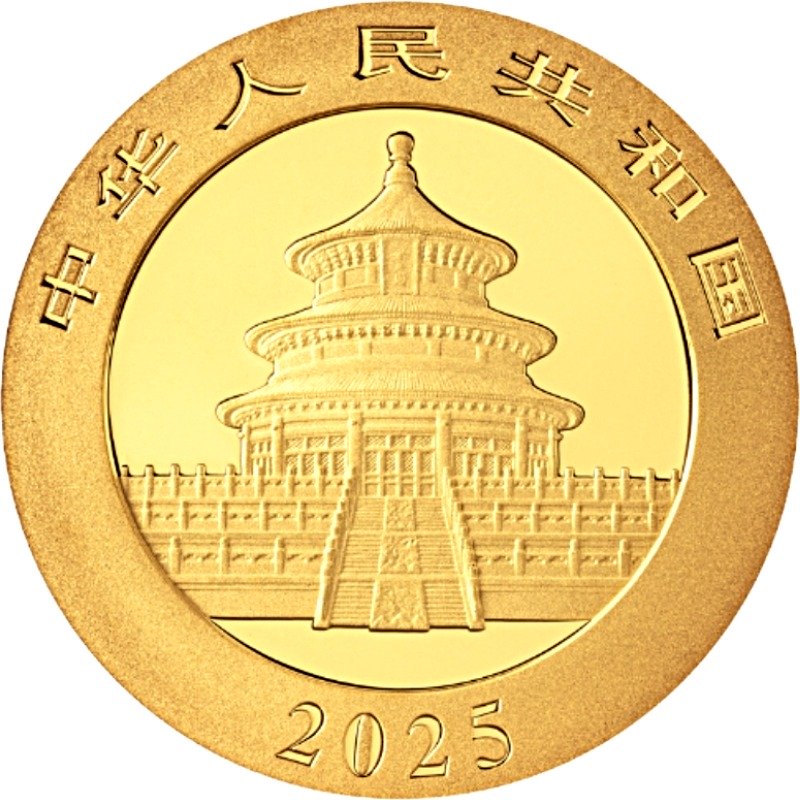

Panda Gold

Chinese Bullion Coins

1982 - Present

30 gram & 1 oz. - Panda Gold Chinese Bullion Coin

15 gram & 1/2 oz. - Panda Gold Chinese Bullion Coin

8 gram & 1/4 oz. - Panda Gold Chinese Bullion Coin

3 gram & 1/10th oz. - Panda Gold Chinese Bullion Coin

1 gram & 1/20th oz. - Panda Gold Chinese Bullion Coin

Other Pages you may like...

|

|

|

|

|

|

Chinese Bullion

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

February 2026

All Articles were Originally Posted on the Homepage