Homepage / Buying Guides: Plat & Pall Guide

Last updated on 03/08/2026

This Page is Under Maintenance...

Due to this, some images and/or text on this page may seem out of place or illegible.

BLUE TEXT IS TEXT THAT NEEDS MORE EDITING - PAGE UNDER MAINTENANCE

Platinum and Palladium Bullion

Buying Guide

with a list of

Reputable Bullion Dealers

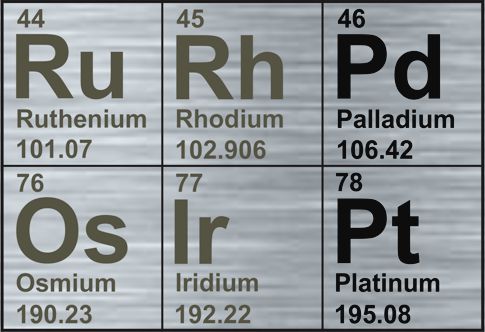

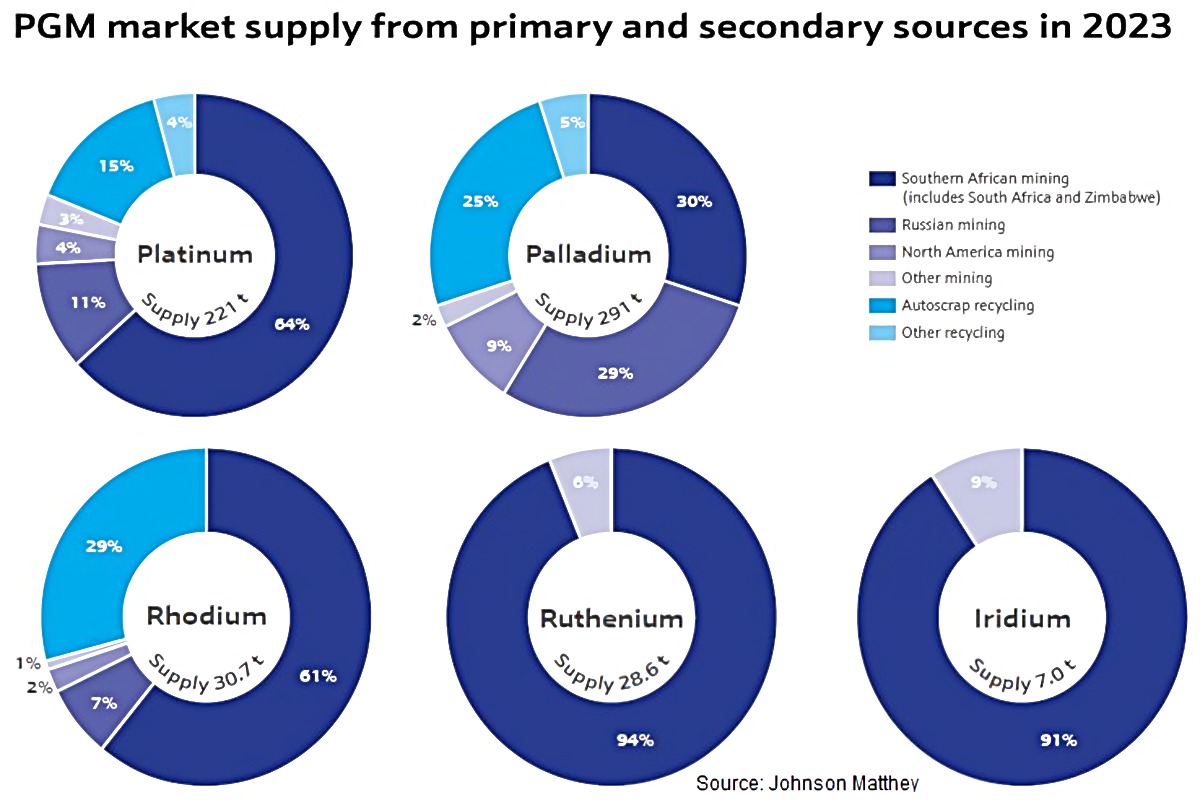

Platinum and Palladium are two precious metals that are in a family of six metals called Platinum Group Metals (PGMs).

The group of six metals includes platinum, palladium, rhodium, ruthenium, iridium, and osmium. They are rare metals that have similar chemical, physical, and structural properties.

Out of the six rare metals, osmium is the hardest and densest, palladium is the most abundant, iridium is the rarest, and rhodium is the most expensive; as of this writing, it was last worth more than $10,000.00 a troy ounce. (price source).

Platinum and palladium are valuable metals that possess unique precious and industrial properties, which help investors diversify their portfolios. The bullion is 99.95% pure and comes as coins or bars in different sizes, making it easy to buy and sell.

The following are the characteristics of Platinum Group Metals (PGMs) provided courtesy of Johnson Matthey:

- Platinum - Platinum is a dense, silverish-white transition metal. Platinum does not corrode, even at high temperatures. It is a indispensable industrial metal with durability and catalytic power. Mining and recycling of the metal are barely keeping up with demand which ensures that investment in the metal will remain high.

Platinum Applications: Jewellery, automotive, electronics, aviation, investment coins / bars, and medical technology

- Palladium - is a grey-white metal, it has the lowest melting point and is the least dense of all platinum group metals, which makes it easier to be worked. It is the most well-supplied PGM, with high demand for gasoline catalysts, chemicals, and electronics.

Palladium Applications: Emissions control, electronics, medical, investment coins / bars, military, and aerospace

- Rhodium and Iridium are difficult to work, but are valuable alone as well as in alloys. Their chemical compounds have many uses, both are particularly good catalyst. Rhodium is critical for reducing gasoline NOx emissions in catalytic converters. Iridium is used along with Platinum in Hydrogen Fuel Cells.

- Ruthenium and Osmium are hard, brittle and almost unworkable in the metallic state. The metals have poor oxidation resistance, but are valuable as additions to other metals, usually other PGMs, and as catalysts.

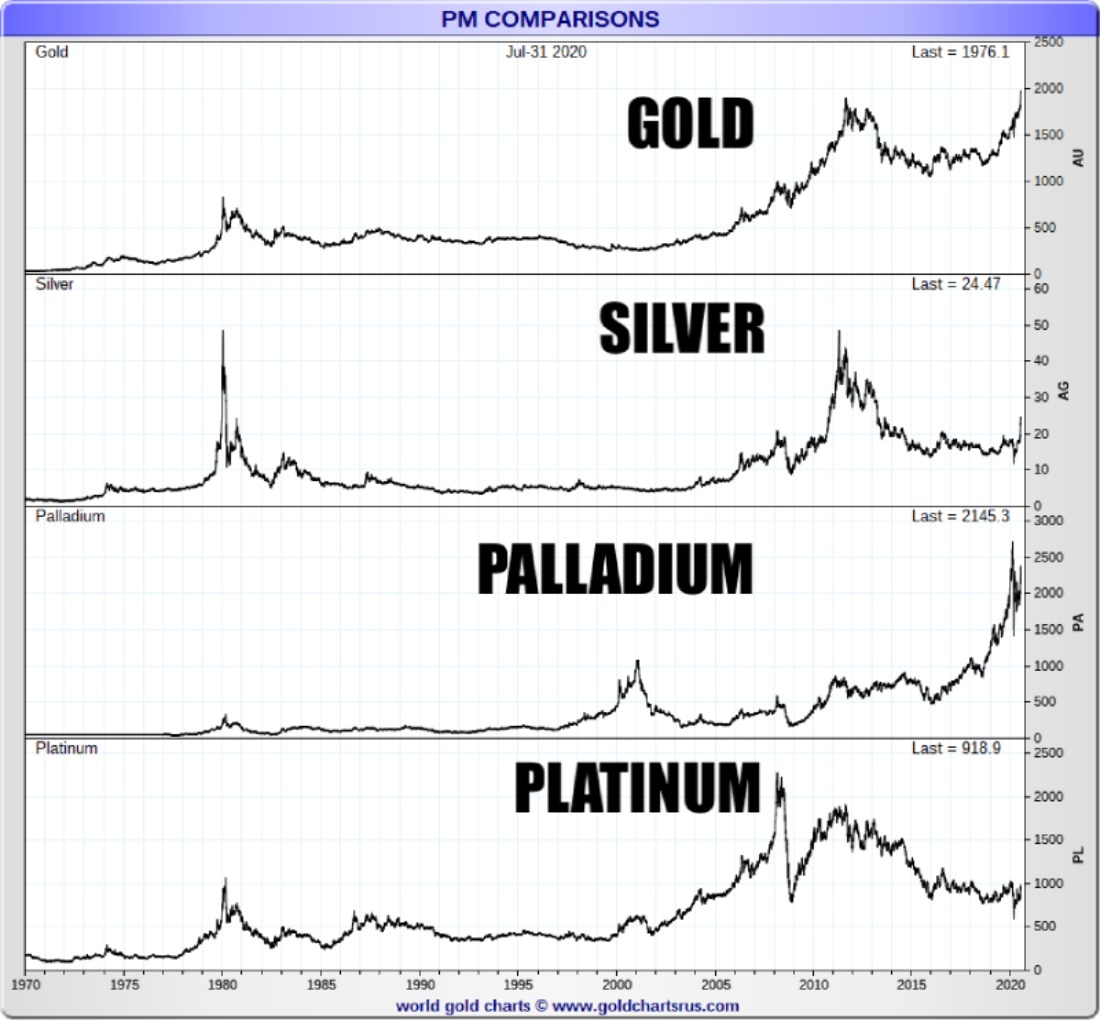

Platinum and Palladium Price Movements

The historic comparison chart below dates between 1970 and 2020; it shows you how gold, silver, platinum, and palladium prices have moved over the fifty-year time period.

Platinum and palladium primarily serve industrial purposes and are not as significantly impacted by investor demand as safe-haven assets compared to gold and silver. However, there are instances of monetary haven buying for these metals, as illustrated in the accompanying 4-way comparison chart.

Since platinum and palladium are primarily industrial metals; thus, investors should focus on their supply and demand dynamics when trading these metals as this buying guide will show.

2019-2020 Price Movements in the Chart Below: Palladium and Gold are seen moving higher late in the chart below coincidentally, and not for the same reasons. Palladium moved up in 2019-2020 because of its low supply and high demand in the automotive industry. Gold, on the other hand, was moving up for monetary reasons as a safe-haven precious metal due to the beginning of the COVID-19 era. Furthermore, even though silver also moves more as an monetary metal than an industrial metal, industry accounts for 55% of its market which makes it react slower to moving as fast as a monetary metal like gold. Platinum's market is mostly industrial like palladium, but it wasn't in deficit at the time and its industry drivers were not in overly high demand.

chart above provided courtesy of SD Bullion and goldchartsrus.com

Platinum Group Metals

Mine Locations & Production

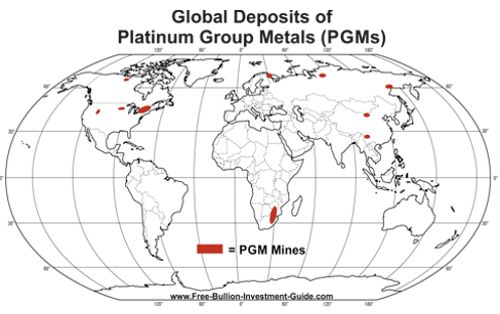

The small orange circles and ovals on the world map below offer you a glimpse into how rare Platinum Group Metals occur in the Earth's crust.

Platinum Group Metals (PGMs) ore deposits are 30 times rarer than gold. Mine production and the scarcity of platinum group metals are among the first things that investors in Platinum and Palladium should keep in mind.

Of all the deposits of Platinum and Palladium scattered around the globe, the largest ore deposits of Platinum Group Metals are found in South Africa.

The chart directly below gives you and idea of just how much South Africa provides the world of five of the six platinum group metals. (click chart to enlarge)

Because South Africa has so much to do with the supply of Platinum Group Metals, investors of these metals often to pay attention to South African news concerning mining unions and mines being shut down for a myriad of reasons.

Note: Prior to the Ukraine War, Russia was the primary provider of Palladium to global supply.

The following sections of this Platinum and Palladium buying guide provides you with the stepping stones to understand what the are the fundamentals that one needs to know before they buy into these precious metals.

Recognizing Demand

Since industry primarily determines how the prices of platinum and palladium fluctuate, knowing where demand is for these two precious metals is essential to investing in them.

Automotive Sector

The automotive sector is Platinum and Palladium's largest demand market.

This market sector should be one of the first sectors researched to find out how these metals have moved in the past, are moving now, and what may cause platinum and palladium to move in the future.

Q: What is it about the Automotive sector that influences Platinum and Palladium so much?

A: Catalytic Converters & Hydrogen Fuel Cells

How Catalytic Converters Work

Platinum, Palladium, and Rhodium are catalysts that are found in Catalytic Converters, which work by neutralizing 99% of a car's toxic exhaust gases to less harmful gases and water.

The gases that come out of an engine before they move through a catalytic converter are Hydrocarbons (HC), Oxides of Nitrogen (Nx), and Carbon Monoxide (CO).

After the gases move through the PGM honeycomb of a catalytic converter, the catalysts react with the toxic gases, converting them to Carbon Dioxide (CO2), Nitrogen Dioxide (N2), and Water (H2O).

The Environmental Protection Agency has called the Catalytic Converter "One of the Great Environmental Inventions of All Time.”

Gasoline vs. Diesel Catalytic Converters

and What you should know about Hybrid Engines

Investors who want to know the future demand of platinum and palladium should look into the sales of gasoline and diesel auto sector to get a grasp of how much demand their is for these metals.

One important key to knowing which metal will receive more demand in this sector is knowing which metal is used in each type of internal combustion engine, and what kind of vehicle has higher sales.

Gasoline Engines

- Catalytic Converters attached to Gasoline engines are filled with more Palladium than Platinum

Diesel Engines

- Catalytic Converters attached to Diesel engines are filled with more Platinum than Palladium

Hybrid Engines

- Catalytic Converters attached to Hybrid Gas or Diesel Engines have more Platinum or Palladium (depending on the fuel of the engine) because the exhaust pipe takes longer to heat up in these vehicles. Catalytic Converters work more efficiently when they are very hot.

Overall catalytic converters are found in generators, motorcycles, buses, tractor trailer trucks, and trains. They are found in the exhaust systems of almost every thing with an internal combustion engine.

The key is to know what industries use either unleaded gas or diesel engines that determine where demand may grow for Platinum or Palladium.

Hydrogen Fuel Cells

(FCEVs & PEMs)

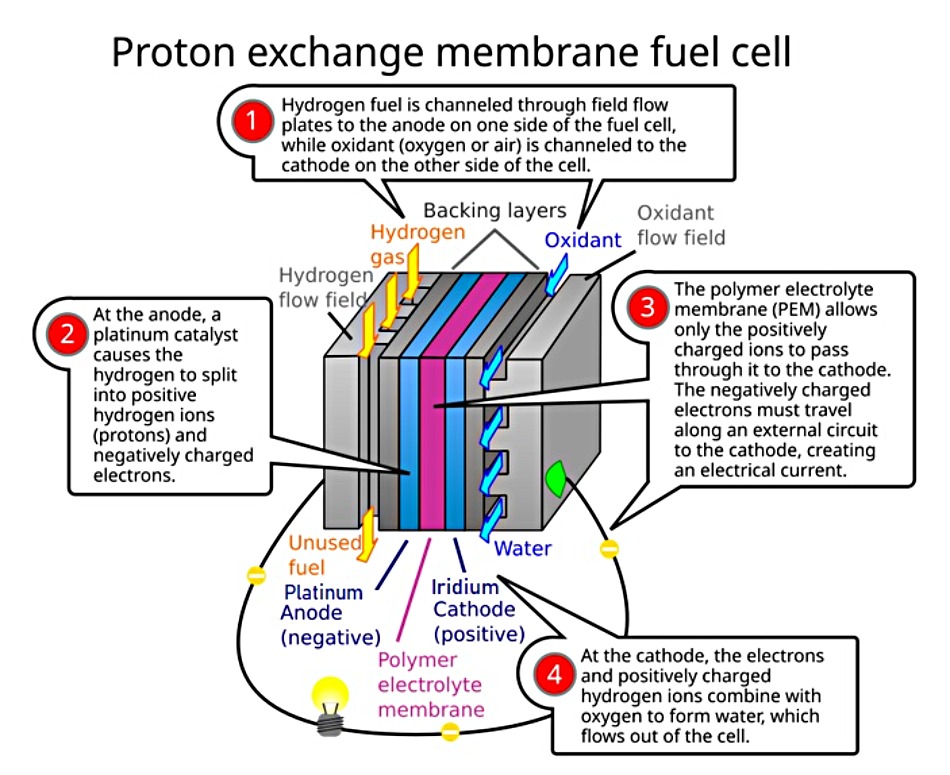

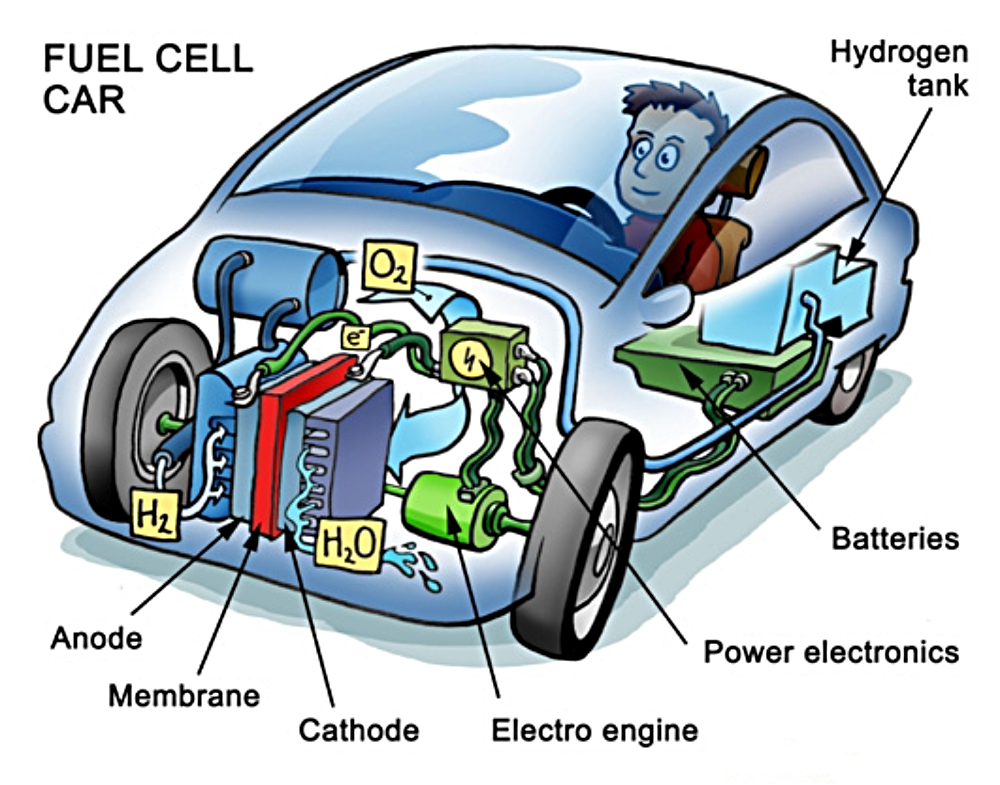

FCEVs stand for Fuel Cell Electric Vehicles and those vehicles with hydrogen fuel cells are run by PEM (Proton Exchange Membrane) fuel cells.

Platinum and Iridium are the two platinum group metals (PGMs) that are used in hydrogen fuel cells.

Hydrogen fuel cells are often referred to as Proton Exchange Membrane Fuel Cells or PEMs for short, click the image to the right to understand more how these fuel cells work.

According to Johnson Matthey, hydrogen fuel cells have been in use for over twenty years. However, their use in vehicles is still in its early stages, but they are a few car companies that offer Hydrogen vehicles.

Currently Toyota, Honda, and Hyundai offer Hydrogen Fuel Cell vehicles, but most the fueling stations for these vehicles are located in California and Canada. To find Hydrogen Fueling Stations in the United States and Canada click this Locator link.

Note: as of February 2026, Hydrogen Fuel Cells are a minuscule part of Platinum demand.

Electric Vehicles

Currently, there is no platinum or platinum group metals (PGMs) in the batteries used to power battery electric vehicles (BEV) models that are solely battery powered.

The following article will help you understand what metals are used in Electric Vehicles (EVs): CHART: EV battery metals index jumps to 27-month highPlatinum

Supply & Demand

Platinum Supply

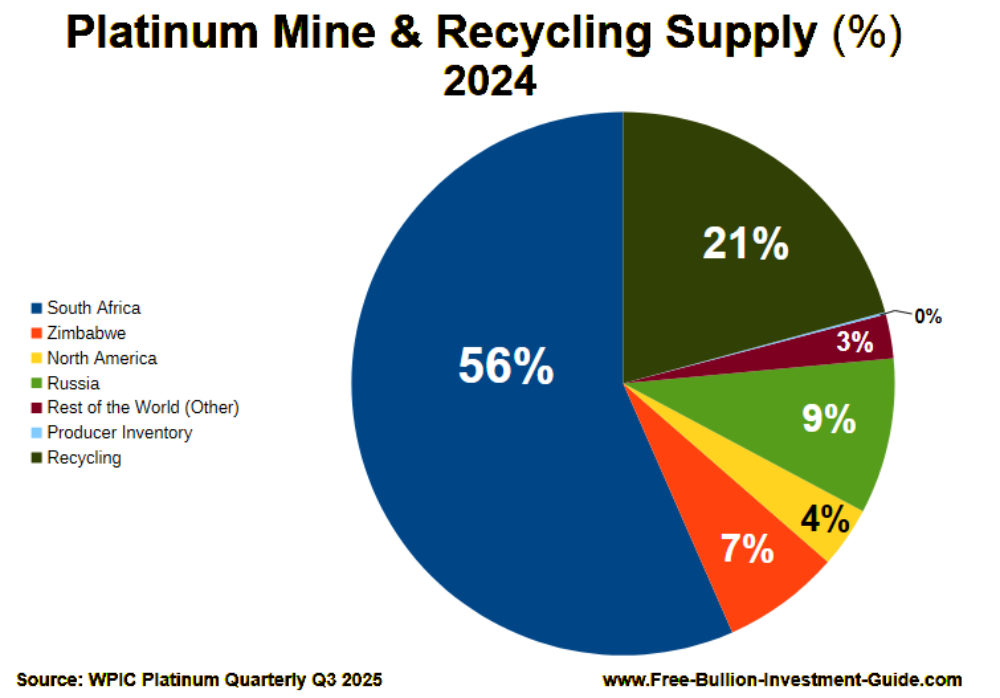

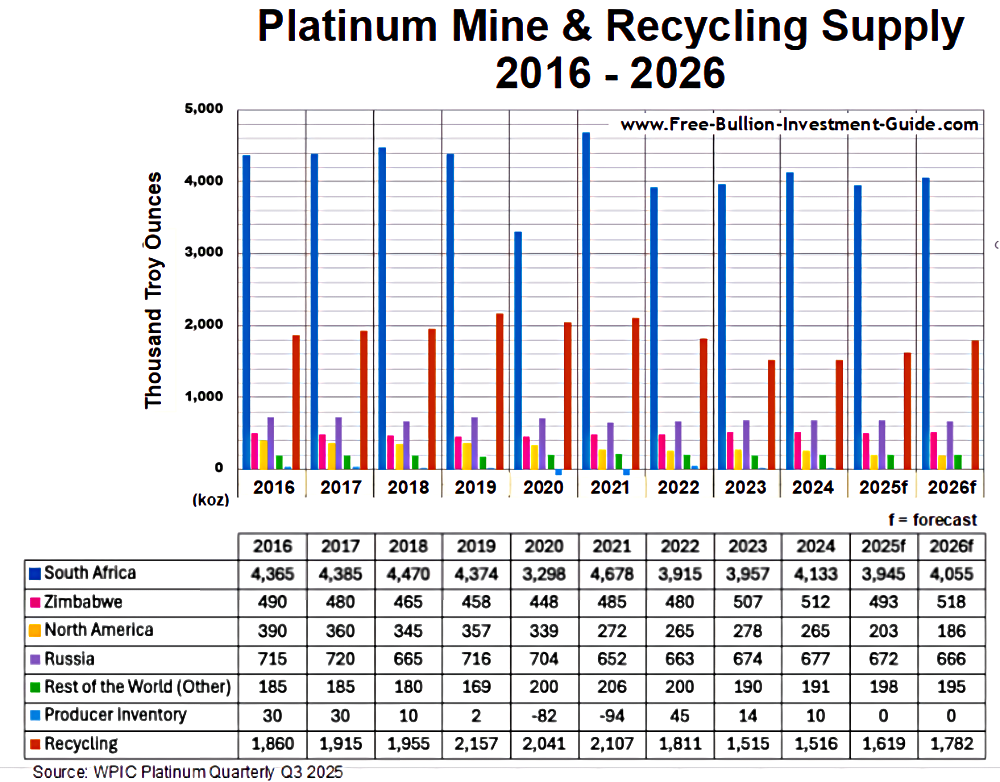

Source: WPIC Platinum Quarterly Q3 2025 page 20

International Recycling Symbol

International Recycling SymbolAs mentioned previously, South Africa is the world's largest supplier of platinum group metals.

South Africa accounts for more than 50% of platinum's the global supply, while the rest of the world accounts for a little over 20%.

As seen in the chart below, recycling is another major supply area for platinum, without it, platinum group metals would skyrocket because mine supply does not fulfill supply alone.

Recycling Supply of platinum is essential for demand, that is understood more when you see chart the next section on Platinum Demand. Sources of recycled platinum come from jewelry, catalytic converters, and other industrial recycling.

In relation to platinum supply, investors want to watch these areas of interest:

- Mine Efficiency in South Africa and other platinum mines around the world.

- Aging Infrastructure of South African Mines - some mines in South Africa have outdated equipment and energy shortages can be an issue.

- South African Mine shaft reduction - since 2008 35% of mine shafts have experienced sustained contraction.

- South African Mine Stoppages due to labor and union strikes, and power outages

- Decreasing Ore Grades - In South Africa miners are going deeper and are processing more material to extract the same amount of platinum

- New Mines opening in South Africa and around the globe - Platinum group metals have recently been found in Brazil.

- Recycling - rates of recycling, and more efficient ways of recycling platinum group metals

- Supply Reports and Forecasts by those in the industry: Johnson Matthey (link), Heraeus (link), World Platinum Investment Council (link)

Source: WPIC Platinum Quarterly Q3 2025 page 20

Platinum Demand

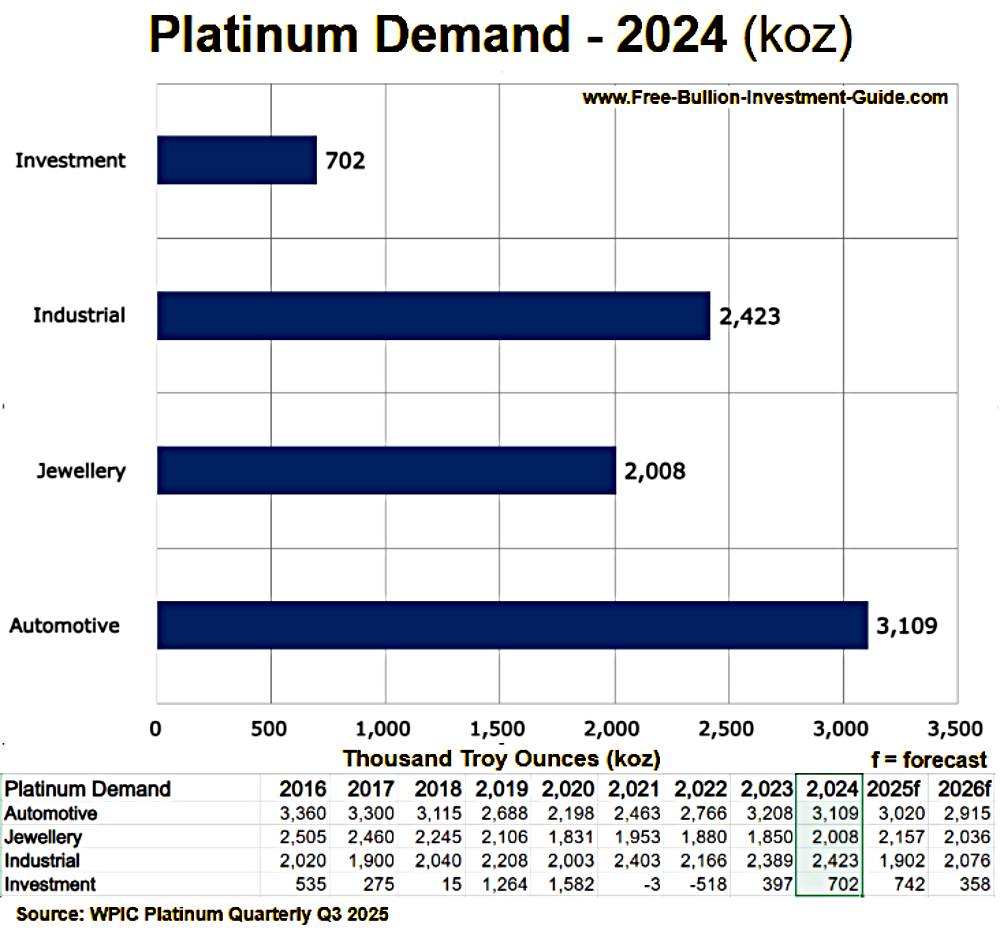

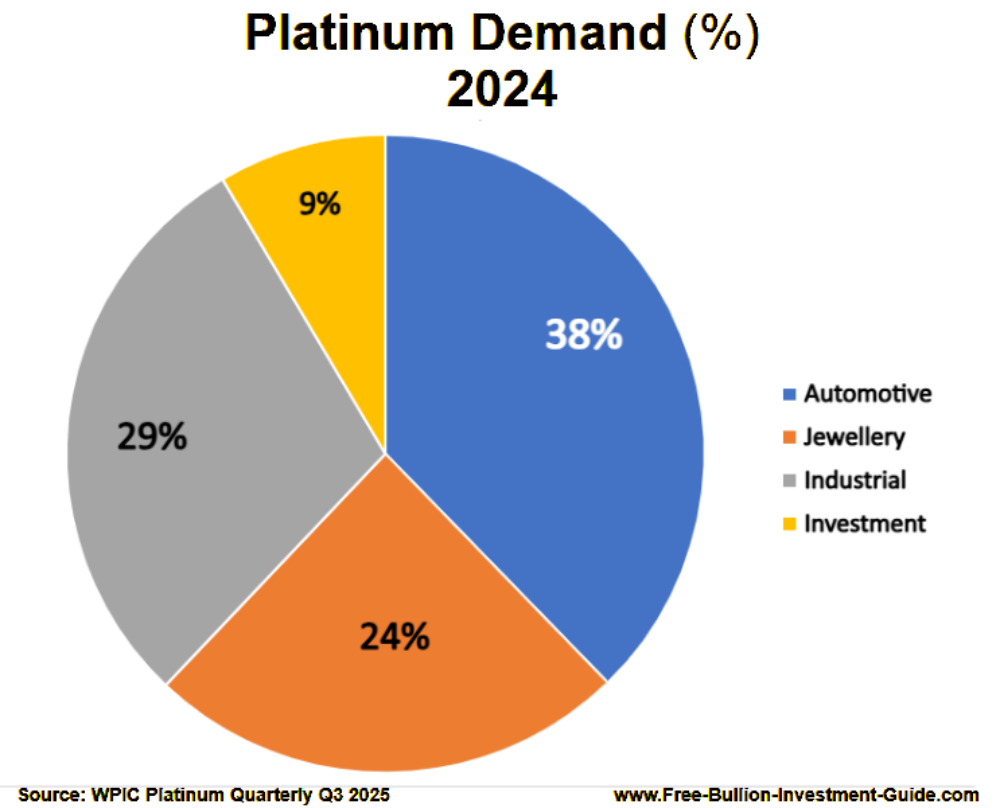

Source: WPIC Platinum Quarterly Q3 2025 page 20

When you compare totals of the Platinum Demand chart above with the Platinum Supply chart directly above it, you can see that the platinum market is, and mostly has been in deficit. Due to this fact, if demand continues to outpace supply, then the price of platinum should rise.

Platinum has a wide array of demand in its market. In relation to platinum supply, investors want to watch these areas of interest:

- Diesel Vehicle Sales - catalytic converters connected to diesel engines contain more platinum.

- Sales of Non-Road Diesel Engines - construction, agricultural and mining equipment

- Hybrid Diesel Vehicle Sales - catalytic converters in hybrid diesel vehicles have more platinum in them because it take longer for the exhaust pipes to heat up. (Note: Diesel hybrid vehicles are currently (02/2026), a small market: Mercedes, Volvo, Audi, and Range Rover are only manufactures)

- Hydrogen Fuel Cell Vehicle Sales - this industry is in its infancy, and as of (02/26), this market makes up a fraction of platinum demand, but that may change.

- Jewelry Demand - Platinum jewelry is popularity has broadened around the world to China and India, and has strong growth in the United States and Europe.

- Industrial & Chemical Demand - Platinum is used in oil refining processes, the making of computer parts, making of fertilizers, premium glass and fiber optics, and pharmaceuticals

- Investment Demand - physical metal bars and coins, as well as learning how many million ounces of platinum are held in exchange traded funds (ETFs).

- Demand Reports and Forecasts by those in the Industry: Johnson Matthey (link), Heraeus (link), World Platinum Investment Council (link)

Source: WPIC Platinum Quarterly Q3 2025 page 20

Palladium

Supply & Demand

Palladium Supply

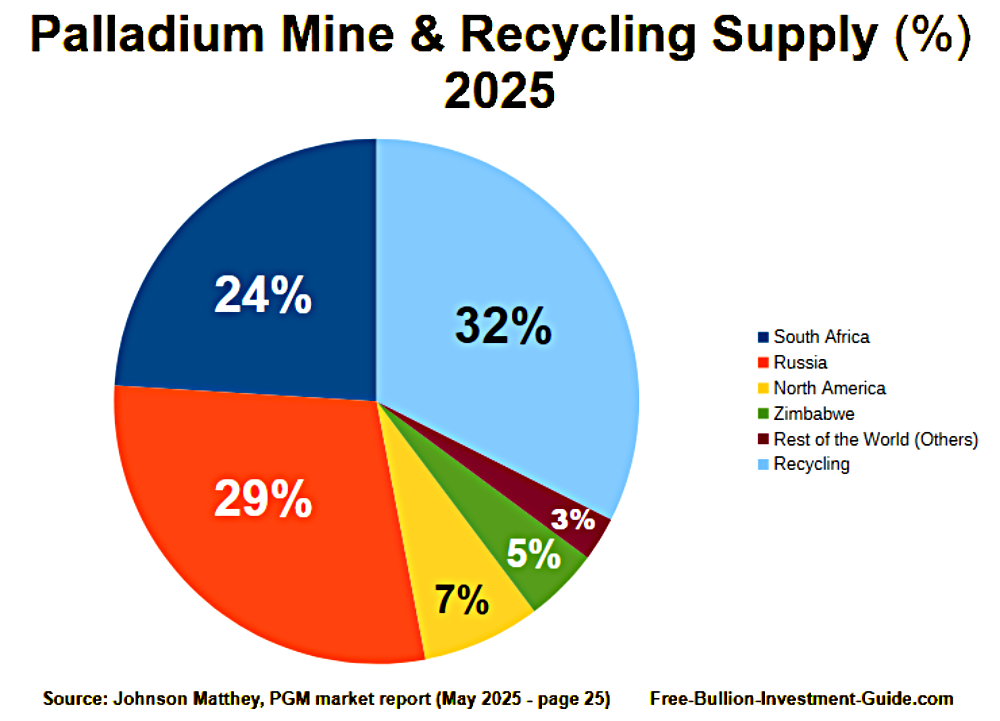

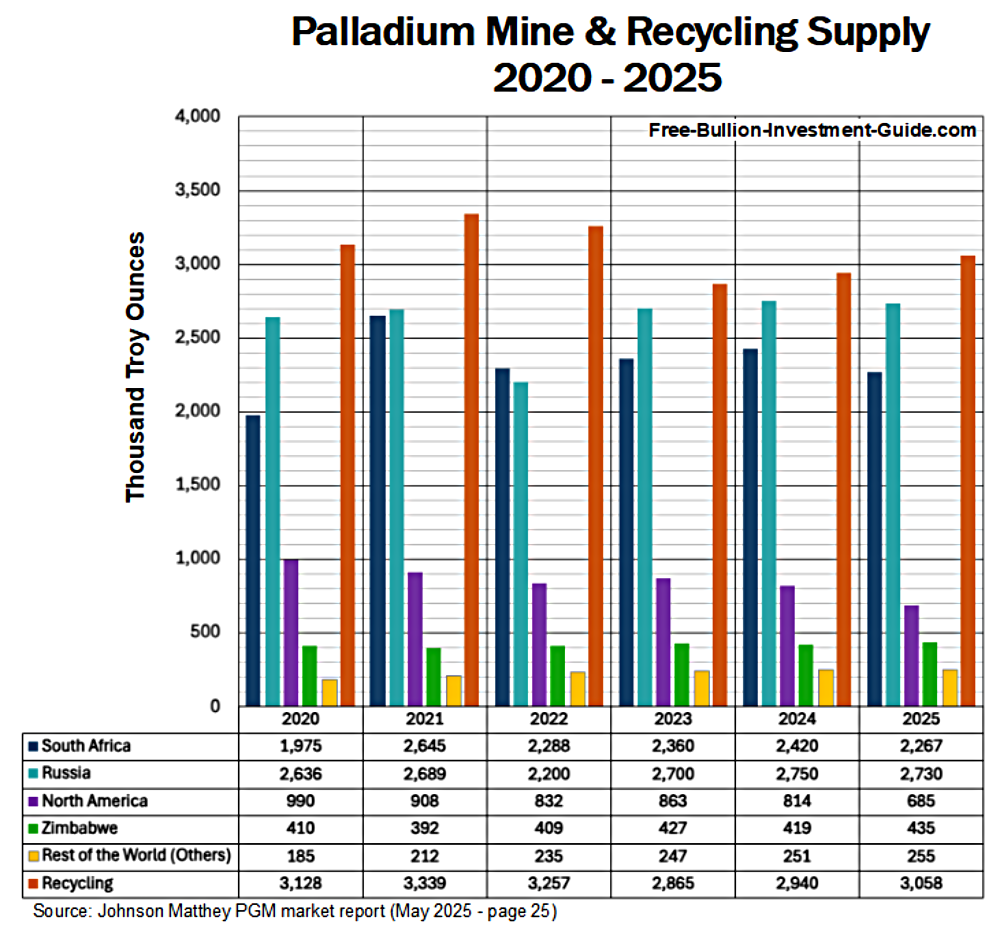

Source: Johnson Matthey PGM market Report (May 2025, page 25)

Recycled palladium provides the world with more palladium than any countries individual output, which comes from the recycling of catalytic converters from vehicles that burn gasoline.

Russia usually provides the most palladium to global supply. In the chart below, it indicates this with 2022 being the one exception which was the year the Ukraine War.

South Africa provides is the second largest supplier of raw palladium ore, with the rest of palladium ore deposits found in North America, Zimbabwe, and lesser known deposits found around the world.

In relation to palladium supply, investors want to watch these areas of interest:

- Gasoline Engine Vehicle Sales - the more of these vehicles that are sold, the more these catalytic converters will be recycled.

- Russian Palladium Supply - How much is Russia supplying global inventories. Sanctions has limited their ability to export their palladium and that could continue in the future.

- Russian Mine Disruptions - Norilsk Nickel is Russia largest palladium and nickel mining company. It has faced operational issues including flooding incidents that has periodically halted production.

- South African Mine Production Constraints: South African operations face persistent, severe power crises, aging infrastructure, and heavy rainfall causing operational delays.

- New Mines opening around the world - Palladium is the most abundant of the Platinum Group Metal and it is often found near nickel-copper ore deposits.

Source: Johnson Matthey PGM market Report (May 2025, page 25)

Palladium Demand

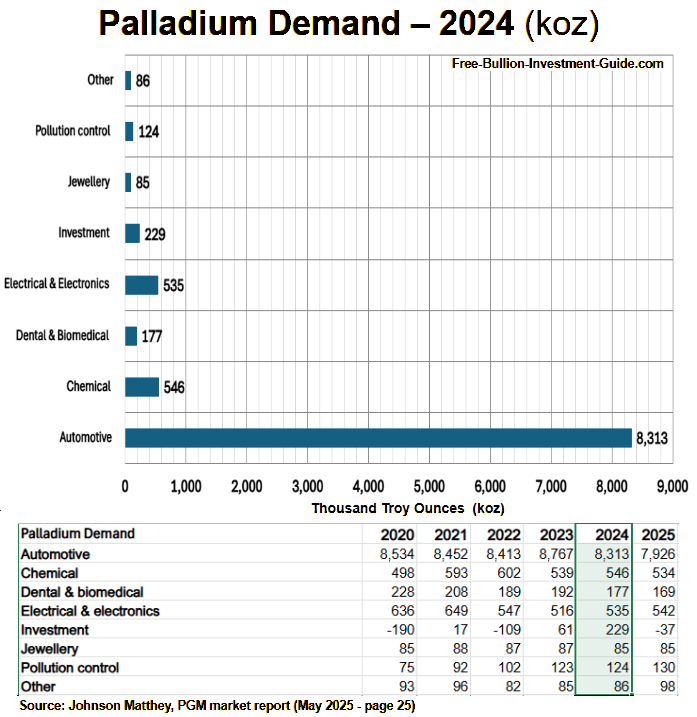

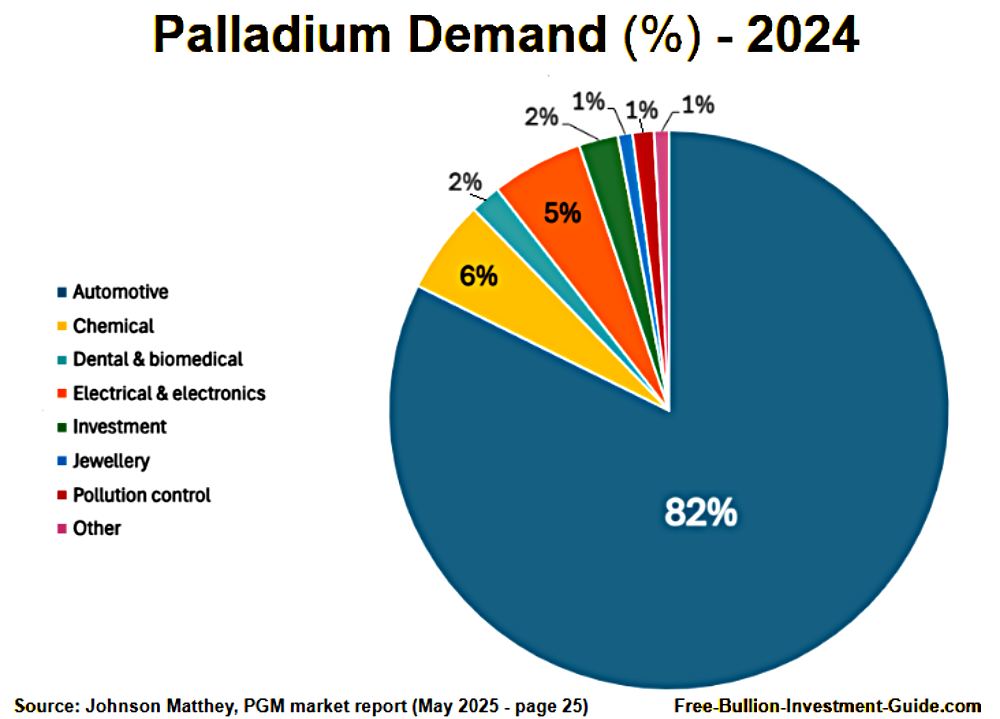

By looking at the chart above palladium demand is dominated by the automotive catalyst industry, and it is this one industry that moves palladium's price the most.

Unless another industry starts to take more of the market share of palladium, investors of palladium will need to mostly pay attention to the sales of Gasoline Engine Vehicles or Hybrid Vehicles that use Gasoline. Key note to remember about Gasoline Hybrid vehicles: their catalytic converters have more palladium because their exhaust pipes take longer to heat up and catalytic converters work better very hot.

In relation to palladium demand, investors want to watch these areas of interest:

- Gasoline Engine Vehicle Sales - the more of these vehicles that are sold, the more these catalytic converters will be recycled.

- Supply Deficits - Supply deficits have been an industry norm for several years and as long as the supply doesn't meet demand the price of palladium should continue to climb.

Source: Johnson Matthey - Market Reports

Physical Platinum Bullion

The rest of this bullion buying guide provides you with what you need to know as to what is available on the platinum and palladium physical bullion market. It also provides additional information that physical bullion investors need and a list of reputable online dealers that offer platinum and palladium physical coins and bullion.

Platinum and Palladium

Bullion Coins

Present and Past

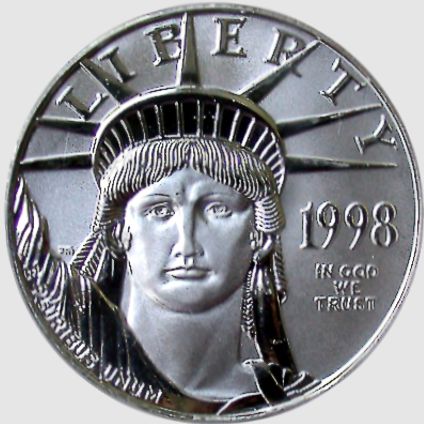

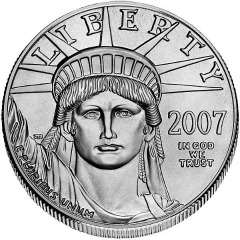

American Eagle Platinum

1oz. | 1/2oz. | 1/4oz. | 1/10oz.

1997 - Present

American Eagle Palladium

2017 - Present

Canadian Platinum

Maple Leaf

1988 to Present

Canadian Palladium

Maple Leaf

2005 to Present

Austrian Platinum

Philharmonic

2016 to Present

U.K. Platinum

Queen's Beasts

1oz.

2017 to Present

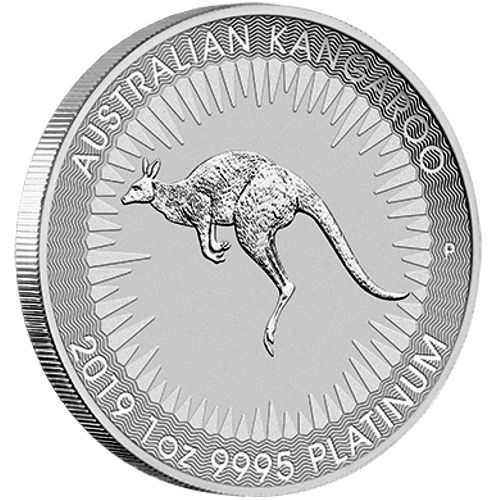

Platinum Australian

Kangaroo

2018 to Present

Platinum Australian

Lunar

2020 to Present

Platinum Australian

Platypus

2011 - 2018

Platinum Australian

Koala

1 kg. | 10oz. | 2oz. | 1oz. | 1/2oz | 1/4oz | 1/10oz. | 1/20 oz.

1987 - 2000

Palladium Australian

Emu

1oz.

1996 - 1998

Soviet Union / Russian Palladium

Ballerina

1oz. | 1/2oz. | 1/4oz. | 1/10 oz.

1989 - 1995

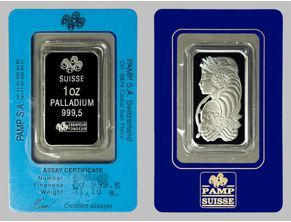

PGMs Bullion Bars

Platinum and Palladium bars are available in all shapes and sizes.

Bullion bars come in three categories, Minted, Extruded, and Cast a.k.a. Poured bullion.

Most Platinum and Palladium bullion bars are minted, not poured, which has a lot to due with Platinum and Palladium's high melt temperatures.

- Platinum's melt temp is 3,215°F / 1,768°C

- Palladium's melt temp is 2,831°F / 1,555°C

Minted bars have a more refined, smoother look than other bullion bars, plus many have a proof-like finish.

Bullion Bar Bullion BarMinting Process |

PAMP - Minted PAMP - Minted1oz. Palladium Bar |

You can find platinum, palladium, and rhodium bullion bars produced by PAMP, Credit Suisse, Valcambi, Johnson Matthey, and Engelhard, among other bullion refiners.

Below you'll find bullion dealers that offer several different types of platinum and palladium bullion.

Bullion Storage

The Free Bullion Investment Guide provides storage guides listed below for those who want to own precious metals but aren't sure which form of storage is best for them.

For those unfamiliar with the various options available for storing assets, including precious metals, our Vault Storage of Assets Buying Guide offers comprehensive information on numerous asset storage solutions.

If you want to learn more about storing precious metals at home, see our Home Safe Buying Guide.

or

If you want to own, store, and trade precious metals abroad, you will want to see our Vault Storage Brokerages Buying Guide.

Furthermore, below is a list of reputable dealers and brokers that offer silver bullion in its many different forms, and there are direct links to their storage services for those who provide it.

List of Reputable

Platinum / Palladium

Bullion Dealers

Note: As a suggestion to anyone interested in buying bullion from any one of the sites listed below, Please Read each company's ordering instructions and shipping rules carefully.

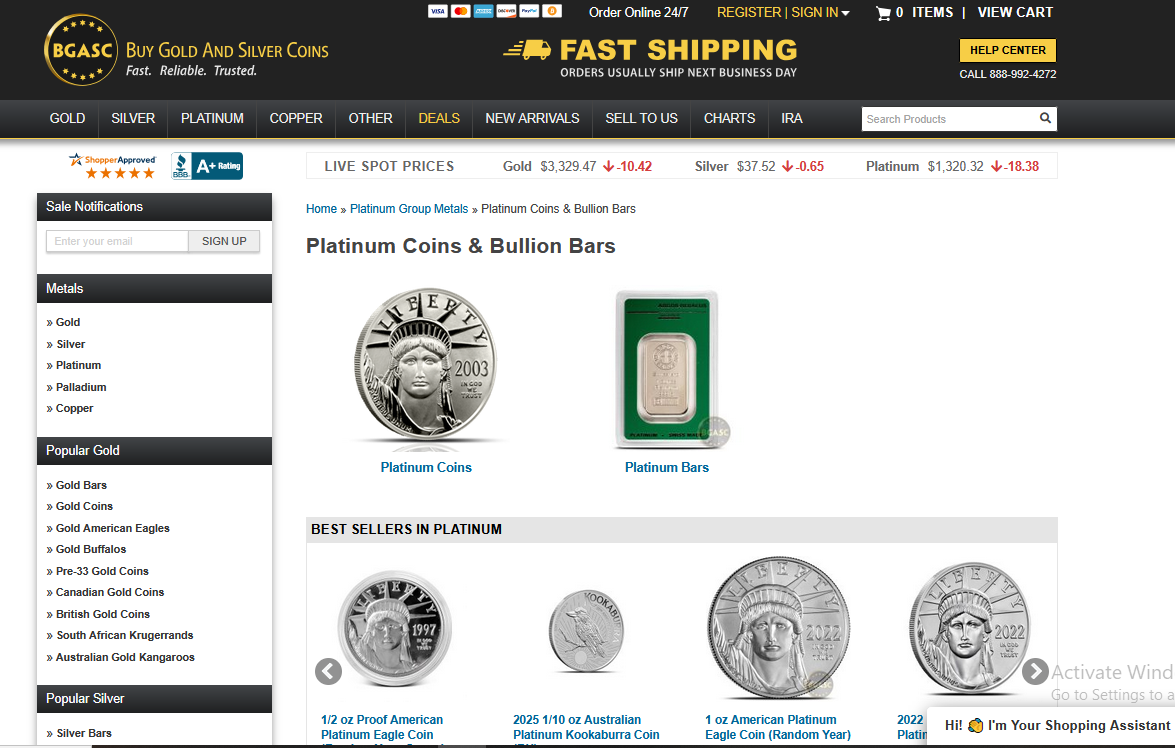

Free Shipping on Orders $199+

BGASC is one of the largest coin and bullion dealers in the United States.

Buy Gold And Silver Coins.com's goal is to be the kind of dealer you've always wanted to trade with: to be in stock, ship fast, be fair & reasonable, and operate honestly and efficiently.

Every single package they ship is sent fully insured for its time in transit.

Customers all across the country have quickly come to recognize BGASC as one of the fastest, and most trusted online precious metals suppliers in the U.S.

Free Shipping on Orders $199+

BBB - Customer Reviews

Stefan Gleason is president of the Money Metals Exchange, which is a national precious metals investment company and news service with over 500,000 readers and 75,000 customers.

Gleason

founded the company in 2010 in direct response to the abusive methods

of national advertisers of collectible, and numismatic coins.

Money Metals Exchange believes the average investor should never purchase precious metals that are not priced at or near their actual melt value.

Now you can safeguard your assets from financial turmoil and the devaluing dollar – without paying costly middleman mark-ups or fending off high pressure, bait-and-switch sales tactics.

Savvy, self-reliant investors are embracing Money Metals Exchange as their trustworthy resource for gold and silver bullion.

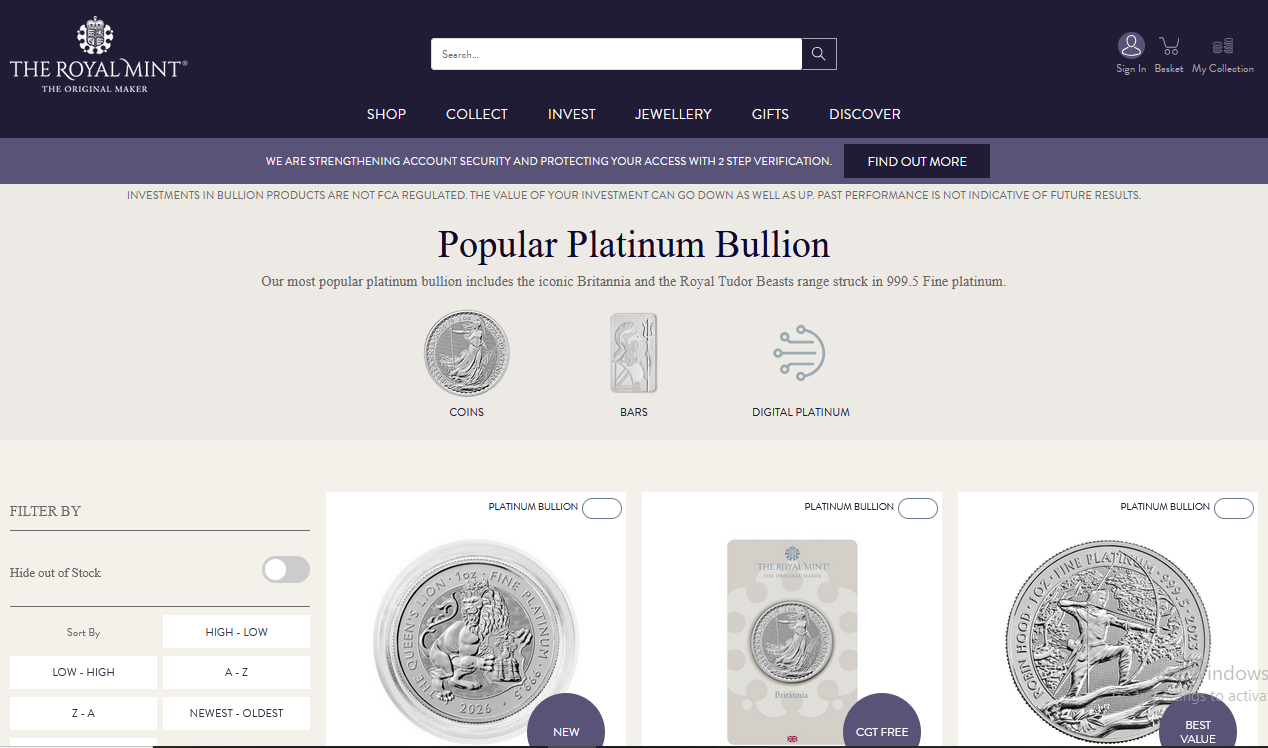

The Royal Mint (U.K.) Delivery Rates

The Royal Mint is known as "The Original Maker" and has over millennia of experience in minting coins globally recognized for its designs and craftsmanship.

The Royal Mint strives to make the customer their primary focus by consistently improving their minting practices to make their bullion more appealing while protecting it from counterfeiters.

Their bullion coins and bullion bars showcase the characteristics of British heritage, which is what makes them sought after by collectors and investors, worldwide. As the Original Maker, the Royal Mint is staying true to its roots while keeping its eyes on the horizon.

Free Shipping on Orders $199+

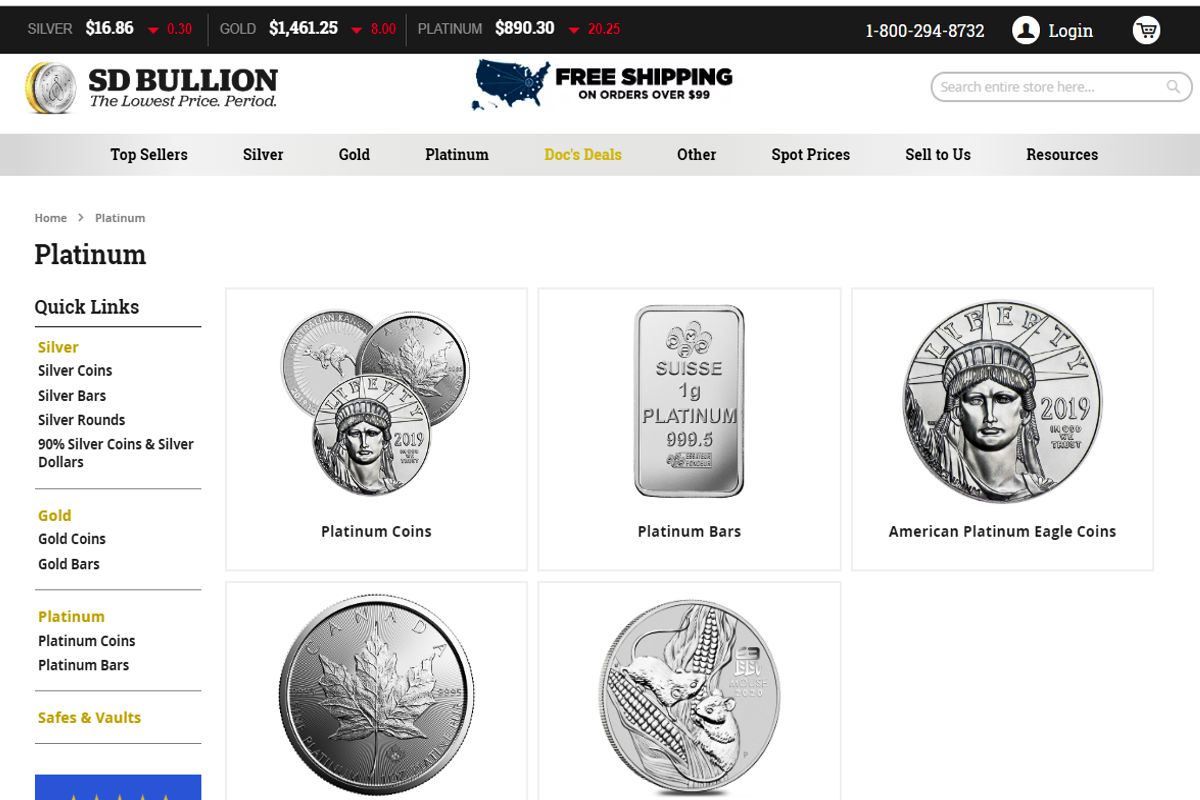

SD Bullion is a Precious Metals Dealer located in Michigan and is part of the Silver Doctor's network.

In 2011, two doctors started the website SilverDoctors.com with one dream: To educate the masses on the value of hard assets and preparation.

The rapid success of this website gave way to the launch of SDBullion.com in March of 2012. SD Bullion now is one of the most trusted, lowest cost online retailers of bullion.

Since 2012, SD Bullion has shipped more than 300,000 orders and hit Inc. Magazines list of 500 Fastest Growing Companies in the United States twice.

They did all this while staying true to their original mission of offering the absolute lowest prices on gold bullion and silver bullion in the industry, guaranteed.

Free Shipping on Orders $199+

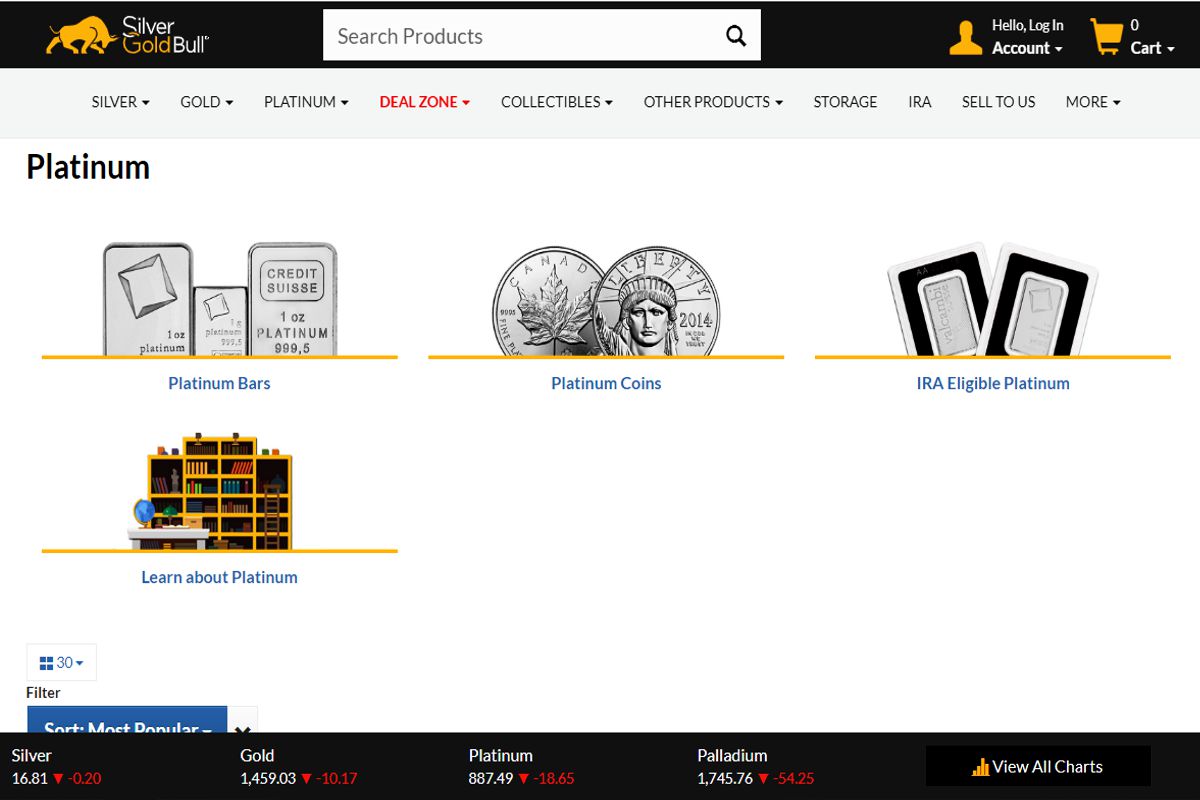

SilverGoldBull has tens of thousands of satisfied customers who have taken their financial future into their own hands by investing in gold and silver.

This bullion dealer is based in Canada and offers a wide variety of precious metals bullion for you to choose from, their commitment to you is to provide extraordinary service throughout your bullion buying experience.

SilverGoldBull provides you with competitive, up-to-minute pricing and we make sure your precious metals are delivered to your door discreetly and fully insured.

SilverGold Bull's in-house customer service representatives will work to assure your satisfaction in a timely, friendly, and professional manner. Never hesitate to get in touch - building relationships with our clients is our number one priority.

If you would like to learn more about what our customers are saying about our service, please view our customer reviews (below).

Shipping prices

vary by item

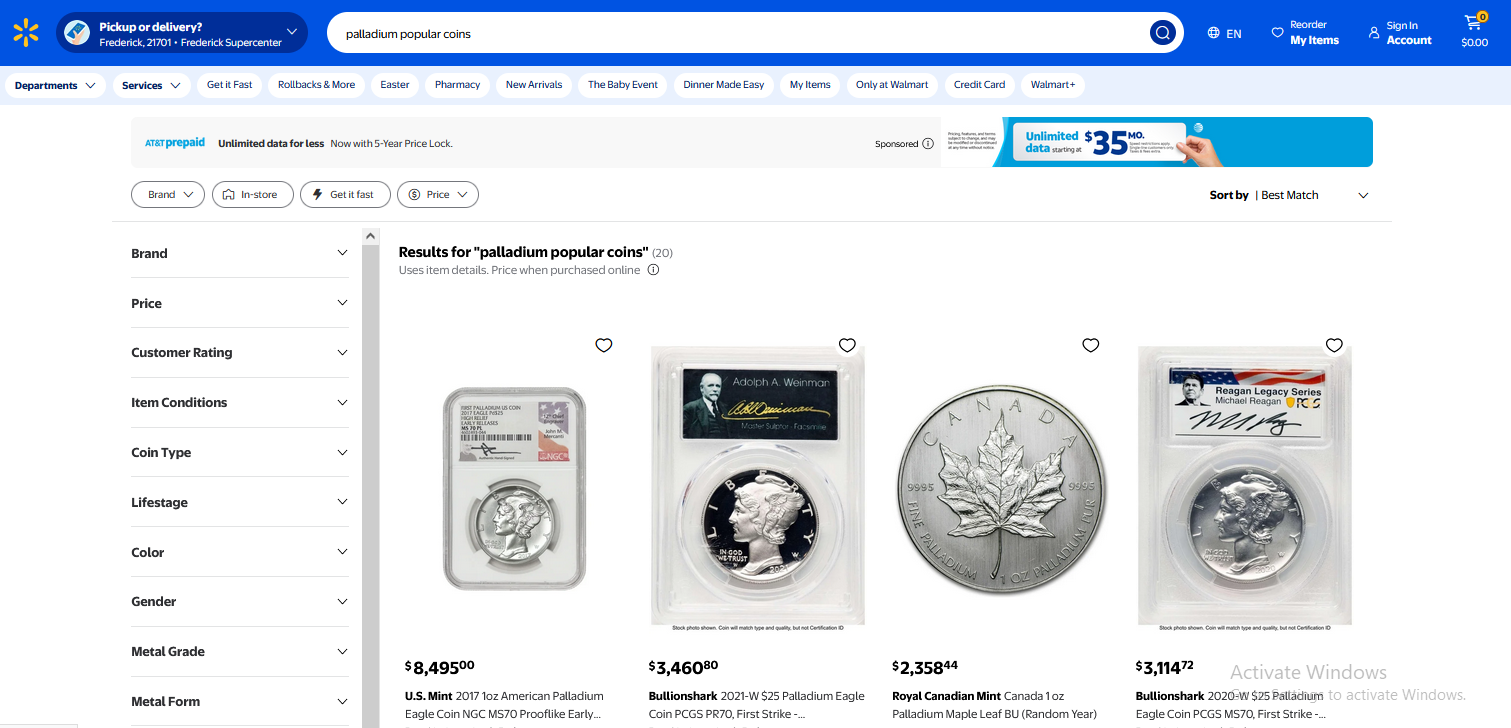

Walmart sells bullion from various reputable dealers; it is advised to avoid items without a specified seller or shipper.

Walmart - Palladium Popular Coins page

Walmart - Palladium Popular Coins pagePrecious Metals from America's Superstore, offering deals from the Top Online Bullion Dealers in the Industry; including: SD Bullion, APMEX, Scottsdale Mint, and more. Walmart's marketplace allows these dealers to offer a wide selection of coins and rounds that you will likely not find anywhere else.

Walmart Inc. is an American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores in the United States, headquartered in Bentonville, AR.

Walmart’s core purpose is summed up in its mission statement and slogan: "We save people money so they can live better.”

Sam Walton famously remarked upon receiving the Presidential Medal of Freedom award in 1992 that, “If we work together, we’ll lower the cost of living for everyone…we’ll give the world an opportunity to see what it’s like to save and have a better life.”

Throughout its 50+ years of history, Walmart has stayed true to its purpose and consistently striven to offer low everyday prices to its customers, and because of this, Walmart has built for itself a strong and loyal customer base.

Low-price leadership is primarily achieved through Walmart's extensive network of suppliers, which allows them to purchase merchandise in bulk at lower prices than competitors.

Platinum, Gold, and Silver

Bullion Broker &

Storage

4.7 star - Customer Reviews

|

BullionVault is the world's largest online bullion investment service taking care of $7 billion for more than 75,000 users. The bullion you own is held in vaults. Bars are stored in professional-market vaults in Zurich, London, Toronto, Singapore or New York. You choose where. Because of their size, you benefit from the low storage costs they've negotiated, which always include insurance. |

with Bullion Vault |

The video below goes into further detail about Bullion Vault's services.

Bullion Buying Guides

Other pages you may like...

|

|

|

|

|

|

For the Latest Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

February 2026

All Articles were Originally Posted on the Homepage

4.7 star - Customer Reviews