Homepage / Bullion Coins: British (U.K.) Coins

The Royal Mint &

United Kingdom Bullion Coins

The Royal Mint is known as "The Original Maker" and has over millennia of experience in minting coins globally recognized for its designs and craftsmanship.

The Royal Mint strives to make the customer their primary focus by consistently improving their minting practices to make their bullion more appealing while protecting it from counterfeiters.

The Sovereign, Britannia, and Queen's Beasts bullion coins showcase the Royal Mint's characteristics, which is what makes them sought after by collectors and investors; and as the Original Maker, the Royal Mint is staying true to its roots while keeping its eyes on the horizon.

"The Original Maker"

The history of coinage in Great Britain dates back to the second century BC. In AD 43, the Romans conquered Britain and established mints across the country, producing Roman coins.

It was not until after the Romans had left Britain and the English Kingdoms emerged that a London mint was in regular operation in the sixth and seventh centuries.

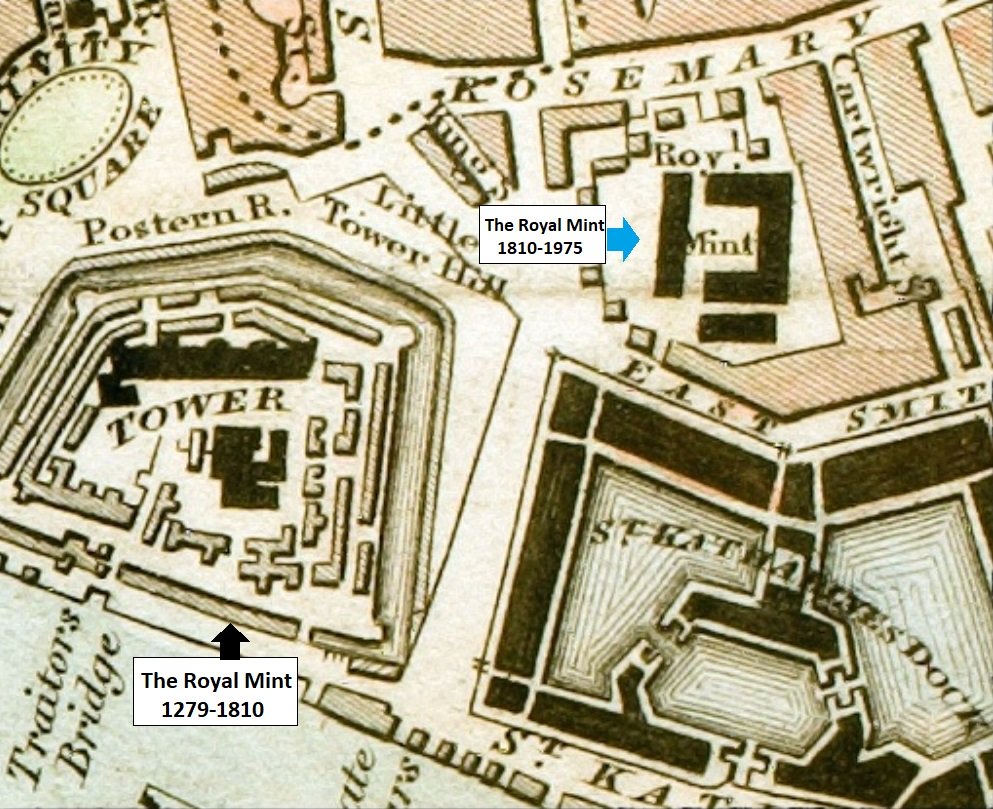

Tower of London

Around 650 AD, with as many as 30 mints dotted throughout the countryside of Britain, the Royal Mint was quite unorganized until the reign of King Alfred the Great (871–899 AD).

By the thirteenth century, the number of mints had been reduced, with most of the minting confined to the Canterbury and London mints.

In 1279, the country's mints consolidated and moved to a more secure location, the Tower of London.

Medieval coinmaking at the Royal Mint was noisy, hot, and very dangerous; all coins were handmade, people worked around huge, fiery furnaces, the air was full of hazardous chemicals, and few who worked at the mint had all their fingers and eyes.

Medieval Minting Techniques graphic provided courtesy of the Bode Museum, Berlin Germany: Source link.

Note: Medieval minting techniques graphic, the right image, depicts a Minting apprentice who looks similar to a medieval jester (Coins Weekly): Source link.

First Gold Sovereign

During the reign of Henry VII, in 1489, the mint produced its first Gold Sovereign; on October 28th, 1489, the King instructed the Royal Mint to mint "a new money of gold."

The name "English Gold Sovereigns" originated from the monarchy's depiction on the coin's obverse side.

The earliest gold sovereigns were minted of 23-karat gold (95.83% gold, 4.17% copper); nevertheless, in 1526, the fineness of the currency was decreased to 22-karat gold (91.667% gold and 8.33% copper), which became known as Crown Gold.

Crown Gold is a gold and copper alloy that is considerably less prone to wear than the softer 23-karat gold of earlier gold sovereigns.

In medieval times and earlier, coins were often the only way the public had any idea what kings or queens looked like.

British Gold Sovereigns are the oldest gold bullion coins still in production.

Creating the Gold Standard

Silver was the first metal used as currency; from 3100 BC to the 18th century, nations traded on a Silver Standard, where silver was the foundation for paying wages, salaries, and trade.

From the 12th century to the early 18th century, silver traded roughly at or near a 12:1 ratio with gold.

In 1717, to help England through the inflation of the time, Sir Isaac Newton, who was Master of the Royal Mint, introduced a fixed ratio between gold and silver of 15½:1.

He moved the Pound Sterling, the silver standard of the time, to the gold standard by setting the bi-metallic relationship between gold and silver coins in favor of gold.

This created the first recorded Gold Standard.

The Royal Mint

at Tower Hill

The Royal Mint remained at the Tower of London for over 500 years; by the 1600s, mechanized minting became the norm; machine mills and presses improved working conditions, coin design, and the edges of coins.

The coin enhancements were also needed to discourage coin clipping (monetary debasement).

As innovation enhanced the minting process, it magnified the need for larger facilities. The Tower of London location became outdated; the buildings were held up by old timbers and cramped, making the facilities inadequate for larger steam-powered minting machines.

This led to plans for the mint to move to Tower Hill.

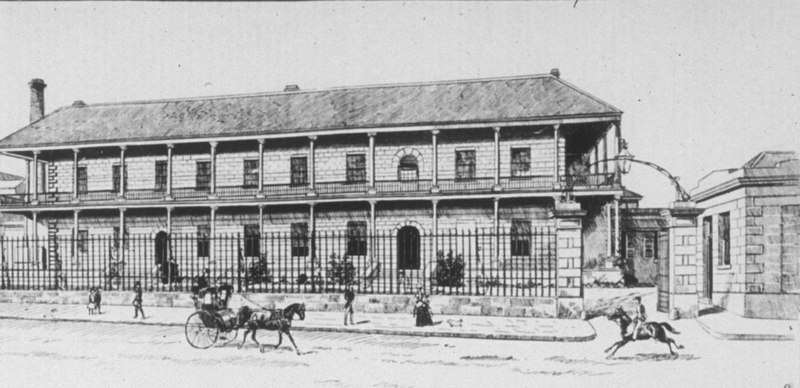

In 1805, construction started on a new mint at Tower Hill, a stone's throw away from the Tower of London; construction on the buildings for the Royal Mint's new facilities ended in 1811.

During the late 1800s, the Royal Mint's Tower Hill facilities expanded, capacity increased, steam power replaced electricity, and restoration became a constant as the mint struggled to keep up with demand.

To help meet global monetary demand, the Royal Mint opened six overseas mints.

Royal Mint - Overseas Branches

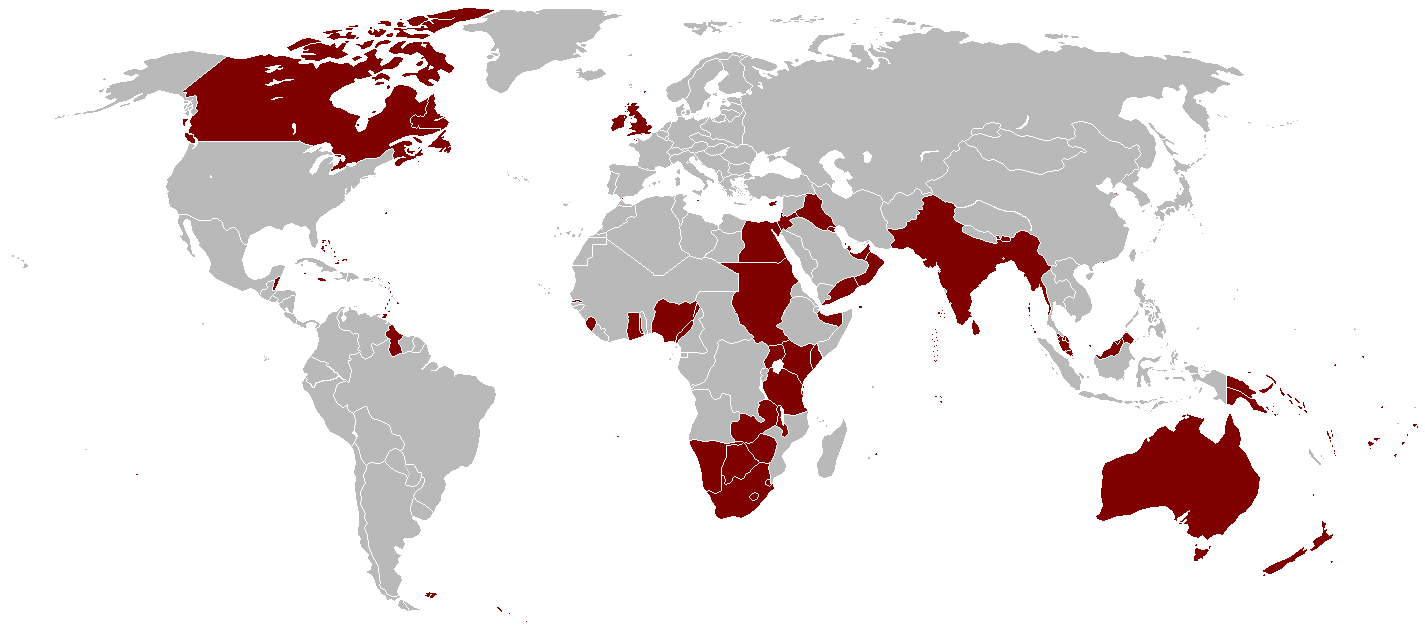

In the 1800s, the British Empire's global influence consistently grew, and the Royal Mint expanded overseas by establishing satellite mints to refine gold and silver ore to expand its currency and economic influence. (Map image provided courtesy of Vadac)

Australia

Australia received the first of three satellite mints: Sydney in 1855, Melbourne in 1872, and Perth in 1899.

In addition to serving the Royal Mint, the Australian government used the three branches to mint gold sovereigns and circulated coins for the Continental nation.

The Melbourne and Perth branches had capabilities superior to those in Sydney, and they took over production responsibilities for Australia when the Sydney branch closed in 1926.

Following the creation of the Royal Australian Mint as the principal mint for Australian coinage, the Royal Mint divested the Melbourne and Perth mints in 1970.

Today, the Perth Mint is operated by Gold Corporation and wholly owned by the Government of Western Australia, and the Melbourne Mint is privately owned.

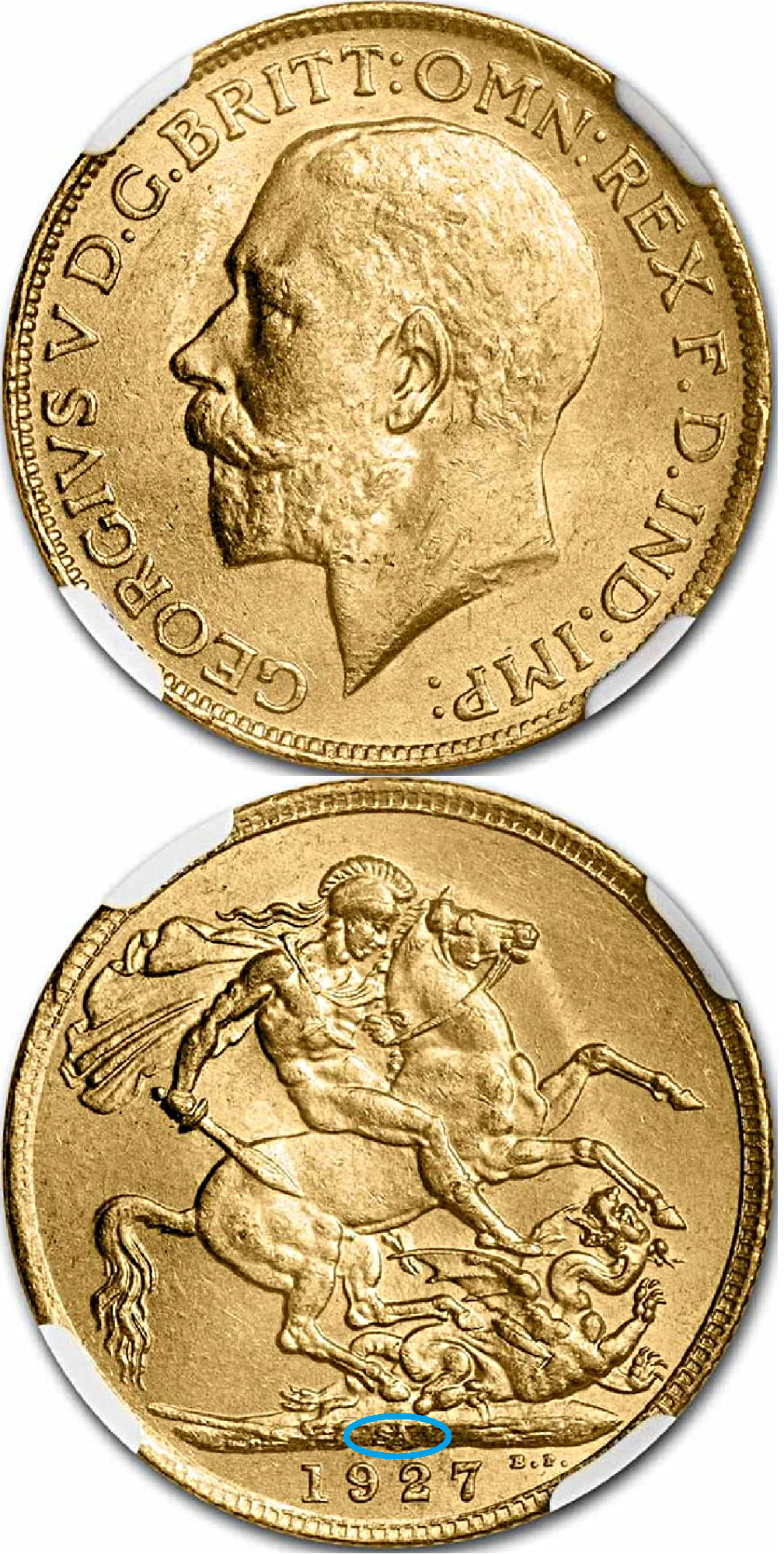

Gold sovereigns from the Royal Mint in Australia are characterized by the first letter of the mint where they were struck: "S" for Sydney, "M" for Melbourne, and "P" for Perth. The mint markings are seen on the ground above the "year of issue" on each of these gold sovereigns.

Canada

Canada had been under British rule since 1763; as Canada developed, the Royal Mint decided to build a mint in Ottawa to refine gold mined in British Columbia and the Yukon.

On January 2, 1908, the Royal Mint was opened by Lord Grey, producing coins for circulation, including gold sovereigns. Gold sovereigns minted at the Royal Mint in Canada have a "C" mint mark for Canada; the mint mark is on the ground above the year of issue.

On December 1, 1931, the Canadian branch of the Royal Mint was transferred to Canada's Government and renamed the Royal Canadian Mint (RCM).

India

In 1918, a Royal Mint branch was established in Mumbai (Bombay), India, to issue British gold sovereigns.

Between 1918 and 1919, over one million gold sovereigns were struck in India, distinguished by an "I" mint mark on the ground above the "year of issue." The branch closed in 1919.

Learn more about these coins here: PCGS - The 1918-I Gold Sovereign and its Connection to India.

South Africa

The Royal Mint established a branch in the Union of South Africa in Pretoria on January 1, 1923, producing millions of gold sovereigns in its lifetime. As South Africa began cutting ties with Britain, the mint closed on June 30, 1941, and reopened in 1988 as the South African Mint.

Gold Sovereigns minted in South Africa are distinguished by an "SA" mint mark on the ground above the "year of issue."

The Royal Mint at Llantrisant

In the 1960s, the Royal Mint's capacity at Tower Hill reached its limits, making it insufficient for the mint's needs.

On March 1, 1966, the United Kingdom's government announced plans to decimalize the nation's currency, requiring the withdrawal and re-minting of many millions of new coins by February 15, 1971, known as "Decimal Day."

The Royal Mint needed larger facilities to strike hundreds of millions of decimal coins while at the same time keeping up with demand from its overseas customers.

In 1967, the Royal Mint announced that it would move from Tower Hill to a 38-acre site in Llantrisant, South Wales; Her Majesty Queen Elizabeth II opened the first building in December 1968.

Over the next seven years, the Royal Mint gradually relocated production to Llantrisant, with the final coin, a Gold Sovereign, minted at Tower Hill in November 1975.

The mint has operated as The Royal Mint Ltd., a limited company, since December 31, 2009.

The Royal Mint strives to make the customer their primary focus; its location at Llantrisant has become a favorite touring site, and the website offers excellent customer service, as its customer reviews reveal here.

Source: The Royal Mint

Bullion Coin Values

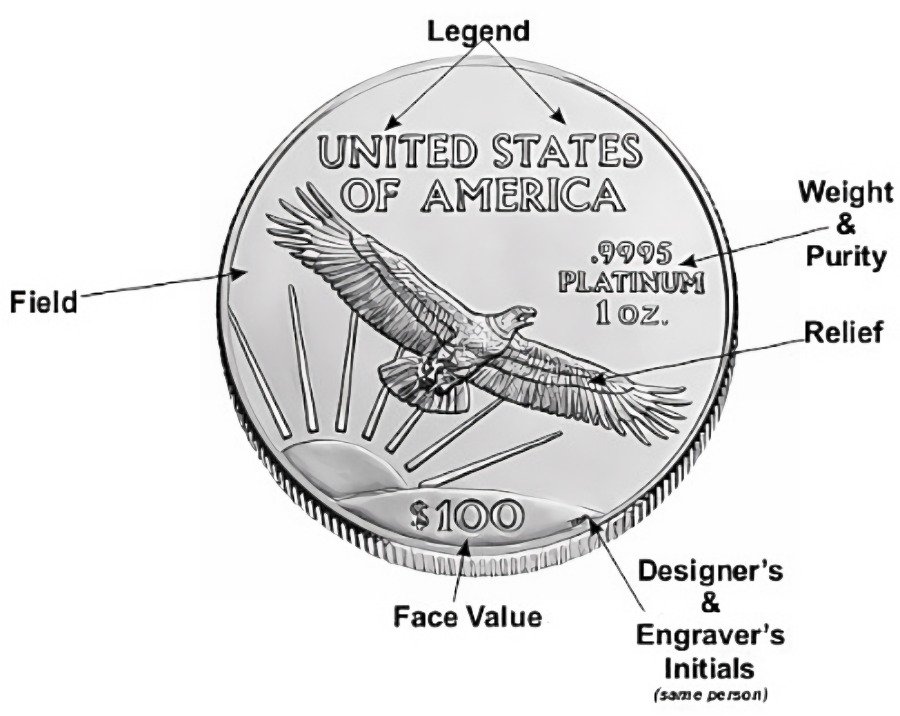

The "Face Value" of a bullion coin does not represent the "Intrinsic Value" of a precious metal bullion coin.

In regards to a coin, a coin's intrinsic value is determined by what it consists of and how much it weighs.

U.K. Bullion Coins are bought and sold based on the current market spot price of gold, silver, or platinum, plus a premium to cover minting, handling, distribution, and marketing costs.

Furthermore, the lower the mintage of the bullion coin, the more a collector's premium will be attached to it.

The Royal Mint's Bullion Coins often carry a higher premium than that of other bullion coins due to their proof-like finish.

Notice to UK residents: One little-known fact that some UK residents are unaware of is that bullion coins from The Royal Mint are Tax-exempt from Capital Gains due to the coins' status as legal British currency, giving UK residents who purchase these coins added profit when they decide to sell.

Visit this link to learn more: All that United Kingdom Investors Need to Know about Gold and Tax.

All That UK Investors Need to Know About Gold and Tax

U.K. Bullion

Gold Sovereigns

1957 - Present

Five, Double, Full, Half & Quarter Gold Sovereigns

Gold, Platinum, and Silver

Britannia Bullion Coins

1987 - Present

Gold, Silver, and Platinum

Queen's Beasts Bullion Coins

2016 - 2021 Gold & Silver

2017 - 2022 Platinum

Other Pages you may like...

|

|

|

|

|

|

The Royal Mint and United Kingdom Bullion Coins

For the Best Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage