Homepage / Buying Guides: Gold Guide

Last Updated on 01/26/2026

Gold Bullion Buying Guide

with a list of Reputable

Gold Bullion Dealers

This physical buying guide offers a comprehensive overview of the benefits of investing in gold. It details the reasons why gold is considered a wise investment choice, emphasizing its stability and potential for profit.

Additionally, the guide provides practical advice on how to confidently incorporate gold into one's investment portfolio, ensuring that readers can make informed decisions regarding this asset.

Gold: a "Precious" Metal

Owning physical gold can become more than an investment for some, like Gollum (a.k.a. Sméagol) in the Lord of the Rings; his "Precious" became an obsession.

Man's obsession with gold has sparked wars, destroyed empires, and forced many into slavery, but the real villain in these scenarios is the deadly sin of greed, not gold.

Gold is a chemical element with the symbol Au, which is derived from the Latin word Aurum, and it has an atomic number of 79.

Gold is a soft, yellow, corrosion-resistant element; gold is the most malleable and ductile metal on earth; it is the second-most reflective and conductive metal [second to silver] and generally occurs in veins and alluvial deposits.

Gold is considered precious because it possesses unique qualities and will never lose all its value. When you own gold, it helps preserve your wealth because, unlike other forms of money today, including Bitcoin, its value is not reliant on any external factors for its existence.

Bitcoin needs electricity to exist, and paper fiat money needs a government to back it, but gold is beholden to nothing but itself; it is "Precious."

In the following paragraphs, this guide provides a comprehensive explanation of the advantages of owning gold, and it identifies reputable gold bullion dealers and brokerages that offer competitive and reasonable prices for gold bullion.

Gold is Money

Gold has been used as money for over 5,000 years. The United States Constitution recognizes gold as money and it was used as such until the Gold Standard ended in 1971. Legendary banker J.P. Morgan is known for stating, "Gold is money. Everything else is credit."

Doug Casey

Doug CaseyDoug Casey, the author of the best-selling book "Right on the Money" and owner of the website International Man, stated in an interview one of the clearest explanations for why "Gold is the Best Form of Money."

"Gold, as we’ve discussed many times, happens to be the best form of money the market has ever produced: It’s convenient, consistent, durable, divisible, has intrinsic value, and can’t be created out of thin air." - Doug Casey on the morality of money - Mining.com

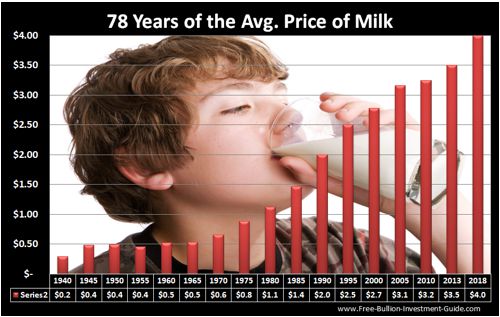

Gold Keeps its Purchasing Power

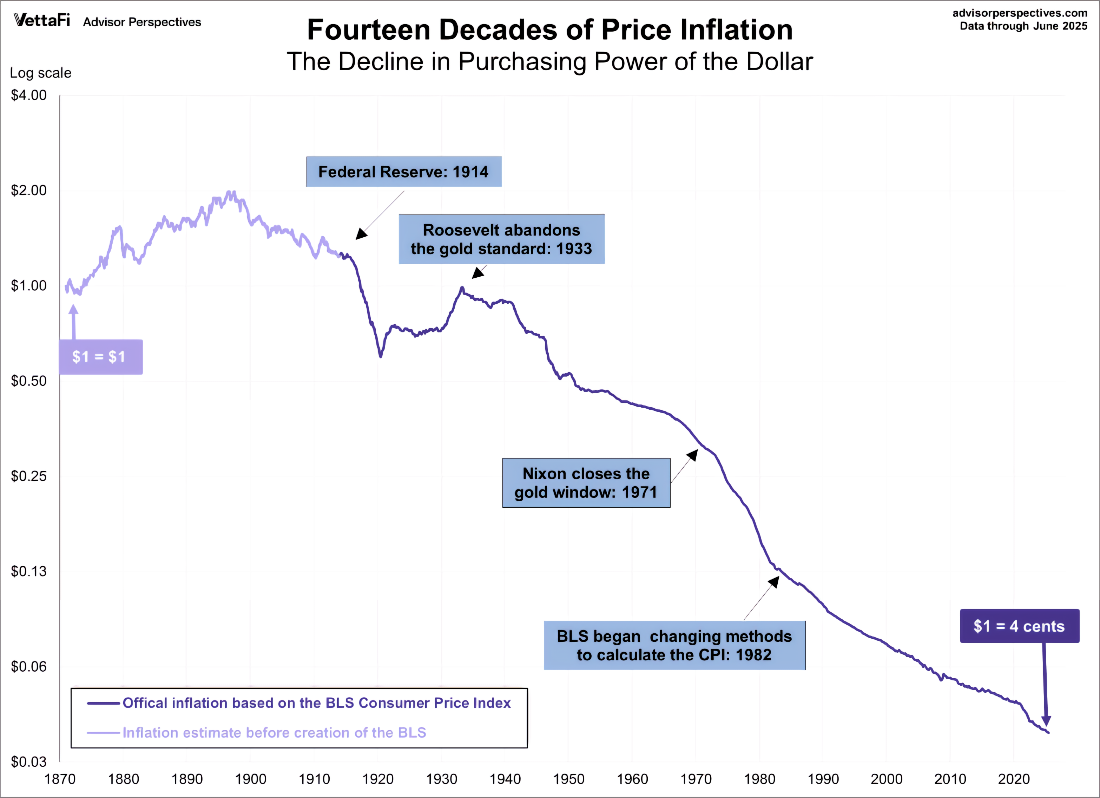

The chart below shows that $1.00

today has the same purchasing power as 4 cents in 1872.

Wouldn't it be great if we could still buy a bottle of Coca-Cola for five cents?

We don't pay that low price for a Coke because inflation has eroded the value of the U.S. dollar so much that its purchasing power now has less value than a nickel had before 1940.

The blue boxes on the chart above reveal many of the biggest reasons for the decrease in the U.S. dollar's purchasing power.

The first two important highlights recognize the creation of the Federal Reserve, which led to a significant decline in the value of the U.S. dollar, but it recovered most of its value by the early 1930s.

Then in 1933, President Franklin D. Roosevelt signed Executive Order 6102, which forbade Americans from holding Gold Coins, Gold Bullion and Gold Certificates, and ended the Gold Standard under which the United States economy functioned. The gold that Americans owned was confiscated and stored in U.S. depositories like Fort Knox.

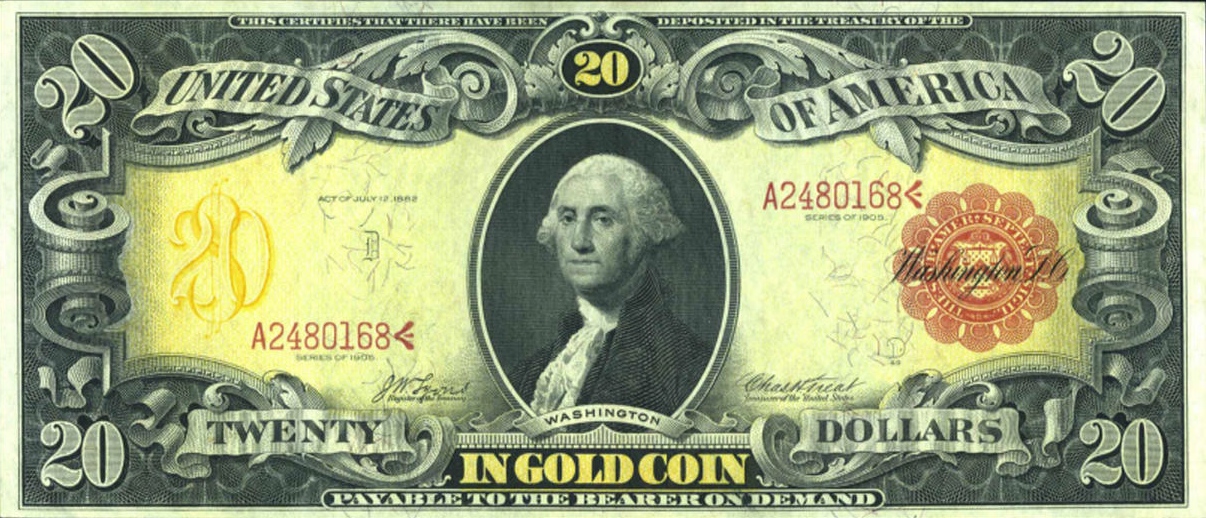

Under the Gold Standard that existed up until that time, Americans used gold, as well as certificates like this 1905 $20 gold certificate (right), as currency.

Prior to Executive Order 6102, gold was priced at $20.67 per troy ounce. When the owner of a gold certificate opted to exchange it, they would receive the equivalent gold coin in return. (Note: Executive Order 6102 was overturned on December 31, 1974, when U.S. President Gerald R. Ford Jr. signed Executive Order 11825.)

In 1934, the Gold Reserve Act was passed, changing the statutory gold value of the U.S. dollar from $20.67 to $35 an ounce. This reduced the purchasing power of the dollar by more than a third, and it enabled the Federal Reserve to expand the money supply.

After World War II, 44 countries convened on Bretton Woods, NH, to create a de facto gold standard known as the Bretton Woods System of Monetary Management.

The Bretton Woods system kept gold valued at $35.00 a troy ounce, but the U.S. dollar was now considered as good as gold to the holder, who could no longer own gold; foreign countries were the only ones who could exchange U.S. dollars for gold bullion or gold bullion for U.S. dollars.

Citizens in countries of the Bretton Woods system were forbidden from holding gold coins, bullion, or certificates unless they were collectible and not exchanged as currency.

This Bretton Woods de facto gold standard worked well until the 60's, when there was a sizable increase in U.S. government spending caused by the Vietnam War and President Lyndon B. Johnson's "Great Society" programs of Medicare, Medicaid, and his "War on Poverty."

The spending policies increased the value of the U.S. dollar against gold, leading to significant imbalances in currency markets and resulting in a global currency crisis that caused many countries to abandon the Bretton Woods system.

On August 15, 1971, with U.S. inflation hitting over 5%, President Richard Nixon took the United States off the Bretton Woods system and completely separated the U.S. dollar's convertibility to gold, which has eroded the value of the U.S. dollar and has ever since.

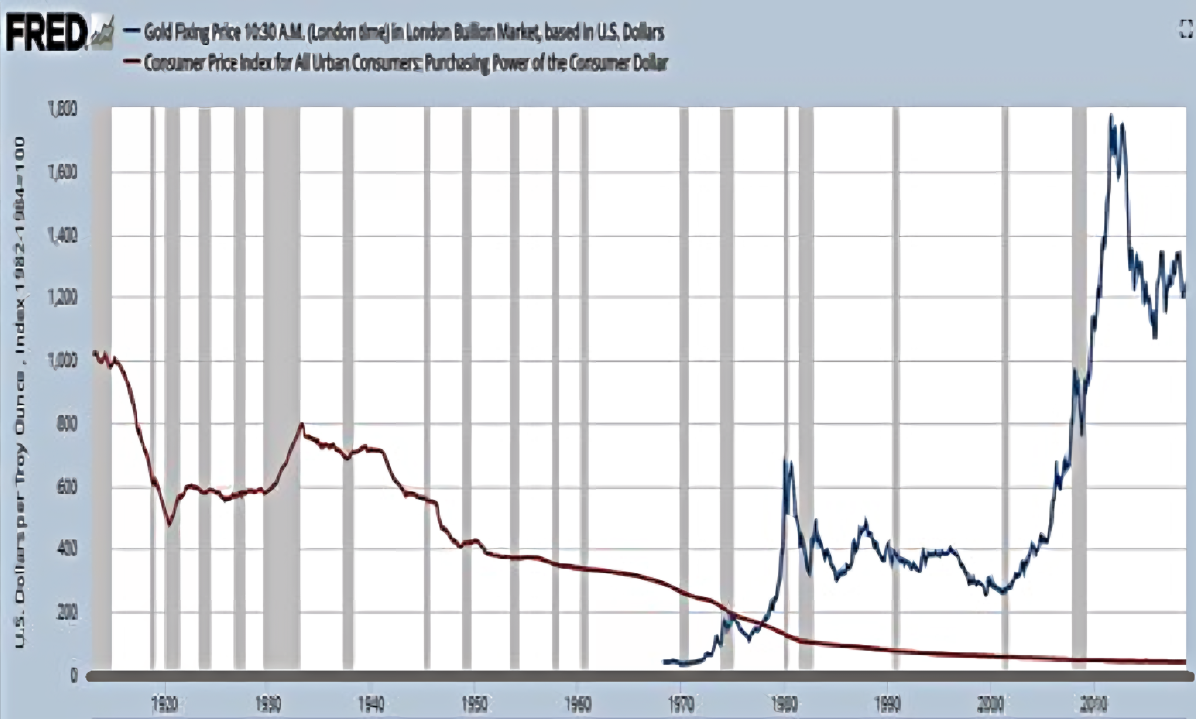

This is shown in the chart below from the Federal Reserve. It's a chart from 2019 that the Federal Reserve no longer provides to the public; however, it shows that since 1971, gold has maintained its purchasing power while the US dollar has not.

The gray vertical lines in the chart below represent times of U.S. recessions; the red line represents the purchasing power of the U.S. dollar using the "Consumer Price Index" (CPI), and the blue line represents the Price of Gold in U.S. Dollars.

To further illustrate how gold has held its purchasing power is to see how it has moved since 2020 in the chart below provided by Bullion Vault.

It indicates that since 2020, market uncertainty, wars, government spending, and public debt have led to an increase in the price of gold, preserving the purchasing power of those who own it.

Interactive Bullion Vault Chart: H = High / L = Low / C = Close

Finally, the last blue box in the chart above mentions the CPI, and says "BLS began changing methods to calculate the CPI: 1982."

In 1982, the Bureau of Labor Statistics (BLS) began altering the Consumer Price Index (CPI) to adjust inflation figures, which has further decreased the dollar's value, and this practice continues today.

The BLS regularly changes the CPI calculations, this page notifies the public of them. Consumer Price Index (CPI) Notices - Bureau of Labor StatisticsGold's Role with the Financial Markets

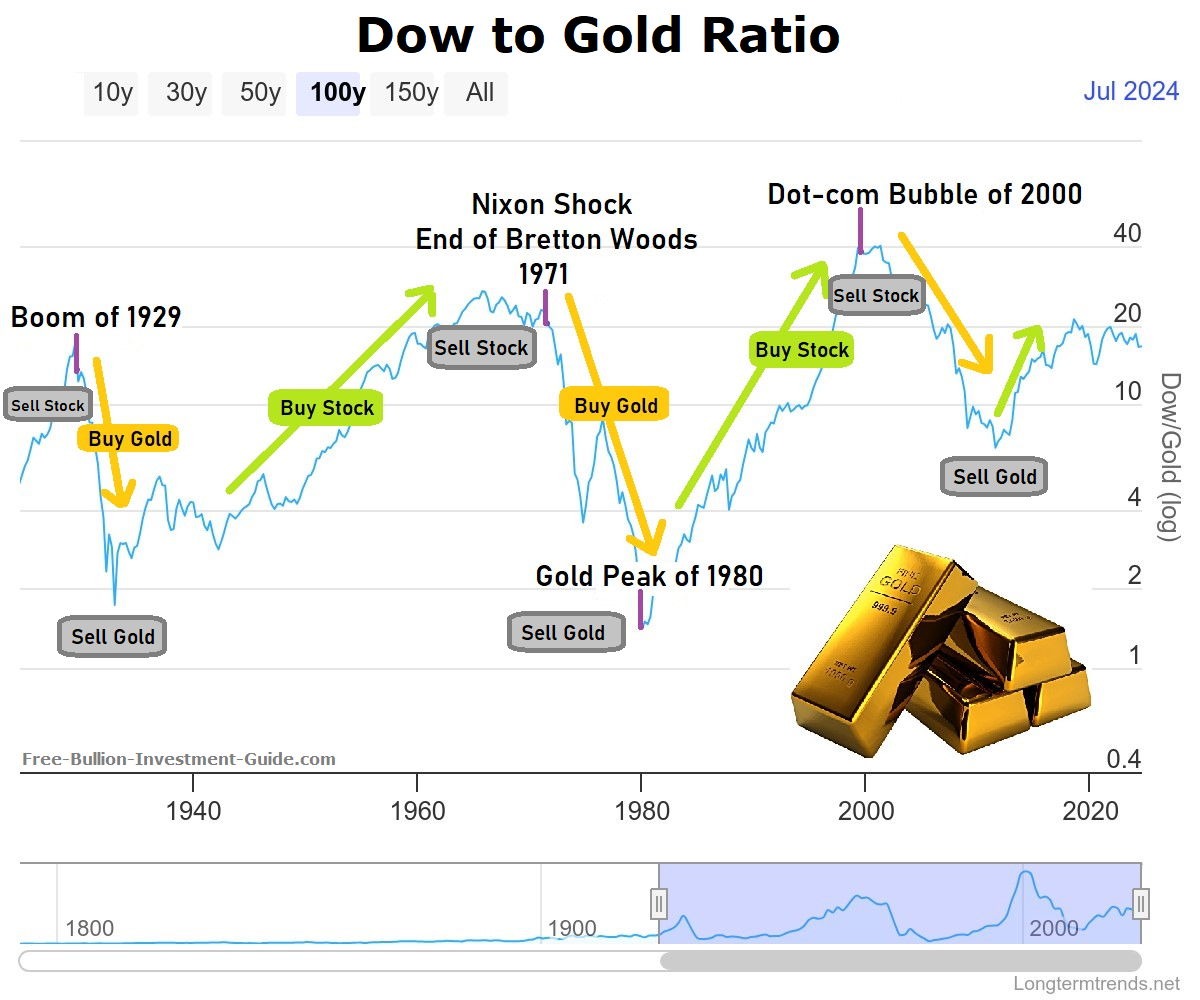

Gold's role in financial markets is analyzed through its correlation with the Dow Jones Industrial Average, as demonstrated by the Dow to Gold ratio, which measures stock market stability compared to gold, a stable safe-haven asset.

The ratio effectively indicates when to stop pursuing an overbought market, whether it is the Dow Jones Industrial Average (DJIA) or Gold.

The Dow-to-Gold ratio is a financial metric calculated by dividing the Dow Jones Industrial Average by the price of one ounce of Gold; depending on how high or low the ratio is, determines which market to buy or sell.

|

|

÷ |

|

Gold's price and the Dow Jones Industrial Average move in opposite directions; gold is an asset with little risk, while stocks are a high-risk asset.

A high Dow-to-Gold ratio indicates the stock market is overbought and in a bubble. In contrast, a falling ratio indicates significant pessimism is waning in the stock market and that gold's price is in a bubble.

There are many strategies that investors have used to profit from the Dow-to-Gold ratio. This article, "Trading the Dow-Gold Ratio," is about one strategy that would have worked out well if you had a time machine, but it is still a good strategy for the future.

Gold is Financial Insurance

Investors frequently become overconfident and adopt a "All-In" mentality during market bubbles, putting all of their money into a single market that continuously rises in value. They make bad choices out of a fear of losing out on a chance to earn quick cash.

Below are some examples of historic market bubbles that destroyed the purchasing power of many investors:

- The Dutch Tulip Mania of 1634-1637

- John Law and the Mississippi Bubble of 1718-1720

- Silver Bubble of 1980 - leading to Silver Thursday

- Japanese Asset Price Bubble of 1985 - 1991

- Dot.com Bubble - 1999 - 2000

- Housing Bubble - 2006 - 2009

- Everything Bubble - 2015 - 20??

Everyone has heard the phrase, "Don't put all your eggs in one Basket," or, in other words, Diversify.

In every bubble market, the person who had diversified investments of high and low-risk assets was the one who didn't lose everything.

Gold is the model of a low-risk asset; it keeps its purchasing power, and unlike stocks or any other financial investment, gold has no counterparty risk, meaning it cannot go bankrupt or default; it's precious. (Cartoon courtesy of Hedgeye.com)

Note: In the 1920s, a car's average selling price was $1,500.00, the car in the photo likely sold for 2 or 3 times as much at the time.

The image shows Walter Thornton, leaning on his Chrysler Imperial Convertable Roadster desperate to sell it for $100 of Cash, the day after the stock market crashed on October 30, 1929.

Types of Physical Gold Bullion

There are many different forms of physical gold bullion that one can choose from; they include:

Gold Bullion Coins

|

American Eagle Gold 1986 - Present Purity: 91.67% Gold, 3.0% Silver, 5.33% Copper

(22K)

|

|

American Buffalo Gold 2006 - Present Purity: 99.99% Gold, (24K)

|

|

|

Gold Sovereign (U.K.) 1489 - Present Purity: 91.67% Gold, 3.0% Silver, 5.33% Copper (22K) |

|

|

U.K. Britannia Gold 1987 - Present Purity 1987-2012: 91.67% (22K) Purity 2013 - Present: 99.99% (24K) |

|

Chinese Gold Panda 1982 - Present Purity: 99.90% Gold (24K) |

|

Austrian Gold Vienna Philharmonic 1989 - Present Purity: 99.99% Gold (24K) |

|

Australian Gold Kangaroo 1987 - Present Purity: 99.99% Gold (24K) |

|

Australian Gold Lunar 1996 - Present Purity: 99.99% Gold (24K) |

|

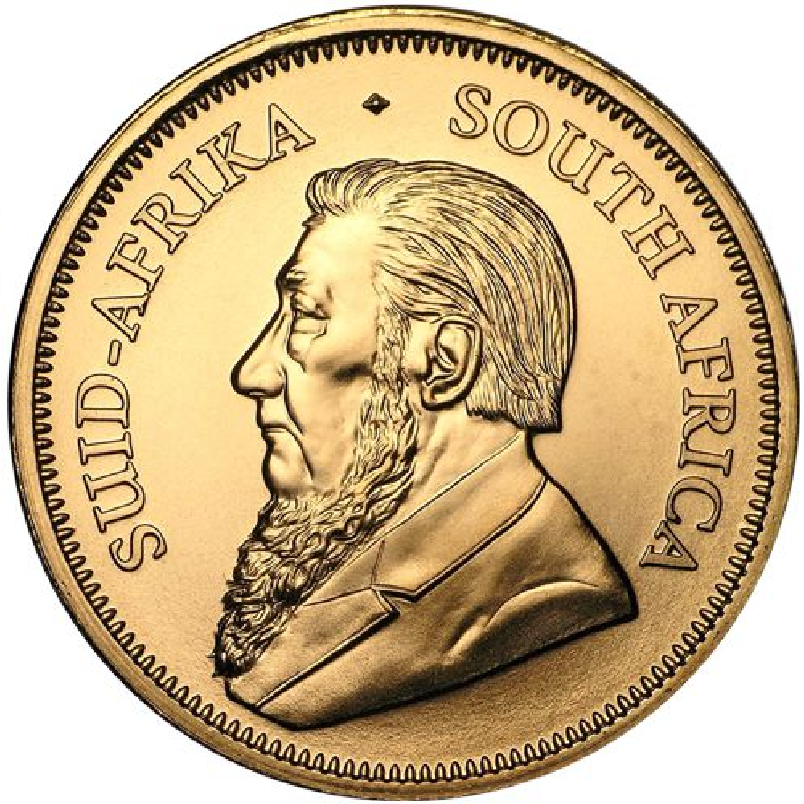

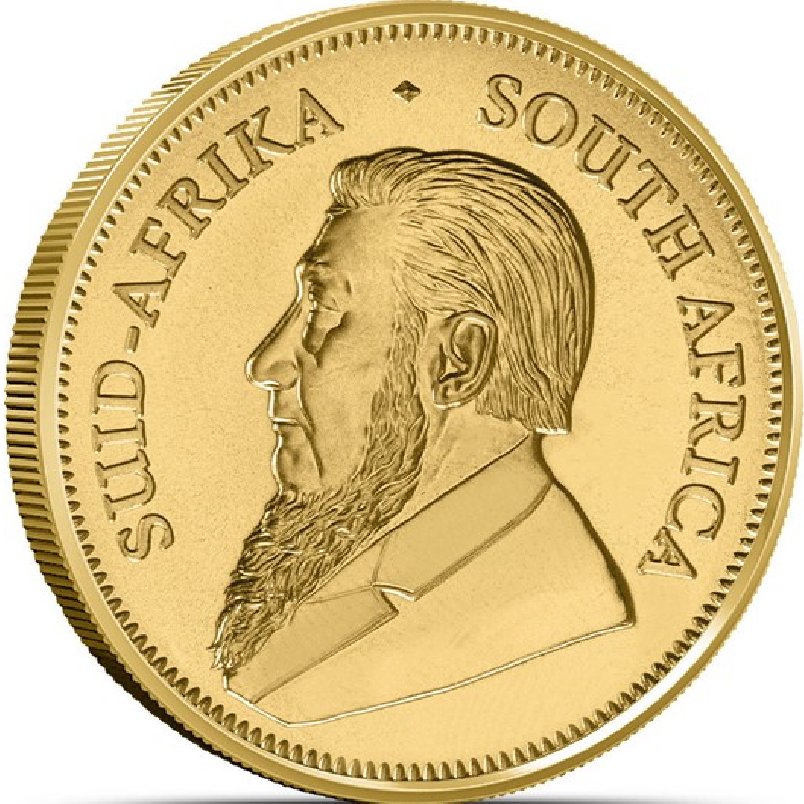

1967 - Present Purity: 91.67% Gold, 3.0% Silver, 5.33% Copper (22K) |

|

Russian Saint George the Victorious 2006 - Present Purity: 99.90% Gold, (24K) |

|

Israel 2010 - Present Purity: 99.99% Gold (24K) |

The gold bullion coins listed above are not a complete list of all the coins that are available on the market; however, many are the most popular.

Other forms of Gold Bullion include:

- Pre-1933 U.S. Mint Gold Coins

- Gold Rounds (made by numerous Private Mints & Refiners)

- Gold Bullion Bars ranging in size from 1 gram to 400 oz., by some of the following refiners: PAMP, Johnson Matthey, Engelhard, Heraeus, Sunshine Minting, Inc., etc.)

- Gold Bullion Jewelry, and Gold-back Notes

The reputable dealers and brokers below offer all of these forms of gold bullion.

Bullion Storage

The Free Bullion Investment Guide provides storage guides listed below for those who want to own precious metals but aren't sure which form of storage is best for them.

For those unfamiliar with the various options available for storing assets, including precious metals, our Vault Storage of Assets Buying Guide offers comprehensive information on numerous asset storage solutions.

If you want to learn more about storing precious metals at home, see our Home Safe Buying Guide.

or

If you want to own, store, and trade precious metals abroad, you will want to see our Vault Storage Brokerages Buying Guide.

Furthermore, below is a list of reputable dealers and brokers that offer silver bullion in its many different forms, and there are direct links to their storage services for those who provide it.

List of Reputable

Gold Bullion Dealers & Brokers

Free Shipping on Orders $199+

As one of the largest bullion dealers in the United States, BGASC has a variety of gold bullion coins, rounds, bars, gold notes, and jewelry.

Buy Gold And Silver Coins.com's goal is to be the kind of dealer they've always wanted to trade with to ship fast, be fair & reasonable, and operate honestly and efficiently.

They are an official PCGS Dealer, a member of the Certified Coin Exchange (CCE), an NGC Collector's Society Member, and a Bulk Purchaser of United States Mint non-bullion coins.

Every package they ship is sent fully insured for its time in transit.

Customers all across the country have quickly come to recognize BGASC as one of the fastest and most trusted online precious metals suppliers in the U.S.

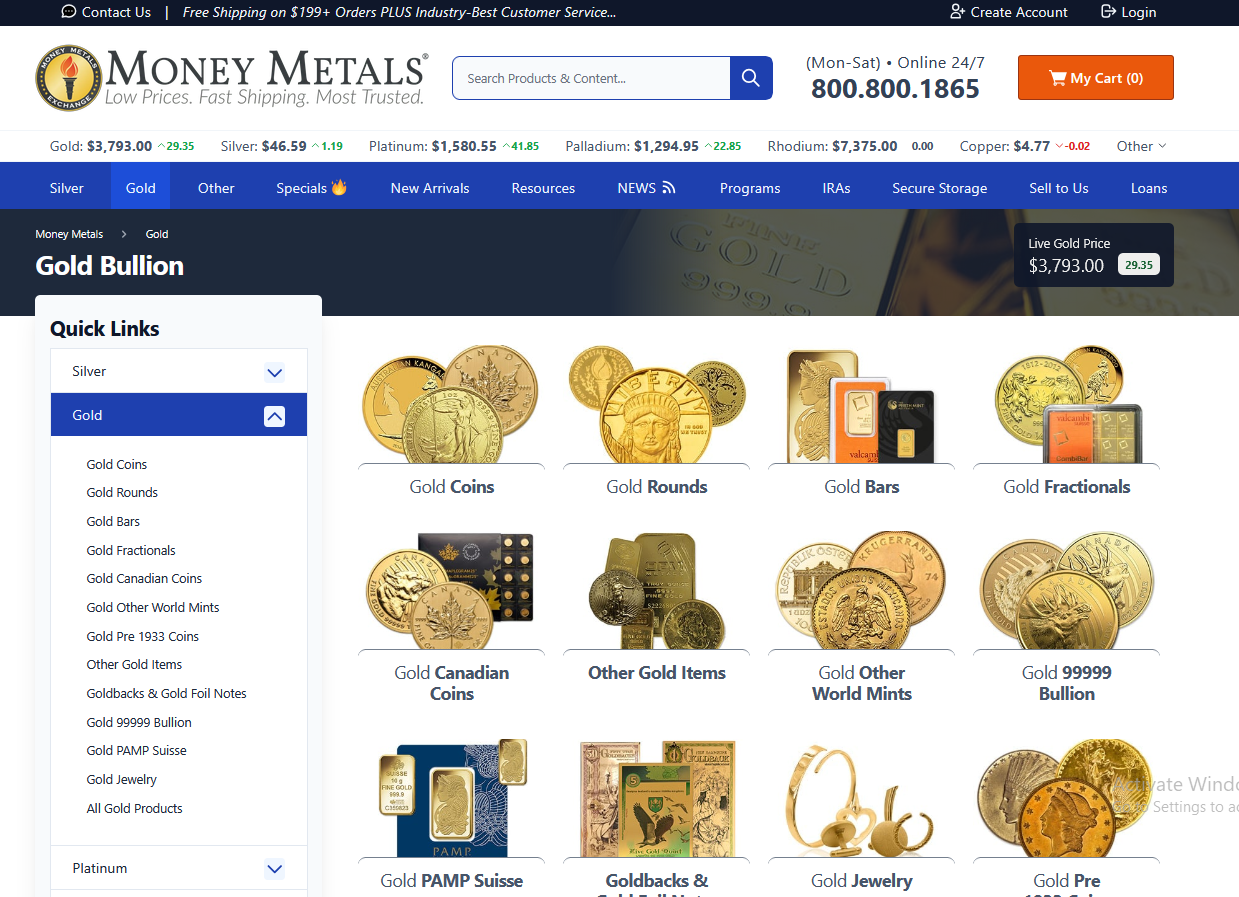

Free Shipping on Orders $199+

BBB - Customer Reviews

Money Metals Exchange is a national precious metals investment company founded in 2010 in direct response to the abusive methods of national advertisers of collectible, and numismatic coins.

Now you can safeguard your assets from financial turmoil and the devaluing dollar – without paying costly middleman mark-ups or fending off high-pressure, bait-and-switch sales tactics.

Savvy, self-reliant investors are embracing the Money Metals Exchange as their trustworthy resource for physical precious metals bullion.

Free Shipping on Orders $100+

(Canada & US) | RCM - Customer Reviews

The Royal Canadian offers gold numismatic coins featuring stunning scenes of Canada's wildlife, historical events, and the iconic maple leaf.

The Royal Canadian Mint stands for excellence in bullion production worldwide.

The only Gold Maple Leaf Bullion Coins that are available through its website is its latest offering called "Premium Bullion."

The RCM's Premium Bullion coins come in special packaging, whereas standard Canadian Bullion coins are not available directly from the Royal Canadian Mint and are only offered through pre-approved dealers in their raw form, without special packaging.

The Royal Canadian Mint is one of the largest and most versatile mints in the world, offering a wide range of specialized, high-quality coinage and related services on an international scale.

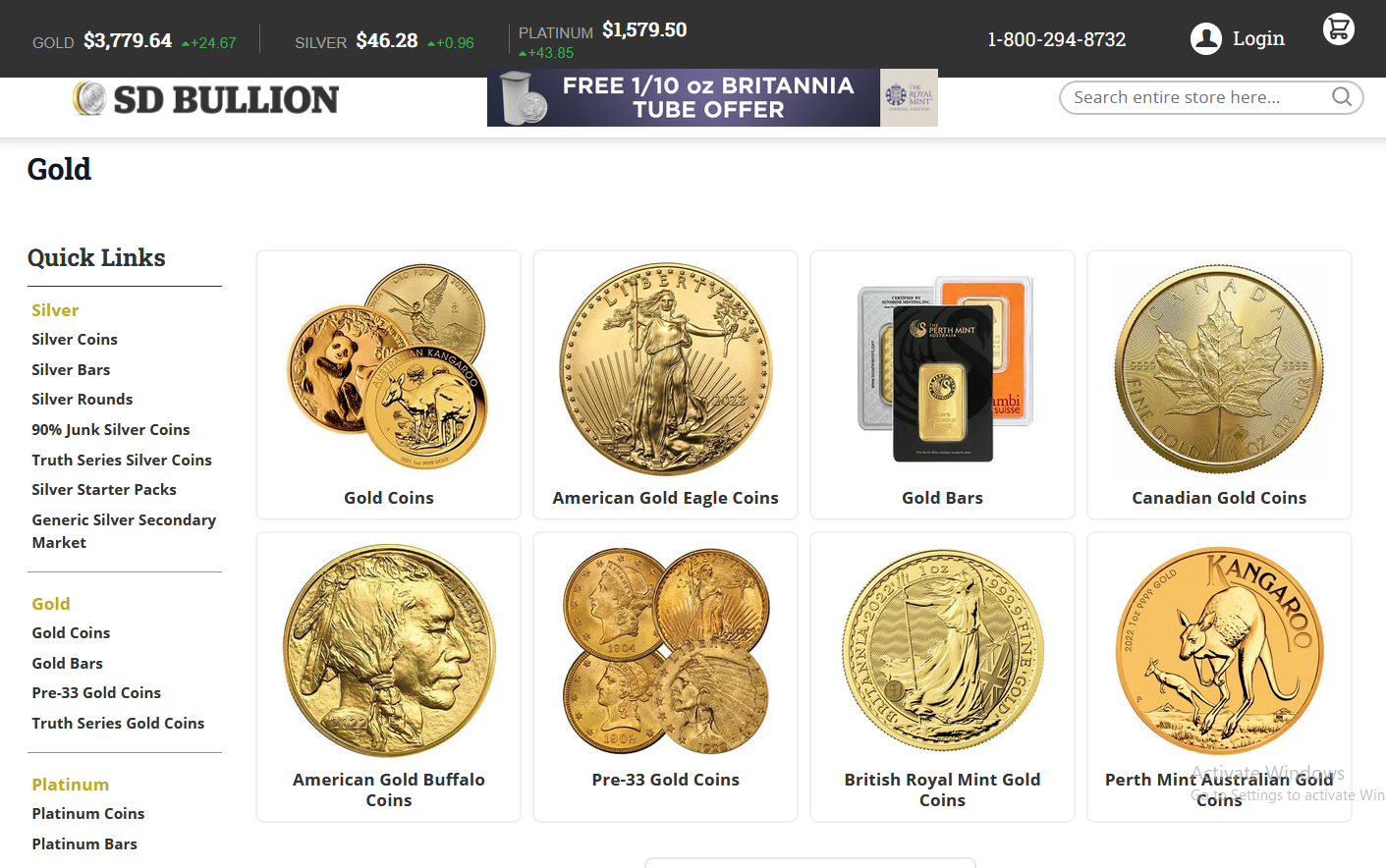

Free Shipping on Orders $199+

SD Bullion is a top dealer of gold, silver and platinum bullion, they offer a huge selection of gold bullion coins, rounds, and bars.

In 2011, two doctors started a highly popular Gold & Silver News website with one dream: To educate the masses on the value of hard assets and preparation.

The rapid success of that website gave way to the launch of SD Bullion.com in March of 2012.

Since then, SD Bullion has executed more than $4 Billion in sales and hit Inc. Magazine's list of 5000 Fastest Growing Companies four times.

They did all this while staying true to their original mission of offering the absolute lowest prices on gold bullion and silver bullion in the industry, guaranteed.

Free Shipping on Orders $199+

SilverGoldBull provides you with competitive, up-to-minute pricing, and we make sure your precious metals are delivered to your door discreetly and fully insured.

SilverGoldBull has the best customer rating (5.0 stars) in the industry; their in-house customer service representatives will work to assure your satisfaction in a timely, friendly, and professional manner.

They are based in Canada and offer a wide variety of gold bullion for you to choose from; their commitment to you is to provide excellent service throughout your bullion-buying experience.

The Royal Mint (U.K.) Delivery Rates

Made from 999.9 fine gold, the Royal Mint's premium collection of gold bullion coins and bars includes a variety of ranges, such as the iconic Sovereign and the heraldic Queen’s Beasts.

Explore the Royal Mint's range of masterfully designed premium gold coins and bars today.

The Royal Mint has been Britain's official and chief mint for over 1,000 years; it became a single institution in 886AD, during the reign of Alfred the Great. Today, the Royal Mint is the world's leading exporting mint.

The

mint makes UK bullion coins, bullion bars, numismatic proof coins,

circulated coins, medals, and commemorative coins for over 60 countries.

The Royal Mint has set out its vision as follows:

- "To be recognized as the world's best mint"

The Royal Mint refines and manufactures the United Kingdom's gold and silver bullion coins, including the Gold Sovereign and the Gold, Silver, and Platinum Britannia & Queen's Beasts Series of Bullion Coins.

Vault Storage

Gold Bullion Brokerages

4.7 star - Customer Reviews

|

BullionVault is the world's largest online bullion investment service taking care of $7 billion for more than 125,000 users. The bullion you own is held in vaults. Bars are stored in professional-market vaults in Zurich, London, Toronto, Singapore or New York. You choose where. Because of their size, you benefit from the low storage costs they've negotiated, which always include insurance. |

with Bullion Vault |

The video below goes into further detail about Bullion Vault's services.

No Minimum Investment on Direct Mail/Shipping ∙ See Ordering FAQs

$5,000 Minimum for Vault Storage Customers, No minimum on subsequent orders.

GoldBroker.com - Customer Reviews

Founded in 2011, GoldBroker.com is an online investment platform that facilitates holding and storing precious metals in your name, outside the banking system, and with direct access to the vaults.

GoldBroker.com offers a simple and safe way to buy physical gold.

Discover our gold bars and coins from recognized refiners certified by the international gold market (LBMA).

The gold bullion products have never left the professional logistics chain since their manufacture. This traceability guarantees precious metals’ authenticity and purity.

4.8 star Customer Review

$100 Minimum to Open an Account

Click Here or their Name/Logo to go to OneGold.com

OneGold gives you direct ownership of vaulted gold, silver, and platinum at an ultra-low cost. A free account will provide you with a platform that is easy to use and offers 24/7 access.

Quick Facts about OneGold

- U.S. based company

- Incorporated in 2018

- Trading 24/7 ~ 365 days a year

- Cash Withdraw after account is verified.

- Redemption in Physical Precious Metals is available.

- 3 Million oz (+) under Mgmt

- 4.8 star Customer Reviews

4.8 star Customer Reviews

Vaulted is a service provided by McAlvany Financial Group, the longest-running gold investment company in the United States.

Vaulted states states that buying gold and silver has never been more simple, affordable, or transparent using their service.

- Purchase Pure Gold and Silver and have it stored in the world's most secure vaults

or

- Take Delivery of Your Kilo Bar or smaller coins and bars, whatever you prefer

Buy and secure gold and silver with the tap of a finger Vaulted is a mobile platform for investing in physical precious metals. Store what you've purchased in international vault storage facilities or have it delivered.

Starting an Account with Vaulted is as easy as 1, 2, 3:

- Login to your Vaulted account

- Link a bank account and transfer funds

- Buy gold and silver with the tap of a finger!

|

Note: All the information on this page are in no way an endorsement of how you should invest or divest. |

Bullion Buying Guides

Other pages, on this Guide, that you

may like...

Gold Buying Guide

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage

BGASC - Customer Reviews