Homepage / Wise Investors: Free Market Capitalists / Doug Casey

ExpressGoldCash - 4.9 star - Customer Reviews

Free Market Capitalist

Doug Casey

Doug Casey is known for telling it like he sees it, which may turn off some people, but others find it to be a breath of fresh air.

He is an American-born free market investor, entrepreneur, and best-selling author, and the founder and chairman of Casey Research.

In 1968, Doug Casey graduated from Georgetown University; he has lived in seven countries and visited over a hundred; he currently resides in Argentina.

Doug Casey's Point of View

His point of view is from a libertarian stance, and he believes in the power of the individual and the freedom to live one's life according to their liberties and individual responsibilities.

Doug Casey is not a fan of the overreaching arms of government, like these other free market capitalist.

Doug Casey's View on Money...

Doug Casey stated these quotes when asked about the Morality of Money.

"... the accumulation of wealth is in and of itself an important social, as well as personal, good. The good to individuals of accumulating wealth is obvious, but the social good often goes unrecognized. Put simply, progress requires capital. Major new undertakings, from hydro-power dams to spaceships, to new medical devices and treatments, require huge amounts of capital. If you’re not willing to extract that capital from the population via the coercion of taxes, i.e., steal it, you need wealth to accumulate in private hands to pay for these things. In other words, if the world is going to improve, we need huge pools of capital, intelligently invested. We need as many “obscenely” rich people as possible."

Source: Daily Reckoning - The Morality of Money Part II

He's stating that Capitalism is a Good Thing, as well as capital, profit, and people who have wealth.

He was then asked, "So money is all good...nothing bad about it at all?"

Doug states:

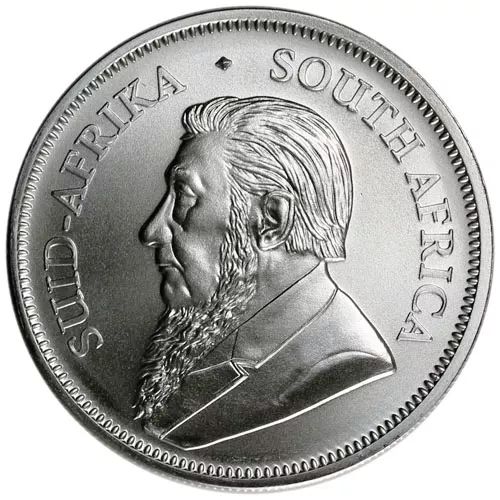

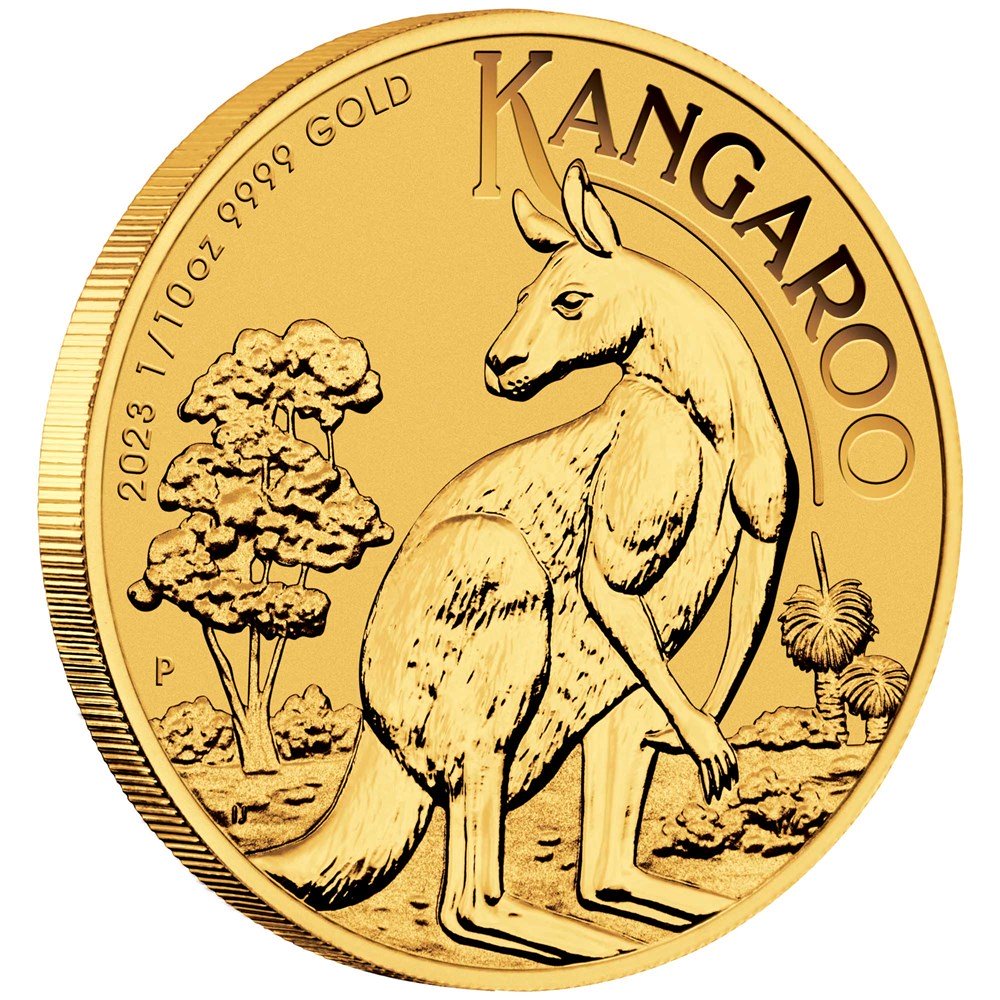

"...money itself isn’t the problem. Money is just a store of value and a means of exchange. What is bad about that? Gold, as we’ve discussed many times, happens to be the best form of money the market has ever produced: It’s convenient, consistent, durable, divisible, has intrinsic value (it’s the second-most reflective and conductive metal, the most nonreactive, the most ductile, and the most malleable of all metals), and can’t be created out of thin air.

Those are gold’s attributes. People attribute all sorts of other silly things to gold, and poetic critics talk about the evils of the lust for gold. But it’s not the gold itself that’s evil — it’s the psychological aberrations and weaknesses of unethical people that are the problem. The critics are fixating on what is merely a tool, rather than the ethical merits or failures of the people who use the tool and are responsible for the consequences of their actions."

Source: Daily Reckoning - The Morality of Money Part II

Money is not evil, it's what individuals do with it that brings scrutiny on to capital and wealth.

Doug Casey Author

Doug Casey wrote his first book in 1979, called "Crisis Investing," it was one of the best-selling financial books at the time. It stood at #1 on the New York Times Best Seller list for 12 non-consecutive weeks.

He is the founder and chairman of Casey Research, a website that offers financial analysis about specific markets. The site focuses its analysis on mining, energy, commodities, and the technology markets.

Since 1979, he has written, and later co-written, the monthly metals and mining-focused investment newsletter, "The International Speculator."

He also contributes to other newsletters, including "The International Man" and other independent, free-market-oriented publications.

He has also served as a trustee on the Board of Governors of Washington College and Northwoods University and has been a director and adviser to several financial corporations.

Doug is widely respected as one of the preeminent authorities on “rational speculation,” in the commodity sector.

Link to Investment Guru - Doug Casey's Casey Research.com

ExpressGoldCash - 4.9 star - Customer Reviews

Doug Casey's Books:

- The International Man: The Complete Guidebook to the World's Last Frontiers, for Freedom Seekers, Investors, Adventurers, Speculators, and Expatriates (1976)

- Crisis Investing: Opportunities and profits in the coming great depression. (1979).

- Strategic Investing (1982)

- Crisis Investing for the Rest of the 90s (1993)

- Lifetime Getting Rich in the Age of Crisis - Investment Opportunities (1994)

- Totally Incorrect - Conversations with Doug Casey (2012)

- Right on the Money - Doug Casey on Economics, Investing and the Ways of the Real World with Louis James (2013)

- Speculator (with John Hunt) (2016)

Other pages, on this Guide, that you

may like...

For Bullion Market News...

Visit the Homepage

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage