Homepage / Bullion Coins: Australian Coins / 1 oz. Silver Kookaburra

ExpressGoldCash - 4.9 star - Customer Reviews

Updated on 04/08/2024

1oz. Australian Kookaburra Silver Bullion Coin

1990 - Present

The Australian Kookaburra Silver bullion coin was introduced in 1990 by Australia's prestigious Perth Mint. It is the Perth Mint's longest-running and one of its most popular silver bullion coin series.

Native to Australia and New Guinea, Kookaburras belong to the family of birds called tree kingfishers, which grow from 11 inches to 17 inches in length.

The name "Kookaburra" originates from a group of Aboriginal Australian people known as the Wiradjuri people, they are from central New South Wales.

The Kookaburra has a loud, distinctive call known for sounding like laughter. Hear the Kookaburra's unique call in the video below.

Design of the

1oz. Australian Kookaburra

Silver Bullion Coin

Obverse

The direction of the monarch's face is a subtle difference between the 2023 and 2024 Australian Kookaburra silver bullion coin.

On the 2023 Australian Kookaburra, the late Queen Elizabeth II is facing the right, whereas the 2024 Australian Kookaburra portrays the new King of England, Charles III, facing the left.

Changing the direction a monarch faces on British Commonwealth coinage is a tradition that dates back to the 17th century for the British Royal Family.

The obverse side of the 1 oz. Australian Kookaburra Silver bullion coin portrays the profile of His Majesty, King Charles III, designed by David Thorne.

Inscriptions:

- CHARLES III

- AUSTRALIA

- • 1 DOLLAR •

- DT - designer's initials under the King's profile

Note: The first two years (1990 and 1991) of the 1 oz. Australian Kookaburra silver bullion coin had a face value of "5 DOLLARS." From 1992 to the present day, the face value of the coin has been "1 DOLLAR."

Obverse side photo provided courtesy of The Perth Mint

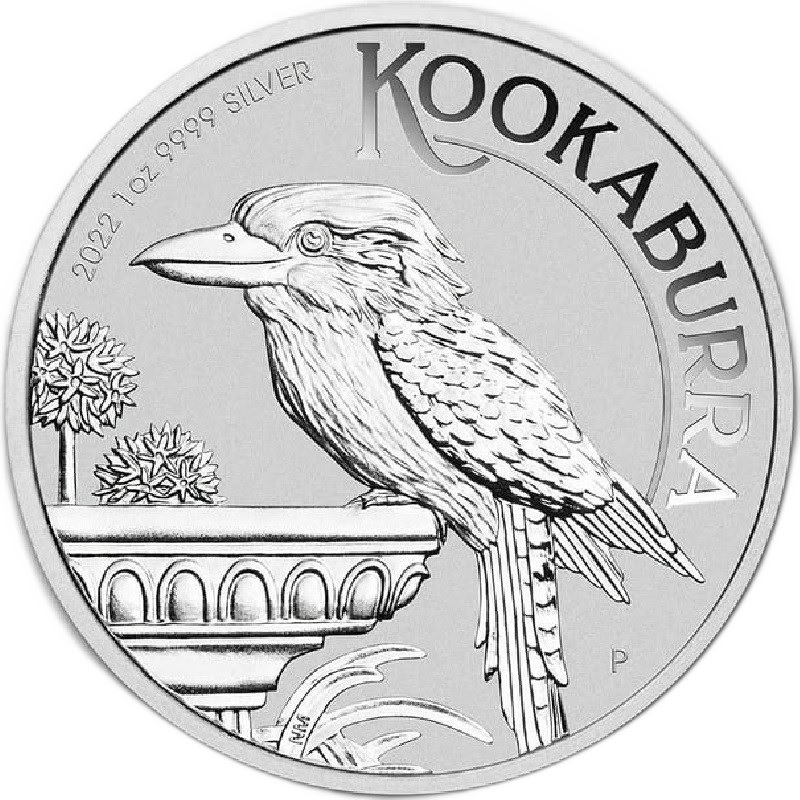

Reverse

The reverse side of the 2024 Australian Kookaburra silver bullion coin portrays a kookaburra in flight over a rocky gorge with a snake in its talons, designed by Sean Rogers.

Inscriptions:

- KOOKABURRA

- 2024 - Year of Issue

- 1oz

- 9999 SILVER

- P125 - mint mark of the Perth Mint's 125th Anniversary

- SR - initials of the reverse side's designer Sean Rogers

The edge of the silver bullion coin is reeded.

Note: From 1990 - 2007 the Silver Kookaburra bullion coin did not have a Mint Mark.

Reverse side photo provided courtesy of The Perth Mint

1oz. Australian Kookaburra

Silver Bullion Coin Information:

Introduction:...........1990

IRA Approved:.........Yes

Grade:....................Uncirculated

Face Value:.............$5 AUD - 1990 - 1991

Face Value:.............$1 AUD - 1992 to Present Day

Silver Content:........1 troy oz.

Total Weight:..........31.10 grams

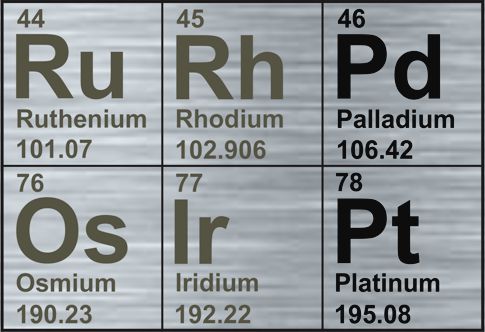

Purity:....................99.90% / .999 (1990 - 2017)

Purity:....................99.99% / .9999 (2018 - Present)

Diameter:...............40.60 mm

Thickness:..............2.98 mm

Obverse Designer:...Ian Rank-Broadley (1998-2019)

Obverse Designer:...Jody Clark (2020-2023)

Obverse Designer:...Dan Thorne (2024 - Present)

Reverse Designer:...Changes Yearly

Mint Mark:...............No - 1990 - 2007

Mint Mark:...............Yes - 2008 to Present Day (P = The Perth Mint)

Edge:.....................Reeded

Buy

Australian Silver Kookaburra & Kangaroo and other Perth Mint Silver

Bullion Coins

from the Reputable Bullion Dealers below.

|

The Links below will take you directly to the page described. |

Silver Kookaburra link

✰

Silver Australian Kangaroo link

✰

Perth Mint Silver bullion coins link

Free Shipping on Orders $199+

Silver Kookaburra link

✰

Silver Kangaroo link

✰

Perth Mint Silver bullion coins link

Free Shipping on Orders $199+

BBB - Customer Reviews

Silver Kookaburra link

✰

Silver Kangaroo link

✰

Perth Mint Silver bullion coins link

Free Shipping on Orders $199+

Silver Kookaburra link

✰

Silver Kangaroo link

✰

Perth Mint Silver bullion coins link

Free Shipping on Orders $199+

Australian Kangaroo bullion coins

The Royal Mint (U.K.) Delivery Rates

America's Superstore offering Precious Metal Coins and Bars from Reputable Bullion Dealers

Silver Kookaburra Bullion Coins page

✰

Silver Kangaroo link

✰

Perth Mint Silver bullion coins link

Shipping prices

vary by item

Notice

- This site receives a commission when you purchase from the merchants above.

- No Personal Information is Obtained by this guide when you visit or order from any of the merchants above.

- See this guide's Affiliate Disclosure page for more information: here)

SilverGoldBull - Customer Reviews - 5.0 stars

1 oz. Australian Kookaburra

Silver Bullion Coin

Mintage Figures

Year Mintage

1990....300,000

Designer: Stuart Devlin

1991....300,000

Designer: Stuart Devlin

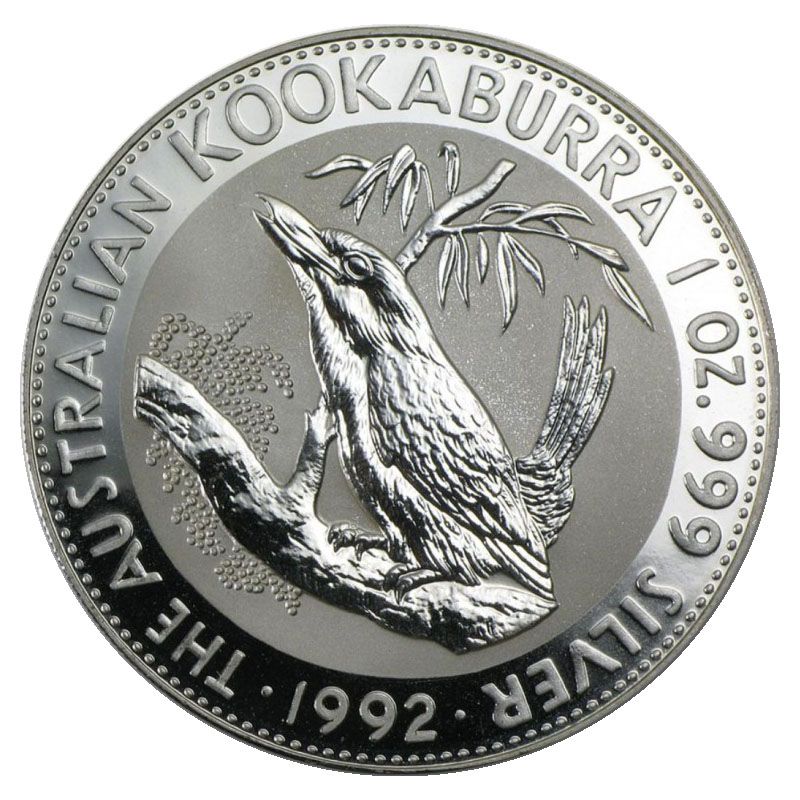

1992....219,694

Designer:

John Bergdahl

1993....190,581

Designer: Leslie Adonis

1994....174,561......................available at Walmart (while supplies last)

Designer:

Milena Milan

1995....154,247...........available at Walmart.here (mint) & here (spotted)(while supplies last)

Designer: Tony Dean

1996....170,105

Designer:

Jovan Radanovich

1997....159,497

Designer: Raphael David Maklouf

1998....103,119......................available at Walmart (while supplies last)

Designer:

Louise Pinder

1999....109,364..........Perth Mint's 100th Anniversary (P100 mint mark)

Designer:

Sara Langridge

2000....104,169

Designer:

Mathew Gee

2001....169,265

Designer:

Mathew Gee

2002....91,604

Designer:

Jovan Radanovich

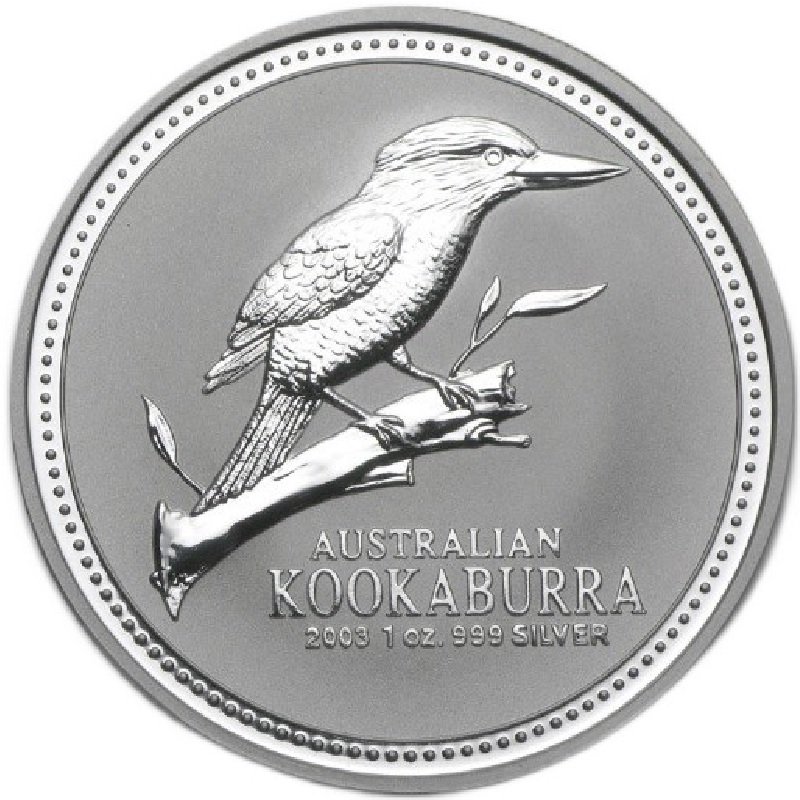

2003....109,439......................available at Walmart (while supplies last)

Designer:

Louis Kwan

2004....84,455

Designer: Jovan Radanovich

2005....95,145

Designer:

Sarah Anderson

2006....87,044........................available at Walmart (while supplies last)

Designer:

Ryan Vanderwiel

2007....213,436

Designer:

Justin Graham

2008....300,000.......................available at Walmart (while supplies last)

Designer: Shevaun Buschenhofen

2009....300,000

Designer:

Darryl Bellotti

2010....300,000......................available at Walmart (while supplies last)

Designer:

Elise Martinson

2011....500,000.......................available at Walmart (while supplies last)

Designer: Elise Martinson

2012....500,000....................available at Walmart (while supplies last)

Designer:

Darryl Bellotti

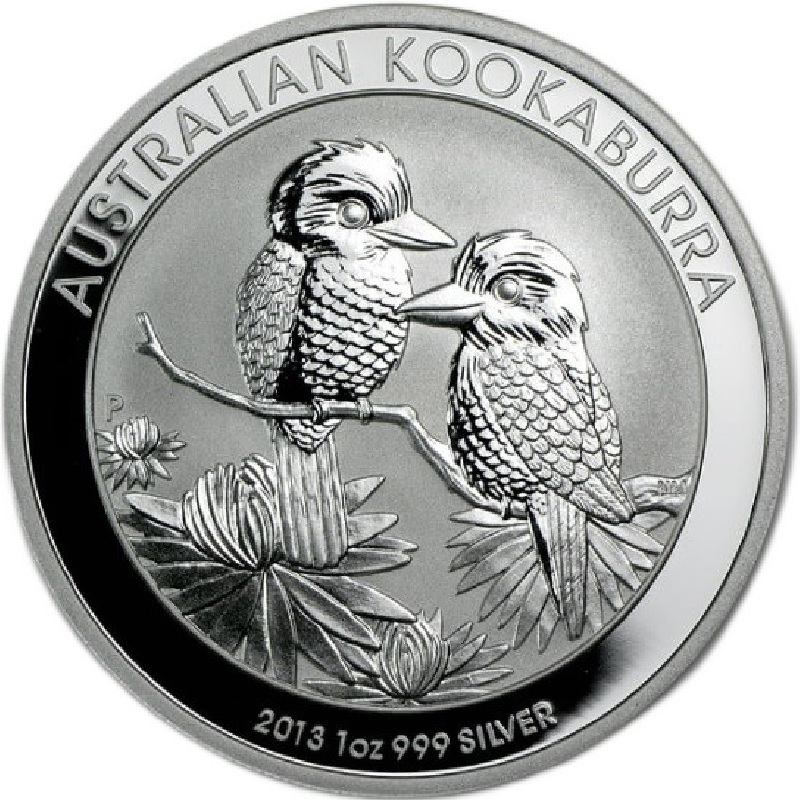

2013....500,000......................available at Walmart (while supplies last)

Designer:

Natasha Muhl

2014....500,000

Designer:

Natasha Muhl

2015....500,000 (25th Anniversary)..............available at Walmart (while supplies last)

Designer:

Stuart Devlin

2016....500,000.......................available at Walmart (while supplies last)

Designer:

Natasha Muhl

2017....406,265.......................available at Walmart (while supplies last)

Designer:

Natasha Muhl

2018....243,740.......................available at Walmart (while supplies last)

Designer:

Neil Hollis

2019....219,660....................available at Walmart (while supplies last)

Designer:

Alyesha Howarth

Obverse 🡱 • Reverse 🡳

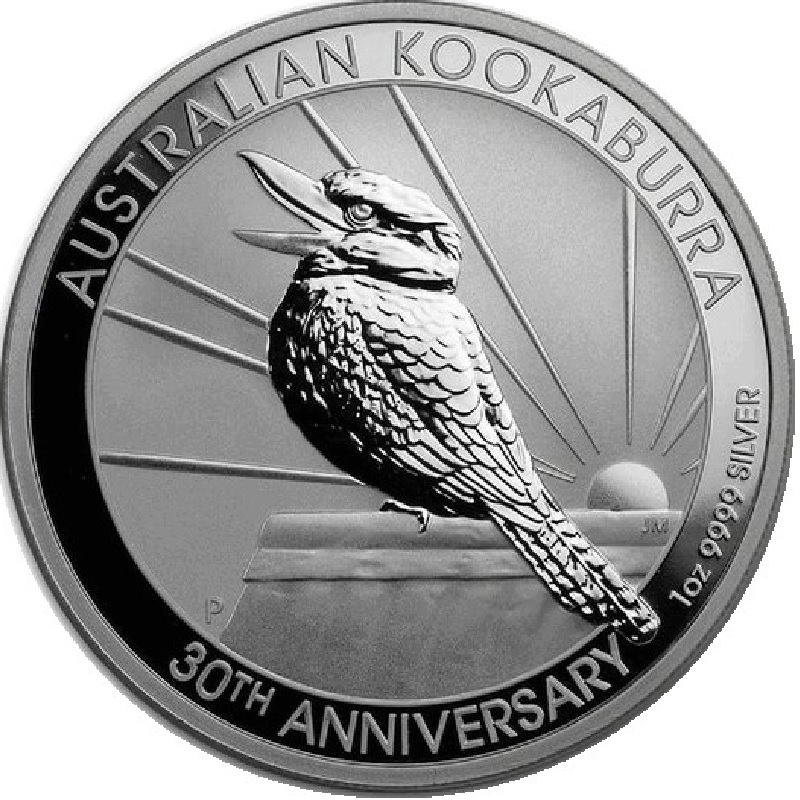

2020....375,914 (30th Anniversary)...........available at Walmart (while supplies last)

Designer:

Stuart Devlin

2021....266,676......500,000 max.mintage...........available at Walmart (while supplies last)

Designer:

Aleysha Howarth

2022....313,995........500,000 max.mintage.........available at Walmart (while supplies last)

Designer:

Natasha Muhl

2023....TBA...........500,000 max.mintage...........available at Walmart (while supplies last)

Designer: Wade Robinson

2024....TBA...........500,000 max.mintage...........available at Walmart (while supplies last)

Designer: Sean Rogers

TBA - To be announced

Mintage figures were last updated on 03/17/23

We are waiting on the Perth Mint to update their mintage figures.

ExpressGoldCash - 4.9 star - Customer Reviews

Australian Kookaburra

Silver Bullion Coin Series

Other pages you may like...

|

|

|

|

|

|

BGASC - Customer Reviews - 4.8 stars

Australian Silver Kookaburra

Visit the Australian Bullion page

OR

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

Ad Gloriam Dei

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

December 2025

All Articles were Originally Posted on the Homepage

ExpressGoldCash - 4.9 star Customer Reviews