Homepage / Bullion Investment Basics: IRAs & Bullion

Updated on 03/09/2026

IRAs &

Precious Metals Bullion

Gold IRAs hold physical precious metals in a Investment Retirement Account (IRA); you can have gold, silver, platinum and palladium bullion bars and coins in these accounts.

Gold IRAs are self-directed, which allows alternative investments for retirement savings.

Physical bullion can be part of your retirement account under the tax-advantaged umbrella of your IRA. Capital gains are just one of the many reasons for getting into precious metals bullion.

You are allowed to buy and sell for gain inside the IRA with no tax consequence. Taxes only take effect until you remove money from the account.

The Internal Revenue Service (IRS) requires that a qualified trustee or custodian hold IRA assets on behalf of the IRA owner.

The trustee/custodian provides custody of the assets, processes all transactions, maintains other records pertaining to them, files required IRS reports, issues client statements, helps clients understand the rules and regulations to certain prohibited transactions, and performs other administrative duties on behalf of the self-directed IRA owner.

Gold IRAs are odd in this one way: you cannot personally store the physical metal your account holds; you direct the trustee/custodian to purchase precious metal bullion bars you like, but you cannot store them yourself, although you can go see them.

In addition, you cannot take physical possession of the precious metals bullion until you hit the age of 59 ½; however, once the precious metals are out of the IRA and in your possession, the tax shelter benefits of the IRA are no longer applicable.

The precious metals are in a regulated depository, licensed by the COMEX and NYMEX Divisions, and insured by Lloyds of London; the Delaware depository is the most commonly mentioned for Gold IRAs.

Minimum Fineness of

Precious Metals Bullion for IRAs

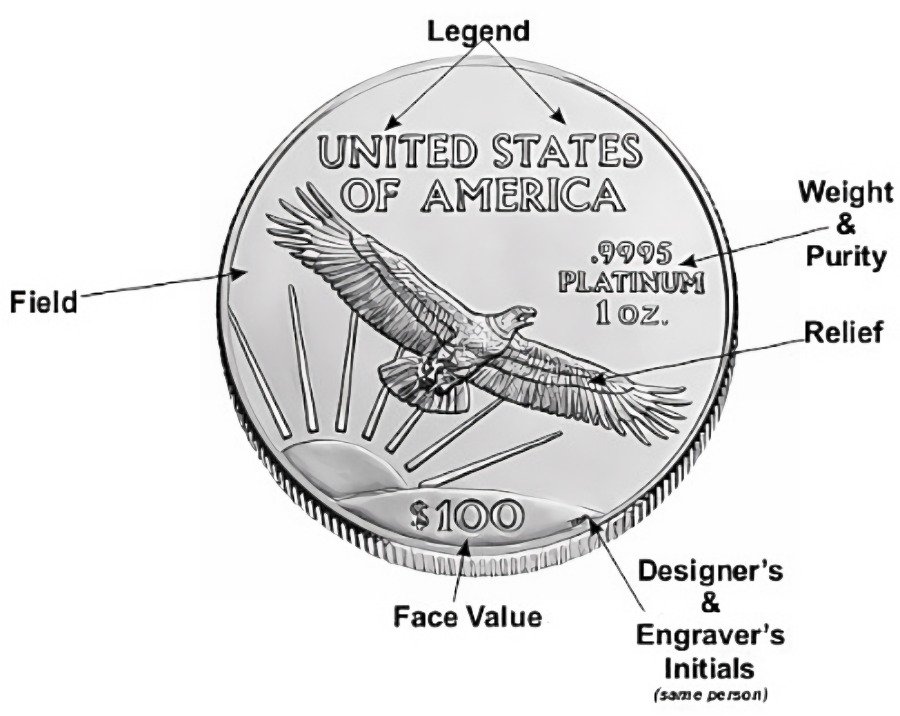

IRA-approved product, precious metals must meet minimum fineness (purity) levels.

- .995 Gold Minimum Fineness

- .999 Silver Minimum Fineness

- .9995 Platinum Minimum Fineness

- .9995 Palladium Minimum Fineness

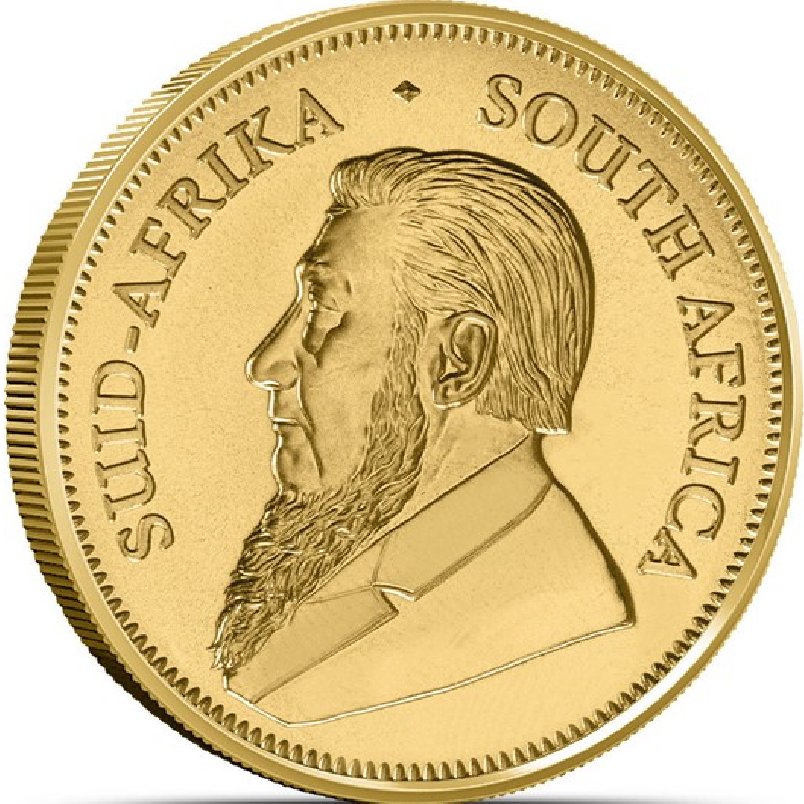

Examples of Non-approved Bullion are Gold Krugerrands, British Sovereigns, and 90% US Silver Coins (a.k.a: Junk Silver Coins).

Acceptable IRA Physical Bullion

Coins & Bars

The following are examples of the precious metals bullion coins, bars and rounds that are allowed in Investment Retirement Accounts.

- American Eagle Gold, Silver, and Platinum Bullion Coins

- Canadian Gold, Silver, Palladium and Platinum Maple Leaf bullion coins

- Australian Silver Koala, Kookaburra and Lunar Bullion Coins

- Australian Gold Kangaroo (Nugget) bullion coins and the Australian Gold Lunar Bullion Coins

- Austrian Philharmonic Silver and Gold bullion coins

- Gold, Silver, Platinum and Palladium Bullion bars and rounds manufactured by NYMEX or COMEX-approved refiner/assayer and meeting fineness requirements.(Ex: PAMP)

Precious Metals IRAs

Have Some Limits

Things you CANNOT DO when setting up an IRA Account with Physical Precious Metals Bullion:

- You CANNOT put bullion you already own into an IRA account; IRS regulations concerning IRAs prohibit it.

- You CANNOT hold the physical bullion yourself; IRS regulations require the precious metal to be held by an approved depository or an IRA trustee.

A Trust Company or "Custodian" is a company that the IRS allows you to maintain and hold the bullion for Precious Metals IRA Investors.

What do IRA Trust Companies Do?

Trustees handle all funds once your account is established and funded through direct deposit or from rolling over another 401K or existing IRA; they pay the Bullion Dealer from who you bought the bullion.

All bullion bought for the IRA must meet the requirements listed above. Trust companies provide monthly account statements with all of your account information.

The depository has two forms of storage.

- Fungible: meaning your coins are grouped with other people's coins.

- Segregated: where your coins are separate from others within the storage facility, ensuring that the exact coins you purchased are yours and yours only.

Depositories charge a small annual account fee plus a storage fee based upon the total value of the account; segregated storage costs slightly more.

Note: Not all Trustee companies have their own depositories. Your Trust company will assist you in finding one if they do not have one for themselves.

|

If you are interested in including physical bullion into a IRA account, you should consider consulting with a good financial advisor about the specific ways you can introduce physical bullion into a Roth or Traditional IRA account. |

|

IRA Resources:

Internal Revenue Service - IRA Online Resource Guide

Other pages, on this Guide, that you

may like...

IRAs (Investment Retirement Accounts)

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

February 2026

All Articles were Originally Posted on the Homepage