Homepage / Bullion Coins: U.S Coins / 1 oz. American Eagle Platinum

Last Updated on 01/06/2025

1 oz. American Eagle Platinum Bullion Coin

1997 - Present

In 1996, the U.S. Congress passed an Omnibus bill (Public Law 104-208) that included legislation authorizing the U.S. Mint to start producing the American Eagle Platinum bullion coins for investors and proof coins for collectors.

First minted in 1997, the 1 oz, 1/2 oz., 1/4oz., and 1/10oz. American Eagle Platinum Bullion Coins are the official investment-grade platinum bullion coins minted by the United States Mint.

Design of the

1 oz. American Eagle

Platinum Bullion Coin

Obverse

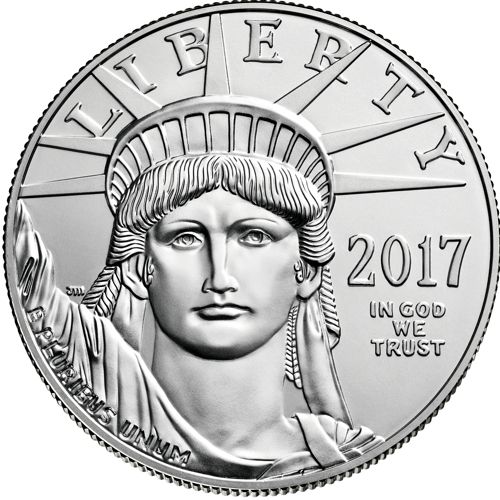

The Statue of Liberty's face graces the obverse side of all American Eagle Platinum bullion coins.

Lady Liberty is wearing her seven-pointed crown with her arm raised; the designer of the obverse side is John Mercanti; his initials are right above Lady Liberty's shoulder.

Inscriptions:

- LIBERTY

- E PLURIBUS UNUM - is Latin for 'Out of Many, One'

- 2023 -

Year of Issue

- IN GOD WE TRUST

- JM - designer's initials (John Mercanti)

The Edge on the platinum bullion coins is reeded.

Coin photos courtesy of the U.S. Mint

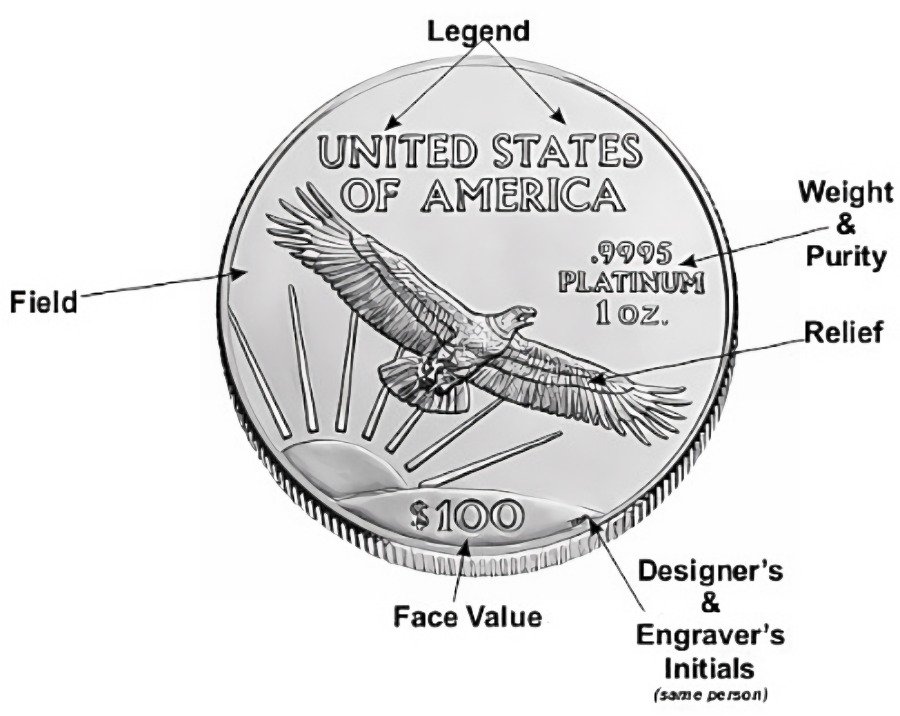

Reverse

The reverse side of the 1 oz. Platinum bullion coin features an American Eagle flying above the setting sun, designed by Thomas D. Rogers

Inscriptions:

- UNITED STATES OF AMERICA

- .9995 PLATINUM

- 1 OZ.

- $100

- TDR - initials of Thomas D. Rogers

Note: The reverse side of the American Eagle Platinum Bullion coin does not change, unlike the collector's Proof version of the Platinum Eagle coin.

Coin photos courtesy of the U.S. Mint

1 oz. American Eagle Platinum

Coin Information

Introduction:.........1997

IRA Approved:........Yes

Grade:...................Uncirculated

Face Value:............$100 US

Platinum Content:..1 Troy oz.

Total Weight:.........1.0005 troy oz. / 31.120 Grams

Purity:...................99.95% / 999.5 per mille

Diameter:..............32.7mm

Thickness:.............2.39mm

Designers:.............John Mercanti & Thomas D. Rogers

Edge:....................Reeded

Minted..................West Point, New York

|

|

|

Buy

Platinum Eagle

Bullion Coins

from the Reputable Bullion Dealers below.

|

The Links below will take you directly to the page described. |

|

Platinum Eagle page Free Shipping on Orders $199+ |

Platinum Eagle page

America's Superstore offering Precious Metal Coins and Bars from Reputable Bullion Dealers

Shipping prices

vary by item

Notice

- This site receives a commission when you purchase from the merchants above.

- No Personal Information is Obtained by this guide when you visit or order from any of the merchants above.

- See this guide's Affiliate Disclosure page for more information: here)

1 oz. American Eagle

Platinum Bullion Coins

Mintage and Sales Figures

Year Year Dated Coin

Mintage Annual Sales

1997................56,000..............................53,000

1998...............133,002............................138,500

1999................56,707..............................45,000

2000................10,003..............................10,000

2001................14,070..............................17,000

2002................11,502..............................10,500

2003..................8,007...............................7,500

2004..................7,009...............................7,500

2005..................6,310...............................7,300

2006..................6,000...............................7,000

2007..................7,202...............................4,700

2008................21,800..............................20,800

2009.......................0......................................0

2010.......................0......................................0

2011.......................0......................................0

2012.......................0......................................0

2013.......................0......................................0

2014..................16,900..............................16,900

2015.......................0......................................0

2016...................20,000............................20,000

2017..................20,000.............................20,000

2018...................30,000............................30,000

2019...................40,000............................40,000

2020...........................0...........................56,500

2021...........................0...........................75,000

2022...........................0...........................80,000

2023...........................0..........................12,700

2024...........................0.............................0

2025...........................0.............................0

Mintage Figures Last Updated on 01/06/2025

*Official "Year Dated" Mintage Figures have not been released

Free Shipping on Orders $199+

For more U.S. Bullion Coins and U.S. Mint Information

Visit the US Mint & US Bullion page

American Eagle Platinum Bullion Coins

Other pages you may like...

|

|

|

|

|

|

ExpressGoldCash - 4.9 star - Customer Reviews

American Eagle Platinum

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage

Platinum per Troy Oz. (ozt.)