Homepage / Bullion Investment Ratios: Gold to Silver Ratio

Updated on 02/06/2024

The Gold to Silver Ratio

Interpreting

the Gold to Silver Ratio

|

|

|

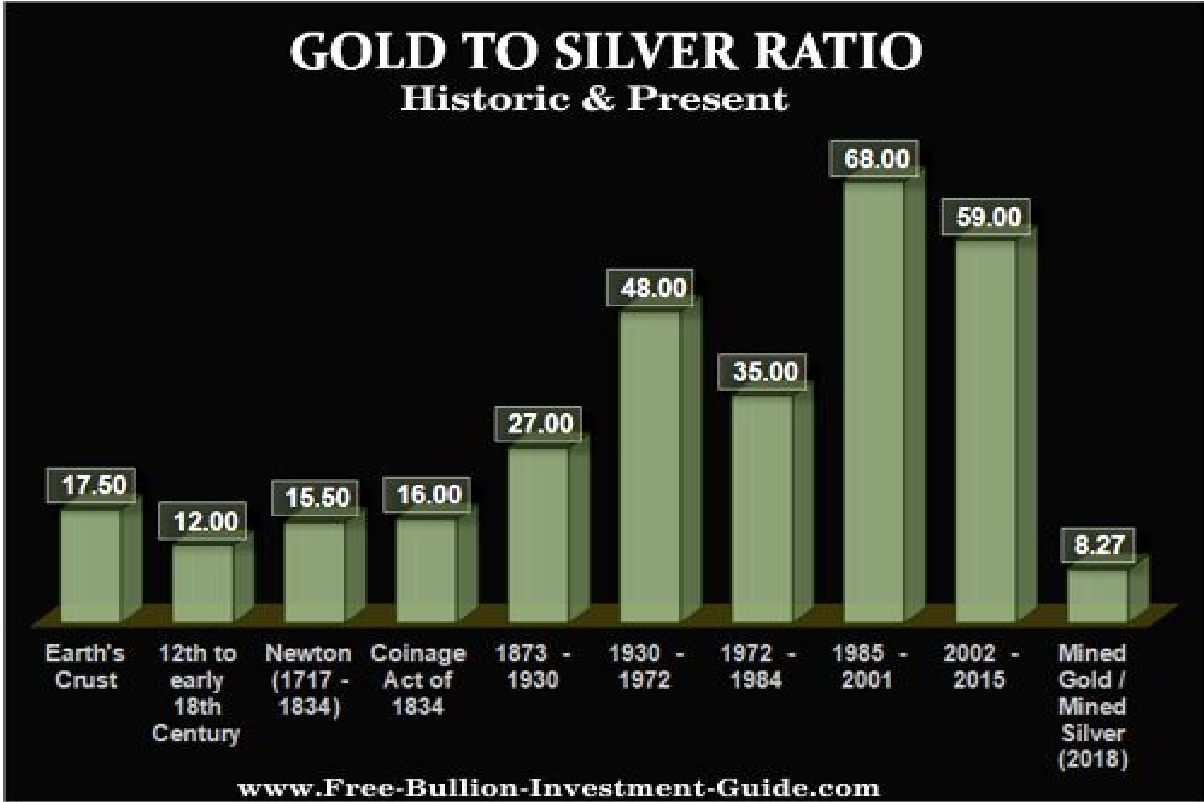

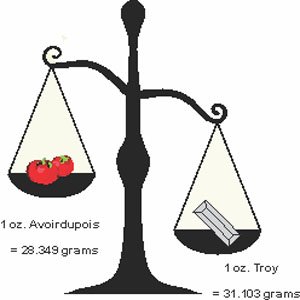

The "Gold to Silver Ratio" represents the number of silver ounces it takes to buy one ounce of gold.

In the late 20th century and now in the 21st century, silver has received the name "Poor Man's Gold," but many of those who invest in it call silver the "Smart Man's Gold."

The reason behind silver's "Poor Man" label is this simple truth: Silver is cheaper per ounce than gold and other precious metals.

This fact doesn't devalue silver's relationship to other precious metals; it simply states the obvious: silver is more affordable.

Those who want to invest in silver and receive the greatest return should pay attention to the gold-to-silver ratio.

|

When the gold-to-silver ratio is above 80, it takes more silver to buy gold, putting silver in a buyer's market, and vice versa. When the gold-to-silver ratio is below 80, it takes less silver to buy gold, putting gold in a buyer's market. |

|

Prior to 2014, when the ratio climbed above "65," it was said you'd receive a great return; for those who follow this ratio, this is something to think about if the ratio falls below "80."

Charts provided courtesy of TradingView.com

The Silver Market's Relationship

with the Gold Market

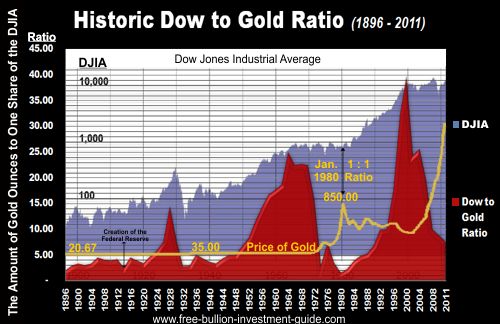

It's good to know how gold and silver interact with the financial markets because silver's price moves much more violently than gold.

Why is this?

Gold is a low-risk asset, and about 90% of gold's demand comes from the jewelry and investment sectors, which causes its price to be more subdued.

Although silver is a safe-haven precious metal, sixty percent (60%) of silver's market demand comes from industry, and silver moves with the stock market's volatility because of its wide use in industrial markets.

The gold-to-silver ratio moves to the upside when the stock market is getting too high, as reflected in silver's price movements, and when it falls, it's a sign that pessimism is in the markets and gold is in demand.

The chart below is an example of how the two markets can move in the same direction, but one moves more violently than the other.

chart provided courtesy of TradingView.com

Silver's Monetary History

with Gold

In the late 1100s (A.D.), a "Silver Rush" took place in Europe after better mining techniques opened newly discovered silver deposits.

The rush of silver in Europe allowed many countries to become more centralized, allowing them to expand their societies.

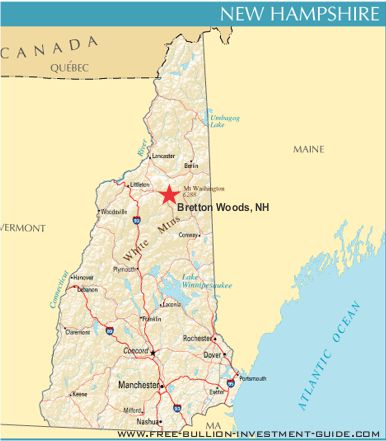

In the 16th century, the Spanish created a "Silver Standard" economy after they discovered large deposits of silver ore in South and Central America.

Like the Gold Standard, the Silver Standard played a crucial role in international trade for Spain, making their coinage the world's reserve currency for almost four hundred years.

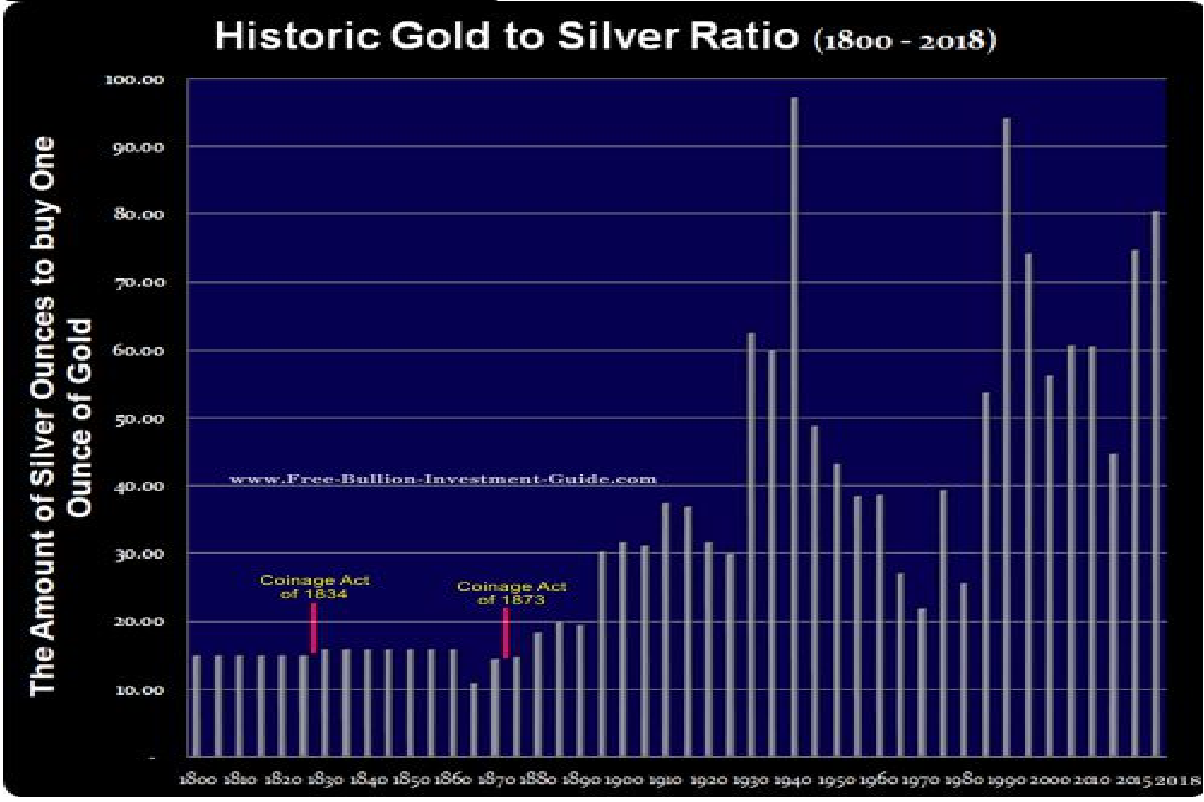

From the 12th century to the early 18th century, silver traded roughly at or near a 12:1 ratio with gold.

In 1717, to help England with their inflationary economic troubles, Sir Isaac Newton, who was Master of the Royal Mint, introduced a fixed ratio between gold and silver of 15½:1.

This action by Newton was the first attempt in recorded history to replace the "Silver Standard" with a "Gold Standard."

In 1834, the central bank in the United States, called the "Second Bank of the United States," was highly unpopular.

U.S. President Andrew Jackson won re-election on the platform of removing the Second Bank and signing the Coinage Act of 1834 into law.

The Coinage Act put Congress back in control of the nation's money supply, as is written in the United States Constitution.

The Coinage Act of 1834 also changed the gold-to-silver ratio by half an ounce to 16:1, valuing gold at $20.67 a troy ounce.

For the next forty years, the United States economy ran on a bi-metallic system; then, in 1873, that all changed.

President Ulysses S. Grant officially ended the "Silver Standard" after he signed the Coinage Act of 1873; the new law removed silver's fixed price to gold.

The United States embraced the Gold Standard and demonetized silver; those who wanted to keep silver monetized labeled the Coinage Act the "Crime of 1873."

Silver became a free-floating commodity, sending its ratio with gold to swing up and down, as shown in the chart below.

Interesting Fact: Did you know President Andrew Jackson was in office during the Georgia Gold Rush?

Other pages you may like...

|

|

|

|

|

Free Shipping on Orders Over $100 |

Gold to Silver Ratio

For Bullion Market News...

|

| |||||

Free Bullion Investment Guide

Search the Guide

| search engine by freefind | advanced |

Daily

Updated

Updated

Numismatic & Bullion Auctions page

3/21/2024

Updated

03/07/2024

Blog Post

Updated

Update

Update

New Page

Mintage Figures

2023

Mintage Figures

Archangel Raphael

~

The Angel of Healing

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!