Welcome

Bullion Market News

07/13: Gold News: Price Reclaims 50-Day Moving Average as Bulls Regain Control - FX Empire

07/13: Silver (XAG) Forecast: Bullish Silver Analysis as Trade War Fuels Safe-Haven Demand - FX Empire

07/13: Gold's Bull Run: Seasonal Strength Meets Conflicting COT Report—Are You In? - barchart

07/13: Trump Tariffs Push Gold Price Higher, But Dollar Is Having Its Best Week In 2025 - Investing Cube

07/13: Silver breaks higher - Redward Associates

07/13: Platinum surges to 11-year high powered by supply deficits and industrial demand - Invezz

07/13: Precious Metals Crushed Their Commodities Peers in the First Half of 2025 - U.S. Global Investors

07/13: Podcast: Riding the Wave: Strategic Metals and the New Commodity Bull Market - Financial Sense

07/13: Deficits 101: What They Are, Why They Matter, and How They Impact an Economy - Dunham Trust and Investment Services

07/11: Silver Hits 14-Year Highs at $38 as Market 'Scrambles' for Supply - Bullion Vault

07/11: Gold price climbs to two-week high as Trump unleashes new tariffs - MINING.COM

07/11: Gold finds some bids in the latest US Dollar outflows - Market Pulse

07/11: The Silver – Copper Connection and the Key Anniversary - Gold Price Forecast

07/11: COT Gold, Silver & USDX Report - July 11, 2025 - GoldSeek

07/11: Silver is Very Close to a Mania Phase - Hubert Moolman

07/11: Unearthed: Gold ETFs 101 — Myths, Mechanics, and Market Access, ft Amanda Krichman - World Gold Council

07/10: Gold Market Update - Technical Analyst Clive Maund shares his thoughts on where he believes gold is headed - Invest Macro

07/10: Silver investment surges as geopolitical risks, price expectations drive 2025 rally - MINING WEEKLY

07/10: COT Report Data for Silver Futures - McClellan Financial

07/10: Report: Gold and Silver Bull Run Continues - Sprott Insights

07/10: NY copper surges on 50% Trump tariff threat - SAXO

07/10: U.S. Mint Launches 2025 Uncirculated Morgan & Peace Silver Dollars - CoinNews

07/10: Shipwreck Found Off Madagascar May Hold $138 Million in Treasure - Greek Reporter

07/09: (.pdf) Report: Precious Metals Appraisal ~ Gold • Silver • Platinum • Palladium, and more. - Heraeus

07/09: Gold, silver, platinum take a timeout after strong first half - SAXO

07/09: (.pdf) Report: Despite near-term headwinds, further upside in the gold price remains intact - Metals Focus

07/09: Gold and Silver Slip as Trump Tariffs Spike US Copper Prices, Nasdaq Tests New High - Bullion Vault

07/09: Global Silver Investment Escalates in 2025 - The Silver Institute

07/09: Safe-Haven Demand Strengthens Commodities - VanEck

07/09: Gold-Mining Stocks Are the Hidden Winners of 2025 - Daily Wealth

07/09: Kennedy Half Dollar, Silver-Clad (1965-1970) - CoinWeek

07/09: Gunmen Hijack 33 Tons of Gold, Silver Concentrate in Truck on Mexican Highway - Breitbart

07/08: (.pdf) Report: • Gold, • Silver • Mining Stocks • Macro • Proprietary Models ~ Monthly Gold Compass - July 2025 - incrementum

07/08: Silver Forecast: Continues to See Volatility - Daily Forex

07/08: Gold Nanoparticle Cancer Research: First Patient Dosed in Early Feasibility Study Trial of Its Cancer Therapy - Sona NanoTech

07/08: Q2 in Precious Metals- Where are they heading in Q3? - barchart

07/08: Ex Libris: The Secret History of Gold, by Dominic Frisby - SPEAR'S

07/08: August sales date for American Liberty gold coin, silver medal - CoinWorld

07/08: Graphic: Is the U.S. Dollar Primed for a Digital Rebound? - Visual Capitalist

07/07: Newsletter: July 2025 - Monthly Newsletter - Free-Bullion-Investment-Guide.com

07/07: Silver consolidates close to the 2012 highs, poised for a breakout? - Market Pulse

07/07: Gold Outlook: Policy Fog, Fiscal Surge, and Tariff Risks Fuel Support - Pepperstone

07/07: Graphic: A Historical Look at the Gold/Silver Ratio and Silver Prices - Mining Visuals

07/07: Gold dips 1% on easing trade tensions - baha - Breaking News

07/07: Why Gold & Silver still shine - The Contrarian Capitalist (Substack)

07/07: U.S. Mint Begins Countdown to America’s 250th Anniversary with Gold Mercury Dime and Silver Medal Set - CoinNews

07/07: Poll Question: Have online marketplaces made it easier or harder to be a collector? Why or why not? - Numismatic News

The Bullion News & Commentary

Continues...

Silver and Gold are purified by Fire,

but God purifies Hearts.

What's In this Guide?

Precious Metals Candlestick Charts

Bullion Market Basics

The Bullion Basics pages were created to help you to get familiar with the Bullion Market.

Modern Government

Bullion Coins

The following pages give you a history of the Mints and or Central Banks that produce the bullion coins, for each country.

You'll find on each page links to the Precious Metal Bullion Coins for each country.

The Coin pages offer you the history, and description of the coins, plus extra large photos of each coin, mintage figures, and other specific coin information.

- Eagle

- Amer. the Beautiful

- Buffalo

- Britannia

- Sovereign

- Queen's Beasts

- Panda

- Maple Leaf

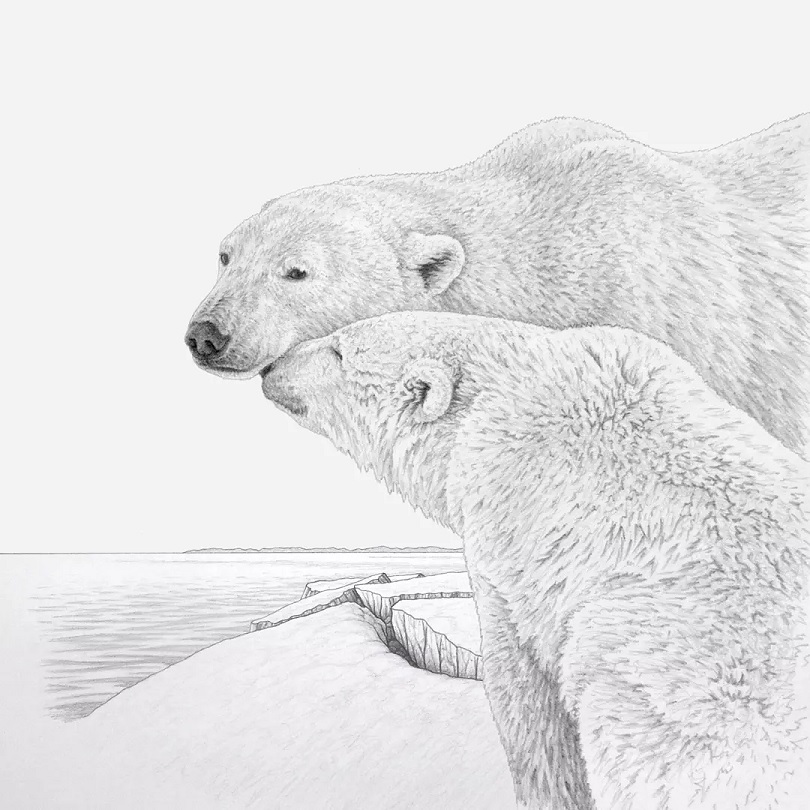

- Anniversary Coins

- Call of the Wild .99999

- Wildlife Series

- 1/2 oz. Silver Timber Wolf

- Libertad

- Krugerrand

- Jerusalem of Gold

Bullion Refiners

The Refiners pages give you a history of each refiner and in-depth information about their bullion.

Bullion Buying Guides

Each page offers you more information about the type of Bullion you may be interested in, in addition, you will find on these pages the links to the reputable dealers who offer the bullion.

Bullion Dealers and their Business Practices

future generations will thank you - Old Proverb

Bullion Security

The Bullion Security pages offers you information about two popular ways to protect your bullion. On your premises and off premises.

The Home Safes page gives you information about the differences in the way home safes are made, how to choose the best one for you and links to suppliers of these safes.

And the Vault Bullion Storage of Gold, Silver, and Platinum Bullion allow you to trade precious metals with low premiums while providing professional vault storage and allowing physical redemption of your investment.

Bullion Investment Ratios

The pages below give you the history behind the ratios and how to interpret them to help you judge the bullion markets.

Bullion Buying Tools & Links

These three pages of the guide will help assist you in purchasing bullion (if you choose to do so). In addition, each page gives you in-depth information about how they can help you in your bullion purchases.

Free Market Capitalist

(Learn the philosophies of a handful of 'Wise Investors')

Financial Market News

Cancer Advocacy

and

The Angel of Healing

Blogs

Martin Luther King, Jr.

Site info pages

| search engine by freefind | advanced |

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Daily

Newsletter

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

June's

All Articles were Originally Posted on the Homepage