Homepage / Popular Bullion Refiners: Credit Suisse

Credit Suisse Bullion

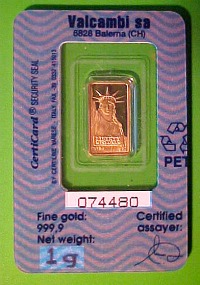

For nearly forty years Valcambi SA has been the only manufacturer of Credit Suisse bullion bars.

Valcambi SA, is one of the world's largest manufacturers of bullion bars and minted ingots. Valcambi is credited with producing the world's first one ounce minted ingot.

The Credit Suisse Group AG is a Swiss multi-national financial services company headquartered in Zurich, Switzerland.

Credit Suisse was founded by Alfred Escher in 1856 under the name Schweizerische Kreditanstalt (Swiss Credit Institution).

The bank is organized into three divisions, Investment Banking, Private Banking, and Asset Management.

In 1988, Credit Suisse gained a controlling stake in The First Boston Corporation, hence the longtime name of its investment banking unit Credit Suisse, First Boston.

Refining operations at Valcambi began in 1961, in 1967 Credit Suisse purchased 80% of the Valcambi.

In 1980 Credit Suisse purchased the remaining 20% of Valcambi and the refinery became a 100%-owned subsidiary of the bank.

Then in 2003, a European Gold Refineries Holding SA was formed by the founding members of Valcambi and Newmont Mining Corporation, purchased 100% of Valcambi.

Credit Suisse's bullion is one of the most popular, easy to carry, store and convert into cash in the world.

The bullion is fully backed by the Credit Suisse Bank of Switzerland.

Credit Suisse bullion bars and ingots come in sizes from 1 gram to a troy kilo (32.13 oz / 2.2lbs) The purity of their bullion bars range from .9999 gold, .999 silver and .9995 palladium and platinum.

Most Credit Suisse bars are encased inside an assay card or certificate with its exact purity, weight, serial number and signature of the assayer stamped and sealed on it for safety and security.

Valcambi SA

Valcambi Gold

Credit Suisse Bank

Other pages you may like...

|

|

|

Free Shipping on Orders $199+

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage