Homepage / Bullion Investment Basics: Bullion Glossary / F - Federal Reserve System of the United States

ExpressGoldCash - 4.9 star - Customer Reviews

The

U.S. Federal Reserve

System

The U.S. Federal Reserve System (a.k.a the Federal Reserve or just 'the Fed') is the central banking system for the United States of America.

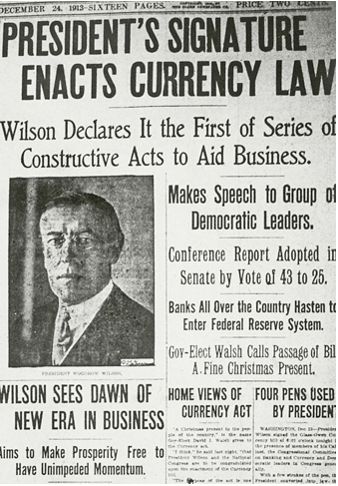

On

December 23rd, 1913, President Woodrow Wilson, signed into law the

Federal Reserve Act that authorized the creation of the Federal Reserve

System of the United States

The U.S. Congress has established three key objectives for monetary policy in the Federal Reserve Act: maximum employment, price stability, and it is to monitor and adjust short-term interest rates.

The first two objectives are sometimes referred to as the Federal Reserve's "Dual Mandate."

ExpressGoldCash - 4.9 star - Customer Reviews

The History of Central Banks

in the United States

The First Bank of the

United States

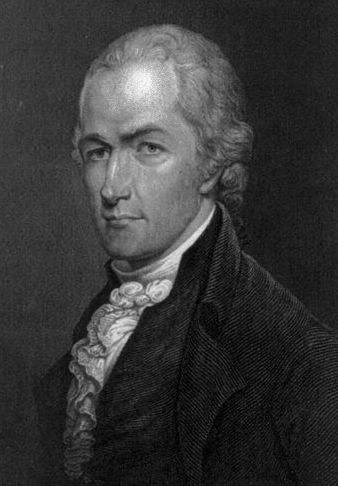

In the 1780's, Alexander Hamilton, who would eventually become the

United States' first Secretary of the Treasury, was a leading advocate

for creating a central bank for the United States.

Hamilton believed the new government of the United States needed a central bank so it could separately monitor and stabilize the monetary system.

Furthermore, he wanted to use the Bank of England as a blueprint for how his Central Bank would work, which did not make him popular in the Post-Revolutionary War Era.

In 1790, during the first session of the First Congress, Hamilton officially proposed the "Bank Bill" which would create the First Bank of the United States.Hamilton's proposal came with a lot of resistance, most notably from Thomas Jefferson

Jefferson argued that the bank was unconstitutional and that it benefited the wealthy at the expense of the common man.

President George WashingtonWashington asked his cabinet members their thoughts about the bill, to help him make his decision.

Washington

heard opposition from his Secretary of State, Thomas Jefferson and from his

Attorney General, Edmund Randolph.

After hearing their argument's

against Hamilton's 'bill', Washington wavered on enacting

the "Bank Bill" into law.

However, Hamilton who served as Washington's senior aide during the Revolutionary War had earned great respect from Washington.

So when Hamilton vehemently supported his positions for the "Bank Bill,"

President George Washington agreed with Alexander Hamilton and signed the "Bank Bill" into Law on February 25th, 1791.

President

PresidentJames Madison

In response to this, the First Bank of the United States was established.

The First Bank of the United States was headquartered in Philadelphia and had several branches in other major cities.

The Bank was given a charter that allowed it to operate for 20years.

James Madison, like Thomas Jefferson, did not believe the First Bank of the United States was Constitutional.

The Second Bank of the

United States

In the aftermath of the War of 1812, a revival of interest in a

central bank began to re-root itself among the citizens of the United States.

The federal government suffered from the disarray of an unregulated currency and a lack of fiscal order.

Modeled

on Alexander Hamilton's First Bank of the United States, the Second

Bank was chartered by President James Madison, in 1816.

Like the First Bank of the United States, the Second Bank of the United States was given a 20 year charter, to operate.

Shortly

after the Second Bank was created, it stirred growing ridicule, many

felt that its mismanagement helped bring on the panic of 1819.

In addition, there was growing resentment from the States over the Second Bank's special banking abilities.

The State of Maryland imposed a tax on any bank that was not chartered within the state. This was a direct attach against the Second Bank of the United States because it was the only bank not chartered by the state.

The cashier of the Second Bank, James McCulloch, refused to pay the tax and the State of Maryland countered with a lawsuit.

But in 1819, the U.S. Supreme Court affirmed the constitutionality of

the

Bank under McCulloch v. Maryland, which said that the Constitution had

granted Congress the implied power to create a central bank and that the

states could not legitimately constrain that power.

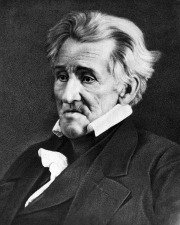

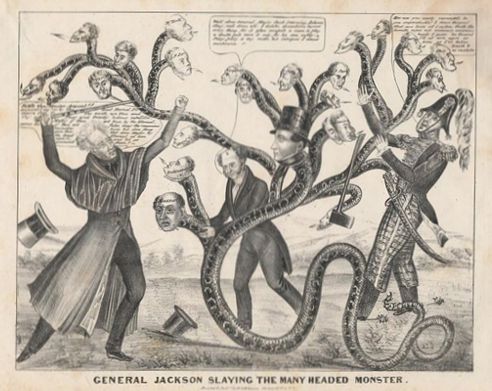

In 1832, the renewal of the 20 year charter for the Second Bank

of the United States became a big issue during President Andrew

Jackson's re-election campaign.

Jackson was not a friend to the

central bank, his views against the bank were the same as those of

Thomas Jefferson had against the First Bank of the United States.

Jackson did not think the central bank was constitutional, also, he believed that the bank favored special interests i.e.: stock investors and the wealthy over that of the common man.

Furthermore, in 1832, Congress voted to reauthorize the Bank's Charter for another 20 years, but President Andrew Jackson vetoed the bill, which helped him win a second term.

Shortly thereafter, Jackson removed federal deposits from the bank and distributed the funds among several private banks.

There were many efforts by the supporters of the bank including the President of the bank, Nicholas Biddle, to have the Charter renewed for the Second Bank of the United States.

However, there efforts did not succeed.

Note: See the Sources Section Below, click "Wikipedia - Bank War" to learn more about this episode in U.S. American History.

The US Federal Reserve

Federal Reserve Act is an Act that was signed into law by President Woodrow Wilson on December 23, 1913, it established the Federal Reserve Banking System.

The basic function of the Federal Reserve is to make possible the flow of credit and money that will promote orderly economic growth and a stable dollar.

Federal Reserve Banks

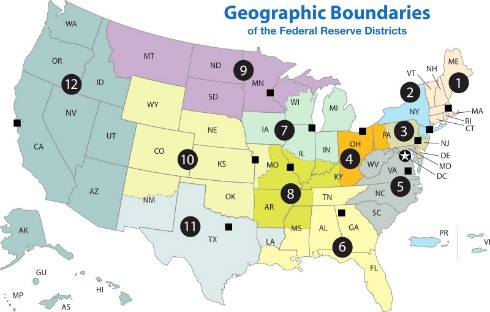

A Federal Reserve Bank is one of twelve banks created under the Federal Reserve Act.

Each bank acts as a fiscal agent for the United States in each of the twelve Federal Reserve Districts.

Every US Federal Reserve bank has a number according to the district in which it operates.

The following are the twelve US Federal Reserve cities and their district numbers.

1. Boston

2. New York City

3. Philadelphia

4. Cleveland

5. Richmond

6. Atlanta

7. Chicago

8. St. Louis

9. Minneapolis

10. Kansas City

11. Dallas

12. San Francisco

Note: Puerto Rico and the Virgin Islands belong to District 2; Alaska and Hawaii belong to District 12.

Federal Reserve Board

The Board of Governors of the Federal Reserve System consists of seven members appointed by the President and confirmed by the US Senate.

They are appointed to terms of 14 years, with terms arranged that one expires every two years. No two members of the board come from the same Federal Reserve District.

The picture below is of the Federal Reserve Building located in Washington, D.C., where the Federal Reserve Board of Governors, meet to discuss policy.

The Federal Reserve Building

The Federal Reserve Building in Washington, DC

Sources:

Digital History - Chapter 4 - Hamilton, Jefferson and the First National Bank of the United States

PBS - Landmark Cases - McCulloch v. Maryland

Wikipedia - Bank War

Wikipedia - Andrew Jackson

More Pages You May Like...

OR

For the Best Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage