Expect Volatility in

Precious Metals

before and after the U.S. Elections

plus

Gold, Silver, and the US Dollar

Review and Weekly Outlook

Originally Posted on 11/06/2016 @4:35pm

by Steven Warrenfeltz

Last week, politics dominated the markets, and it will likely continue to do so this week, but the ride will get a whole lot bumpier.

Additionally, last week, gold and silver prices rose mostly because the markets had not yet factored in the possibility of Trump winning the U.S. Presidency.

Most of the market has ignored the thought of Trump as President because of all the unknowns of how he would govern; plus, they've always thought that Clinton had the election won.

That was until the FBI announced that they had reopened the Clinton email case. Now, as Trump's poll numbers rise, the U.S. dollar and the markets fall, while gold and silver rise.

This movement in the gold and silver markets will likely continue, at least until Election Day on Nov. 8th, and if Trump wins the Presidency, expect it to continue.

Here's what you can expect to see happen in the Gold and Silver Markets if either candidate wins:

If Trump Wins the Presidency

The markets are really nervous about Trump.

If Trump wins the Presidency of the United States, expect a whole lot of volatility in all the Markets, from Tuesday through to who knows when the hysteria will stop.

The initial shock will last at least a week, and volatility will continue in the markets, but it is impossible to say how long it will last because the markets find Donald Trump that hard to judge.

For Gold and the other precious metals, I expect to see a spike in prices, bigger than BREXIT. In fact, if Trump wins the election, all signs indicate that Gold will break its 'Long Term Falling Trend-line.'

Furthermore, in the Gold Chart below, I've indicated BREXIT, which happened on 06/23/2016. (continued...)

I've stated in the past that on a daily basis, Gold and Silver trade relatively the same, but in the long run, silver leads gold in chart movements.

The silver price chart below displays all of the falling trend lines that silver has broken as it has led gold in its chart movements.

In the past, I have posted the charts below. I've noted and posted that Silver has already broken all of its "Long Term Falling Trend-lines." So, I believe that it is a foregone conclusion that if Trump wins the Presidency, gold, in the chart above, will follow silver's lead and break its falling trendline sometime in the future. (continued...)

A closer look - (click charts to see blog post about them).

(continued...)

If Clinton Wins the Presidency

If Clinton wins, I expect Gold and Silver to drop and the U.S. Dollar and broader markets to climb in price.

The market views Mrs. Clinton as 'More of the Same' or as a 'Safe Bet, ' and it is expected that if she were to win the presidency, nothing much would change.

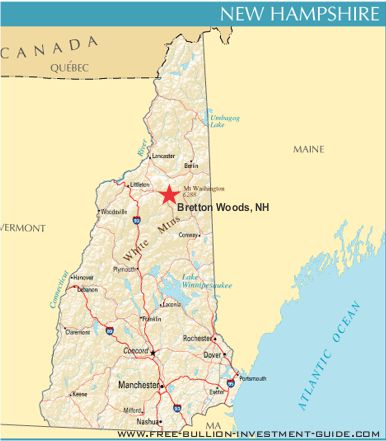

The chart below was posted on this

blog on 10/08

after silver fell in price and broke its ascending channel, which could

be a future indicator of what will happen to Gold if Clinton Wins. (continued...)

Ultimately, nobody knows what will happen on Election Day, but whatever happens, Expect Volatility!

GOLD (Review & Outlook)

Last week, gold and silver moved up because of the news about the Clinton emails and Trump's rise in the polls.

In the chart below, the vertical, maroon dotted line, on the far right, indicates the latest FOMC meeting on 11/02/2016 had no effect on the markets because there was no Interest Rate hike.

The red line at the top right of the chart (below) is the 'Long-Term Falling Trend-line' I mentioned in the introduction of this post. As you can see, after last week's move in gold, it doesn't have far to go to reach or break the trend line. (continued...)

Charts provided courtesy of TradingView.com

Gold's Price Resistance and

Support Levels

Gold's Resistance Level

$1380.00

$1350.00

$1310.00

Gold's Support Levels

$1300.00

$1275.00

$1250.00

SILVER (Review and Outlook)

Like gold, Silver rose in price for most of the last week. However, in both gold and silver charts, you can clearly make out what looks to be a “cup” shape forming, and this could be the beginning of a technical pattern known as a Cup and Handle.

('Click' on this Cup and Handle link for a full definition of the technical pattern)

Silver's 'Cup and Handle' has moved a little further in the formation of the pattern, but we'll have to see the election results before it may fully take shape.

The maroon-dotted line at the top left of the chart is Silver's 'Broken Long-Term Falling Trend-line' that I mentioned in the introduction. (continued...)

Charts provided courtesy of TradingView.com

Silver's Price Resistance and

Support Levels

Silver's Resistance Level

$19.35

$18.75

$18.50

Silver's Support Level

$18.25

$17.80

$17.20

US DOLLAR (Review and Outlook)

The U.S. Dollar fell last week, with Trump's rise in the polls weighing it down.

Also, the Fed's announcement on Nov. 2nd to keep rates at their low levels didn't give the U.S. Dollar any strength, which added fuel to its falling price.

For the week ahead, we'll have to see what happens after November 8th, when the U.S. Presidential Elections take place. It depends on which candidate wins the election; this will decide how the U.S. dollar will move. (continued...)

Charts provided courtesy of TradingView.com

U.S. Dollar's Price Resistance and Support Levels

U.S. Dollar's Resistance Level

$99.00

$97.35

U.S. Dollar's Support Level

$96.40

$95.50

Music

This week I listened to Garth Brooks, and this is one of the great songs I listened to: "The River."

For those who don’t know, because they haven’t visited this blog from the Free-Bullion-Investment-Guide, when I can, I prefer to listen to music when I work, and once in a while, I’ll share with the readers of these posts the song that stuck in my mind the most as I worked.

To view prior Blog posts - Go to the Bullion Guide's Blog.

For our 2016 Blog posts see our Tumblr Archive page.

Other pages you may like...

|

|

|

|

|

|

Thank You for Your Time!

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage