Gold, Silver & the U.S. Dollar -

What Happened Last Week?

and the Answers....

Weekly Bullion Market Review & Out-Look

Originally Posted on 10/09/2016 @3:24pm

by Steven Warrenfeltz

Gold and silver's unexpected drop in price took me by complete surprise, so last week I searched for answers.

Here's what I found.

False Answers

In my research, I read many theories that the decline in precious metal prices was caused by the announcement of a "Hard Brexit" by British Prime Minister Theresa May on Sunday evening.

"Hard Brexit” refers to Britain leaving the European Union, which the British people voted for in June 2016.

Bloomberg - (Theresa) May to Pull Brexit Trigger by March, But Most Issues UnresolvedHowever, as you can see in the chart below, the British Pound didn't fall hard until Thursday (Oct. 6th), which was mostly due to the French President's call for Britain to 'suffer' for its Brexit vote.

CNBC - France's Hollande says Britain must suffer consequences of Brexit: FTThe call for a 'Hard Brexit' gave support to the U.S. Dollar, which in turn hurt gold, but it didn't cause the fall in gold on Tuesday (Oct. 4th). (continued...)

In my search for answers, I also read that gold's fall was caused by the IMF's report on the Global economy.

The Telegraph - Global debt hits all-time high of $152 trillion as IMF warns of world-wide economic stagnationHowever, identifying $152 trillion in global debt and stating that Global growth will be stagnant is hardly a negative for gold.

Answers Found

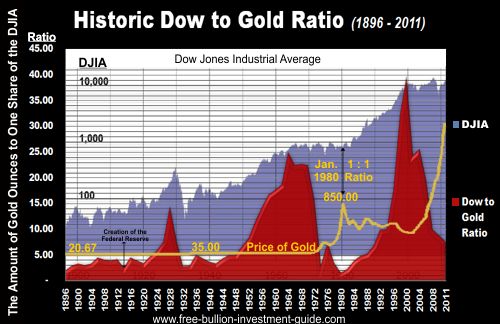

There are several reasons behind gold's fall last week, the biggest being the U.S. Federal Reserve and those who respond to its every word, a.k.a. market traders.

First, since the last FOMC meeting on September 21st, the markets have been looking to the Non-Farm Payroll Jobs Report for a sign of which way the economy and the Fed will move. (this is discussed in last week's post seen here.)

Although I had an optimistic tone in the last blog post, Gold was already falling last week; it ended the week resting right on the lower trendline of the Ascending Channel - see the chart below.

(continued...)

On early Monday, when the 'Hard Brexit' news was announced, traders sold the GBP for the USD, which didn't help gold and sent it below the ascending channel.

In addition, on the same afternoon as the 'Hard Brexit news, the Federal Reserve Bank of Cleveland's President, Loretta Mester, said the economy is ripe for an interest-rate hike, which wasn’t good news for gold, and its price moved lower.

VIDEO : Bloomberg - Fed’s Mester Says Case for November Hike Will Likely Be StrongThen, on Tuesday morning, before the U.S. markets opened, the Richmond Federal Reserve President Jeffrey Lacker said rates might need to rise a lot.

This hurt gold’s price more.

Reuters - Fed's Lacker says rates might need to rise a lot, case for hike strongSo, What's Up with all this New Hawkish rhetoric by the Federal Reserve???

I

think the FOMC is trying to show through this 'Fed Speak' that they

don't have a political bias and that they base their decisions on 'data'

and not 'politics.'

Basically, the

Fed's other members are circling the wagon around Janet Yellen, after

her embarrassing testimony on 9/29, in front of Congress, where she was

put on the spot about the Fed's political biases - see the video here or click the link below.

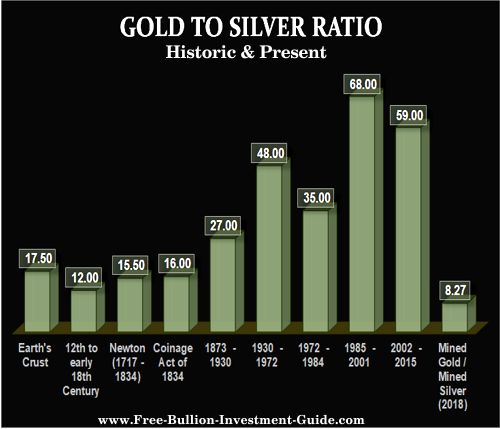

Gold and Silver started to fall after all the “Hawkish” rhetoric from numerous Federal Reserve officials; plus, the looming Jobs Report was hanging over the Gold and Silver markets.

Then, once gold fell below the $1310 and $1300 support levels, huge amounts of stop orders were filled, and the price plummeted.

The same happened to silver after it fell below its $18.50 support level.

GOLD

(Note: the chart below is a little confusing; to clarify, the green lines are from the old Ascending Channel, seen in the chart above, and the blue lines are from the New Ascending Channel that will be in future posts.)

As mentioned in the first sentence of this post, gold's move took me by complete surprise.

The biggest surprise wasn't that it broke its 'Old Ascending Channel, but that it broke below the falling wedge.

On the right of the chart is a vertical black line; this line represents when the U.S. Presidential Elections will occur. (continued...)

Charts provided courtesy of TradingView.com

Gold's Price Resistance & Support Levels

Last week, gold broke almost all of its positive trend-lines, for now, gold needs to hold onto support or break one of the resistance levels indicated below to change this new downward movement.

Gold's Resistance Level

$1300.00

$1290.00

$1270.00

Gold's Support Levels

$1250.00

$1225.00

Free Shipping on Orders $199+

SILVER

After Silver broke under its support level of $18.50 on Tuesday (10/4), the price of Silver sold off until it hit support at $17.25.

In addition, like gold, silver broke under its falling wedge and broke its Ascending Channel. (continued...)

Charts provided courtesy of TradingView.com

Silver's Price Resistance & Support Levels

In the week to come, Silver will need to stay above its support levels, to regain support in the market.

Silver's Resistance Level

$18.50

$18.00

$17.75

Silver's Support Level

$17.50

$17.40

$17.10

US DOLLAR

On Thursday of last week, after the GBP had its 'flash crash', the dollar broke above its Rising Wedge, which is usually a negative pattern, and since the U.S. dollar broke it to the upside, it was a failed pattern. (As seen in the chart below)

DalyFX- GBP/USD ’Flash Crash’ Rebound Looks to BoE/Fed Rhetoric for FuelThen, the next day, something very weird happened, and I pointed it out in the chart below. The Market Opened 50 cents ($0.50) higher than it closed the previous day, and it closed Friday below Thursday's close.

It doesn't make sense because, technically speaking, we are looking at a chart where the price of the U.S. dollar broke above its falling trend-line on a down day.

For this reason, I'm going to keep the falling and rising trend-lines on the US dollar chart (for now), and because of the U.S. dollar's weird movement and the up and upcoming U.S. Presidential Elections, there isn't much analysis that can be done. We'll see what happens in the week to come. (continued...)

Charts provided courtesy of TradingView.com

Tunes

When I can, I like to listen to music while I work on the blog for the Free-Bullion-Investment-Guide, and I usually share with you the song that sticks in my mind the most.

The first time I heard Frank Sinatra was at my father’s best friend’s restaurant in Middleburg, Virginia; the restaurant was called The Coach Stop. For those who may not know, Middleburg is in the heart of Virginia’s horse country, and it possesses some of the most beautiful countryside you’ve ever seen.

My father’s friend never played Sinatra in his restaurant until Frank started to eat there, and the two became friends; after that, all you heard in his restaurant was Frank Sinatra.

I was about 10 years old when this happened, and I thought Sinatra’s music was the coolest, and nothing’s changed. So this weekend, it was all Sinatra.

God Bless and I hope you have a Great Week! SW

To see all prior Bullion Market Analysis Blog posts.

Go to this Guide's Blog page here, or see our Archive page on Tumblr.

Thank You for Your Time!

Other pages, on this Guide, that you

may like...

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

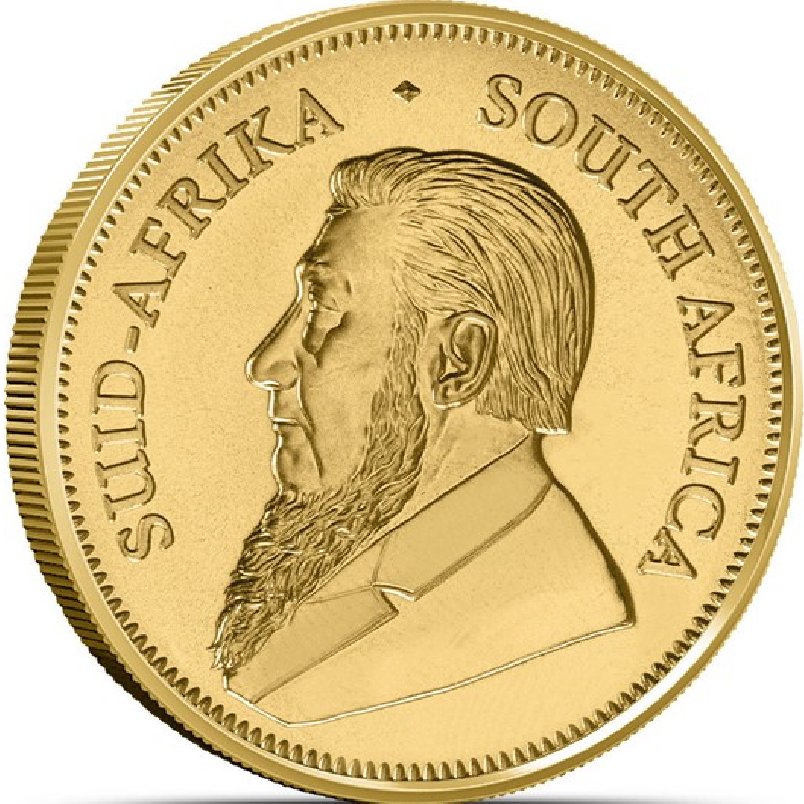

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

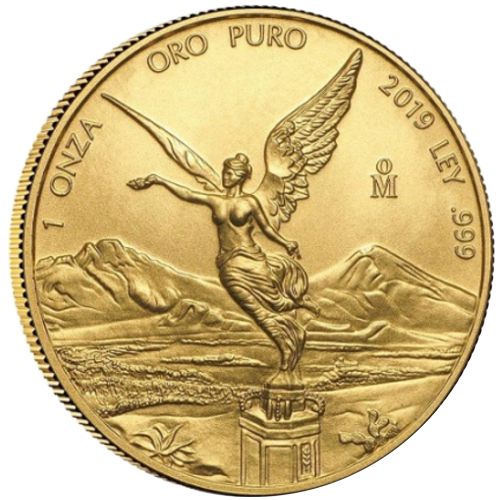

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage