Homepage / Archived News or Quarterly News / 3rd Quarter 2012

ExpressGoldCash - 4.9 star - Customer Reviews

3rd Quarter - 2012

Charts, Bullion News & Commentary

This page provides a comprehensive overview of gold, silver, platinum, and palladium during the quarter.

For each of the precious metals, you'll find charts. Below the charts, you will find Bullion News Headlines from the 3rd Quarter of 2012. Every news link was originally posted on this guide's homepage.

The charts below are provided courtesy

Gold Price Charts - 3rd qtr. 2012

Gold Price Chart (Jul. 1st, 2011 - Sept. 30th, 2012)

Bullion News

Gold Price Summary

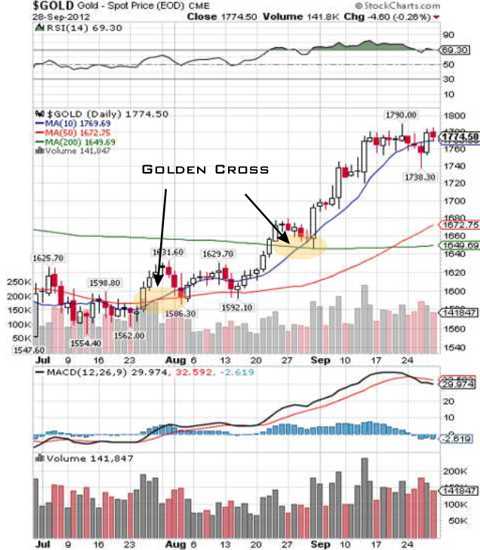

In the third quarter of 2012, gold's price chart displayed three golden crosses, indicating a strong bullish signal for gold.

The first golden cross occurred in late July when the 10-day moving average rose above the 50-day moving average. The second golden cross happened when the

10-day moving

crossed above the 200-day moving average.

The third golden cross, not pointed out in the chart (below), happened when the 50MA crossed above the 200MA; this was another bullish signal in Gold's price chart.

Gold's price chart showed clear signs that more buyers were in the market than sellers, the volume of buyers was high, and the RSI (Relative Strength Index) and the MACD (Moving Average Convergence-Divergence) were both in positive territory.

However, near the end of the quarter, the MACD, RSI, and trading volume were all topping out, and the volume of sellers in the market had started to overtake those of buyers. All of these were indications that some consolidation was in order after the rise in gold's price.

Gold Price Chart (Jul. 1st, 2012 - Sept. 30th, 2012)

Gold Price Chart (Oct. 1st, 2010 - Sept. 30th, 2012)

Bullion News

4.7 star - Customer Reviews

Silver Price Chart - 3rd qtr. 2012

Silver Price Chart (Jul. 1st, 2011 - Sept. 30th, 2012)

Bullion News

Silver Price Summary

Silver's quarterly spot price chart closely resembles gold's chart for the third quarter of 2012.

Silver, like gold, experienced three Golden Crosses in the third quarter of 2012. The first Golden Cross for silver occurred in the second week of August, which was later than the one noted in gold’s chart. This event signaled that a bottom had been reached and that a new upward trend had begun in the spot price.

Near the end of the quarter, the spot price of silver seemed to have peaked at around $35.00 per troy ounce. However, when the 50-day moving average crossed above the 200-day moving average, creating another golden cross, it signaled a positive trend.

Silver's spot price at this time was looking for further positive movement, but with the RSI and MACD topping out and breaking down, the future price of silver was in question.

Silver Price Chart (Jul. 1st, 2012 - Sept. 30th, 2012)

Silver Price Chart (Oct. 1st, 2010 - Sept. 30th, 2012)

Bullion News

Platinum Price Chart - 3rd qtr. 2012

Platinum Price Chart (Jul. 1st, 2011 - Sept. 30th, 2012)

Bullion News

Platinum Price Summary

Similar to Gold and Silver, Platinum's spot price experienced two Golden Crosses in the third quarter of 2012. After undergoing consolidation for much of the previous quarter and the first half of this quarter, buyers were eager to purchase Platinum at a discounted price.

Silver, platinum, and palladium are all industrial metals that also serve as commodities for savings and investment. Due to these shared characteristics, their price charts often show similarities.

In Platinum's 3rd quarter chart, the increase in price and investment volume are both positive signs for the next quarter.

Platinum Price Chart (Jul. 1st, 2012 - Sept. 30th, 2012)

Platinum Price Chart (Oct. 1st, 2010 - Sept. 30th, 2012)

Bullion News

Palladium Price Chart - 3rd qtr. 2012

Palladium Price Chart (Jul. 1st, 2011 - Sept. 30th, 2012)

Bullion News

Palladium Price Summary

Palladium's spot price chart for the third quarter of 2012 shares many characteristics with the previous three quarterly charts of precious metals.

Palladium's price chart has two golden crosses, and both the RSI and MACD were showing positive signs of price movement. However, late in this quarter, Palladium's spot price shows signs of being overbought.

Palladium Price Chart (Jul. 1st, 2012 - Sept. 30th, 2012)

Bullion News

Palladium Price Chart (Oct. 1st, 2010 - Sept. 30th, 2012)

The charts above are provided by the courtesy of

3rd Quarter - 2012

Bullion News & Commentary

The Quarterly News starts with the end of the quarter articles, first.

Please be aware that not all of the links below are working; they have been retained because the headlines provide information on the state of the markets at the time.

09/30/12 - Bullion News

MINING – Gold set to rise on inclusion as Tier 1 banking asset

TimesUnion – Unfavorable tax treatment for gold

CoinNews – Gold, Silver Surge in Quarter, Sept. Sales of US Bullion Coins Swell

Charleston Voice – Are You Ready to Join the Nickel Hoarders?

The State Journal Register – Line of creditors long in Parsons/THR bankruptcy

09/29/12 - Bullion News

MoneyNews – Dallas Fed's Fisher: US 'Drowning in Unemployment'

Political Metals – Gold All Time High in Euro, Franc, Peso, Rupee, Rupiah, Real & Rand

Reuters – U.S. gold coins on track for weakest September sales in five years

Trader Dan – Gold Still Stuck near $1785 - $1800

VIDEO (08:37) : CNBC – (06:30) Kramer "Bullion is #1"

The New American – The Fed is Playing With Fire

Orlando Sentinel – Analysis: Gold favors slow burn over surge post-Fed easing

CoinNews – US Mint Tweaks Its Website

Motley Fool – Is Warren Buffett Wrong About Gold?

Wall St. Cheat Sheet – Gold Logs Best Quarter Since 2010, Silver Outperforms Everything in Q3

09/28/12 - Bullion News

Ahead of the Herd – What Does Gold Have Going For It?

CHARTs : Inside Futures – Gold Shines into Quarter-End

Market Anthropology – Pavlov's QE Dogs

Perth Mint Bullion – Video: 2013 Kangaroo Gold Bullion Coin Series

Gold Versus Paper – Silver and the Myth of Diminishing Returns From QE

247 Bull – Death Knells for the US Dollar: Part II

ZeroHedge – Euro And Swiss Franc Fall To New Record Lows Against Gold

Bullion Street – Peru holds 120,000 tons of Silver underground

Affiliate Ad

09/27/12 - Bullion News

Profit Confidential – Steak Houses Struggle as Big Spenders Start to Feel the Pinch

XINHUANEWS (China) – U.S. QE3 signals deepening credit crisis: Dagong

Dollar Collapse – Tom Cloud: Silver is the Hot Thing Now

CoinNews – US Mint Sales: Sets, Covers Overshadow Collector Gold and Silver Coins

VIDEO (25:45) : Max Keiser – Keiser Report: Boom & Bust Vicious Cycle - Interviews Detlev Schlichter of Paper Money Collapse

Business Week – Hedge Funds Bullish on Silver as Hoard Nears Record: Commodities

Canada Free Press – Welcome to Bernankeville, the City of Jokernomics

VIDEO (01:12) : Bloomberg – Federal Reserve Bank of Philadelphia President Charles Plosser: QE Risks May Be Much Higher Than Benefits

San Fransisco Chronicle – Why Are People Hoarding Coins?

VIDEO (04:56) : CNBC – Fed's Inflation Nation Looms

09/26/12 - Bullion News

Profit Confidential – Dow Theory Flashes Sell Signal

SafeHaven – Global Currency Wars in Full Escalation

MineWeb – US election years, QE and a few "oh oh" moments for gold

Business Insider – BofA Makes The Case For $3,000 Gold

The Wall Street Journal – Silver Appears Set to Continue Its Upward Move

The Real Asset – The Hayekian currency

247 Bull – A brief history of money & banking: Part I

ZeroHedge – Presenting Warren Buffett's "Gold Cube"

USA Watchdog – Gold is a Currency

Silver Doctors – Chart of the Day: Federal Minimum Wage in Gold

Perth Mint Bullion – How Tiny Particles Of Gold Get Transformed Into Solid Gold Bars

GoldSilver – Golden Cross Signals Gold Gains, Silver Surge Ahead

CoinWeek – Spectrum’s A-Mark Precious Metals, Inc. Announces New Line of Sunshine Branded Bullion Products

Wealth Wire – Chinese Company Marketing FAKE Gold!

Business Week – A Lost Decade for Savers

Bloomberg – South African Strikes Halt 39% of Nation’s Gold Output

Financial Sense – The Currency Experiment Has Failed

The Daily Bell – Bernanke and Money Printing Have Got to Go

09/25/12 - Bullion News

Moneda De Plata Para Mexico – Reflections on the effects of War as compared to the effects of Fiat Money by Hugo Salinas Price

Wealth Daily – Junk Gold and Silver - Talking to a SHTF Survivor

Silver Doctors – SILVER EAGLE SALES JUMP 1 MILLION OVER THE WEEKEND

Numismaster – Tungsten-Filled 10-Ounce Gold Bars Raise Questions

LA Times – Use commemorative coins to pay down deficit, lawmakers suggest

VIDEO (01:27) : Wyatt Research – Where the Fed Money Really Goes

Financial Sense – What If the Fed Has It All Wrong?

Investment Rarities – TRANSPARENCY by Ted Butler

NewsMax – Deutsche Bank: Gold Might Not Be Overvalued Until $2,960

AUDIO : FSN - Ranting Andy Hoffman – COMEX Short Position… Silver Under $35 Or Bust

Bullion Street - Colombia drug lords turns to Gold

JS MineSet - In the News Today

The Telegraph - Financial regulators need to consider breaking up big banks to make the global economy safer

Wall St. Cheat Sheet - Fundamental and Technical Indicators Glitter for Gold

VIDEO (27:50) : Capital Account - Jim Grant offers his Observations on QE to Infinity and the Great Levitation!

09/24/12 - Bullion News

Casey Research - The #1 Reason Inflation Will Win

Ricochet - Milton Friedman Schools Hugo Chavez

Wyatt Research - What’s REALLY Moving Gold

International Man - Manipulation of the Gold Price

VIDEO (06:44) : CNBC - Silver to Gold Ratio

FX Empire - Gold Fundamental Analysis September 25, 2012 Forecast

SafeHaven - Interest Rates Are Prices

Profit Confidential - First Time Since 2009: Earnings Growth for S&P 500 Companies Turns Negative

GoldMoney - Spanish crisis hurting commodities (again)

Resource Investor - How to Store Silver at Home

Silver Coins Today - 2012-P Hawaii Volcanoes 5 Ounce Silver Uncirculated Coin Available

09/23/12 - Bullion News

VIDEO (10:38) : Financial Markets - The Solution - Part 2

TECHNICAL ANALYSIS : VIDEO (11:56) : The Running Of the Bulls Special QE3 Gold Report 9.23.2012

ZeroHedge - Gold Counterfeiting Goes Viral: 10 Tungsten-Filled Gold Bars Are Discovered In Manhattan

American Thinker - QE Forever

ETF Daily - If You Like QE3 But The Stock Market Makes You Nervous; Buy Gold

09/22/12 - Bullion News

CoinNews - Gold Gains 0.3% on Week, Silver Dips 2 Cents, US Silver Coins Explode

International Man - What You Should Think about Before Traveling With Precious Metals

VIDEO (04:13) : Wall Street Journal - What Do Central Banks Know That We Don't?

The Market Oracle - Gold-Silver Ratio Declining As U.S. Dollar Collapses

VIDEO (01:34) : Bloomberg - What Does Infinite Central Bank Buying Look Like?

VIDEO (28:04) : Capital Account - David Stockman on Federal Reserve Arrogance and Monetary Mission Creep!

Commodity Online - Copper market could face supply challenges in Q4 2012: Deutsche Bank

ZeroHedge - Gold And Silver Trump US Equities In Q3 And Year-To-Date

09/21/12 - Bullion News

VIDEO (04:54) : U.S. Global Investors - Interview with Frank Holmes on Bloomberg’s Taking Stock: Gold to Hit $2,000? $7,000? $40,000?

CHART : World of WallStreet - Strange "Gap" in Gold Chart..."Gold: I've Never Seen A Gap Like This Before"

VIDEO (03:08) : CNBC - Dalio: 'Gold' is the New 'Cash'...says Buffets making a "Big Mistake" in Gold

Jesse's Café Américain - Update on the Gold 'Shadow Chart' - Review of the 'Cup and Handle' Formation

ZEAL - New Silver Upleg

Gold and Silver Blog - Platinum Has Soared 17% Since Early August – What Now?

GoldSeek - I Have an IRA. How Can I Invest in Gold and Silver?

VIDEO (06:59) : CNBC - Why Fed's Easing Makes Santelli Uneasy

AdvisorOne - PIMCO’s El-Erian: Fed Wants Inflation Now, Will Clean Up ‘Mess’ Later

Bloomberg - Gold Seen Luring Wealthy as Central Bankers Expand Stimulus

Enterprising Investor - Poll: What Do You Think Will Be the Most Likely Impact of QE3?

VIDEO 04:00) : 3news - Gold a building block for investment - New Zealand Mint

Inside Futures - Silver Futures Analysis With Key Levels and Price Targets

GoldSilver - “How High Can Gold Go?” "There Is No Telling" James Grant Tells CNBC

VIDEO : Mish's Blog - Davidowitz on QE and the Economy: "Bernanke is Certifiably Nuts"

Ahead of the Herd - Poverty’s Roll Call

Gold Alert - “No Linkage” Between QE3 and Job Growth

CHARTS : Market Anthropology - Legends of the Fall

VIDEO (28:05) : Capital Account - John Mauldin and Jim Rickards discuss the Looming Debt Crisis and the Fiscal Abyss!

09/20/12 - Bullion News

Wealth Wire - 10 Quotes From Financial Experts About The Effect That QE3 Will Have On Gold And Silver

CoinNews - US Mint Sales: Numismatic Coins Solid, Bullion Eagles Superb

VIDEO (04:36) : Arabian Money - Gold bulls taking centre stage as BOA forecasts $2,400 an ounce

VIDEO (25:47) : Keiser Report: World Flash Clash Center, Max Keiser Interview's "Currency Wars" author Jim Rickards

Daily Wealth - Silver Is Up 25% Since August – What to Do Now

ZeroHedge - Deutsche Bank: Gold Is Money

CoinWeek - What If Only 3% of Adults Wanted To Purchase Physical Gold And Silver?

Perth Mint Bullion - How Much Gold Does China Have?

GoldScents - MARKETS ARE WAITING FOR THE OIL CYCLE TO BOTTOM

Article & VIDEO (01:18) : CNBC - ‘Golden Cross’ May Signal Big Gold Gains Ahead

VIDEO (11:56) : USA Watchdog - Peter Schiff-Dollar Vulnerable to a Massive Collapse, Buy Gold and Silver

09/19/12 - Bullion News

Article & VIDEO (01:36) : Silver Doctors - TUNGSTEN FILLED 10OZ PAMP SUISSE GOLD BAR DISCOVERED IN MANHATTAN

CoinNews - Gold Gains Marginally, Silver Dips 13 Cents, US Gold Coins Spurred

VIDEO (05:11) : Bloomberg - Are Central Banks' Throwing Everything at Markets?

Financial Sense - The Trouble With Printing Money by Chris Martenson

Article & VIDEO (01:36) : ZeroHedge - South African Violence Returns As All Miners Demand Pay Hike

VIDEO (05:30) : Capital Account - Word of the Day: Exchange-Traded Fund (ETF) (explains the ETF - GLD in detail)

VIDEO (03:19) : Yahoo (BreakOut) – It’s Time to Go for Gold

Wyatt Research – The Definitive Hyperinflation List

PDF : Hera Research – Neil Barofsky: Another Financial Crisis All But Inevitable

AUDIO : FSN – Andy Hoffman – Infinite QE No One Gets What They Want

AUDIO (33:23) : McAlvany Commentary – QE to Infinity

Profit Confidential – Didn’t Get into Gold Early Enough? This Other Metal’s Your Second Chance

Xinhuanet – London offers to push yuan's globalization

CoinNews – Premiums Decline for US Mint Silver Coins as Melt Values Riser

VIDEO (25:50) : Casey Research – Legalized Plunder

Ricochet – Dr. Thomas Sowell discusses his new essay "Trickle Down Theory" and "Tax Cuts for the Rich"

09/18/12 - Bullion News

VIDEO (04:56) : Learn Liberty – Should We End the Fed (Link to the Video above)

321gold – He Who Hesitates Is Lost

Casey Research – When Money Dies...

Advisor Perspectives – Weekly Gasoline Update: Eleventh Week of Price Increases

VIDEO (11:57) : Got Gold Report – Kevin Warsh about the Fed

Money Management – The value of gold in an investment portfolio

The Daily Reckoning – The World’s #1 Money Printer

VIDEO (05:30) : Arabian Money – Why gold could hit ‘$2,000 relatively quickly’ as the Chinese and ECB follow Fed devaluation

Business Insider – How 9 Countries Completely Lost Control Of Inflation

Market Watch – Why QE3 makes retirees queasy

The Street – The Fraud of Negative Gold/Silver Lease Rates: Opinion

VIDEO (23:50) & Transcript : Silver Doctors – DAVID MORGAN: SILVER MOVING TOWARDS PAR WITH GOLD!

09/17/12 - Bullion News

CoinNews – Gold Dips from 7-Month High, US Silver Coins Rally

U.S. Global Investors – All Signs Pointing to Gold by Frank Holmes

VIDEO (14:37) : USA Watchdog – Jeff Berwick-0% Interest Rates Until the System Dies

Fast Markets – Gold pauses after heady QE3 rally, platinum slips as Anglo prepares restart

Casey Research – Where Will QE3 Take Us?

AUDIO : FSN - Gary Wagner – Markets Have Changed: Gold $2200 Soon

Summary & VIDEO (10:34) : Silver Doctors - Fiat Currencies – The Good, The Bad, and The Ugly: Dollar’s End Game is HERE!

Las Vegas Sun - Gold worth $7 million found in house after Nevada man dies

Commodity Online - ‘China’s Silver buying interest advances’

Forbes - A Ponzi Schemer Parts With His Silver

09/16/12 - Bullion News

The Daily Bell - David Morgan on the Value of Silver in an Upcoming Inflationary Depression

CHARTS - TECHNICAL ANALYSIS : World of WallStreet - Is Gold Overbought And The Two Month Outlook

The Globe and Mail - Copper/Gold Ratio: Stimulus Fever Skews Key Market Indicator

Jesse's Café Américain - Purchasing Power Of Various Currencies and Gold

The Economist - The global debt clock

09/15/12 - Bullion News

CoinNews - Gold Prices Add 1.9% on Week as Silver Gains 2.9%, US Gold Coins Soar

Business Insider - Ben Wins, Who Loses...The Fed Is Committed To Making Food And Gas Even More Expensive

VIDEO (05:59) : CNBC - Peter Schiff - "First the Fed Gave Us Operation Twist, Now they Got The Operation Screw"

Wealth Daily - Silver Goes Ballistic

VIDEO (02:24) : Yahoo (BreakOut) - America Is Facing a Lost Generation: Jim Rogers

Paper Money Collapse - Stimulus, to infinity and beyond

Daily Wealth - A big move in gold is coming...

VIDEO (54:25) : Chris Martenson Interviews - Janet Tavakoli: Understanding Derivatives and Their Risks

GoldScents - THE NEXT RECESSION WILL BE TRIGGERED BY OIL

09/14/12 - Bullion News

Deviant Investor - Gold is TOO Expensive! I Can’t Buy Now. WRONG!

VIDEO (28:01) : Capital Account - Deficit Spending and the "Coercion-Backed Greenback" with Edward Harrison

VIDEO (08:22) : Bloomberg - Faber: Fed Policy Will 'Destroy the World'

Motley Fool - Ride This QE3 Rocket to $2,000 Gold and $50 Silver

MineWeb - Watch platinum as it closes the gap on gold

VIDEO (02:46) : U.S. Global Investor - Frank Holmes on CNBC Asia Squawk Box: Lack of Fiscal Discipline May Drive Gold Higher

Enterprising Investor - Why the Current Account Deficit Helps Explain the Economics of QE3

Financial Sense - “Unlimited QE3” Quick Analysis

VIDEO (11:33) : Andrew Schectman on How to Avoid Gold Scams & How a COMEX Default will Change the Bullion Industry

CNBC - US Credit Rating Cut by Egan-Jones...Again

ZeroHedge - Inflation Expectations Suggest 5% Inflation Is In The Cards

Dollar Collapse - The Long Wave Versus the Printing Press: Central Banks Go All-In

Kitco - US Gold Production Rose 8% In June - USGS

Perth Mint Bullion - Platinum: History Of A Metal On The Move

Summary & VIDEO (06:44) : Silver Doctors - Bart Chilton Sends Warning Letter to Printer in Chief Bernanke

Ahead of the Herd - Bankers, Bankers, Bankers

09/13/12 - Bullion News

U.S. Global Investors - When You Should Stop Buying Gold by Frank Holmes

VIDEO (27:50) : Capital Account - Marc Faber on Hedging the Bernanke Put and QE3 with Gold, Land and Equities!

Trader Dan - The Fed and the ECB determine to Destroy the Middle Class

VIDEO (51:36) : Press Conference with Chairman of the FOMC, Ben S. Bernanke

Arabian Money - German court sharply restricts what the ECB can do to save the eurozone

Rick Ackerman - The Fed’s Wizard Behind the Curtain

Eric De Groot - Fed Pulls Trigger, to Buy Mortgages in Effort to Lower Rates

Inside Futures - Gold & Silver futures show fresh buy signals

VIDEO (08:30) : Bloomberg - David Stockman on Fed Policy, U.S. Budget Deficit

CoinWeek - The More Gold And Silver Prices Are Suppressed, The Higher They Will Rebound

The Daily Bell - James Grant Calls for a Gold Standard

09/12/12 - Bullion News

Article & VIDEO (67:05) : Business Insider - Hedge Fund Manager RAY DALIO: There's No Sensible Reason To Not Own Gold

Financial Sense - Fiat Money Is Immoral

Perth Mint Bullion - Sales Update: On Course For Sell Out At The Mint

247 Bull - Fed prepares to print $780 billion a year in open-ended stimulus

VIDEO (25:49) : "The Federal Reserve Is a Cartel" - G. Edward Griffin

POLL : Rasmussen Reports - 58% Lack Confidence in Fed To Keep Inflation Under Control, Interest Rates Down

Fast Markets - Technical Analysis - Dollar Index - Looking weak

Bullion Street - Platinum eyes sharp gains on supply concerns

VIDEO (17:04) : USA Watchdog - Hyperinflation is Virtually Assured – John Williams

Bullion Bulls Canada - German Court Caves-In To Euro-Zone Hyperinflation

CoinWeek - The World’s Most Popular Gold Coin

09/11/12 - Bullion News

247 Bull - The Single Best Reason to Own Gold

Seeking Alpha - Gold Bullion Vs. Gold Miners: The Truth Behind The Valuation Gap

CoinNews - 2012 Hawaii Volcanoes 5 Oz Silver Bullion Coin Sales Begin

SilverSeek - Silver Bars or Coins? What to Buy?

Wealth Daily - Gold and Silver Continue to Rock and Roll

Real Clear Politics - An Economic 'Plan'? by Thomas Sowell

International Man - Interview with former President Thomas Jefferson on Liberty

The Real Asset - Spaniards trust in gold over euro

Market Anthropology - Pavlov's QE Dog - Silver

First Coast News - Lake City police: Man arrested for selling stolen rare coins

Business Insider - The Complete History of the $20 Bill

Perth Mint Bullion - Will We Run Out Of Gold And Silver?

MoneyNews - Moody's Threatens to Cut US' AAA Rating if Federal Budget Deal Isn’t Reached

ZeroHedge - US August Budget Deficit Soars To $192 Billion, $1.17 Trillion In Fiscal 2012

Wealth Wire - The New California Gold Rush

The Royal Mint - The history of UK Bullion Coins – Sovereign and Britannia

The Gold Report - Is $1,740 Gold a Blip or a Trend? Notes from the Casey Research Summit

09/10/12 - Bullion News

Profit Confidential - Corporate Insiders Dumping Stocks at Alarming Pace

The Real Asset - What sparked your interest in gold?

Casey Research - Gold, the Dollar, and the Euro – The Bottom Line

VIDEO (14:27) : USA Watchdog - Greg Mannarino-You Are Going To See Inflation You Are Not Going To Believe

Seeking Alpha - Gold And Silver Surge On Anticipation Of More Central Bank Money Printing

VIDEO (04:13) : CNBC - Jim Rogers: Policy Makers Saying 'Same Old Garbage'

ZeroHedge - Gold In Euros Touches New Record High At EUR 1,360 Per Ounce

VIDEO (02:00) : Interview with Silver Guru David Morgan - Weak Jobs Number JOLTS Gold & Silver HIGHER

VIDEO (09:56) : Financial Sense - David Stockman: U.S. Faces Permanent Fiscal Cliff

Economic Noise - Bob Woodward Inadvertently Confirms The Coming Economic Apocalypse

The Acting Man - Credit Markets – Benign Reaction to the ECB’s Plans, But Dire Fundamentals Remain

VIDEO (02:36) : CNBC – Jim Rogers: They Teach You to Print Money at MIT

Gold and Silver Blog - Gold and Debt – What Would Benjamin Franklin Have Said?

CoinWeek - The Coin Analyst: The MS70 Debate Revisited

VIDEO (05:07) : U.S. Global Investors - Frank Holmes Talks Gold and Commodities on CNBC Asia Squawk Box

09/08/12 - Bullion News

CoinNews - Gold Jumps 3.1% on Week as Silver Soars 7.1%, US Bullion Coins Solid

examiner - Markets, Huge gains on gold, silver copper and metal prices

Silver Coins Today - Melt Values of American Silver Coins and Sets Surge

Business Insider - Merkel Is Getting Ready To Cave On Greece

ZeroHedge - 99 Years Of Keynesian-Monetarist "Winning"

Market Watch - How to follow the money in rare-coin collecting; Beware the pitfalls and pitches investors and hobbyists face

Science Daily - In Quest of the Cosmic Origins of Silver: Silver and Gold Materialized in Different Stellar Explosions

VIDEO (25:43) : Max Keiser - Keiser Report: Euthanized Economy

09/07/12 - Bullion News

VIDEO (06:44) : Bloomberg - Pimco's El-Erian Says Fed QE3 Likely This Year

Market Watch - Silver steals the spotlight from gold

CNBC - Silver Bulls Dig for the Mother Lode

VIDEO (04:18) : Commodities Guru Jim Rogers talks live from APEC Summit in Russia

azizonomics - Junkie Recovery

The Gold Report - Mike Niehuser's Gold Investing Lessons from Banking School

Money Show - Central Bankers Can't Save Us Now

Arabian Money - Gold and silver prices jump as bad jobs data puts QE3 back on the agenda for next week

Business Week - Argentines feeling trapped by currency controls

Market Watch - All that’s gold, glitters

09/06/12 - Bullion News

Silver Coins Today - 2012 Silver Coins Lead Sales, 2011 Un-circulated Silver Eagle Tops 300K

AUDIO (26:25) : GoldMoney - Mike Krieger on why gold and silver prices are headed much higher

CHART : Fast Markets – Technical Analysis - Silver - From strength to strength

Fox Business – Premature Celebration? Euro’s Hopes Hinge on German High Court

AUDIO : FSN – Andy Hoffman – Quadruple Bottoms… It’s All Good For Gold And Silver

Advisor One – Gold Up on ECB Hopes

Daily Mail – Family told ten rare Double Eagle gold coins worth $80 million obtained in 'uncertain circumstances' belong to the U.S. not them

VIDEO (11:18) : Bloomberg – Pimco's Gross: I'm Leaning Toward Gold Over Bonds

Bullion Street – Turkey gets back ancient Troy Gold

GoldSilver – Mike Maloney in Horrible Car Crash with Tesla

09/05/12 - Bullion News

Silver Investing News – Are We Running Out of Silver - "Is Future Silver Supply at Risk?"

VIDEO (28:05) : Capital Account – GATA's Bill Murphy on the JP Morgan Silver Shortage and the next Bullion Bank Run!

Bullion Street – PNG Warns Consumers about "Tribute Gold Coins" Advertised on TV

Stockhouse – Two things your broker doesn't know about Silver

AUDIO (35:22) : McAlvany Commentary – Bernanke in the Land of Oz

GoldSeek – Is Central Bank Buying Just a Driving Force Behind Gold or Much More?! – Part II?

Investor Place – Tracking GLD to gauge Gold's next move

AUDIO (10:42) : Talk Digital Network – Keeping Investment Risks Under Control

CMI Gold and Silver – Is gold getting ready to push towards a new all time high?

KPTV – What Happens When You Store Your Gold & Silver Coins in the Garage

09/04/12 - Bullion News

Silver Coins Today – American Silver Eagle Bullion Coins Rebound in August 2012 Sales

Trader Dan – Gold Hits $1700, Eases off a Bit

MineWeb – Gold could hit $1850 sometime in Q4 - GFMS

AUDIO : Sprott Money – John Embry: Interview with CFRAs John Budden

VIDEO (07:34) : Silver Doctors – Ned Naylor-Leyland: € Gold Break-Out an Indication Major Rally Has Begun

Gold Made Simple – Gold price about to re-enter its long-term trading range

Paper Money Collapse – U.S. Republicans introduce gold standard debate – mainstream media go mental

VIDEO (00:59) : Bloomberg – This Is What Going to the Gold Standard Looks Like

CoinWeek – Gold And Silver—I Told You So!

My Budget 360 – Student Debt Crisis at Tipping Point

Inflation Data – The Biggest Commodity: The College Degree and Academic Inflation

VIDEO (20:44) : Peter Schiff – Bernanke, Jackson Hole, Politics, QE, Debt, and Gold

Casey Research – What to Do When – Not If – Inflation Gets Out of Hand

321gold – Gold Makes Resistance Key Support

AUDIO : Sprott Money – Eric Sprott: Interview with CFRAs John Budden

Washington Times – Federal debt tops $16 trillion, Treasury Dept. says

Rasmussen Reports – Rasmussen Employment Index Falls to Ten Month Low

Reuters – South Africa police fire teargas as mine unrest spreads

09/03/12 - Bullion News

TECHNICAL ANALYSIS : GoldScents – HAS QE3 ALREADY BEGUN? GOLD & COMMODITIES MAY BE SAYING YES.

The Telegraph – Federal Reserve has already started QE3, says investor Jim Rogers

ZeroHedge – First Platinum, Now Gold: As South African Miners Strike Spreads, Thousands Of Ounces Remain In The Ground

VIDEO(s) : Perth Mint Bullion – 2013 Kookaburra, Lunar Bullion Coin Releases Available Today

MineWeb – Silver gives you more - at least potentially

The Independent – Lawyer 'helped in £730,000 scam' over school to buy gold

SafeHaven – The Gold Price and the Exponential Growth of Our Problems

Bloomberg – Gold Wagers on Rally Jump to Five-Month High on Stimulus

09/01/12 - Bullion News

CoinNews – Gold Surges 4.5% in August, Silver Soars 12.6%, Bullion Coins Rally

TECHNICAL ANALYSIS : Inside Futures – Gold & Silver show fresh buy signals

Washington Post – Ben Bernanke should return the Fed to its golden roots

VIDEO (02:28) : Bloomberg – This IS Your S&P 500…On Inflation (S&P / Gold Ratio w/ Jim Rickards)

azizonomics – The Shape of 40 Years of Inflation

Business Week – Euro-Area Unemployment at Record 11.3%, Inflation Quickens

Ludwig von Mises Institute – The Theory of Money

Bloomberg – Bernanke Defends Bond Purchases in Signal of More Fed Easing

08/31/12 - Bullion News

The Golden Truth – The Action in Metals Today

The Daily Caller – Bernanke: QE3 possible, cost-benefit approach to be taken

CoinNews – 2013 Year of the Snake Gold Bullion Coins from Perth Mint of Australia

PDF : U.S. Global Investors – Gold; First Mover Advantage by Frank Holmes

ZeroHedge – Friday Humor: Gold Is A Barbeque Relish

VIDEO (08:35) : USA Watchdog – Ron Hera-We’re at 2008 crash levels

NuWire Investor – Platinum Investment’s Powerful Draw

MineWeb – SA mine unrest widens, contagion fears rise

24/7 Bull – Governments have it backwards. It’s lowering taxes that increases revenue not raising them

Casey Research – Goodbye, US Debt Ceiling, We Barely Knew Ya

My Budget 360 – When the Financial Clock Strikes Zero - Half of Americans Die Broke

VIDEO (04:55) : Yahoo (BreakOut) – Americans Will Demand a Return to the Gold Standard, Predicts Peter Schiff

The Prospector Site – #1 REASON SILVER & GOLD WILL GO HIGHER

Investor Place – Gold vs. Silver: Which Is the All-Time Champ?

Perth Mint Bullion – Can My Wife/Partner/Father/Mother Sign For My Bullion If I’m Not In When It Is Delivered?

08/30/12 - Bullion News

Money News – Ahead of Bernanke Speech, Fed's Plosser Notes Risk of More Easing

CoinNews – US Mint Sales: Demand Rises for Collector and Bullion Gold Coins

Sovereign Man – Some clear thinking on the debt

Bullion Vault – Dr Copper's China Diagnosis

VIDEO (04:23) : Bloomberg – Walker: Dollar Outlook Hinges on Bernanke Speech

POLL : Rasmussen Reports – Just 16% See A Better Future for Today's Children

24/7 Bull – From boom to bust: How credit shaped the past & how it will shape the future

Reuters – U.S. states' debt tops $4 trillion-report

The Gold Report – Will Expert David Morgan Call the Bottom on the Metals Market Again?

08/29/12 - Bullion News

PDF : U.S. Global Investors – Love Trade Cools as Central Banks' Gold Demand Heats Up! by Frank Holmes

AUDIO (44:00) : McAlvany Commentary - Bill King : Trader's perspective A crucial conversation

MineWeb – The current state of platinum's supply demand balance - CPM Group

Fast Markets – Technical Analysis - Gold - Still consolidating recent gains but holding up well overall

Real Clear Politics – A Rational Discussion of the Federal Budget by Thomas Sowell

Daily Wealth – The Two Things Your Broker Doesn't Know About Silver

VIDEO (04:47) : Market Watch – "Helicopter Ben is Back" - Editorial board member Mary Kissel on Ben Bernanke's letter to Darrell Issa

Business Insider – China Could Soon Announce That Their Gold Reserves Have Doubled

MineWeb – Gold, China and the commodities super cycle - Jim Rogers

Investors Chronicle – Gold: to have and to hold

Money Morning – Is Gold Still “The Next Greatest Trade Ever”?

VIDEO (05:21) : Got Gold Report - Rick Rule – Artificial Liquidity Propping up Markets

Gold Investing News - Gold in an Election Year

08/28/12 - Bullion News

The Golden Truth - The US is in Much Worse Shape than Europe

Sprott Asset Management - NIRP: The Financial System’s Death Knell?

Seeking Alpha - 1 Oz Gold Valued By U.S. Currency In Circulation And Outstanding Debt

Numismaster - Watch Out: Premium Can Disappear

Casey Research - Your Window to Buy Below $1,700 Is Closing

ZeroHedge - QE3 Mechanism Is Broken

Liberty Blitz Krieg - 28,000 “Cash For Gold” Outlets in Italy as Serfs are Forced to Sell

SafeHaven - The Gold Standard Gets Another Look by Peter Schiff

VIDEO (03:35) : JS Mindset - Louise Yamada Predicts Gold's Future

08/27/12 - Bullion News

Paper Money Collapse - More QE is on the way – The central banks are digging themselves a deeper hole

U.S. Global Investors - Gold: First Mover Advantage by Frank Holmes

VIDEO (02:30) : CNBC - Santelli's Rant on More Quantitative Easing

VIDEO (03:48) : Perth Mint Bullion - Perth Mint Unveils 2013 Australian Bullion Coin Program

The Globe and Mail - Gold short positions fall to lowest level since May Add to ...

The Gold Report - Eric Sprott Cautions Investors to Fear the Financial System

VIDEO (04:35) : Forbes - Steve Forbes discusses "Freedom Manifesto: Why Free Markets Are Moral And Big Government Isn't"

Reuters - Dallas Fed President Fisher commissions paper to bolster easy money opposition

Calculated Risk - Cleveland's Fed President Pianalto discusses Benefits and Costs of QE3

OPB - Thieves Take Scrap Metal From Eugene Students' Fundraiser

MineWeb - Jeff Nichols: ‘No gold bug - just super bullish'

Ludwig von Mises Institute - Keynesianism vs. the Gold-Coin Standard

AUDIO (12:34) : Ellis Martin Report INTERVIEW with David Morgan: 30 and UP

08/25/12 - Bullion News

TECHNICAL ANALYSIS : SafeHaven - Hedgers & Speculators - "Contrary Gold Futures"

AUDIO (23:21) : TFMetals Report - Turd Ferguson Interviews David McAlvany of McAlvany Financial Group

24/7 Bull - Investment strategy: Getting wealthy vs. staying wealthy

VIDEO (25:44) : Max Keiser - Keiser Report - Debt Bomb

Commodity Online - PGMs likely to benefit further from South African output issues: HSBC

AUDIO (08:34) : Interview with David Morgan - SILVER Update, I called the BOTTOM, watch for RESISTANCE at $32

Silver Vigilante - CNBC & Rasmussen Polls - Americans favor return to the Gold Standard

Reuters - Turkey raises gold reserves by 18 pct in July-IMF

VIDEO (03:05) : Peter Schiff 2012 - Silly Blond and her Charts, has never bought Gold

08/24/12 - Bullion News

AUDIO (20:38) : GoldSeek Radio's Chris Waltzek talks to Silver Guru DAVID MORGAN

Reuters - Bernanke says Fed has scope to provide more stimulus

SafeHaven - Gold and the $600 Billion Question

Summary & VIDEO (11:47) : ETF Daily - Peter Schiff: Major Development In Metals; “The Time To Buy Cheap Will Soon Be Gone”

321gold - Fractal Gold Report

Business Week - Brink’s to Open One of Largest Bullion Vaults as ETPs Climb

Wyatt Research - Alert: Silver on the Move

ZeroHedge - Guest Post: A Gold Standard: Easier Said Than Done

Bullion Street - Investor exhaustion hit China Gold demand

VIDEO (04:15) : Wealth Wire - Jim Rogers Isn't Going to Argue With Thousands of Years of Stupidity

The Gold Report - Doug Casey Predicts Day of Economic Reckoning Is Near

CNBC - 'A Lot of Reason' for More Easing, Says Fed's Evans

MoneyNews - Analysts: Why No More Easing Would Be a Good Thing

Business Insider - Okay, Folks, Let's Put Aside Politics And Talk About Taxes... [CHARTS]

08/23/12 - Bullion News

CoinNews - US Mint Sales Figures: Proof Silver Coins Jump

Sovereign Man - Why you always want physical EVERYTHING…

Perth Mint Bullion - Six Trading Days Left To Secure Dragon Bullion Coins

Smart Money - What Fed Action Would Mean for the Dollar

Mish's Blog - Trends in Interest Rates on National Debt Suggest Currency Crisis is Coming

ZeroHedge - Gold And Silver Surge Above 200DMA

CoinWeek - The Coin Analyst: Precious Metal Bull Run Likely to Continue

Trader Dan's Market Views - Silver Tacks on the "30" Handle

Daily Reckoning - The United States and Argentina: Lost Like Tokyo

VIDEO (52:04) : Casey Research - Interview with Doug Casey and his Ten Tips on Speculation and Life

08/22/12 - Bullion News

Alphaville - FOMC minutes

MineWeb - U.S. silver output plunges between January and May-U.S.G.S.

VIDEO (46:48) : Marc Faber's forecasts for the global economy

ETF Daily - Why A Gold Supply Crisis Looms?

Golden Truth - Gold (and silver) Is Getting Ready For Big Move

AUDIO (61:47) : Voice America - Interview with Chris Powell of Chris Powell of the Gold Anti Trust Action Committee (GATA)

Merk Funds - Gold: Escape from Slavery

VIDEO (03:12) : CNBC - Gold Regains its Glitter

GoldSeek - Financial Alchemy and Fraud in Gold

MineWeb - Serious issues afflicting the Platinum Industry as a whole - RBPlat CEO

AUDIO (20:34) : Talk Digital Network - Lack Of US Fiscal Policy Damaging

Fox Business - Pimco Adds to Gold Holdings on Inflation Concerns

Inflation Data - Inflation Definitions

CoinWeek - LIBOR Scandal Investigation Sparking Higher Gold And Silver Prices

Wealth Wire - Rothschild, Paulson and Soros All Betting on Coming Financial Disaster

VIDEO (17:05) : USA Watchdog - Nick Barisheff – $10,000 Gold within 5 Years

New York Times - Inflation Should Be Feared

Bloomberg - Many on FOMC Favored Easing Soon if No Pickup in Growth

08/21/12 - Bullion News

CoinNews - 2012 Acadia National Park 5 Oz Silver Coins Enjoying Stronger Sales

VIDEO (25:54) : Silver Doctors - Ned Naylor-Leyland: Gold & Silver Parmanent Backwardation Omen of Total Meltdown

321gold - Gold's Little Brother Is Talking

Gold Made Simple - Gold price itching to break higher as silver price touches $29

Article & VIDEO (01:29:27) : CMI Gold and Silver - So many fallacies. So little time.

Market Watch - Are gold cycles turning up with easy money?

Arabian Money - S&P 500 ready for 10% correction and bad 2013 says Marc Faber

The Globe and Mail - Skeptics show flaws in the Fed model

American Thinker - Funding Failure

Wealth Wire - Is China Preparing a Gold Standard?

ZeroHedge - Gold Breaks To Three Month Highs

PDF : Investors Digest - John Embry "Gold Increasingly Likely to be in Short Supply"

VIDEO (12:39) : Silver Guru - David Morgan INTERVIEWED on The Keiser Report

SilverGold Bull - Precious metals “break-out”: is this the Real Deal?

Bloomberg - How Volcker Launched His Attack on Inflation

08/20/12 - Bullion News

CoinNews - Gold Starts Week Higher, Silver Rallies 2.1%, US Coins Surge

SafeHaven - Long-Term Technical Outlook for Gold and Silver

Gold Versus Paper - Trade of the Year - Gold Versus Paper

MineWeb - Central bank gold buying and the importance of investment demand - says WGC's Marcus Grubb

GoldSeek - Gold and Silver Shine on Weaker U.S. Dollar

Money Morning - Why Investors Are Hoarding Silver

Trader Dan's Market Views - Stealth Mode Rally in Silver Maybe not so Stealthy Anymore

ZeroHedge - Silver Jumps To Two Month Highs As Oil Reverts

VIDEO (11:51) : Casey Research - This Banker Is Buying Gold

Ludwig von Mises Institute - Hyperinflation Is Not Inevitable (Default Is)

Seeking Alpha - Silver May Be A 'Poor Mans Gold' But It Could Still Make You Rich If You Invest Now

US Global Investors - Love Trade Cools as Central Banks’ Gold Demand Heats Up by Frank Holmes

08/18/12 - Bullion News

Casey Research - Big Changes Ahead: Gold Just Became Money Again

VIDEO (15:08) : TECHNICAL ANALYSIS : Strategy is Everything: Chart This! w/ Gary Wagner

Taipei Times - Platinum price spikes on deadly strike in S Africa

The Golden Truth - Friday Chart Porn

CoinWeek - Gold’s performance reflects continued challenging economic climate

ZeroHedge - US Treasury Admits It Conducted A Circular Ponzi Scheme For Years

Virtual Economic Conditions - Precious Metals IRA Gaining Momentum on Gloomy Economic Conditions

08/17/12 - Bullion News

Ahead of the Herd - The "Fear" Trade

AUDIO : FSN - Mark Faber – Financial Survival Is About Diversification And Personal Survival

The Globe and Mail - Silver showing signs of a breakout Add to ...

Silver Coins Today - 2013 Pronghorn Antelope Silver Bullion Coin Fifth in Canadian Wildlife Series

Gold Alert - “The US dollar must be devalued in order to shrink the destructive power of debt”

The Source (WSJ) - Gold’s Volatile Mood

SafeHaven - In A Paper System, All Assets Are Backed by the Treasury Bond

CoinWeek - Newly Emphasized Gold And Silver Price Suppression Tactic Unleashed

MoneyNews - Moody's: Risks of California Muni Bankruptcies Rising

CoinNews - 2012 .99999 Gold Maple Leaf Bullion Coin Marks Anniversary

ZeroHedge - “Gold Ponzi Schemes” Revealed - Physical Gold Favored Over Derivatives

Total Investor - Silver Quietly Sneaking Higher

Truth in Gold - Gold Not Money? CME Clearing Europe To Accept Gold As Collateral

Perth Mint Bullion - World Gold Council: Gold Demand Trends Second Quarter 2012

08/16/12 - Bullion News

Financial Sense - How to Introduce a Gold Standard

VIDEO (02:20) : The Street - Gold Prices Surge on Dollar Weakness

321gold - The Gold Price for the Next 16 Years

Gold Made Simple - Gold price drifts higher as Poland shows the importance of physical deliverable gold

Article & VIDEO (11:41) : Wealth Wire - Silver Hoarding: Investor Holdings Spike to Record

VIDEO (05:29) : Arabian Money - Gold heading past $2,000, silver to new high, says Swiss Asia Capital

POLL : Rasmussen Reports - 37% Are Confident in Fed To Keep Inflation Under Control

Street Talk Live - Gold, Dollar & Rates Say No QE

Daily Reckoning - Dogged by Nixon’s Dollar

Gold Silver Worlds - Gold price of $10,000: Is it possible or not?

Bullion Vault - What Determines the Gold Price?

Minyanville - Three Alternative Currencies Gaining Traction

ZeroHedge - Guest Post: What To Do When Every Market Is Manipulated

08/15/12 - Bullion News

AUDIO (07:55) : David Morgan Interviews Patrick MontesDeOca from the CMT Group - Part 1

AUDIO (08:39) : David Morgan Interviews Patrick MontesDeOca - Part 2 Answering Listener Questions

SilverSeek - If you have to own one precious metal buy silver not gold

International Man - After the Storm (Part 1 of 2)

Market Watch - When will the euro collapse? It’s already dead

Bullion Vault - Rats Don't Eat Gold Bullion

VIDEO (03:22) : CNBC - Paulson & Co. Increases Stake in SPDR Gold

ZeroHedge - Aaaand It's Gone: This Is Why You Always Demand Physical

Business Insider - George Soros Called Gold The 'Ultimate Bubble' Just Two Years Ago

Affiliate Ad

08/14/12 - Bullion News

Numismaster - Fake Round Can Cause Real Problem

VIDEO (28:03) : Capital Account - Neil Barofsky on the On-Going Bailout of Wall Street and the lack Criminal Prosecutions

Market Watch - Dollar up after solid U.S. data

Silver Investing News - Silver Manipulation: Closure Ahead?

Mish's Blog - Germany 6% Current Account Surplus a "Threat to the Continent" Says EU Commission; Solution is Gold Coupled With Eurozone Breakup

GoldSeek - Five Reasons Why The Government Is Destroying The Dollar

US Global Investors - Which Way Will the Pendulum Swing for Gold?

VIDEO (03:25) : Fox Business - Faber: Too Much Government is U.S. Economy's Biggest Problem

CoinWeek - Quiet Gold Market Needs Big Bang

The Real Asset - What does debt really mean for the economy?

08/13/12 - Bullion News

Washington Times - Inflation: Lies, Damned Lies, and Statistics

Inflation Data - What Is Fiat Currency?

Eric De Groot - Buy When Dumb Money Sells Silver and Vice Versa

GoldSeek - Ron Paul; Legalize Competing Currencies

Rick Ackerman - Treading Water on a Sea of Funny Money

VIDEO (11:56) : Jesse's Café Américain - How Andrew Jackson Killed the Second Bank of the United States

Wealth Wire - Peter Schiff Opens Gold Bank

Mish's Blog - Percentage Growth in Government Jobs vs. Private Jobs vs. Population Growth; Facts and Consequences

CNBC - Problems Riddle Moves to Collect Credit Card Debt

Scotsman - Comment: More golden moments to come for investors

Acting Man - Gold, Silver and Gold Stocks

CHARTS : TECHNICAL ANALYSIS : GoldScents - BULLS STILL IN CONTROL, BUT TIME IS RUNNING OUT

Bullion Vault - Keynesians vs Gold Bullion

08/11/12 - Bullion News

Coin News - Gold, Silver Notch Weekly Gains, Eagle Silver Coins Improve

Fast Markets - Technical Analysis - Gold - Still struggling

Gold Alert - “The Fed is the epicenter of the financial disaster”

Gold and Silver Blog - Platinum Perspectives – Time To Buy Or Will The Bears Win?

Sprott Management - The Solution…is the Problem, Part II

Wealth Daily - Constitution, What Constitution?

Bullion Street - Bullion market marking time until US Fed symposium

VIDEO (28:03) : Capital Account - Gerald Celente on Eurozone Reckoning Day and dropped charges for Goldman Sachs!

08/10/12 - Bullion News

AUDIO : FSN - David Morgan – It’s Beginning To Look Like The Precious Metals Bull Market Lives On

Seeking Alpha - Silver Net Short Positions Rising: Prepare Yourself For A Coming Silver Bull Market

ZeroHedge - Cash Out Of Gold And Send Kids To College?

Resource Investor - The Dumb Money Hates Silver, It’s Time to Go Long

MineWeb - Platinum: gold ratio falls further

VIDEO (04:38) & Article : Yahoo Finance - U.S. Government Debt Grows $10 Million a Minute: David Walker

Profit Confidential - Think Housing Is Safe Again? This Will Change Your Mind

Summary & VIDEO (05:08) : Future Money Trends - Bernanke Says Student Loans Won't Cause Crisis

Whiskey and Gunpowder - The “New” Migration To Gold And Silver

08/09/12 - Bullion News

GoldSeek - Gold and silver are still the ultimate reserve currency

The Sovereign Man - Why dost thou whet thy knife so earnestly?

The Gold Report - There Is More to Gold than Mere Capital Appreciation: John Hathaway

SilverSeek - The CFTC Silver Investigation by Ted Butler

Money Show - Peter Schiff; Has Fed Action Helped or Hurt the US?

Mish's Blog - Camden NJ, Population 77,344 Fires Entire Police Force, 270 Officers; Why Cities are Going Bankrupt

ZeroHedge - Gold, Silver, Corn, And Brent Are Best Performers On The 5-Year Anniversary Of The Great Financial Crisis

Whiskey and Gunpowder - Got Physical Gold?

Hinde Capital - Gold Poised for Upside Breakout of Current Range

Truth In Gold - CFTC’s Chilton the Only One Positive on Action

Perth Mint Bullion - Then, As Now, Silver's Course Dangerous To Predict

Commodity Online - Gold remains range bound, but sentiment to swing in its favor: UBS

NBC News - You've just won a gold medal! So why are you trying to eat it?

08/08/12 - Bullion News

Wealth Daily - Silver Backwardation Explained...(Silver Is About to Rocket Higher, Silver Is Now in Backwardation)

VIDEO (17:36) : USA Watchdog - Charles Biderman-What else is there besides gold?

Casey Research - Could Gold Be Tripped Up by a Coming Deflation? - Interview with Jim Puplava

CoinNews - Gold, Silver and Other Precious Metals Log Modest Changes

Fast Markets - Technical Analysis - Gold/Silver Ratio - Paused, or about to stall

Seeking Alpha - Gold Outlook Still Bullish And Ripening For Melt Up

Howe Street - Doug Casey - Governments Are Out of Control

The Prospector Site - THREE PREDICTIONS SOON TO SEND GOLD HIGHER

My Budget 360 - US Dollar Already Went Off a Fiscal Cliff

CMI Gold and Silver - Boston Fed Head calls for “open-ended” quantitative easing

Free Gold Money Report - The Fiat Currency Bubble seals the euro’s fate by James Turk

News Track India - Jewellery trade thrives in Rajasthan despite rising bullion prices

VIDEO (27:51) : Capital Account - GATA's Chris Powell on the Silver Manipulation Probe & the Fed Gold Audit!

08/07/12 - Bullion News

Daily Finance - CFTC Commissioner Bart Chilton Comments on the Silver Investigation

Summary & VIDEO (08:39) : ZeroHedge - Putting A Face To Einstein's Definition Of Insanity

MineWeb - Gold will hit new highs in 2013 and beyond - Blanchard

azizonomics - Gold, Price Stability & Credit Bubbles

Libertarian News - People Now Pay In More To Social Security Than They Take In Payouts

Article & VIDEO (04:46) : Yahoo Finance - US Needs The Devaluation of the Dollar

SafeHaven - Money Printing Doesn't Create Jobs by Michael Pento

Mining - Mexico’s record gold production takes it closer to new bullion superpower status

The Golden Truth - To Be Or Not To Be, Is The Silver Market Truly Free?

Bullion Street - SGE to set up new Gold bullion platform to help investors

08/06/12 - Bullion News

Casey Research - Is a Strong Dollar Trouble for Gold?

Iacono Research - Gold Investors: Patience is the Most Important Commodity

Bullion Street - CFTC to end Silver price manipulation probe

VIDEO (11:22) : USA Watchdog - One-on-One with Silver Guru - Eric Sprott

The Real Asset - The week ahead – further data will make gold shine

VIDEO (01:30) : Arabian Money - How gold and silver prices are joined at the hip

VIDEO (35:41) : Physical Gold: antidote against the ongoing global debt crisis (summary)

VIDEO (88:18) : Physical Gold: antidote against the ongoing global debt crisis (full unedited version)

MineWeb - If hyperinflation ahead gold to $10,000 - if deflation, $2,000 - Taylor

VIDEO (02:03) : Wyatt Research - The Only Thing to Fear

Business Insider - Unregulated Government Lending Is Completely Out Of Control

Fox News - Does audit show Federal Reserve Bank sitting on $21 billion in gold?

08/05/12 - Bullion News

The Daily Bell - Ranting Andy on 'Gold as Money' and What to Do Now to Protect Yourself Before It's Too Late

Dubai Chronicle - Silver Price Actions Consolidation Pattern

ZeroHedge - On This Day In 2016

Daily Wealth - A 20% Gain in Just Three Months – Trading This Hated Metal

Gold Alert - $1,900 Gold by Year-End, Says HSBC

VIDEO (05:00) : Yahoo (BreakOut) - Election or Not, QE3 Is Coming in September: Economist

Commodity Online - Platinum-Gold ratio falls to lowest levels since 1985: Barclays

The Source (WSJ) - Tough Week for Copper

08/03/12 - Bullion News

The Street - Gold Climbs as Unemployment Rate Rises

GoldMoney - Turd Ferguson and Alasdair Macleod on the end of the Great Keynesian Experiment

CNBC - Gold to Rally Above $1,900 by End 2012: HSBC

Money Talk News - 15 Ways to Keep Your Home Safe When You’re Gone

CoinWeek - The Coin Analyst: America the Beautiful Five-Ounce Silver Coin Sales in 2012

LA Times - What's in your vault? Uncle Sam audits its stash of gold at the New York Fed

MineWeb - Sprott Physical Silver Trust offer underwriters take up additional units

Smart Money - Markets Guru Arnott: Inflation Will Triple

08/02/12 - Bullion News

CoinNews - Gold Slips Below $1600, Silver Under $27, US Bullion Coins Up

Action Institute - The Prospects of More QE for Economic Stimulus: A Lesson from History

GoldSeek - Gold and silver facing an exceptionally volatile autumn?

AUDIO (19:23) : FSN - Mickey Fulp’s Masterful Monthly Market Review

Mish's Blog - San Bernardino Files Chapter 9 Bankruptcy Petition; Pension and Medical Liabilities Impossible to Meet; Major Wave of Municipal Bankruptcies Has Begun

AUDIO (10:00) : Talk Digital Network - Low Spirits in Precious Metals

Forbes - Deadly Gold Scam Used Cyber-Currency

Silver Gold Bull - The Tortoise and the Hare

forUm - National Bank of Ukraine to expand its range of bullion coins

SafeHaven - Priced For Collapse

08/01/12 - Bullion News

Bullion Vault - 30% Gold Investment "Needed to Defend Your Portfolio"

VIDEO (28:02) : Capital Account - Mike Maloney tells Ben Bernanke to "Quit and Close the Federal Reserve!"

321gold - Challenging the Paradigms of Investing

NewsMax - Fed Says Economy May Need Help But Keeps Policy on Hold

Market Watch - Silver set to rally amid forced reflation

ETF Daily - Gold Prices: Why Have Gold Bugs Been So Wrong?

Gold and Silver Blog - Gold Bullion Coin Sales Plunge 50% In July, Silver Sales Off 20%

VIDEO (02:09) : CNBC - Fear, Greed & Gold

Wealth Wire - Warning for Gold Coin Buyers

VIDEO (02:50) : Wyatt Research - The Corn Conspiracy

Dollar Collapse - Welcome to the Currency War, Part 3: US Corporate Profits Plunge

Arabian Money - The cult of inflation has just begun says Bill Gross

ZeroHedge - What The US Government Spends Its Money On

Summary & VIDEO (05:37) : CMI Gold and Silver - The federal budget cannot be balanced

CoinWeek - GATA Files New Freedom Of Information Act Document Requests

07/31/12 - Bullion News

The Tennessean - We need Milton Friedman's wisdom today by Thomas Sowell

VIDEO (29:01) : Milton Friedman on Hayek's "Road to Serfdom" 1994 Interview 1 of 2

VIDEO (29:19) : Milton Friedman on Hayek's "Road to Serfdom" 1994 Interview 2 of 2

CoinNews - 2012 Acadia National Park 5 Oz Silver Bullion Coin Sales Begin

MineWeb - The bottom is probably in for silver - says Silver Guru David Morgan

The Real Asset - Saving the terminally ill

Merk Funds - Gold at ECB: Accident or Strategy?

Bullion Vault - Gold Prices "Could Be Under Pressure" from Central Bank Meetings, Fed "Can Sit Tight" But Draghi "Must Put Money Where Mouth Is

ETF Daily - Investing In Silver: States Support Move To Metals As U.S. Dollar Weakens

Numismaster - Scandal to Push Gold Coins Higher?

Casey Research - Interview with Jim Puplava; Deflation? Don't Count On It…

Rasmussen Reports - Rasmussen Employment Index; Employment Index Slips to 2012 Low

Wealth Daily - Gold Will Fly on QE3

ZeroHedge - The Fed On Gold Price Manipulation

Gold and Silver Blog - 75% Of Americans Believe The Fed Should Be Audited – Why It Won’t Happen

Royal Mint Blog - The Olympic and Paralympic victory medals – the facts behind the medals

Rick Ackerman - Stocks Galloped Higher in 1929, Too

SafeHaven - Mr. Bernanke Has To Know!

Truth In Gold - Most Accurate Gold Forecasters Split

Profit Confidential - U.S GDP Growth Falls 25%; What Happens Next

Libertarian News - The Insanity of Spending as a Measure of Growth

07/30/12 - Bullion News

Wall St Cheat Sheet - Gold and Silver Lessons from Pawn Stars

Article & VIDEO (13:53) : MoneyNews - Eric Sprott: US In a Recession, and Stimulus Policies Won't Help

Market Watch - Is gold getting ready for take-off?

Financial Sense - What Keeps the Free Market Free?

VIDEO (10:40) : USA Watchdog - One-on-One With Rick Ackerman

VIDEO (11:22) : Future Money Trends - Challenging the Deflation Godfather, Robert Prechter Interview

ZeroHedge - The World’s Gold Is Moving From West To East

Bullion Street - Vietnam to ban 'Gold in and Gold out'

dshort - Real GDP Per Capita: Another Perspective on the Economy

07/28/12 - Bullion News

CoinNews - Gold, Silver, and Eagle Bullion Coins Rebound for Week

Financial Sense - Technician Louise Yamada: It’s A Very Difficult Market-You Don’t Want To Be Short

Liberty Blitz Krieg - My Response to a Gold Hater

Arabian Money - Why the gold bears have got it completely wrong

VIDEO (28:03) : Doug Casey on Crisis Investing, Political Risk, and a Benign Anarchy!

07/27/12 - Bullion News

CNBC - Are Fiat Currencies Headed for a Collapse?

Wealth Wire - What "Disaster Economics" Means for Your Investments

Dollar Vigilante - Auditing The Fed is Like Auditing a Mafia Counterfeiting Operation

VIDEO (25:46) : Max Keiser - Keiser Report: Jellyfish Rat-Heart Robot Bankers

VIDEO (33:29) : John Williams of Shadowstats.com Interview: The Next Crash Will Be A Lot Worse!

INFO-GRAPHIC : Visual Capitalist - Global Gold Mines and Deposits Ranking 2012

ZeroHedge - In Q2 America Added $2.33 In Debt For Every $1.00 In GDP

Gold and Silver Blog - Would Auditing The Fed Send Gold Higher?

VIDEO (28:04) : Capital Account - From Natural Resources to Currency Wars w/Rick Rule & Jim Rickards

Ahead of the Herd - A Food Report

07/26/12 - Bullion News

AUDIO (12:32) : FSN - David Morgan On The Road Again – Upcoming CFTC Silver Report A Non-Event

USA Watchdog - Mainstream Media Recovery Hoax

Wyatt Research - Five Unbelievable Facts about the Spanish Debt Crisis

Bullion Street - Silver to significantly outperform Gold in few years

CoinWeek - Huge Physical Gold Shortage Looms

VIDEO (04:22) : Fox Business - U.S Economy: More Money, More Problems?

07/25/12 - Bullion News

CoinNews - Gold Jumps Above $1600, Silver Eagle Coins Top 19M

The Motley Fool - Unlike Big Banks and Bigger Governments, Gold Doesn't Lie

VIDEO (07:01) : CNBC - Gold Could Hit $2,100 By Year End

Perth Mint Bullion - Expect Investment Coin Shortages Should Mass Market Demand Emerge

VIDEO (02:04) : Bloomberg - Where is Gold Going? Ask the Euro

AUDIO (59:38) : Stansberry Radio - The Coming of the World Depression - Interview with Eric Sprott

VIDEO (02:43) : Wyatt Research - The Secret Financial War

Bloomberg - Former Citigroup CEO Weill Says Banks Should Be Broken Up

MineWeb - Standard Bank's Marc Ground looks at the state of the South African platinum sector, the outlook for prices and the likelihood of further mine closures

AUDIO (01:46:49) : Interview and Lecture by G. Edward Griffin - Author of The Creature From Jekyll Island

Sovereign Man - Why do we need a central bank?

Huffington Post - Olympic Gold Medal Worth $650 Melted Down

VIDEO (28:05) : Capital Account - Marc Faber on a Global Crash, the U.S. Treasury Bubble and China's Slowdown

07/24/12 - Bullion News

CoinNews - Gold, Silver Down; American Gold Eagle Coins Rise

Hard Assets Investor - Less Volatile Gold Poised To Benefit As Eurozone Crisis Reaches Critical Stage

Barron's - Coming: The End of Fiat Money

Wyatt Research - One Major Mainstream News Outlet That Doesn’t Understand Gold

MineWeb - How will gold and silver prices perform in a shrinking, debt-distressed world?

Seeking Alpha - Gold Prices On Hold As U.S. Dollar Strengthens

Wealth Wire - Gold Continues to Move Towards the Financial System

POLL : Rasmussen Reports - 45% Fear Federal Government Will Do Too Much To Help Economy

The Daily Gold - Anatomy of Future Gold & Silver Bubble

BullionVault - Policymakers "Recognizing New Financial Uses" for Gold Bullion

Market Oracle - Defining “Intrinsic Value” in Gold and Silver Investing

Total Investor - 5 Straight Years of $1 Trillion Deficits!

ZeroHedge - On Gold And The US Debt Trap?

Casey Research - China, Metals, and Your Money

CNBC - In Euro Zone, Debt Pressure Tightens Grip

CMI Gold & Silver - Gold for Grabs

07/23/12 - Bullion News

SilverSeek - The War on Silver by Ted Butler

VIDEO (01:31) : CNBC - Gold Finishes Off Lows

Coin Update - Release Dates for 2012 America the Beautiful Five Ounce Silver Bullion Coins

The Real Asset - The calm before the storm

Commodity Online - Swiss Palladium exports hit new high for 2012: HSBC

Profit Confidential - Fourth California Bankruptcy Comes Knocking

Investment Rarities - WHISTLING PAST THE GRAVEYARD

SilverSeek - China Precious Metals Strategy

Mish's Blog - Full Spanish Bailout Coming Up; New Record High Yields on Spanish Bonds; Misguided Faith in Can-Kicking

07/22/12 - Bullion News

Eric De Groot - The Boat of Irresponsibility Has Many Passengers

Dollar Collapse - Still Think That Money Market Fund Is “Cash”?

The Golden Truth - Weekly Chart Porn - Uber-Bullish Silver Signals

Financial Sense - Safely Stashing Cash in a Near-Zero Rate, High-Risk Environment

IBTimes - Lear Capital: Silver’s Best Kept Secrets

Market Watch - Copper fares better than gold and silver

Paper Money Collapse - Happy interventionists: The economists’ attack on your property

07/21/12 - Bullion News

AUDIO (13:50) : Ellis Martin Report with David Morgan--Silver: Are you in? Sprott and the Chinese are!

azizonomics - Why is the Fed Not Printing Like Crazy?

Oregon Live - In times of low returns, are investors more gullible?

The Prospector Site - FLASH MOBS SOON TO FIND SILVER & GOLD

Wall St. Cheat Sheet - SILVER: A Metal of Sunken Treasure and Champions

07/20/12 - Bullion News

VIDEO 28:51) : Future Money Trends - Doug Casey Interview: Governments are Igniting Bubbles

VIDEO 28:02) : Capital Account - Charles Ferguson on the Financial Landscape after 2008's "Inside Job"

ZeroHedge – Friday Humor: Keynesianism For Kretins

SafeHaven – Why Won't Fine Art Collapse?

The Market Oracle – Silver Price Undervalued

Perth Mint Bullion – Making A Gold Nugget From Electronic Waste

Seeking Alpha – Is It Time To Buy Silver? (Part 2)

Business Insider – GEITHNER: 'I Have Been The Most F------ Transparent Secretary Of The Treasury In This Country's Entire F------ History'

07/19/12 - Bullion News

CoinNews – Gold, Silver Snap 3-Day Losing Streak, US Silver Coins Rise

Daily Reckoning – Has Bernanke and the Fed Discovered a New Invention in Wealth Creation?

VIDEO (12:09) : USA Watchdog - Ron Hera – The End of Cheap Everything

Numismaster - Bullion Buyers See Red?

AUDIO (10:09) : Exclusive Interview with David Smith (Senior Research Analyst for The Morgan Report)

MineWeb - The biggest misconception in gold and other factors driving the metal

Investor Place - Gold Is Under Seige From QE3 Speculation

Seeking Alpha - Time To Buy Silver? Part 1

Commodity Online - Weak EU vehicle demand may keep pressure on Platinum

TF Metals Report - I Hope You're Ready. I am.

VIDEO (04:27) : Yahoo (BreakOut) - Is QE3 The Easy Way Out? Not So Much

CBC News - WWII shipwreck yields $38M worth of silver, so far

07/18/12 - Bullion News

Sprott Money - Ask The Expert – Eric Sprott – Sprott Money (VIDEO Links - Parts I thru IV)

CoinWeek - We Don’t Need Inflation Of The Money Supply

American Thinker - Fed Action. Helping or Hurting?

Wealth Daily - Platinum Cheaper Than Gold; The White Metal Hits a Tipping Point

Bullion Vault - Why We All Need Some Bullion in the Vault

VIDEO (04:39) : CNBC - Ron Paul Asks Bernanke About Deflation

Clean Energy - Silver prices force solar researchers to innovate

Times News - Sullivan Co. worker accused of stealing nearly $720,000 in gold bars

Article & VIDEO (05:35) : Wealth Wire - Peter Schiff: Bernanke Is Hiding Some Scary Truths

VIDEO (04:39) : BBC – A brief history of money

VIDEO (01:44) : Wyatt Research – Why I'm OK with Being Wrong about Commodities

Financial Sense – How Gold Will be Made Acceptable by the Powers that Be

VIDEO (30:43) : Casey Research – David Stockman: Austerity Is Not Discretionary

Market Watch – Odyssey Announces First Load of Silver Cargo from Three Miles Deep

azizonomics – Poor Thieves Go To Jail, Rich Thieves Don’t

Mish's Blog – What Role Does Government Play in Price Inflation? Various Charts Provide the Answer!

07/17/12 - Bullion News

Silver Lunar – Perth Mint 2013 Lunar Snake Coin Pictures Leaked

CoinWeek – Knowledge and Diversification Keys to Successful Coin Investing

The Daily Bell – Inflation is a Monetary Phenomenon by Ron Paul

Eric De Groot – Commercial Banks Increasing Cash Assets Represents Another Warning Signal

VIDEO (08:36) : CNBC – Real Danger of a New Great Depression: Author

Market Watch – How Bernanke will cause the next crash before 2014

Top Secret Writer – Looking for the Lost Silver Mine of Captain Sunday in Maine

07/16/12 - Bullion News

arabian money – Why you should save in gold and silver rather than US dollars or euros

VIDEO (05:52) : Bloomberg – David Stockman: We're Heading Toward Recession, Paralysis

MineWeb – Silver - a modest outlook at best; HSBC

CoinNews – US Mint Suspends 2012-W Proof American Silver Eagle Coins

Resource Investor – Bullion Now Flat on a Year Ago Price Level

Wealth Daily – Silver and Gold, Silver and Gold

MoneyNews – Hulbert: Gold ‘Remains the Intelligent Bet Today’

CoinWeek – The Coin Analyst: Groundwork for Gold-Backed Reserve Currency is Being Laid

AUDIO : FSN - “Turd Ferguson” – Everyone Should Be Buying Precious Metals

VIDEO (00:58) : Bloomberg - Here Is Proof That Social Security Is in Crisis

Wealth Wire - How to Find Valuable Silver in Your Pocket Change

07/15/12 - Bullion News

Inside Futures - Silver And Gold - Forget Fundamentals And Opinions

Columbia Tribune - U.S. Mint in Philly reopens to public with new tour

Liberty Blitz Krieg - Gold Manipulation is Going Mainstream

Resource Investor - FDIC to Classify Gold as a 0% Risk-Weighted Asset?

arabian money - Emerging market central banks the biggest official buyers of gold but will buy much more

azizonomics - Penis Length, LIBOR & Soviet Growth

07/14/12 - Bullion News

Casey Research - Deflation or Inflation? Yes.

FX Empire - Silver Weekly Fundamental Analysis July 16-20, 2012, Forecast

AUDIO : FSN - Peter Schiff (Live at Freedom Fest 2012) – Socialism is the Problem – Capitalism Is The Solution

Got Gold Report - COMEX Swap Dealers Net Long Gold for Third Time Ever

321gold - The Other-Side of the Gold Manipulation Argument; Urban Legends and Gold by Bob Moriarty

MineWeb - Fading QE talk keeps gold on track for weekly loss

07/13/12 - Bullion News

VIDEO (28:04) : Capital Account - Jim Grant on Safe-Haven Bubbles and a Bull Market in Black Walnut Trees!

Financial Sense - Does Central-Bank Gold-Buying Signal the Top Is Near?

Wealth Wire - Have We Reached 'Peak Gold'?

Solon Patch - Cash For Gold Business Swindled With Counterfeit Coins

The New American - Deficit Headed for $1.1 Trillion This Year

Minyanville - Four Insanely Bold Predictions About the Commodity Industry

CNBC - Market Savior? Stocks Might Be 50% Lower Without Fed

CNBC - Dollar Could Fall Off Fiscal Cliff Into Euro Abyss

07/11/12 - Bullion News

VIDEO (24:24) : Sprott Management; Managing Wealth in Uncertain Times

CME Group - Is Gold Stuck in BIZARRO Land?

Hard Assets Investor - Deutsche Bank’s Brebner: Gold Headed To $2,000/oz. In Early 2013 Amid Inflationary Bias By Central Banks

Seeking Alpha - Beginners' Guide To Buying Metals

Fox Business - Another California City Seeks Bankruptcy

The Globe and Mail - Get ready for gold bullion's season of strength

Perth Mint Bullion - Thomson Reuters GFMS Sees Gold Above $1,800 Later This Year

Wyatt Research - Another Shocking Revelation about the Death of the Dollar

The Bismarck Tribune - Gold buying company operating in Bismarck bounced checks in Dickinson

Acting Man - In Gold We Trust, 2012 Edition (PDF at bottom of article)

Merk Funds - Gold to Outshine Dollar?

Gold Investing News - Peter Schiff on Gold and Money

Article & VIDEO (28:03) : SafeHaven - How To Protect Yourself From Collapse of the Faith-Based Financial System

VIDEO (06:33) : arabian money - Sharjah Gold Souk sees a revival of interest in buying silver and increases range of silver bars

POLL : Gallup - Americans' Confidence in Television News Drops to New Low

07/10/12 - Bullion News

Peak Prosperity- Our Money Is Dying;Don't let your wealth die w/ it

Numismaster - Does Slab Add Value to Bullion?

ZeroHedge - China Imports More Gold From Hong Kong In Five Months Than All Of UK's Combined Gold Holdings

azizonomics - Propping Up The Gold Price?

The Daily Caller - CBO: US posts $900 billion dollar deficit in first nine months of fiscal year 2012

Gold Alert - Can Gold Prices Climb to $2,000 by Year-End?

VIDEO (03:37) : Learn Liberty - How Cronyism Is Hurting the Economy

Index Universe - Jim Rogers Waits For Gold, Shorts Stocks

07/09/12 - Bullion News

ZeroHedge - Dismal Equity Volume Day As Gold And Treasuries Surge

Bullion Vault - How Fiat Money Has Depressed Living Standards

VIDEO (04:32) : CNBC - Santelli Interviews Nigel Farage, UK Independence Party leader, discusses Europe's looming fiscal crisis,

Wyatt Research - Shouldn’t Commodities be Headed for the Moon by Now?

Forbes - The Psychological Mind Set of a Precious Metals Buyer

Arabian Money - Why do so few investors seem to understand the silver story?

Paper Money Collapse - Central banks: Running out of ideas, road

VIDEO (04:01) : Max Keiser - Ned Naylor-Leyland on CNBC: “Gold May Have Been Manipulated Like Libor”

The Bull - Steve Forbes Interview: How The US Federal Reserve Is Damaging The Economy

Wealth Daily - Buy Dips in Gold

Times of India - E -waste contains $21 billion worth gold and silver: Experts

PCGS - PCGS Gives Congressmen A Close Look At Counterfeiting Problems

07/08/12 - Bullion News

ENCORE VIDEO (03:47:25) : PBS - Money, Power & Wall Street

SafeHaven - Market Report: A Glimpse of Gold Capitulation?

Ludwig von Mises Institute - Why Gold?

07/07/12 - Bullion News

CoinNews - Gold, Precious Metals Fall on Week. US Coin Sales Weaker

NPR - What Does London's LIBOR Mean To The U.S.? (AUDIO to story will be avail. after 7pm/ET)

VIDEO (28:04) : Capital Account - Steve Keen on the Minsky Singularity and the Debt Black Hole's Event Horizon!

Acting Man - The Gold Silver Ratio As An Early Warning Indicator

AUDIO (44:38) : Peak Prosperity - Paul Brodsky: Central Banks are Nearing the 'Inflate or Die' Stage; So hold tightly to your gold

AUDIO (20:29) : Future Money Trends - Interview With James Turk of GoldMoney.com

Daily Reckoning - Imagining a Universe Without Central Banks

Money Morning - What I Wish Ben Bernanke Knew About Japan

Numismaster - Battle Against Fakes Continues

07/06/12 - Bullion News

The Market Oracle - The Next Time Silver Crosses Above $30.00 Will Be The Last Time

VIDEO (02:54) & Article : Bullion Vault - FRIDAY EVENING UPDATE AND WEEK IN REVIEW VIDEO

Washington Blog - Are Banks Raiding “Allocated” Gold Accounts?

Wealth Wire - The Shocking Rise of U.S. Gold Exports

Kitco News - CME Group Lowers Margin Requirements For Nymex Palladium Futures

Bullion Street - Japan Gold reserves drop below $40 billion

Yorkshire Evening Post - Leeds bullion fraudster jailed for internet card scam

Summary & VIDEO : Silver Doctors - Jim Cramer. “I trust Gold, I don’t trust Paper!?!”

Ahead of the Herd - The Ancient Metal of Kings

07/05/12 - Bullion News

Coin News - Gold Prices Dip, Silver Falls. US Gold Coin Sales Up

Bullion Street - The Dow/Gold ratio this independence day

chron - Franchise Agreement Signed to Bring Precious Metals Refinery to Pittsburgh

Bloomberg - Gold Futures Fall on Stimulus Outlook, Dollar’s Rally

The Telegraph - Revealed: why Gordon Brown sold Britain's gold at a knock-down price

Breit Bart - Worried central banks slash global interest rates to new lows

The Independent - Cut in platinum output by Aquarius

The Star - Coin collector learns the difference between legal tender and spending money the hard way

ETF Daily News - Currencies Don’t Make Gold Prices Look Good

Buy Silver Coin - Deciding which Precious Metal is Best for You

VIDEO (23:26) : Got Gold Report - Ronald Reagan’s First Inaugural Address

07/04/12 - Bullion News

VIDEO (26:45) : Got Gold Report - COMEX Silver Futures Skewed Short, Potentially Explosive

The Daily Journal - San Mateo County Dealer talks about the Gold and Silver Industry

Manchester Evening News - Doing your own Gold Products Homework

The Source (WSJ) - Platinum Miners Under Pressure

ZeroHedge - The Ultimate History-Of-Markets Chartbook

VIDEO (01:05) : Bloomberg - The Ticking Debt Bomb: $16 Trillion and Climbing

King World News - This Will End In Inflation & Destruction of Paper Currencies

07/03/12 - Bullion News

CoinWeek - Why Aren’t There “Hotel Sellers” Of Gold And Silver?

Advisor One - State Capitalism to Rule the U.S.: Roubini Report

AUDIO (30:00) : BBC Radio - The Gold Standard

Wyatt Research - The Real Cause of Hyperinflation

Financial Sense - Audit the Fed Headed for the House Floor! by Ron Paul

MoneyNews - Investopedia: Consider Real Estate, Gold as Alternatives to Cash SilverSeek - The Silver Two Year Cycle Continues

VIDEO (03:21) : David Morgan - Gold Headed for a Minimum of $2,500 an Ounce

LA Times - Mammoth Lakes files for bankruptcy

SafeHaven - Monetary Inflation and Gold

07/02/12 - Bullion News

Wall Street Cheat Sheet - Did the EU Summit Change Anything for Gold?

AUDIO (57:49) : Financial Sense - In-Depth Precious Metals Market Mechanics with Jeff Christian

MineWeb - Gold coin sales tumble to pre 2008-crisis levels

CoinWeek - IS SILVER A GOOD DEAL AT $27 to $29?

Resource Investor - Deflation is the Biggest Catalyst for Precious Metals

VIDEO (27:37) : USA Watchdog - One on One with Reggie Middleton

Arabian Money - $15m Roman silver hoard uncovered in Jersey, wealth preserved for 2,000 years

Gold Silver Worlds - 7 facts proving we are in a long term powerful uptrend in Gold and Silver

VIDEO (03:07) : Learn Liberty - Would Taxing the Rich Fix the Deficit?

Gold and Silver Blog - John Paulson Remains Bullish On Gold With $4,000 Target

novinite - Romanian Caught Smuggling Silver at Bulgarian - Turkish Border

BBC - Eurozone unemployment rises to fresh record high in May

07/01/12 - Bullion News

VIDEO (02:54) : Bloomberg - Show Me the Money: European Bailout Funds

azizonomics - The Origin of Money

ZeeBiz - Rich Indians hoarding banknotes, gold and art works in Swiss banks

VIDEO (04:08) : WSJ - Just Like 1965, These Are Golden Years

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

December 2025

All Articles were Originally Posted on the Homepage

Platinum per Troy Oz. (ozt.)

Click Ad to Request a Free Appraisal Kit

ExpressGoldCash

Customer Reviews 4.9 stars

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)