Homepage / Archived News or Quarterly News / 1st Quarter 2012

1st Quarter - 2012

Charts, Bullion News & Commentary

When investing in any market, a good way to judge price movement in the future is to learn from the past.

Peter Lynch, one of the most respected investors of the twentieth century and author of "One Up on Wall Street" and "Beating the Street," once said, "Investing without research is like playing stud poker and never looking at the cards."

This page provides a comprehensive overview of gold, silver, platinum, and palladium during the quarter.

For each of the precious metals, you'll find charts. Below the charts, you will find Bullion News Headlines from the 1st Quarter of 2012. Every news link was originally posted on this guide's homepage.

The charts below are provided by the courtesy of

Gold Price Chart - 1st qtr. 2012

Gold Price Chart (Jan. 1st, 2011 - Mar. 31st, 2012)

Bullion News

Gold Price Summary

In the last week of Q4 2011, gold's price reached a low of $1,523.90 per troy ounce. While the yearly chart indicates that gold's price is beginning a new uptrend, the quarterly chart presents a different story.

In the first month of the quarter, the chart shows us two golden crosses, which are very bullish technical signals. The first Golden Cross occurred when the 10-day Moving Average (MA) crossed above the 200-day MA. A few days later, the 10-day MA also crossed the 50-day MA.

After the price of gold tested the $1800 resistance level in late February, it dropped, and a Death Cross Signal appeared on gold's quarterly charts.

The first "death cross" occurred when the 10-day moving average fell below the 50-day moving average. A few days later, the 10-day moving average also dropped below the 200-day moving average, forming the second "death cross."

Gold Price Chart (Jan. 1st, 2012 - Mar. 31st, 2012)

Bullion News

BGASC - Customer Reviews - 4.8 stars

Silver Price Chart - 1st qtr. 2012

Silver Price Chart (Jan. 1st, 2011 - Mar. 31st, 2012)

Bullion News

Silver Price Summary

Like gold, silver's price bottomed at $26.30 during the last week of the last quarter.

Silver's price began a new uptrend in the first quarter of 2012. The golden cross that occurred early in the quarter was a positive indicator for the direction of silver's price.

After more than a month of positive movement, the silver bulls faced a death cross in mid-March, where the 10-day moving average fell below the 50-day moving average. This was a clear indication that lower silver prices were on the horizon.

Silver Price Chart (Jan. 1st, 2012 - Mar. 31st, 2012)

Bullion News

Platinum Price Chart - 1st qtr. 2012

Platinum Price Chart (Jan. 1st, 2011 - Mar. 31st, 2012)

Bullion News

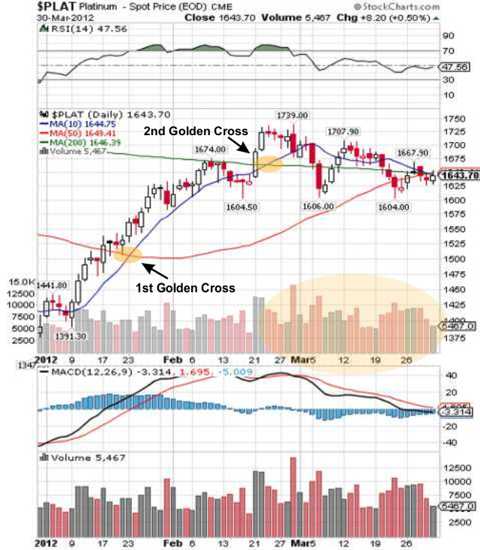

Platinum Price Summary

Like Gold and Silver, Platinum's spot price hit bottom in the last week of the last quarter (q4 2011) at $1347.60.

In addition, much like Gold and Silver's price charts, Platinum developed a golden cross in January of 2012, when the 10MA crossed above the 50MA. However, unlike gold and silver, platinum's golden cross gave platinum's price solid support for the first two months of the quarter.

Additionally, the second golden cross during the quarter occurred when the 10-day moving average (10MA) rose above the 200-day moving average (200MA). This provided support for platinum's spot price for the remainder of the quarter. However, volume indicated that more sellers were returning to the market, and the MACD showed signs of breaking down.

Platinum Price Chart (Jan. 1st, 2012 - Mar. 31st, 2012)

Bullion News

ExpressGoldCash - 4.9 star - Customer Reviews

Palladium Price - 1st qtr. 2012

Palladium Price Chart (Jan. 1st, 2011 - Mar. 31st, 2012)

Bullion News

Palladium Price Summary

Palladium's price was mostly positive for the first half of the quarter.

By mid-February, sellers began to outnumber buyers, and by March, it was evident that sellers clearly outnumbered buyers in the Palladium market. The trend continued for the rest of the quarter.

Palladium Price Chart (Jan. 1st, 2012 - Mar. 31st, 2012)

Bullion News

The charts above are provided by the courtesy of

1st Quarter - 2012

Bullion News & Commentary

The Quarterly News starts with the end of the quarter articles, first.

Please be aware that not all of the links below are working; they have been retained because the headlines provide information on the state of the markets at the time.

03/31/12 - Bullion News

CoinNews – Gold Prices Advance 6.7% on Quarter as Silver Soars 16.4%

VIDEO(s) (34:42) : Silver Doctors – David Morgan with The Doc: Cartel Wearing Out All But the Most Diehard Silver Investors

Mish's Blog – Spiegel Says "Even a 1-Trillion Euro Firewall Wouldn't Be Enough"; Mish Says "The Bigger the Bazooka, the More Money Will be Lost"

Article & VIDEO (36:11) : Chris Martenson - Charles Biderman: The Problem with Rigged Markets

ZeroHedge – Will India Stop Buying Gold?

Total Investor – Fantastic op-ed: These four numbers will bankrupt America

Commodity Online – China wastes 1500Kg of Gold, 30000Kg Silver every year

VIDEO (28:03) : Capital Account – Reflections on Post-Capitalism, Political Entrepreneurialism, and the Bernanke Contrarian Index

Miles Franklin – Gold is Manipulated… and It’s Not Okay

Summary & VIDEO (01:07) : arabian money – No escape from the next crisis says Obama’s fiscal commission chair former Senator Alan Simpson

03/30/12 - Bullion News

CNN – Canada getting rid of the penny to save costs

Reuters – Gold climbs as dollar index plumbs one-month low

Resource Investor – Bullion: Is it Part of Your Currency Reserve?

Minyanville – Observations on Quarter-End and the Forward Path of Gold

Perth Mint Bullion Blog – Uncertain Times Require Certain Diversifications

AUDIO (13:28) : FSN – Kerry Lutz interviews Peter Grandich Takes On The Gold Perma-Bears

Wall Street Pit – Possible Opportunity in Gold Bullion Due to Indian Strike

American Thinker – General Strike in Spain over government austerity measures

Acting Man - LTRO Fail – Euro Area Credit and Money Supply Shrinks

Business Insider - 8 Investment Lessons From Bruce Berkowitz

VIDEO (01:54) : TGIF : Batman gets pulled over in Washington, D.C. driving a Lamborghini

03/29/12 - Bullion News

Whiskey and Gunpowder - Ben Bernanke Considers Your Happiness and Security Expendable

Summary & Video (03:51) : Business Insider - CHARLES NENNER: Investors Who Miss This Gold Rally Need To Be 'Educated Better'

Financial Sense - Martin Armstrong on the Sovereign Debt Crisis

Silver Coins Today - US Mint Silver Coin Sales Slow, Star-Spangled Banner Commemorative Leads

MoneyNews - U.S. Corporate Pensions See Record $326.8 Billion Funding Shortfall

ZeroHedge - Paul Mylchreest Presents Various Visual Case Studies Of Gold Price Manipulation

321gold - What Causes Interest Rates to Rise

CoinWeek - Persistent Investment Needed to Support Gold as Indian Duty Hike “Kills Imports”

Business Week - Palladium Seen Beating Gold With Record Car Sales: Commodities

Chris Martenson - Gold is Manipulated (But That's Okay)

Ludwig von Mises Institute - Mises on the Basics of Money

VIDEO (03:16) & Article : CTV - Ontario highway cleared after millions in coins spill

Casey Research - ETFs: Do You Really Know What You're Buying?

03/28/12 - Bullion News

Market Watch - The next leg of gold’s bull run

arabian money - US declares electronic war on Iran with Swift action says gold bug Jim Sinclair

ZeroHedge - Turkey Once Again Proves That Gold Is First And Foremost Money

Zee News - India's Bullion Strike enters 11th day

Business Insider - GOLDMAN: BUY GOLD

CoinNews - Coins and Engraver Collection Return to Historic U.S. Mint Building at Community College of Philadelphia

Forbes - Peter Schiff: Market-Crushing Treasury Collapse To Hit Around 2013

MoneyWeek - How to spot fake gold Ready Nutrition - Testing Precious Metals for Long-Term Preparations

Bullion Bulls Canada - Sideways Precious Metals Prices Mean It’s Not Too Late

03/27/12 - Bullion News

CoinNews - Gold Dips 70 Cents, American Silver Eagles Top 10 Million

The Source (WSJ) - Bernanke Leads the Dollar in a Merry Dance

VIDEO & Summary (17:17) : Mish's Blog - Mish vs. Jo Weisenthal: Debate on Capital Account Regarding Gold

Summary & VIDEO (05:31) : arabian money - Emirates NBD’s gold chief Gerhard Schubert explains how Iran and other factors are driving precious metal prices

Seeking Alpha - Death Of The Gold Bull Market?

Mish's Blog - Obama vs. Ryan: Budget Showdown - Deficit and Total Debt Projections Through 2021 - Interactive map; Path to Prosperity or Path to Ruin?

The Golden Truth - Got Gold?

Numismaster - With Coins, Learn or Get Burned?

VIDEO (02:37) : Perth Mint Bullion Blog - Simple Rule For Buying Gold

Total Investor - BRICs’ move to unseat US dollar as trade currency

Merk Funds - Bernanke's Problem with the Gold Standard

ZeroHedge - Confidence Drops As Consumers Brace For Surge In Inflation

AUDIO (15:10) : FSN - “Ranting” Andy–When Ben Bernank Speaks, Gold Listens

Investment Rarities - Remember Silver by Jim Cook

03/26/12 - Bullion News

Casey Research - What Inflation Could Look Like in 2014

Reuters - Gold rises 1.5 pct on renewed US easing hopes

Paper Money Collapse - Does the ‘recovery’ matter?

Perth Mint Bullion Blog - Fake Bars - The Facts

VIDEO (06:13) : Got Gold Report - Gene Arensberg - Silver Best Way to Buy Gold

Wyatt Research - My Crazy Gold Investment Strategy

arabian money - Will silver prices rise as stocks fall as in 2007-8 or also take a plunge?

Seeking Alpha - Marc Faber: Continuing Financial Crisis Must Be Endured

Mile Franklin - The Seven Characteristics of Money

Howe Street - The Evolution of Money from a THING (e.g. silver) to a UNIT of ‘Consciousness’ (No THING)

03/25/12 - Bullion News

Commodity Online - Gold: Where are the buyers?

ZeroHedge - Tungsten-Filled 1 Kilo Gold Bar Found In The UK

TECHNICAL ANALYSIS : Gold Scents - CAN BERNANKE BREAK THE DOLLAR RALLY?

VIDEO (03:34) : Max Keiser - “Everyone should own a little Silver.” Is this even possible given today’s tight supplies?

Fox Business - The Other Debt Time Bomb

ZeroHedge - The Fed Is Losing The "Race To Debase"

VIDEO (19:42) : Real Assets - Interview with the Adam Smith Institute

03/24/12 - Bullion News

Coin Update - 2012 Proof Silver Eagle Release Date and Pricing

RollingStone - Gangster Banks Keep Winning Public Business. Why?

VIDEO (27:59) : Capital Account w/ Lauren Lyster - Interview with Jim Rogers

Business Insider - Check Out The Positively Absurd Assumption That Bullish Analysts Are Making...

arabian money - 9.4% Apple ‘flash crash’ is the stock market trend turning down?

Daily Finance - Currency Intervention and the Leap-Year Gold Massacre

Gold Made Simple - UK consumer confidence falls to 44 – Bank of England to respond by printing?

VIDEO (05:08) : SHTF plan - Do You Trust This Man With Your Future?

03/23/12 - Bullion News

CoinWeek - Why Are Bullion Bankers Lying To The Media And Public?

Business Insider - REPORT: Jon Corzine Ordered $200 Million Of MF Global Customer Funds To Be Moved Before Bankruptcy

AUDIO (15:04) : Ellis Martin Report with David Morgan - Part 1

AUDIO (15:04) : Ellis Martin Report with David Morgan - Part 2

Spot gold rebounds on stronger euro ahead of Bernanke speech

Ed Steer's Gold & Silver Daily - GFMS Global Head: "Buy This Gold Dip" as $2,000/oz Possible

USA Today - 30,000 Roman silver coins found at work site in Bath

Perth Mint Bullion Blog - 10 Kilo Dragon Gold Coins In The Making

Wealth Cycles - Cashless Society Is Totalitarian Dream

VIDEO (09:06) : James Turk - Hyperinflation On Our Way

US Funds - Why Gold Can Go the Distance by Frank Holmes

VIDEO (05:30) : Gas Prices Explained

03/22/12 - Bullion News

The Golden Truth - How Much Treasury Debt?

GoldSeek - Gunning for Gold

The Big Picture - Peak Imbalances Are Falling

Bloomberg - Golds Declines to Two-Month Low on Manufacturing, Dollar

Investment U - Investing in Mexican Silver Libertad Bullion Coins

Bankrate - 5 tips to shine in investing in gold coins

Silver Coins Today - American Silver Eagles Bullion Coins Highlight of US Mint Sales, Followed by Proof Coins

Reuters - UK Treasury says no plans to add to gold holdings

Mish's Blog - Ben Bernanke: Inflationist Jackass, Devoid of Common Sense, and Clueless About Trade, Debt, History, and Gold

Seeking Alpha - Palladium: The Not-So-Precious Precious Metal

Gold and Silver Blog - What Precious Metal Has Performed Best In 2012 And Where Do We Go From Here?

Ludwig von Mises Inst. - Saving India from the Keynesians

Silver Investing News - Talking Metals with David Morgan

03/21/12 - Bullion News

VIDEO (10:26) : David Morgan - SILVER is The Achilles' Heel to the ENTIRE ECONOMIC SYSTEM!

VIDEO (04:26) : Fox Business - David Tice on why Federal Reserve policies are having a negative impact on the markets

Kitco - Technical Trading; Gold Holding Key Fibonacci Support For Now

VIDEO (29:51) : 2012 California Resource Investment Conference - Precious Metals, A Risk On Trade Or A Safe Haven?

Market Watch - Slow-cooking inflation as a global problem

GoldSeek - Have Gold, Silver Entered a Bear Market?

Summary & VIDEO (03:08) : ZeroHedge - The Simple Problems Of Too Much US Debt

Business Insider - ART CASHIN: A Mountain Of Cash Is Piling Up With Treasury Bonds Selling Off And Nobody Knows Where It Is Going

Article & VIDEO (13:31) : CNBC - Long-Term Bond Bubble Getting Ready to Burst

AUDIO (10:42) : MineWeb - Johnson Matthey's Publications manager looks at the reasons for Platinum's strong run and its relationship to gold

Investment Rarities - Free Stuff by Jim Cook

03/20/12 - Bullion News

Wyatt Research - Why You Should Be Rooting for Lower Priced Gold

CoinWeek - The Coin Analyst: China Strives to Make Silver Pandas as Popular as American Silver Eagles

Total Investor - One of the Market's Most Reliable Indicators Says "Sell"

AUDIO (15:54) : Mike Maloney & Jim Rogers - Is Gold Money?

IBTimes - How to Avoid Being Caught in a Common Gold Scam

AUDIO (19:48) : Ellis Martin Report with Jim Sinclair and the Nuclear Economic Trigger

arabian money - Silver prices holding up better than gold

Market Watch - Don’t be fooled by the money illusion

Forbes - The Rising Price Of the Falling Dollar

The Real Asset - The top five gold commentators

Townhall - Gold to Silver Ratio; Widening

03/19/12 - Bullion News

Casey Research - What's Really Happening with Gold and Silver in India

CBS News - Sweden moving towards cashless economy

Mish's Blog - Is There a Bubble in Treasuries? Both Sides of the Case; Explaining the 2011 Treasury Rally (It's Not What You Think); Where to From Here?

CoinWeek : Wanted! Bearish Gold Bulls

AUDIO (08:20) : Jim Rogers is the special guest on Goldseek radio

SafeHaven - Is Gold Getting a Tad Seductive at Recent Levels?

VIDEO (17:17) : Greg Hunter Interviews Karl Denninger on the EU Debt Crisis and Coming Financial Crash

Gold Made Simple - Indian government doubles gold import tax: a warning for us all

The Hindu - Indian Bullion markets close for third day to protest gold duty hike

The Real Asset - Is gold too simple for your savings?

VIDEO (02:27) : CNBC - Credibility Issue At the Fed?

Market Anthropology - Gold and Silver's ups and downs precedes overall market movement

03/18/12 - Bullion News

CoinNews - Gold and Silver Weekly Losses Bullish for US Mint Coin Sales

AUDIO (14:26) : Jim Rogers on Everything Financial Radio

SafeHaven - Money Supply Booming, Seeds of the Next Greater Recession

Wyatt Research - Danger Ahead for Stock Investors

03/17/12 - Bullion News

TECHNICAL ANALYSIS : The Gold Report - When to Acquire Silver, the Metal of Emperors?

AUDIO (40:16) : Chris Martenson Interviews Marc Faber - The Perils of Money Printing's Unintended Consequences

Seeking Alpha - Stay Away From The Big Banks

Reuters - Central banks snap up gold after price pressure

MineWeb - Is gold now the contrarian play?

Mish's Blog - Gallup Struggles to Explain BLS Jobs Data

VIDEO & Summary (06:12) : Yahoo Finance - PIMCO’s Bill Gross: QE3, Inflation, Muted Growth on the Way

03/16/12 - Bullion News

Gold and Silver Blog - U.S. Mint Sales of Gold and Silver Bullion Coins Jumps 100%

Article & VIDEO (07:38) : Road to Roota (Bix Weir) - The Hidden Meanings in the New $100 Bill!

Silver Investing News - Silver Weak as Bull and Bear Battle

CMI Gold and Silver (Blog) - The fiat dollar and the de-industrialization of America

321gold - The relationship between gold and interest rates

ZeroHedge - Dylan Grice Explains When To Sell Gold

Gold Made Simple - FTSE:Gold ratio: Gold still undervalued by about 360%

The Daily Caller - Federal Reserve joins Twitter, prompting 140-character insults

Business Insider - This Is The Chart That Makes ECRI Scream Recession

Bloomberg - Consumer Prices in U.S. Rose in February as Gasoline Jumped

Real Assets - Do gold investors need the luck of the Irish?

American Thinker - Unleashing the government parasite

Business Insider - 3 Great Charts On The Dow Vs. Gold

Wealth Wire - Gold's Stairway to Heaven

The Gold Standard Now - Gold or the Glacier

Ahead of the Herd - A Nations Metallurgical Achilles Heel

03/15/12 - Bullion News

Fox Business - No Shift Yet in Fed Policy That Punishes Savers

VIDEO (18:53) : "Trading Talk" investigates the Growing Federal Deficit Crisis

Market Anthropology - Kumbaya

CoinWeek - Gold “Vulnerable” as Treasury Bond Sell-Off Worsens, Indian Demand Revives

Total Investor - How Commodities Predict Market Movement

VIDEO (01:17) : WSPA (South Carolina) - Investor "Devastated" To Learn Former Upstate Councilman Accused In Precious Metals Ponzi Scheme

VIDEO (03:56) : CNBC - Gold Falls After Fed Meeting

Rick Ackerman - How High Can the Fed Pile Manure?

CoinNews - Gold, Silver Prices Tumble as Bullion Silver Eagles Top 9M

AUDIO (16:32) : FSN - According to Barry Stuppler Platinum has a Golden Future

321gold - The Government's New Plan for Retirees Includes Pink Slime, Horse Meat, and Horse Hockey Investments

VIDEO (05:53) : Yahoo (Breakout) - 3 Signs a Market Sell-Off Is Coming Soon

Bullion Bulls of Canada - The Virtues of the Humble Investor

MineWeb - Yesterday's Top Story: Some central banks showing concerns about their gold holdings

03/14/12 - Bullion News

Total Investor - Pensions All Over America Are Being Savagely Cut Or Are Vanishing Completely

Article & VIDEO (01:58) : Gold Made Simple - Turning a new PAGE – new physical backed precious metal exchange in the offing?

Reuters - Dollar, Fed push gold to lowest since mid-Jan

VIDEO (05:24) : arabian money - BGC Financial predicts new silver all-time high this year

VIDEO (35:21) : Wealth Wire - "Unmasking the Federal Reserve"

Financial Sense - M2 Money Velocity Plunges Most Since 1959

VIDEO & Summary (05:47) : ReasonTV - HOW HOUSING POLICY CAUSED THE FINANCIAL CRISIS

Numismaster - More Private Gold and Silver Coins?

Bloomberg - Gold Seen Heading for 12th Annual Advance on Investor Hoarding

03/13/12 - Bullion News

VIDEO (12:36) : Keiser Report guest David Morgan on gold/silver market manipulation

Technical Analysis - Silver - Is that a H&S on the chart?

Commodity Online - COMEX Gold extends decline after retail sales data

ZeroHedge - Presenting Bridgewater's Weimar Hyper-inflationary Case Study

Financial Sense - The Silver Catalyst: An Exclusive Interview with Hugo Salinas Price

Silver Investing News - Silver As Currency

VIDEO (03:20) : CNBC - Kyle Bass of Hayman Capital explains why he's so Bullish on Gold

Market Watch - To ease or not to ease?

The Sovereign Investor - Why the Government’s Fears Mean a Gold and Silver Opportunity for You

Jesse's Café Américain - Monetary Deflation - Not Visible Yet

MineWeb - South African gold production continues to plunge

Ludwig von Mises Institute - Is Inflation about General Increases in Prices?

Business Insider - Buy Gold Because a Currency Crisis is Coming

03/12/12 - Bullion News

Daily Wealth - A Gold Trade with Dramatic Upside That Can't Go to Zero

The Daily Caller - Debt hawk to US: You may soon ‘have your creditors basically controlling you’

Reuters - Eurozone okays Greek aid, demands deeper Spanish deficit cut

Washington Times - Germany proposes a Drudge Tax

AUDIO : Korelin Report - Monday Gold Commentary from Big Al and Trader Rog

VIDEO & Summary (09:29) : SafeHaven - Barclays co-CEO to Bloomberg TV: 'Challenges for Continental Banks'

Whiskey and Gunpowder - Analysts Predict Gold Will Plunge Below $1000

AUDIO (12:19) : Interview with Silver Guru; David Morgan about the Silver Sell-Off, Naked Shorting & Paper vs. Physical

Daily Wealth - New Proof the U.S. Dollar is No Longer "King"

Bloomberg - Gold Declines as Commodities Retreat, Hedge Funds Cut Holdings of Bullion

Business Insider - We Are Entering The Cataclysmic Stage Of The Fake Wealth Era

MoneyNews - Report: Wealthy Say Gold Best Investment

MineWeb - Does gold rise with inflation or is it just rising anyway?

Ludwig von Mises Institute - Crony Capitalism Revisited (Is Keynesianism What We Think It Is?)

VIDEO (58:29) : Nicolai Foss; The Continuing Relevance of Austrian Capital Theory

ZeroHedge - Why China Is Dumping The Dollar - And Why You Should Read Up on the Weimar Republic

The Daily Caller - Why former Reagan Budget Director; David Stockman isn't buying the hype on the economy

03/11/12 - Bullion News

Business Insider - GOLD, OIL, CHINA, LIES, BIKE LANES: Jim Rogers Tells All To Business Insider

ZeroHedge - Europe's Scariest Chart Just Got Scarier

CoinNews - Gold Ekes Out Weekly Gain as Silver Dips, 1 Oz Gold Bullion Coins Hot

Nevada Appeal - Doomsday cash

Summary & VIDEO (04:28) : Jesse's Café Américain - Biderman: Fed Helping Wall Street and Corporate America Rig the Stock Market

Silver Doctors - Local Coin Shop Open Thread- The Doc Visits A Local Dealer

Silver Seek - Long-term Silver Chart Analysis

AUDIO (21:52) : FSN - Julian D.W. Phillips Has A Long Golden Memory

03/10/12 - Bullion News

AUDIO (18:25) : Die MetallWoche - Interview with “Mr. Gold” – Jim Sinclair – exclusive on Metallwoche

Wealth Wire - Gold "Trigger" Could Make Prices Explode

MineWeb - Gold goes up with inflation. Except when it goes up anyway..

Future Money Trends - You Can’t Beat Silver as an Investment

The Dismal Optimist - Enjoy the Central Bank Party While It Lasts

VIDEO (26:20) : Chris Martenson - Intereview with Robert Mish: Front-Line Evidence That We are Nowhere Near a Gold Bubble

03/09/12 - Bullion News

Financial Sense - Gold Not Automatic Crisis Winner

Casey Research - Time to Accumulate Gold and Silver

GoldSeek (Golden Jackass)- Handicapping the Collapse

ZeroHedge - US Budget Deficit Hits All Time High In February

VIDEO (01:12) : CNBC - Art Cashin: A 'Ton of Money, But No Velocity'

Market Watch - Silver’s fresh swings heighten need for strategy

VIDEO (01:12) : Perth Mint Bullion Blog - Koala Coin Video A Beauty!

Resource Investor - Bullion Remains in Consolidation

MineWeb - Texas AG halts AGT American Silver and Gold bullion, coins sales

Silver Lunar - Counterfeit Silver Lunar Dragons - Don't Get Stung!

Numismaster - Mint Stats: 2012 Gold Buffalo Sales Begin

SFTF plan - 15 Potentially Massive Threats To The U.S. Economy Over The Next 12 Months

The Market Oracle - Gold, Silver and the Crisis of the Fractional Banking System

VIDEO (28:05) : Capital Account - Super Mario Draghi says "ball is now in the banks' court," as he prints over 1 Trillion Euros

03/08/12 - Bullion News

Perth Mint Bullion Blog - An Idea Of Premiums On 1oz Lunar Gold Series I Coins

Silver Lunar - An Early Look at the Perth Mint's 2013 Year of the Snake Lunar Coins

VIDEO (17:38) : Future Money Trends - David Morgan; Silver, Gold, Mining, and How to be a Wise Investor

Bloomberg - Gold Futures Advance as Greek Rescue Spurs Demand for Dollar Alternative

321gold - Bernanke Spooks Gold

arabian money - Markets on the cusp of a major fall with Greece about to default

CMI Gold & Silver (blog) - Buy the dips; it’s a long-term bull market

Silver Coins Today - US Infantry Soldier Dollar Sales Surge as 5 Ounce Silver Coins Retreat

VIDEO (02:23) : WAFB - 5 arrested in gold coins triple murder in Gonzales

MineWeb - Can gold confiscation happen again? Part 2

Daily Reckoning - Unintended Consequences by Eric Sprott

VIDEO (08:52) : CNBC - James Grant; Smaller Government, Lower Taxes?

03/07/12 - Bullion News

Wall St Cheat Sheet - Gold and Silver Rise on New Fed Bond-Buying Chatter

MineWeb - People always look for the most stable kind of money - usually gold or silver

GoldScents - HAS THE CORRECTION FINALLY BEGUN?

Silver Coins Today - US Silver Coins Return Following Suspensions

Business Insider - The 10 Countries With The Biggest Gold Reserves In The World

Market Anthropology - Is the Market Vulnerable? Silver says - Yes.

03/06/12 - Bullion News

Silver Doctors - Nearly Entire Open Interest in COMEX Silver Trades Hands in Single Hour

American Thinker - The Fed: Oops, we're doing it again!

Gold Standard NOW - Statement by Alan Greenspan Before the Federal Gold Commission (1981)

Numismaster - Judging Silver or Something Else? (the Norfed Case)

Ludwig von Mises Institute - Seventeen Years of Boom and Bust

Miles Franklin - Greatest Threat to Precious Metals Purchasers Will Be Supply Shortages

ZeroHedge - Silver Catching Gold's Cold?

Mish's Blog - Greek 1-Year Bond Yield Hits 1,006%

Paper Money Collapse - Thinking inside the box – Chatham House on gold

Resource Investing News - Buying Physical Silver: a Guide for Investors

Market Watch - IIF warns of massive Greek default fallout: report

Article & VIDEO (51:57) : Chris Martenson - Erik Townsend: Expect a US Price Shock as Black Swans Come Home to Roost

03/05/12 - Bullion News

CoinWeek - The Coin Analyst: How the U.S. and World Mints Are Dealing with Increased Precious Metal Price Volatility

Casey Research - This Is What Volatility Looks Like

MineWeb - Sentiment hit hard by big gold sell-off - could be more falls to come

03/04/12 - Bullion News

CoinNews - Gold and Silver Mark Weekly Losses, US Mint Coin Demand Improves

ZeroHedge - David Rosenberg: "The Best Currency May Be Physical Gold"

The Atlantic - How Much Gold Do You Need to Pay Yale's Tuition? The Same as in 1900

The Street - Kass: Constant Craving for Equities Misguided

SafeHaven - How to Put Yourself on the Gold Standard

The Advocate - Home invasions for rare coins on rise, collectors say

The Market Oracle - Where is Greece’s Gold?

Reuters - Insight: Wall Street, Fed face off over physical commodities

Total Investor - Elliot Wave chartist's; Nick Laird - Forecasts his Gold Price High

03/03/12 - Bullion News

The Gold Report - Gold Far From Bubble Phase: Marc Faber

AUDIO (25:50) : FSN - Ty Andros Says Fed Interventions Are Going Up, Up and Away

Gold-Speculator - The Broken Pension Promise

IBTimes Gold - Gold-Platinum Gap Narrows

VIDEO (27:56) : Capital Account - Is the ECB choking on its own liquidity as Spain's economy grinds to a halt?

dailycamera - Gold, silver currency bill fails in Colorado Senate

ZeroHedge - Art Cashin On Why The "Economy Is Weaker Than It Has Been In 21 Months"

VIDEO (14:17) : arabian money - How Warren Buffett got forced out of silver in 2006

03/02/12 - Bullion News

MineWeb - Gold poised for take-off again or dead cat bounce?

VIDEO (13:07) : Silver Doctors - JS Kim Discusses Gold, Silver Manipulation with Max Keiser

VIDEO (12:16) : Liberty Coin & Precious Metals interviews Silver Guru David Morgan

VIDEO (05:11) : Koreline Report - Roger Wiegand Explains What Global Turmoil Means for Gold and Silver

AUDIO (11:47) : FSN - David Morgan–Aliens Are Trying To Confiscate Your Silver

The Telegraph - UK's top gold fund manager: 'I see gold's strong trend continuing'

iol - Platinum becoming jewellers’ new gold standard

GoldScents - WILL IT EVER CORRECT?

03/01/12 - Bullion News

CoinWeek - The Coin Analyst: Outlook for Precious Metals Still Strong Despite Big Drop on February 29

VIDEO (03:51) : David Morgan on Fox Business (Gold & Silver MOVEMENTS)

VIDEO (28:02) : Capital Account - Central Bank Bubble Blowers and the Rehypothecation Inflation-Nation!!

Seeking Alpha - Sales of American Eagle gold and silver coins from the U.S. Mint slowed significantly in February

Rick Ackerman - Bullion Shakedown Stampedes the Ignorant

Casey Research - Is Gold Backwardation Now Permanent?

Reuters - Gold rebounds after price rout draws buyers

AUDIO (18:04) : FSN - Bob Chapman Leap Day Panic Metals Report

VIDEO (05:14) : Jim Rogers Speaks at the University of Alabama

Investment Rarities - BAD DEAL by Jim Cook

Wealth Wire - Gold to $2,000 This Year Despite 'Manic' Crash

Mish's Blog - Gold Plunges Over $100; Some Blame Bernanke; What Did He Say? Nothing

02/29/12 - Bullion News

the guardian - British bank chief warns quantitative easing is 'laying seeds for next crisis'

Reuters - Iran's gold-for-oil offer won't shake bullion world

InvestorPlace - Gold, Silver Down Sharply Early Wednesday

The Economist - The role of gold

The Source (WSJ) - Slippery Silver, the ‘Devil’s Metal’

Article & VIDEO (10:13) : CNBC - Jim Rogers: Play This Rally With Commodities

Market Anthropology - the Terrarium

USA Watchdog - Dollar Alternative Anyone?

Merk Funds - Currencies: Crisis & Opportunity

02/28/12 - Bullion News

Investment U - Investing in Palladium - Part I

Investment U - Investing in Palladium - Part II

CoinWeek - The Coin Analyst: Soros, Paulson, and Buffet: How Three Billionaires View Gold

VIDEO (03:54) : Is Buying Foreign Silver a Good Idea?

NY Post - US credit-card debt nearing toxic levels

VIDEO (11:05) : CNBC - Pimco's El-Erian: Greek Package Will Fail

ZeroHedge - Chatham House: Gold Standard Impractical But Gold Hedge Against Declining Values of Key Fiat Currencies

VIDEO (07:53) : Silver Guru David Morgan discusses a few of the Myths In Silver

Economy Watch - Capitalism On Strike – Why Corporations Are Hoarding Cash

02/27/12 - Bullion News

SafeHaven - The Financial System Is Sick, Are Precious Metals the Cure?

ZeroHedge - Name The Bubble

The Street - Gold Prices Waver on U.S. Housing Data

Seeking Alpha - Why This Isn't Your Father's Gold Market

Ludwig von Mises Institute - The Objectives of Currency Devaluation

Jesse's Café Américain - What Is the 'Spot Price' of Gold and Silver?

VIDEOs (23:22) : arabian money - How the Hunt Brothers and Saudis cornered the silver market in the 1970s

Money Morning - Investing In Silver: How to Buy Silver Coins and Bars

Silver Doctors - Silver/Gold Ratio Breaks Below 50:1

Commodity Online - Russia's gold production to hit 7.9 mn ounces by 2015

ZeroHedge - Riksbank Denies IMF Data Showing Sweden Gold Reserves Up Sharp 18.3 Tons in January

Journal Times - Dealers predict gold prices will still go higher, but warn of risks

VIDEO (56:41) : Chris Martenson Interviews Ben Davies: Greece is Just a Preview of What's Coming For the Rest of Us

02/26/12 - Bullion News

ZeroHedge - Animation: America's Metamorphosis To A Welfare State

Independent - Price of bullion leads to sea-bed treasure hunt

The Golden Truth - IS The United States Bankrupt?

02/25/12 - Bullion News

VIDEO (68:52) : Wall St for Main Street Interviews Silver Guru David Morgan

Alaska Dispatch - Cable TV show ignites modern-day Alaska Gold Rush

CoinWeek - How Greek Debt Crisis Could Bankrupt Major US Banks

CoinNews - Gold, Silver Surge in Weekly Gain and Silver Eagles Rebound

Daily Wealth - How China Plans to Change the Way Gold Is Traded

Silver Coins Today - US Mint Suspends Eagle and ATB 5 Oz Coin Sales as Silver Prices Surge

Business Insider - Why India's Demand For Gold Jewelry Plummeted 44% Last Quarter

Ahead of the Herd - Silver Eagles Soar

Whiskey and Gunpowder - The Fear of Gold

02/24/12 - Bullion News

VIDEO (28:52) : Ellis Martin Report with David Morgan's Apology to Chinese People for Verbal Gaffe

ZeroHedge - What Rising Gasoline Prices Do To The Economy

Article & VIDEO (12:20) : Future Money Trends - GATA's Chris Powell - Why the Gold Price is Manipulated

Investment Rarities - WAKE UP CALL by Jim Cook

VIDEO (02:13) : CNBC - Santelli on Geithner: 'What a Bunch of Hogwash!'

02/23/12 - Bullion News

Courthouse News - Goldline Customers Get $4.5 Million Refund

Perth Mint Bullion Blog - New Dragon 1oz Silver Bullion Coin Coming Soon

arabian money - How far down the road has the can been kicked for Greece and the eurozone?

CoinWeek - Will Greek Sovereign Debt Default On March 23?

Rick Ackerman - T-Bills May Offer Boomers a ‘Safe’ Way to Lose

VIDEO (05:23) : Yahoo Finance (BreakOut) - Precious Metals: The Forgotten Asset Class

CoinNews - Gold Closes to 3-Month High as Silver Declines, Silver Eagles Jump 300K

Daily Wealth - The Largest Gold-Accumulation Plan of All Time

Wall Street Examiner - WTF Did All That Printed Money Go?

Casey Research - Ben Graham’s Curse on Gold

VIDEO (07:38) : GATA's Bill Murphy: High Gold Prices Bad for Business

Coin Update - Legacies of Freedom Set Featured Liberty and Britannia

02/22/12 -

'Gold Bullion Or Cash'

Seeking Alpha - In Search Of Silver

CoinNews - 2012 Chinese Silver and Gold Panda Coins Available

US Global Investors - The Enduring Popularity of Gold

Numismaster - Rare Coins Lag Bullion Coins

arabian money - Why silver is the standout buy after the Greek deal

AUDIO (11:00) : MineWeb - Gold and silver to be much higher by end of Q1 says GoldMoney's James Turk

Real Clear Politics - The 'Fairness' Fraud by Thomas Sowell

02/21/12 - Bullion News

AUDIO (16:24) : FSN - Ron Hera Likes Gold, Silver, Limited Government & Individual Rights

Jesse's Café Américain - Gold Daily and Silver Weekly Charts - Picture of the Housing Bubble Collapse

Numismaster - War Nickels Loophole in Melting Ban

Business Insider - Greece Debt Deal: "Kicking Giant Beer Keg Down Road Risks Destroying The Road"

Daily Reckoning - WTF, Warren Buffet?

MoneyWeek - The inconvenient truth about gold

Ludwig von Mises Institute - The Government and the Currency

02/20/12 - Bullion News

Casey Research - Gold Speaks Up

VIDEO (14:20) : SGT Report - David Morgan: More Bullish on SILVER NOW Than Ever Before!

Mish's Blog - Disability Fraud Holds Down Unemployment Rate; Jobless Disability Claims Hit Record $200B in January

PR Web - Gainesville Coins Launches Improved Web Site for Gold and Silver Investors

Gold and Silver Blog - Are Gold Investors Nuts?

Peoples Daily Online - Promising gold market in China

Townhall - Enter The Hedge Funds on Gold

arabian money - Money printing is good for gold, silver and oil but what about the real economy?

VIDEO (10:41) : Future Money Trends - Gold Price Manipulation Explained and Why Silver Will Soon Go Ballistic - Bill Murphy of GATA.org

DailyFX - Gold Drifts as CPI Print Trim QE Bets - Focus Remains on Europe

02/19/12 - Bullion News

Seeking Alpha - Evidence That Warren Buffett Manipulated The Silver Market In Late 1990s

CMI Gold and Silver (Bill's Blog) - More BS from the Bureau of Labor Statistics

Fast Markets - Technical Analysis - Dollar Index - Rebound gets going

Bloomberg - Gold Bulls Expand as Billionaire Paulson Says Buy

Wall St Cheat Sheet - Will Gold Cleanse The World From Dirty Fiat Currencies?

02/18/12 - Bullion News

Article & VIDEO (29:26) : ZeroHedge - Chris Martenson Interviews Jim Rickards: Paper, Gold Or Chaos?

Coin News - Gold Flat on Week, American Silver Eagles Crawl as Silver Retreats

Munknee - Monumental Change is Coming for Most Americans – Here’s Why

Whiskey and Gunpowder - Is Taxation Voluntary?

VIDEO (06:20) : Future Money Trends - GOLD 1980 Vs. TODAY

Perth Mint Bullion Blog - Another Impressive Year For Global Gold Demand - World Gold Council

CNN - Arrests made in Italy after discovery of $6 trillion in fake U.S. bonds

02/17/12 - Bullion News

VIDEO (04:51) : Eric Sprott - Central Banks Don't Have Enough Gold

SafeHaven - Inflation: As 'Contained' As An Arrow From A Bow

Mish's Blog - Gallup Reports Unemployment in February Increases to 9%, Up From 8.6%; Underemployment Increases to 19%

VIDEO (06:58) : Reason TV - IS HARRISBURG'S NIGHTMARE AMERICA'S FUTURE?

Yahoo Finance - 12 Scary Debt Facts for 2012

VIDEO (27:27) : Full Speech: Daniel Hannan at CPAC 2012

Commodity Online - Central bank Gold buying rise 471% in 2011 to highest since 1964: WGC

Perth Mint Bullion Blog - Ten Kilo Silver Bullion Dragon Coin - Picture

Reuters - Singapore to exempt gold, other precious metals from tax

CoinWeek - How Could Silver Short Sellers Cover Their Positions?

Gonzalo Lira - The Deflationary Undertow Before The Inflationary Wave

CNBC - Jim Rogers: Don’t Pay Governments Much Attention

Investment Rarities - Bubble Dynamics by Doug Noland

NBC Chicago - $1 Million in US Gold Coins Fall from French Rafters

02/16/12 - Bullion News

VIDEO (30:55) : Silver Guru David Morgan's full presentation at the California Resource Investment Conference

The Gold Report - Gold, Silver Heading Up: Roger Wiegand

Perth Mint Bullion Blog - Another Impressive Year For Global Gold Demand - World Gold Council

VIDEO (20:42) : Trading Talk - Silver Guru David Morgan discusses 2012 Precious Metals Fundamentals

arabian money - John Paulson warns Greece is the next Lehman as default nears and bets on gold

Numismaster - Mint Stats: Do Coin Buyers Need Nudge?

Business Insider - 10 States That Are Getting Pummeled By Foreclosures

Telegraph - China set to become world's biggest gold market

02/15/12 - Bullion News

Miles Franklin - How to come through this mess with your wealth intact

ZeroHedge - Russia Dumps Treasurys For 14 Consecutive Months; China Slashes Holdings To Lowest In Over A Year

Real Clear Politics - The Progressive Legacy: Part I by Thomas Sowell

Real Clear Politics - The Progressive Legacy: Part II by Thomas Sowell

Real Clear Politics - The Progressive Legacy: Part III by Thomas Sowell

Perth Mint Bullion Blog - Limited Number Of Silver Bullion Dragon Coins To Be Released Soon

Advisor One - Hold Cash, Gold and Hard Assets Until ‘Funny Money’ Frenzy Fizzles Out

VIDEO (03:10) : CNBC - Gold an Indicator of Sentiment?

ZeroHedge - David Rosenberg - "Let's Get Real - Risks Are Looming Big Time"

The Source - Gold Has Humbled Smart Men Before

02/14/12 - Bullion News

VIDEO (27:58) : Capital Account - G. Edward Griffin, "The Federal Reserve is a Private Banking Cartel"

Numsimaster - Buy Proof Gold, Lose Money

Weekly Standard - The Cost of Obama

VIDEO (04:10) : How an Ancient Empire Debased it's currency

Marietta Daily Journal - A beginner's guide for understanding the role of gold in your financial future

Nasdaq - When the World’s Wealthiest Man Says a Really Silly Thing

Mish's Blog - Japan Announces $130 Billion QE Program, One Percent Inflation Target

CMI Gold and Silver - Fractional Reserve Banking Explained

The Market Oracle - Can We Profit From Gold Price Seasonality?

The Economic Collapse - 20 Things We Can Learn About The Future Of America From The Death Of Detroit

iol - Vietnam battles ‘gold fever’

Forbes - Coin Community Fears Damage From Repeal Of Sales-Tax Exemptions; Maryland Current Battleground

Seeking Alpha - Platinum: Not All Precious Metals Are The Same

02/13/12 - Bullion News

VIDEO (02:37) : The Street - Gold Prices Close Flat on Greek Debt Deal

Money Morning - Is Gold Money?… Don't Ask Ben Bernanke, Examine the Federal Reserve

AUDIO (57:15) : YouTube - Silver Intervention Roundtable Pt.1 David Morgan Steve Quayle and Chris Duane

AUDIO (54:42) : YouTube - Silver Intervention Roundtable Pt.2 David Morgan Steve Quayle and Chris Duane

AUDIO (54:29) : YouTube - Silver Intervention Roundtable Pt.3 David Morgan Steve Quayle and Chris Duane

Gresham's Law - Charting the Federal Reserve’s Assets – 1915 to 2012

Jim Sinclair's Mind Set - The Lonely Road We Take Together

Market Watch - Gold breaks on cue — is rebound coming?

PIMCO - Investment Outlook; Life – and Death Proposition

Seeking Alpha - China: The Gold Market's 'Elephant In The Room'

arabian money - What next: CPI and wage inflation or an asset price collapse?

Wall St Cheat Sheet - Warren Buffett Trashes Gold, But What About Silver?

02/12/12 - Bullion News

VIDEO (28:04) : YouTube - Capital Account - Interview with Lew Rockwell

Jim Sinclair's Mind Set - The Terminal Beginning Of The Western Financial World

Commodity Online - Conflict between Iran, West could raise gold prices: HSBC

321gold - Bell Rings for Bond Bubble

Frederick News Post - Maryland Proposed tax on bullion, gold coins draws concern from local business owner

ZeroHedge - Whither Gold

VIDEO (09:38) : Martin Armstrong - Movie Trailer - Martin Armstrong

Bullion Bulls Canada - Precious Metals: The Only Alternative

02/11/12 - Bullion News

Silver Doctors - New Silver/ Zinc Bandages Being Examined by the Army

VIDEO (25:45) : Max Keiser - Keiser Report: FBI vs Gold Standard ‘Extremists’

SafeHaven - Where a Nation's Gold and Your Gold Should Be Held: Part II

The Gold Report - The Gospel of Gold According to Peter: Peter Grandich

02/10/12 - Bullion News

Casey Research - Permanent Gold Backwardation

AUDIO (59:59) : YouTube - Silver Guru David Morgan on Radio Liberty

INFO-GRAPHIC : Silver Doctors - Gold & Silver Sales on eBay- a State by State Comparison

AUDIO (15:22) : FSN - BrotherJohnF Is All About Freedom And Silver

The Street - With Greek Impasse, Europe's Debt Mess Is Just Beginning

CHARTS : Kitco - Today's Analytical Charts for Gold, Silver and Platinum and Palladium

Commodity Online - Reasons why Gold is the best ever investment vehicle

VIDEO (04:52) : CNBC - Clint Eastwood on Chrysler's Super Bowl Ad

CoinWeek - Two Fresh Examples Of Gold Price Suppression

Article & VIDEO (06:10) : SHTF plan - The Collapse Of America In Raw Numbers

Ahead of the Herd - Of Jobs, Debts and Budgets

ZeroHedge - Infographic: Presenting A World Covered In (Hundred Dollar Bill) Debt

The Economic Collapse - Why Is Global Shipping Slowing Down So Dramatically?

02/09/12 - Bullion News

SilverSeek - Enough is Enough by Ted Butler

Acting Man - Deficit Spending, Monetary Pumping and The Business Cycle

Boston Globe - Andover voters to decide on silver dollars as pay alternative for town employees

Investment U - Investing in Gold Coins

Business Week - $25B settlement reached over foreclosure abuses

ZeroHedge - CME Cuts Gold, Silver, Platinum And Copper Margins

VIDEO (25:41) : Max Keiser - Keiser Report: Black Holes & Gold Hills

Paper Money Collapse - There will be no end to ‘quantitative easing’

Wealth Wire - 10 Things That Every American Should Know About the Federal Reserve

Seeking Alpha - Buffett Disses Gold

VIDEO (03:18) : YouTube - Jim Rogers on Emerging Markerts, Elections & Gold

CoinWeek - The Coin Analyst: U.S. Mint Announces Some Major Changes to the America the Beautiful Five-Ounce Series

Market Watch - The insiders are selling equities heavily; July was last time insiders were equally as bearish

AUDIO (22:46) : YouTube - FSN's Kerry Lutz Interviews David Morgan & Chris Duane

Perth Mint Bullion Blog - How Are Perth Mint Gold And Silver Spot Rates Calculated?

arabian money - Bill Bonner explains why gold and silver are not at a 1980-style high

The Gold Report - How High and Low Can Gold Go?

Wealth Cycles - Investor Demand, Shrinking Supply Keep Silver Climbing

New Zealand Herald - Beware of Scammers; Family's $340,000 in gold lost

Chris Martenson - Why Our Currency Will Fail

02/08/12 - Bullion News

Business Insider - Gold Increased in Value in Both Extremes, Inflationary and Deflationary Scenarios (1900 - 2011)

VIDEO (03:00) : CNBC - Gold to Hit $2,000 in Second Half

Bloomberg - Platinum’s Investment Potential May Exceed Gold’s

Silver Doctors - Backwardation in Silver Continues...

Coin Update - US Mint Continues Sales of 2011 America the Beautiful Silver Bullion Coins

Wyatt Research - Will Your Savings Exist if the Dollar Doesn't?

Financial Post - Gold takes a break on more hopeful euro outlook

Numismaster - Dawning of New Silver Eagle Age?

SafeHaven - Equity Market Continues to Lose Momentum

Mining Weekly - Heightened risk of platinum supply disruption

Numismaster - Strange Physical Gold, Silver Trades

Commodity Online - Gold standard believers are anti-government: FBI

The Indy Channel - 'Sovereign Citizen' Wants $1.6M In Gold From State

02/07/12 - Bullion News

Casey Research - The Fed resumes Printing

Financial Sense - Where a Nation’s Gold and Your Gold Should be Held – Part I

Courthouse News - New From China! Bogus Old Coins, Prof Says

Market Watch - Japan’s interest in gold and silver is growing

CoinWeek - “Someone” Apparently Trying To Conceal US Government Manipulation Of Gold Market

Reuters - Hong Kong gold flow to China more than triples in 2011

The Atlantic - A Short History of American Money, From Fur to Fiat

Gold-Eagle - SILVER: The Bastard Child Of The Commodities Family

02/06/12 - Bullion News

SafeHaven - In the Bullring With Gold by Frank Holmes

Wyatt Research - When Money is Free

CHARTS : Kitco - Monday's Analytical Charts for Gold, Silver and Platinum and Palladium

AUDIO (13:19) : YouTube - Butler On Business Interviews Silver Guru - David Morgan

FX Empire - Introduction and Guide to Investing in Silver

The Globe and Mail - No holiday for China’s gold retailers

Wealth Wire - $3 Billion in Platinum Found on Sunken WWII Ship

02/05/12 - Bullion News

ZeroHedge - On The Failure Of Inflation Targeting, The Hubris Of Central Planning, The "Lost Pilot" Effect, And Economist Idiocy

Nevada Appeal - How (and how not) to buy and sell gold

Salt Lake Tribune - Business Insight: The many sides of turning coins into cash

Daily Reckoning - A Crisis in Worthwhile Opinions of Capitalism

02/04/12 - Bullion News

Business Insider - Goldcore Research: US Mint Gold Coin Sales for January - Signal Return to Fundamental Driven Demand?

VIDEO (25:44) : Max Keiser - Keiser Report – The Vaporized and the Deleted

Financial Sense - Gold: Debt, Deficits, Doom, and Gloom

321gold - Fed Stimulus and BDI crash and USD and gold

The Economic Collapse - I Can’t Take It Anymore! When Will The Government Quit Putting Out Fraudulent Employment Statistics?

Winnipeg Free Press - Know where to invest Energy, metals expected to be strong in 2012

02/03/12 - Bullion News

CoinWeek - Primary Differences Between Investing in Bullion Coins and Collector Coins

AUDIO (14:05) : YouTube - SGT Report Interviews Chris Duane and Silver Guru David Morgan

Coin Update - Royal Canadian Mint 2012 “Moose” Silver Bullion Coins

Commodity Online - 'Next target for Gold at $ 1,800/oz, for Silver at $37/oz'

ZeroHedge - Kyle Bass: "Don't Sell Your Gold"

AUDIOs : Die MetallWoche - Interview with Mr. Gold himself, Jim Sinclair

Wealth Daily - More Investors Turn to Gold Coins

Market Watch - China feeds copper run, but gains may not last

Perth Mint Bullion - Uses And Sources Of Gold – Where Gold Comes From And Where It Goes

CoinNews - Teletrade Redesigns Website and Improves Coin Bidding

Daily Mail - Silver bullet for cancer: Metal can kill some tumours better than chemotherapy with fewer side effects

CMI Gold and Silver - Is Timothy Geithner preparing to supercharge the gold price?

AUDIO (09:30) : YouTube - James Turk - GoldSeek radio

02/02/12 - Bullion News

VIDEO (28:00) : YouTube - Capital Account - Lauren Lyster Interviews Jim Rogers

Jim Sinclair's Mind Set - In the News Today

CoinWeek - Rush To Buy Physical Gold And Silver Hasn’t Started Yet

The Sovereign Investor - How to Profit From US Dollar and Euro’s Race to the Bottom

Whiskey and Gunpowder - The Revolution of 1913

Numismaster - Mint Stats: Interest Wanes for 5-oz Coins

ZeroHedge - A Gold (And Physical Platinum) Bug At The Fed?

VIDEO (04:42) : The Telegraph - Gold will rise against 'heavily debased' currencies

Market Watch - Getting back to the gold standard

MineWeb - China's gold output and demand could be far greater than ‘official' data suggest

arabian money - Precious metals trounce stocks in best January for decades

The Gold Report - Great Deals on Gold and Silver: James Turk

IBTimes Gold - Gold to Silver Ratio

02/01/12 - Bullion News

Coin Update - Silver Eagle Bullion Coin Sales Top 6 Million

VIDEO (09:55) : Korelin Economics Report - David Morgan, Silver and Gold Will Hit New Highs in 2012

Financial Planning - ETFs; A Golden Headache - Investors who benefit from rising gold prices may find unexpected pitfalls in the tax code

Reuters - MF Global's missing money traced: report

AUDIO (13:13) : MineWeb - Long term gold prices, short term speculators and macroeconomics - HSBC's chief commodities strategist, James Steel

01/31/12 - Bullion News

VIDEO (27:59) : Capital Account - A Financial System Built to Fail: 2008 vs 2012

Ludwig von Mises Institute - Currency Wars

Wyatt Research - Silver Opportunity Begins Anew

VIDEO (25:51) : Max Keiser - Keiser Report: Starving the Economy

AUDIO (16:33) : FSN - Nothing Ever Surprises “Ranting” Andy Hoffman Anymore–Especially Gold and Silver Prices (link corrected)

Investment U - 10 Ways Protect Yourself From Fake Bullion Coins

The Acting Man - The ‘Gold Bubble’ In Perspective

INFO_GRAPHIC : ZeroHedge - Visualize: The European Super Highway of Debt

CoinWeek - Gold And Silver Strong In January—What Now?

Mortgage rb - Dr. Steven Yates: Did Alexander Hamilton Launch Today's Economic Crisis?

Business Insider - The 5 Scariest Debt And Unemployment Charts From The CBO Report

Seeking Alpha - The U.S. Dollar Is Under Attack

Perth Mint Bullion - Coin Investors Among The First To Jump Back Into Gold And Silver

Silver Coins Today - 2012 Chinese Panda Silver Coins Released

Real Clear Politics - Getting Nowhere, Very Fast by Thomas Sowell

AUDIO (15:25) : FSN - Casey Research’s Jeff Clark Is Buying Gold Insurance

01/30/12 - Bullion News

Gold versus Papers - The Last Gasp

VIDEO (13:09) : YouTube - Silver Guru David Morgan's SILVER Update!

VIDEO (03:09) : CNBC - Jim Rogers; There Is No More Money in Finance

Financial Sense - The Coming Paradigm Shift in Silver

Wealth Wire - China Doubles Gold Holdings: No Other Asset is Safe

Wyatt Research - The Real Story Behind the Fed's Interest Rate Announcement

StateImpact - Idaho Tax Protester Introduces Gold and Silver Currency Bill

Miles Franklin - The Upcoming Hyper-inflationary Great Depression

SafeHaven - Why Gold Is Shining Bright and What the Fed is Doing

Gold Scents - ARGUING WITH THE MARKET

Article & VIDEO (36:08) : Jesse's Cafe Americain - How Did the Big Banks Get So Powerful? Easy Is the Descent Into Hell

01/29/12 - Bullion News

AUDIO (27:56) : FSN - Chris Martenson Says History Will Certainly Repeat Itself

SHFT plan - What are you so Afraid of? (The Story from a Minnesota State Trooper)

Seeking Alpha - Silver Could Rise Dramatically In 2012

Finacial Sense - A Golden Solution to a Global Crisis

CoinWeek - Precious Metals that can be held in an IRA or 401k

01/28/12 - Bullion News

Miles Franklin - Solid... as a Rock (Week in Review)The Acting Man - Gold Bonds: Averting Financial Armageddon

The Sydney Morning Herald - Gold rises on disappointing US GDP

The Market Oracle - Gold GLD ETF Investors Mass Exodus

01/27/12 - Bullion News

AUDIO (05:51) : YouTube - Ellis Martin Report with David Morgan at the Vancouver Resource Investment Conference

Mish's Blog - Prepare for Greece to Leave Eurozone...

Wall St Cheat Sheet - With Friends Like These Does Gold Need an Official QE3?

Jim Sinclair's Mind Set - In The News Today

VIDEO (05:25) : CNBC - Newmont CEO discusses the Supply Side of Gold Production

Gold-Eagle - Inflation And Price Trends 1920 To 2012

Wealth Wire - Biggest Threat to Investing? Your BRAIN!

Commodity Online - 'The truth behind the silver market'

Bloomberg - Gold Bulls Ascendant on Biggest Rally Since ’80

Barron's - Hedge Fund Guru Sees Gold Price Soaring

arabian money - How long can the Fed pump up the US bond bubble? Time to shift into hard assets?

Gresham's Law - Looking Back on a Century of the Fed’s BS

01/26/12 - Bullion News

ZeroHedge - Has Bernanke Become A Gold Bug's Best Friend?

Ludwig von Mises Institute - Money and Freedom

AUDIO (13:02) : FSN - Triple Lutz Report–The World Changed Yesterday-Gold and Silver Did Not

Reuters - Gold hits 6-1/2 week high as Fed boosts markets

VIDEO (02:22) : CNBC - Barrick Gold CEO; Central Bank Policies Are Good For Gold

AUDIO (14:01) : MineWeb - Platinum outlook and difficulties within the PGM basket

Wyatt Research - Don't Blink: Portugal Now on the Chopping Block

AUDIO (04:03) : Korelin Economics Report - The impact of the President’s speech on gold

01/25/12 - Bullion News

Daily Reckoning - Gentlemen, Start Your Printing Presses!

CNBC - Gold Soars After Fed Decision

Casey Research - Doug Casey on the Collapse of the Euro and the EU

Commodity Online - US silver imports jump 16.2%, exports climb 25.7% in 2011

Commodity Online - US gold production gains 2.6%, silver declines 8.7% in 2011

The Independent - UK's Royal Mint accused of making a mint from overpriced souvenir coins

Jesse's Cafe Americain - Gold Daily and Silver Weekly Charts - Sharp Metals Rally Off the FOMC Policy Statement

AUDIO (14:05) : MineWeb - Sprott Asset Management's John Embry discusses Gold, China and Quantative easing to infinity

Rick Ackerman - Yellow Flag Out for Stock and Gold Bulls

CMI Gold and Silver - Inflation is good for you

SHTF plan - Spread the Wealth Around: 48.5% of American Households Receive Government Benefits; $6,640 For Every Member Of the Population

The Telegraph and Argus (UK) - Take care of your gold, Bradford police warn

American Thinker - The debt iceberg ahead

Gold and Silver Blog - A Rush For Gold In Iran – Currency Collapse Sends Gold Prices Soaring

VIDEO (27:06) : YouTube - Capital Account - The American Debt Imperium and the Mother of all Bubbles

01/24/12 - Bullion News

Wall St Cheat Sheet - Fed Expected to Set Inflation Target, Hold Interest Rates Near Zero Into 2014

Wealth Wire - Silver's 2011 Big Move: The End or the Beginning?

Mish's Blog - Premature Dollar Obituaries and Mainstream Economists' Monetary Insanity; Keynes-Inspired Great Depression; Lessons Not Learned

CoinWeek - 2012 American Eagle Palladium Bullion Coin Maybe in Jeopardy

VIDEO & Article (02:26) : The Street - Gold Prices Gain on Greek Debt, Middle East Tensions

MoneyWeek - Look what's happening to silver

MineWeb - Governments will support much higher gold prices, but beware windfall tax

01/23/12 - Bullion News

VIDEO : DAVID MORGAN - THE MORGAN REPORT & SILVER-INVESTOR.COM - CAMBRIDGE HOUSE LIVE

Casey Research - The Industrial Man's Gold

Wall St Cheat Sheet - Currency Wars Are Driving Gold and Silver Higher

MineWeb - In gold, inflation we trust - Sprott's CEO David Franklin argues

VIDEO (26:48) : YouTube - David Morgan Silver Vancouver Canada January 22 2012

Fast Markets - Gold extends multi-week highs on stronger euro ahead of key eurozone meeting

Rick Ackerman - Talk of Economic Recovery Not Rooted in Reality

Paper Money Collapse - Deceits and delusions – Some thoughts on the euro-crisis and democracy

VIDEO (06:36) : Reason TV - RANKING ECONOMIC FREEDOM WITH THE HERITAGE FOUNDATION'S JAMES ROBERTS

VIDEO (23:36) : YouTube - Future Money Trends; CURRENCY WARS! Exclusive Interview with James Rickards

Munknee - Debt-to-GDP Ratio of 10 Largest Economies

Arabian Money - $58-60 silver price by September says Dubai silver trader

Bullion Bulls Canada - Exposing Silver Mythology, Part I

Silver Seek - US mint better stocked to supply silver coins in 2012: refiner

01/22/12 - Bullion News

AUDIO : Korelin Economic Report - Weekend Show

VIDEO (05:40) : Mish's Blog - Irish Journalist Hounds ECB Official Regarding Irish Taxpayer Bailout of French and German Banks

Resource Investor - Using Vaults to Store Gold & Silver

VIDEO (05:14) : Market Watch - Inflation or Deflation? - Pimco's founder Bill Gross Explains

Spiegal - 'I Don't Believe the Euro Should be Rescued at All Costs'

01/21/12 - Bullion News

VIDEO (28:00) : YouTube - Capital Account - Interview with GoldSilver's Mike Maloney on Credit-Based Money, Feudalism, and Financial Enslavement

Munknee - These 5 Apocalyptic Engines Causing Hyperbolic Growth in US Money Supply

Money Morning - QE3, $2,200 Gold, and the Trillion Dollar Bazooka

Summary & VIDEO (03:24) : CoinWeek - Dealers; Coin & Bullion Market Predictions

ZeroHedge - Explaining Yesterday's Silver Surge

The Globe and Mail - Another theory for the gold run

Advisor Perspectives - A Long-Term Look at Inflation

01/20/12 - Bullion News

Wall St Cheat Sheet - Inflation Concerns Remain as Gold and Silver Climb Higher

VIDEO (25:46) : Max Keiser - Keiser Report: Scam On Epic Scale

Perth Mint Bullion - If It Sounds Too Good To Be True…

The Golden Truth - Got Silver? An Overlooked Factor that Will Affect Supply this Year

Daily Reckoning - How a Deficit in Capitalism Helped Engender the Financial Crisis by Bill Bonner

AUDIO (21:15) : FSN - Mish "Mish" Shedlock Explains Why We Have Deflation and Gold is Going Up

MineWeb - How realistic are the chances of a return to a gold standard?

Wealth Wire - The Real Risks to Gold Prices

Coin Update - Misused Numismatic Grades

VIDEO (08:14) : YouTube - Rich Dad / Poor Dad author Robert Kiyosaki talks about GOLD & SILVER

01/19/12 - Bullion News

ZeroHedge - "A Longer-Term Perspective On Gold" And More, From Nomura

Wyatt Research - The Man Who Jumped from a Skyscraper and Lived

Jim Sinclair's Mind Set - In The News Today

Ludwig von Mises Institute - How Deflationary Forces Will Be Turned into Inflation

Investment U - Investing in Silver Bullion Coins

VIDEO (10:04) : arabian money - Chartist; Hubert Moolman explains his forecasts for a possible explosive silver price rise coming within months

Casey Research - When Will Gold Reach a New High?

AUDIO (37:56) : FSN - Kerry Lutz Interview's G. Edward Griffin author of the book "The Creature From Jekyll Island" about the Federal Reserve

VIDEO (06:09) : YouTube - Max Keiser -- World is Witnessing Financial World War III. Gold Is Your Shield

The Huffington Post - Price Manipulation: Look for Motive

VIDEO (03:34) : YouTube - The Great Silver Market Myth!

01/18/12 - Bullion News

CNBC - Is Bullion Back? 'Gold Is Still In a Super Bull Market'

Commodity Online - Why silver is better than gold?

Wyatt Research - Plan For an Economic Meltdown

AUDIO (25:54) : FSN - John Butler is Predicting a Golden Revolution

SafeHaven - The Intrinsic Value of the Dollar and Gold

VIDEO (03:42) : Fox Business - The Grandich Letter’s Peter Grandich argues that gold will continue to rise based on lower value of global currencies

U.S. Global Investors - What the Next Decade Holds for Commodities by Frank Holmes

AUDIO (14:53) : MineWeb - Geoff Candy Interview's Thomson Reuters GFMS's Philip Newman

01/17/12 - Bullion News

AUDIO (23:33) : FSN - Peter Grandich Sees Where The Markets Are Headed And He’s Going For The Gold

AUDIO (10:08) : Jim Sinclair's MindSet - Ellis Martin Report With Jim Sinclair – QE3 and Hyperinflation

SafeHaven - A Short-lived Pause in the Silver Rally is More Than Likely

Gold Scents - HAS GOLD'S D-WAVE BOTTOMED?

ZeroHedge - $10 TRILLION Liquidity Injection Coming? Credit Suisse Hunkers Down Ahead Of The European Endgame

VIDEO (02:32) : YouTube - Capital Account - Word of the Day: LTRO

AUDIO(s) - Part(s) I-III : Silver Doctors - Interview with Golden Jackass's Jim Willie; Large Physical Gold Orders Are Clearing at $230 OVER Paper Markets

Mish's - Graphical Representations of Bernanke's Effort to Stimulate Bank Lending

Total Investor - An Even Better Deal than Gold

Wealth Daily - Gold Coins and Freedom

01/16/12 - Bullion News

Casey Research - When Will Silver Make a New High?

SafeHaven - Gold Trend Forecast for 1st Quarter of 2012

AUDIO (14:57) : YouTube - RedChip Interview with Silver Guru David Morgan

Seeking Alpha - All The Gold Bugs In China

Cypress Creek Mirror - BBB warns: Don’t rush to sell your gold

Coin Update - Would It Really Be So Bad If the US Dollar Failed?

01/15/12 - Bullion News

American Thinker - The Tale of the Swine

01/14/12 - Bullion News

CoinWeek - Considering a “Gold” IRA? – Choose Wisely

VIDEO (28:00) : YouTube - Capital Account - Pimco's Mohamed El-Erian tells us that he believes QE3 is coming and that the Age of Credit is at Risk

MSN Money - Ahead: Inflation and a gold rally

The Atlantic Wire - Federal Reserve Officials Look Extra Dumb in 2006 Transcripts

VIDEO (25:44) : Max Keiser - Keiser Report: Wall Street Gangsta!

Commodity Online - 'Six reasons why still to buy gold bullion or gold'

Casey Research - The US Government Is Bankrupt; A In-Depth Breakdown by Doug Casey

Coin Update - American Platinum Eagle Bullion Coins May Return in 2012

MoneyNews - Jim Rogers: US Govt to ‘Juice Up’ Economy in Election Year

IBTimes Gold - Gold Falls 1 pct on Euro Zone Downgrade Talk

VIDEO (12:18) : CNBC - Before the European Downgrades - Marc Faber's point of view

01/13/12 - Bullion News

Wealth Wire - Gold Bugs, Stop Laughing!

Perth Mint Bullion - Dollar Cost Averaging - A Strategy For Making The Most Out Of Fluctuating Gold Prices

VIDEO (27:53) : YouTube - Capital Account - Reggie Middleton on what the Economic Crisis has in Common with Education in America

Money Morning - Prepare Your Portfolio for Eurozone Money Printing

CHARTS : Kitco - Friday's Analytical Charts for Gold, Silver and Platinum and Palladium

Total Investor - “Please move into gold,” urges Richard Russell

ZeroHedge - Silver Guru Eric Sprott: "The Financial System Is A Farce"

Wealth Wire - China's Gold Imports Alarmingly High

01/12/12 - Bullion News

Jim Sinclair's MindSet - Gold Correction Is Over

Financial Sense - Deadly Dow 36,000 & The Secret History Of A 70% Market Loss

CNBC - US Fund's Frank Holmes on Gold and the Markets (link to video below)

Fast Markets - BULLION MORNING - Gold rises on safe-haven concerns ahead of ECB meeting, bond auctions

Reuters - Gold hits 1-month high, breaks ranks with euro

VIDEO (03:47) : CoinWeek - Gold expert and writer Patrick Heller shares his perspectives on Gold

Article & VIDEO (05:45) - Central Banks 'Printing Money Like Gangbusters': Gross

arabian money - Cracks are already showing in global financial markets

01/11/12 - Bullion News

CoinNews - US Mint Sales: Numismatic Products Cool as Bullion Coins Take Limelight

VIDEO (01:24) : CNBC - Rick Santelli: 'Nero is Fiddling and Fiddling and Fiddling'

CHARTS : Kitco - Wednesday's Analytical Charts for Gold, Silver and Platinum and Palladium

AUDIO (20:12) : MineWeb - Copper demand, Chinese growth and the platinum:gold ratio

IBTimes Gold - India's Central Bank OKs More Banks to Import Gold

The Street - Gold Prices Gain on China's Buying Binge

MoneyNews - Fitch: Europe Must Do More to Prevent 'Cataclysmic' Euro Collapse

PDF : US Funds - The Periodic Table of Commodity Returns

01/10/12 - Bullion News

The Source (WSJ) - Gold Tipped to Keep on Shining

Whiskey and GunPowder - Why Federal Deficits May Not Be the Ones That Matter Most to You

David Morgan's Blog - Gold, Silver Buying Service Newest Voluntary Benefit

Bullion Bulls Canada - Gold/Silver Price Ratio Getting Silly Again

ZeroHedge - A Glimpse into Hyperinflation as it Comes To Iran

SafeHaven - The Dollar's Lucky Streak by Peter Schiff

AUDIO (08:47) : YouTube - Ellis Martin Report with Jim Sinclair: A Big Surprise is Coming

Miles Franklin - Again, gold is money. Not an investment.

Real Clear Politics - Kodak and the Post Office by Thomas Sowell

Perth Mint Bullion - Reasons For Gold’s Weakness

Market Watch - 'Vital' that Fed use all its tools, San Francisco Fed President says

VIDEO (03:50) : ArabianMoney visits Sharjah Gold Souk to discuss gold and silver prices

Numismaster - Expect to Find Damage to Coins Used for Jewelry

01/09/12 - Bullion News

Investment Rarities - THE THREE ELEMENTS OF MANIPULATION by Ted Butler

The Gold Report - Copper Reflects World Economy

Silver Doctors - Is Silver Making a Head & Shoulders Top, or A Massive Flag Formation?

CHARTS : Kitco - Monday's Analytical Charts for Gold, Silver and Platinum and Palladium

SafeHaven - Why the Wealthy Own Gold

INFO-GRAPHIC : Numbersleuth - All The World's GOLD

VIDEO (04:38) : The Market Oracle - Warning Fake High Quality Gold, Silver Coins and Ingots

MineWeb - Forecasts for gold still very positive for 2012, but volatility seen too

Summary & VIDEO (05:01) : CMI Gold & Silver - The Fed continues to secretly bail out Europe

Forbes - Why Gold is the Only Real Asset

Daily Wealth - The Top Piece of Advice from a 30-Year Precious Metals Veteran

CoinNews - US Bullion Coins Robust in 2012 Start

Minyanville - Precious Metals Parabola Likely to Begin Later This Year

01/08/12 - Bullion News

arabian money - For how long will Cash be King?

Whiskey and GunPowder - The Monetary Metal That Won’t Die

CoinWeek - Silver's Volatility Makes it's Future price is Hard to Predict

Wyatt Research - The Final Stage of the Commodity Bull Market

Wealth Daily - The Gold/Platinum Ratio

Gold-Eagle - Silver Confirms The Bullish Outlook For Precious Metals

Gold Made Simple News - There have been 3 great gold buying opportunities in the past 3 years… is/was that the 4th?

MINING - Are investors getting physical with gold and silver?

01/07/12 - Bullion News

VIDEO (25:45) : Max Keiser - The Keiser Report plus Max Keiser Interviews Silver Guru - David Morgan

Paper Money Collapse - “When they stop buying bonds, the game is over.” by Detlev Schlichter

Casey Research - Was 2011 a Dud or a Springboard for Gold?

VIDEO (07:52) : YouTube - Capital Account; James Turk, "We could easily go over $2000 per ounce" for gold in 2012

01/06/12 - Bullion News

IBTimes – Palladium Likely to Outperform PGM in 2012

AUDIO (34:31) : Corporate Interviews – A Few Minutes with Peter Grandich

ZeroHedge – Physical Silver Surges To Record 30% Premium Over Spot, In Backwardation

SilverSeek – Silver Value Investing With A Financial System Off the Rails

Bullion Street – US Mint silver eagle coins sale get early 2012 boost

01/05/12 - Bullion News

Inside Futures – Precious Metals Ready to Soar

CNBC – Fed Will Be Forced to Ease Again Soon: Morgan Stanley

Casey Research – Why Has Gold Been Down?

VIDEO (03:40) : CoinWeek – The Psychology of Gold

Mish's – Hungary Marches Down Hyperinflation Path; What About the US?

Smart Money – Gold Vs. Platinum: How to Play Heavy Metals

Money Morning – Special Report: How to Buy Silver

The Silver Institute – Silver’s Average Annual Price for 2011 a Record High

01/04/12 - Bullion News

Silver Doctors - Official Mint Silver Sales Surpass Domestic Silver Production in US & Canada in 2011

VIDEO (28:04) : YouTube - Capital Account - Interview with James Turk on Fat Tails, LTRO and Banking on Gold Money

Money Morning - Gold Price Conspiracy: What Uncle Sam Doesn’t Want You To Know

ZeroHedge - Gold Jumps As Citi Says Gold Sell Off Over, Reiterates $2400 Target

Seeking Alpha - Silver Over $50 Coming Sooner Than You Think

VIDEO (05:41) : BNN - What to Expect from the Gold & Silver Markets in 2012

Perth Mint Bullion - Gold The Most Explored Mineral Commodity

CoinNews - 2012 American Gold Eagle and Silver Eagle Bullion Coins Released, Sales Robust

ABC News (Australia) - Top 10 charts of 2011

01/03/12 - Bullion News

Coin Update - US Mint Bullion Sales: New Record for American Silver Eagles

Ludwig von Mises Institute - The Austrian Theory of Money

AUDIO (17:59) : FSN - Interview with Bill Murphy of the Gold Anti-Trust Action

Jesse's Cafe Americain - Gold Daily and Silver Weekly Charts - Big Relief Rally From the End of Year Mark-To-Market Boogie Woogie

The Street - Jim Cramer believes gold is a currency not a commodity and it is going to see it's old High's

ZeroHedge - US Closes 2011 With Record $15.22 Trillion In Debt, Officially At 100.3% Debt/GDP, $14 Billion From Breaching Debt Ceiling

Acting Man - Keynes Was Not Right

Pragmatic Capitalism - HEDGEFUND - BRIDGEWATER: CAUTIOUS ON 2012

Global Investments - The Possibility of $1,000 Silver before Hyperinflation

Business Insider - There's A BOMBSHELL Story Out Of Greece Today, And Nobody Seems To Care

Perth Mint Bullion - Australian Koala Silver Bullion Coins Released Today

CHARTS : Kitco - Tuesday's Analytical Charts for Gold, Silver, Platinum and Palladium

Commodity Online - Who holds the world's biggest gold reserves?

MineWeb - Dr. Copper heading back to school

01/02/12 - Bullion News

Coin Update - United States Mint 2011 Financial Results

SafeHaven - It Ain't Over 'Til It's Over

Calculated Risk - Europe Update

Market Watch - Gold bugs’ unmerry Christmas

The Globe and Mail - What the pros say is in store for markets

For Bullion Market News....

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage

Click Ad to Request a Free Appraisal Kit

ExpressGoldCash

Customer Reviews 4.9 stars

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)