ExpressGoldCash - 4.9 star - Customer Reviews

Hitting Resistance

Precious Metals Review & Outlook

03/18/2017 thru 04/14/2017

Originally Posted on 04/09/2017 @7:06pm

Subscribe to this Weekly Blog post

Hello,

Thank you for visiting the Free-Bullion-Investment-Guide's latest blog post, I hope that you and your family had a great week.

Before we get to this week's post; here are a few of Last Week's Best News Articles that were taken from this guide's homepage.

DiMartino Booth - Is the Fed’s Balance Sheet Headed for the Crapper?

Reuters - Global debt hits $215 trillion in 2016, led by emerging markets: IIF

INFOGRAPHIC : Visual Capitalist - The Buying Power of the U.S. Dollar Over the Last Century

Perth Mint - Iconic swan makes rare appearance on spectacular Australian bullion coin

OPINION : Market Watch - The Smart Money is Record ‘Short’ in Stocks, and the Dumb Money is Record ‘Long’

GoldReporter.de - Gold reserves: China does not report any gold purchases again - google translation link

Best of the Week for Gold NanoParticle Cancer Research

GOLD NANOTECHNOLOGY : CANCER RESEARCH : PHYS.ORG - Researchers Develop a Lab-Scale Prototype for the Treatment of Skin Tumors

GOLD NANOTECHNOLOGY : PHYS.ORG - Using Nano-Particles to Detect Deadly Viruses

Hitting Resistance

For the last two weeks, gold and silver have hit resistance as they've moved up in trading.

Silver’s resistance levels are at $18.30 and $18.50, while gold’s are at the $1250 and $1270.

Last week, they both were able to breach their first levels of resistance, but they were not able to break above the latter two resistance levels.

The precious metals charts below are showing that this week will most likely be a week of consolidation and profit taking.

However, fundamentally we still have the French Elections coming up on April 23rd which should continue to support the prices of silver and gold.

Also, Janet Yellen, the Federal Reserve Chairman made a surprise announcement that on the 10th of April she will be making a speech and taking questions.

This may have something to do with the Resignation of Jeffrey Lacker or it may not, either way, whatever she says about the future of interest rate hikes, could be either positive or negative for the precious metals.

Furthermore, fundamentals trump (no pun intended) technical analysis so depending on what Yellen states in her speech, it could change the direction of the market in an instant.

But, barring anything out of the ordinary, this week's charts are showing us that a new negative pattern will reverse the prices of the precious metals in the short-term future, while their long-term direction is still positive.

SILVER

Three weeks ago, I posted the chart below for silver, in it, you could see the Old Falling Expanding Wedge and a New Falling Expanding Wedge (bullish patterns) in the chart.

Over the last two weeks, the New Falling Expanding Wedge pattern has been playing itself out as expected.

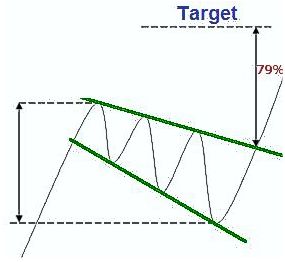

Note: Click the chart (to the right) of a 'Falling Expanding Wedge' for Forex-Central's definition of the technical pattern.

Now that silver has finished playing out the Falling Expanding Wedge pattern, a new Rising Expanding Wedge (bear pattern) has formed.

In addition, the MACD and RSI, lower indicators, are showing that silver is hitting resistance.

But, even though a pullback is expected, silver is also expected to continue to trade inside its ascending channel.

Note: Click the chart (to the right) of a 'Falling Expanding Wedge' for Forex-Central's definition of the technical pattern.

Silver's Price Resistance &

Support Levels

Silver's Resistance Levels

$18.75

$18.50

$18.30

Silver's Support Levels

$18.00

$17.70

$17.25

GOLD

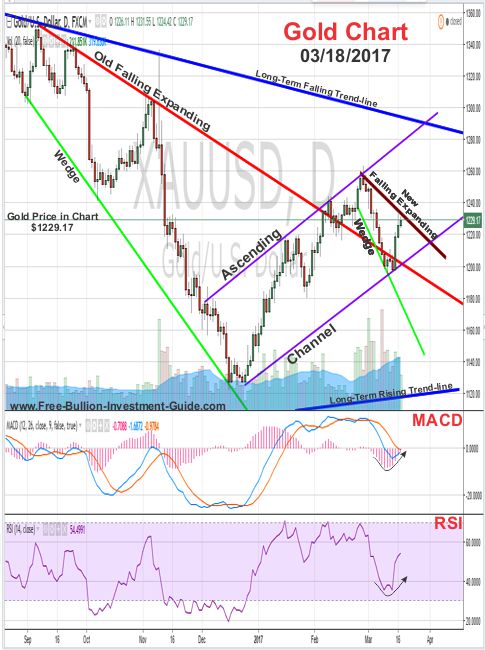

Gold’s chart patterns may look familiar….

Three weeks ago, I posted the following chart for gold, and like silver's chart, it too showed an Old Falling Expanding Wedge and a New Falling Expanding Wedge (bull patterns).

(continued...)

Charts provided courtesy of TradingView.com

Over the last two weeks, the New Falling Expanding Wedge pattern has been playing itself out, and now that the pattern has been fulfilled, a New Rising Expanding Wedge (bear pattern) has formed in gold's chart.

(continued...)

But, gold's bottom indicators aren't showing the reversal in the trading pattern like silver's indicators are, which may be an indication that gold is taking back the lead in their short-term trading patterns.

Gold and silver’s trading pattern have been discussed in these blog posts: Gold leads Silver, Gold still leads Silver, and

The Freak is Back on the Leash.

However, the New Expanding Falling Wedge is looming over Gold's price, so like silver more consolidation in price is expected.

In conclusion, for gold, although a consolidation or pullback is expected, gold, like silver it is expected to continue to trade inside the rising ascending channel.

Gold's Price Resistance and

Support Levels

Gold's Resistance Levels

$1300.00

$1270.00

Gold's Support Levels

$1250.00

$1225.00

$1215.00

US DOLLAR

Three weeks ago, I posted the Dollar chart below; in it, I stated the following, after I pointed out the Rising Wedge pattern on the US dollar chart:

'The other negative pattern that is showing up in the US Dollar chart is a Head and Shoulders pattern.

If the price of the US Dollar passes below the Neck-line on the chart, the Head and Shoulders pattern will be fulfilled. Time will tell.'

Unfortunately, time has shown "it isn't happening."

(continued...)

The US Dollar did not move below the 'neck-line', it briefly touched it then reversed its price direction.

But, the dollar is still trading inside the Rising Falling Wedge (bear pattern) and is still trading in a negative direction with lower lows and lower highs.

As long as Janet Yellen doesn't announce anything new tomorrow in relationship to interest rates, the dollar should see resistance at the $101.40 level.

Something to keep your eye on....

Tomorrow, Janet Yellen will give a speech, if the speech is more about policy than Jeffrey Lacker (which I doubt), then we may see silver, gold and the US Dollar make some strong moves.

U.S. Dollar's Price Resistance and Support Levels

U.S. Dollar's Resistance Levels

$102.10

$101.75

$101.40

U.S. Dollar's Support Levels

$101.00

$100.00

$99.75

Platinum

The last two weeks, platinum has moved up its ascending channel, it has tested the bottom trend-line of the channel twice and continues to trade above it.

This week, platinum’s chart isn’t giving much of an

indication as to which direction it will move, but it looks like it may test the bottom of the ascending channel once again.

Platinum's Price Resistance and Support Levels

Platinum's Resistance Levels

$1000.00

$980.00

$960.00

Platinum's Support Levels

$935.00

$905.00

$890.00

Palladium

Since the beginning of 2016, Palladium’s price has been trading inside an ascending channel.

This week, palladium price has formed a rising wedge (bear pattern) and either this week or next it will hit resistance between its current price of 801.50 and $835 and reverse in price.

Note:

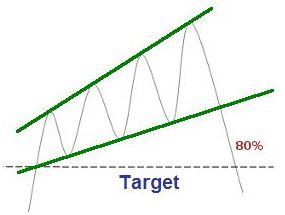

Click the chart above for Forex-Central's definition of the Rising Expanding Wedge or 'Ascending Broadening Wedge.'

Palladium's Price Resistance and Support Levels

Palladium's Resistance Levels

$835.00

$820.00

Palladium's Support Levels

$785.00

$770.00

Have a Great Week.

Thank you for your time & God Bless,

Steve

'Click Here' see all of the prior Blog posts,

Thank You for Your Time!

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage