Negative Patterns are Looming Over the Precious Metals

in their short-term trade

Precious Metals Review and Outlook from

8/14 thru 8/25/2017

Originally Posted on 08/21/2017 @ 4:25 pm

by Steven Warrenfeltz

Subscribe to this Blog

Hello,

Thank you for visiting the Free-Bullion-Investment-Guide's latest blog post. Before we get to this week's post, below are some of the Best News articles that were posted last week on this guide's homepage.

PDF : 2nd Quarter of 2017 Report on HouseHold Debt and Credit - The Federal Reserve of New York

Gold Was Chemically Destined to Be Money All Along - U.S. Global Investors

VIDEO : The Gold Standard : There’s not Enough Gold? Nonsense! - The Tenth Amendment Center

Final design choices for the 2018 America the Beautiful quarters - Mint News Blog

VIDEO : BullionStar Presentation on Real Vision TV – Bullion Banking, ETFs & Physical Gold - Bullion Star

Best of the Week for Gold NanoParticle Cancer Research

08/17: GOLD NANOPARTICLE ~ CANCER RESEARCH : Gold nanostars and immunotherapy vaccinate mice against cancer - The new approach relies on a "photothermal immunotherapy" technology developed by an interdisciplinary group of Duke researchers that uses lasers and gold nanostars to heat up and destroy tumors in combination with an immunotherapeutic drug. - PHYS.ORGGOLD NANOPARTICLE ~ CANCER RESEARCH : Gold Nanoparticles Increase Efficacy of Lung Cancer Treatments - Specialty Pharmacy Times

'Question Mark' graphic courtesy of Pixabay.com

Last week’s outlook and review dealt with the fact that nobody really knew how gold and silver were going to move in their short-term trade.

Fundamentally, due to the heightened military tensions between the United States and North Korea, the precious metals had the potential to move a lot higher.

But, the technical patterns in gold and silver’s charts showed a different outlook for last week.

They showed that a pull back should happen and after North Korea backed down from their threats, gold and silver did just that, their prices pulled back confirming the technical patterns that were indicated this in last week’s post.

Gold and Silver did recover from their price drop shortly after the Federal Reserve released their minutes from their last meeting, the minutes revealed that the members of the FOMC are confused and perplexed.

The Fed says they want to start reducing their balance sheet of 4 Trillion in assets, but low inflation and other economic indicators are showing an unfavorable climate for such an act, the minutes made it sound like the meeting was filled with several of the FOMC members shrugging their shoulders.

Therefore fundamentally, between the uncertainty with North Korea and the market guessing what the Federal Reserve will do at their next meeting (9/19-9/20), we’ll most likely be seeing gold and silver see-saw in price.

But technically, negative patterns are looming over the precious metals prices in their short-term trade.

This weeks review and outlook include Gold, Silver, US Dollar, Platinum, Palladium, and GDX.

GOLD

In Review

Below is last week's outlook for gold.

As you can see in the chart below, everything that was posted two weeks ago is still playing itself out.

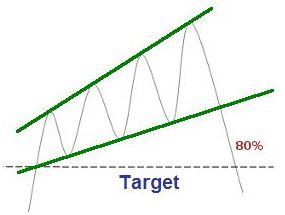

Gold is still trading inside the 'Rising Expanding Wedge' and it is now trading inside the resistance zone between $1280-$1300, but it has also formed another negative 'Rising Expanding Wedge' pattern.

So, if fundamentals change, meaning that if tensions between the United States and North Korea ease, then you can expect gold’s price to be correcting sometime in the near future.

In Review - continued

As you can see in the chart below, last week gold's price did pull back confirming the new 'Rising Expanding Wedge' that had formed inside the larger wedge.

Gold - This Week's Outlook

For the week to come, gold is still trading inside the larger 'Rising Expanding Wedge' that formed in its price chart over a month ago.

This means that although the price has continued to move up, the negative pattern is still looming over it and will continue to do so until it is either confirmed or denied.

Charts provided courtesy of TradingView.com

Gold's Price Resistance and

Support Levels

Gold's Resistance Levels

$1300.00

$1290.00

Gold's Support Levels

$1260.00

$1240.00

SILVER

In Review

Below is the silver commentary and chart from last week.

Now that silver has confirmed the 'Rising Expanding Wedge' from two weeks ago, it has now created a new one.

In the chart below, you can see that the new Rising Expanding Wedge is still mostly moving upwards, the MACD and RSI are giving mixed messages.

The MACD says 'silver may have more room to move up,' while the RSI is saying 'things may change sooner than you think.'

But, actuality says 'Fundamentals currently hold all the cards' so it matters if the tensions between North Korea and the United States increase or decrease.

So, if tensions decrease, the rise in the price of silver will subside and technical patterns are showing us to expect a pullback.

In Review - continued

In the silver chart below, you can see that on Tuesday of last week silver closed the day below the 'Rising Expanding Wedge' confirming it, then it bounced back but fell below it again on Friday.

Technically once a pattern is confirmed, it doesn't need to be confirmed again.

Silver - This Week's Outlook

For the week to come, silver's price chart has formed a 'Rising Wedge' another negative pattern.

The wedge looks like silver may still find some space to trade inside it, but Silver's RSI looks like it's going to be changing directions, time will tell how or when this pattern will be confirmed or denied.

charts provided courtesy of TradingView.com

Silver's Price Resistance &

Support Levels

Silver's Resistance Levels

$17.75

$17.20

Silver's Support Levels

$16.50

$16.10

US DOLLAR

In Review

Below is the U.S. Dollar's commentary and chart from last week.

In the chart below, we can see that the U.S. Dollar is basically trading sideways inside the Falling Expanding Wedge.

But it is still expected to confirm the pattern, so sometime in the near future, we should see the dollar rise breaking the upper trend-line of the 'Falling Expanding Wedge, confirm it.

In Review - continued

As you can see in the chart above, the U.S. Dollar still hasn't broken the upper trend-line of the 'Falling Expanding Wedge' but it is expected to do so sometime in the future.

U.S. Dollar - This Week's Outlook

There isn't much to say about the dollar's movement for the short-term except that it looks like we can expect more of the same as it moves sideways, closer towards the upper trend-line of the positive wedge.

Charts provided courtesy of TradingView.com

U.S. Dollar's Price Resistance and Support Levels

U.S. Dollar's Resistance Levels

$95.00

$94.50

U.S. Dollar's Support Levels

$92.70

$92.00

Platinum

It's been since late July that I've posted anything for Platinum.

This week, like gold, platinum has formed a negative 'Rising Expanding Wedge.'

So, for the week to come, platinum's MACD and RSI are both giving the indication that the price could be about to roll over, time will tell.

Charts provided courtesy of TradingView.com

Platinum's Price Resistance and Support Levels

Platinum's Resistance Levels

$1000.00

$985.00

Platinum's Support Levels

$960.00

$940.00

Palladium

Like platinum, it's been since late July since I've posted any charts for palladium.

Palladium is still rising inside a nearly two-year old 'Ascending Channel' and it has been generally trading up over the last 3weeks.

This could easily continue, however, it has formed a 'Rising Expanding Wedge' just like the other precious metals and sometime in its future, it is expected to fall below the bottom of the wedge.

Although palladium overall price direction is expected to be positive as long as it trades inside the 'Ascending Channel.'

Here's another view of Palladium's price chart

Charts provided courtesy of TradingView.com

Palladium's Price Resistance and Support Levels

Palladium's Resistance Levels

$940.00

Palladium's Support Levels

$895.00

GDX - Gold Miners ETF

Lastly, I wanted to update you on last week's GDX chart.

Last week, I posted that I did not agree with the same chart analysis of the GDX - Gold Miners ETF as that Morris Hubbartt posted in his article on 321gold 'seen here'.

Below is what I wrote and the charts that I posted, all of last week's comments are in 'blue,' under last week's 'Stock Chart.com chart is this week's update.

Once in a while, I review other technical analyst's technical analysis, but whether or not I agree or disagree, I rarely post contradictions.

This weekend I was reading this post 'here' on 321gold.com and when I came to the GDX chart in the article, I looked at my chart and found some differences.

This link will take you to the GDX chart in the post 'here.'

Below, is an updated view of the my chart above.

(continued...)

Trading View GDX Chart

After I looked over the chart in the article again, I wanted to be completely fair, the author of the post used StockCharts.com's charts (not TradingView.com) and the chart is dated from mid-December 2016 - August 13, 2017, below is a StockCharts.com comparison.

I'm posting this update to show you that from my experience, the GDX hasn't broken the 'Falling Wedge' yet, although because of the nature of the falling wedge, it is expected to do so sometime in the future.

So lastly, we'll see what the price of the GDX does this week, and I'll update you next week on what happens.

Stock Charts GDX Chart

GDX - Update

As you may have guessed, last week I kept a close eye on the GDX chart to see what it would do.

The GDX has never closed a day of trading above the upper trend-line of the 'Falling Wedge' and in my experience that is the only time you can confirm or deny a technical pattern.

I did not check to see what Morris Hubbartt posted this week, but according to my charts, the GDX price has not confirmed nor denied the 'Falling Wedge' yet, but I'll update you when it does.

Until that time comes, you can expect the GDX to continue to trade inside the 'Falling Wedge.'

Charts provided courtesy of TradingView.com

Thank You for Your Time.

Have a Great Week.

God Bless, Steve

'Click Here' see all of the prior Blog posts,

Thank You for Your Time!

Investment/Information Disclaimer:

All content provided by the Free-Bullion-Investment-Guide.com is for informational purposes only. The comments on this blog should not be construed in any manner whatsoever as recommendations to buy or sell any asset(s) or any other financial instrument at any time. The Free-Bullion-Investment-Guide.com is not liable for any losses, injuries, or damages from the display or use of this information. These terms and conditions of use are subject to change at anytime and without notice.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage