Homepage / Archived News or Quarterly News / 4th Quarter 2013

4th Quarter - 2013

Charts, Bullion News & Commentary

When investing in any market, a good way to judge price movement in the future is to learn from the past.

Benjamin Graham, author of "The Intelligent Investor" and recognized as the "Father of Investing," famously observed, "The individual investor should act consistently as an investor and not as a speculator."

The charts and news on this page help you to be an informed "Investor" and not a "Speculator."

For each of the precious metals, you'll find charts. Below the charts, you will find Bullion News Headlines from the 4th Quarter of 2013. Every news link was originally posted on this guide's homepage.

The quarterly charts provide insight into the volatile precious metals markets, while the news below the charts provides a deeper understanding of the fundamentals influencing these markets.

The charts below are provided courtesy of

Gold Price Chart - 4th qtr. 2013

Gold Price Chart (Jan. 1st, 2011 - Dec. 31st, 2013)

Bullion News

Gold Price Summary

The 4th quarter of 2013 was not a good quarter for those investors wanting higher prices in the precious metals markets.

The price of the precious metals started to move lower in November when the MACD (lower indicator) started to indicate negative momentum.

Throughout the entire quarter, Gold's price was mostly finding new lows; it was capped on the last day of trading for the quarter, New Year's Day, when the price dropped to $1178 and closed the day at $1206.

However, both the MACD (lower indicator) and the RSI (upper indicator) showed signs of market momentum at the end of the quarter.

Gold Price Chart (Oct. 1st, 2013 - Dec. 31st, 2013)

Bullion News

Gold Price Chart (Oct. 1st, 2012 - Dec. 31st, 2013)

Bullion News

Silver Price Chart - 4th qtr. 2013

Silver Price Chart (Jan. 1st, 2011 - Dec. 31st, 2013)

Bullion News

Silver Price Summary

In the 4th quarter of 2013, the price of silver moved down, trading along a descending trend line.

On the last day of trading, 12/31/2013, the price of silver dropped to a multi-year low of 18.49 and closed the day at 19.46 a troy ounce; however, silver's RSI and MACD were both showing positive signs for the next quarter.

Silver Price Chart (Oct. 1st, 2013 - Dec. 31st, 2013)

Bullion News

Silver Price Chart (Oct. 1st, 2012 - Dec. 31st, 2013)

Bullion News

Platinum Price Chart - 4th qtr. 2013

Platinum Price Chart (Jan. 1st, 2011 - Dec. 31st, 2013)

Bullion News

Platinum Price Summary

Platinum, like silver and gold, followed a descending trend-line throughout the 4th quarter of 2013.

However, Platinum's price started to move back up late in the quarter.

Platinum Price Chart (Oct. 1st, 2013 - Dec. 31st, 2013)

Bullion News

Platinum Price Chart (Oct. 1st, 2012 - Dec. 31st, 2013)

Bullion News

Palladium Price - 4th qtr. 2013

Palladium Price Chart (Jan. 1st, 2011 - Dec. 31st, 2013)

Bullion News

Palladium Price Summary

Palladium's price chart has been the only chart of all the precious metals that has been kinda fun to watch.

Palladium's price is essentially being squeezed during the quarter, as you can see in the 3-year+ chart above and the 1-year+ chart (below the quarterly chart).

By looking at the charts, you'll notice that a pennant is forming and that there is more upside support for Palladium than negative resistance, which are good signs for the price of palladium.

In addition, the RSI (upper indicator) and the MACD (lower indicator) are starting to move up late in the quarter, which indicates the squeeze will move the price higher.

Palladium Price Chart (Oct. 1st, 2013 - Dec. 31st, 2013)

Bullion News

Palladium Price Chart (Oct. 1st, 2012 - Dec. 31st, 2013)

The charts above are provided courtesy of

4th Quarter - 2013

Bullion News & Commentary

The Quarterly News starts with the end of the quarter articles, first.

Please note that not all of the links below work; the links are kept because the headlines still provide insight into how the markets were moving at the time.

12/31/13 - Bullion News

MineWeb - Bullion banks forcing hedging to replenish their gold stocks?

Business Standard (India) - Rising demand for platinum jewellery

CoinNews - Public Tour Photos of US Mint at Denver, Colorado

12/30/13 - Bullion News

TECHNICAL ANALYSIS : Trader Dan's Market Views - Gold Down below $1200

CoinWeek - Three Silver Coins That Moved the Meter in 2013

CoinWeek - Three Silver Coins That Moved the Meter in 2013

Numismaster - High Demand, Higher Price

The Daily Bell - Price of Gold Part of a Larger 'Party' Pattern?

In Gold We Trust - China Accumulates Gold For The “World Dream”

Gold-Eagle - Gold And The 120-Year Cycle Bottom

Bullion Vault - Robbing the Poor by Ron Paul

12/29/13 - Bullion News

SilverSeek - Silver poised for a surge – come on, any minute now

The Hindu - Gold traders opt for jewellery imports to tackle curbs on bullion

MINING - Germany repatriated 37 tons of gold in 2013

Independent - Hunt for stolen crown jewels failed to solve great mystery

12/28/13 - Bullion News

FGMR - The Money Bubble

Kitco - What Will Drive U.S. Treasury yields In 2014? Two words: The Fed

SPECIAL REPORT : Market Watch - Mile Wide, Inch Deep - Bond Market Liquidity is Dries Up

CHART : King One Eye - Updated: Gold, the US Dollar, and the See-Saw of Pain

TECHNICAL ANALYSIS : Kimble Charting - Bullish “Doji Star” bottoming pattern taking place in Silver?

Got Gold Report - Smugglers smile as NRI carriers bring gold into country legally

In Gold We Trust - More On The West To East Gold Exodus

Turkish Weekly - Gold at center of corruption, money laundering allegations hitting Turkish gov't

Azomining - LBMA Lists OPM Metals on Good Delivery List for Gold

12/27/13 - Bullion News

The Gold Report - Leading Indicators from the Superstars of Resource Investing

Got Gold Report - Bah, Goldbug!

Investor Intel - David Morgan forecasts a good but not a great year in 2014

CoinWeek - 900 Billion Reasons to Remain Bullish on Gold and Silver

In Gold We Trust - Smuggling Gold Into The Mainland

Bonner & Partners - Hold onto Your Gold!

Energy & Capital - The Best Silver Coins for Investors

12/26/13 - Bullion News

CFA Institute - The Strategic Case for Gold as an Investment

U.S. Global Investors - The Top Gold Stories in 2013

TECHNICAL ANALYSIS : Market Anthropology - Silver Rattles

TECHNICAL ANALYSIS : Active Trading Partners - Bear Market Cycle Bottom Forming in Gold and Gold Stocks Right Now!

VIDEO : Bloomberg - Too Many Bears in the Woods for Gold

CHARTS : Zero Hedge - What Could Go Wrong Here?

TheGoldandOilGuy - The Stock Market Holiday Bulge – Prepare for Selling

The New York Times - Krugman a Relic of Keynes

VIDEO : CNBC - Santelli Exchange: The velocity of money

TECHNICAL ANALYSIS : Nifty Charts - SILVER Ascending triangle

VIDEO : Silver-Investor - We are UNDER the cost of PRODUCTION (Silver Talk with David Morgan)

Plata - Scarcity of Gold in Mexico by Hugo Salinas Price

Zero Hedge - What Chinese Consumers Are Rushing To Buy This Christmas

China Daily - China world's largest country for gold trading

CSInvesting - Hey, Joe!

AUDIO : McAlvany Weekly Commentary - Richard Duncan: QE Replaces Growth, For Now

12/24/13 - Bullion News

MERRY CHRISTMAS!

VIDEO : Next Big Trade - You Can’t Even Make This Up

SafeHaven - Queen Gold Changes Horses In 2014

Greedometer - Margin Debt: yet another new all-time high

Gold Chat - The difficulty of proving manipulation

Zero Hedge - Almost Every Passenger On A Flight From Dubai To India Was Found Carrying 1 Kilo Of Gold

VIDEO : GoldSilver - Will USA Default Or Inflate? Mike Maloney

Sober Look - The unintended consequences of Abenomics

12/23/13 - Bullion News

Money and Markets - The Two Most Important Questions About Gold Today

Gold-Eagle - J.P. Morgan Sees Golden Opportunities for Huge Gains in 2014 With Gold and Silver

VIDEO : Kitco - Technical Analysis : Gary Wagner: Looks at Gold in the New Year, Part 2

VIDEO : WealthTrack - Consuelo Mack Inteviews James Grant & Richard Sylla : THE GREAT FED DEBATE!

Outsider Club - A Fed-Sponsored Currency Collapse - There's No Such Thing As "Good Money"

Profit Confidential - Small Pullback in Money Printing = Big Spike in Interest Rates?

Zero Hedge - On The 100th Anniversary Of The Federal Reserve Here Are 100 Reasons To Shut It Down Forever

International Man - Jim Rogers On "Buying Panic" And Investments Nobody Is Talking About

Deviant Investor - Christmas Wishes

VIDEO : Bloomberg - Best of 2013: Inside an Underground Swiss Vault

12/22/13 - Bullion News

Wall Street Parade - PBS Drops a Bombshell on the Federal Reserve’s 100th Birthday Party

PDF : Wizzen Trading - Technical Analysis : Bear Flags By The Book

My Budget 360 - Comparing the inflated cost of living today from 1938 to 2013: How the US Dollar has lost incredible purchasing power since 1938

VIDEO : USA Watchdog - Eric Sprott: 2014 Sends Gold North of $2,000 and Silver Over $50

Bloomberg - Shanghai Gold Exchange Contract Volume Surges on Price Slump

ZeeNews (India) - Commerce Ministry for easing of gold import norms for exporters

AUDIO : Chris Martenson - David Collum: Broken Markets, State Capitalism & Eroding Liberty

Zero Hedge - The Annotated (223 Year) History Of The US Bond 'Bubble'

12/21/13 - Bullion News

Money and Markets - 7 Fundamental Conclusions about 2014

VIDEO : Boom Bust (RT) - David Collum's Year in Review and a Fed Fueled Demise

Cyniconomics - 3 Leftovers from Wednesday’s FOMC Meeting

AUDIO : Sprott Money - Rick Rule on FED's Decision to Taper

TECHNICAL ANALYSIS : Gold Made Simple - Gold price retest July lows and breaks its seven month trading range to the downside

Bonner and Partners - A Vicious Collapse in Gold?

AUDIO : FSN - John Rubino – The Money Melt Down

The Sovereign Investor - Dollar Bears Love Silver Coins

MineWeb - Even more smuggled gold enters India

First Post - China trading volumes climb as global bullion prices drop

CMI Gold and Silver - Gold is money but what about Bitcoin?

12/20/13 - Bullion News

Peak Prosperity - 2013 Year in Review (Part 1) - Austerity is not a policy by by David Collum

Peak Prosperity - 2013 Year in Review (Part 2) - Broken markets, too much debt, and less & less liberty by by David Collum

Inside Futures - Where Are Gold & Silver Headed

TECHNICAL ANALYSIS : Sunshine Profits - Will Precious Metals Drop Any Further?

The Daily Bell - Fed's 'Elixir' Is Surely a Temporary One

Zero Hedge - The Illustrated Guide To 4 Years Of Currency Wars

Silver-Coin-Investor - Spinning Straw into Silver and Gold

TECHNICAL ANALYSIS : Market Anthropology - BarKeeper's Friend

GoldSeek - What a bubble looks like (and why gold's price action wasn't bubble-like)

Profit Confidential - Share Buybacks Reach Highest Level Since 2007

12/19/13 - Bullion News

Bloomberg - How to Keep Banks from Rigging Gold Prices

VIDEO : CNBC - RBC's Gero: Why gold will rise in 2014

GoldBroker - Interview with Jesse on COMEX/LBMA Manipulation, Default Event and the Long Correction in Precious Metals

CHARTS : Pragmatic Capitalism - A QE and Stock Market Thought Experiment

VIDEO : Bloomberg - Fed Action a 'Non-Taper Taper': Jim Grant

Zero Hedge - What Happened The Last Time A Major Central Bank "Tapered" QE?

Sprott Asset Mgmt. - Inform Act

AUDIO : Bullion Vault - Gold Portfolio Allocation

Gold Chat - India planning gold confiscation and gold market interventions?

VIDEO : Sufiy - Bloomberg: London Gold Vaults Are Virtually Empty

12/18/13 - Bullion News

Plata - When Reality Overthrows Imagination by Hugo Salinas Price

Dollar Collapse - The Private Sector Is Borrowing Again – And That’s Not Good

Gold-Eagle - Gold: Money Velocity Takes Centre Stage

MineWeb - Bullion Vault's Adrian Ash discusses the gold market's big themes of 2013 and looks ahead to 2014

Trader Dan's Market Views - FOMC - Taper Arrives - Finally!

Gold Chat - Implications of ETF redemption in physical gold coins

AUDIO : McAlvany Weekly Commentary - China, the Cure for Lower Gold Prices

Sunshine Profits - What Can Happen with Gold If the Dollar and the Euro Collapse? - Updated

Deviant Investor - Gold Investors: Take the Red Pill!

VIDEO : USA Watchdog - 2014 Going to Be Better for Silver & Gold-David Morgan

Daily Resource Hunter - The Best And Worst Metals Plays

Numismaster - Fakes Turn into Hot Potatoes at Show

12/17/13 - Bullion News

Got Gold Report - New Trend Guarantees Higher Gold Prices

Bullion Vault - 2013 Proves Gold as Insurance

VIDEO : CNBC - House of mirrors market distorts value: James Grant

CHARTS : Advisor Perspectives - A Long-Term Look at Inflation

TECHNICAL ANALYSIS : Market Anthropology - the Third Choir

VIDEO : Zero Hedge - James Grant Slams Steve Liesman "The Fed Can Change How Things Look, But Not What They Are"

Investor Intel - David Morgan: Silver Threads among the Gold

Forbes - World Mints Sees Unprecedented Demand For Silver Coins In 2013

My Budget 360 - Quantitative Easing has become heroine to the financial markets: Federal Reserve balance sheet hits $4 trillion this week

VIDEO : Zero Hedge - Marc Faber Warns The Fed "Will Never End Its Insane Policies"

INTERACTIVE GRAPHIC : MoneyBeat - A Look Inside the Fed’s Balance Sheet

12/16/13 - Bullion News

Kitco - Gold Consolidates Above Multi-Month Support Zone

Market Watch - Forget the taper, focus on copper

Money and Markets - Ron Paul on 100 Years of the Federal Reserve: Nothing Lasts Forever

Zero Hedge - Silver & Gold Surge On POMO; DeMark Tells Santelli "Big Move Coming"

Money Morning - This Chart Will Save You from a Dangerously Popular Delusion

Profit Confidential - Burning Money at the Rate of $113 Billion a Month; How Can They Stop Printing?

Bullion Vault - 100 Years of the Fed

FOFOA - An Eye for Gold

Business Standard (India) - 5 reasons why gold import curbs need to be lifted

The Hindu - Money talks

The Real Asset - Zimbabwe bans private gold sales

Reuters - China's third gold ETF in muted start as consumers prefer physical metal

12/15/13 - Bullion News

Money and Markets -The Biggest Interest-Rate Turn in 37 Years

AUDIO : Sprott Money -Rick Rule on Positive US Economy Data & EU Bail-in

Gold-Eagle -Weakening US dollar could spark major change in gold market

Financial Sense - The 100th Anniversary of The Federal Reserve

Sober Look - US debt ceiling risk: out of sight, out of mind

The Golden Truth - The Real Budget Deficit Was $1 trillon In The Government's Fiscal 2013 Year

How Fiat Dies - List of 590+ Dead Currencies

12/13/13 - Bullion News

The Market Trend Forecast - GOLD’s Elliott Wave Analysis Bear Cycle Coming to a Close in December

PDF : Gold-Eagle - Let’s Get Physical by John Hathaway - Portfolio Manager and Senior Managing Director of Tocqueville Asset Management

AUDIO : Sprott Money - Ask The Expert: Silver Guru - David Morgan

CHART : Kimble Charts - What does the 1974 Low when Nixon was impeached, the 1987 & 2000 highs have in common?

Ludwig von Mises Inst. - 7 Ways the Government May Try to Fix the Paper Money Experiment

12/12/13 - Bullion News

Sunshine Profits - What Can Happen with Gold If the Dollar and the Euro Collapse?

AUDIO : Bullion Vault - Jim Rogers' First Rule of Investing

MineWeb - ‘Volcker Rule’ could hamstring big banks’ gold and silver trades

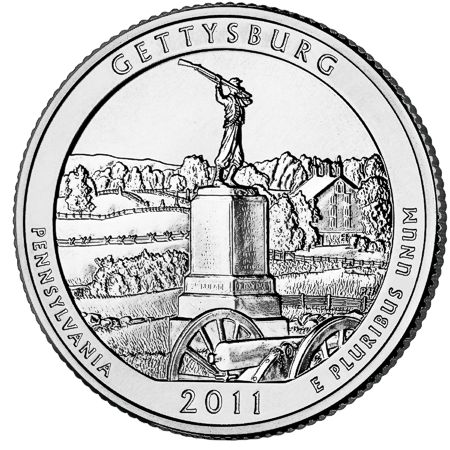

Silver Coins Today - 2013 America the Beautiful 5 Ounce Silver Bullion Coins Sell Out

TECHNICAL ANALYSIS : Nifty Charts - Silver Chart Update

Deviant Investor - Gold Will Plummet to $500! Charles Ponzi and I Believe It

CHART : Zero Hedge - 200 Years Of Dollar Debasement

AUDIO : McAlvany Weekly Commentary - Andrew Huszar: Confessions of a Quantitative Easer - The massive ongoing QE is not working, Consequence of QE will bring severe distortion, U.S. Economy must fix basic structural flaws

Cyniconomics - If You Don’t Trust the Fed, Here’s an Inside View That Confirms Your Worst Suspicions

Profit Confidential - Opportunity for Gold Today Same as It Was for Stocks in 2009

VIDEO : Future Money Trends - Rick Rule: "Mines are about to shut down"

CEO.CA - Gold consolidation underway in West Africa

12/11/13 - Bullion News

Midas Letter - Woe is Gold

CHART : King One Eye - Gold, the US Dollar, and the Seesaw of Pain

12/11: TECHNICAL ANALYSIS : Market Anthropology - Play Ball!

VIDEO : CNBC - Rick Rule, Sprott U.S. Holdings Chairman - Sticking with gold despite its past

Outsider Club - The Wealth Mirage; We Aren't Getting Richer, We're Getting Poorer

VIDEO : USA Watchdog - Brace for Volatility-Look for Protection-Axel Merk

Trader Dan's Market Views - Gold seeing some Dip Buying; Sellers digging in

VIDEO : Zero Hedge - Santelli & Stockman Blast "Festering Fiscal" Budget Deal "Betrayal"

Bullion Vault - What India Did to the Gold Price

In Gold We Trust - China Prepares For Financial Warfare

FOFOA - Public Service Announcement - Beware of fake gold being sold on eBay

Yonhap News - N. Korea sells gold in sign of imminent economic collapse

MINING - Kitco to file claim for $122 million in damages against Revenue-Quebec

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

12/10/13 - Bullion News

Bloomberg - Gold Futures Advance on China Demand Speculation, Weaker Dollar

Zero Hedge - Gold Halted As Prices Spike Higher; Stocks Stumbling

TECHNICAL ANALYSIS : Trader Dan's Market Views - Gold breaks Resistance

GoldSeek - 30%+ Gold in a Diversified Portfolio? by Axel Merk

TECHNICAL ANALYSIS : Nifty Charts - Silver Chart Update

Silver Doctors - Silver Eagle Sales Shatter Record at 42.4 Million Oz in 2013!

Money Morning - Silver Set to Double, According to… Apple?

Daily Resource Hunter - The Most Important Gold Chart in the World

VIDEO : Get Real - Jan Skoyles - Gold, Silver & Bitcoin with Ben Davies

PDF : 321gold - There is no way out! The markets are on a “high.” Gold will show the way!

Bullion Vault - Ageing Bull

12/09/13 - Bullion News

The Telegraph - In the face of an uncertain future, gold remains the best insurance policy

GoldSeek - Rising Interest Rates Spoil the Party

Got Gold Report - U.S. Bullion Banks Positioned for Higher Gold Prices

CBC - Accused in Quebec gold tax scam face jail and $750M in fines - Project Carat investigators allege Montreal-based Kitco Metals and 11 other companies evaded taxes

Gold-Eagle - Why Are The Chinese Stampeding Into Gold?

Money and Markets - It’s Time to Take Action Against Washington and Wall Street

VIDEO : Bloomberg - David Stockman explains why he believes there is a bubble in the equity market

Gold Made Simple - Turkey imports record amounts of gold so far in 2013 – more than DOUBLE the full 2012 amount

Outsider Club - Too Big To Fail Banks Are Taking Over...

VIDEO : Forbes - John Mauldin: If I Were Janet Yellen

12/08/13 - Bullion News

Gold Scents - BEAR MARKET BOTTOMS: SMART MONEY BUYING OPPORTUNITY

Daily Reckoning - Killing the U.S. Dollar: 100 Years and Counting

Cyniconomics - Why the Fed Won’t Taper in December

CSInvesting - Selling All My Gold (Not!)

PDF : Wizzen Trading - Technical Analysis : Ugly Is As Ugly Does

In Gold We Trust - China Mainland Gold Import Accelerating

12/07/13 - Bullion News

Money and Markets - Your Trip on My Time Machine - This week, U.S. financial markets crossed a critical historic threshold that could change the lives of millions of investors...

AUDIO : Sprott Money - Eric Sprott discusses Dr. Laurence Kotlikoff's recent comments on US insolvency and Chris Powell shares his thoughts on Bitcoin

CoinNews - Gold, Silver Start December Lower; US Gold Bullion Coins Surge

TECHNICAL ANALYSIS : Edge Trader Plus - Gold And Silver – Your Economical Survival Depends On Them

SRSrocco Report - GOLD PRODUCTION WARS: The East Slays the West

PDF : U.S. Global Investors - Dressed to the Nines with Gold by Frank Holmes

Shanghai Metals Market - Norilsk sees palladium shortage as early as next year

Arabian Money - India will buy 22% of world silver production and 44% of investment silver this year as tax hits gold consumption

Gold Chat - Producer/Merchant net long is not necessarily bullish

The Fiscal Times - Now, It’s the “London Fix”—A Gold Pricing Scheme

12/06/13 - Bullion News

McClellan Financial - Gold COT Data Again Proclaiming a Price Bottom

Kitco - Gold's Ability To Hold Up After Strong Data Seen As Encouraging Sign

MineWeb - Frank Holmes - PMI bell ringing and gold’s love trade

TECHNICAL ANALYSIS : Nifty Charts - Silver Chart Update

Sprott's Thoughts - The Curious Case for Silver

Peak Prosperity - There Is Too Little Gold in the West - The history of gold's flight to the developing world

AUDIO : Ellis Martin - Silver Manipulation UnPlugged, David Morgan

CoinNews - 2014 Silver Maple Leaf Bullion Coins, New Security and Finish - Article Features High-Definition Photos of Obverse, Reverse and new security features

TECHNICAL ANALYSIS : Safe Haven - Gold and Silver Update

Investor Intel - Precious Metals at a Crossroads: Sword of Damocles or Golden Sunrise?

Picket News - All That Glitters: Why You Can't Go Wrong Giving Gold Jewelry

12/05/13 - Bullion News

CoinWeek - The Coin Analyst: America the Beautiful Silver Coin Series Gathers Steam

The Sovereign Investor - Is the World Currency Market Rigged?

AUDIO : Silver-Investor - An Interview with David Morgan

Shanghai Metals Market - China 2013 gold supply shortfall seen at 700 tonnes - WGC

The Real Asset - Should I invest in more than one precious metal?

Profit Confidential - The Mother of All Bubbles?

The Golden Truth - Is Atlas Starting To Shrug?

CNBC - So far at least, austerity is winning the war

VIDEO : Bloomberg - Rare Interview w/ Peter Lynch Journeys From Funds to Philanthropy

12/04/13 - Bullion News

CNW - Royal Canadian Mint refines security of its market-leading Silver Maple Leaf bullion coin for 2014

MINING - SHORT SQUEEZE: Gold price spikes $40

TheGoldandOilGuy - Using Options to Capitalize on Strong Fundamentals for Gold

Gold Switzerland - “Gold as Part of Gresham’s Law for Interest Rates”

Sovereign Man - Yet another massive nail in the dollar’s coffin

AUDIO : McAlvany Weekly Commentary - This Weeks Show: McAlvany clan meets with Shanghai Gold Exchange, As Chinese income grows, so grows it’s gold demand, The China Dragon accumulates gold at record pace

TECHNICAL ANALYSIS : Nifty Charts - Gold's Resistance Zone

CEO.CA - An Extreme Relationship...

GoldSeek - Bubbles, bubbles everywhere

VIDEO : Bloomberg - Fed Taper Fears Send Junkies ie: Stock Investors, Scrambling

Perth Mint Bullion - Perth Mint's Gold & Silver Sales for November 2013

Profit Confidential - Inflation Running at 7.7%?

Business Insider - People are Buying A Lot of Gold and Silver with Their Bitcoins

12/03/13 - Bullion News

CoinNews - US Mint Bullion Coins Steady in November Sales

Investment Contrarians - Avoid Regret: Accumulate Some Gold Bullion

GoldSeek - Is the Fed increasingly monetizing government debt?

CHARTS : SRSrocco Report - 5 CHARTS: The Real Story Behind Silver

Gold Made Simple - Gold price falls below the cost of digging it out of the ground

Investing - Why This “Other” Metal Looks So Attractive

12/02/13 - Bullion News

Gold-Eagle - Gold To Rise Like The Proverbial Phoenix In 2014-2015

TECHNICAL ANALYSIS : Nifty Charts - Silver Chart Update

The Outsider Club - The Best Precious Metal of 2014 - It's Not Silver or Gold...

INFO~GRAPHIC : Zero Hedge - Inflation Watch 2013; Price Of Christmas Surges 7.7%

Ludwig von Mises Inst. - Revolutionary France’s Road to Hyperinflation

Wealth Daily - The Federal Reserve's Latest Scam - Gold or Poverty: Your Choice

The Money Illusion - I’m puzzled as to why economists are puzzled

VIDEO : TheGoldandOilGuy - Technical Analysis & Updates on the Financial Markets

TheGoldandOilGuy - Why You Lose Money Trading & The Answer

CHART : Zero Hedge - The Fed Now Owns One Third Of The Entire US Bond Market

Bonner and Partners - Three Major Market Events That WILL Happen

South China Morning Post - US stock market boom 'could end badly', says Nobel economist

Money Control - Here's why cloud over gold has silver lining

12/01/13 - Bullion News

TECHNICAL ANALYSIS : Wizzen Trading - Gold Bulls Struggle To Give Thanks

Project Syndicate - The Long Short Run

CNBC - $3 trillion headache on the way for corporations

TEC - China Is On A Debt Binge And A Buying Spree Unlike Anything The World Has Ever Seen Before

SRSrocco Report - Canadian Maple Leaf Sales Q1-Q3 Already Surpass 2012 Total

Daily Resource Hunter - The Last “Hard Money” President

11/30/13 - Bullion News

TECHNICAL ANALYSIS : Edge Trader Plus - Gold And Silver – Reverse Bubble. Huge Rally When Broken. Note Bitcoin Results.

Zero Hedge - Metallic Money (Gold/Silver) vs. Credit Money: Know The Difference

AUDIO : Sprott Money Weekly Wrap Up - David Franklin on Federal Reserve Balance Sheet

Gold and Silver Blog - U.S. Mint Runs Out of Silver Bullion Coins – Gold and Silver Coin Sales Hit Record Levels in November

McClellan Financial - Chart In Focus - 1929 Analog

VIDEO : TheGoldandOilGuy - Technical Analysis : Black-Friday Trading Analysis & Setups for the Markets

Investment U - What You Need to Tell Your Kids Today

My Budget 360 - The average American is broke and buying things they cannot afford with debt again. Debt based consumer financing again filling the gap of a shrinking middle class

Ludwig von Mises Inst. - The Fed Must Inflate

INFO~GRAPHIC : Zero Hedge - Visualizing Abenomics - Japan's Dangerous Experiment

Gold Chat - So who are the The Liars and Cartel Apologists?

11/29/13 - Bullion News

Gold and Silver Blog - Why Gold Stocks Are Not a Substitute for Gold

In Gold We Trust - Minutes Of Kissinger Meeting On Gold, 1974

Profit Confidential - Biggest Case of “Financial Engineering” in History?

CHARTS : Advisor Perspectives - NYSE Margin Debt Hits Another Interim High

TECHNICAL ANALYSIS : Nifty Charts - Silver Trend Update

CoinWeek - Independent Precious Metals Market Analysts Running Conservative

Dollar Collapse - China Gives Thanks For Cheap Gold

First Post - Cash is king: Asian investors look to coins for big returns

Scrap Register - China's Platinum imports rise 61% y/y to 248.7 Koz in October

11/27/13 - Bullion News

VIDEO : Kitco - I Sleep Better With Gold Holdings Than Equities: Axel Merk

Seeking Alpha - Physical Silver: How To Stack With Stealth

TECHNICAL ANALYSIS : Market Anthropology - A Closer Look at Gold & Silver

VIDEO : GoldSilver - Silver & Gold: When Money Is Corrupted - Hidden Secrets Of Money 5 - Mike Maloney

Daily Reckoning - The Mythical Merits of Paper Money by Ron Paul

AUDIO : Alt. Investor HangOut - Alasdair Macleod- Govt Cooking Inflation Numbers

In Gold We Trust - Official India PM Import August: Gold Down, Silver Holds

Business Standard - India - Domestic jewellery industry to double in five years : Report

MineWeb - Call to rollback gold import duty to 5% gathers momentum in India

VIDEO : CNBC - The Fed has created a huge global bubble: Stockman

11/26/13 - Bullion News

The Globe and Mail - Is gold still a good investment?

ZeroHedge - Citi "Bullish" Gold And Silver

Gold Made Simple - Gold price rises back above $1250 after 5 month low as regulators finally start to scrutinize the paper gold market

Investor Intel - Still waters run deep: Silver’s evolving supply crunch by David Morgan

Casey Research - Platinum & Palladium, Hitch a Ride on This Supply Crunch

VIDEO : Kitco - Ron Paul: Yellen Dangerous For The Economy

Hard Assets Alliance - Higher Interest Rates: No Longer a Death Sentence for Gold

In Gold We Trust - Chinese Gold Mining Exploding

Bloomberg - What Is Goldman Sachs Doing With Venezuela's Gold?

Bonner and Partners - America’s New Growth Sector: Poverty

RCP - Thomas Sowell - Random Thoughts

11/25/13 - Bullion News

CoinNews - Gold Hits 20-Week Low, Silver Eagle Bullion Coins Top 41M

Deviant Investor - QE Is Hazardous to Your Retirement

INFO~GRAPHIC : Visual Capitalist - Global Gold Mine and Deposit Rankings 2013

TECHNICAL ANALYSIS : Market Anthropology - The Buck Stops Here

Silver Doctors - China Announces That It Is Going To Stop Stockpiling U.S. Dollars

Daily Reckoning - When Gold Demand Awakes a Sleeping Dragon

VIDEO : CNBC - Santelli Exchange: The market is tightening up

CHARTS : Zen Trader - Serious Consequences If S&P Tops 1900

The Golden Truth - Zimbabwe Ben, Janet "von Havenstein" Yellen And The Taper That Will Never Happen

The Economist - Gold trade in Thailand - Bullion backwash

VIDEO : USA Watchdog - Bubble Inflating All Around Us-David Stockman

UnCommon Wisdom - A Great Way to Own Physical Gold

Rapid City Journal - Rapid City coin shop owner rolls into retirement

11/24/13 - Bullion News

TECHNICAL ANALYSIS : Wizzen Trading - PDF : Metals Weak When They Should Be Strong

TheGoldandOilGuy - Silver, Gold & Miners ETF Trading Strategy – Part II

Outsider Club - Would You Rather Buy Stocks or Silver? Sanity With Silver...

Gold-Eagle - Why Gold's Contango Suggests Central Bank Interference

King One Eye - A Brief History of Gold

VIDEO : GoldSilver - Rickards & Maloney - BANKS CAN STEP ON THROTTLE WITH NO LIMIT

INFO~GRAPHIC : MINING - Meet the 10 men behind China's river of gold

TECHNICAL ANALYSIS : Sunshine Profits - Precious Metals: The Long-Term Perspective

ZeroHedge - Jim Rogers Blasts "Abolish The Fed" Before It Self-Destructs

11/23/13 - Bullion News

CoinWeek - The Coin Analyst: 2014 World Silver Bullion Coins Offer Potential

TECHNICAL ANALYSIS : 321gold - Silver Prices on Track to Re-Test June Lows

CoinNews - Ft. McHenry and Mt. Rushmore 5 Oz Silver Bullion Coins Sell Out

VIDEO : The Circle Bastiat - David Stockman: ‘It’s 2007/2008 All Over Again.’

Heartland - Wealth Destruction Hidden by Government Debt

AUDIO : Wall St. for Main St. - Rick Rule - Now You Have To Be A Contrarian Or You Will Be A Victim

The Golden Truth - China Is Getting Closer To Pulling The Plug On The Dollar

Rick Ackerman - Snapchat Takes Greed to Awesome New Heights

11/22/13 - Bullion News

Silver Coins Today - 2013 Fort McHenry 5 Ounce Silver Bullion Coins Sell Out

ZEAL - Gold Tapering Hysteria

VIDEO : Fox Business - Ron Paul Yellen More Of The Same, Only Worse

Gold-Eagle - CME lower Margins on both Gold and Silver

Ludwig von Mises Inst. - Social Security: The Most Successful Ponzi Scheme in History

Wealth Daily - America's $200 Trillion Debt is Closing In

VIDEO : CoinWeek - Is There Really Gold in Fort Knox?

Stockhouse - Why gold and silver are having a tough time

Bloomberg - London Bullion Market Association Is Reviewing Benchmarks

FXStreet - Dollar's 30 Year Slide May Be Gold's New Life: 2014 Outlook

ZeroHedge - The Amazing Disappearance Of Gold From The American Psyche

11/21/13 - Bullion News

GoldSeek - Hard to Believe but Gold Remains in a Bull Market!

MineWeb - The pros and cons of investing in gold coins

- South African Gold coin exchange chairman, Alan Demby discusses the benefits of investing in gold coins and a few things to watch out for

McClellan Financial - Perhaps The Only Chart That Matters (For Now)

INFO~GRAPHIC : The Austrian Insider - The End of the Dollar Standard Graphic: The Currency Graveyard

AUDIO : FSN - Gordon T. Long – No Sign of Tapering Ahead: QE To Increase

Asia Confidential - Deflation Is Crushing QE Right Now

Market Watch - 4 reasons gold is poised for a comeback

AUDIO : McAlvany Weekly Commentary - This Week's Show: Corporate investment low, exec bonuses preferred, 1929,1999 & 2013, the three most overvalued years, Raise cash now!

Reuters - Gold pours into China to meet record demand, bypasses Hong Kong

VIDEO : ZeroHedge - Charles Schwab Warns "We Are In A Manipulated Market"

MoneyBeat - Einhorn Likes Apple, Micron and Gold

Perth Mint Blog - Perth Mint Releases the 2014 Australian Koala, for sale now.

11/20/13 - Bullion News

The Telegraph - Why did the gold price plunge $10 in 10 seconds?

PDF : U.S. Global Investors - Special Gold Report - How Government Policies Affect Gold's Fear Trade

TECHNICAL ANALYSIS : Trader Dan's Market Views - Gold Crashes through Chart Support

TECHNICAL ANALYSIS : Market Anthropology - Impressionist Paintings of March 2009

TECHNICAL ANALYSIS : Sunshine Profits - Is Silver Likely to Decline from Here?

Deviant Investor - Silver Fundamentals from an Historian’s Perspective

Sober Look - 5 years of QE and the distributional effects

AUDIO : ZeroHedge - Jim Rogers: "Own Gold" Because "One Day, Markets Will Stop Playing This Game"

INFO~GRAPHIC : Twitter - Ally Bank - Our study says saving money makes us happier

AUDIO : Perth Mint Blog - China’s Impact On Gold To Strengthen - Korelin Report Interview with the Mint's Bron Suchecki

11/19/13 - Bullion News

Bloomberg - Gold Benchmarks Said to Be Reviewed in U.K. Rates Probe

VIDEO : Max Keiser - Keiser Report: Art Market Melt-Up - In the second half, Max interviews Jim Rickards, author of Currency Wars

Daily Resource Hunter - Gold: Short Term Sell vs. Long Term Buy

MINING - James Turk retires as GoldMoney chairman

Daily Reckoning - Value of Silver vs. Value of the Dollar

AUDIO : Silver-Investor - "China, Russia, India have an insatiable appetite for Gold" David Morgan

Money Morning - Gold's Shocking New "Pick and Shovel" Play

11/18/13 - Bullion News

Investing - Gold And Silver: The Wheels Are Turning And You Can't Slow Down

The Gold Report - Could Bad Data Be Depressing the Gold Price? Eric Sprott Says GFMS Stats Are Flawed

TECHNICAL ANALYSIS : TheGoldandOilGuy - Silver, Gold & Miners About To Sell Off Again

VIDEO : Kitco - Chart Technician Gary Wagner Talks Next Key Level For Gold

McKinsey & Co. - QE and ultra-low interest rates: Distributional effects and risks

INFO~GRAPHIC : SilverSeek - Little-Known Facts About The Importance of Silver in Technology

Royal Canadian Mint - Royal Canadian Mint Celebrates 25 Years of the Silver Maple Leaf Bullion Coin by Releasing a Special Anniversary Edition

AUDIO : Ellis Martin - Ellis Martin Report with David Morgan-The Fiat Money Experience is Going to Fail Globally

Benzinga - Three Bullish Reasons to Renew Your Trust in Gold

Profit Confidential - Take Out Stock Buybacks and Corporate Earnings Growth Negative?

11/17/13 - Bullion News

PDF : Wizzen Trading - Technical Analysis : Easy Money, But Not In The Metals

VIDEO : ZeroHedge - What Is A Gold Standard?

AUDIO : SoundCloud - Sprott Money Weekly Wrap-Up: Eric Sprott - Yellen's Remarks & WGC's Gold Demand Data

Kitco - Why the Meltdown in Copper Prices this Week is Very Important for Precious Metals, and Possibly Equities Markets

Safe Haven - Platinum: Today's 'Rich Man's Gold' Palladium: Tomorrow's? by David Morgan

Dollar Collapse - Welcome to the Currency War, Part 11: Europe’s Imploding Recovery

Birch Gold - Exclusive Interview with Jim Rogers: QE, currency wars, gold and inflation

King One Eye - The Cariboo Gold Rush: Grub High, Whiskey Bad, Money Plenty!

11/16/13 - Bullion News

Money and Markets - Monetary Madness

VIDEO : TheGoldandOilGuy - Technical Analysis : Trading Strategies for SPX, Gold, Silver, Bonds and Oil

Investment News - Rebound in gold suits big guns Paulson, Soros

TECHNICAL ANALYSIS : Trader Dan's Market Views - Gold Knocking on the Door of Overhead Resistance

VIDEO : The Rundown Live - Interview with Mike Maloney

11/15/13 - Bullion News

Sovereign Man - No inflation to see here...

VIDEO : Bloomberg - Jim Rickards - In Currency War Now, Could Last a Decade

VIDEO : 321gold - Technical Analysis : A Real Gold Rally, Please!

Market Watch - Silver coin supplies buckle on fever-pitch retail buys

King One Eye - Yellen About the Yellow Metal

TECHNICAL ANALYSIS : Gold Scents - GOLD: WILL IT DROP TO $1000 OR WAS THE BOTTOM FORMED THIS SUMMER?

CNN Money - 3 Reasons Family Offices Should Invest in Gold

Bullion Street - Gold ETFs back in favour, Paulson retains stake in SPDR Gold Trust

U.S. Global Investors - In 20 Years, What Country Will Produce the Most Gold?

11/14/13 - Bullion News

Heartland - The Adverse Effects of Monetary Stimulation

Washington Times - Russian lawmaker wants to outlaw U.S. dollar, calls it a Ponzi scheme

Cyniconomics - What an Ex-FOMC Governor Wants to Tell You about the Fed

The Wall Street Journal - Andrew Huszar: Confessions of a Quantitative Easer

Business Insider - Thailand Has Become A Major Hub For Gold

MineWeb - WGC's Marcus Grubb discusses the rise in allocated accounts, the shift from west to east and the growing popularity of high carat jewellery pieces.

Business Insider - Gold Is Flowing From The Western World To The East

AUDIO : GoldSeek - Eric Sprott: Silver, Silver Stocks will go much higher!

TECHNICAL ANALYSIS : Nifty Charts - GOLD Chart update

King One Eye - Gold Is Up and the Dollar Is Down -- Chart

VIDEO : CoinWeek - Edmund C. Moy, Former US Mint Director, discusses the Correlation between the Price of Gold and the National Debt

Affiliate Ad

11/13/13 - Bullion News

Market Watch - Yellen Backs Fed’s Bond-Buying Program

VIDEO : CNBC - Ex-Fed official: 'I'm sorry for QE'

Deviant Investor - Gold & Silver vs. Hope & Change. Place your Bets!

TECHNICAL ANALYSIS : King One Eye - Charts of Gold, Dollar, Natural Gas and More

TECHNICAL ANALYSIS : Nifty Charts - SILVER Descending triangle

VIDEO : Keiser Report - Keiser Report: Troika Occupiers (ft. Peter Schiff)

Mining Weekly - Silver-fabrication demand to grow 3.9% this year

CoinNews - US Mint Silver Eagle Sales Reach Record 40,175,000

AUDIO : McAlvany Weekly Commentary - This week’s show: Emerging markets: trigger for next crises, Government favoritism: rationing of credit, Gold benefits from deflation and inflation

CNBC - Un-Manipulated Investments See Price Inflation

How Fiat Dies - Food Prices as Early Warning for Hyperinflaton

MineWeb - Platinum set for biggest deficit since 1999 - Johnson Matthey

MINING - Gold mining ghost town for sale on Craigslist

11/12/13 - Bullion News

The Outsider Club - Why Investors Love Gold and Silver Coins

Money and Markets - When Will Americans Become Fed Up With the Fed?

U.S. Global Investors - Big Ideas on Gold and Resources in the Big Easy

Mish's Blog - Venezuela’s Hyperinflation Anatomy; Army Storms Caracas Electronics Stores; Total Economic Collapse Underway; Could This Happen in US?

SRSrocco Report - U.S. TREASURY: Ramps Up the Zimbabwe Style Printing Press

TECHNICAL ANALYSIS : Trader Dan's Market Views - Long Term Monthly Gold Chart

VIDEO : CNBC - Peter Schiff gives his Opinion on Gold, Bitcoin & Janet Yellen's nomination to the Fed

The Sovereign Investor - The Fed is Killing the Middle Class

The Gold Report - Three Reasons Why Gold's Best Days Are Ahead: Sean Brodrick

Business Standard - India's Jewellers in a fix over gold imports

Numismaster - Is Your Stored IRA Gold Genuine?

11/11/13 - Bullion News

Sunshine Profits - Curious Case of Ben Bernanke

Daily Reckoning - The Illusion of Wealth: What QE Can and Cannot Do

Acting Man - Deflation-Phobia Set to Bring on More Monetary Inflation

TECHNICAL ANALYSIS : Gold-Eagle - Steps From A Correction

Market Watch - This is all the bulls have left

Money Morning - "Democratize" Gold and Give the Government a Black Eye

Platinum Today - Automotive Roundup - November 2013

Money and Markets - Mixed-Up World: A Stronger Economy Is Scaring Stock Investors

CNBC - S&P cuts France's sovereign credit rating

ZeroHedge - "Beggar Thy Neighbor" Is Back: Goldman's Five Things To Watch As Currency Wars Return

11/10/13 - Bullion News

MoneyBeat (WSJ) - Flurry of Stock, Bond Issuance Is a Danger Sign for Markets

PDF : Wizzen Trading - "Half & Half" - Technical Analysis of Gold, Silver, Platinum & Palladium

Bullion Street - Record Sales in American Silver Eagle Bullion Coins

Deviant Investor - Created Currencies… are NOT GOLD! (Financial Prepping 101)

Ahead of the Herd - Copper Catch Up

AUDIO : SGT Report - Tom Woods - THE LIBERTARIAN VIEW... of America

Fox Business - Week Ahead: Fed Speeches and Economic Data

11/09/13 - Bullion News

Cyniconomics - M.C. Escher and the Impossibility of the Establishment Economic View

VIDEO : ZeroHedge - Bill Fleckenstein Blasts "The Price Of Everything Is Out Of Whack"

AUDIO : Peak Prosperity - Bob Moriarty: Solving Our National Problems Starts With Sound Money

Got Gold Report - Jim Rickards - QE May Never End

TECHNICAL ANALYSIS : Trader Dan's Market Views - Gold Falls Under $1300

MoneyBeat (WSJ) - A Few Good Reasons to Hoard Some Cash Now

11/08/13 - Bullion News

Silver Coins Today - 2013 Mt. Rushmore ATB 5 Ounce Silver Bullion Coin Sales Begin

VIDEO : Got Gold Report - Gold Dives 20 Seconds Before BLS Payroll Figures

VIDEO : Fox Business - Stockman: Brace for the Mother of All Bubbles

Daily Resource Hunter - The Gold Shortage You Didn’t Hear About...

AUDIO : FSN - Mickey Fulp – Mickey’s Monthly Major Market Review

Mish's Blog - Establishment Survey: +204K Jobs, Household Survey: -735K Jobs; How Federal Layoffs Distorted the Picture

The Brics Post - Japan Government Debt Hits Record High

ZeroHedge - Turkey Gold Demand Spikes To 8-Year High (As Price Drops)

VIDEO : Reuters - 2014 Economy Outlook - Jim Rogers - Korea, Global Economics, Gold Price and More

Plata - The Siren-song of Welfare State by Hugo Salinas Price

11/07/13 - Bullion News

The Gold Report - Leonard Melman: Put Your Trust in Precious Metals, Not Governments

Acting Man - Federal Bubble Blindness

CoinUpdate - Year End Availability and 2014 Release Details for US Mint Bullion Programs

Sovereign Man - This one chart shows you who’s really in control

The Telegraph - Appetite for gold rises to six-month high

Gold-Eagle - Can The Fed Prevent A Crash In 2014?

Rolling Stone - Chase Isn't the Only Bank in Trouble

The Daily Bell - Premeditation of Currency Wars

11/06/13 - Bullion News

TECHNICAL ANALYSIS : Gold Made Simple - Gold price being kept in check by the 100 day moving average… for now

How Fiat Dies - BOJ only buyer of JGBs

DealBook - Citing the Hunt brothers,’ the CFTC has Proposed Limits on the Size of Commodities Traders’ Positions

MahiFX - Is the gold rally over?

Deviant Investor - Gold, S&P, or the Dollar, Mr. Bernanke?

Bonner and Partners - Repeat After Me: Economics Is NOT a Science

AUDIO : McAlvany Weekly Commentary - About this week’s show: Can the dollar hold above 79? Deficit spending no longer the cure, Equity margin debt has broken all time highs

TECHNICAL ANALYSIS : Market Anthropology - Down Under Silver

MineWeb - Platinum giants ready to stare down union over pay

Daily Reckoning - Marc Faber: Real US Economy Trampled by “White Elephants”

MoneyNews - Gallup: Confidence in the Economy Plummets

Carney Capital - Bitcoin – the canary in the goldmine?

11/05/13 - Bullion News

Money and Markets - Dead Man Walking: The United States of America

TECHNICAL ANALYSIS : King One Eye - Is The US Dollar Rally for Real?

TECHNICAL ANALYSIS : Acting Man - Gold and Gold Stocks – Meaningful Divergence?

VIDEO : Silver-Investor - David Morgan at Silver Summit "People don't buy bottoms"

Bullion Bulls Canada - Gold Standard: the Perfect Prescription

VIDEO : Why Gold and Silver - Silver & Gold - The Biggest Lessons Of Money

In Gold We Trust - Greater China Net Gold Import 1316 Tons YTD

Perth Mint Bullion - Monthly Sales - October 2013

VIDEO : CNBC - Santelli Exchange: Shrinking the debt

11/04/13 - Bullion News

SafeHaven - Gold vs. Wall Street's Program Traders

Acting Man - Yellenomics – or the Coming Tragedy of Errors

Reuters - Fed in no rush to cut bond buys, top policymakers say

VIDEO : Kitco - Chart This! Gold Above $1,330 To Be Bullish Says Wagner

Rick Ackerman - Remembering Why We Hold Gold

Sunshine Profits - Can VIX Substitute Gold?

VIDEO : SNN - David Morgan, The Morgan Report - Precious Metals: Putting it into Perspective

Silver Coins Today - US Mint Bullion Silver Coins Near Record, Silver Rises in October

VIDEO : Bloomberg - What Could Move Gold This Week?

11/02/13 - Bullion News

AUDIO : FSN - Peter Schiff – Get Ready for Quantitative Easing to Increase

TECHNICAL ANALYSIS : Edge Trader Plus - Gold And Silver – Fundamentals Do Not Matter.

Dollar Collapse - China’s Appetite for Gold: “Waning” or Surging? - by John Rubino

MineWeb - China imports another 109 tonnes of gold in September

Energy and Capital - How to Spot a Gold Coin Scam

DealBook (NYT) - Currency Traders Put on Leave Amid Investigation

11/01/13 - Bullion News

Truman - After “Currency Wars” Comes “The Death of Money”

TECHNICAL ANALYSIS : Market Anthropology - Dollar Hollers - like a Bear

VIDEO : Peter Schiff - Fed Wants Inflation to Sustain Asset Bubbles & Monetize Debt

Silver Doctors - US Mint Alerts Primary Dealers Silver Eagle Production to Be Halted for 4 Weeks

SafeHaven - DOW 20,000? or 5,000?? by Gordon Long & John Rubino

The Automatic Earth - How Can We Have Record Bad Loans And Record Excess Liquidity At The Same Time?

VIDEO : 321gold - Technical Analysis : Gold Inverse Head & Shoulders Bottom Chart

MINING - BofA Merrill Lynch: 'No damage' to gold's long-term uptrend

Bullion Street - Palladium to be bullish on strong supply-demand fundamentals

Profit Confidential - National Debt to Double from $17.0 trillion to $34.0 Trillion?

Forbes - The World's Next Gold Standard Will Come Through China And Africa, Not America

Numismaster - End of Paper Dollar Asked in Legislation

10/31/13 - Bullion News

Gold Chat - More Deception About the COMEX

MineWeb - India, Fed tapering and the impact of lower tail risk for gold

- According to HSBC's James Steel, the market was on a high-octane fuelled rally for a good five years so it is unsurprising things have cooled somewhat but that doesn't mean there is no further upside

The Real Asset - Daily Nugget – gold slips

321gold - Bernanke vs. Yellen: A Spooky Outlook?

VIDEO : OtterWood Capital - A crash caused by excess debt. Wash, rinse, repeat...

Deviant Investor - QE + Desperation = Higher Gold Prices

SRSrocco Report - Important Charts On Gold & Silver Eagle Sales

VIDEO : ABC News - Old Safe Given Away for Scrap Filled With Gold Coins

10/30/13 - Bullion News

INFO~GRAPHIC : Sharps Pixley - PDF : Gold Protects Investors’ Purchasing Power

VIDEO : USA Watchdog - Annihilation of U.S. Dollar Coming-Jim Sinclair

VIDEO : Future Money Trends - Rick Rule's Strategies for Making Money (Casey Summit Interivew Part 2)

VIDEO : ZeroHedge - Larry Summers Admits The Fed Is In A Liquidity Trap

MineWeb - Gold and the evolution of the dollar

Resource Investor - Silver Eagle bullion coin sales head for annual record

AUDIO : McAlvany Weekly Commentary - Bill King: “Buy Real Things”

King One Eye - Important Heads Up on China Gold Prices

VIDEO : SilverSeek - Are we Seeing a Squeeze Now on Silver Supply? Vanessa Collette interviews the Silver Guru David Morgan at the 11th Annual Silver Summit

Inside Futures - The Precious Metals Look Bullish

MOVIE TRAILER : Money for Nothing - The Movie "In Theaters Now" Play Schedule

New York Post - Man throws away $500K in gold to spite ex-wife

10/29/13 - Bullion News

Daily Reckoning - Gold’s Gift on the Eve of Zero Hour

The Real Asset - Michael J. Kosares: Fiat gold could get very violent wake-up call

Numismaster - Warning Signs of Dealers to Avoid

Inside Futures - Silver Prices Look To Break Out Soon

AUDIO : Silver-Investor - David Morgan Discusses The Gold & Silver Markets

The Golden Truth - The Wall Street Journal Published Blatant Lies About The Gold Market

FXEmpire - Chinese Gold Consumption and Production Increasing

Gold-Eagle - Crashing U.S. Dollar…and the future price of gold

TheGoldandOilGuy - Stock Market Trend – Eye Opening Information

Investment Contrarians - Two Precious Metals with a Compelling Supply-Demand Dynamic

Lew Rockwell - Is There a Way Out? by Walter E. Williams

VIDEO : ZeroHedge - Santelli Stunned As Nobel Winner Fama Explains Fed Unwind "Is No Big Deal"

VIDEO : WhyGoldandSilver - Chris Martenson On The Biggest Scam In The History of Mankind - Mike Maloney

Bloomberg - Fed Bubble Agonistes Persists as Zero Rates Prompt Debate

10/28/13 - Bullion News

In Gold We Trust - Central Banks Bullish On Gold At LBMA Conference

VIDEO : Fox Business (Stossel) - The origins of the Fed

INFO~GRAPHIC : Perth Mint Bullion - World’s Highest Gold Producing Countries

Business Recorder - Turkey, Kazakhstan raised gold reserves in September: IMF

Bullion Vault - Efficient Markets' Nobel Nonsense by Doug Casey

VIDEO : FirstPost - You can’t wish away demand for gold by crushing supply: WGC

Kimble Charting - Important sector creating another Head & Shoulders pattern?

VIDEO : Fox Business - Odyssey Marine Exploration president Mark Gordon displays Gold and Silver Treasures from Shipwrecks

10/27/13 - Bullion News

TECHNICAL ANALYSIS : Wizzen Trading - Metals Show Strong Action, Miners Too

VIDEO : BARRON'S - Marc Faber on Gold, Miners, and China

Zero Hedge - The Entire US Fiscal And Monetary Policy Gambit (In One Cartoon)

PDF : 321gold - The More Gold Will be Pushed Down the Harder Gold will Bounce Back

The New York Times - In Fed and Out, Many Now Think Inflation Helps

Sober Look - Has the Great Recession created behavioral changes in the labor markets?

CHARTS : TheGoldandOilGuy - The Great American Wall Of Worry – US Stock Market

10/26/13 - Bullion News

Money and Markets - U.S. Dollar on the brink of 13-month lows! Here are the long-term consequences...

AUDIO : Peak Prosperity - John Rubino: Out of Good Options

NCPA - The High Cost of a Cheap Dollar

Silver Doctors - Metals & Markets With Alasdair Macleod: “Swiss Refiners Working 24/7 Producing Kilo Bars Headed to China”

VIDEO : Market Sanity - Ron Paul explains Austrian economics

TECHNICAL ANALYSIS : Edge Trader Plus - Gold And Silver – Sticking With The Charts, From A Buddhist Perspective.

VIDEO : Future Money Trends - How to Become a Millionaire in Any Circumstance, Rick Rule of Sprott Asset Management

INFO~GRAPHIC : MINING - Which are the richest oil states in the US?

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

10/25/13 - Bullion News

VIDEO : 321gold - Technical Analysis : Gold Fib Lines & USD Double Trouble

Gold-Eagle - 12 Reasons Why Gold Will Rebound and Make New Highs in 2014

Dollar Collapse - A Tale of Two Charts: Are We 2007 America or 2006 Zimbabwe?

ZEAL (Speculation & Investment) - Silver Launchpad

Peak Prosperity - The Fed Can Only Fail

The Washington Post - Most Americans accumulating debt faster than they’re saving for retirement

VIDEO : Kitco - We Are In QE Forever - Famed Economist

Bullion Street - India Gold futures backwardation signals short supply: Kotak

10/24/13 - Bullion News

Bonner & Partners - Alan Greenspan’s Shock Revelation

VIDEO : CNBC - Gold your only hope: Hedge fund manager

TECHNICAL ANALYSIS : Nifty Charts - GOLD Resistance levels

CoinNews - Gold Tops $1,350; US Mint Gold Eagles Triple Sept. Sales

Perth Mint Bullion - Lunar Bullion Coin Sales Update

ZeroHedge - Gold Hits 1-Month High In Aftermath Of Goldman's (And Gartman's) "Slam Dunk Sell" Advice

VIDEO : RT - Mike Maloney : How to Make 1 Trillion Dollars Per Year

The Real Asset - Is gold a safe haven?

Wealth Daily - Gold Coin Scams - How to Ensure a Legitimate Gold Coin Purchase

Bloomberg - Platinum Shortages Extending as Car Sales Quicken: Commodities

AUDIO : McAlvany Weekly Commentary - Wise Investing Eliminates the Time Question

10/23/13 - Bullion News

VIDEO : MoneyBeat (WSJ) - Forget Tapering; It’s a Code-Red Economy, John Mauldin Says

How Fiat Dies - Foreign Treasury Holdings Down

TECHNICAL ANALYSIS : Got Gold Report - “Dollar Diamond Top” - Implications for the Precious Metals

Perth Mint Bullion - Year of the Horse 1oz Coins Officially Sold Out

Daily Reckoning - 3 Reasons Gold Could Scream Higher

Deviant Investor - Gold, Silver and the Debt Ceiling

VIDEO : CNBC - Interview with Discovery Channel's "Gold Rush" host Todd Hoffman

ZeroHedge - Chart Of The Day: "Japan Has No Alternative But To Print And Print And Print"

Sovereign Man - 3 currencies to avoid like the plague

AUDIO : Silver-Investor - David Morgan explains the manipulation of the precious metals market

Numismaster - Gold Supplies Disappearing

The Real Asset - Eric Sprott: WGC and their misleading data

10/22/13 - Bullion News

Gold Made Simple - Gold price smashes back above its 100 day moving average on bad but ‘good’ US unemployment data

Market Watch - Kiss the dollar goodbye

TECHNICAL ANALYSIS : Nifty Charts - SILVER Resistance levels

VIDEO : kirotv - Fake silver bullion and coins show up on Craigslist

Reuters - Not much of a festival season for Indians as gold runs dry

AUDIO : Ellis Martin - Ellis Martin Report with David Morgan --Pass or Fail

The Real Asset - Five central bankers who champion gold

VIDEO : The Daily Show - Exclusive - Alan Greenspan Extended Interview Pt. 1 - Greenspan "We really can't forecast all that well, we pretend that we can, but we really can't"

CoinNews - NGC Grades First 2014 Chinese Silver Panda Coins

The Telegraph - Gold really does grow on trees, researchers discover - Researchers have found a surprising marker for deep-buried gold: miniscule traces in the leaves of Eucalyptus trees.

10/21/13 - Bullion News

Money and Markets - 7 Reasons Why Gold Prices Are Poised to Take Off Again

VIDEO : CNBC - Rick Santelli Makes the Case that the Dollar's Weakness is More About the Fed and a Mediocre Economy

Daily Resource Hunter - China Scolds, Buys Gold!

VIDEO : MINING - Here's what goes on at the London Metal Exchange

AUDIO : Sprott Money - Ask the Expert - James Turk - Sprott Money News

VIDEO : CNBC - Marc Faber: The World is in 'Gigantic Asset Bubble'

Investment Contrarians - Global Gold Bullion Demand Still Rising, Supplies Running Dry

Sovereign Man - Check out the Fed’s dismal track record

Bullion Vault - Thank Gold & Ben Bernanke

VIDEO : CNBC - Marc Faber: Fed is 'boxed in' with no exit strategy

10/20/13 - Bullion News

PDF : Wizzen Trading - Technical Analysis : Lower Patterns Negated

AUDIO : Peak Prosperity - Alasdair Macleod: Currency Crisis Dead Ahead

PDF : US Global Investors - Shareholder Report : For the Love of Gold

AUDIO : Wall St. for Main St. - Doug Casey & Jim Rogers: Legendary Investors' Roundtable

Kitco - Bearish Technical Clue in U.S. Stock Market Could be Boon to Gold, Silver Bulls

AUDIO : Birch Gold - Interview with Ron Paul: gold, dollar, debt ceiling and the Fed

CHARTS : Business Insider - 50 Charts Behind The Bull Case For Gold

10/19/13 - Bullion News

Business Insider - 9 Signs That China Is Making A Move Against The US Dollar

TECHNICAL ANALYSIS : Nifty Charts - US Dollar Weekend update

TECHNICAL ANALYSIS : Edge Trader Plus - Gold and Silver – Back Story v Charts; Charts Are Superior

VIDEO : Future Money Trends - James Rickards: Helicopter Money is Coming! Jim Rickards, Currency War Update

U.S. Debt Clock - U.S. Debt passes 17,000,000,000,000

TECHNICAL ANALYSIS : Acting Man - Gold Fails to Obey Script

CoinNews - Gold, Silver Notch Weekly Gains; US Mint Bullion Coins Soar

PDF : 321gold - THE ROSEN MARKET TIMING LETTER

Reuters - Indian sage dreams of gold to save economy, government starts digging

10/18/13 - Bullion News

Cyniconomics - Fonzie or Ponzi? One Theory on the Limits to Government Debt

The Golden Truth - The Budget/Debt Ceiling Bill Potentially Eliminates The Debt Ceiling Limit

Inside Futures - U.S. Dollar To Decline Further

CHARTS : Market Anthropology - Goldman Has it Backwards

TECHNICAL ANALYSIS : GoldSeek - Don’t Miss Out on These Important Charts

Zero Hedge - SocGen: "Physical Gold Squeeze Returns"

VIDEO : Max Keiser - Keiser Report: Walmart & Wall Street’s Sugar Daddy - In the second half, Max interviews Alasdair Macleod of GoldMoney.com about the $640 million sell order of gold

Money Morning - Silver Prices in 2014 Will Ride Higher Thanks to India

PHOTOS : IBTimes - China's Gold Obsession Goes Beyond Stocks And iPhone5s

10/17/13 - Bullion News

Silver Coins Today - Sales of 2013 American Eagle Silver Bullion Coins Near 38 Million

CMI Gold & Silver - The Disingenuous Mr. Buffet

TECHNICAL ANALYSIS : King One Eye - Bottom Alert: 2 Must-See Signals in Gold

VIDEO : Kitco - Debt Ceiling Not Over, Fed Could Increase QE

Gold Made Simple - Indian Central banks says it “can always pay the world in gold” – but we thought gold wasn’t money

Investment U - China’s Plan to De-Americanize the World

GoldSeek - The Jim Rogers view on gold

RCP - A Return to Keynes? by Thomas Sowell

Zero Hedge - Why I Stopped Worrying And Learned To Love The Currency Collapse

10/16/13 - Bullion News

King One Eye - Gold Price Watch: 10 Fundamental Truths on Gold

MINING - Gold price drop boosts gold and silver coin sales

CoinNews - Gold, Silver and Other Metals Advance after Senate Deal

Silver Doctors - Jim Rickards – Why China is Buying Gold & Calling for a De-Amercanized World

AUDIO : Howe Street - Doug Casey - Lack of confidence - U.S. Government and the American dollar : Danielle Park - Cheap credit has encouraged bad fiscal behavior

Deviant Investor - SILVER: 4 Cycles in 12 Years

VIDEO : CNBC - Bill Gross: Treasurys & kicking the can

Daily Reckoning - Janet Yellen: An Insane Choice for a Debt-Crazed Economy

VIDEO : CNBC - Frank Holmes; Why investors should hold gold and energy stocks

MoneyBeat (WSJ) - Why the U.S. Should Be Downgraded

China Daily - Cooperation projects inked - Agreements with UK to give boost to wider use of yuan in London

10/15/13 - Bullion News

Buy gold and silver at GoldSilver.com!

VIDEO : GoldSilver - The Biggest Scam In The History Of Mankind (Debt Ceiling Truth)

Mish's Blog - Marc Faber on Investment Strategies, Government Idiocies, Gold, Safe Havens

Business Line - Platinum, palladium prices set to firm up next year

AUDIO : Silver-Investor - Hunt Brothers History Lesson

How Fiat Dies - Hyperinflation Explained in Many Different Ways

VIDEO : RT - Jim Rogers: US is exceptional...it's largest debt nation in the world!

Numismaster - Low Mintage Not Necessarily High Value

MineWeb - Indian demand keeping gold:silver ratio in check

10/14/13 - Bullion News

TECHNICAL ANALYSIS : King One Eye - Gold Price Watch: The Market Is Terrified of a Broken Neck!

Gold Broker - Interview of James Rickards About Central Bank Manipulation of Gold and Silver Markets

CHARTS : Market Anthropology - Cliff Notes

CNBC - After sudden plunge, gold traders cry conspiracy

Midas Letter - UBS’ Art Cashin on the ‘Strange Happenings’ in the Paper Gold Market

Lew Rockwell - New Fed Boss Same as the Old Boss by Ron Paul

gulfnews - Makkah gold sales slashed in half by Arab Spring

The Big Picture - How Columbus Caused Inflation

INFO~GRAPHIC : The Washington Post - How the government pays its debt

10/13/13 - Bullion News

PDF : Wizzen Trading - Technical Analysis : Lots Lower To Go

Scents on Cents - Has Uncle Sam Ever Defaulted Before?..."Yes"

NPR - Everyone The U.S. Government Owes Money To, In One Graph

Inside Futures - Will Gold Prices Make New Yearly Lows

ZeroHedge - China Imports Over 2,000 Tons Of Gold In Last Two Years

In Gold We Trust - July Silver Import India High At 797 Tons, YTD 3942 Tons

Acting Man - St. Yellen’s Ascension to the Throne

10/12/13 - Bullion News

AUDIO : Peak Prosperity - Bud Conrad: The Bursting of the Bond Bubble Is Now Upon Us

Ludwig von Mises Institute - How Much Longer Will the Dollar be the Reserve Currency?

CEO.CA - A Further Explanation to Friday’s Gold Sell-Off

The Gold Report - Born Libertarian: Doug Casey on Ron Paul and the Price of Freedom

CHARTS : Shenandoah - The Truth About the Upcoming October Stock Market Crash was Predicted in April by Gold

MINING - Thousands of gold, silver Vatican’s medals misspell ‘Jesus’

CoinWeek - The Coin Analyst: “Numismatic” Gold & Silver American Eagle Coins – Lessons from the Past

10/11/13 - Bullion News

TECHNICAL ANALYSIS : Nifty Charts - Gold's Bearish Price Action

The Washington Post - James Grant - America’s Default on its Debt is Inevitable

VIDEO : 321gold - Technical Analysis : Gold Bulls Need A Sharper Edge

MoneyBeat (WSJ) - Why Gold Slumped So Much This Morning

Bloomberg - European Central Bank Gold Sales Lowest Since 1999 Accord

The Gold Report - Busting the Myths That Could Wipe Out Your Investments: Louis James, Marin Katusa and Rick Rule

VIDEO : Max Keiser - Keiser Report: When US backed cartel controls meth trade - In the second half, Max interviews Jan Skoyles of The Real Asset Company

VIDEO : MINING - Gold speeds up malaria diagnosis

Scrap Monster - Gold could act as insurance against India's 22% external debt to GDP : RBI Governer

SLIDE-SHOW : The Washington Post - Tom Toles on the economy

10/10/13 - Bullion News

Silver Coins Today - 2013-P White Mountain ATB Five Ounce Silver Coins Sell Out

Sovereign Man - Gold, and the four words that define western economic policy

Gold Made Simple - Morgan Stanley joins Goldman in the ‘slam-dunk’ call for lower gold prices – will be found to be TOTALLY wrong… again

VIDEO : The Daily Ticker - Rickards on Fed & Yellen: Here Comes the ‘Helicopter Money’

TECHNICAL ANALYSIS : IKN - Defining the Dead Cat Bounce...on charts

Gold-Eagle - If gold successfully retests the 61.8% Fibonacci level...

Market Watch - Crazy currencies are blowing up

The New York Times - At Risk: The Dollar’s Privilege as a Reserve Currency

CNBC - Why gold is set for a 20% rally

VIDEO : CNBC - Spending is on auto pilot, no pause button: Santelli

10/09/13 - Bullion News

10/09: TECHNICAL ANALYSIS : King One Eye - Chart of the Day: What's Up With Ol' Mister Dollar?

10/09: CHARTS : Market Anthropology - The Song Remains the Same

AUDIO : FSN - Mike Maloney – The Hidden Secrets Of Money

MoneyBeat - Wall Street’s Fear Level in Five Charts

Deviant Investor - Created Currencies… are NOT GOLD! (Financial Prepping 101)

VIDEO : Kitco - Safe Have Demand Still In The Cards For Gold

Business Insider - India's Gold refineries shutting bulk operations

AUDIO : McAlvany Weekly Commentary - Your Antidote to BIG DATA/BIG BROTHER is Gold

International Man - What Ron Paul Told Me About the End of Dollar Hegemony

Marc to Market - Great Graphic: International Ownership of US Treasuries

VIDEO : CNBC - Fed lost influence on bonds?

10/08/13 - Bullion News

Acting Man - It Is Unanimous: Gold Remains the Most Hated Asset Class - Sell-Side Analysts Tripping Over Each Other With Bearish Pronouncements

VIDEO : Kitco - Focus On The Debt Ceiling Countdown, Not The Shutdown – Peter Hug

CoinNews - Gold Nearly Flat, US Mint Bullion Sales Rise

CHART : Market Anthropology - Cable Ready

AUDIO : Silver-Investor - PAPER DOES NOT EQUAL PHYSICAL! - Interview with David Morgan

Business Insider - The Time The US Had An Unrepentant Gold Bug On The $100 Bill

In Gold We Trust - Mainland & Hong Kong Net Gold Import Jan-Aug 1154 Tons

Times of India - Gold bar, coin fabrication added $17.6bn to India's GDP in 2012: PwC

Seeking Alpha - China Gold Imports Continue To Impress

CHART : Perth Mint Bullion - Monthly Sales - September 2013

VIDEO : TheGoldAndOilGuy - Technical Analysis of Current Market Trends

10/07/13 - Bullion News

VIDEO : Bloomberg - "If We Default, We will No Longer Have the Benefit of Being the Worlds Reserve Currency" - James Tisch, Loews Corp.

CNBC - China warns US 'clock is ticking'

VIDEO : Fox Business - Pawn Stars' Rick Harrison talks business in recession

TECHNICAL ANALYSIS : Gold Scents - IS THE NEXT BEAR MARKET ABOUT TO BEGIN?

Perth Mint Bullion - China Surreptitiously Acquiring Gold Via The Perth Mint?

10/06/13 - Bullion News

Cyniconomics - Why the Debt Ceiling Debate Should Be Different This Time

TECHNICAL ANALYSIS : Wizzen Trading - PDF : False Breakdown

Gold-Eagle - The Fire Fueling Gold by Frank Holmes

McClellan Financial - Summation Indices’ Messages

TECHNICAL ANALYSIS : Edge Trader Plus - Silver – QE4ever, POMO4ever, Nevermore4ever

10/05/13 - Bullion News

Sovereign Man - The real change to watch out for

TECHNICAL ANALYSIS : Edge Trader Plus - Gold And Silver – Central Bank Death Dance, Part II. Good News/Bad News

Money and Markets - Five Shocking Debt-Limit Scenarios

Market Watch - Gold coins vs. highflying bubble stocks

AUDIO : The Real Asset - Good Interview: Is Silver a Ticking Time Bomb?

USA Gold - Golden Gut Check 2013 Is the secular bull market still on course?

Forbes - Is Hyperinflation Just Around The Corner?

Bonner & Partners - The Biggest Mistake Libertarians Can Make...

Wealth Cycles - X-Ray Detectors Promise More Gold, Less Waste

10/04/13 - Bullion News

Investing - Gold falls as investors mull fate of U.S. government shutdown

CoinWeek - LOW MINTAGES, LOW PRICES: Fractional Mexican Silver Libertads

Market Watch - Why Uncle Sam is hoarding gold

VIDEO : Ellis Martin - Ellis Martin Report with David Morgan_No Endgame

TECHNICAL ANALYSIS : Market Anthropology - 3 Up 3 Down - Tie Goes to the Bulls

In Gold We Trust - ABC Bank: Run On The FED Highlights The Importance Of Gold Reserves

Jesse's Cafe' Americain - Currency Wars and the Ghost of Bear Stearns - The Mass Exodus of Gold Bullion

Reuters - Pimco's Gross: Low interest rates may persist for decades

ZeroHedge - Have We Reached Peak Federal Reserve?

TECHNICAL ANALYSIS : 321gold - Gold Bulls Have Technical Edge

Ahead of the Herd - Biggie Size the Plutocrats While the Circus Plays On

CoinNews - How the Philadelphia Mint Polishes Dies to Make Proof Coins

10/03/13 - Bullion News

The Real Asset - Uncovering China’s Rush for Gold

MineWeb - Unpacking China's gold surge - Jan Skoyles

Jan Skoyles discusses why there is more to China's role in the gold market than just the Shanghai Gold exchange and why 2013 is likely to be remembered as the Asian giant's year.

CoinNews - US Government Prints 1.18 Billion Banknotes in September 2013

The Economic Times - Indian, US silver price arbitrage,trade sees upswing after gold curb

VIDEO : Fox Business - Former Rep. Ron Paul, (R-Texas), on the government shutdown and the debt ceiling debate

AUDIO : FSN - Ross Hansen – Currencies Will Come And Go, But Gold Is Forever

MoneyNews - James Rickards: QE Will Go Down as 'One of the Greatest Economic Blunders in History'

VIDEO : The Daily Ticker - This Is The Next Sub-Prime Crisis: Jim Rickards

Elk Daily Free Press - Mines help raise awareness on breast cancer

VIDEO : ZeroHedge - Rolling Stone's Matt Taibbi On The CNBC "Presstitutes"

10/02/13 - Bullion News

FNArena - US Dollar Under Pressure - "Historic Lows presently sit at $76.08 set back in May of 2011. So a break below $79.50 that sticks will see the potential for these major lows to be surpassed. A newsworthy item on a global scale to say the least."

Sunshine Profits - Currency Strength and Central Bank's Activity – Got Gold?

MoneyBeat - Don’t Push it Congress; World’s Faith in Dollar Not Guaranteed

AUDIO : McAlvany Weekly Commentary - US Downgrade Looms

VIDEO : USA Watchdog - David Morgan-Massive Debt Problem-Were Getting Very Close to the Edge

Shanghai Metals Market - London bullion body could charge more or disband gold rates

AUDIO : Perth Mint Bullion - Gold Fever Hits Asia

Deviant Investor - The Smell of Collapse is in the Air – Part 3

MineWeb - Texas eliminates sales tax on precious metals coins

RCP - Destroying Household Jobs by Thomas Sowell

10/01/13 - Bullion News

IBTimes - China's Gold Fever Rises, Showing No Signs Of Abating As ‘Golden Week’ Holiday Kicks Off

VIDEO : CNBC - Gold gets gutted down 3%

IG - Gold breaks lower - Support levels in gold have been reached and breached in this afternoon’s trading

TECHNICAL ANALYSIS : Sunshine Profits - Gold & Mining Stocks: The Outlook Remains Bearish

VIDEO : YouTube - James Rickards - Future of Money 2.0 - Future of Money, Gold & Currency

King One Eye - Gold Eagle Sales & 3 Reasons to Be Bullish on Gold

VIDEO : Kitco - Owning Gold & Silver Makes Sense: Adrian Ash

Daily Reckoning - “Really? There’s no gold in Fort Knox?”

VIDEO : Bloomberg - Pimco's Bill Gross: Fed Will Stay Put for Next Few Years

VIDEO : Perth Mint Bullion - Australian Kangaroo Coins Available From Today

Other pages you may like...

|

|

|

|

|

|

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage

Click Ad to Request a Free Appraisal Kit

ExpressGoldCash

Customer Reviews 4.9 stars

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)