Magic

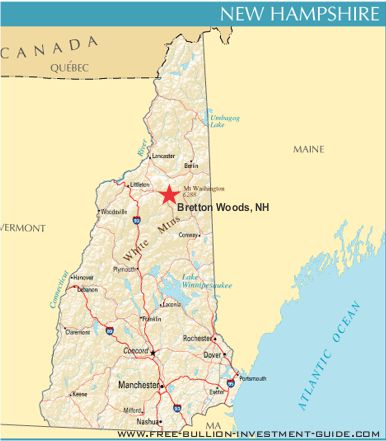

What Markets Traders hear when the Fed Speaks

(plus) Gold & Silver

Weekly Review and Outlook

Originally Posted on 12/11/2016 @7:44pm

Last Edited on 12/15/2016 @7:22pm

by Steven Warrenfeltz

In this week’s intro, I’m going to give you a satirical view of how ‘it seems’ the markets interpret the Federal Reserve.

When

I was growing up, both my parents worked all the time, so until I was

about 11 or 12, I had many babysitters, and one of those babysitters had two

young daughters who loved listening to Olivia Newton-John.

Every morning,

when I was dropped off at this babysitter’s house, I was told to sit

downstairs, and when the school bus came, they’d call me.

While I waited, the oldest daughter would always play Olivia Newton-John’s – ‘Magic’ over and over and over.

This same scenario repeated itself almost every morning in my 78-79 school year.

A

few days ago, I heard 'Magic' come on the radio; I decided to leave it

on because of all Olivia Newton John’s songs; it’s probably my favorite.

As

I listened to the song, I paid closer attention to the lyrics, and

realized, 'this is what markets traders hear when Janet Yellen speaks.'

The most telling lyric in the song is "I'll be guiding you."

Below is a video of the song and below that are the song's lyrics.

I put my interpretations under some lyrics (in parenthesis), but a lot of the song speaks for itself - in this frame of mind.

I’ll let you hear the song and read the lyrics and let you decide for yourself to see if you agree.

Lastly, the inspiration for Yellen's picture came from an old Howard Thurston poster, you can 'click the pic' to learn about the man who became the most famous magician of his time.

Lyrics to Magic

Come take my hand

(follow

me)

You should know me

I've always been in your mind

(we give our opinion all the time)

You know that I'll be kind

(TARP, Quantitative Easing, Operation Twist, QE Taper)

I'll be guiding you

(Fed Dot-Plot Chart, Statements, Minutes, Outlook)

Building your dream

Has to start now

There's no other road to take

(Only look to us for guidance)

You won't make a mistake

I'll be guiding you

You have to believe we are magic

Nothin' can stand in our way

You have to believe we are magic

Don't let your aim ever stray

And if all your hopes survive

Your destiny will arrive

I'll bring all your dreams alive

For you

From where I stand

You are home free

The planets align so rare

(we think we can control the

business cycle)

There's promise in the air

And I'm guiding you

Through every turn

I'll be near you

(when you pay for anything)

I'll come anytime you call

(market falling, crash, crisis)

I'll catch you when you fall

(TARP, Quantitative Easing,

Operation Twist, QE Taper)

I'll be guiding you

You have to believe we are magic

Nothin' can stand in our way

You have to believe we are magic

Don't let your aim ever stray

(don’t listen to those who doubt us)

And if all your hopes survive

Your destiny will arrive

I'll bring all your dreams alive

For you

Week in Review

Last week was full of mixed messages as I thought it might in last week’s post – seen here.

Fundamentally, on Monday, for gold, silver not much happened after Italy voted against Prime Minister's Renzi’s referendum.

The Euro had a brief dip, but because it has been oversold for the last few weeks, it came back up in price.

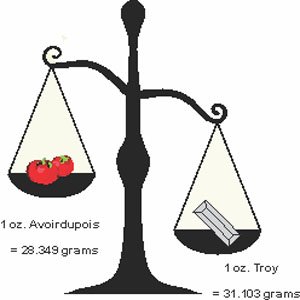

The Euro’s movement is relevant to gold and silver's movement because they all generally move in the opposite direction of the dollar.

Then on December 8th, Mario Draghi, the ECB President, announced that the European Central Bank would ‘taper’ their quantitative easing in March of 2017, instead of stopping it completely, this caused the Euro to weaken and drop in price; the same happened to gold and silver.

The Fed - 800lb. Gorilla

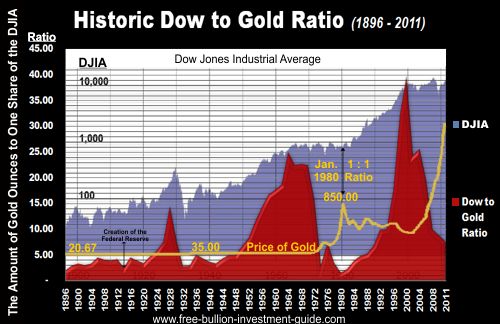

The Fed - 800lb. GorillaPlus, market traders in the U.S. and around the world are waiting on the Federal Reserve or 800lb. Gorilla to announce what they are going do on Dec. 14.

Just about everyone, including me, expects them to raise rates on December 14th, by a quarter percent; they will also give their outlook for future rate hikes.

It’s anyone’s guess into how many more rate hikes they think there will be coming in the future, but I believe it is possible that we will see rates drop before we see another rate hike, after this one.

For gold and silver, we will only see a rise in price if the Federal Reserve surprised everyone by 'Not' raising interest rates

In the charts below, the falling expanding wedges are only getting bigger as the precious metals drop, which is a sign for a positive January.

GOLD

In gold’s chart, the falling expanding wedge, a bullish indicator, continues to grow.

Both of gold’s bottom indicators are moving in oversold territory, but with the Fed’s announcement coming this week, we’ll probably see more of the same movement in the precious metal; down.

Charts provided courtesy of TradingView.com

Gold's Price Resistance &

Support Levels

Gold's Resistance Level

$1225.00

$1200.00

$1180.00

Gold's Support Levels

$1150.00

$1125.00

$1100.00

SILVER

For most of the week, silver’s inverted head and shoulders pattern and its industrial properties helped to give it support as the market continues to move up in the euphoria.

But, like gold, silver’s price is also under the influence of the Federal Reserve’s announcement on Wednesday the 14th; until that announcement is made it will continue to put downward pressure on its price.

Charts provided courtesy of TradingView.com

Silver's Price Resistance and

Support Levels

Silver's Resistance Level

$17.75

$17.25

$17.10

Silver's Support Level

$16.40

$16.25

$15.90

US DOLLAR

Like silver, the U.S. Dollar’s head and shoulders pattern helped the dollar move down at the beginning of the week until Mario Draghi made the announcement that they would continue their QE after March 2017, although they say they will be spending less.

Plus, all eyes and ears are pointed toward Federal Reserve to find out what they will say on Wednesday, which is the biggest reason the U.S. Dollar ended the week in the positive.

But, there is a bearish pattern forming in the U.S. Dollar, it too is an expanding wedge, but a rising one, which isn’t a good sign, time will tell how all these expanding wedges play out.

Charts provided courtesy of TradingView.com

U.S. Dollar's Price Resistance and Support Levels

U.S. Dollar's Resistance Level

$103.00

$102.00

U.S. Dollar's Support Level

$101.00

$100.20

Other pages you may like...

|

|

|

|

|

|

Thank You for Your Time!

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

February 2026

All Articles were Originally Posted on the Homepage