Homepage / Archived News or Quarterly News / 3rd Quarter 2014

3rd Quarter - 2014

Charts, Bullion News & Commentary

Learning from the past is a useful way to judge price movement in the future when investing in any market.

This page provides a comprehensive overview of gold, silver, platinum, and palladium during the quarter.

For each of the precious metals, you'll find charts. Below the charts, you will find Bullion News Headlines from the 3rd Quarter of 2014. Every news link was originally posted on this guide's homepage.

The quarterly charts provide insight into the volatile precious metals markets, while the news below the charts provides a deeper understanding of the fundamentals influencing these markets.

The charts below are provided courtesy of

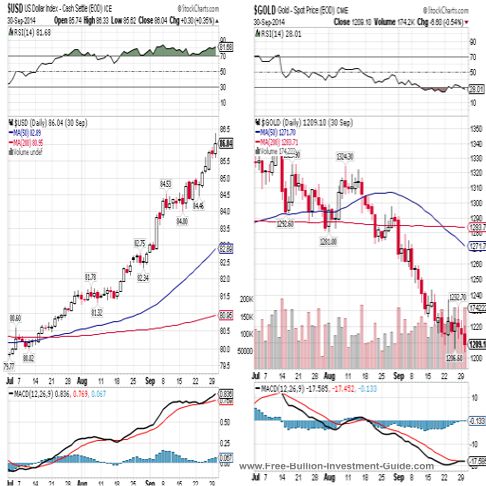

USD / Gold Price Charts -

3rd qtr. 2014

The two quarterly charts below are a side-by-side comparison of the U.S. Dollar Index and the Gold Price, they typically move in opposite directions.

Watching what the U.S. Dollar is doing is often a way to judge what Gold will do; this isn't always the case, as you can see in the charts below, and if you check the two charts today, it is likely the two are moving in separate directions.

Bullion News

Gold Price Charts - 3rd qtr. 2014

Gold Price Summary

The price of gold during the 3rd quarter of 2014 generally followed one direction: down.

In the quarterly chart (below), the first breakdown in price is pointed out by the shaded horizontal purple bar.

The 'Golden cross' at the beginning and the 'Death cross' near the end of the quarter proved to be insignificant indicators of gold's price movement.

You can see in the highlighted purple bar at the beginning of the quarter that the RSI and MACD show that the gold market had reached the top and was about to change direction. In addition, the RSI and MACD also showed late in the quarterly chart that a positive change in gold's price was imminent.

(continued...)

Gold Price Chart (July 1st, 2014 - September 30th, 2014)

Bullion News

Gold Price Chart (July 1st, 2013 - September 30th, 2014)

Gold Price Chart (October 1st, 2011 - September 30th, 2014)

Bullion News

Gold Price Summary (continued)

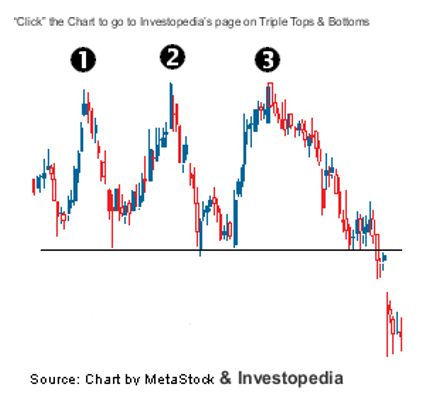

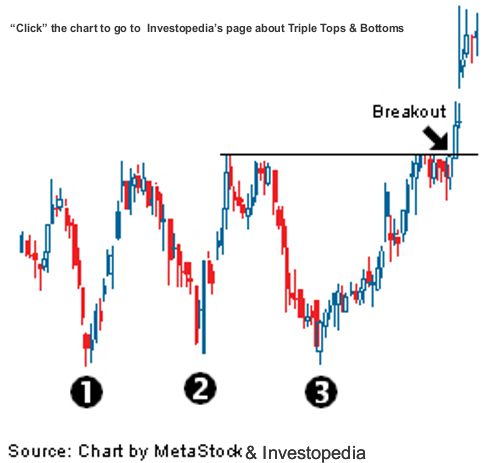

In conclusion, it looks like the gold chart is making either a triple top or a triple bottom; it depends on whether the price holds above its support level of $1180.00 a troy oz. Only time will determine which way Gold will go.

(Click either chart below to go to Investopedia's page on Triple Tops and Bottoms to understand them better)

Source: Triple Top & Triple Bottom Charts provided courtesy of Investopedia

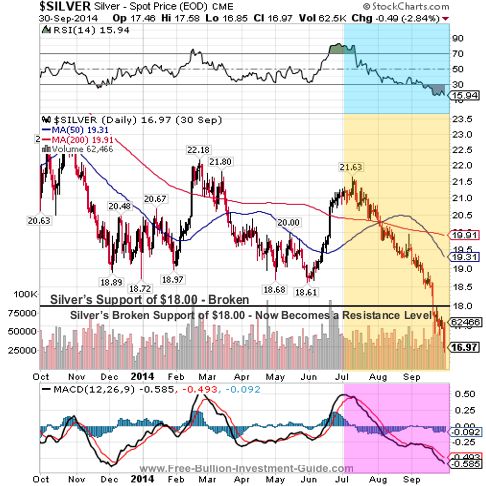

Silver Price Charts - 3rd qtr. 2014

Silver Price Chart (July 1st, 2014 - September 30th, 2014)

Bullion News

Silver Price Summary

Like gold, silver's price fell consistently during the 3rd quarter of 2014.

The "Golden Cross" in the quarter was a false indicator of the price of Silver, and the 'Death Cross' was simply a late indication of the direction of Silver's price.

Both the RSI (Relative Strength Indicator) and the MACD showed that silver was overbought at the beginning of the 3rd quarter of 2014; in addition, both indicators showed that the price of silver was going to change direction and fall in price.

The big surprise for Silver's Price in the 3rd quarter of 2014 was the Broken Support Price level of $18.00 during the quarter. This broken support level for Silver has now become a resistance level, creating a new hurdle that Silver's price must overcome to demonstrate positive movement to investors.

Silver Price Chart (October 1st, 2013 - September 30th, 2014)

Bullion News

Silver Price Chart (October 1st, 2011 - September 30th, 2014)

Bullion News

Silver 10-year chart

Since Silver broke its long-standing support level of $18.00 a troy ounce, its new support holds at $15.00 a troy ounce.

The $15.00 support level was last touched by Silver in 2010, right before Silver started its move towards $49.00 a troy oz. (highlighted in the 10-year chart below)

Silver Price Chart (January 1st, 2004 - September 30th, 2014)

Silver 10year chart provided by TradingView.com

Platinum Price Charts - 3rd qtr. 2014

Platinum Price Chart (July 1st, 2014 - October 30th, 2014)

Bullion News

Platinum Price Summary

Last quarter, the price of Platinum was moving higher, and its price was getting squeezed in a negative rising wedge pattern. The squeeze in the wedge broke shortly after Platinum's price briefly moved above the $1500 resistance level.

The movement in platinum's price was surprising since the metal had been rallying. There were signs that more platinum supplies were going to be coming back online after platinum miners ended their strike in South Africa. Most observers anticipated a pullback, but not to the extent of the price decrease.

Early in the quarterly chart (above), you can see that both the RSI (upper indicator) and MACD (bottom indicator) sloped downward, right after platinum's price peaked for the year.

Late in the quarter, you can see the MACD's Histogram (blue bar chart) shortening and the RSI bottoming (highlighted in the chart above), indicating that a price change is about to happen.

The MACD's Histogram measures the difference between the Signal Line (Red Line) and the Black line.

Platinum Price Chart (October 1st, 2013 - September 30th, 2014)

Bullion News

Platinum Price Chart (July 1st, 2011 - June 30th, 2014)

Palladium Price Charts - 3rd qtr. 2014

Bullion News

Palladium Price Summary

From July to late August, the price of Palladium slowly crept up to prices it hadn't seen since 2001, and then in early September, the price collapsed. However, the price of Palladium was able to hold above the levels it reached when the price was squeezed during the 1st Quarter of 2014.

Palladium was the only precious metal able to fight off the selling of precious metals until later in the quarter. In addition, as long as the U.S. dollar stays up in price, it will continue to hold the prices of precious metals down.

Palladium Price Chart (July 1st, 2014 - September 30th, 2014)

Bullion News

Palladium Price Chart (October 1st, 2013 - September 30th, 2014)

Bullion News

Palladium Price Chart (October 1st, 2011 - September 30th, 2014)

The charts above are provided courtesy of

Free Shipping on Orders $199+

3rd Quarter - 2014

Bullion News & Commentary

The Quarterly News starts with the end of the quarter articles, first.

Please note that not all of the links below work; the links are kept because the headlines still provide insight into how the markets were moving at the time.

09/30/14 - Bullion News

Money and Markets - Major Foreign Currencies Collapsing as U.S. Vs. World Policy, Growth Gap Grows!

TECHNICAL ANALYSIS : The Bullion Desk - Gold – Breakout pressure continues to build

TECHNICAL ANALYSIS : Kimble Charting - New “Deflationary Ball Game” just starting to pick up speed?

TECHNICAL ANALYSIS : CEO.CA - Is Silver Heading to $15?

Gold-Eagle - Why China Thinks Gold Is The Buy Of The Century

BullionStar - China Aims For Official Gold Reserves At 8500t

Zero Hedge - Why Is China Hoarding Gold? Alan Greenspan Explains

Contra Corner - Uncle Sam’s $8 Trillion Annual Debt Churn: Why Washington Is Pertrified Of Honest Interest Rates

VIDEO : CNBC - Santelli Exchange: 'Politics' vs. central banks

The Gold Report - Jay Taylor Urges Investors to Stay Liquid for the Coming Gold Boom

VIDEO : CNBC - Bacon Cheeseburger Index: The real inflation gauge

09/29/14 - Bullion News

TECHNICAL ANALYSIS : Market Anthropology - The Inverse Symmetry of Market Reflexivity - Gold & Silver's Inverse Symmetry with the US Dollar & the 10 Year Treasury Note

CoinNews - Gold Climbs from 2014 Low; US Mint Bullion Coins Gain

VIDEO : CNBC - Is the Fed 'in trouble'...

The Prudent Bear - The Bear's Lair: Fed policy makes spendthrifts of us all

Bloomberg - Draghi Devaluing Euro Cheers ECB as Inflation Seen Fading

The Sydney Morning Herald - Gold price: The world's wealthy are snapping up bullion

Dollar Collapse - Does Surging Demand For Gold & Silver Coins Signal a Bottom?

Bullion Vault - Gold/Silver Ratio Leading the Dollar

Shanghai Daily - New gold exchange aims to catapult China into ranks of global bullion centers

Bullion Star - Chinese Gold Demand Explosive

International Man - The Mexican Libertad: The Currency Solution?

GoldSeek - Russia’s Gokhran Buying Gold Bullion In 2014 and Will Buy Palladium In 2015

Sovereign Man - No, America isn’t Communist. It’s only 70% Communist.

09/28/14 - Bullion News

GoldSilverWorlds - Gold Investors Weekly Review

Bullion Vault - Cash Starved Mining Stocks Go Bang

CHART : ReadtheTicker - SP500 down hard, the real reason

Contra Corner - Peak Debt—-Why The Keynesian Money Printers Are Done by David Stockman

VIDEO : Peak Prosperity - Demographics - Crash Course Chapter 15

Bloomberg - Dollar Heads for Best Month Since 2012 as Central Banks Diverge

MoneyNews - Fed's Fisher: US Risks Falling behind Curve on Inflation

AUDIO : McAlvany Weekly Commentary - Too Big NOT to Fail!

Profit Confidential - The Flight Back Down to Reality Ahead for the Rich

Forbes - Transacting in Gold Can Shaft The IRS

Sovereign Man - Yet another reason why FATCA is utterly retarded

09/26/14 - Bullion News

Gold Chat - Gold bottom update

GoldReporter - German Bullion Dealers Report Major Increase in Sales

BullionStar - The Workings Of The Shanghai International Gold Exchange, Part One Global Financial Intelligence - THE (BIG) PROBLEM OF HAVING A CENTRAL BANK - Google Translation Link

The Deviant Investor - Gold, Silver, Fish Lines, and Rhino Horns

The Telegraph - Cheapest way to buy Royal Mint gold? Not from the Royal Mint

New York Post - Tapes showing meek oversight of Goldman are about to rock Wall Street

MineWeb - LBMA names Citigroup as gold/silver market maker

TECHNICAL ANALYSIS : Kimble Charting - Bill Gross & Pimco fund sending kiss good-bye message?

The Independent - The Seaton Down Hoard: Amateur metal detector uncovers 22,000 Roman coins

09/25/14 - Bullion News

Future Money Trends - Has The Gold Price Drop Run Its Course?

TECHNICAL ANALYSIS : DecisionPoint - GOLD: Possible Triple Bottom

AUDIO : FSN - Danielle Park – Debt Fueled “Growth” Running Out of Gas

Reuters - U.S. Mint American Eagle gold coin sales set to rise sharply in Sept

SLIDESHOW : Visual Capitalist - A Year’s Extraction of Metal Shown Next to Landmarks and Cities

Reuters - Gold Price Seen Near Tipping Point for Mine Cuts, Closures

BDlive - China Seems to Appreciate True Importance of Gold

TECHNICAL ANALYSIS : SOLARCYCLES - Increasing Deterioration

Trader Dan's Market Views - Stock Market Weakness Brings Safe Haven buying into Gold, Bonds

REWIND : The Washington Post - What if a typical family spent like the federal government? It’d be a very weird family.

The Bullion Desk - Platinum and Palladium Struggle Despite Positive Fundamentals

Profit Confidential - A Rational Look at Gold

Nanotechweb - Gold NPs Kill MDR Bacteria

Affiliate Ad

09/24/14 - Bullion News

TECHNICAL ANALYSIS : SafeHaven - Strong Dollar Pressures Gold

Market Watch - Opinion: Gold May Rebound as Extreme Bearishness Sets In

Coin Update - RCM Introduces “Maplegram25? Innovative One Gram Gold Bullion Coin Product

Monetary Metals - A Monetary Cancer Metastasizes in Europe

GoldandSilverWorlds - Gold Price Outlook - Bullish/Bearish Factors

Bloomberg - BofA checks Venezuela’s gold vault to calm investors

SRSrocco Report - Shanghai Silver Stocks Continue To Fall As Silver Eagle Sales Explode Higher

Market Realist - Everything You Need to Know About Gold and Gold Companies (Parts 1 - 20)

Gold-Eagle - How Much Gold Is Really Out There? ...Not Enough!

CHARTS : Advisor Perspectives - NYSE Margin Debt Drifts Higher in August

Zero Hedge - The Chart No Fed-Loving Equity Bull Wants You To See

Money and Markets - More on Gold and the World Fire That’s Brewing...

The Strait Times - "Asia's first" gold-dispensing ATMs installed in Singapore

09/23/14 - Bullion News

TECHNICAL ANALYSIS : Gold-Eagle - The Golden Kiss

The Bullion Desk - Precious metals under pressure but shorts looking stretched

Market Realist - Gold dilemma: Should you invest in physical gold or gold stocks?

Resource Investor - Gold American eagle coins soar

TECHNICAL ANALYSIS : The Next Big Trade - Gold and Silver are Dramatically Oversold...But May Fall Further

The Deviant Investor - Silver, Gold, Debt & Taxes

TECHNICAL ANALYSIS : TheGoldandOilGuy - Leading Sectors Breaking Down – Internet & Social Stocks

Market Anthropology - Dollar Hollers - What does it say?

MoneyBeat (WSJ) - Here Are the Top 20 Biggest Buybacks

The New York Times - Charles Plosser and Richard Fisher, Both Dissenters, to Retire From Fed

Business Insider - 19 Of The Most Expensive Substances In The World

09/22/14 - Bullion News

The Next Big Trade - Notes on Carnage in Gold and Silver

The Gold Report - Tell Us, Christos Doulis, Can Gold Act as a Safe Haven Again?

INFO~GRAPHIC : The Austrian Insider - Keynesian vs. Austrian Economics

TECHNICAL ANALYSIS : Kimble Charting - Silver- Why the $15 Level Looks Like a Good Buy Point.

Bullion Vault - Gold Bullion "Seeking Base, Nears $1180 Double-Bottom" as Silver Bears Outweigh Physical Bulls at 4-Year Lows

Sovereign Man - Silicon Valley insider: “If 2000 was a bubble factor of 10, we are at an 8 to 9 right now.”

arabian money - US households most heavily invest in stocks since 2000

Blanchard - Fitch warns of “a negative shock that erodes the role of the U.S. dollar”

GoldCore - China Moves To Dominate Gold Market With Physical Exchange

The Independent - Royal Mint puts its gold bullion up for sale

VIDEO : Bloomberg - Silver Presents a Great Buying Opportunity: Horwitz

CNBC - Billionaires are hoarding piles of cash

Billionaire - Smart Gold ATMs Get Singapore Lift-off

09/21/14 - Bullion News

The Daily Bell - Weekly Gold Trend Analysis: King Dollar Squeezes Gold

VIDEO : Peak Prosperity - Assets & Liabilities - Crash Course Chapter 14 - Why the US is deeply insolvent

TECHNICAL ANALYSIS : Olivier Tischendorf (Twitter) - SILVER Monthly chart $15 area 'Price Magnet' analysis.

VIDEO : TruthNeverTold - Silver Warning Of Market Crash October?

South China Morning Post - Established rivals may keep Shanghai trade zone's gold exchange in check

BullionStar - Chinese Gold Demand 41t in week 37, 1331t YTD

TECHNICAL ANALYSIS : Rick Ackerman - Technical Analysis for Gold and Silver Futures - Silver & Gold Analysis starts @ 12:27 mark

Bloomberg - Gold Bulls Extend 2014 Exit as Slump Erases $6.7 Billion

Seeking Alpha - Afraid Of The Plummeting Gold Price? Russia Certainly Is Not

MineWeb - The Future for Gold is Physical

Trader Dan's Market Views - Speculators Remain Net Long as Gold Drops Lower

VIDEO : CNBC - Here a bubble, there a bubble: Ol' Marc Faber

Wealth Daily - Buy Gold to Hedge Against Currency Manipulation

Kid Dynamite - The Fine Print in the FOMC Docs That You Probably Weren’t Aware Of...

09/19/14 - Bullion News

Daily Resource Hunter - Why the Federal Reserve Will Launch Another Round of QE

INFO~GRAPHIC : Visual Capitalist - Missing Money: Uncle Sam’s Accounting is Suspect

Midas Letter - The Mother of all Bubbles and Other Unpopular Realities

CHARTS : Advisor Perspectives - Market Cap to GDP: The Buffett Valuation Indicator

PLATA - The Tribute the World Pays to the Empire

Bullion Vault - Bad News for Gold from the Strong Dollar

GoldMoney - The End of Tapering and Government Funding

Forbes - Amazingly The US Mint Loses Money On Making Money

CoinNews - American Silver Eagle Production at West Point Mint

The Globe and Mail - The bullish case for gold prices? Add me to the skeptics

NewsMax - The Growing Popularity of Gold IRAs

MineWeb - At least 15 firms seeking to run new London gold fix

09/18/14 - Bullion News

TECHNICAL ANALYSIS : CEO.CA - Double-Bottom for Gold?

MoneyBeat (WSJ) - If Scotland Splits, What Happens to the Gold?

Gold Chat - Gold bottoming?

TECHNICAL ANALYSIS : Gold Prices - Monetary Policy Weighs on Precious Metals

The China Post - Zimbabwe signs US$3 bil. platinum mining deal with Russian gov't and investors

The China Money Report - China opens gold market to foreigners, seeks to block price fixing by Western Banks

South China Morning Post - Hong Kong secures nod for Qianhai metal vault

TECHNICAL ANALYSIS : The Deviant Investor - Silver: A Collapse and a Rally

Sprott Thoughts - Eric Sprott: Get Your Money ‘Out of Banks and into Something Tangible’

The Telegraph - Super-rich rush to buy 'Italian Job' style gold bars

Profit Confidential - Should You Buy Into the U.S. Dollar Rally?

Numismaster - Loyal buyers buoy 5-ounce silver coin series

09/17/14 - Bullion News

Market Watch - To see inflation, you have to open your eyes

Financial Sense - Can Gold Finally Recover?

CHART : GoldBroker - US Debt vs Gold

AUDIO : McAlvany Weekly Commentary - Volatility, Volume & Seasonal Vulnerability & Gold - Is an Insurance Investment for Your Money

South China Morning Post - China may boost gold reserves amid asset imbalances

AUDIO : MisesEconomicsBlog - Thornton: ‘US-Russia political tensions will speed up demise of dollar’

Zero Hedge - End Of Empire - The 'De-Dollarization' Chart That China And Russia Are Banking On

Bullion Vault - Shanghai Gold Trading: The Real Challenge to London

TECHNICAL ANALYSIS : Kimble Charting - Gold bugs index is about to breakout from this pattern

Peak Prosperity - The Dollar May Remain Strong For Longer Than We Think

Market Watch - Scotland ready to call London’s bluff over sterling

VIDEO : Perth Mint Blog - New Australian Kangaroo Gold Bullion Coins Available Now

TECHNICAL ANALYSIS : Don't Ignore This Chart - Would a Russell 2000 Death Cross Really be Bad?

09/16/14 - Bullion News

TECHNICAL ANALYSIS : GoldSilverWorlds - Cycle Analysis Supports Both Bearish and Bullish Views On Gold and Silver

VIDEO : U.S. Global Funds - Frank Holmes : All Eyes Are On Yellen

VIDEO : CNBC - Sterling to plummet if Scotland votes Yes

Bloomberg - Scotland Gold Demand Seen Rising Before Independence Vote

HEXAPOLIS - Electronic skin made from gold nanoparticles and polymer, can detect breast cancer

VIDEO : Bloomberg - India Gold Imports Up 176% on Year

Reuters - China advances gold exchange launch, Singapore delays contract

AUDIO : Silver Investor - David Morgan interviewed by Butler On Business

TECHNICAL ANALYSIS : Financial Sense - Last Stand Approaching for Gold

PD&D - Is 3D Printed Gold the Future of Jewelry?

Bullion Vault - Switzerland's Gold Vote

TG Techno - Research on how Gold Nanoparticles can destroy Super Bacteria featured on Popular Mechanics

09/15/14 - Bullion News

TECHNICAL ANALYSIS : CEO.CA - US Dollar Most Overbought Since 2010

NEXT BIG TRADE - U.S. Dollar Due for a Rest

Money Morning - The Real Reason the Federal Reserve Is Afraid to Raise Interest Rates

The Telegraph - Anxious Scottish investors buying gold

Business Insider - Europe's Biggest Bear Warns The Pound Could 'Plunge Into The Abyss' If Scotland Goes Independent

The Bullion Desk - Real Rates, Gold & the ‘know nothing’ Fed – ADRIAN ASH

The Bullion Desk - CONTRIBUTOR STORY: Real Rates, Gold & the ‘know nothing’ Fed – ADRIAN ASH

Shanghai Metals Market - CME to Launch Asia Gold Contract as Race for Pricing Power Heats Up

TECHNICAL ANALYSIS : The Deviant Investor - The Silver Sentiment Cycle

Kingdom Economics - Jim Rickards warnings – mostly right on!

International Man - Babson’s Warning

Houston Chronicle - Using Gold to Fight Cancer

Greek Reporter - Greek Man Takes Gold Coins to The Grave

09/14/14 - Bullion News

Market Watch - Low volatility is a sign of high risk-taking, BIS official says

TECHNICAL ANALYSIS : SOLARCYCLES - Gold Market Update

INFO~GRAPHIC : Zero Hedge - Inflation Watch: How Much $1 Used To Get You!

AUDIO : FSN - John Rubino – Real Interest Rates and Future Chaos

CoinWeek - As Legal Issues Mount, Merit Gold Customers Seek Relief

The Bullion Desk - GOFO – One-year gold at widest contango in over a year

BullionStar - Chinese Gold Demand 39t In Week 36, YTD 1290t

VIDEO : Peak Prosperity - Debt - Crash Course Chapter 13

The New York Times - Student Loan Debt Burdens More Than Just Young People

TECHNICAL ANALYSIS : Kimble Charting - Junk bond fund repeating 1999 & 2007's pattern?

09/12/14 - Bullion News

McClellan Oscillator - Gold - Watch the €1000 Level

CEO.CA - Gold at Lowest Sentiment Levels Since June 2013 Bottom

CHARTS : GoldBroker - Gold vs Currencies of Countries in Crisis

Economic Noise - Fiat Currency vs. Gold

GoldMoney - Market Report: Strong dollar undermines precious metals

The New Zealand Herald - Nano-tech boom looming, says Akl scientist

OilPrice - Here's A New Update in India's Gold Saga

The Sovereign Investor - Next Week’s Fed Meeting Could See a Rise in the Dollar

Scrap Monster - Gold Bullion at 8-Month Low on "Weak" Demand as China "Gains Pricing Power"

MineWeb - South African gold, pgm, diamond and copper outputs down sharply

09/11/14 - Bullion News

TECHNICAL ANALYSIS : DailyFX - US Dollar Topping Warning Remains, SPX 500 Finds Interim Support

The Bullion Desk - Comex burdened by weak investor demand, persistent dollar strength

OPINION : Market Watch - Gold may be a ‘buy’ as investors turn ever more bearish

The Hindu - How Key Commodities Swing with Currency Movements

GoldSeek - China Holds “Gold Congress” - Positioning Itself As Global Gold Hub, “In China, Gold Is Money”

Bloomberg - Gold Trading to Begin in FTZ as CME Plans Futures in Hong Kong

Daniels Trading - Gold futures fall; CME launches new contract with Hong Kong

AUDIO : FSN - Gary Christenson – What Is Gold Worth?

Market Watch - American credit-card debt hits a post-recession high

Economic Policy Journal - The "There is No Inflation" Report: Rents Are Up Over 8%

TECHNICAL ANALYSIS : SOLARCYCLES - 10 Indicators Cross-Referenced

Record-Courier - Feds chase treasure hunter turned fugitive Thompson

09/10/14 - Bullion News

TECHNICAL ANALYSIS : Acting Man - Gold Gets Whacked – What Happens Next?

AUDIO : McAlvany Weekly Commentary - Money Printing = Inflation: ALWAYS!

INFO~GRAPHIC : Visual Capitalist - How to Test for Fake Gold and Silver

Zero Hedge - Platinum Fixing Under The Microscope

Forbes - CME Enters Race For Gold Pricing Benchmark After Winning Silver Fix Bid

Bloomberg - Platinum Volatility Near Lowest Since 2005 in New York

VIDEO : GoldBroker - Interview with Gary Christenson: Gold Prices in 3 Waves, Silver Is Inexpensive & The Stock Market/Gold Relationship

Zero Hedge - A Historic First: Bank Of Japan Monetizes Debt At Negative Rates

The Atlantic - Article about Private Debt makes Better Case showing All Debt is Bad, and it's Not Getting Better

Scrap Monster - Gold Bars and Biscuits worth over Rs 1 Crore seized in Indian Airport

MINING Global - World Gold Council: Can Gold Be Used to Solve Certain Environmental Concerns?

09/09/14 - Bullion News

U.S. Global Investors - Strong U.S. Dollar Weakens Gold Prices this September

Daily Pfennig - CME To Ban Manipulative Trading Practices...

GoldBroker - Gold Demand - Jewellery vs Investment

TECHNICAL ANALYSIS : DailyFX - Gold Drops to Three-Month Low, US Dollar Sets New 2014 High

Perth Mint Blog - 2015 Australian Kangaroo Gold Coins To Be Released Early

MineWeb - Goldcorp CEO expounds on Peak gold and $900 gold price

TECHNICAL ANALYSIS : The Deviant Investor - Long Cycles and Trend Changes

Market Watch - Opinion: Almost no one believes the stock market will fall

AUDIO : FSN - Danielle Park – When Is A Bubble Not A Bubble?

MoneyBeat (WSJ) - Senators Say Billion-Dollar Settlements Not Enough Punishment For Banks

csinvesting - A Bear and a Value Investor Throw in the Towel

TECHNICAL ANALYSIS : SOLARCYCLES - Short Term Clues

nanowerk - The Potential for Laser Nano-Surgery of Cancer

kirotv - Top Five Best Designed Platinum Coins

09/08/14 - Bullion News

TECHNICAL ANALYSIS : CEO.CA - Gold’s Last Stand

CoinNews - 2015 America the Beautiful Quarters and Coin Design Images

Casey Research - Hold, Fold, or Be Bold?

International Man - How Empires End

Reuters - Perth Mint's silver sales hit 7-month high in August

CHART : Perth Mint Blog - Monthly Sales – August 2014

TECHNICAL ANALYSIS : DailyFX - Market Updates on U.S. Dollar, Gold, S&P 500 and Oil

Reuters - U.S. Mint to stop 2014 platinum Eagle coin sales after Oct 1

Bloomberg - From Chocolate to Beer, Shrinkflation Hits the Supermarket

Zero Hedge - Obama's Former Chief Economist Calls For An End To US Dollar Reserve Status

Nomi Prins - The People vs. Federal Bank Settlements and Liquidity Rules

JCK - Ancient Roman Jewelry Hoard Found Under U.K. Department Store

09/07/14 - Bullion News

TECHNICAL ANALYSIS : GoldSilverWorlds - Gold – Contradictory Technical Indicators In Play

COMMERCIAL : Taco Bell - If Grandpa Knew the True Value of His Silver Dollar, He Would Know, He Could Get More Than a Dozen Tacos with it.

Dollar Collapse - Real Interest Rates and Future Chaos

Sovereign Man - Everything that’s wrong with banking summed up in one bonehead advertisement

Wealth Daily - Russia Welcomes Executive Order NCO1

BullionStar - Another Week Of Strong Gold Demand In China

Silver remains scarce in Shanghai

CoinNews - What I Told Alan Titchmarsh About $1920 Gold Prices

CoinNews - Great Sand Dunes National Park Quarter Launch Ceremony Highlights

MineWeb - Gold monetisation scheme aims to treat gold as currency in India

SunSentinel - Treasure hunters uncover bling and beer cans

09/05/14 - Bullion News

Numismaster - Gold Coins the Best Buy Right Now?

CoinNews - Gold Declines Slightly, US Mint Bullion Coins Climb

TECHNICAL ANALYSIS : TheGoldandOilGuy - The Truth About Where Gold Price Is Headed

TECHNICAL ANALYSIS : Seeking Alpha - Gold And Silver Testing 3-Year Lows As Palladium Hits New Highs

GoldMoney - Market Report: Short-sellers driving prices

SafeHaven - Gold Needs to be Rising in All Currencies!

HealthUnlocked - Nanotech Methods May Be the Future of Cancer Treatment

Daily Reckoning - Hold Onto Your Gold: A Supply Shortage is Coming

U.S. Global Investors - Remember, Remember, Gold in September

MoneyBeat (WSJ) - CME, Thomson Reuters Seen as Favorites to Manage London Gold Fix

The Bullion Desk - LME confirms cancellation of gold, silver forward curves from Sept 22

Reuters - Asia Gold-Buying picks up as price drops; Indian festive demand eyed

BullionStar - Does The WGC Understand The Chinese Gold Market?

09/04/14 - Bullion News

TECHNICAL ANALYSIS : Safe Haven - Gold and Silver Market Update

EverBank - Daily Pfenning : A Day Of Central Bank Meetings

MoneyBeat (WSJ) - How the ECB Finally Learned to Be Like the Fed

CEO.CA - The Central Banks Aren’t Done Yet

Gold and Silver Blog - Silver American Eagle Bullion Coin Sales in Summer Slump

Kitco - Gold Pressured by Soaring U.S. Dollar Index; U.S. Jobs Data Next Up

VIDEO : Gordon T Long - MACRO ANALYTICS - Special Guest: Egon von Greyerz

INFO~GRAPHIC : Visual Capitalist - A Forecast of When We’ll Run Out of Each Metal

GoldSilverWorlds - Silver’s Value In 3-D Printing And Curing Cancer

The Deviant Investor - Gold Model Projects Prices From 1971 – 2021

Plata - How the Dollar Will Die

CHARTS : Zero Hedge - Obviously Not A Bubble

arabianmoney - Goldman Sachs is the world’s worst gold forecaster so go long when they say short

Affiliate Ad

09/03/14 - Bullion News

TECHNICAL ANALYSIS : DailyFX - Gold Slides to Three Month Low as US Dollar Accelerates Upward

INFO~GRAPHIC : Gold-Eagle - Gold History and Mining in the USA

AUDIO : McAlvany Weekly Commentary - Gold & the Real Value of an Asset

Mises Economic Blog - Finally, the Fed Blames Itself

VIDEO : CNBC - Santelli: All about central banks Thursday

The Gold Report - How is Doug Casey Preparing for a Crisis Worse than 2008? He and His Fellow Millionaires Are Getting Back to Basics

USA Today - You can't have solar without silver

Kimble Charting - King Dollar at 11-year resistance, 77% bulls

Rick Ackerman - A Warning to Those Grown Bored with Gold

King5 - The New Orleans Mint

TECHNICAL ANALYSIS : SOLARCYCLES - Last 30 Years

The Sovereign Investor - Why Raising the Minimum Wage Will Increase Inflation and Hurt the Economy

09/02/14 - Bullion News

TECHNICAL ANALYSIS : NuWire Investor - Dark Clouds for Gold

NuWire Investor - Gold vs The US Dollar

VIDEO : Technical Traders - Chris Vermeulen's Technical Outlook on Stocks, Gold, Miners, Corn, and Oil

Sovereign Man - The morning after: What happens when a government destroys its currency

Martin Armstrong - Will Gold Still Go to $5000?

AUDIO : FSN - John Rubino – Imagine a World Without Central Banks and Fractional Reserve Banking

Daily Reckoning - Preserve Your Wealth in the Face of Financial War by James Rickards

South China Morning Post - Chinese lenders boost precious metals stock amid rising demand

BullionStar - Chinese Weekly Gold Demand Highest Since February

Reuters - Gold imports, premiums to jump on festive demand - top refiner

SRSrocco Report - The Great U.S. Retirement Asset Bubble vs Physical Gold Investment

The Daily Bell - Don't Believe Government About Price Inflation

The Deviant Investor - Tabloid Version of Financial and Political News

Money and Markets - Buying on Margin? Here’s the Risk/Reward

SilverLunar - PAMP Lunar Calendar Series: 2015 Year of the Goat

08/31/14 - Bullion News

TECHNICAL ANALYSIS : DailyFX - Gold Jumps to One-Week High as SPX 500 Chart Setup Warns of Pullback

VIDEO : FXEmpire - Technical Analysis : Gold's price chart says to wait and see what happens...

VIDEO : Chris Martenson - Understanding Inflation

Market Watch - Europe needs to stop the insanity

Seeking Alpha - Gold's Headwinds Now Starting To Fade - Look For Higher Prices Ahead

Ludwig von Mises Institute - The Myth of the Unchanging Value of Gold

TECHNICAL ANALYSIS : SOLARCYCLES - Last Trading Day Of August

Profit Confidential - History Repeats: Car Loans to People Who Don’t Qualify?

The Mess that Greenspan Made - Generation “X” = Generation “Debt”

Sovereign Man - 422% increase in price to leave the Land of the Free

08/29/14 - Bullion News

The Bullion Desk - No Recovery – What does it mean for Bullion?

Financial Sense - James Grant: Two Alternative Outcomes From Fed Policy – Much Higher Inflation or More Money Printing

VIDEO : Kitco - Technical Analysis : Gary Wagner Charts Gold's Next Possible Move...

PDF : Best Minds Inc. - A History of Unlimited Money: Learn From It or Repeat Its Mistakes

Silver Coins Today - Great Sand Dunes 5 Oz Bullion Coins Debut, Lead Sales

Bullion Vault - "Buy Gold Now" Says the September Average

Bloomberg - Palladium Rises to 13-Year High on Russia Supply Concerns

GoldSilverWorlds - Should Retirement Plans For Individuals Hold Precious Metals And How?

BullionStar - Precious Metals Markets: China vs US

VIDEO : CNBC - Fed is now in 'a bind'

TECHNICAL ANALYSIS : King One Eye - Updated Dollar Chart -- The Greenback Bumps Its Head

CoinNews - Assaying Gold at the West Point Mint

The Guardian - The joy of metal detecting – it’s not just about the treasure

08/28/14 - Bullion News

ThinkAdvisor - Silver Pricing Change Takes Effect; Other Metals to Follow

VIDEO : Bloomberg - Why September Should Be Glowing for Gold

VIDEO : GoldSwitzerland - Alasdair Macleod - “The Three Biggest Reasons to Invest in Gold"

Bullion Vault - China Leads "Strong Recovery" in PV Silver Demand

VIDEO : Daily Mail - Is the Eurozone about to Start Printing Money? Markets boosted and euro falls as Draghi hints Europe will launch 'Quantitative Easing'

Peak Prosperity - I Blame The Central Banks

VIDEO : CNBC - Rick Santelli discusses the effect of QE on equities and the future of interest rates

REWIND : VIDEO : Glenn Beck - Understanding Gold Re-Hypothecation

TECHNICAL ANALYSIS : SOLARCYCLES - Last 18 Months

TECHNICAL ANALYSIS : Kimble Charting - Russell 2000 – Long term momentum is breaking down

Zero Hedge - This Has Never Happened Before

08/27/14 - Bullion News

GoldStockBull - CFR Recommends Policy Shift that is Very Bullish for Gold

AUDIO : Turning Hard Times into Good Times - Jay Taylor Interviews Dan Oliver - Director of The Committee for Monetary Research & Education - Interview starts at the 32:22 mark

CHART : Bloomberg - Gold Shines Most in September on Seasonal Buys: Chart of the Day

AUDIO : McAlvany Weekly Commentary - Adam Fergusson: When Money Dies * About this week’s show: Governments always indulge in inflation, Inflation destroys trust in more than money, Unlimited credit creation the new “printing.”

Zero Hedge - Another Nail In The Petrodollar Coffin: Gazprom Begins Accepting Payment For Oil In Ruble, Yuan

SRSrocco Report - Canadian Silver Maple Sales Stronger Than Last Year

VIDEO : CNBC - Rick Santelli : Fed & Monetary Velocity

Market Watch - Russian, Kazakhstan gold reserves rising: IMF

Mashable - 8 Valuable Coins That Could Be Hiding in Your Change

MINING - Abandoned Canadian mining town up for sale

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

08/26/14 - Bullion News

Juggling Dynamite - The Sucking Sounds of Extractive Thinking

TECHNICAL ANALYSIS : Gold-Eagle - Road Sign Says: Pot Of Gold Ahead

MineWeb - Is Asian gold demand really slipping so much?

CoinNews - Gold, Silver Rise; Silver Eagle Bullion Coins Top 28M

SilverLunar - Royal Mint 2015 Year of the Sheep Lunar Coin Range

CHART : Market Update - Which Countries Buy Gold - Google Translation Link

The Sovereign Investor - The Demise of American Yield

The Deviant Investor - Staring Into the Great Abyss

Bonner & Partners - Print, Dupe and Transfer

Library of Economics & Liberty - Richard Timberlake on Money

VIDEO : GoldSwiterland - Ambrose Evans-Pritchard - "I have never seen a more dangerous confluence of circumstances, or more remarkable complacency"

GoldSilverWorlds - How The Coming Silver Bubble Will Develop

by Theodore Butler

CoinDesk - Bullion Dealer Drops Credit Card Payments After Bitcoin Success

PHYS.org - Introducing the multi-tasking nanoparticle

08/25/14 - Bullion News

Got Gold Report - Why “S&P 2000? Is A Fed Manufactured Mirage: The “Buy The Dips” Chart That Says It All by David Stockman

TECHNICAL ANALYSIS : CEO.CA - What is the Gold/Silver Ratio Really Telling Us?

Wall St. Cheat Sheet - Why the Fed Should Just Let Bad Banks Die

The New York Times - Central Bankers’ New Gospel: Spur Jobs, Wages and Inflation

GoldSeek - CME Halt Electronic Gold and Silver Futures Trading Due to “Technical Glitch”

Money and Markets - Scared Money Moving FAST!

Reuters - China's net gold imports from Hong Kong fall to lowest since June 2011

Zero Hedge - What's $100 Really Worth In Each State?

INFO~GRAPHIC : Visual Capitalist - Abenomics: Japan’s Dangerous Experiment

TECHNICAL ANALYSIS : SOLARCYCLES - The Alternatives

Resource Investor - Gold Refiners Refine Refining

C&EN - Gold Nanoparticles Highlight Tumor Borders During Brain Surgery

08/23/14 - Bullion News

Rick Ackerman - The Ignorant Still Hang on Yellen’s Every Word

FOFOA - Six!

TECHNICAL ANALYSIS : Kimble Charting - Commodities Message To The World Is...

Wealth Daily - Is Palladium a Better Investment Than Gold?

AUDIO : Peak Prosperity - Lacy Hunt: The World Economy's Terminal Case of Debt Sclerosis

Korea Joongang Daily - South Korea's Government Attempts to Tap the Underground Gold Economy Underwhelms

The New York Sun - Krugman’s Kryptonite

Profit Confidential - Stock Market Fake? Economic Growth Falls to Slowest Pace Since 2009

TECHNICAL ANALSIS : SOLARCYCLES - Stock Market Update

PDD - Breakthrough in Imaging Gold Nanoparticles

Numismaster - Error coin found in change pays off big

08/22/14 - Bullion News

Financial Sense - Gold Is the Money of Kings, Debt the Money of Slaves

AUDIO : Turning Hard Times into Good - Jay Taylor Interviews - Rick Rule, Ivan Bebec, Daniel McAdams and David Jensen

TECHNICAL ANALYSIS : GoldSeek - Big Picture: Most Important

CHART : King One Eye - How About That US Dollar Rally?

Business Spectator - Gold lifts as physical demand ticks up

AUDIO : Sovereign Man - Tim Price on gold, value, and the danger of complacency

The Bullion Desk - PGM trade data sees split fortunes for platinum & palladium

VIDEO : arabian money - Palladium up 22% this year and trouncing gold and silver

SRSrocco Report - THE BANKERS REAL THREAT: Physical Silver Bar & Coin Demand

Shanghai Metals Market - Silver demand in India plunged 75% during current fiscal: IBJA

Mish's Blog - Time to Short the US Dollar? Go Long Commodities?

Market Watch - Copper's warning, gold's scolding

CoinWeek - Merit Gold & Silver No Longer Accepting Bullion Orders; Going Out of Business (Update)

SD Bullion - 4.8 star Customer Reviews

08/21/14 - Bullion News

Market Watch - Gold, Silver Bullion Coins’ ‘Fondle Factor’

GoldBroker - 777, Kondratieff, and the 2000-2021 Crisis (Part I)

GoldBroker - Massive Devaluation of Paper Money – 777, Kondratieff, and the 2015-2021 Crisis (Part II)

Ludwig von Mises Institute - Six Myths About Money and Inflation

Money and Markets - Uncertainty: What Great Buying Opportunities Are Made Of

Bloomberg - U.S. Mint Platinum Coins Bypassed in Rush for Gold

AUDIO : SafeHaven - Shanghai Gold Exchange and Other Topics

TECHNICAL ANALYSIS : Kimble Charting - King Dollar Is Nearing 11-Year Resistance, Sentiment Getting Lofty!

TECHNICAL ANALYSIS : Market Anthropology - Breaking the Banks & Finding Gold

Bloomberg - Russia Boosts Gold Reserves by $400M to Highest Since ’93

Azonano - Analyzing Gold Nanoparticles in Cancer Cells Using Darkfield Hyperspectral Imaging

08/20/14 - Bullion News

The Sovereign Investor - Inflation, Interest Rates, and Why You Should Own Gold

CNBC - Santelli Exchange: Servicing debt

Casey Research - Silver: As Close To A No-Brainer Investment As It Gets

VIDEO : CNBC - Mob Boss Calls a Stock Bubble - He advises investing in gold and silver, but if you're thinking about the exchange-traded funds, Fuggedaboutit. He likes physical bars.

Wealth Daily - Silver in the Digital Age

Market Watch - When PIIGS fly, everything you know about euro crisis is wrong

The New York Times - Fed Dissenters Increasingly Vocal About Inflation Fears

Zero Hedge - Car Repos Soar 70% As Auto Subprime Bubble Pops; "It's Contained" Promises Fed

AUDIO : FSN - David Morgan – Palladium Prices Still White Hot

CoinWeek - The Coin Analyst: Modern World Coin Round-Up for August

TECHNICAL ANALYSIS : Kimble Charting - Gold Miners…Bullish Falling Wedge Breakout Near?

Mish's Blog - Idiot's Guide to Austrian Economics

Wall St. Daily - A Simple Hedge Against Inflation

08/19/14 - Bullion News

TECHNICAL ANALYSIS : CEO.CA - The Price of Gold has been Coiling for Weeks...

MineWeb - Is the LBMA Silver Price more transparent than the Fix? No!

VIDEO : U.S. Global Investors - Diversification and Discipline Are Key to Investing in Gold

Bullion Vault - Long-Term Gold, Starting in 1999

NuWire Investor - Allow Me to Reintroduce You to Silver and Gold

The Federalist - The Ayn Rand Dollar

Zero Hedge - Charting The Diminishing Effects Of QE

VIDEO : Gordon T Long - Macro Analytics Sub Prime Economy - Part II w/ John Rubino

South China Morning Post - Three more banks gain approval to import gold into China

BullionStar - East Asia Geared Up For RMB Gold Trading

Star Tribune - Feds in Minneapolis charge 3 coin dealers with coin fraud

CoinWeek - CFTC Confirms Its Reported Gold And Silver Market Data Is Erroneous

nanowerk - Scientists unveil new technology to better understand small clusters of atoms

08/18/14 - Bullion News

MoneyBeat (WSJ) - For Interest Rates, Low Is the New Status Quo

Market Watch - The 10.8 trillion failures of the Federal Reserve

Profit Confidential - Two Reasons Why Interest Rates Will Rise

TECHNICAL ANALYSIS : Kimble Charting - Commodities…Time To Catch A Falling Knife?

MINING - Not just the smart money getting into gold

SilverGoldWorlds - The US Gold in Fort Knox is Secure, Gone, or Irrelevant? - by The Deviant Investor

MineWeb - India Gold Smuggling Explodes YoY

Resource Investor - Indian Gold Exporting Firm Raided

VIDEO : Daily Reckoning - James Rickards : Warren Buffett And The Chinese Are Loading Up On Hard Assets

Gold-Eagle - Why Chinese Citizens Invest In Gold

Bloomberg - Shanghai Gold Exchange Said to Plan FTZ Contract for Sept

Newsweek - Magnetic Bacteria Could Help Destroy Tumors and Fight Cancer

08/17/14 - Bullion News

TECHNICAL ANALYSIS : Inside Futures - In Fiat We Trust

Investing - As The HUI Turns: A Bottom Is Formed, What Is Next?

VIDEO : Peak Prosperity - A Brief History of US Money

TECHNICAL ANALYSIS : SOLARCYCLES - New Secular Stocks Bull

Perth Mint Blog - Unveiled – The 2015 Australian Bullion Coin Program

RINF - 14 Reasons Why The U.S. Economy’s Bubble Of False Prosperity May Be About To Burst

RT - Russia seeks safe haven in gold, away from dollar and euro

Gold-Eagle - Fighting The Fed Can Be Great For Your Wealth

MineWeb - Global gold demand returning to positive long term trends

TECHNICAL ANALYSIS : SafeHaven - HUI, Gold and Silver; Fun With Monthly Charts

Dollar Collapse - Europe Is Tanking, QE Is Coming

Daily Pfennig - The U.S. Dollar: Looking Back, Looking Ahead

VIDEO : ABC News (Australia) - RIP - Robin Williams : Excellent Interview with Robin Williams on Addiction, Comedy and Acting

08/15/14 - Bullion News

MidasLetter - Liquidity Bubble: When and How Will it Pop?

South China Morning News - Silver market sets scene for new benchmarking in electronic era

AUDIO : FSN - Charles Goyette – It’s the 43rd Anniversary of Nixon’s Closing of the Gold Window

CNBC - Inflation bites into food retailers' results

MineWeb - Russia may become World No. 2 gold miner this year

GoldStockBull - BRICS Countries are Going for Gold!

Bloomberg - Palladium Nears 13-Year High as Gold Is Little Changed

08/14/14 - Bullion News

Market Watch - More Quantitative Easing to Come?

Money and Markets - The Dollar Anniversary

arabian money - Silver price steady as the London price fix ends today

MoneyBeat (WSJ) - Gold’s ‘Golden Cross’ Moment Gets Little Fanfare

TECHNICAL ANALYSIS : SafeHaven - Gold, Silver, Dow and VIX Update

VIDEO : National Geographic - California Drought Launches New Gold Rush

Profit Confidential - Where I’d Put My Money Now

Sydney Morning Herald - Gold beats oil on safe haven demand

AUDIO : GoldSeekRadio - Interview with Silver Guru - David Morgan

Wall St. Cheat Sheet - Gold Demand Is Mediocre, But Central Banks Are Still Heavy Buyers

live mint - Indian Govt hikes import tariff value on gold and silver

Scrap Monster - Festive Season Demand Impulses Jewelers to Buy Gold from Commercial Banks

Daily Mail - Gold dust that could help beat brain cancer: Tiny particles are used to carry drug into diseased cells and destroy them

Affiliate Ad

08/13/14 - Bullion News

Sovereign Man - These guys used to issue the world’s reserve currency too

The Sovereign Investor - Does Our Money Really Belong to Us?

VIDEO : Peter Schiff - Exclusive Interview: Jim Rickards & Peter Schiff Discuss Global Gold Markets

MineWeb - U.S. gold production continued its decline in May - USGS

The Deviant Investor - Black Swans on Final Approach

Phys.org - 'Trojan horse' gold nanoparticles treatment could beat brain tumors

BullionStar - Shanghai Silver In Backwardation

Bloomberg - Gold-Oil Ratio Rises to Highest Since March on Economy

CEO.CA - 4 Fundamental Reasons Gold is Still in a Super Cycle

TECHNICAL ANALYSIS : SOLARCYCLES - Market Developements...

Financial Sense - The Death (or Rebirth?) of Money: An Exclusive Interview With Jim Rickards

Daily Mail - Romanian treasure hunter finds what could be oldest forged coins in history worth £120,000 - and he's going to spend it on a new metal detector

INFO~GRAPHIC : Visual Capitalist - The Dollar Bill Deconstructed

08/12/14 - Bullion News

INFO~GRAPHIC : Visual Capitalist - Currency Wars: A Race to the Bottom

VIDEO : GoldBroker - Interview with Ronald-Peter Stöferle: Monetary Tectonics and Gold

Bullion Vault - Silver vs. Gold Investing

Silver Lunar - Perth Mint 2015 Australian Lunar Year of the Goat Silver & Gold Coins Revealed

Laissez Faire - 6 Major Flaws in the Fed’s Economic Mode

CNBC - 'Perma-bear' Schiff's funds have been on a roll

MineWeb - Confused by the new London silver fix? You should be!

TECHNICAL ANALYSIS : See It Market - How ‘Expensive’ Are Stocks? Comparing Today To 2000 And 1929

Market Watch - Gold fear spike may be on its way

Wall St. Cheat Sheet - 5 Signs Americans Are Flat-Out Broke

The Telegraph - French builders 'kept buried treasure' unearthed during works on an extension

PHOTOS : MINING - Mining Trucks in Trouble

08/11/14 - Bullion News

Gold-Eagle - Hopelessly Devoted To Inflation

AUDIO : Silver-Investor - Silver Guru - David Morgan Reveals Extraordinary Drivers in Silver

Casey Research - Top 7 Reasons I’m Buying Silver Now

CEO.CA - Gold Output Is Still Falling In This Critical Center

Bullion Vault - Silver vs. Gold Investing

TECHNICAL ANALYSIS : SOLARCYCLES - Timing Major Market Peaks: Revisited

AUDIO : FSN - John Rubino – Giving Credit Where Credit Is Not Due

CHARTS : GoldBroker - Gold and Silver - The Eternal Monetary Couple

REWIND : FRONTLINE - DOCUMENTARY : VIDEO : MONEY, POWER & WALLSTREET (Episodes 1 thru 4)

i24news - Israeli Scientist uses Gold to Boost Cancer Diagnostics

Bullion Baron - Lunar Maa-aadness with 2015 Year of the Goat Coins

MoneyBeat (WSJ) - Flat Gold Prices Are Enough To Lure Investors To Gold Mining Stocks

08/10/14 - Bullion News

arabian money - Buying gold and silver now makes more sense than chasing stocks

VIDEO : Gordon T Long - Liquidity Is Not Wealth Nor Collateral

Daily Reckoning - The Safest Investments in a Dangerous World Market - by James Rickards

Wall St. Cheat Sheet - Why Gold Is Spiking (And Why You Should Buy It)

TECHNICAL ANALYSIS : Got Gold Report - Tenacious GDX - Inverted Head and Shoulders Breakout

Daily Pfennig - Is This A New Anti-Dollar Alliance?

The Sovereign Investor - Why Gold Will Rise When the Dollar Falls

BullionStar - Chinese Gold Demand 1094 MT YTD, Silver Premium At Record High

Money and Markets - Our War Forecasts Come True in Aces and Spades! Obama White House Overwhelmed! Up Next: GLOBAL OIL WARS!

VIDEO : Yahoo News - Ca-ching! Florida workers find 2,000 silver coins during home demolition

CNBC - This man's pure gold shirt is worth $213,000

08/08/14 - Bullion News

SRSrocco Report - 2014 Official Coin Sales: Silver The Big Winner

Silver Coins Today - Numismatic Silver Coin Sales Slow, Bullion Sales Surge

Bullion Vault - The Dollar, Gold & Middle East Oil

Gold Chat - JPM's 18 tonne Comex fat finger

BullionStar - HMRC And Eurostat Alter Historic UK Gold Trade Data

CHART : King One Eye - I'm flying to Prudhoe Bay -- Links & Gold Chart

Reuters - The new London Silver Price heralds a new era in precious metals benchmarks

OilPrice - Russia Bids $3 Billion To Control This "Precious" Metal

RT - Russia, China agree more trade currency swaps to bypass dollar

Acting Man - When the Money Runs Out … So Does the Empire

CHARTS : Kimble Charting - Buffett Indicator Hitting Second Highest Level in 60 Years!

CoinNews - US Mint Suspends In-Person Kennedy Gold Coin Sales

NorthEasternU - Attack Ebola on a nanoscale with Gold NanoStars

08/07/14 - Bullion News

The Telegraph - The Seven Drivers of the Gold Price

INFO~GRAPHIC : Visual Capitalist - Buying and Selling Precious Metals: What the IRS Needs to Know

CHARTS : Zero Hedge - Gold Jumps As Ukrainian Fighter-Jet Shot Down Over Donetsk

KGW - The Top Ten Most Famous Animal Coins

TECHNICAL ANALYSIS : GoldSilverWorlds - Bubble Mania: Is The Mother Of All Bubbles About To Burst In 2014?

Reuters - In cat-and-mouse game, India uncovers new gold smuggling route - smugglers have come up with innovative ways to bring in gold ranging from swallowing nuggets to hiding bars in dead cows

csinvesting - Fed Trap; Fragile by Design

Sprott Money - Massive Silver Derivatives Bail-Out Announced with New “London Silver Fix”

TECHNICAL ANALYSIS : Gold-Eagle - US Stock Market; Weekly Charts

Bullion Vault - America's Immature Recovery

Scicasts - Scientists Test a Nanoparticle “Alarm Clock” to Awaken Immune Systems Put to Sleep by Cancer

08/06/14 - Bullion News

Daily Resource Hunter - Rick Rule: This Gold Sell-off is a Normal Event in this Market

TECHNICAL ANALYSIS : GoldBroker - Gold in the Starting Blocks

Ludwig von Mises Institute - Confusing Capitalism with Fractional Reserve Banking

GoldStockBull - Gold Investors Shouldn’t Fear Rising Interest Rates: Here’s Why

AUDIO : McAlvany Weekly Commentary - Fingers of Instability

Bloomberg - Russia Sanctions Accelerate Risk to Dollar Dominance

Sovereign Man - And the next country to join the renminbi fan club is...

VIDEO : GoldSilver - Mike Maloney : World Events Mean Deflation First, Then Inflation

TECHNICAL ANALYSIS : SOLARCYCLES - Market Crashes

The Mess that Greenspan Made - Housing Market Now Clearly Rolling Over

VIDEO : TheGold&OilGuy - The US Stock Market Trend Is Technically Down

Jeweller Magazine - Platinum jewellery strikes gold in India

08/05/14 - Bullion News

Sovereign Man - Pump and Dump promoters are at it again: check out the newest scam

TrimTabs - US is Bankrupt: $89.5 Trillion in US Liabilities vs. $82 Trillion in Household Net Worth & The Gap is Growing

FOFOA - "Dirty Float"

Howe Street - Building Your Position During the Current “Precious Metals’ Grind”

Daily Wealth - Why RISING Rates Are a Screaming "Buy" for Gold...

Bullion Barron - ALERT : Fake Pamp Gold Bullion is Being Sold on eBay : Replica vs Real: 1oz Gold PAMP Bar Comparison

MineWeb - Central banks continuing to boost gold reserves

VIDEO : Cambridge House - No doubt inflation is coming; gold is answer - Jeff Clark

CNW - Royal Canadian Mint launches new "Birds of Prey" silver bullion coin celebrating the bald eagle

VIDEO : GoldBroker - Interview with Julian Phillips on Gold, Geopolitics & the Big Reset

Saudi Gazette - India accounts for 42% of Swiss gold, silver exports

BusinessWire - Oraya Therapeutics Awarded Small Business Technology Transfer Grant for Gold Nanoparticles Development

08/04/14 - Bullion News

International Man - Not Worth a Continental

Global Financial Intelligence - Backwardation REPORT: AGREE MORE GOLD OR SILVER? - Google Translation Link

TECHNICAL ANALYSIS : GoldSilverWorlds - Gold Chart – False Breakdowns And Breakouts Suggest Indecision

Money and Markets - Stocks, Gold and More: What to Do!

BullionStar - Chinese Gold Demand 1063 MT YTD

CHART : Perth Mint Blog - The Perth Mint's Gold and Silver Bullion Sales for July were Down

Bullion Vault - Silver: 3 New Tech Uses to Grow 275% by 2018

The Wall Street Journal - Why It’s Worrying That U.S. Companies Are Getting Older

The Telegraph - Investors dash for gold as markets tumble on Russia sanctions and Argentina default

NewsWise - Veterinarians Use "Gold" Nanoparticles to Deliver Cancer Treatment in Dogs and Cats

The Gold Report - John Hathaway and Doug Groh: Buy Gold Like It's 1999

SD Bullion - 4.8 star Customer Reviews

08/03/14 - Bullion News

The Sovereign Investor - Gold Prices Reveal Truth About U.S. Economy

CoinWeek - U.S. Mint Offers First Look at 2015 America the Beautiful Quarters® Designs

NDTV (India) - Swiss Gold Exports to India Rise to 42 Per Cent, Hit Rs. 50,000 Crore

The Hindu - Gold to gain from rupee weakness

AUDIO : McAlvany Weekly Commentary - The New Cold War Russia & Gold

The Daily Bell - Marc Faber on Commodity Cycles, Monopoly Central Banking and the Wealth Redistribution Craze

VIDEO : Peak Prosperity - Money Creation: Banks

TECHNICAL ANALYSIS : SOLARCYCLES - Weekend Update

Wall St. Cheat Sheet - What Gordon Gekko Got Right About Greed

08/01/14 - Bullion News

NewsMax - The Current State of the US Bullion Coin Market

- by Ed Moy

USA GOLD - The Gold Owners’ Guide to the Rest of 2014

AUDIO : FSN - Monty Pelerin – Government Is Destroying Wealth

The Deviant Investor - Gold Prices 1971 – 2014 in 3 Waves

FXStreet - Gold's Sweet Spot - Strongest Months Are August, September, November And January

Jesse's Cafe' Americain - Gold Daily and Silver Weekly Charts - Good Vibrations

SRSrocco Report - Chinese Silver Inventories Nearly 90% Depleted At Shanghai Futures Exchange

INAUTONEWS - Dark picture for the Global Auto Industry

TECHNICAL ANALYSIS : SOLARCYCLES - The Fire is Lit

Bonner & Partners - This Market Is a Titanic in Search of an Iceberg

Mish's Blog - Nonfarm Payrolls 209,000, Unemployment 6.2%, Employed +131,000

TECHNICAL ANALYSIS : Kimble Charting - Small & Mid Caps haven’t done this in 10-years says Joe Friday!

07/31/14 - Bullion News

Daily Reckoning - Why the Fed Has Declared War on Your Money

TECHNICAL ANALYSIS : Bullion Vault - Spot the Sheeple

Bullion Baron - How Safe Are Unallocated Bullion Accounts?

Reuters - Chinese gold jewellery demand sees first quarterly drop in 8 years

TECHNICAL ANALYSIS : SOLARCYCLES - QE is mantra rather than driver

International Man - Peter Schiff and Doug Casey on the REAL State of the Economy

TECHNICAL ANALYSIS : Gold Scents - S&P 500 Breaks Important Trend Line

CHARTS : McClellan Oscillator - A Scary Valuation Indicator

GoldBroker - U.S. Authorities Starting to Worry about Deutsche Bank’s Mountain of Derivatives

Kimble Charting - Triple Top in this”Value Index” take place?

Economic Policy Journal - The Worst Comment on Economics That'll You'll Read All Day

Reuters - London platinum, palladium fixing co seeks third-party administrator

07/30/14 - Bullion News

Kimble Charting - Since 2000, the S&P 500 on an "Inflation-Adjusted" Basis is STILL BELOW where it was 14-years ago - Whereas exactly 14 years ago today, Gold was $273.00 & Silver was $4.90 a troy ounce

Forbes - The Government's Assault On Retirees

MineWeb - Hold some gold. Better safe than sorry

CoinNews - Gold Dips, Silver Eagle Bullion Coins Top 26 Million

Munknee - Gold Production to Drop By 50%; Few New Discoveries Will Exacerbate Problem

South China Morning Post - Stricter emissions control in China to drive palladium prices higher

GoldBroker - Shanghai Gold Exchange - Gold deliveries since December 2008

CHARTS : Zero Hedge - 3 WTF Charts

Casey Research - Why the Fed’s Taper Hasn’t Hurt the Stock Market… Yet

VIDEO : Mises Economics - Jim Grant: “The Federal Reserve Has So Little Self-Awareness…”

StreetTalkLive - The End Of Q.E.

VIDEO : Bloomberg - Greenspan: Significant Correction Likely in Stocks

Profit Confidential - The Era of Financial Insanity

Mish's Blog - Whopping 35% Have Debt in Collection! Delinquent Debt in America: By Region and Metro Area, Where Is It?

07/29/14 - Bullion News

Howe Street - The Morgan Report's David Smith - Following the Trading Herd Will Get you Slaughtered

GoldSilverWorlds - US Dollar Facing Competition From Other Currencies, Gold Will Also Benefit

VIDEO : Bloomberg - James Grant - The Fed is Manipulating the Interest Rates and the Markets

Hussman Funds - Yes, This Is An Equity Bubble

The Bullion Desk - Gold fix race to open in ‘late August’, close in September – LBMA

VIDEO : CNBC - Ron Paul: Why I still believe in gold

AsianScientist - Gold Nanoparticles are Killing Tissue-Deep Tumors With Light

Zero Hedge - Is Hong Kong-US Dollar Link About To End? HKMA Buys $715 Million To Support Peg

Gold-Eagle - Fed Exit a Blue Pill?

MINING - China's war on pollution to push palladium higher still

AUDIO : Bullion Star - Interview with BullionStar's CEO on the development of the Asian gold market - Mr. Persson touches specifically on the development of the Chinese and Singaporean gold markets

TECHNICAL ANALYSIS : Market Anthropology - The Miners Lead a Rising Tide

07/28/14 - Bullion News

Casey Research - Seeing Rallies and Corrections for What They Are—And Profiting Either Way

King One Eye - Chart of the Day: The US Dollar

CHARTS : Advisor Perspectives - NYSE Margin Debt Surged in June; Leading Indicator for a Market Correction?

CoinNews - Billions in Gold, Treasures of History at West Point Mint

GoldSilverWorlds - Silver Price In 2014 Establishing Another Megaphone Pattern

Money and Markets - Shifting Sands of Time, Countries and Markets. What to Do...

CHARTS : Got Gold Report - COMEX Swap Dealers Hedging a Massive Long Play on Silver?

GATA - Financial Times deleted gold manipulation story because it was too 'sensitive'

AUDIO : FSN - John Rubino – 2007: Deja Vu All Over Again

Rick Ackerman - Economist’s 1999 Warning Now Seems Quaint

Zero Hedge - The Case For A Bull Or Bear Market In Two Charts

Jesse's Cafe' Americain - What Is the Effective Limitation on the Fed's Ability to 'Print Money?'

07/27/14 - Bullion News

TECHNICAL ANALYSIS : Edge Trader Plus - Gold And Silver – Use “Magic” Of Gold/Silver Ratio To Greatly Increase Your Physical Holdings

CHARTS : Zero Hedge - "London Fix" Gold Rigging By Bullion Bank Exposed In Class Action Lawsuit: The Complete Charts

Daily Pfennig- The Fix is In : Coming Changes in the Metals Market

Reuters - Silver bullion banks accused of manipulation in U.S. lawsuit

The Telegraph - Former CBI boss to join Osborne rigging review

TECHNICAL ANALYSIS : Kimble Charting - Small caps (Russell 2000) does this for the first time in 13-years!

Sprott Money - What If We Never Left The Gold-Standard? Part II

Acting Man - QE3 by the Numbers

The Bullion Desk - Indian gold jewellery imports up more than 100 pct y-o-y in June

TECHNICAL ANALYSIS : Market Anthropology - the Second Stage

Money and Markets - Oh no! Did you miss all (or most of) this!?

Business Standard - Gold for bitcoin new fad as e-currency count nears 500-mark

International Man - The Biggest Opportunity for Americans to Reduce Their Taxes

07/25/14 - Bullion News

The Sovereign Investor - Higher Minimum Wage Leads to Inflation

VIDEO : Peak Prosperity - What is Money?

The New York Times - A Chinese Gold Standard?

Wealth Daily - BRICS Targeting the Dollar

AUDIO : McAlvany Weekly Commentary - King Dollar is 70! Is it Now Out With the Old?

Market Watch - Unbelievable collapse in small-cap stocks

TECHNICAL ANALYSIS : Kimble Charting - Momentum back at 1987, 2000 & 2007 levels…Long in the tooth?

POLL : Rasmussen Reports - Americans View Poverty As A Bigger Trap Than Ever

VIDEO : Get Real - Jan Skoyles presents a special on Silver. She talks to Mark O'Byrne of Goldcore.com

The Bullion Desk - Palladium price worries car makers, but platinum, rhodium swap unlikely

R&D Mag - Nanoparticle “alarm clock” may awaken immune systems put to sleep by cancer

CNW - Royal Canadian Mint launches its first 99.99% pure 10 oz. silver bullion bar

07/24/14 - Bullion News

The Telegraph - Have central banks been breaking the law?

- Quantitative easing has had a reverse Robin Hood-type effect by robbing from the poor and giving to the rich...

King One Eye - Gold Dips Below $1,300 -- Chart and Analysis

TECHNICAL ANALYSIS : Kimble Charting - Hey Tonto…These “Patterns and Sentiment” could hurt Silver!

CHARTS : Zero Hedge - Silver Tumbles Most In 6 Months

INFO~GRAPHIC : Visual Capitalist - The Gold Series: 2014 Trends and Beyond

Silver Coins Today - 2014 Silver Eagle Coin Sales Pendulum

Market Update - China imports less re gold via Hong Kong

- Google Translation Link

Bullion Vault - 100 Years to the Day Since the Gold Standard Died

The Deviant Investor - Clear and Present Danger Zone

McClellan Oscillator - A-D Line Divergence Again

CHARTS : Financial Sense - Bulls Take Notice - Caution Suggested as Credit Markets and Equity Markets Diverge

07/23/14 - Bullion News

TECHNICAL ANALYSIS : SOLARCYCLES - Last Gasps

Got Gold Report - COMEX Producer/Merchants in Gold, View from 30,000 Feet an Eye Opener

CityIndex - Silver eyed on soaring speculative sentiment

Hard Assets Investor - Gold’s Fair Value: Bear Says $800, Bull Says $5,000

Casey Research - The Approaching Inevitable Market Reversal

SRSrocco Report - INDIAN SILVER IMPORTS: Near Record At A Quarter Of Global Mine Supply

MoneyNews - China's Gold Demand Drops in First Half as Bars Outweigh Jewelry

AUDIO : FSN - Gordon T. Long – Call On Next Credit Crisis Coming True

The Bullion Desk - FOCUS - Platinum and Palladium import data could signify diverging fortunes

The Gold Report - Doug Loud and Jeff Mosseri: Three Reasons Why Gold and Gold Stocks Will Rise

CoinTelegraph - More Questions than Answers about a New Pure Gold Physical Bitcoins Minted in China

Auburn Journal - Fake silver dollars causing Auburn concerns

Ludwig von Mises Institute - How to Start Reforming the Federal Reserve Right Now

Reuters - U.S. gold ETF delivers first physical bullion coins; holdings grow

gizmag - Gold nanomotors clocked at a record 150,000 RPM

07/22/14 - Bullion News

FXStreet - Platinum – Supply Deficit Widens to Record High

Market Update - Gold exports from Switzerland to Asia: 600 tons

- Google Translation Link

Howe Street - Interview with David Smith of "The Morgan Report" : Gold and Silver Bears: Was Last Week Your Best Shot?

SRSrocco Report - “Wrecking The Silver Monetary System”: Silver Suppressors Hiding In The Dark — PART 2

VIDEO : The China Money Report - Jim Rogers: This Can’t Go on

- First 3min. of Video are in the Chinese Language, Jim Rogers and Interviewer speak in English Language at the 2:59 mark

SafeHaven - Setting The Stage for The Next Collapse

TECHNICAL ANALYSIS : Kimble Charting- So Goes a HOG, So Goes the S&P 500?

CNBC - Harley-Davidson Investors Fall Off the Hog

The Sovereign Investor - Government Confiscation of Dormant Assets

Business Insider - The Wreck Of The SS Central America - The 'Ship Of Gold' - Keeps Giving Up Millions

IIFL - MMTC-PAMP India awarded the London Bullion Market Association’s for Good Delivery

07/21/14 - Bullion News

Casey Research - Western Delusions vs. Chinese Realities

Market Watch - The worst for gold may be over: Bank of America Merrill Lynch

examiner - 25 Interesting Facts About Gold

TECHNICAL ANALYSIS : SOLARCYCLES - Second Chance Peak

King One Eye - Monday Morning Reads -- Energy, Agriculture, and the Gold Chart of the Day

VIDEO : Bloomberg - 'Dr. Doom' Faber: Stocks in a Bubble, Buy Gold

CoinNews - Gold Rises 0.3%, Silver Advances 0.6%; US Mint Bullion Coins Gain

GoldSilverWorlds - Russia Adds 500,000 Ounces Of Gold Reserves In June 2014

GoldBroker - Above-ground Gold Stock - How Much Is There and Why Does it Matter?

The Telegraph - The dollar's 70-year dominance is coming to an end

VIDEO : Michael Hudson - Escaping the dollar

Zero Hedge - "Buying The Car Was The Worst Decision I Ever Made" - The Subprime Auto Loan Bubble Bursts

The Gold Report - Miners Must Control Costs to Improve Share Prices: Byron King

VIDEO : nano werk - Scientists explain how gold nanoparticles easily penetrate cells, making them useful for delivering drugs

07/20/14 - Bullion News

TECHNICAL ANALYSIS : Bullion Vault - Gold: The "Worst" Currency of Them All by Gary Tanashian in his Notes from the Rabbit Hole

Zero Hedge - The 2 Charts That Have BofA Worried About A "Greater Correction" In Stocks

Sprott Assets - The Ongoing Rot in the Economy

PDF : Wizzen Trading - Technical Analysis : Perfect Week That Shows Just How Dangerous Gold Is To Trade

The Bullion Desk - INTERVIEW – Asian gold trading hub a risk to London – Bloomberg’s Ken Hoffman

Bullion Star - Chinese Gold Demand 998 MT YTD

VIDEO : Gordon T Long - Macro Analytics - TAR PIT That is FINANCIAL REPRESSION w/ John Rubino

AUDIO : FSN - Alasdair MacLeod – What’s With The Silver Fix?

CoinNews - Trip to West Point Mint Begins… Stay Tuned

Nanotechnology Now - Iranian Scientists Use Nanosensors to Achieve Best Limit for Early Cancer Diagnosis

The Washington Post - Monuments Men: A Baltimore writer learns her father helped in the search for Nazi plunder

07/18/14 - Bullion News

Macro Business - The Truth About “Gold Backed” Cryptocurrencies

Bullion Vault - India "Can't Risk" Easing Gold Import Rules as Trade Deficit Jumps

Bullion Star - India Imported 713 MT Of Silver In April, 1921 MT YTD

Profit Confidential - The Only Thing I Can Find to “Buy Low” These Days

Forbes - Palladium Hits 13-Year High; Analysts Bullish But Also Warn Of Possible Short-Term Pullback

AUDIO : The Daily Coin - Interview with Silver Guru - David Morgan, discusses the Current Silver Market

GRAPHIC : Kitco - World's Largest Silver Producer : Mexico

Global Money Trends - Which way is Inflation Blowing? Watch Commodities

King One Eye - Another Interesting Chart -- the Smart Money Index

TECHNICAL ANALYSIS : Kimble Charting - Joe Friday…This could get very ugly for the Russell 2000!

Zero Hedge - High Yield Bonds Are Flashing Red Again

nanotechweb - Plasmonic chip (pGold chip) diagnoses diabetes

07/17/14 - Bullion News

Spear's - Forget the Gold Bugs, It's All About Silver Bugs These Days

U.S. Global Investors - Domestic and Indian Gold Rally Points to a Strong Second Half - by Frank Holmes

Gold Chat - How Eastern Gold Demand Is Transforming The Gold Market

CoinWeek - First Read: American Gold and Platinum Eagles: A Guide to the U.S. Bullion Coin Programs

The New York Sun - The Fed in Danger

Economic Policy Journal - Are Prices Rising Around You? The Dollar Peddlers Say You're Crazy!

fin24 - Brics set up $100bn bank to break Western grip

Sovereign Man - Delusional IMF “delighted” to be marginalized by BRICS

The Gold Report - Sean Rakhimov: Upward Trend a Silver Investor's Friend

TECHNICAL ANALYSIS : SOLARCYCLES - Markets Update

VIDEO : CNBC - Former OBM Director David Stockman says he doesn't see a strengthening economy...

Reuters - U.S. gold dealer launches first digital currency backed by bullion

DailyMail - 43 gold bars, 1,300 double eagle coins and thousands of pieces of silver: Inventory of treasure worth MILLIONS of dollars revealed from 1857 shipwreck off South Carolina coast

07/16/14 - Bullion News

CoinNews - Gold Climbs from Losses, Silver Eagle Bullion Coins Top 25M

TECHNICAL ANALYSIS : Kimble Charting - Gold & Silver Bulls want to see this happen!

Casey Research - The Stress Tests That Could Stress Markets

csinvesting - Victor Sperandeo on the Inevitability of U.S. Hyperinflation - Good Article

Reuters - London gold fix company seeks third party to run benchmark

SkyNews - Banks To Overhaul Gold-Fix Amid Rigging Fears

Bullion Star - ICBC: A New Global Currency Setup Is Being Conceived

GoldSilverWorlds - How Eastern Gold Demand Is Transforming The Gold Market

Investment U - Silver's Monthly Price Performance

Perth Mint Blog - Monsoon - Better Late Than Never For Indian Gold Demand

fin24 - Gold imports drive up India's trade deficit

Zero Hedge - Are Share Buybacks About To Hit A Brick Wall?

Dollar Collapse - They’re Lying To Us, Part 4: Fake Pensions

07/15/14 - Bullion News

Money and Markets - Just What is Yellen Yellin’ About? Here’s My Take on Today’s Testimony!

MineWeb - Gold and silver smashdown: More to come?

Barron's - Platinum Supply Deficit to Widen, Prices to Benefit: HSBC

Gold Chat - GLD amendment refers to "unforeseen reasons" for unallocated failure

King One Eye - Charts on Gold, The Drought, and the Bulls and da Bears

The Telegraph - BIS chief fears fresh Lehman from worldwide debt surge

GoldBroker - Is Gold the Anti-Dollar? United States’ Role in the Gold Market

The Deviant Investor - Silver, Gold and Living By The Sword

BullionVault - How Did Bretton Woods Work?

VIDEO : CNBC - Jim Rickards - The significance of a BRICS development bank

Sovereign Man - When you see this happen, you’ll know it’s game over for the dollar. I give it 2-3 years.

nj.com - New York man tries to hawk fake gold bullion in Bayonne, police say

nano werk - Photorealistic plasmonic printing with aluminum nanostructures

07/14/14 - Bullion News

Reuters - Yellen says Fed easy money needed even after recovery -report

Bonner & Partners - Rick Rule on Why the Resource “Super-Cycle” Is Still Intact

VIDEO : CNBC - Santelli's Epic Rant on the Fed, Easy Money & Markets

KIROtv - The First U.S. Mint

Profit Confidential - Investors Forgot Everything That Happened Just a Few Years Ago?

Market Watch - Why gold just posted its biggest drop this year

South China Morning Post - Improvements Need to Be Made to Enhance the Accountability and Governance of the Gold Pricing Process

Albuquerque Journal - Embossing nanostructures shows promise

07/13/14 - Bullion News

AUDIO : Peak Prosperity - John Rubino: Taking Control Of The Time In Which We Live

PDF : U.S. Global Investors - Gold Special Report : The Fear Trade

TECHNICAL ANALYSIS : Gold-Eagle - Gold Forecast and Gold Stocks Bottoming Analysis

The Sydney Morning Herald - A Golden Fleecing: The Mystery of the Missing Millions

Gulf Business - How To Defend Your Portfolio

Nevada Appeal - Things to Look for When Choosing a Rare Coin or Bullion Dealer

BullionStar - For How Long Will People Trust Fiat Money?

Market Watch - Gold stock rally ‘foreshadows a trend’ for the metal

Deviant Investor - Destroying Confidence – the Last 40 Years

ZEAL - Massive PM-Futures Buying

OncologyNurseAdvisor - DNA origami can deliver targeted cancer drugs

MINING - Ohio firm granted rights to shipwreck's gold worth up to $80m

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

07/11/14 - Bullion News

Reuters - CME, Thomson Reuters win battle to replace century-old silver benchmark

TECHNICAL ANALYSIS : Market Anthropology - The Sweet Spot

Gold Chat - No Indian gold import policy change explains RBI gold swap

Money and Markets - Why I Just Added More Gold Exposure for the First Time in YEARS!

Fed Presidents...Do They Sound Like They Know What's Going...

VIDEO : Bloomberg - Federal Reserve Bank of Chicago President Charles Evans Discusses His Views of the Economy

VIDEO : Bloomberg - Federal Reserve Bank of Philadelphia President Charles Plosser Discusses His Views of the Economy

VIDEO : Bloomberg - Federal Reserve Bank of Atlanta President Dennis Lockhart Discusses His Views of the Economy

Economic Policy Journal - I Just Sent Fed Vice President Stanley Fischer...a Copy of Austrian School Business Cycle Theory by Murray Rothbard

Zero Hedge - CEO Of Europe's Largest Insurer Pops The Utopia Bubble: "Nothing Is Solved And Everybody Knows It"

Profit Confidential - Taking It Too Far Again...

GoldBroker - Danger Warning: Banks Knowingly Underestimate their Risks

Reuters - LBMA appoints Johnson Matthey official as new chairman

Got Gold Report - CME Lowers Gold and Silver Futures Margin Requirements

Smithsonian - How Doctors Are Harnessing the Power of Gold to Fight Cancer

07/10/14 - Bullion News

Reuters - As silver fix decision nears, LME ties up with Autilla

- The results of the high-profile process are likely by the end of the week.

VIDEO : Gold Investing News - Survey: Does the London Gold Fix Need to Go?

Money and Markets - Gold Surges, Euro Tanks as “PIIGS” Yields Fly Again!

Yahoo Finance - India surprises by keeping gold import duty at 10 percent

TECHNICAL ANALYSIS : CEO.CA - Gold Breaks Out

BusinessKorea - Korean Research Team Develops New Nanomaterial for Cancer Treatment - (Using Gold Nano Dots)

Profit Confidential - What’s Up Three Times More Than Stocks So Far This Year?

VIDEO : CNBC - Peter Boockvar End of QE will cause major correction

arabian money - Buying gold to insure against the global bond bubble

JCK - Bidz.com Ceases Operations, Will Liquidate

07/09/14 - Bullion News

CoinNews - Gold, Silver Rise Slightly; US Mint Gold and Silver Coins Climb

The Bullion Desk - LBMA delays silver fix decision, LME/Autilla bid throws race open

The Telegraph - LME eyes role in London gold fix after silver deal

VIDEO : JM Bullion - How to Ship Silver and Gold Safely?

TECHNICAL ANALYSIS : Kimble Charting - This could put a “Big Smile” on Gold Bugs faces!!!

Market Watch - Dow 17,000 is on the wrong side of history

VIDEO : Bloomberg - The Fed Doesn't Have a Clear Exit Strategy: Piegza

TECHNICAL ANALYSIS : Market Anthropology - Follow The Yellow Brick Road

Gold Stock Bull - $10,000 Gold, Is it Possible?

07/08/14 - Bullion News

Casey Research - Q&A with the Casey Metals Team

Howe Street - David Smith : Hold On Until You See Solid Market Trend

SilverGoldWorlds - Silver Particles Carry Drugs to Tumors

Fananz und Wirtschaft - We will continue to swim in liquidity : Three top investors in a round-table discussion

- Google Translation Link

Rick Ackerman - When Will the Fed Tighten? Never.

Deviant Investor - QE: Quantitative Easing or Questionably Effective

Dollar Collapse - This Is Disgusting — And the Food Sounds Gross Too

My Budget 360 - Feeling poorer through the power of inflation

ETF Daily News - The Platinum Supply Squeeze Is Just Getting Started

Bloomberg - Gold Shines Again as Hedge Funds Boost Wagers on Advance

Wall St. Cheat Sheet - Here’s Why It Might Be the Right Time to Buy Silver

Businessweek - The Gold Fix: Can Benchmark Price Be Manipulated?

VIDEO : CNBC - Marc Faber: The asset bubble has begun to burst

07/07/14 - Bullion News

Bloomberg - Black Rock's Fund Manager Evy Hambro Discusses the WGC Gold Fix Forum and the Current Gold Market

The Bullion Desk - INTERVIEW – World Gold Council to publish gold fix reformation report

gulfnews - London’s scandal-hit gold price fixing under spotlight

VIDEO : CNBC - France Slams Dollar Dominance

Daily Wealth - The Last Time the Dollar Almost Died (It Wasn't Long Ago)

Perth Mint Blog - New 1/2oz Silver Bullion Coin Marks Major World War II Battle

NuWire Investor - Considering A Self-Directed Gold IRA Or 401(k) To Gold IRA Rollover?

Bullion Vault - Investment Tips for a Dying Dollar

AUDIO : FSN - Silver Guru - David Morgan – What’s Next For Gold And Silver Prices?

USA Today - Service Makes "Texas Precious Metals" Shine

Profit Confidential - This Is Odd...

07/06/14 - Bullion News

Money and Markets - Perfect Storm Driving Gold Higher

Zero Hedge - CEO Of One Of The World's Largest Energy Majors "Sees No Reason For Petrodollar"

Zero Hedge - By "Punishing" France, The US Just Accelerated The Demise Of The Dollar

Global Financial Intelligence - SWITZERLAND ALSO empowers the YUAN, weakening the dollar - Google Translation Link

AUDIO : Peak Prosperity - Mike Maloney: The Dollar As We Know It Will Be Gone Within 6 Years

Numismatic News - Gold Bullion Sells While Silver Bullion Falters in June

In Gold We Trust - Chinese Gold Demand 947 MT YTD

Resource Investor - India to set up gold scrap refining facility

AUDIO : FSN - John Rubino – They’re Lying To Us, Part Deux