Homepage / Archived News or Quarterly News / 1st Quarter 2014

1st Quarter - 2014

Charts, Bullion News & Commentary

Learning from the past is a useful way to judge price movement in the future when investing in any market.

This page provides a comprehensive overview of gold, silver, platinum, and palladium during the quarter.

For each of the precious metals, you'll find charts. Below the charts, you will find Bullion News Headlines from the 1st Quarter of 2014. Every news link (below) was originally posted on this guide's homepage.

The quarterly charts provide insight into the volatile precious metals markets, while the news below the charts provides a deeper understanding of the fundamentals influencing these markets.

The charts below are provided courtesy of

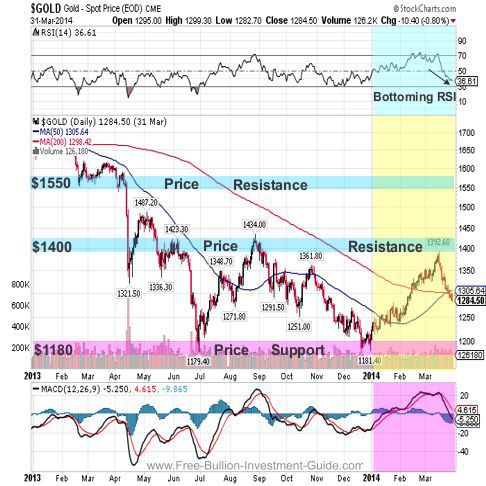

Gold Price Chart - 1st qtr. 2014

Gold Price Chart (April 1st, 2011 - March. 31st, 2014)

Bullion News

Gold Price Summary

The 1st quarter of 2014 was generally good for the gold market. Gold's price for the quarter rose a little over 8%, from $1181 a troy ounce at the beginning to $1284 at the end of the quarter.

The price of gold was able to close above $1390 on March 14th; it was the first time it had done this since August 23rd, 2013. But Gold was unable to break the major resistance price boundary of $1400 a troy ounce during the quarter.

$1400 is a major long-term resistance level that gold needs to break and hold above before the price can move higher.

After March 14th, when Gold's Price Peaked, it cascaded down to end the quarter at $1284.50 a troy ounce.

The upper indicator, "RSI - Relative Strength Indicator" (red triangle on the quarterly chart), and the lower indicator, "MACD" (yellow rectangle on the quarterly chart) (below), both indicated that the gold price was topping out. Both indicators can be helpful in trying to figure out the future direction of a price chart.

The highlighted Golden Cross on the chart (below) signals a possible positive future for gold for the next quarter.

However, a Golden Cross doesn't always pan out the way investors hope; look to the 2nd quarter of 2014 to see if the "Golden Cross does.

Other positive signs in the quarterly chart were the bottoming, RSI (upper indicator), and MACD (lower indicator) at the end of the 1st quarter of 2014; both are signs of a move to the upside in the near future.

Note: A Death Cross or a Golden Cross are Technical patterns; a Death Cross indicates/predicts a declining asset price, whereas a Golden Cross indicates/predicts a rising asset price.

Gold Price Chart (Jan. 1st, 2014 - March. 31st, 2014)

Gold Price Chart (Jan. 1st, 2013 - March. 31st, 2014)

Bullion News

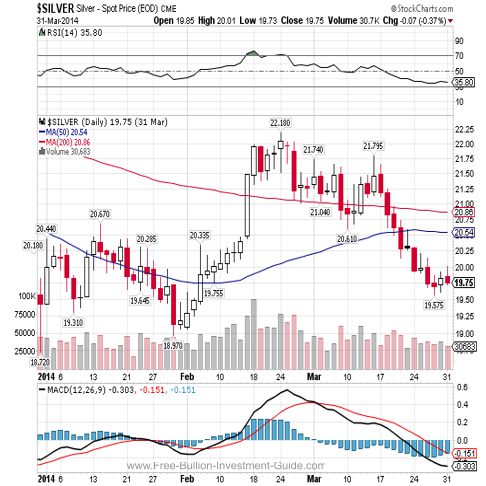

Silver Price Chart - 1st qtr. 2014

Silver Price Chart (April. 1st, 2011 - March 31st, 2014)

Bullion News

Silver Price Summary

Silver's price in the 1st quarter of 2014 was just like gold's price, up and down.

The price in January flirted with its support price of $19.00 and bounced back each time it touched that price. Silver's price also flirted with its resistance level of $23.00 a few times during the quarter. However, the price of silver could not close above or below its support or resistance levels, to give investors a sense of which way the price might move.

Silver Price Chart (Jan. 1st, 2014 - March 31st, 2014)

Bullion News

Silver Price Chart (Jan. 1st, 2013 - March 31st, 2014)

Bullion News

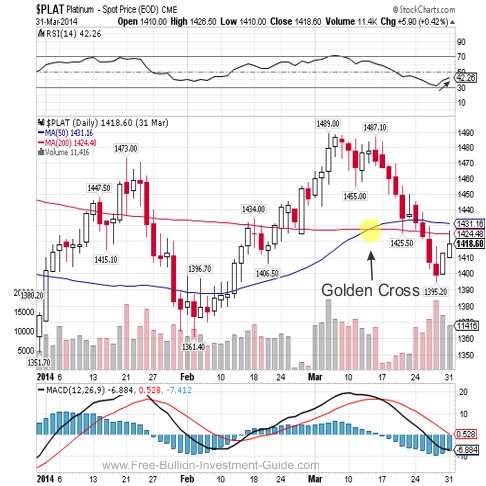

Platinum Price Chart - 1st qtr. 2014

Platinum Price Chart (April. 1st, 2011 - March. 31st, 2014)

Bullion News

Platinum Price Summary

Platinum, like most precious metals, has been falling in price for the majority of 2013. However, since July 2013, the MACD (lower indicator) has frequently produced higher lows on the chart, signaling a very likely (and actual) price reversal. In addition, late in the 4th quarter of 2013, platinum hit a low price of 1311.70, changing the trend in the price of platinum.

During the first quarter of 2014, the new platinum price trend was characterized by higher highs and higher lows. Before we witness a shift in the price direction of gold and silver, we must see the same indicators on their respective price charts.

Platinum Price Chart (Jan. 1st, 2014 - March 31st, 2014)

Bullion News

Platinum Price Chart (Jan. 1st, 2013 - March 31st, 2014)

Bullion News

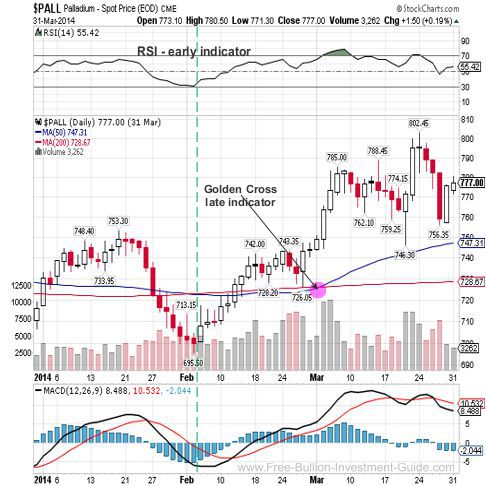

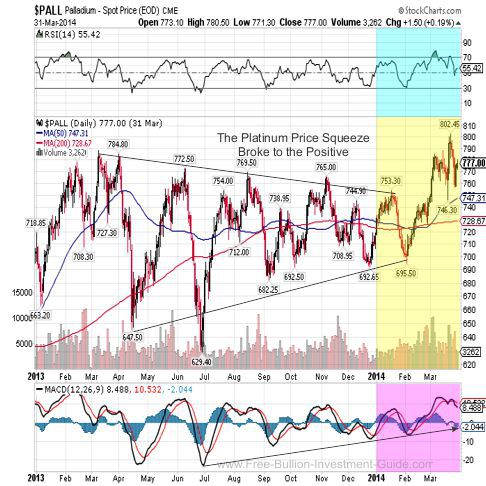

Palladium Price - 1st qtr. 2014

Palladium Price Chart (April 1st, 2011 - March. 31st, 2014)

Bullion News

Palladium Price Summary

In the 1st Quarter of 2014, we finally saw the palladium price squeeze break to the positive.

This was expected in both Platinum and Palladium's price charts due to striking South African platinum miners and international pressure on Russia about their invasion of Ukraine. These events are very significant in these two metals because South Africa is the world's top producer of platinum, and Russia is the world's top producer of palladium.

In the first quarter of 2014, automakers consistently showed increased

demand, indicating an increasing requirement for palladium in catalytic

converters. Furthermore,

Russia had repeatedly reported lower production and reserves of palladium

for a series of quarters, which helped the price of the metal to

squeeze.

The price of palladium in the first quarter of 2014 clearly displays where technical analysis and fundamentals intersect to explain what is happening on the price chart.

The "Golden Cross" did not appear on the quarterly price chart below until the price of palladium began to recover.

The horizontal green dotted line indicates where the rebound began; clearly, the RSI (Relative Strength Indicator) showed the move in palladium before the other indicators on the price chart.

Palladium Price Chart (Jan. 1st, 2014 - March 31st, 2014)

Bullion News

Palladium Price Chart (June 1st, 2013 - March 31st, 2014)

The charts above are provided courtesy of

1st Quarter - 2014

Bullion News & Commentary

The Quarterly News starts with the end of the quarter articles, first.

Please note that not all of the links below work; the links are kept because the headlines still provide insight into how the markets were moving at the time.

03/30/14 - Bullion News

Got Gold Report - COMEX Commercial Traders Covering Gold Shorts in a Hurry

TECHNICAL ANALYSIS : Wizzen Trading - Time Is On Your Side

NDTV - How does $40M of Gold and Silver Indian gold premiums fall to 5-month low on supply hopes

The Zimbabwe Standard - Is it Time for the Zimdollar to Return?

CoinWeek - How does $40M of Gold and Silver Disappear: The Collapse of Tulving Company

Inside Futures - Where Are Silver Prices Headed

Wealth Daily - Russia and China Join Forces to Kill the U.S. Dollar

CHARTS : Kimble Charting - Waterfall pattern starting in white hot Bio Tech sector?

INFO~GRAPHIC : Visual Economics - Real Price of Gold since 1791–2013

Money and Markets - My Answers to Your Questions From My Fireside Chats - by Martin D. Weiss, Ph.D.

Plata - The Dollar Cannot Be Devalued and Suicidal Bankers

About - Gold Investing for Your Golden Years

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

03/28/14 - Bullion News

VIDEO : TheGoldandOilGuy - Why Gold Is Falling & A Gold Forecast You May Not Like

Sprott Money - Metals Experience Yo-Yo Action Over Ukraine Crisis and Fed Announcements

CNN Money - The absurd way the U.S. measures inflation: Your rent

Zero Hedge - Japanese Prepare For "Abenomics Failure", Scramble To Buy Physical Gold

TECHNICAL ANALYSIS : Acting Man - Gold and Gold Stocks – A Comment on the Correction

Bullion Vault - Silver, Buffett & the Hunt Brothers

AUDIO : GoldSeek Radio - GSR interviews DOUG CASEY

Voice of America - South Africa Platinum Strike Cripples Mine Companies

CHART : Twitter - Does anyone else see irony of calling this "Investors Intelligence" survey? Bullish '07, Bearish '09, Bullish Now...

TECHNICAL ANALYSIS : Market Anthropology - Offsides

South China Morning Post - Cinda warns trust defaults rising rapidly on mainland

VIDEO : Fox Business - Rogers Holdings chairman Jim Rogers talks Gold, Agriculture and the Markets.

NBC News - Drought Spurs Mini-Gold Rush in California's Sierra Nevadas

WFMZ (Pennsylvania) - Backyard hobby (Metal Detecting) turns up wedding ring missing for more than 40 years

03/27/14 - Bullion News

Mish's GETA - Can Inflation be Too Low?

Wall St. Cheat Sheet - Here’s Why the Government Wants Inflation

Sovereign Man - We’ve Seen This Movie Before...

TECHNICAL ANALYSIS : Sunshine Profits - Gold & Silver Trading Alert: From Bearish to More Bearish

AUDIO : Sprott Money - Ask the Expert - James Rickards (March 2014) | Sprott Money News

Market Watch - The truth about gold in the long run

CNBC - The dollar’s fate—Is it tied to the yield curve?

CoinWeek - What Can You Do When The US Government Stops Supporting The US Dollar?

MineWeb - Gold slips below $1,300, likely to stutter short term

Profit Confidential - Why Is the U.S. Dollar Collapsing in Value All of a Sudden?

Citizen - Platinum price ‘may spike soon’

MINING - The Best Protection Against Corrupt Governments and Geopolitical Tensions is Gold.

03/26/14 - Bullion News

King One Eye - Gold Struggles Despite Big Purchases

Dollar Collapse - Welcome to the Currency War, Part 14: Russia, China, India Bypass the Petrodollar

AUDIO : McAlvany Weekly Commentary - James Rickards: The Death of Money

CoinDesk - Agora Commodities Reports $10m in Bitcoin Sales

SafeHaven - Gold's Macro Fundamentals

Inteligencia Financiera Global - JIM RICKARDS: CHINA IS IMPORTING GOLD SECRETLY USING MILITARY CHANNELS (EXCLUSIVE INTERVIEW!)

GoldSeek - Russia Raises Gold Holdings By 7.247 Tonnes To Over 1,040 Tonnes In February

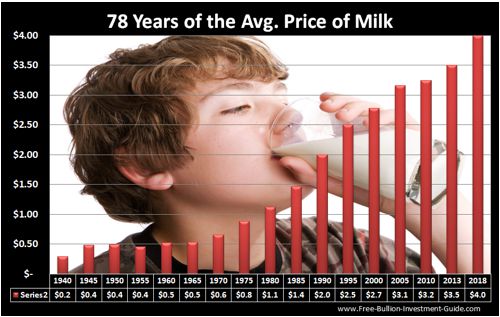

Zero Hedge - The Real Inflation Fear - US Food Prices Are Up 19% In 2014

Laissez Faire - The Government Inflation Scam

AUDIO : FSN - Chris Vermeulen – From A 16 Year Old Wannabe To Master Trader

03/25/14 - Bullion News

CoinWeek - The Main Street Case for Gold

Sovereign Man - US now spending 26% of available tax revenue just to pay interest

CYNICONOMICS - Message to the Fed: Here Are a Few Things That You Can’t Do

TECHNICAL ANALYSIS : King One Eye - Will Gold Hold Support?

Gold Chat - Gold forecaster with 100% accuracy says gold to remain weak

Bullion Vault - Serious Gold Investors

Deviant Investor - The 60th Anniversary of Nothing Special

MINING - China’s monthly gold imports jump 30%

AUDIO : FSN - David Morgan – Palladium Is Leading The Precious Metals

MineWeb - SA platinum strike causing ‘irreparable’ damage - producers

Ludwig von Mises Institute - How Government Wrecks the Economy

Zero Hedge - Who Is And Isn't Saving For Retirement

Azonano - Plasmonic Gold Nanoparticles Could Kill Tumour Tissue with Heat

03/24/14 - Bullion News

McClellan Financial - Gold Bugs Cheer The Rain

9News - Palladium Rises on Russian Supply Fears

Zero Hedge - Guess Which Precious Metal Is Controlled By The Russians

TECHNICAL ANALYSIS : Gold-Eagle - Inflection Points In The Precious Metals And The Dollar

In Gold We Trust - Interview Jim Rickards On The Death Of Money

Rick Ackerman - When Tightening Comes, It Won’t Be by Choice

TECHNICAL ANALYSIS : Gold-Eagle - Gold’s Golden Cross Not Necessarily Positive Technical Signal

TECHNICAL ANALYSIS : Kimble Charting - 14-year resistance and high valuations for Small caps right here!

VIDEO : Mises - Hazlitt, My Hero | Jim Grant

SRSrocco Report - PEAK GOLD: How The Romans Lost Their Empire

Bloomberg - Silver Vault for 600 Tons Starting in Singapore on Demand

Korea JoongAng Daily - Solid start to trading of gold on KRX

VIDEO : CNBC - Why this top technician recommends buying gold now

03/23/14 - Bullion News

PDF : Wizzen Trading - Technical Analysis : Palladium Shines

- Gold, Silver & Platinum Price Charts

Arirang News - Korea's first-ever gold exchange to start trading on Monday

World Mint News - Kremnica Mint Considers Gold and Silver Bullion Coins

TribLive - Gold may regain its luster

Arab News - Gold smugglers defy India’s curb on imports

Zero Hedge - Goldman Doubles Down Its Hate On The Best Performing Asset Of 2014: Gold

AUDIO : GoldSeek Radio - Chris Waltzek talks to Charles Goyette author of "The Dollar Meltdown" and "Red Blue and Broke All Over"

Market Watch - Stock buybacks likely to peak with end of cheap debt

VIDEO : GoldSilver - Jim Rickards & Mike Maloney: Gold Revaluation & THE DEATH OF MONEY

International Man - International Trusts: Graduating from Training Wheels

FARS - Surprising New Way to Kill Cancer Cells

03/21/14 - Bullion News

Zero Hedge - Gold Completes Golden Cross

AUDIO : Smart Metals Radio - The Death of Money - James Rickards Interview

Wall St. Cheat Sheet - Should You Add Gold and Silver Coins to Your Portfolio?

Money Morning - Warning: This Year's Spike in Margin Debt Is a Huge Red Flag for the Market

VIDEO : Fox Business - James Grant "Gold is Insurance"

In Gold We Trust - Chinese Gold Demand 488 MT YTD, Up 29 %

Wealth Daily - China Default?

SRSrocco Report - Collapse Of U.S. Gold Scrap Exports As Suppy Dries Up

Kiplinger - Smart Ways to Sell Your Gold

CEO.CA - A Clear Explanation for This Week’s Gold Selloff

CHARTS : Kid Dynamie's World - Who Drives the Price of Gold?

GoldSilverWorlds - Ted Butler: Suing JPMorgan and the COMEX

Brisbane Times - Miners bet on golden future

03/20/14 - Bullion News

Profit Confidential - Why Two-Thousand-Dollar-Ounce Gold Becomes Plausible Scenario

Trade Precious Metals - Russian Palladium Exports could be in Jeopardy

The Real Asset Co. - India’s gold flowerpot trade

GoldBroker - World Gold Reserves - Top 20 Holders

TECHNICAL ANALYSIS : Zen Trader - Dollar Could Break Support In Coming Weeks

TECHNICAL ANALYSIS : Nifty Charts - Gold Engulfing Pattern

Bullion Vault - India "Eases" Gold Import Rules as Modi Victory Looms

Gold-Eagle - Gold Is Not An Investment…It Is Money

MineWeb - Willem Middelkoop discusses the history of gold in the monetary system and the likelihood of a big reset of a fundamental change in the structure

In Gold We Trust - The Gold Market, Part 5

Casey Research - John Embry: Why Gold Is Unstoppable

How Fiat Dies - Living Like Parasites

Newsday - Cops: Queens man sold more fake coins on LI

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

Affiliate Ad

03/19/14 - Bullion News

GoldBroker - The Stock Market Priced in Ounces of Gold

VIDEO : Sprott - Tekoa Da Silva Interviews Sprott's Rick Rule

TECHNICAL ANALYSIS : Trader Dan's Market Views - Fed to Continue Tapering - Gold Jettisoned as Dollar reacts

VIDEO : CNBC - Peter Schiff: Fed adds to structural problems

Zero Hedge - Yellen's Fed Tightens ($10bn Taper) And Loosens (Lower For Even Longer); Blames Weather - Full Statement Redline

TECHNICAL ANALYSIS : Gold-Eagle - Gold & Silver Update

AUDIO : McAlvany Weekly Commentary - The Plague of the Black Debt

TECHNICAL ANALYSIS : Acting Man - Gold Loses ‘Ukraine Premium’

TECHNICAL ANALYSIS : Market Anthropology - There is no plot for Je Ne Sais Quoi

SRSrocco Report - The Run On U.S. Gold Continues...

International Man - The Old Rules of the Game No Longer Apply

03/18/14 - Bullion News

Merk Investments - Fishing for Gold?

TECHNICAL ANALYSIS : 321gold - Gold Market Fear Is Unnecessary

Sprott Money - Deconstructing the U.S. Economy: The Non-Recovery

CoinWeek - Questions Loom as Precious Metals Firm ‘The Tulving Company’ Folds

Gold-Eagle - Real Money (Part 2)

TECHNICAL ANALYSIS : Nifty Charts - Gold Support Levels

Deviant Investor - Brave New Deviant World

GoldSeek - Russian Sanctions May Create Serious Supply Shortages For Platinum and Palladium

Bonner & Partners - Planet Debt

Reuters - Taiwan to allow banks to sell gold, silver coins from China

Casey Research - Doug Casey’s 9 Secrets for Successful Speculation

New York Post - Rash of finance pro suicides baffles experts

03/17/14 - Bullion News

GoldSilverWorlds - Gold’s Protection Against Counterparty Risk Is Coming Alive

Zero Hedge - UBS Investigated For Gold Manipulation Suggesting Gold Inquiry Goes Beyond London Fix

MoneyNews - Why You Should Own Some Gold and Silver

Sunshine Profits - Can Gold and Interest Rates Move Higher at the Same Time?

Investing - Is a Silver Supply Deficit On The Horizon?

In Gold We Trust - New York Federal Reserve Lying About Gold Storage

The Daily Bell - Gold Versus Bitcoin: An Unnecessary Argument

VIDEO : CNBC - Chinese demand for gold at record levels

MineWeb - 2013 U.S. gold production down 128,602 oz - USGS

The Money Savings Dude - Five Types Of Investors — Which Group Do You Belong?

03/16/14 - Bullion News

TECHNICAL ANALYSIS : Investing - Gold Continuing To Lead Silver Out Of Bear Market Lows

The Daily Bell - Andy Hoffman on the Golden Bull, Failing Fiat and the Foundering of the Central Bank Economy

Zero Hedge - The Failure of Keynesianism

South China Morning Post - Gold trading to open up to foreigners in Shanghai

In Gold We Trust - Week 10, SGE withdrawals 36 MT, 454 MT YTD

Liberty Voice - Gold Price Outshines Stock Market With 14% Gain This Year

ZEEBIZ (India) - Govt raises gold's import tariff value

Zero Hedge - Every Chart You Should Be Tracking But Were Too Afraid To Find

Daily Pfennig - Gold Manipulation May Not Be a Crazy Conspiracy

ValueWalk - Hedge Fund Sues Major Banks Over Market Manipulation

03/14/14 - Bullion News

VIDEO : TheGoldandOilGuy - Technical Analysis : The Next Three Bull Markets

TECHNICAL ANALYSIS : Market Anthropology - Rock, Taper, Scissors - Shoot

Pf Hub - Bitcoins or Bullion: Ignorance of one journalist shines through

CHART : Kimble Charting - Happy Anniversary Top at hand? 5-year rally the “Exact” same length?

The Globe and Mail - Gold, silver charts flashing 'buy' signals Add to ...

CHARTS : GoldBroker - Gold vs. Black Gold

Oregon Live - Local dealer Blue Moon Coins faces police investigation

TECHNICAL ANALYSIS : Nifty Charts - Golden Cross of Gold

The Real Asset Co. - When should I buy gold?

Gold Chat - How ETFs Haven't Altered The Dynamics Of Gold

VIDEO : RTL Z - RTL Z interviews economist James Rickards: the monetary system will collapse

Miningmx - Building the platinum demand of tomorrow

Silver Coins Today - Mule Error 2014 Britannia Silver Bullion Coins Authenticated

03/12/14 - Bullion News

Advisor Perspectives - Global Debt of More Than $100 Trillion Is Threatening Your Portfolio

AUDIO : McAlvany Weekly Commentary - Mark Faber: Gold is Your Best Cash

TECHNICAL ANALYSIS : Trader Dan's Market Views - Western Investment Demand Surfacing for Gold

TECHNICAL ANALYSIS : Kimble Charting - Patterns suggests Doc Copper could fall 30% more!

Deviant Investor - Gold: 14 Years & Three Patterns

CHARTS : The Real Asset Co. - What does Ukraine mean for the gold price?

CHARTS : SolarCycles - Demographics And Secular Bull Markets

iol - Platinum strike losses reach R12bn

TECHNICAL ANALYSIS : Peak Prosperity - Why 2014 Is Beginning to Look A Lot Like 2008

In Gold We Trust - The Gold Market, Part 4

abcNews - 'Pawn Stars' Shop May Have Melted Stolen $50,000 Coin Collection

03/07/14 - Bullion News

The Real Asset Co. - Five years of daylight robbery

Sovereign Man - “No inflation” Friday: the dollar has lost 83.3% against...

Wealth Daily - Should You Worry About Hyperinflation?

TECHNICAL ANALYSIS : Nifty Charts - Silver's Bearish Price Action

About.Ag - Tulving Post Mortem

In Gold We Trust - China’s Road To Secret Gold Accumulation

The Economist - In a fix, Mr Bond

Mail & Guardian (S. Africa) - Banks bear brunt of gold-fix blame - If guilty, the five major institutions could be sued in SA for deals done locally

GoldSilverWorlds - Why Increased Western Gold Demand Could Lead To A Gold Supply Shortage

03/06/14 - Bullion News

SRSrocco Report - Silver Eagle Sales Steal The Show While Top Silver Miners Lose Money

GoldSeek - Gold Scams Revisited

Gold Chat - US deep storage gold - weights

Financial Sense - The Dollar’s Long Term Decline

AUDIO : McAlvany Weekly Commentary - Money Printing & Your Personal Gold Standard

CHARTS : Advisor Perspectives - The Q Ratio and Market Valuation: Monthly Update

TECHNICAL ANALYSIS : Market Anthropology - Euro has Broken out of its Consolidating Range... includes Charts for Precious Metals

BullionVault - UK QE and 0.5% Interest Rates, 5 Years On

AUDIO : Silver-Investor - Precious Metals & The Restoration of Liberty Interview with David Morgan

Gold Made Simple - India is experiencing an ‘acute shortage’ of gold – prices are 21% HIGHER than spot gold

VIDEO : Bloomberg - A Rare Look Into a Copper Warehouse

03/05/14 - Bullion News

iol - Futures point to $1 400 for gold

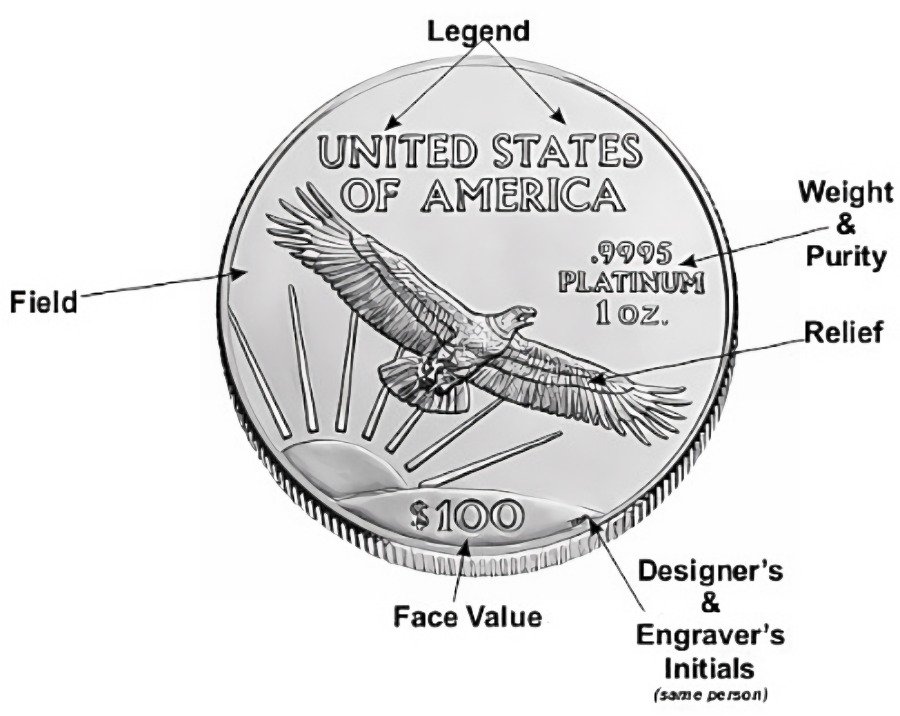

CoinNews - 2014 American Platinum Eagle Bullion Coins on Sale March 10

MineWeb - The effects of gold market manipulation and the opportunities for equities - Eric Sprott

TECHNICAL ANALYSIS : Gold & Oil Guy - How Much Will a 15% Hair Cut Cost Your ETF Portfolio?

TECHNICAL ANALYSIS : Market Anthropology - The 46' Parallel

In Gold We Trust - Interview Fabrice Drouin Ristori From Goldbroker.com

Kitco - Palladium Hits 11-Month High On Russia, South Africa Supply Concerns

Reuters - Australia's Perth Mint gold sales rise in Feb, silver falls

Bloomberg - Barclays, Deutsche Bank Accused of Gold Fix Manipulation

BullionVault - India Gold Curbs Tighten Even as Minister Says "Need to Ease"

Arizona Daily Star - Man melted stolen jewelry, made gold bars, Tucson police say

Birmingham Mail - Pics and video: The REAL Goldfinger's house goes up for sale for £1m

03/04/14 - Bullion News

Courthouse News Service - Elderly Man Says Gold Dealer Rolled Him - Kraner claims he gave Merit Gold $4 million for what he was assured were rare gold and silver coins, but which were worth only half as much.

GoldSeek - Real Money

BullionVault - Gold Buyers Outnumber & Outweigh Sellers in Feb.

VIDEO : YouTube - Jim Rickards: Bernanke and the Fed

In Gold We Trust - India Imported 6125 Tonnes Of Silver In 2013

Deviant Investor - This Gold Model Calculates Prices Between 1971 & 2017

Cato Institute - Hyper-Inflation, Will Venezuela Be Next?

03/03/14 - Bullion News

VIDEO : Bloomberg - Gold Poised to Challenge $1,400 Per Ounce

Futures Magazine - Gold miners see looming output drop after cut in spending

iol - Platinum stocks dwindle as strikers dig in

VIDEO : TheGoldandOilGuy - Investing in Assets in Bull Markets is the Key

Silver Coins Today - US Mint Silver Coins Solid in February, Silver Prices Soar

Kimble Charting - 300% decline far enough? Reversing so far in 2014, Gold Bugs up 25%!

In Gold We Trust - Chinese Physical Gold Demand YTD 369t Up 51 % Y/Y

Ludwig von Mises Institute - Anti-Logic and the Keynesian “Stimulus”

IBTimes - India Raids Gold Stocks in Bid to Halt Smuggling

Bloomberg - India Jewelers Plan Shutdown to Demand Easier Gold Import Rules

eCommerce Bytes - Would You Sell Gold Coins Stash on Amazon or eBay?

Affiliate Ad

03/02/14 - Bullion News

The Daily Bell - FT's Shocking Gold-Manipulation Glitch

PDF : Wizzen Trading - Technical Analysis : Little Pullbacks

GoldSilverWorlds - Gold & Silver: From Now On All that Matters Is That You Own Both

Bangkok Post - Is the London Gold Fix...Fixed?

Mises Economic Blog - Remembering Mr. Libertarian on his birthday

ZEEBIZ (India) - Elections results to influence gold prices: Study

02/28/14 - Bullion News

VIDEO : Bloomberg - Are Gold Prices Being Manipulated by Banks?

TECHNICAL ANALYSIS : King One Eye - Gold and Miners Consolidate ... But for How Long

CHARTS : In Gold We Trust - Gold Trade Numbers 2013 Broke All Records

Market Watch - Gold sidekick silver breaks some ground of its own

FOFOA - Think like a Giant 3

Investment U - Who’s Got the Gold?

GoldSilverWorlds - Gold Price Explodes In Ukrainian Currency

ZEEBIZ (India) - Govt hikes import tariff value of gold, silver

China Daily - Renminbi may become global reserve currency

02/27/14 - Bullion News

Kitco - Gold Ends Firmer, Gets Slight Boost From Yellen Remarks

MineWeb - China’s January Hong Kong gold imports soar 326% year on year

AUDIO : Korelin Economics Report - Rick Ackerman and Technicals

Bonner & Partners - Are We on the Cusp of a New Bull Market in Gold?

GoldSeek - 24 Karat Gold: The Top 5 Perks of American Buffalo Gold Coins

BullionVault - 3,000 Years of Inflation

Keith Weiner Economics - The National Debt Cannot Be Paid Off

Gold Prices - The Federal Reserve, Janet Yellen, QE and Gold

Anglo Far East - Transcript of AFE's Interview with Jim Rickards

Mashable - The Crazy True History of the Saddle Ridge Gold Coins

Saving Advice - From Bitcoin to Bullion: The Tangibility of Currency

QUIZ : Daily Mail - Are you right-brained or left-brained? And what does it say about your personality? Take this interactive QUIZ to find out

02/26/14 - Bullion News

Investing - What’ll Yellen’s Testimony Do To The USD?

Casey Research - Don Coxe: The End of Financial Heroin

INFO~GRAPHIC : Visual Capitalist - GOLD : The Most Sought After Metal on Earth

Ludwig von Mises Institute - The High Price of Delaying the Default

Sprott Asset - Don't Miss this Golden Opportunity! by Eric Sprott

Forbes - PGMs Expected To Benefit If South African Strike Becomes Protracted

TECHNICAL ANALYSIS : Gold Made Simple - Gold price now up 13% from the new-year lows and within reach of some key levels

CoinNews - Saddle Ridge Hoard of Buried Gold Coins Authenticated by PCGS

RCP - The 'Fairness' Fraud by Thomas Sowell

02/25/14 - Bullion News

MoneyNews - How to Profit From the Yellen Fed by Axel Merk

Bonner & Partners - Debt + Demography = Destiny

GoldSilverWorlds - FT Removes Article “Gold Price Rigging Fears Put Investors On Alert”

King One Eye - 4 Gold Stories & 4 Smokin' Hot Charts

Inside Futures - Staying Bullish on Gold & Silver

VIDEO : The Real Asset - Skoyles talks to Keiser about gold, China and GetREAL

Deviant Investor - Equilibrium Gold Price Model

Mish's Blog - You Too Can Make Millions "Flipping" Houses

SRSrocco Report - Market Continues To Purchase “All” Allocated Silver Eagles From U.S. Mint

VIDEO : Zero Hedge - Rick Santelli Summarizes The Problem: "It's The Government"

abcNews - California Couple Finds $10M Buried Treasure in Back Yard

02/24/14 - Bullion News

Wealth Daily - Win Gold by Trading Silver

TECHNICAL ANALYSIS : Market Anthropology - Back to the Bull Market Highway for Silver & Gold

AUDIO : The Daily Gold - David Morgan Shares his Insight on Precious Metals

The Real Asset - The London Gold Fix: the saga continues

VIDEO : CNBC - Stocks are set for a big fall, thanks to the Fed: James Grant

In Gold We Trust - The “Chinese dream” of ICBC’s Precious Metals Department - an interview with Zhou Ming

MoneyNews - Mint Gold Coin Sales Head for Worst Month Since September

Personal Liberty Digest - Bartering With Gold And Silver

U.S. Global Investors - Going for the Gold

MINING - Bubba explains why US only gave Germany back 5 tonnes of gold

02/23/14 - Bullion News

Money and Markets - 3 Dire Warnings Fall on Deaf Ears!

TECHNICAL ANALYSIS : Wizzen Trading - PDF : Gold Medal Action

AUDIO : Hard Assets Alliance - Paper Money Collapse - Detlev Schlichter Interview

TECHNICAL ANALYSIS : GoldSilverWorlds - Silver Could Be The Tipping Point While Gold And China Get All Attention

VIDEO : Gordon T Long - Macro Analytics - What Blows Up First - Part 1 w/ John Rubino

In Gold We Trust - Weekly Chinese Gold Demand Transcends Global Mining Production, Again

Business Standard (India) - Jewellers tell govt to reduce gold import duty to 2%

CoinNews - Gold, Silver Gain for Third Week; US Mint Bullion Coins Mixed

Mining - Gold price: Hedge funds add 30% to bullish bets

02/21/14 - Bullion News

GoldSeek - Alleged Gold & Silver Scams Abound

Numismaster - Gold Surprises Wall St.

VIDEO : 321gold - Technical Analysis : Gold Stock Pause & Pop Update

Profit Confidential - Demand/Supply Equation for This Investment Guarantees Higher Prices Ahead?

Bullion Vault - India Tightens 80:20 Gold Import Rules

In Gold We Trust - Bundesbank Attempts to Subdue Concerns Gold Repatriation

Forbes - China Seeks Seat On Gold Fix Table. What Does It Mean For The Gold Price?

AUDIO : McAlvany Weekly Commentary - Global Debt Bomb: From TNT Now to Nuclear

International Man - On the Ground in the Cook Islands "For a number of reasons, the Cook Islands might deserve a central role in for your plan for internationalization—particularly for asset protection and estate planning"

02/20/14 - Bullion News

TECHNICAL ANALYSIS : Hubert Moolman - Silver Price Forecast 2014: Significant Silver Rallies Usually Follow Major Dow Peaks

VIDEO : SGT Report - Interview with Sprott Money's Rick Rule

TECHNICAL ANALYSIS : King One Eye - Chart of Gold -- Test of 200-day MA

CoinWeek - Is The FMQ Having An Impact On Gold Prices?

Jesse's Cafe Americain - The Recovery™ - Bubble Back To the Bar For the Hair of the Dog That Bit You

TECHNICAL ANALYSIS : Kimble Charting - Head & Shoulders top in the Dow? Right shoulder in place today?

AUDIO : Silver-Investor - Interview with David Morgan

GoldSeek - These Gold Charts Will Make Your Heart Beat Faster

VIDEO : Xinhua.Net - China Leads the World in Gold Production

Bloomberg - Switzerland Sent 80% of Bullion Exports to Asia in January

The Real Asset - The Five Greatest Gold Robberies

02/19/14 - Bullion News

Financial Sense - Gold’s Comeback and Bitcoin’s Silent Crash

Zero Hedge - In 2013 The Fed Bought 150% More Treasurys Than All Foreigners Combined

AUDIO : Sprott Money - Rick Rule: US Debt Out of Control, “Gold is Catastrophe Insurance”

The Sydney Morning Herald - Fed to change rate guidance as optimism grows

VIDEO : CNBC - The Santelli Exchange: Anniversaries & voices

TECHNICAL ANALYSIS : Market Anthropology - Salty Dogs Surf Silver

VIDEO : Bloomberg - "We Are In the Mists of a Policy Experiment We've Never Seen Before, So I Do Think as an Investor Having Gold in Your Portfolio Makes Sense"

MineWeb - SA Platinum producers table final offer

Bullion Vault - Gold Demand Trends Diverge

In Gold We Trust - The World Gold Council Clueless on Chinese Gold Demand?

GRAPHICS : Visualizing Economics - 1947 - 2010 : The Defining 20 US Industries

Acting Man - Venezuela: From Bad to Worse to Zimbabwe

Zero Hedge - Second JPMorgan Banker Jumps To His Death: Said To Be 33 Year Old Hong Kong FX Trader

02/18/14 - Bullion News

TECHNICAL ANALYSIS : Kimble Charting - Gold creating bullish “Cup & Handle” pattern?

The Sydney Morning Herald - Fears of looming China credit crunch spark new gold rush

Dollar Collapse - What Blows Up First? Part 4: China

Money Beat - Gold Prices Hurdle Technical Milestone

MINING - Report: Chinese bank poised to join London gold fix

World Gold Council - Gold Demand Trends : Latest Issue: Gold Demand Trends Full Year 2013

Yahoo Finance - China Is Now The World's Largest Consumer Of Gold

CHARTS : Prometheus Market Insight - Potential Cyclical Topping Pattern

ZEEBIZ - Gold smuggling in India to rise if curbs stay: WGC

BDlive - Paulson, hedge funds remain bullish on bullion

Trade Arabia - Qatar’s online gold, silver trading platform opens

02/17/14 - Bullion News

CoinWeek - Gold and Silver American Eagles: Big Sellers in a Sluggish Economy

MINING - Platinum, palladium price react as strikes drag on

TECHNICAL ANALYSIS : Money and Markets - Don’t Be Fooled by Gold’s Glitter

In Gold We Trust - The End Of Bretton Woods And The Race To The Bottom, 1971

Library of Economics & Liberty - In the 1930s it seemed "obvious" that financial turmoil had caused the Great Depression

TECHNICAL ANALYSIS : Zero Hedge - Bank Of America Warns "The US Dollar Is In Trouble"

SRSrocco Report - THE COMING SILVER STORM: The Public Is Not Prepared

MineWeb - Christian vs Embry: Gold, lies and video interviews

Perth Mint Blog - Tribute Coin Proves A Boon For Bullion Sales

Gold-Eagle - Monetary Metals Supply And Demand Report

McClellan Oscillator - Can Earnings Get Better Than This?

Seeking Alpha - Gold And Silver: Are Shorts About To Panic?

02/16/14 - Bullion News

Investing - Gold and Silver: An Investor's Safe Haven, Still

MineWeb - Gold and the Dow – Beware the Ides of March

PDF : US Funds - The Ups & Downs, Twists & Turns in the World of Commodities by Frank Holmes

TECHNICAL ANALYSIS : Gold-Eagle - Gold Price Forecasts

Financial Sense - Watch for a Taper Time-Out

TECHNICAL ANALYSIS : Trader Dan's Market Views - A Different View Point on Gold's Recent Price Movement - "Sloping Trend-lines"

Profit Confidential - First Cyprus, Then Poland, Now These Savings Accounts to Get Confiscated Next

Macro Business - Tumbling US Dollar Boosts Gold -- But that's Just ONE Factor

02/15/14 - Bullion News

TECHNICAL ANALYSIS : King One Eye - Tumbling US Dollar Boosts Gold -- But that's Just ONE Factor

VIDEO : Bloomberg - Is Now Finally the Time to Get Bullish on Gold

CoinWeek - Merit Gold & Silver Lawsuit: Third Bullion Firm Targeted Under California Consumer Protection Law

TECHNICAL ANALYSIS : Silver Pheonix 500 - Silver Global Price Forecast: The Sterling Opportunity

Numismaster - Gold is Freedom

AUDIO : Peak Prosperity - Dan Ariely: Why Humans Are Hard-Wired To Create Asset Bubbles

Gold Chat - Fractional reserve bullion banking and gold bank runs: a run or stroll?

In Gold We Trust - Thoughts Behind PBOC Gold Purchase Policy

Money and Markets - As Bernanke Passes the Buck(s), Gold Will Be a Winner

CNBC - Gold to scale new heights on strong technical picture

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

02/13/14 - Bullion News

VIDEO : TheGoldandOilGuy - Technical Analysis : The Commodity Bull Market Is Starting... Corn, Sugar, Gold, Silver....

TECHNICAL ANALYSIS : Gold-Eagle - Getting Positioned In Precious Metals

Casey Research - Paper Gold Ain’t as Good as the Real Thing

TECHNICAL ANALYSIS : Market Anthropology - Still Waters Run Deep

CNBC - Does China plan to use gold to internationalize the yuan?

Gold Chat - Fractional reserve bullion banking and gold bank runs: bank run theory

Zero Hedge - Gold Breaks Above $1,300

02/12/14 - Bullion News

VIDEO : Bloomberg - What Could Prompt the Next Big Move for Gold?

TECHNICAL ANALYSIS : Zero Hedge - Goldman On Gold - "This Is A Very Important Level To Watch"

Gold Chat - Fractional reserve bullion banking and gold bank runs: the role of central banks

SRSrocco Report - U.S. Mint Nearly Sells Out Of Its Weekly Silver Eagle Allocation In Two Days

In Gold We Trust - January Chinese Gold Demand All-Time Record, 247 Tons

VIDEO : Financial Sense - Fed Taper Too Little Too Late

MoneyBeat - The Dangers of Central Bank Flip Flops on Forward Guidance

VIDEO : Cato Institute - The Libertarian State of the Union: Federal Spending

Casey Research - James Turk on How to Protect Your Portfolio from the Mother of All Bubbles

Investing - Mining Stocks, Chinese Demand, And A Potential Golden Surprise

Business Report - 2000 miners maintain strike at AngloGold Mali mines

02/11/14 - Bullion News

Twitter - (Zero Hedge) Q: Is the Fed financing and enabling the US deficit?

The New York Times - A World Unprepared, Again, for Rising Interest Rates

Gold Chat - Fractional reserve bullion banking and gold bank runs – Frankenstein Free Banking

Deviant Investor - 17 Questions That Deserve Answers

The Telegraph - Gold prices rise amid China's missing bullion mystery

Sprott Thoughts - John Embry: Silver to 100 Dollars within ‘Reasonable Timeframe’

Market Watch - Scary 1929 market chart gains traction

02/10/14 - Bullion News

King One Eye - Is the Gold Bull Back?

TECHNICAL ANALYSIS : Gold Made Simple - Gold price trades above its 100 day moving average and is up nearly 8% from NY lows

Gold Chat - Fractional reserve bullion banking and gold bank runs – inter-bank buddies business

In Gold We Trust - The Gold Market, Part 2

Times of India - Gold smugglers turn creative to beat law

Scrap Monster - Silver demand from India's gigantic solar plant to exceed 20 million ounces a year

VIDEO : Prometheus Market Insight - Has the Stock Market Bubble Burst?

CoinNews - US Government Prints 505.6 Million Banknotes in January 2014

Wall St. On Parade - Suspicious Death of JPMorgan Vice President, Gabriel Magee, Under Investigation in London

Commodity Online - Gold prospectors make a killing in Californian drought

02/09/14 - Bullion News

TECHNICAL ANALYSIS : Zero Hedge - Citi: "Gold Is Putting In A Base"

SilverSeek - Thinking Of Getting Some Silver? (And What To Do With It?)

Inside Futures - Buy Gold On Dip

IBTimes - China's Gold Demand Remains Robust...

Market Watch - For investors, something wicked this way comes

CHARTS : Zero Hedge - Long-Term Charts 1: American Markets Since Independence

King One Eye - Why Are Financial Executives Killing Themselves? Or Are They Killing Themselves?

02/08/14 - Bullion News

Money and Markets - Tapering Toward Tragedy

Inside Futures - How Do You Invest With A Weak U.S Dollar

TECHNICAL ANALYSIS : Kimble Charting - Gold Bugs index creating Bullish inverse head & shoulders pattern?

TECHNICAL ANALYSIS : Wizzen Trading - PDF : Little Bars Lead To Big Bars

AUDIO : FSN - Nick Santiago – Central Banks Trying To Banish Fear

The Epoch Times - Interview with Jim Rickards: Gold Set for Massive Rally

Gold-Eagle - The Game Changer For Gold In One Chart

Market Watch - Silver bullion coin demand has quadrupled in since 2007, says the U.S. Mint

Reuters - Exclusive - UBS seeks first-mover immunity in U.S. currency probe: sources

AUDIO : Peak Prosperity - FerFAL: Here's What It Looks Like When Your Country's Economy Collapses Argentina is showing us the playbook in real-time

Fox Business - Week Ahead: Yellen To Testify Before Congress

VIDEO : Bloomberg - Bling and Glory: What's an Olympic Gold Medal Worth?

02/07/14 - Bullion News

Bullion Vault - Invest 8% Gold "Whatever the Price"

Sunshine Profits - How Can Money Printing Exist and be Absent at the Same Time?

Gold Chat - Fractional reserve bullion banking and gold bank runs - how can I default on thee? let me count the ways

Profit Confidential - The Best Investment You Can Make in 2014?

TECHNICAL ANALYSIS : Trader Dan's Market Views - Weak Payrolls Number spurs Commodity Buying

TECHNICAL ANALYSIS : McClellan Oscillator - Coppock Curve Turns Down

Zero Hedge - Scandal: Bank Of England Encouraged Currency Manipulation By Banks

Midas Letter - Gold and Silver Prices Poised to Rise Dramatically

Zero Hedge - Consumers Max Out Their Credit Cards In Month When Personal Savings Tumble

VIDEO : CNBC - This is what Greenspan is really worried about...

02/06/14 - Bullion News

TECHNICAL ANALYSIS : Gold Made Simple - Gold edges back towards its 100DMA after briefly rising above it yesterday

VIDEO : CNBC - Gold bugs, be patient your time is coming

Gold Chat - Fractional reserve bullion banking and gold bank runs - unallocated as real (gold) bills

TECHNICAL ANALYSIS : King One Eye - Doctor Copper Delivers a Warning to the World

AUDIO : Casey Research - Doug Casey on the Difference Between Investors and Speculators

Investing - Dark Gold: A Mysterious Market by Peter Schiff

FOFOA - Seventeen

AUDIO : Turning Hard Times into Good Times - The Money Bubble. What To Do Before It Pops Jay Taylor Interviews John Rubino & James Turk

Dollar Collapse - Bitcoin: Revolution or Trap? Part 2

Wall St. Cheat Sheet - 7 Reasons Why India Craves Silver

Reuters - As gold supplies are squeezed, India's jewellery imports soar

Outsider Club - Gold Prices Gather Steam as Bullion Disappears From the Market

GoldSilverWorlds - Gold Coins: The Difference Between 24k and 22k

Bloomberg - Fed Is Misled by Wealth Effect

02/05/14 - Bullion News

Sprott Money - Demand for Physical Gold Remains Intense Despite FED Taper Announcement – Nathan McDonald

Gold Chat - Fractional reserve bullion banking and gold bank runs - the model says we are hedged

The Sovereign Investor - A Withdrawal Slip and a Note From Mom

INFO~GRAPHIC : GoldSilverWorlds - How A Physical Gold IRA Can Protect Your Wealth

CNW - Royal Canadian Mint Launches New Silver "Birds of Prey" and 99999 Pure Gold "Call of the Wild" Bullion Coin Series

BDlive - Platinum wage talks collapse, ‘intensified’ strike looms

AUDIO : McAlvany Weekly Commentary - Submerging Markets Propel Gold to Haven Status

SRSrocco Report - 2014 Silver Eagle Sales Limited By Rationed Blank Supply

Bloomberg - Hedge Funds Raising Gold Wagers Dump Copper: Commodities

Bloomberg - Lawsky Said to Open Currency Probe of Over Dozen Banks

Reuters - Lloyds suspends FX trader as investigation deepens

02/04/14 - Bullion News

King One Eye - Gold & China -- The Mystery of The Dog That Didn't Bark

Midas Letter - Downward Spiral Triggered by Quantitative Tapering "Now at $65 billion a month in the U.S., that represents a $240 billion cut in annual welfare payments to the financial services sector"

Gold Chat - Fractional reserve bullion banking and gold bank runs - a bullion bank's "assets"

In Gold We Trust - The Gold Market, Part 1

TECHNICAL ANALYSIS : Zero Hedge - Citi: Stocks, Bonds, Gold, & JPY Levels To Watch

TECHNICAL ANALYSIS : Market Anthropology - Back to the 70's (US Dollar)

Profit Confidential - Exodus Away from U.S. Dollar On?

Gold-Eagle - Gold Arbitrage And Backwardation Part II (the Lease Rate)

VIDEO : CNBC - Marc Faber: Hoping for 40 percent correction

321gold - Gold Bull Janet & The Dow

Scrap Monster - Gold up to 80 kg sneaks through Indo-Nepal border every day

Houston Chronicle - World's only real pirate treasure dug up and coming to Galveston

02/03/14 - Bullion News

Rick Ackerman - Why We Should Be Nervous When Stocks Fall

SafeHaven - Markets Say Tapering Is Tightening

Gold Chat - Fractional reserve bullion banking and gold bank runs - the setup

Casey Research - Now Is the Time to Buy Gold

MineWeb - Gold finds major support from bullish double bottom

Gold Made Simple - Sales of gold coins jump 10% in Australia and over 60% in the US

CHART : Perth Mint Blog - Monthly Sales – January 2014

Deviant Investor - S&P and Gold Extremes and Reversals

Fox Business - Gold Ticks Higher on Disappointing Data

The Golden Truth - Bad Weather And The Economy: Wall Street's Version Of "The Dog Ate My Homework"

VIDEO : Bloomberg - Dr. Copper's Price Taking Hits From China, Automakers

Jesse's Cafe Americain - Dead Bankers, Missing Reporter, and Unfolding Wall Street Scandals

02/02/14 - Bullion News

TECHNICAL ANALYSIS : TheGoldandOilGuy - Is February a Risk-On or Risk-Off Trade: Equities or Gold & Bonds

MineWeb - Christian sees $1320 gold before end of Q1, $1900 long term

Laissez Faire Club - The New American Elite : The Government Class

Sprott Thoughts - “Gold Price Going Up or Mines Will Close” Within 6 Months: Steve Todoruk

AUDIO : Peak Prosperity - Jim Bruce: The Siren Song of 'Money For Nothing'

CHART : 321gold - GOLD, the Mystery Chart

In Gold We Trust - The Need For China To Buy Gold

Silver Coins Today - US Mint Sales of Silver Coins Surge in January; Silver Falls

CPI Financial - GoldMoney: Biggest Gold buying spree since last summer

Dollar Collapse - Bitcoin: Revolution or Trap? Part 1

Zero Hedge - Market Cornered: JPMorgan Owns Over 60% Notional Of All Gold Derivatives

02/01/14 - Bullion News

CoinNews - Gold Rallies in January, US Eagle Gold and Silver Coins Surge

TECHNICAL ANALYSIS : Edge Trader Plus - Gold And Silver – Calls For Explosive Upside In PMs Misplaced

TECHNICAL ANALYSIS : DailyFX - Downside risk accelerates on Silver price as FOMC looms

INFO~GRAPHIC : Visual Capitalist - Which Gold Miners Hold The Most Supply?

SafeHaven - Taper Trouble Hits Gold's No.4 Biggest Buyer (Turkey)

Reuters - Japan turns net importer of gold in Dec, 1st time since July 2010

Gold Chat - Central Bank gold reserves transparency

TECHNICAL ANALYSIS : Market Anthropology - Silver:Gold & the Turk- en-tina Flu

Bullion Vault - Gold Investing a Safe Haven Again. Like, Surprise!

AUDIO : FSN - John Butler – The Golden Revolution: What A Difference A Book Makes

Wealth Cycles - Science Advances Use of Therapeutic Gold, Silver Nanoparticles

Mish's Blog - What the Crisis Taught Us: More Bubbles! We Need Bigger Bubbles to Combat Deflation!

Zero Hedge - Third Banker, Former Fed Member, "Found Dead" Inside A Week

01/30/14 - Bullion News

Money Forever - Bernanke’s Legacy "While banks were making record profits, seniors and savers had been left to fend for themselves."

Outsider Club - Paper Asset Ponzi Scheme Revealed

Library of Economics & Liberty - Keynesian Confirmation Bias

VIDEO : Resource Clips - The global economy according to Chris Berry, Rick Rule, Frank Holmes, Murray John and Frank Giustra

Deviant Investor - The Status of Gold Exchange Traded Funds

Gold Chat - Watching the China 2710 tonne reserves meme creation

Voice of Russia - World mints hastily minting gold coins

Sovereign Man - Presenting the latest country to lose confidence in the dollar...

GoldCore - Faber: “Physical Gold” In Switzerland and Singapore Is 20% Of “Net Worth”

RCP - The Inequality Bogeyman by Thomas Sowell

INFO~GRAPHIC : MINING - How much do metallurgists make

01/28/14 - Bullion News

VIDEO : Bloomberg - Gold and Fed Taper’s Unintended Consequences

CHARTS : Kimble Charting - Margin Debt hits all-time highs! & The Best 13-year inflation hedge is??? (Hint: It's Yellow)

TECHNICAL ANALYSIS : The Market Trend Forcast - Gold and Silver Ready To Rumble Higher?

VIDEO : CNBC - Fed Experimented in 'Price Controls': James Grant

Laissez Faire Club - Debt Ceiling Déjà Vu: The Government That Cried Wolf

Trader Dan's Market Views - Gold Tug of War Continues

AUDIO : McAlvany Weekly Commentary - This Week: Bernanke to Yellen :”Good night and good luck,” Emerging Market Chaos, Currency Crises: Replay 2008?

VIDEO : CNBC - Investors rebel against rate hikes in South Africa, Turkey

GoldChat - The story behind JPM's 10 tonne gold withdrawals

01/28/14 - Bullion News

TECHNICAL ANALYSIS : Gold-Eagle - GOLD, Bottom or Bounce

About.Ag - ALERT ON THE TULVING COMPANY

Scrap Register - US Mint New Year Gold Coin sales hit best since April

Zero Hedge - Overheard In A Gold Vault In Singapore: "We Need Additional Capacity", China's Appetite Is "Insatiable"

Acting Man - Bitcoin, Gold, and the Quantity of Money

Mish's Blog - Credit Equals Gold No.1

In Gold We Trust - Central Bankers Know All About Gold

The Gold Report - David Morgan: 'The Silver Bottom Is In: Time to Hold, Add and Ride It Out'

Scrap Monster - World’s Biggest Gold Producer-Barrick Gold Corp Warns Drop of Production

Gold Made Simple - Indian government admits 3000kg of gold a month is being smuggled into the country – restrictions to be eased soon?

AUDIO : Silver-Investor - 79% Of Americans Say We're Still In Recession

TECHNICAL ANALYSIS : Market Anthropology - Just Another Tequila Sunrise

Bonner & Partners - Don’t Buy the Dip...

Gold Chat - Diversified Precious Metals Portfolio

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

01/27/14 - Bullion News

Midas Letter - China’s ICBC Analagous to Bear Stearns First Domino in Crisis

Dollar Collapse - What Blows Up First? Part 3: Subprime Countries

King One Eye - Doctor Copper's Warning

VIDEO : CNBC - Rick Santelli - Current stock market vs. 1929

In Gold We Trust - Week 3, 2014 Withdrawals From SGE Vaults 60 Tons, YTD 159 Tons

Investor Intel - China’s gold hunger — and what that means for Beijing’s global financial power

VIDEO : GGR - Biderman and Bianco for January 2014

Bullion Vault - Floor for Gold Price at Last?

Money and Markets - Ron Paul Podcast: It’s Time, Again, for a Government-Spending Reality Check

Gold Broker - Argentina Gold Going Crazy

AUDIO : Peak Prosperity - James Turk: We're Living Within A Money Bubble of Epic Proportion

Plata - Hugo Salinas Price: 'Everything in our modern world is a lie' (Exclusive interview!)

01/26/14 - Bullion News

Shanghai Metals Market - Speculators raise copper, gold length, cut silver longs - CFTC

The Sovereign Investor - A Golden Opportunity to Insure Your Lifestyle

TECHNICAL ANALYSIS : Gold Scents - THE MOST DANGEROUS CHART IN THE WORLD

Bloomberg - Gold Mint Runs Overtime in Race to Meet World Coin Demand

CNBC - Huge short squeeze could spike gold

Seeking Alpha - 3 Friendly Reminders Why I Buy Silver

MineWeb - China ties new gold ‘spot’ contract to the Yuan

Sober Look - Fed's taper and weaker foreign participation will leave domestic investors with higher proportion of treasury purchases

TECHNICAL ANALYSIS : CEO.CA - A Looming Global Flight to Quality

Financial Express - Minting, printing and counterfeiting - Although (circulated) coins are physically durable, they fail to withstand inflation

Mish's Blog - Mid-Level Manager at Target Responds to Mish Part-Time Job Thesis

01/24/14 - Bullion News

The Golden Truth - Something Ominous May Be Coming At Us

TECHNICAL ANALYSIS : Nifty Charts - Gold Bullish Price Action and Resistance Levels

VIDEO : 321gold - Technical Analysis : Gold Market Key Indicators Are Bullish

CoinNews - 2014 America the Beautiful Quarters – Release Dates and Images

TECHNICAL ANALYSIS : ZEAL - Gold Bottoming

AUDIO : Sprott Money - Ask the Expert – Peter Schiff

MineWeb - Global mined gold output rose 4% in 2013

Gold Chat - Wealthy Chinese short sellers a source of future demand?

Perth Mint Blog - Year Of The Horse 5oz Silver Bullion Coin Available Now

Money Morning - One of the Many Reasons Gold was Up Yesterday...

Gold Made Simple - Does Germany hold the key to higher gold prices in 2014?

Cato Institute - Food Stamp Growth Continues, Despite Economic Recovery

McClellan Oscillator - Important Points About The Minimum Wage

Zero Hedge - How the Paper Money Experiment Will End

01/23/14 - Bullion News

TECHNICAL ANALYSIS : Zero Hedge - Bank Of America: "Gold Squeeze Gets Explosive Above 1270"

Daily Reckoning - When Gold Knocks On China’s Front Door

Profit Confidential - Why We’re Headed for a Period of Stagflation and What It Means for Investors

VIDEO : CNBC - Cashin: Why 'everybody is on alert'

King One Eye - Stocks Swoon, Gold Soars

MoneyNews - South African Strike Hits World's Top Platinum Producers

GoldSilverWorlds - Russia Adds 79.5 Tonnes Of Gold In 2013 To Its Reserves

GoldCore - China Reports Gold Reserves Unchanged Again at End 2013

In Gold We Trust - Open Letter To CPM Group

Bloomberg - Abenomics Spurs Gold Sales in Japan as Inflation Hedge

SilverSeek - Silver “Bullets” – Not just about Vampires and Werewolves - by David Morgan

forexlive - London fix on the way to the scrapheap as volumes plunge

The Real Asset - Understanding the London Gold Fix

Gold Chat - Gaming the London Fix ... Seat Price

01/22/14 - Bullion News

TECHNICAL ANALYSIS : Trader Dan's Market Views - Range Trade in Gold remains Intact

B2C - Gold Market to See Supply Shock in 2014?

Profit Confidential - Massive Shock Coming to the Gold Market Soon?

AUDIO : McAlvany Weekly Commentary - 3 Canaries in a Coal Mine: Watch Them Closely!

Deviant Investor - 14 Questions for 2014

Bloomberg - Century-Old London Gold Benchmark Fix Said to Face Overhaul

Bullion Vualt - Gold Market to See Supply Shock in 2014?

Peak Prosperity - "Endless Growth" Is the Plan & There Is No Plan B

SRSrocco Report - Is The U.S. Running Out of Gold Scrap?

Numismaster - No Gold in Warehouse?

Business Insider - Here's Ray Dalio's Advice For Investing In The Market Cycle We're In Right Now

01/21/14 - Bullion News

TheGoldandOilGuy - Gold Market Traders: Metals And Stock Market will Swap Trends – Part II

Reuters - Gold holds steady below six-week high

Bullion Vault - Gold Bars at NY Fed "Need Recasting", Says Bundesbank

Gold Chat - The Bundesbank & the Narrative of Central Bank Omnipotence

Kimble Charting - Hollywood and Gold investors have poor timing at extremes?

South China Morning Post - Asian players develop an appetite for risky commodities trading - Capital-rich Asian firms show interest as Western banks exit sector

In Gold We Trust - Chinese Gold Leasing: Hidden Danger

TECHNICAL ANALYSIS : King One Eye - 3 Charts on Gold

CoinWeek - The Coin Analyst: Forces Shaping Precious Metals in 2014

INTERACTIVE CHART : U.S. Global Investors - Explore how natural resources have performed over the last 10 years

01/20/14 - Bullion News

TECHNICAL ANALYSIS : Nifty Charts - Gold Chart at Crucial Resistance Zone

TECHNICAL ANALYSIS : Nifty Charts - Silver Chart Update

VIDEO : Gold Switzerland - THE MATTERHORN INTERVIEW 2014 SPECIAL Interview with James G. Rickards; author, economist, lawyer. entrepreneur.

TECHNICAL ANALYSIS : Rambus Chartology - Precious Metals…A Reversal of Fourtune ?

Bloomberg - Platinum Mines Face Biggest Strike Since Deadly ‘12 Clash

SilverSeek - Silver – The Power Of Thought Will Ultimately Prevail

VIDEO : Cambridge House - The US is living a lie - David Morgan Interview

MineWeb - Deutsche Out, China In for the Fix?

The Real Asset - Daily Nugget – The gold price climbs as China gets ready to announce...

Shanghai Daily - China Expected to Announce it has more than Doubled Gold Reserve, Expert says

VIDEO : Cambridge House - Mike Maloney: The US Dollar WILL Collapse!

Bullion Vault - Central Banks, Gold & the Currency Market, Part II

01/19/14 - Bullion News

McClellan Oscillator - Gold Breaks Downtrend, Sort Of

PDF : Wizzen Trading- Technical Analysis : Gold’s Base Building

Silver Coins Today - 2014 Australian Gilded and 1/10 Oz Koala Silver Coins

TECHNICAL ANALYSIS : ZenTrader - Speculative Buying Underlies Strength In Silver

Gold-Eagle - China Expands Gold Reserves, Surged Past Italy and France in Ranking

Seeking Alpha - Preciously Functional: Palladium May Outshine Its Cohorts ... Again

Zawya (Dubai) - DSF gold sales strongest in seven years, jewellers say

01/18/14 - Bullion News

TECHNICAL ANALYSIS : Edge Trader Plus - Gold – Disconnect Between Fundamentals And Price. Perception Rules

The Economic Times - Gold will rally, but silver will do better: Jim Rogers

AUDIO : Sprott Money - Weekly Wrap Up : Eric Sprott on Bafin's Findings on Metals Manipulation

ZEAL - Gold Drives Silver

AUDIO : Peak Prosperity - A New Way to Hold Gold

CoinNews - Gold Up for 4th Week; 2013 vs. 2014 US Mint Bullion Sales Starts

In Gold We Trust - Spectacular Gold Demand (79 Tons) on SGE in Week 2, 2014

SRSrocco Report - U.S. Total Gold Exports Up 31% In October 2013

VIDEO : Future Money Trends - The Money Bubble...& Gold & Bitcoin - John Rubino Interview

MoneyBeat (WSJ) - New Warnings From an Investing Pioneer

SD Bullion - 4.8 star Customer Reviews

01/17/14 - Bullion News

TECHNICAL ANALYSIS : MoneyBeat (WSJ) - Gold Bugs Poised to Pounce on Next Big Rally

Reuters - How London's gold and silver price benchmarks are "fixed"

Bloomberg - Metals, Currency Rigging Is Worse Than Libor... Bafin

Gold Chat - What Bafin's König really said about precious metals manipulation

Sprott Asset Mgmt - One More Sign of Manipulation in the Gold Market by Eric Sprott

VIDEO : Kitco - Global PMI: Key Number To Track Says Frank Holmes

CHART : King One Eye - Commodity Prices in the Bernanke Era

Acting Man - The Mainstream Loves to Hate Gold

VIDEO : Bloomberg - Fed-Fueled Stock Market Rally: A Bull Built on QE

Gold Made Simple - China to launch Yuan backed gold contract – another move towards Yuan gold backing?

In Gold We Trust - The Big Reset, Part 1

The Real Asset - Palladium, the one to watch in 2014?

The Australian - World's Biggest Gold Coin Goes on Tour

01/16/14 - Bullion News

Bullion Vault - Gold Prices Bottoming, "Long-Term Buy": CPM's Christian

Gold-Eagle - Gold As A Deflation Hedge

Peak Prosperity - Why We All Lose If the Fed Wins by Chris Martenson

VIDEO : Bloomberg - Bernanke on Crisis: We Did the Right Thing, I Hope

Zero Hedge - Who Are The Top Holders Of US Treasurys

The Bullion Desk - Shortage of large gold bars leads to rare London premiums

Gold Chat - How to know when there is a real physical-paper disconnect developing

Shanghai Metals Market - Silver Could Rise in 2014 — Here are 4 Reasons Why

MineWeb - Notable physical demand keeps bearish gold thoughts in check says HSBC's James Steel

POLL : Gallup - More Americans Worse Off Financially Than a Year Ago

01/15/14 - Bullion News

Casey Research - Contrarians’ Wildest Dream Coming True

VIDEO : Zero Hedge - Marc Faber Warns "The Bubble Could Burst Any Day"; Prefers Physical Gold To Bitcoin

Bullion Vault - Gold Mining Costs "Put Floor" at $1150, Supply to "Decline Rapidly"

VIDEO : Bloomberg - Will Gold Rally in 2014?

King One Eye - Top 10 Reads on Gold and Silver -- the best values in decades!

CHART : Kimble Charting - These 3-year worst performers (Dogs) about to perform well?

VIDEO : GoldBroker - Physical Gold, the Safest Asset in an Unsafe World

Coin Update - Silver Eagle Bullion Allocation to Drop Next Week

In Gold We Trust - Zhang Bingnan: Gold Safeguarding National Economy

The New York Times - China Grants Gold Import Licenses to Foreign Banks for First Time: Sources

AUDIO : FSN - Jerry Robinson - Is China's 24 Trillion Credit Bubble Abut to Pop?

Profit Confidential - If Gold’s a Bad Investment, Why Is This Country Buying 150% More of It?

Deviant Investor - Fire and Ice: Inflation and Deflation

NDTV (India) - Government seeks gold purchase information from jewellers as smuggling rises

01/14/14 - Bullion News

Money Morning - 1,600 Reasons to Buy Gold

TECHNICAL ANALYSIS : Gold Made Simple - Gold price trades back above the average cost of production – now up 6% from the new-year’s eve lows

GoldSilverWorlds - Gold Coin Demand Exploding In Europe And China On Gold’s Price Lows

Perth Mint Blog - Platinum Platypus To Continue In 2014

TECHNICAL ANALYSIS : Market Anthropology - Esoterica

Market Watch - Monday selloff is a warning sign

CHART : Kimble Charting - Three largest SPY declines in 7-years took place when this happened!

Numismaster - Gold: Bad Year, Good Decade

Mish's Blog - Gold Manipulation: Is it Illegal? Risk Free? What About JP Morgan?

Dollar Collapse - Europe’s Really Bad 2014 In Two Charts

Bullion Vault - China Slowdown Speeds Up

Perth Mint Blog - Why Gold Can Never Be In A Bubble

SHTFplan - Top Strategist: A Shocking Revelation About Gold Mining Companies

01/13/14 - Bullion News

CoinNews - 2014 American Silver Eagles Limited in Sales Start

VIDEO : Bloomberg - Jim Rogers Explains How Capitalism (the Free Market) is Suppose to Work

Commodity Trade Mantra - Economy Outlook For 2014 – From An Austrian Economist’s Perspective

GoldSeek - Why China wants low Gold prices?

Coin Update - First Day 2014 Silver Eagle Bullion Sales Reach 3,180,500

Seeking Alpha - Open Letter To Gold Investors: Will The Real Manipulator Please Stand Up?

CEO.CA - Silver Poised for Breakout

VIDEO : SGT Report - "He Who Owns the Gold Makes the Rules" -- DAVID MORGAN

01/12/14 - Bullion News

Silver Coins Today - 2014 American Eagle Silver Coins, Ordering Limits on Release

TECHNICAL ANALYSIS : TheGoldandOilGuy - New Gold Bull Market Has Started

TECHNICAL ANALYSIS : Trading to the Mark - Gold retrospective for 2013: If you traded with these charts, you profited

Zero Hedge - Did Goldman Just Kill The Music? - "The S&P500 Is Now Overvalued By Almost Any Measure"

The Indian Express - A golden corridor

INFO~GRAPHIC : Bloomberg - Waste : Congress funds another project that America doesn't need

01/11/14 - Bullion News

TECHNICAL ANALYSIS : Edge Trader Plus - Gold And Silver – There Are Reasons Greater Than Demand For Owning Them

My Record Journal - Man charged with selling fake Morgan Silver Dollars

MoneyBeat - When Does A Bubble Spell Trouble?

Forbes - The Most Reliable Indicator Of An Approaching Market Top

McClellan Oscillator - Presidential Cycle Inverting?

MoneyNews - Gold, Silver Imports by India Tumble as Government Keeps Curbs

Reuters - Shanghai Gold Exchange eyes launch of international board

Zero Hedge - When A Stock Bubble Goes Horribly Wrong And Hyperinflation Results

VIDEO : Bloomberg - El-Erian: Jobs Report Puzzling, Worrisome, Shocker

XinhuaNet - China to expand cross-border use of RMB: PBOC

01/10/14 - Bullion News

BullionVault - Fed Tapering, Jobs & Gold

CoinWeek - How to Avoid Becoming the Victim of a Fake Gold Coin

TECHNICAL ANALYSIS : SilverSeek - Silver Bottoming?

TECHNICAL ANALYSIS : Rambus Chartology - Gold… The Bull vs Bear ; Checkmate or Game On ?

King One Eye - Gold and Jobs, Aqua Vortex Edition

Bloomberg - China Seen by Bloomberg Industries Boosting Bank Gold Reserves

CoinWeek - Precious Metals IRAs … A Primer

Wall St. Cheat Sheet - Are Goldbugs Getting More Physical?

01/09/14 - Bullion News

VIDEO : CNBC - Who will buy Treasurys now?

VIDEO : Prometheus Market Insight - Technical Analysis : Historic Sentiment Extreme Suggests Stock Market Bubble on Verge of Collapse

Business Insider - MONETARY TECTONICS: Here Are 50 Slides Detailing The War Between Inflation And Deflation

VIDEO : Bloomberg - Gold Restrictions Fuel Black Market in India

Numismaster - Will 2014 Gold Eagle Demand Beat 2013?

Money and Markets - What's Ahead for Gold?

AUDIO : McAlvany Weekly Commentary - 2014: Year of Unintended Consequences

TECHNICAL ANALYSIS : Market Anthropology - Australian for Gold

CSInvesting - Tobin’s Q: The Market is 60% Overvalued

Perth Mint Bullion - Comex Stocks: Claims On Bullion Well Below Historical Highs At 5:1

MINING - Canada's coldest mines

01/08/14 - Bullion News

Silver Coins Today - Ending Annual Sales Record for 2013 American Eagle Silver Coins

BMD - What are Physical Precious Metals Capital Gains Rates...

ETF Daily News - Why Gold Still Belongs In Your Portfolio

VIDEO : Bloomberg - Can Palladium Build on a Strong 2013 Market?

Zero Hedge - One Week Into 2014, UK Royal Mint Runs Out Of Gold Sovereigns

Casey Research - 23 Reasons to Be Bullish on Gold

MineWeb - Nic Brown of Natixis looks at some of the big themes likely to be seen in the gold market over 2014 and explains why he is a big fan of platinum

Daily Reckoning - The Best Bet Against a Reckless Fed

FOFOA - Chapter 1

TheGoldandOilGuy - The Most Important Trading Tool That Money Can’t Buy

Coin Update - 2014 Silver Eagle Bullion Coin Sales Begin January 13

Zero Hedge - They Give Awards For That?!

Kimble Charting - Finally proof…”Deflation” is taking place at the Fed!

01/07/14 - Bullion News

VIDEO : CNBC - Ron Paul: Correction hasn't corrected anything

VIDEO : CNBC - Inflation Threat

MineWeb - Further short term volatility for gold expected

INFO~GRAPHIC : GoldSilverWorlds - The Wonderful Uses Of Silver

VIDEO : Kitco - No U.S. Economic Recovery Says James Turk

TECHNICAL ANALYSIS : Market Anthropology - Two roads diverged in a yellow wood...

GoldSeek - It’s not (just) about the Gold by David Morgan

In Gold We Trust - China’s FX Research Center: Gold Is The Strategy

Proactive Investors - Spot gold continues to firm as Asian investors snap up physical bullion

Zero Hedge - Gold "Speculation" Drops To Record Low

AUDIO : Tom Woods - David Stockman: Krugman Wrong, Critics Right About Fed, Economy

Business Week - BullionVault’s Gauge of Client Buying Declines to Five-Month Low

CoinNews - How the Denver Mint Makes Dies to Produce Coins

Affiliate Ad

01/06/14 - Bullion News

Daily Reckoning - The Terminal Velocity of Money

TECHNICAL ANALYSIS : Acting Man - Gold in 2014 and Beyond

Trader Dan's Market Views - A Real FLASH CRASH

Mining - Shorts could be behind gold price flash crash

TECHNICAL ANALYSIS : Gold Made Simple - Gold price now up 5% in 2014 but remains UNDER the cost of production for nearly a month

GoldSilver - Weimar Hyperinflation's 1000 Billion Mark Note | Mike Maloney

Capital Liberty News - Jim Rogers: Collapse of the Federal Reserve is ‘a probability’

VIDEO : Silver-Investor - David Morgan's 2014 Silver Survival Guide

Reuters - India considers easing gold import curbs - govt sources

Gold Chat - Reinhart and Rogoff: 1933 US gold reprice was a debt default

BusinessWeek - SNB Expects $10 Billion Loss for 2013 as Gold Price Plummets

01/05/14 - Bullion News

PDF : Wizzen Trading - Technical Analysis : Double bottoms Up

ElliottWave - Historic Optimism in the Stock Market - What Does it Mean?

Market Watch - Stock market to find out if the Fed made the right move, Week ahead: FOMC minutes, jobs report, and a slow start to earnings season

MineWeb - Don’t get too carried away by gold’s good 2014 start

In Gold We Trust - Unprecedented Total Chinese Gold Demand 2013

Daily Reckoning - The Fed’s War on Pennies

AUDIO : McAlvany Financial - First High Quality Gold Hoard In Over A Decade

CSInvesting - Templeton’s 16 Rules; Go Where the Outlook is MOST Miserable; Young Investors

Sprott's Thoughts - Who Is Teaching the Young About Investing?

01/04/14 - Bullion News

Acting Man - This Unexpected Event Will Cut the S&P 500 in Half

AUDIO : Peak Prospertiy - Brian Pretti: The World's Capital Is Now Dangerously Boxed In - Creating asset bubbles ready to burst

CoinWeek - The Coin Analyst: U.S. Modern Coins in 2014 U.S. Global Investors - Interactive Recap: Our Favorites from 2013

01/03/14 - Bullion News

VIDEO : CNBC - We'll have to wait till Monday to see if "things get real" here - Art Cashin

TDMV - Strong Physical Demand out of Asia is the story

VIDEO : CNBC - 2014 won't be a good year for the US dollar says Michael Woolfolk, Currency Strategist at BNY Mellon

The Telegraph - IMF paper warns of 'savings tax' and mass write-offs as West's debt hits 200-year high Debt burdens in developed nations have become extreme by any historical measure and will require a wave of haircuts, warns IMF paper

Market Watch - Gold has its S.O.S. moment, and it’s bullish

Zero Hedge - Physical Gold Demand Soared As Gold Price Tumbled In 2013

Seeking Alpha - Eric Parnell Positions For 2014: The Payoff In Precious Metals Has Enormous Potential

SRSrocco Report - The Historic Gold-Oil Ratio Forecasts A Much Higher Price For Gold

Perth Mint Bullion - Monthly Sales - December 2013

VIDEO : GoldBroker - The Coming Failure of the Gold Paper Market and the Importance of Owning Physical Gold as Insurance

01/02/14 - Bullion News

Resource Clips - Fools for Gold - Matthew Hart examines how the yellow metal makes men mental by Greg Klein

AUDIO : Korelin Economics - Rick Ackerman and Technicals – Thu 2 Jan, 2014

Financial Sense - Gold Down 28% in 2013 Despite "Skyrocketing Demand"

Library of Economics & Liberty - Why Government Doesn't—and Can't—Manage Resources Like a Private Business

In Gold We Trust - Sun Zhaoxue: US Intends To Suppress Gold To Ensure Dollar’s Dominance

How Fiat Dies - How We Know Inflation is Coming

Cyniconomics - 2013 Most Viewed Posts

Forbes - U.S. Mint Gold-, Silver-Coin Sales Rise In 2013 On Retail Bargain Hunting

Brisbane Times - Gold and silver bullion worth $200K stolen from war veteran's home - Australia

Brisbane Times - Bullion collector fourth to be robbed in recent months - Australia

AUDIO : ABC Brisbane - Police appeal for help in bullion theft - Australia

01/01/14 - Bullion News

The Sovereign Investor - This Hated Sector Will Surprise Everyone in 2014

Investing - Silver A Wise Investment Against Inflation

My Budget 360 - The Great Income Divide: IRS data shows 50 percent of households make less than $35,000 per year. Top 10 percent pay 68 percent of income taxes

SoberLook - By the End of 2014, Student Loan Balances held by the Federal Government will Exceed $850 Billion

Perth Mint Bullion - 2014 Australian Kookaburra 1oz Silver Bullion Coin Sold Out

McAlvany Weekly Commentary - Albert Cheng: Gold Markets Move East

321gold - Bitcoin Takes on Gold

The Japan Times - Bank of Japan likely to maintain easing policy, chief says

Other pages, on this Guide, that you

may like...

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage

Click Ad to Request a Free Appraisal Kit

ExpressGoldCash

Customer Reviews 4.9 stars

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)