Homepage / Archived News or Quarterly News / 2nd Quarter 2014

2nd Quarter - 2014

Charts, Bullion News & Commentary

This page provides a comprehensive overview of gold, silver, platinum, and palladium during the quarter.

For each of the precious metals, you'll find charts. Below the charts, you will find Bullion News Headlines from the 2nd Quarter of 2014. Every news link (below) was originally posted on this guide's homepage.

The quarterly charts provide insight into the volatile precious metals markets, while the news below the charts provides a deeper understanding of the fundamentals influencing these markets.

The charts below are provided courtesy of

Gold Price Charts - 2nd qtr. 2014

Gold Price Summary

The price of Gold during the 2nd quarter of 2014 had its ups and downs. During the first two weeks of April, Gold saw higher close after higher close, and then the price fell (green dotted line - below) almost without warning.

In the quarterly chart below, the RSI (upper indicator) showed a slight indication that the price would turn south. After the price drop in gold, the 50MA (50-day moving average) started to slope down, creating a Death Cross.

In early June, the RSI showed that the price was going to head higher (purple dotted line).

(continued...)

Gold Price Chart (April 1st, 2014 - June 30th, 2014)

Bullion News

Gold Price Chart (April 1st, 2013 - June 30th, 2014)

Gold Price Summary (continued)

Support for the price of gold held at the $1180.00 level.

For gold's price to break into a new bull market, it must surpass several resistance levels. The first resistance level for gold is around $1400.00; then it will need to break the $1550.00 price level before the market realizes that gold is back in a bull market.

Gold Price Chart (July 1st, 2011 - June 30th, 2014)

Bullion News

Silver Price Charts - 2nd qtr. 2014

Silver Price Summary

Silver's price in the 2nd quarter of 2014 continued to be choppy.

During

the first two-thirds of the quarter, the price of silver repeatedly

tested the $18.00 a troy oz. price support level, only to bounce back up

again.

Shortly after the first of June, the price dramatically changed direction to the upside.

However, highlighted below, late in the quarterly chart, the RSI (upper indicator) and the MACD (lower indicator) were both topping out, showing a change in the price of silver was coming, in the next quarter.

Silver Price Chart (April 1st, 2014 - June 30th, 2014)

Bullion News

Silver Price Chart (April 1st, 2013 - June 30th, 2014)

Bullion News

Silver Price Chart (July 1st, 2011 - June 30th, 2014)

4.7 star - Customer Reviews

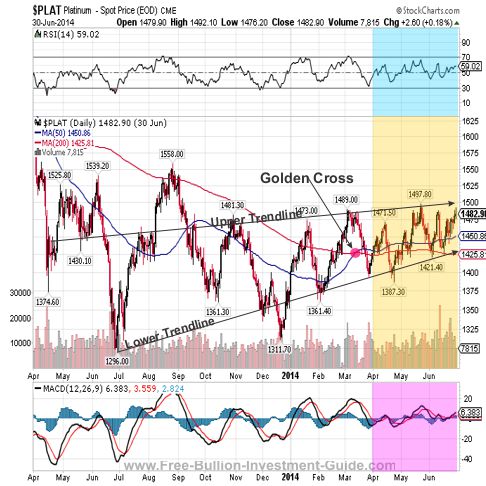

Platinum Price Charts -

2nd qtr. 2014

Platinum Price Chart (July 1st, 2011 - June 30th, 2014)

Bullion News

Platinum Price Summary

Platinum's Price during the 2nd Quarter of 2014 continued its slow march towards higher prices.

The Golden Cross showed up late in the 1st Quarter of 2014, signaling the price was probably going higher, and it did.

However, a golden cross doesn't always indicate higher prices.

The Upper and Lower Trend-lines, in the 1year chart, are squeezing the price of Platinum.

In addition, the squeeze is also showing up in the MACD (lower indicator) and the RSI (upper indicator), on the 3year chart, above.

The

price and both indicators have risen throughout the quarter, a

reversal or consolidation in price may be in Platinum's future.

Platinum Price Chart (April 1st, 2014 - June 30th, 2014)

Bullion News

Platinum Price Chart (April 1st, 2013 - June 30th, 2014)

Bullion News

Palladium Price Charts -

2nd qtr. 2014

Palladium Price Chart (July 1st, 2011 - June 30th, 2014)

Bullion News

Palladium Prices

The price of palladium has been steadily heading higher, during the 2nd quarter of 2014.

In the 1st Quarter of 2014, we saw the squeeze in the price of Palladium, break to the positive.

For

this quarter, there are no obvious signs showing up on Palladium's

chart of future price direction, except for the fact that no chart

continually goes up without a pullback or consolidation.

So look for some sort of correction in price to come in the 3rd quarter,

possibly larger than the one seen in mid-June of this quarter.

Palladium Price Chart (April 1st, 2014 - June 30th, 2014)

Bullion News

Palladium Price Chart (April 1st, 2013 - June 30th, 2014)

The charts above are provided courtesy of

2nd Quarter - 2014

Bullion News & Commentary

The Quarterly News starts with the end of the quarter articles, first.

Please note that not all of the links below work; the links are kept because the headlines still provide insight into how the markets were moving at the time.

06/30/14 - Bullion News

TECHNICAL ANALYSIS : Acting Man - Gold So Far Still Looking Good

VIDEO : The Daily Gold - Gold COT Analysis

The Epoch Times - Is the Fed Unconstitutional? - Constitutional Lawyer Edwin Vieira explains the history and legal structure of the Federal Reserve System. Intro by Wall Street legend Victor Sperandeo

Sovereign Man - A Time of Universal Deceit

The New York Times - Central Bankers, Worried About Bubbles, Rebuke Markets

The Gold Report - Dodge Economic Bullets with Greg McCoach's Golden Strategy

TECHNICAL ANALYSIS : Kimble Charting - Are inflation assets about to “Break out” or Peak out?”

Inflation Data - Japanese Inflation Higher than U.S- First Time Since 1978

In Gold We Trust - SGE Withdrawals 36 MT in Week 25, YTD 920 MT

Xinhua.Net - China signs RMB business MoUs with Luxembourg, France

06/29/14 - Bullion News

Global Research - Inflation, Deflation and the Gold Market : “Gold is the constant” - Interview with “In Gold We Trust“ report, renowned gold market analyst Ronald Stoeferle

INFO~GRAPHIC : JM Bullion - Bitcoins vs. Gold

Indian Express - Swiss money trail: From gold and diamond to stocks and bitcoins

Bloomberg - Dollar Falls Most Since April Amid Pessimism on Economic Growth

TECHNICAL ANALYSIS : Market Anthropology - Friday Night Lights

AUDIO : WallSt. for MainSt. - Charles Goyette & John Rubino: Global Fiat Ponzi Scheme Will End Badly

CHARTS : USA GOLD - Three developing gold market situations to monitor for the rest of 2014

CHARTS : Zero Hedge - 13 Ways Of Looking At Record Low Volatility

Bloomberg - South African Miners Quit World Gold Council on Costs

06/27/14 - Bullion News

TECHNICAL ANALYSIS : SOLARCYCLES - Turning Point?

TECHNICAL ANALYSIS : Kimble Charting - 10-year yield could fall 20% if this breaks, says Joe Friday!

Wealth Daily - Is Your Gold Safe from the Government?

FOFOA - Fiat 33

Bullion Vault - Gold Price vs. Pundits: Can't Both Be Wrong

TECHNICAL ANALYSIS : The Bullion Desk - Silver Price – In Bearish Wedge Formation

VIDEO : GoldBroker - Interview with Julian Phillips on Gold, Geopolitics & the Big Reset

06/26/14 - Bullion News

CoinNews - Gold Slips for First Loss in Seven Sessions, US Mint Coin Sales Rise

TECHNICAL ANALYSIS : Kimble Charting - Gold Bulls “day & year could be made” if this comes true!

King One Eye - Ohmergerd, Gold Is Doomed! Oh Wait!

CoinsWeekly - Israel Continues Gold Bullion Coin Series: Hurva Synagogue

VIDEO : CNBC - The world's first wholesale 25 kilobar gold contract

Bloomberg - China Finds $15 Billion of Loans Backed by Fake Gold Trades

VIDEO : Gordon T Long - Macro Analytics - Mysterious Buying w/ John Rubino

Sovereign Man - Singapore official discusses ‘uneasy calm’, tells banks to prepare for financial collapase

VIDEO : Market Update - Antal Fekete: Gold as the ultimate Destroyer of Debt - Google Translation Link (Video in English)

CNBC - Obamacare Will Suck the Life Out of the Economy

PDF : DRSchoon - SMART MONEY, DUMB MONEY & YOUR MONEY

Mish's Blog - Bitcoins to Become Legal Currency in California; Bill Awaits Signing by Gov. Brown; Commodities vs. Currencies

nano werk - Liposuction goes Nanotech - Melting Fat with Gold-NanoParticles

06/25/14 - Bullion News

Investment U - Catch the Golden Goose

Casey Research - Does Gold Belong in Every Portfolio?

Fast Markets - LBMA releases details of silver fix bids

INFO~GRAPHIC : Visual Capitalist - The Gold Series: Five Reasons To Own Gold

VIDEO : Mises Media - The Mises View: "The Fed Distorts Everything"

My Budget 360 - The chasm between the real economy and stock market: Where is the wealth in the US?

Dollar Collapse - They’re Lying To Us, Part 2: GDP

AUDIO : CATO Institute - Returning to a Stable Dollar : Interview with Steve Forbes

Reuters - Secretive Swiss vaults may hold missing link in platinum price equation

AUDIO : McAlvany Weekly Commentary - Copper, Aluminum & Gold, Where’d It All Go?

U.S. Global Investors - FATCA: Good Intentions, Poor Design

Reuters - China, Singapore vie for Asia gold pricing alternative to London

In Gold We Trust - LBMA Forum Singapore: SGE Chairman Confirms Chinese Gold Demand In 2013 Hit 2000 MT

06/24/14 - Bullion News

PDF : Acting Man - Incrementum AG : In Gold we Trust 2014 Report – Extended Version

TECHNICAL ANALYSIS : Gold-Eagle - Midas Touch Gold & Silver Update

news24 (S. Africa) - The Great Platinum Mine Strike is Over!

MineWeb - CPM predicts largest-ever platinum market deficit in 2014

VIDEO : International Man - Doug Casey Talks About Meltdown America

CHARTS : GoldBroker - Russia’s Role in the Gold Market

: Zero Hedge - Head Of German Gold Repatriation Initiative Responds To Bloomberg Story About Repatriation Halt

Bloomberg - So Long, Disinflation, as JPMorgan Sees Global Prices Rising

Market Anthropology - Bubble Bubble Toil & Trouble

TECHNICAL ANALYSIS : Kimble Charting - Monster “Mega-Phone” pattern breakout near?

Market Watch - Short-lived correction threatens overbought market

Perth Mint Blog - Coins Or Bars - What's Best For You?

06/23/14 - Bullion News

Wall St. Cheat Street - Fundamental Reasons to Buy Precious Metals

U.S. Global Investors - Ah, the Power of Mean Reversion by Frank Holmes

Sprott Money - Janet Yellen Gives the Green Light to Inflation…Gold and Silver Surge

CNBC - Sovereign debt the 'ultimate bubble': Wilbur Ross

CoinNews - Gold Inches Up, US Mint Shenandoah Bullion Coins Temporarily Sold Out

TECHNICAL ANALYSIS : CEO.CA - The Seeds are Planted for the Next Gold Bull

VIDEO : TheGoldandOilGuy - Technical Analysis : Gold, Silver and Gold Stocks Rally - How to Invest Correctly

Money and Markets - War Cycles Sending Gold, Mining Shares SOARING!

Bloomberg - German Gold Stays in New York in Rebuff to Euro Doubters

cnsnews - 11,004,507: Disability Beneficiaries Top 11 Million for First Time

TECHNICAL ANALYSIS : King One Eye - Could Gold Keep Rallying? If So, How Far?

Bloomberg - Platinum Strikers May Report June 25 If Pay Deal Accepted

In Gold We Trust - Hong Kong Is The Key In Global Gold Trade, For Now

06/20/14 - Bullion News

MoneBeat (WSJ) - Few Predicted Gold’s Rally, Few Believe It’ll Last

VIDEO : CSInvesting - Fire or Ice: Our Economic Future

MoneyWeb - Platinum miners reconsidering backdating offer

CHART : MINING - Silver price busts out of 3-year downtrend

TECHNICAL ANALYSIS : Market Anthropology - Beware the Fury of a Patient Position

Daily Reckoning - Value of Silver vs. Value of the Dollar

Bloomberg - Shanghai to Start International Gold Trading in 4Q

OPINION : The Bullion Desk - Sizing up the horses in the LBMA silver fix race

Profit Confidential - Why Gold Went Up $50 Yesterday

Money and Markets - “Inflation Trade” Raging! How to Make Money as Gold, Rates Rise!

06/19/14 - Bullion News

NanoTechWeb - Gold Nano-Matryoshkas Kill Cancer Cells

VIDEO : CNBC - RBC's George Gero: Why gold is so hot today

CHART : Profit Confidential - What the Collapse in Lumber Prices Means for Stocks

AUDIO : HoweStreet - Danielle Parks "The Fed’s Efforts Basically Dead"

Economic Policy Journal - The Price Inflation That is About to Hit Will Catch the Fed Flatfooted

CoinNews - Gold Soars 3.3% to Top $1,300; Silver Surges 4.4%

China Economic Net - Panda gold, silver bullion coins issued in Malaysia - "From 2015, coins will use gram and kilogram as measurement units and the 2014 Panda Gold coins will be the last coins measured by ounce."

MoneyBeat (WSJ) - Silver Fix Knock-Out Stage Starts Friday

Bloomberg - New Silver Benchmark Seen Heralding Gold Fix Revamp

In Gold We Trust - Investment Gold Demand Higher in Switzerland than China?

GoldBroker - India’s Role in the Gold Market

LA Times - - Coin Firm's $2 Bill Offer Doesn't Make Sense

- Coin Dealer Offers $9.50 for a $2.00 Bill

VIDEO : GoldSilver - Silver Or Gold - What To Buy? Mike Maloney, Ed Steer & Peter Spina

06/18/14 - Bullion News

The Telegraph - Gold Buyers and Sellers to Explore Reform of the London Fix - Representatives of bullion banks, exchange traded funds, refiners, exchanges, industry bodies, central banks and miners to meet to discuss changes

The Blaze - When Will the Multi-Trillion-Dollar Debt Parties Stop?

Sprott Money Blog - Debt Numbers that will Blow Your Mind

GoldChat - Allocated Gold at Bank of England declines 755 tonnes

AUDIO : FSN - Chris Vermeulen – Get Ready For The Precious Metals And Miner Breakout

TECHNICAL ANALYSIS : Kimble Charting - Gold Miners about to blast off due to this potential bullish pattern?

321gold - Outlook on the Dollar, Currencies & Markets: Look Out Below!

Acting Man - A Survivor’s Guide to the World of Funny Money

The Gold Report - Is It 2003 All Over Again? U.S. Global Investors' Frank Holmes Predicts a Resurgence of the Love Trade for Gold

Kitco - Palladium Used To Transform Radioactive Waste Into Rare Earth Element

The Journal - Golden find at Northumberland Roman fort after 40 years of digging

06/17/14 - Bullion News

U.S. Global Investors - Gold Investors: Let This Cycle Be Your Guide - by Frank Holmes

TECHNICAL ANALYSIS : Gold-Eagle - Gold and Oil Fuel the Canadian Stock Market Rally

In Gold We Trust - The Bank Of England Lost 487 Tonnes Of Gold In 2013

CHARTS : dshort - What Inflation Means to You: Inside the Consumer Price Index

CNBC - Few-strings-attached loans at record levels

SRSrocco Report - PRECIOUS METALS & The Death Of The Business Cycle

MoneyWeb - Platinum firms and Amcu agree 'in principle' on wage offer

VIDEO : CoinWeek - Precious Metal Verifier Available to Help Determine Genuine Gold & Silver Items

Wall St. Cheat Sheet - Mining for Investments: Silver Is a Golden Opportunity

GoldChat - Fixing the Fixed Fix - Barclays Case

VIDEO : GoldSilver - Silver Investing: A Game Of Ounces - Mike Maloney

Numismaster - Russia, others move toward currency union

IOM Today - World’s first solid gold credit card to be launched by IMGold

06/16/14 - Bullion News

Heartland - Gold, Government and Monetary Freedom

Global Financial Intelligence - CHINA wants to monopolize WORLD GOLD AND DETERMINE THEIR PRICES

- Google Translation Link

TECHNICAL ANALYSIS : Kimble Charting - Head & Shoulders topping pattern in the banks taking place?

TECHNICAL ANALYSIS : Gold-Eagle - Gold Finally Bombed Out

TECHNICAL ANALYSIS : SafeHaven - Palladium Double Top

Reuters - London Metal Exchange offers three alternatives to silver fix

Zero Hedge - "Cluster Of Central Banks" Have Secretly Invested $29 Trillion In The Market

Bloomberg - Bonds Liquidity Threat Is Revealed in Derivatives Explosion

Forbes - Why The Fed's New Vice Chairman Will Be A Disaster For the U.S. Economy

Deviant Investor - Silver to Gold Ratio as a Timing Indicator

GoldSeek - Pope Francis Warns Risk Of “Economic Collapse”

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

06/15/14 - Bullion News

Happy Father's Day!

The Daily Bell - Nick Giambruno on FATCA, GATCA and the Changing Investment Scene, Worldwide

TECHNICAL ANALYSIS : SafeHaven - US Dollar Index Huge Consolidation Pattern

TECHNICAL ANALYSIS : SOLARCYCLES - Cross Referencing

- Wim Grommen argues there have been 3 industrial revolutions: 1780-1850, 1870-1930 and 1940-2000. They terminated with major peaks in the stock market and then gave way to degeneration phases

The New York Times - The Nation’s Economy, This Side of the Recession

Dollar Collapse - We Are So Not Prepared For Another Oil Shock

INFO~GRAPHIC : Zen Trader - 15 Ways To Save Money

Market Watch - DoubleLine’s Gundlach likes gold and gold miners

TECHNICAL ANALYSIS : CEO.CA - Gold and the Rule of Maximum Pain

The Japan Times - BOJ holds course as analysts delay action calls

- The Bank of Japan will continue to expand the monetary base at a pace of ¥60 trillion to ¥70 trillion per year

06/13/14 - Bullion News

TECHNICAL ANALYSIS : SOLARCYCLES - Comparison to 1937

- 1937 was a solar maximum, like 2014, and notably the stock market peaked out despite negligible interest rates and with preceding QE.

McClellan Oscillator - VIX Below 12!

AUDIO : GoldSeekRadio - Interview with David Morgan about the Markets

The Bullion Desk - PGM industry probably on hold until next week for strike outcome

INFO~GRAPHIC : Visual Capitalist - Silver: The Undercover Super Metal

In Gold We Trust - SGE Chairman: China Should Become First Class International Gold Market

Diamonds - U.S. Jewelry Store Sales +2% to $2B

- U.S. jewelry store sales rose 2.4 percent year on year to $2.492 billion in April.

Bloomberg - Ten Firms Express Interest in Silver Fixing Replacement

Wealth Daily - Negative Interest Rates Will End in Disaster

VIDEO : CNBC - James Rickards : Iraq crisis MAY escalate into 'regional war'

06/12/14 - Bullion News

Money and Markets - Falling Real Yields: A Buy Signal for Gold

eNCA - Platinum strike: deal reached "in principle"

Financial Sense - Will the Swiss Gold Initiative Start a Revolution In Europe?

In Gold We Trust - March Indian Gold Import Highest In 10 Months

TECHNICAL ANALYSIS : Market Anthropology - Macro Musings

Silver Prices - Will Import Taxes on Solar Panels hamper Silvers ability to rally?

MineWeb - China has world’s second largest gold resource

Modern Survival - 7 Mistakes That Burglars Love, Even With A Home Burglar Alarm

The Epoch Times - Worst Money Mistakes You Can Make at Any Age

06/11/14 - Bullion News

Sovereign Man - Introducing the Newest Tactic for Governments to Raise Cash

VIDEO : Midas Letter - Rick Rule of Sprott Inc. : Is the Resource Sector About to Rebound?

CoinWeek - Chinese Coins: It’s a Panda, Panda, Panda World!

Market Update - Direct import of gold in China nearly doubled

- Google Translation Link

VIDEO : Fox Business - Capitalizing on Real Assets

Acting Man - Inflation Warnings Ridiculed

Zero Hedge - Palladium Surges To 14 Year High; "Can Go To $1,000" On Miner Strikes

Bullion Vault - Gold Prices Break Higher from "Doji", Investing "Attractive" Long-Term as Real Rates Stay Low Despite Rich-World Growth

Liberty Voice - Cancer Bursting Nano-bubbles Discovered

CHART : MINING - China construction vs copper price – something's gotta give

Profit Confidential - If You Only Look at One Picture Today, Make it This One

Gothamist - Gold ATM Dispenses $1,300 Gold Bars In Midtown, NY

06/10/14 - Bullion News

VIDEO : GoldandSilver - Mike Maloney : End Of USA Dominance? Death Of The Dollar Update

Global Financial Intelligence - WORLD AHEAD dedollarization

- Google Translation Link

Silver Coins Today - 2014 Arches 5 Ounce Bullion Silver Coins for Investors

TECHNICAL ANALYSIS : SafeHaven - Analyzing Dr. Copper

timesunion - Two Charged with Selling Fake American Eagle Gold Bullion Coins on Craigslist

Reuters - Palladium at 3-1/2 year high after S.Africa wage talks fail

Scrap Register - Indian, Chinese Central Banks on track to absorb 90% of Gold mine output

In Gold We Trust - Chinese Gold Demand Stable (823 MT YTD), Shanghai Silver Scarce

GoldBroker - China’s Role in the Gold Market

Reuters - Gold price benchmark open to manipulation-London Metal Exchange CEO

Market Update - How much gold does the FIFA World Cup trophy?

- Google Translation Link

SD Bullion - 4.8 star Customer Reviews

06/09/14 - Bullion News

Bullion Vault - The Euro's Insane Negative Rates

AUDIO : Peak Prosperity - Alasdair Macleod: All You Need To Know About Negative Interest Rates

BNN - Gold fix under scrutiny as regulators probe archaic system

Dollar Collapse - The Bubble is Back

Deviant Investor - Houston, We Have A Problem – or – Market Extremes Are Back

Huffington Post - This Breath Test Could Help Sniff Out Lung Cancer

GoldBroker - Is Platinum “White Gold”, Or Is It Different?

TECHNICAL ANALYSIS : Investing - Gold: Signs The Selling Has Ceased

Times of India - Gold buyers make the most of lower prices

VIDEO : Daily News - Montana residents claim there are pure gold flakes in their drinking water

06/06/14 - Bullion News

321gold - Is there a Bear Case for Gold?

06/05/14 - Bullion News

Market Update - Ten questions to Koos Jansen

- Google Translation Link

Bloomberg - Silver Electronic Auction Favored as Replacement for Fix

South China Morning Post - All that glitters: businessman 'who bought HK$270m of gold' ends up with metal bars - A senior officer said it would be the city's biggest heist in a decade if it was confirmed that all the gold had been stolen.

Sovereign Man - Don’t have a plan B yet? Here’s why you should have one...

MoneyBeat - Very Nice Mr. Draghi, But Will It Work?

Bullion Vault - Bonds vs. Precious Metals

Perth Mint Blog - The Perth Mint's May Sales Bounce Up

Investing - The Platinum Supply Shock - by Peter Schiff

Reuters - S. African union rejects gov't proposal to end platinum strike-newspaper

In Gold We Trust - I Was Wrong. Rectification

MoneyNews - Economic Adviser Benko: Gold Standard Would 'Unleash Tsunami of Prosperity'

The Daily Bell - The Golden Bear: Pure Directed History?

Market Watch - Not even a bull market can interest people in stocks

06/04/14 - Bullion News

Global Financial Intelligence - LOW PRICE OF GOLD; OUT OF CIRCULATION - Google Translation Link

Bloomberg - China Mulls Offshore Yuan Gold Trade in Free Trade Zone

In Gold We Trust - The World Gold Council’s New Clothes

dnaIndia - Finance minister Arun Jaitley plans 2-5% cut in gold import duty in Budget

VIDEO : Forbes - Investor Jim Grant on Bubbles And Bargains

TECHNICAL ANALYSIS : UnCommon Wisdom - Silver & Gold Looking Bearish

Ludwig von Mises Inst. - Why Central Bank Stimulus Cannot Bring Economic Recovery

TECHNICAL ANALYSIS : Market Anthropology - Silver: Still Seeing the Forest for the Trees

VIDEO : Bloomberg - Marc Faber: Why I Would Be the Greatest Hawk in World

The Real Asset Co. - 21 reasons to buy gold

CoinNews - 2014 Australian Saltwater Crocodile Silver Bullion Coin Sells Out

The Sovereign Investor - Why You Should Avoid Low-Yield Government Bonds

International Man - The Next Shot Has Been Fired at Your IRA

06/03/14 - Bullion News

MoneyBeat - Calm or Complacency, in Three Charts

Deviant Investor - Russian Roulette – Derivative Style

Zero Hedge - Gold Price Manipulation Was "Routine", FT Reports

CoinNews - Arches National Park Five Ounce Silver Coins and Event Dates

CYNICONOMICS - Where $1 of QE Goes: The Untold Story

The Washington Examiner - Steve Forbes: Link dollar to gold or face Great Depression II

Laissez Faire - Your Personal Gold Standard

The Real Asset Co. - Did Russia steal 300kg of gold?

The Florida Times-Union - Silver coin found off Nassau County could be evidence of missing Spanish treasure ship

06/02/14 - Bullion News

Sprott Management - Connecting the Dots by Eric Sprott

Money and Markets - Gold, Silver, Mining Dip: A Bull in Disguise

Dollar Collapse - Is THIS The End?

Medical Express - 'Quadrapeutics' works in preclinical study of hard-to-treat tumors (using Gold Nano-Particles) - The first preclinical study of the anti-cancer technology "quadrapeutics" found it to be 17 times more efficient than conventional chemoradiation therapy against aggressive, drug-resistant head and neck tumors.

TECHNICAL ANALYSIS : Acting Man - A Few Signs of Life in Gold-Land

AUDIO : Wall Street Daily - Gold Market Update with Bullion Dealer

CoinWeek - The Real Diehl: Three Gold Myths that Confuse Buyers

LibertyBlitzKrieg - Ecuador to Transfer More Than Half its Gold Reserves to Goldman Sachs in Exchange for “Liquidity”

Daily Resource Hunter - Your Dollars Have An Expiration Date

Bullion Vault - Central Banking's Wile E.Coyote Moment

Shanghai Metals Market - Palladium the best-performing precious metal so far in 2014

06/01/14 - Bullion News

PDF : Wizzen Trading - Technical Analysis : A Golden Fall

CoinNews - US Mint Ends American Silver Eagle Rationing

Perth Mint Blog - Perth Mint Closes Order Book On Australian Saltwater Crocodile Coin

nanowerk - On Step Closer to a Nano-Particle Breath Sensor to Test for Lung Cancer

SheKnows - Innovative ways to save more money

VIDEO : arabian money - Traders see a secret buy signal for gold

Bullion Vault - Modi's Morning in India

The Hindu - Ease up on gold

05/30/14 - Bullion News

TECHNICAL ANALYSIS : MiningFeeds - Gold Bear Market Losing Momentum - Analyzing Inverse Charts

VIDEO : The Daily Gold - Precious Metals Market Update 5/30/14

MorningStar - Why Investors Should Consider Silver

MineWeb - China and India Consuming More Gold than the World Mines

In Gold We Trust - Chinese Weekly Gold Demand Highest Since Late February, 787 MT YTD

Sprout Money - China Loves Gold

MoneyNews - Fix the London Gold Fix

TECHNICAL ANALYSIS : Market Anthropology - Nature's Law of Symmetry, Proportion & Balance

Mish's Blog - Balancing the Budget and the Trade Deficit is Easy: Return to Gold Standard

Armstrong Economics - Paul Volcker and the move Toward a New Bretton Woods

05/29/14 - Bullion News

Money and Markets - Economy Tanks … and Stocks Soar?

King One Eye - Updated US GDP Analysis -- Mind the Shrinkage

CHARTS : Zero Hedge - 3 WTF Charts

TECHNICAL ANALYSIS : Got Gold Report - COMEX Silver Futures Positioning Shows Potential Short Squeeze

VIDEO : reason.tv - The Death of Money: Q&A With James Rickards

The Bullion Desk - Market underestimating Modi effect on gold prices – Anthem Vault

SRSrocco Report - First Quarter Canadian Maple Leaf Sales Up A Hefty 24%

Reuters - CME, LME compete to provide alternative to London silver 'fix'

Kitco - CME Group & Kitco Trying to Make Their Cases for a Alternative To Silver Fixing

ValueWalk - Fed’s Lacker: Can Raise Rates Before Inflation Rises

05/28/14 - Bullion News

The Sovereign Investor - What Austria’s Gold Audit Means for You

Global Financial Intelligence - CHINA WORLD GOES FOR GOLD MARKET - Google Translation Link

AUDIO : FSN - Interview with Silver Guru - David Morgan

Bullion Vault - Gold Makes "That" Move

CNW - Royal Canadian Mint Reports Further Growth in 2014 First Quarter Financial Report

PDF : Bloomberg - Johnson Matthey : What is the Supply / Demand Situation for PGM?

Profit Confidential - The New Land of Oz

VIDEO : RT - James Rickards : 'Very bad news for dollar': Bucks slipping as world's reserve currency

Economic Policy Journal - NBC: Price Inflation is About to Get Worse

VIDEO : CNBC - Inflation : Market & Fed complacent

GoldBroker - Gold and Silver – Long and Short-Term Performance

MineWeb - Australia's top gold mine coming to life

International Man - The Shocking Real Reason for FATCA, and What Comes Next

05/27/14 - Bullion News

VIDEO : Mises Media - The Mises View: "Silver Money and Inflation"

Economic Policy Journal - The Price Inflation Squeeze on the Bottom 20%

MidWest Bullion Exchange - Global Currency Reset

In Gold We Trust - Shanghai Gold Exchange International Board Another Blow To US Dollar

Wall St. Cheat Sheet - Gold Manipulation Receives Official Recognition

Market Update - Scope derivatives bubble to record - Google Translation Link

Zero Hedge - Here Is The Mystery, And Completely Indiscriminate, Buyer Of Stocks In The First Quarter

CHART : Zero Hedge - When, Not If

CHART : Kimble Charting - 7-Year cycle suggest an important high in 2014?

MineWeb - Kitco pushing silver fix benchmark creation

Deviant Investor - Silver to Gold Ratio: 27 Years of Data

CoinWeek - A Fresh Example Of Gold Price Manipulation!

Bloomberg - Russian Palladium Flows to Switzerland Jump on Sanction Concerns

05/26/14 - Bullion News

Mining Weekly - Full Transparency Needed in Gold, Platinum Price Determinations

MineWeb - Gold to fall to $1,100 then skyrocket - silver, platinum in behind

TECHNICAL ANALYSIS : Gold-Eagle - If Ever A Picture Told Us The Bottom Is in This Is It...

Inside Futures - Where Are Gold & Silver Going

Contra Corner - Financial Storm Chasing With Blinders On: How The Fed Is Driving The Next Bust

VIDEO : USA Watchdog - James Rickards-Financial Collapse and Massive Shortages in Gold Coming - Video is located at the bottom of the article

Liberty BlitzKrieg - Gotta Keep Dancing – Trading of Penny Stocks Soars to Record on OTC Markets

Business Standard (India) - Leading bullion traders conducted wash trades on MCX: PwC report

Reuters - Putin says Russia and China need to secure their gold and currency reserves

GoldReporter - Austria to audit gold reserves at the Bank of England

MINING - Switzerland last year exported $132 billion of gold

05/25/14 - Bullion News

PDF : Wizzen Trading - Technical Analysis : Tight Action Leads To Big Moves

Mish's Blog - Former Bundesbank Vice-President Recommends Gold, Says Current Economic System is "Pure Fiction"

Bloomberg - Barclays Manipulated Gold as Soon as It Stopped Manipulating Libor

AUDIO : Howe Street - David Morgan – China – How it could affect you and your investments

VIDEO : Bloomberg - Marc Faber: I Will Never Sell My Gold

Bullion Vault - India Gold Prices "Tumble" on Easier Import Rules

Zero Hedge - Federal Reserve Admits Truth In Internal Memo: "Prices Continue To Rise Between 3% And 33%"

AUDIO : TED - William Black: How to rob a bank (from the inside, that is)

Bloomberg - Empty Buses Show Defiance in S. Africa’s Platinum Strike

Bloomberg - Gold Traders Investigated in Colombian Cocaine Laundering

The Huffington Post - 6 Hidden Treasures That Are Still Waiting To Be Found

05/23/14 - Bullion News

Gold-Eagle - The Demise Of The US Dollar?

TECHNICAL ANALYSIS : Kimble Charting - Gold-Bullish inverse head & shoulders at 30-year support forming?

Market Watch - Gold needs rising GDP, negative interest rates: Holmes

CEO.CA - Will This Time Be Different for Gold?

Acting Man - 1913-2013: The Lost Century

BBC - Barclays Bank fined £26m for gold price failings

gulfnews - Fixing and its many interpretations

Yahoo Finance - LBMA extends deadline on daily silver benchmark consultation

Economic Times - How London's gold and silver price benchmarks are 'fixed'

Sprout Money - India Is Importing More Gold Again

Metal Miner - Don’t Worry, Gold Investors; There Will Be No Repeat of Brown’s Bottom

Money and Markets - The BIGGEST FACTOR in the platinum and palladium markets

kirotv - How the Peace Dollar Won WWI

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

05/22/14 - Bullion News

VIDEO : The Wall Street Journal - Members of New York University's Graduating Class asked..."Who is Janet Yellen?" (their commencement speaker) and "What Does the Fed Do?"

Bonner & Partners - These Debt Levels Are Crazy...

TECHNICAL ANALYSIS : Market Anthropology - Fear & Loathing in Las Vegas

CHART : Kimble Charting - S&P 500 peaked in 2000 & 2007, when Margin debt did this...

VIDEO : CNBC - Peter Schiff's full take on bitcoin and gold

INFO~GRAPHIC : PolicyMic - Here's a Surprising Look at How Nanotechnology Could Reengineer Our Bodies

The Hindu - The Reserve Bank of India eases gold import norms

AUDIO : Silver-Investor - Precious Metals Market Updade With David Morgan

Bloomberg - Ron Paul's Dream ETF: Gold and No Taxes

Perth Mint Blog - Perth Mint First Refinery Accredited By Shanghai Gold Exchange

Scoop - NZ Mint goes platinum

05/21/14 - Bullion News

VIDEO : International Man - The Collapse of the International Monetary System and the Petrodollar, Part II

TECHNICAL ANALYSIS : The Crux - This Chart Says a "Sharp" Move is Coming in Gold

CHARTS : Advisor Perspectives - NYSE Margin Debt Declined Again in April; Leading Indicator for a Market Correction?

Dollar Collapse - Fractional-Reserve Banking: From Goldsmiths To Hedge Funds To…Chaos

MoneyBeat - More Debt Leads to More Defaults

Bullion Vault - Targeting 16:1 on the Gold/Silver Ratio

GIZMODO - The World Is Running Out of Gold

news-press - Cancer treatments are inching toward market

Bloomberg - Palladium Rises to 33-Month High on Supply Concerns

AUDIO : McAlvany Weekly Commentary - McAlvany Financial Briefing Part 1

Zero Hedge - As Russia Dumps A Record Amount Of US Treasurys, Here Is What It Is Buying

HeartLand - Lessons from the Great French Inflation

05/20/14 - Bullion News

VIDEO : Kanzius Cancer Research Foundation - Human Trials to begin soon & the Future of the Foundation

- The Guide will announce where it's Future Support will be donated to in the Next Ledger Entry (06/07/2014)

Market Watch - Charles Plosser thinks there’s a ticking time bomb at the Fed

VIDEO : CNBC - Deciphering the Fed

VIDEO : CNBC - The 'un-investable' market

GOLD NANO : Courthouse News - Nanotech Initiative Could Keep U.S. Ahead of China, Congress Told - "Nano-sized gold particulars can kill cancer cells," Dr. Lloyd Whitman

The Gold Report - Time Is the Trigger for Equities and Bullion: Charles Oliver

Reuters - Gold demand in India to rise, Modi seen easing import curbs

VIDEO : Gordon T Long - Macro Analytics - Paradox of Inflation w/ John Rubino

VIDEO : Bloomberg - How Student Loan Debt Is Hurting the U.S. Economy

In Gold We Trust - Gold Price Manipulation Goes Mainstream On German TV

Deviant Investor - Gold – A 40 Year Perspective

MineWeb - London's precious metals fixes fixable?

Wall St. Cheat Sheet - A Few Reasons to Consider Buying Silver

05/18/14 - Bullion News

ZEAL - Silver Stealth Buying

MineWeb -'It would be interesting to see how they produce cars without Russian palladium'

R&D Magazine - Ultra-sensitive "Gold" nanochip detects cancer early

VIDEO : Vsauce - Why Don't We All Have Cancer?

SRSrocco Report - U.S. Exports 128 Metric Tons Of Gold Jan & Feb 2014… Supply Deficit Increases

Seeking Alpha - A Forgotten Friend: Gold Investors Should Welcome The Bengal Tiger

Yahoo - Inflation in wonderland: Disney hikes prices as much as 10%

Zero Hedge - How Fractional Reserves And Inflation Cause Economic Inequality

Gains, Pains & Capital - The $12 Trillion Ticking Time Bomb

Bloomberg - Eurpoean Central Banks Make Gold Agreement

05/18/14 - Bullion News

PDF : Wizzen Trading - Golds Great Base

Global Financial Intelligence - STOCK MARKET, AT RISK

- Google Translation Link

Acting Man - Inflation in the Nation

Inside Futures - Where are gold prices headed

Delhi Daily News - Gold jewellery exports jump in April

Forbes - New Indian Government Seen Easing Gold Import Rules But Not Right Away

In Gold We Trust - Chinese Real Estate Debt Settled In Silver, SGE Premium 5.7 %

Got Gold Report - CME Lowers Gold and Silver Margin Requirements

05/16/14 - Bullion News

Reuters - Death of silver fix heralds overhaul for precious metal benchmarks

TECHNICAL ANALYSIS : Gold Scents - HAS THE BEAR RETURNED? MAYBE...

Dollar Collapse - Amazingly Deceptive Headlines, Part 1

Kitco - Gold Traders Should Keep An Eye On Bond Yields

TECHNICAL ANALYSIS : Market Anthropology - Weekend Update

Business Insider - GUNDLACH: We Could Be On The Verge Of 'One Of The Biggest Short-Covering Scrambles Of All Time'

Market Watch - Is the U.S. dollar headed for a breakdown?

VIDEO : BBC - Deadlock continues at South Africa's platinum mines

MINING - India raises gold, silver import tax again

MineWeb - Modi win renews calls for gold import regime to end

Reuters - First Indian gold refiner approved to join LBMA standard

05/15/14 - Bullion News

CoinWeek - Gold and Another Stock Market Bubble

EconomicPolicyJournal - Explaining Purchasing Power To Robert Reich

VIDEO : CNBC - I have 'sick feeling' 25% crash is ahead: Acampora

VIDEO : INO - Technical Analysis : Is Gold Getting Ready To Move To The Upside?

CPI Financial - Global commodities expert says platinum market could be changing

In Gold We Trust - Are The London Gold Vaults Running Empty?

South China Morning Post - Gold sales plummet in Hong Kong as mainland demand slumps

Investing - Silver Shone In 2013: Will It Continue?

Reuters - Historic silver price benchmark bites the dust as banks pull out

VIDEO : Kitco - Silver Fix Gone, Is Gold Next? - Jeff Christian

Financial Sense - The End (of the Silver Fix) Is Nigh

Zero Hedge - Russia Dumps 20% Of Its Treasury Holdings As Mystery "Belgium" Buyer Adds Another Whopping $40 Billion

The New York Times - Banks That Are Criminals Remain in Business

05/13/14 - Bullion News

Zero Hedge - The Beginning Of The End Of Precious Metals Manipulation: The London Silver Fix Is Officially Dead

Zero Hedge - The History Of The London Silver Market Since 1600

TheGoldandOilGuy - Gold Prediction using Statistics & Technical Analysis

SRSrocco Report - U.S. Mint Sells More Silver Eagles In A Week Than Gold Eagles Over Past Three Years

The Silver Institute - Total Physical Silver Demand Achieves Record Level in 2013

InvestorIntel - From 4600 BC to today’s nanotechnology: Silver has a long shelf life

Market Watch - Inflation is evident to everyone but the government

International Man - The Collapse of the International Monetary System and the Petrodollar, Part I

Casey Research - The Scary Deflation Monster: The Fed vs. Prosperity

Digital Journal - Op-Ed: Russia taking steps to 'de-dollarize' its financial dealings

Sovereign Man - What happens when America goes bankrupt?

05/13/14 - Bullion News

AUDIO : Ludwig von Mises Institute - Easy Money Policy

- Interviewed with Mark Thornton discussing Martin Wolf's support for continued easy money policy, and also the latest push by the central bankers and their friends in the media to try to convince us that rising prices are good for us

Daily Reckoning - Your Personal Gold Standard - by James Rickards

TECHNICAL ANALYSIS : Gold-Eagle - The Big Picture in Precious Metals

Physics World - Shape Matters when "Gold" Nano-Particles Fight Cancer

GoldBroker - Very Close to a Major Reversal on Stocks and Gold

Reuters - South African police deploy in platinum belt as strike breaks

CoinNews - Gold Dips, Silver Edges Up; Silver Eagle Sales Top 20M

Numismaster - Warehouse silver supplies shrink

AUDIO : Silver-Investor - David Morgan On The Precious Metals Market

MineWeb -< India's gold imports plunge in April

Shanghai Metals Market - New Government’s Gold-Friendly Policies Likely to Drive India Gold Prices Higher

International Man - Understanding Hyperinflation

Affiliate Ad

05/12/14 - Bullion News

Forbes - Why Gold Is The Best Money Of Them All, And Nothing Comes Close

nano werk - Gold Nano-Particles for cancer treatment - A New Project at the National Physical Laboratory will study the Effectiveness of Gold-Nanoparticles used in Cancer Radio-Therapy.

Zero Hedge - Fed Governor Admits Truth About QE: "Can't Go From Wild Turkey To Cold Turkey Overnight"

SRSrocco Report - Top Official Coin Sales: Market Overwhelmingly Chooses Silver

Money Morning - Not All Gold Is Created Equal: What to Know Before You Buy

TECHNICAL ANALYSIS : Market Anthropology - Custer's Ghost

iol - Gold breaks above crucial chart level

TECHNICAL ANALYSIS : Kimble Charting - Opportunity knocking in Silver after 61% decline?

Got Gold Report - The Good, the Bad and the Opportunity

GoldBroker - Gold and Geopolitics

CNBC - Inflation is becoming a question of when, not if

Perth Mint Bullion - New Australian Silver Bullion Coin Portrays Saltwater Crocodile

05/11/14 - Bullion News

Happy Mother's Day!

PDF : Wizzen Trading - Technical Analysis : Karate Kid Markets

Inside Futures - Have Silver Prices Bottomed

Bullion Bulls Canada - Bernanke Can’t Read A Chart

PDF : The Silver Institute - 2014 Silver News April Edition

Gold Made Simple - More signs that gold trade is shifting to the East as Dubai builds massive gold refinery

Gold-Eagle - The Precious Metals Monetary-Political Debacle

In Gold We Trust - Chinese gold demand 694 MT YTD, Silver In Backwardation

ZeeBiz - Gold imports down 74% to $1.75 billion in April

05/09/14 - Bullion News

INFO~GRAPHIC : Visual Capitalist - “The Eclipsing Demand of the East”

VIDEO : Hedgeye - Real Conversations: Rickards, McCullough Unplugged on Fed, USD, Economy & More

The Telegraph - US admits it can prioritize payments in default crisis

SafeHaven - ZIRP Era in Pictures

VIDEO : CNBC - Jim Grant: Yellen needs to speak more clearly

CEO.CA - What is the Next Bullish Fundamental Driver for Gold?

Sprott's Thoughts - Jim Rogers: Governments Will Loot Pensions, Savings – Hold onto your Gold

Seeking Alpha - Is Something Big Brewing In Silver?

MetalMiner - Silver Price Volatility Near 10-Year Lows

Professional Jeweller - IN DEPTH: A bright future for silver?

Financial Post - When you’re guarding other people’s gold, it helps to keep a low profile

05/08/14 - Bullion News

SRSrocco Report - Canadian Silver Production Down Significantly

CoinNews - Gold Drops for Third Day, PGMs Rise; US Coins Gain

MoneyNews - Carnegie Mellon's Allan Meltzer: Fed Easing Sets Stage for 'Damaging Inflation'

Investing - Platinum Inches Up As South African Mining Companies Bypass Union

Zero Hedge - China Demands Gold As Collateral For Zimbabwe Loans

AUDIO : FSN - Jim Rogers – More On Street Smarts

abc30 (Fresno, CA) - Ocular melanoma: saving lives, saving eyes

Liberty Blitz Krieg - When Asked if the U.S. is a Capitalist Democracy or Oligarchy, Janet Yellen Can’t Answer...

Zero Hedge - "Capital" As Seen By An Austrian Economist

BullionVault - UK Gold Sales, 15 Years to the Day

05/07/14 - Bullion News

TECHNICAL ANALYSIS : Kimble Charting - This only took place in 1999 & 2007…Now its happening again!

MorningStar - Gold Price Will Rise

China Daily - Less bullish on bullion: Gold bar demand dives - However "China's demand for gold will maintain a growth rate of 20 to 25 percent in the next four years."

Sovereign Man - The next shoe drops just 2 days after the last one

AUDIO : McAlvany Weekly Commentary - Monetary Dictator: Managing People & Choices

Deviant Investor - Gold – Fertile Ground for Sarcastic Analysis

The Gold Report - John Mauldin's Knock on the Side of the Head to World Leaders

05/06/14 - Bullion News

Investors Chronicle - Sector Focus : Golden Bulls

AUDIO : BullionVault - CPM's Jeffrey Christian: "Forceful" Gold Rally Ahead

Bloomberg - Einhorn Finds Dinner Chat With Bernanke ‘Frightening’

VIDEO : Elliot Wave - A Classic Case of Early Bear-Market Buying

In Gold We Trust - CORRECTION: India Imports 32 Tonnes Of Gold In February

AUDIO : FSN - John Rubino – GDP Report Is Far Worse Than It Looks

TECHNICAL ANALYSIS : Market Anthropology - the $ Buckles

The New York Times - Banks Sued on Claims of Fixing Price of Gold

Perth Mint Bullion - Monthly Sales – April 2014

BusinessWeek - Treasure Hunters' Undersea Gold Rush Is Threatened by U.S. Navy

05/05/14 - Bullion News

TECHNICAL ANALYSIS : Kimble Charting - Gold-Bullish Inverse H&S pattern? Gold Could lose $500 per ounce (update)...

Money and Markets - Putin, gold and silver: What you need to know right now...

ComputerWorld - Nanotech Trojan horses target and kill brain cancer - "Gold" Nanoparticles deliver 'death genes' to cancer cells, leaving normal brain tissue healthy

Inside Futures - Are Silver Prices Going Higher

Dallas News - Gold bullion coins buying peace of mind

CoinNews - US Government Prints 509.4 Million Banknotes in March 2014

Economic Policy Journal - Why the Next Acceleration in Price Inflation Could Be Very Near

CYNICONOMICS - 3 Underappreciated Indicators to Guide You through a Debt-Saturated Economy

Reuters - Gold industry shifts east as Dubai plans huge refinery, spot contract

TECHNICAL ANALYSIS : Acting Man - Gold and the Naked Emperor

BDlive - Platinum seen at more than $1,700/oz this year

Daily Reckoning - The Future of Money that No One Saw Coming...

05/04/14 - Bullion News

Seeking Alpha - The Ukraine Saves The Gold Market Again, But Can This Continue?

PDF : Wizzen Trading - Technical Analysis : Living On The Edge

TECHNICAL ANALYSIS : Zero Hedge - NASDAQ: Classic Head-and-Shoulders & Blow-Off Top?

Market Watch - Is Marc Faber right that U.S. stocks could crash?

In Gold We Trust - The Round Tripping Myth And Why It Doesn’t Hurt Chinese Gold Demand

IG - Gold’s resilience tested

Malaysian Sun - Tourists Gather for Massive Golden Kangaroo Coin

gulfnews - Golden loophole: How an alleged Turkish crime ring helped Iran

05/02/14 - Bullion News

Zero Hedge - Even The CME Is Getting Tired Of Silver Manipulation

SRSrocco Report - Canadian Silver Maple Leaf Sales Shatter All Records

CNW - Royal Canadian Mint reports the highest revenue in its history

Times of India - Gold Imports Slide & Silver Imports Soar

Daily Resource Hunter - What The Fed Is Really Doing To Your Money

GoldMoney - Papering over the cracks - the risks associated with owning paper gold

Kimble Charting - Defensive White hot sector (Utilities) breaking support today?

TECHNICAL ANALYSIS : Market Anthropology - Chasing Tail

In Gold We Trust - Weekly Chinese Gold Demand Increases At 35 MT, YTD 670 MT

Resource Investor - Half of Italy's gold is held in New York fed vault

05/01/14 - Bullion News

TECHNICAL ANALYSIS : Gold-Eagle - Why Is Gold Behaving This Way? Money and Markets - Deflation was the last war; NOW a more dangerous enemy lurks

Kimble Charting - Margin debt takes a turn from all-time high levels. Be concerned?

King One Eye - US Dollar at Support -- Will it Break Down or Bounce?

Bloomberg - Silver Looks Like Gold as Slump Defies More Car-Part Use

FOFOA - Eastbound and Down

In Gold We Trust - Internationalization Renminbi Requires Increase In Gold Reserves

CoinNews - US Mint Silver Eagle Bullion Coins Swagger in April Sales

FXEmpire - Silver Might Be Good Buy – Grab On The Dips

VIDEO : CNBC - Santelli: Watch the ISM number

MetalMiner - Platinum Up Only 1% as Miners’ Strike Continues, But Stockpiles Are Dwindling

MineWeb - U.S. Senate Aging Committee probes precious metals fraud

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

04/30/14 - Bullion News

Reuters - And then there were 2: Deutsche exit renews scrutiny of silver fix

CoinWeek - Gold & Silver: The Case For Separation Of Government And Money!

Profit Confidential - Dying for Gold? This Man Almost Did

AUDIO : Hard Assets Alliance - The Love Trade - Frank Holmes Interview

Sprott - The Chinese Gold Vortex

Kimble Charting - The Madness of Crowds and the Eiffel Tower Pattern...

Sovereign Man - Wisdom from Steve Jobs on the coming system reset

Perth Now - Perth Mint home to world’s biggest, heaviest and most valuable gold bullion coin

Zero Hedge - Here's A Chart You Won't See On CNBC

MINING - World Bank: China to overtake US as biggest economy THIS YEAR

04/29/14 - Bullion News

Zero Hedge - Gold Fix Manipulation Crackdown: Deutsche Officially Resigns London Fix Seat

Fast Markets - Market not surprised by Deutsche’s failure to sell gold fix seat

CoinNews - Gold, Silver Prices Fall; US Gold and Silver Coins Surge

Forbes - Is James Rickards Right About A Coming Monetary Apocalypse?

VIDEO : CNBC - Former OMB Director, David Stockman - Is not fan of the Fed's dovish policies. Here's where he sees the real risk now

Market Realist - Assess the shape of the yield curve

TECHNICAL ANALYSIS : Sunshine Profits - Gold & Silver Trading Alert: Miners Break Out but Gold Fails to Follow so Far

Gold and Silver Blog - Silver Supply Glut Weighs on Silver Price – Time for Some Contrary Thinking?

Scrap Monster - Gold Smuggling in India Touches 3,000 Kg Every Month: Chidambaram

Bloomberg - Union Says S. Africa Platinum Strikers Rejecting Pay Deal

04/28/14 - Bullion News

GoldBroker - Switzerland’s Role in the Gold Market

AUDIO : Wall St. Daily - Frank Holmes : Why is Switzerland Melting Gold Bricks?

King One Eye - The Relationship Between Gold and The Dollar

Gold-Eagle - PALLADIUM Price Forecast Factors

In Gold We Trust - SGE Withdrawals 29 MT In Week 16, YTD 635 MT

MineWeb - Chinese gold imports from Hong Kong jump 27% in Q1

BullionVault - Silver $50: April 2011 - Part 2

TECHNICAL ANALYSIS : Deviant Investor - Buy Signal in the PM Sector

Casey Research - Listen, Silver: We Need to Talk

GoldSeek - The World's Most Undervalued Asset - by Ted Butler

Dollar Collapse - Why Housing Has Stalled — And Why Everything Else Will Follow

Mauldin Economics - Thoughts from the Frontline: The Cost of Code Red

04/27/14 - Bullion News

PDF : Wizzen Trading - Technical Analysis : In the Precious Metals Markets - "Critical Support Holds"

TECHNICAL ANALYSIS : Investing - Silver Prepares To Rally...Along With Gold

Global Financial Intelligence - EXTINCTION OF GOLD PRICE - Google Translation Link

South China Morning Post - Hong Kong and Shanghai exchanges plan gold and silver alliance

Got Gold Report - China Holds the Keys to the Gold Market

Sufiy - China Making Discreet Gold Imports Through Beijing

The Sovereign Investor - China Escapes Ties to the Dollar

The Daily Bell - James Turk on Rising Gold, the Sinking Dollar and His New Book, 'The Money Bubble'

The Gold Report - Prepared for the Attack of the Short Sellers: Joe Reagor

Zero Hedge - These Are America's 10 Most And Least Expensive Cities (And The 361 Cities Inbetween)

04/25/14 - Bullion News

Bloomberg - FCA Said to Observe Banks’ London Gold-Fixing Calls

BusinessWeek - U.K. Gold Demand Seen Rising as Regulator Reviews Pensions

Trader Dan's Market Views - Safe Havens Boost Gold

BDlive (S.Africa) - Hopes of settlement to platinum strike dashed

BDlive (S.Africa) - Desperate pay high price in illegal mining boom

KJRH (Oklahoma) - Fake coins: Skiatook couple spends more than $400 at auction on fakes; how you can spot a fake

Zero Hedge - Tokyo CPI Spikes To Highest Since 1992 (Well Above Abe's 2% Target)

TECHNICAL ANALYSIS : Kimble Charting - Head & Shoulders top in the Russell 2000?

AUDIO : FSN - Gordon T. Long – It’s Beginning To Look A Lot Like 2008

Midas Letter - A False Requiem for Gold and Silver

04/24/14 - Bullion News

Financial Post - Barrick Gold Corp. Chairman Peter Munk says gold prices impossible to predict

TECHNICAL ANALYSIS : Market Anthropology - What's Up With Silver & Gold?

Market Watch - A currency war is coming - Opinion: The race to the bottom could have disastrous effects

BullionVault - Only the Sane Fear Hyperinflation

King One Eye - 2 Charts Showing Inflation Is Heating Up

CoinNews - Gold Gains on Safe-Haven Demand, US Mint Gold Coins Up

TECHNICAL ANALYSIS : TheGoldandOilGuy - Silver Forecast and Prediction of Silver Stocks

SRSrocco Report - U.S. Exports A Record Amount Of Gold To Hong Kong In January

Reuters - Swiss platinum imports from South Africa slump in March

MetalMiner - Platinum, Palladium Inch Up as South African Strike Settlement Drags

AUDIO : BullionVault - Inside Good Delivery Gold Refining

AUDIO : Market Sanity - Chris Martenson’s most important advice

04/23/14 - Bullion News

Market Watch - What’s that fishy smell? The Fed’s corrupt policies - Opinion: Central bank costs savers more than $100 billion a year

Gains, Pains & Capital - The Central Banks Have Realized Their Worst Nightmares Are Approaching

iol - Gold flat, holds above key support

In Gold We Trust - Chinese Gold Demand Dropping

Daily Reckoning - How Gold Will Respond to Declining Discovery

AUDIO : McAlvany Weekly Commentary - Dr. Goodhart: Central Banks Can’t Fix the System

The Citizen - Platinum talks still underway

BullionVault - SILVER PRICES hit $50 three years ago this week

Phys.org - Gold nanoparticles help target, quantify breast cancer gene segments in a living cell

Zen Trader - Markets Have Bearish Bias In My View

04/22/14 - Bullion News

VIDEO : Sovereign Man - Ex-Morgan Stanley Chief Economist: Fed is distorting markets

Advisor Perspectives - The End of the Gold Standard

International Man - When in Rome

The Daily Bell - Reuters Analysis: Printing Money Is More Important Than Ever for Yellen

BullionVault - Knowing when to Trade Silver

CNBC - Einhorn: Tech bubble brewing, shorting momentums

Contra Corner - Chronicling The Fed’s Follies: America’s Housing Fiasco Is On You, Alan Greenspan

AUDIO : Sprott Money - Ask the Expert - Koos Jansen founder of the website "In Gold We Trust"

Deviant Investor - Silver Up & S&P Down

Trader Dan's Market Views - Goldman Sachs Saves Gold from Falling Apart

Moneyweb - Palladium falls most in nine months

miningmx - Platinum offer 'won't break strike'

04/21/14 - Bullion News

CoinNews - Gold Falls, US Mint 5 Oz Silver Bullion Coins Temporarily Sell Out

CYNICONOMICS - Is This What a Credit Bubble Looks Like?

GoldBroker - Gold vs the CRB Commodity Index

Market Watch - Poorer Americans pick gold over stocks as the best investment

South China Morning Post - China opens Beijing to gold imports, cutting into Hong Kong's transit role

VIDEO : CNBC - Albert Cheng, Managing Director, Far East at the World Gold Council, describes the benefits of China's decision to allow gold imports via Beijing.

TECHNICAL ANALYSIS : Acting Man - Gold Looks Ugly, but the Dollar Looks Uglier

Money and Markets - Mining Shares I Like Ahead of the Gold Rush

Nomad Capitalist - Top 5: Worst cases of hyperinflation in history

Skegness Standard - Can you solve the riddle and find the hidden gold bullion?

04/20/14 - Bullion News

Happy Easter!

PDF : Wizzen Trading - Technical Analysis : Gold Can’t Glitter

AUDIO : FSN - John Rubino – ECB Ready For QE Because It Works So Well

Zero Hedge - The One Thing Most Desired By Chinese Consumers Is...

Arabian Money - Why China is a positive and not a negative for the gold price going forward

Financial Sense - Jim Rickards on The Death of Money: The Coming Collapse of the International Monetary System

TECHNICAL ANALYSIS : Trader Dan's Market Views - Weekly Gold Chart

Sober Look - The Latest TIPS Auction Showed a Sudden Increase in Investor Demand

Wealth Cycles - Perot Offers Tough Prescription for U.S. Debt Dependency

Market Watch - The Fed’s enormous balance sheet in seven charts

CSInvesting - Gold Discipline Melts Away or Case Study in Reading the News

TECHNICAL ANALYSIS : Rambus Charting - Silver’s Bermuda Triangle

04/18/14 - Bullion News

Sprott's Thoughts - Why Rick Rule Says ‘Anti-gold Investors Will be Destroyed’

King One Eye - 6 Hot Stories & Charts on Gold & Silver

Market Watch - ETFs hold clues for gold, copper, coffee outlooks

SRSrocco Report - The Dark Side Of The Silver Mining Industry

MoneyNews - Near-Record Silver Sales at US Mint in Q1

Inside Futures - Why Are Silver & Gold Weak

INFO~GRAPHIC : The Austrian Insider - Is the Next Bubble About to Burst?

Business Standard (India) - Official gold supply dries up further

NDTV - Delhi: Gold Biscuits Found in the Abdomen of a Businessman

Zero Hedge - These Are America's Most And Least "Taxing" States (And Everything Inbetween

MoneyBeat - Bank Executive Used TARP Money for Luxury Condo

04/17/14 - Bullion News

McClellan Oscillator - Gold’s Cycle is in Left Translation

Sprott's Thoughts - Will We Have Enough New Mines? -- Richard Schodde

Daily Reckoning - Value of Silver vs. Value of the Dollar

Dollar Collapse - Amazing Story From Japan

MineWeb - Platinum producers capitulate on union pay demand

MINING - Platinum, palladium sell off after producers raise wage offer

Business Week - Platinum Strike Widens Output Deficit Lasting Years: Commodities

GRAPHIC : Truth-Out - Want to See Where Your Taxes Go?

GoldBroker - David Morgan Interview on Silver Market, Silver Price Manipulation and the Coming Global Monetary Reset

KHQ - South Korea Options and Futures Exchanges (SKOFX) Silver 1000 Contract Witnesses Record Delivery of 1010 kg

Azonano - Gold and Anticancer Treatment - The Use of Gold in Anticancer Treatments by World Gold Council

Kanzius Cancer Research Foundation - MAKING WAVES: The Honor of Being Number One!

04/16/14 - Bullion News

Mish's GETA - Gold Doomed or Resting? Gold vs. Major Currencies; Goldman Sachs and Morgan Stanley Reiterate Sell Signal

AUDIO : Azom - Gold - Novel Technologies and Applications

TECHNICAL ANALYSIS : Gold-Eagle - Gold Forecast & Major Currency Is Collapsing

AUDIO : McAlvany Weekly Commentary - David Gurwitz: Of Cycles and Seasons

In Gold We Trust - SGE Withdrawals Equal Chinese Gold Demand, Part 3

AUDIO : Mises Media - Understanding Monetary Chaos

INFO~GRAPHIC : MINING - Gold price – a seismograph of supply and demand

VIDEO : Prometheus Market Insight - Stock Market Cyclical Bull Faces Important Test

CoinWeek - The Real Diehl: An Unclassified Peek Inside Fort Knox

AUDIO : FSN - James G. Rickards – Death of Money: Coming to a Central Bank Near You

04/15/14 - Bullion News

CoinNews - Gold, Silver Tumble; US Mint Bullion Coins Jump

CSInvesting - Anniversary Day for the April Gold Massacre

TECHNICAL ANALYSIS : King One Eye - The US Dollar Is Confused

TECHNICAL ANALYSIS : Kimble Charting - Critical level for Silver, that needs to holds here or...

The Telegraph - Gold paves streets for China's rising urban middle classes

Deviant Investor - Silver, Gold, and What Could Go Wrong

VIDEO : Mises Media - Inflation: Causes, Consequences, and Cure

Gold Investing News - Marc Faber is Calling for an Economic Crash — How Will Precious Metals be Affected?

VIDEO : CNBC - Peter Schiff and Paul Krake's gold feud

04/14/14 - Bullion News

NuWire Investor - Are We In Worse Shape Today Than Prior To The Last Financial Crisis?

Midas Letter - Understanding (and Ignoring) the Media Bandwagon Against Gold

King One Eye - 3 Important Charts on Gold

TECHNICAL ANALYSIS : CEO.CA - Gold Nearing Key Inflection Point

AUDIO : Peak Prosperity - Jim Rickards: The Coming Crisis is Bigger Than The Fed

Cato Institute - Government Keeps Growing

VIDEO : CNBC - Santelli Exchange: Government is the problem

The Japan Times - Higher prices risk ‘Abenomics’ backlash

Detlev Schlichter - No end to central bank meddling as ECB embraces ‘quantitative easing’, faulty logic

04/13/14 - Bullion News

PDF : Wizzen Trading - Technical Analysis : Base Building

TECHNICAL ANALYSIS : Seeking Alpha - A Weak Dollar Environment

Got Gold Report - Gold Silver Ratio Remains near Nosebleed High Levels

Money Morning - Why the Gold Price Per Ounce is Rebounding in 2014

Scrap Monster - India-China Collectively Contributed 53 % of Global Physical Gold Demand in 2013: World Gold Council

MineWeb - Gold smuggling arrests jump 750% YoY in India

Gold Made Simple - China’s gold demand ROSE 41% in 2013 – and this doesn’t include scrap and home production

Business Week - Shanghai Gold Exchange to Start Leasing Platform by End of June

Bullion Vault - Gold's Gory Crash, One Year On

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

04/11/14 - Bullion News

McClellan Oscillator - Household Debt Shrinking

Kimble Charting - Low cost-retail breaking support…what is the Big Picture message?

Bloomberg - Family Dollar to Close 370 Stores, Cut Jobs

Casey Research - Debt: Destroyer of Lives, Businesses, and Countries

Opposing Views - People's Tax Refunds Will Be Used to Pay Decades-Old Debts From Parents

CATO Institute - Why Did Western Nations Continue to Prosper in the 20th Century even though Fiscal Burdens Increased?

GoldSeek - The U.S. Dollar: Currency Masquerading as Money

The Daily Gold - More Weakness Ahead for Precious Metals

Hubert Moolman - Silver Price Forecast 2014: Monetary Collapse and Silver’s Not So Orderly Rise

MineWeb - U.S. mined silver output continues to fall - USGS

Scrap Monster - Platinum Strike To Drive Up Price Soon; On-Ground Stocks Nears Expiry

TECHNICAL ANALYSIS : Market Anthropology - Yield to Yields

04/10/14 - Bullion News

SafeHaven - Inflation Part III - Click Here for Parts I & II

AUDIO : Peak Prosperity - China's Demand for Gold Has Trapped The West's Central Banks

In Gold We Trust - Golden Ruble Symbol Appears In Front Of Russian Bank

Kimble Charting - Gold Bugs index poised to rally 150% again???

VIDEO : Bloomberg - James Rickards, managing director at Tangent Capital Partners and author of “The Death of Money,” - explains the role confidence plays in supporting a currency on Bloomberg Television’s “Market Makers

abcNews - Green Tea and Gold to Treat Prostate Cancer?

Forbes - Copper Is The New Gold Standard For Saving Lives

Business Week - South Africa Platinum-Mine Output Plunges Most in Two Years

TECHNICAL ANALYSIS : Trader Dan's Market Views - Safe Haven bids boost Gold

The Telegraph - China 'has more gold than official figures show'

Bullion Vault - Gold Supply & Demand: Shocking Numbers

eTurbo News - First gold shop at European airport opens

04/09/14 - Bullion News

CoinWeek - The Coin Analyst: CCAC Recommends New Reverse Design for American Silver Eagle Program - "It quickly became apparent that designs 40 and 41 were favored by most"

Market Watch - Margin debt, commodity investment worries new to Fed minutes

Gold Made Simple - Janet Yellen’s game of Jenga

Trader Dan's Market Views - Dovish Fed sinks US Dollar

TECHNICAL ANALYSIS : Market Anthropology - A Staggered Start

TECHNICAL ANALYSIS : King One Eye - US Dollar Is Breaking Down -- a Boost for Gold

AUDIO : McAlvany Weekly Commentary - A Planned Economy! Complements of the Fed

In Gold We Trust - Chinese Gold Demand 559 MT YTD, Up 16 %

GoldBroker - Chinese Gold Imports From Hong Kong

Sprott Money - Perth Mint & US Mint See Record Silver Demand on Global Uncertainty – Nathan McDonald

Gold-Eagle - Whatever It Takes 2.0?

04/08/14 - Bullion News

AUDIO : Ellis Martin - Ellis Martin Report with David Morgan: Gold and Silver Bull or Bear

SRSrocco Report - Real U.S. Silver Money Would Consume Nearly Half Of Total Mine Supply

PHYS.org - Gold Nanorods Attach to, Kill Bladder Cancer Cells

Sprott Thoughts - Some Kind of Financial Calamity Is Inevitable: Jim Rickards, Author, The Death Of Money

Profit Confidential - Will the U.S. Escape the Rapid Inflation That Usually Follows Massive Money Printing?

Sovereingn Man - Stunning: US government calls 2% tax rate “extortion”

Deviant Investor - Gold Q&A from Readers

Silver Investing News - March a Record-breaking Month for American Eagle Silver Coin Sales

WIVB (Buffalo, NY) - Police: Jeweler Sold Fake Diamonds & Gold for 20 Years

AUDIO : FSN - James Turk – Discussion Of The Money Bubble

04/07/14 - Bullion News

GoldBroker - Gold Backwardation: What Does It Mean?

TECHNICAL ANALYSIS : Gold Made Simple - Gold price remains around $1300 as Dubai gold exchange introduces spot gold contract

VIDEO : Fox Business - The Death of Money’ author James Rickards on his predictions for the next financial collapse

King One Eye - 6 Hot Links and Charts for Monday

VIDEO : CNBC - Frank Holmes Explains Gold and the Reasons to Hold it, on Squawk Box

Business Standard - Gold imports may hit 10-month high in March

In Gold We Trust - January India Silver Import 462 MT

CATO Institute - 50 Years of Federal Spending

VIDEO : Sprott Group - Sprott Gold Roundtable Webcast - Are we in a New Bull Market?

MINING - Platinum, palladium prices tank

Investing - Gold: What A Difference A Year Makes

NanoWerk - Nanoparticles aid the microscopic detection of a protein relevant for cancer

04/05/14 - Bullion News

PDF : Wizzen Trading - Technical Analysis : The Gold Turning

Sprott Thoughts - Rick Rule: Platinum, Palladium Supply Squeeze Will Turn Ugly

The Daily Bell - Doug Casey on the Continuing Debasement of Money, Language and Banking in the Modern Age

ValueWalk - What’s Abuzz About Gold?

Albawaba - 2250 tons or 40% of world's gold passes through Dubai

AUDIO : Sprott Money - Rick Rule on Eastern Gold Demand, US Interest Rates & Gold Price | SM Weekly Wrap Up

Trader Dan's Market Views - COT Breakdown

Mises - Government Debt: Ontario vs. California

Investment U - From the Mailbag: Silver in the High $50s?

04/04/14 - Bullion News

SRSrocco Report - Real Gold? Are You Sure? An Examination Of Modern Gold Counterfeiting

AUDIO : Bullion Vault - "What Yellen Says Matters to Gold": Frank Holmes

CoinWeek - The Real Diehl: Gold as Wealth Insurance

INFO~GRAPHIC : Visual Capitalist - Unearthing the World’s Gold Supply

Got Gold Report - CME Lowers Gold and Silver Margin Requirements

Gold-Eagle - Bull Market Leaders Are Now Leading the Way Lower

Gold Republic - Why China Matters for Gold in Three Charts

Trader Dan's Market Views - "Disappointing" Payrolls Number Spurs Gold Buying

Plata - We Have Seen This Play Before

Peak Prosperity - The Screaming Fundamentals for Owning Gold

iol - Platinum towns gripped by fear, hunger

OC Register - Secret Service launches probe of O.C. coin dealer Tulving Co.

04/03/14 - Bullion News

Shanghai Metals Market - Gold, Silver and Common Sense Investing

VIDEO : Jesse's Cafe Americain - Rickards: Collapse of International Money System - Not Apocalypse, But a Change

VIDEO : CNBC - Sotheby's? The best indicator you've never heard of

CHART : Kimble Charting - This “Wealth Indicator” is sending a rare signal!

GoldBroker - Why Are We Being Told that Deflation Is the Absolute Evil?

MineWeb - The dirt on India's latest gold-smuggling seizures

Trader Dan's Market Views - Gold Oscillating around a Key Pivot Point

The Columbian - Precious coin business in Vancouver investigated...Blue Moon Coins

Miningmx - Anatomy of the platinum strike ... 10 weeks on

iNVEZZ - Silver moved higher after finding support at 19.55

Gold-Eagle - Why Was China Carrying Gold?

CoinNews - Perth Mint Silver Bullion Sales Rise in March, Gold Sales Decline

CoinUpdate - Royal Mint Offers SS Gairsoppa 2014 Britannia Silver Coins

04/02/14 - Bullion News

GoldBroker - Gold and the Special Drawing Rights (SDR)

GoldSeek - Foolish Investment Ideas

Mail & Guardian - Platinum mines warn they can't serve suppliers

iol - Platinum majors run low on metal

MineWeb - HSBC's James Steel examines why gold has been struggling to break free from the $1,300 level, and why he is viewing the market in two segments - Last Podcast

Profit Confidential - Significant Divergence Between Copper Prices and Stock Market Not to Be Ignored

Zero Hedge - Have We Reached Peak Wall Street?

TECHNICAL ANALYSIS : Market Anthropology - Thin Ice

AUDIO : McAlvany Weekly Commentary - What’s in Your Wallet?

Dollar Collapse - Debt Makes You Dumb, Japanese Edition

TECHNICAL ANALYSIS : Trader Dan's Market Views - Gold Nearing an Important Inflection Point

Daily Resource Hunter - Timing Gold’s Next Big Gain

Chicago Tribune - Investors scoop up new U.S. platinum coins as gold slumps

CoinNews - US Mint Silver Eagle Bullion Coins Top 5.3M in March Sales

04/01/14 - Bullion News

Gains, Pains & Capital - The Two Things Investors Need to Know About Gold Right Now

MineWeb - Why are platinum and palladium not meeting analyst expectations?

In Gold We Trust - West to East Gold Exodus In Full Swing

GoldBroker - US Mint Coin Sales

AUDIO : Ellis Martin - Ellis Martin Report with David Morgan:The Dollar Could Fail

Deviant Investor - The Budget Box & Containing the Craziness

Ludwig von Mises Institute - What to Expect From Janet Yellen

Sovereign Man - Fed apologizes for 100 years of destroying the dollar

Financial Sense - The Bank of England’s Paper on Money Creation

AUDIO : FSN - John Rubino – Is The Demise Of The PetroDollar Coming?

Forbes - For Bitcoin, Lessons In The History Of Failed Currencies

Other pages, on this Guide, that you

may like...

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage

Click Ad to Request a Free Appraisal Kit

ExpressGoldCash

Customer Reviews 4.9 stars

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)