The Pendulum Swings

plus

Gold, Silver, and the US Dollar

Review and Weekly Outlook

Originally Posted on 11/13/2016 @4:16pm

by Steven Warrenfeltz

The Pendulum Swings - the Markets are Weary after the 2016 Election.

In last week's post, seen here, I gave you my scenarios of how gold and silver may move if Trump or Clinton won the Presidential election.

My scenario for a Trump win was completely wrong, but only after Trump gave his Acceptance Speech.

Had Trump come out with an Acceptance Speech about radically changing the way things are, which is what traders expected to hear him say, gold and silver would have moved higher, and the markets would still be freaking out over his words.

But instead, Trump’s Presidential Acceptance Speech was a lot less stressful to the ears in the market, which made stocks rally, and gold and silver prices dropped.

Here are a few articles that agree with this point of view:

The New York Times - The Trump Stock Rally: Calamity Averted with a Little CharmGold-Eagle - Gold Price At 5-Month Lows – Why Aren’t Prices Up Following Trump's Win?

The Gold chart below shows what happened in the last few days before and after the election:

- Nov. 6th, 2016 - Two Days before the Election: The Market Anticipates a Clinton Win and Gold (and Silver Sell off)

- Nov. 7th, 2016 - The Day before the Election: We see a small move down in the price of Gold

- Nov. 8t,h 2016 - Day of the Election - The price of Gold shoots up to the level of the highlighted arrow on the chart, but then drops, and holds a small gain.

- Nov. 9th, 2016 - Day after the Election - Gold falls in price after President-Elect Trump makes his Acceptance Speech.

- Nov. 10th, 2016 - Two Days after the Election - Gold falls even more in price after President-Elect Trump meets with President Obama.

(continued...)

Charts provided courtesy of TradingView.com

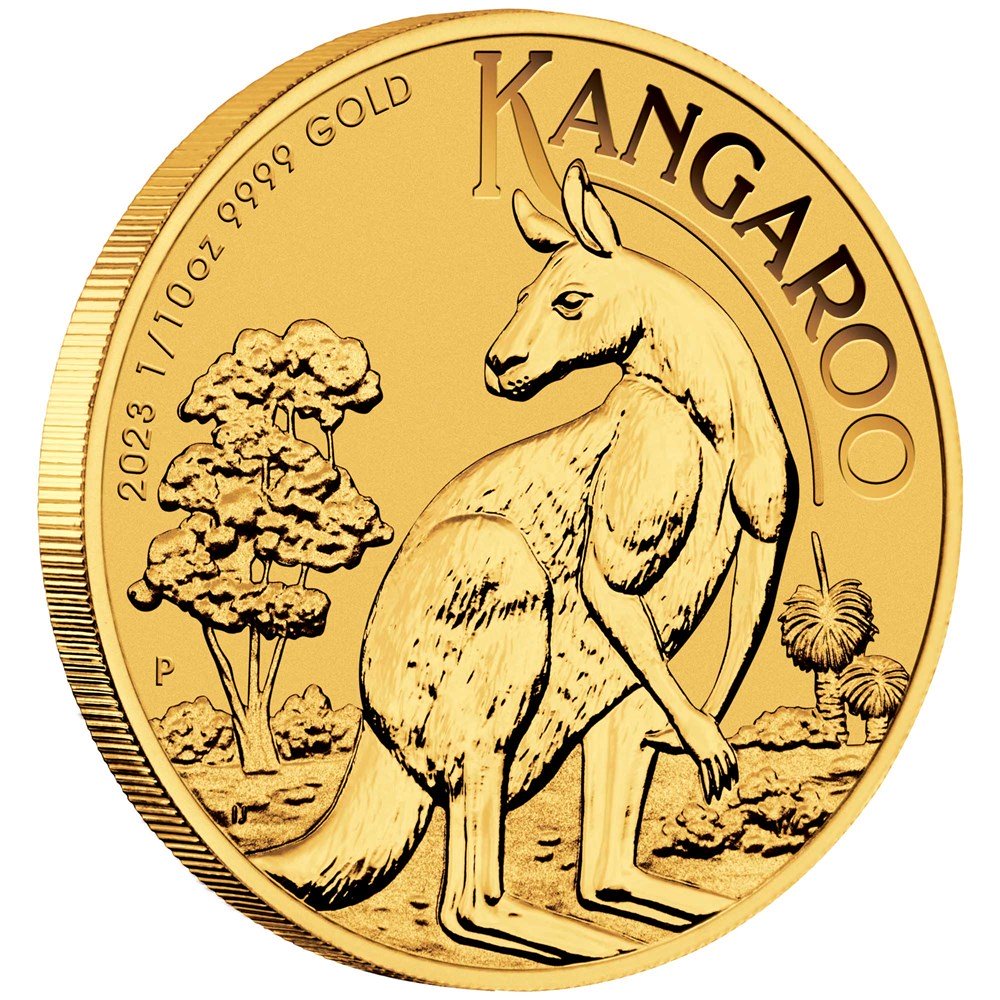

GOLD (Review & Outlook)

Last week, gold fell through the Ascending Channel.

Gold could easily bounce back up above the bottom of the ascending channel and stay above it, making this latest fall in the gold market an anomaly.

It remains to be seen how the market will respond because there are many variables at play regarding President-Elect Trump's economic intentions. Additionally, significant damage has been done to gold's price chart.

Once traders become more familiar with the market fundamentals, it should be easier to identify patterns that can indicate future price direction.

There has been a lot of damage done in the charts, and once traders get comfortable with the fundamentals in the market, it should be easier to find patterns to tell of future direction in the price charts.

(continued...)

Charts provided courtesy of TradingView.com

Gold's Price Resistance and

Support Levels

Gold's Resistance Level

$1350.00

$1300.00

$1275.00

Gold's Support Levels

$1215.00

$1200.00

$1180.00

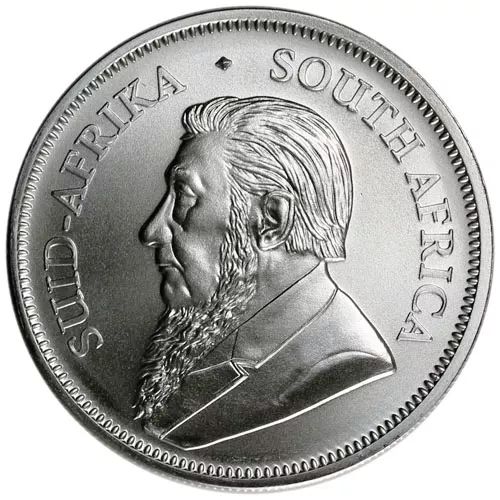

SILVER (Review & Outlook)

Last week, silver fell below its rising trend-line, but like gold, there is the possibility that it could be an anomaly because of how nervous the markets are now.

The sudden drop in silver’s price has eliminated nearly all short-term technical analysis to try to determine which way silver will move in the future.

So, like gold, we are in a wait-and-see mode to see what happens in the silver price chart to try to analyze the chart for future price movement.

(continued...)

Charts provided courtesy of TradingView.com

Silver's Price Resistance and

Support Levels

Silver's Resistance Level

$18.95

$18.50

$17.70

Silver's Support Level

$17.15

$16.90

$16.30

US DOLLAR (Review & Outlook)

The U.S. Dollar moved in unison with the broader markets this week.

Before the U.S. Election (dotted line on chart), the dollar rose because most in the markets expected Clinton to win the Presidency. After Trump was initially called the winner of the election, the dollar fell in price, as shown by the arrow pointing this out in the chart below.

However, after Trump made his acceptance speech, the U.S. dollar bounced back and traded higher throughout the rest of the week.

Last week, the market bought up stocks and the U.S. Dollar; it's difficult to say which way the markets will move. Hopefully, next week, more technical analysis can be applied to the price charts.

Charts provided courtesy of TradingView.com

U.S. Dollar's Price Resistance and Support Levels

U.S. Dollar's Resistance Level

$101.00

$99.50

$99.00

U.S. Dollar's Support Level

$98.25

$97.00

To view prior Blog posts - Go to the Bullion Guide's Blog.

For our 2016 Blog posts see our Tumblr Archive page.

Other pages, on this Guide, that you

may like...

Thank You for Your Time!

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage