May 2025

Monthly Newsletter

This Newsletter was originally sent to subscribers on May 5th.

Blog Post made on May 6th

Hello,

I hope you and your family had a Happy Easter and are doing well.

Thank you for subscribing to receive this newsletter from the Free Bullion Investment Guide.

Note: This newsletter and the Free Bullion Investment Guide are best viewed on a desktop computer, not a mobile phone.

Updates to the Guide...

For over a year, the Free Bullion Investment Guide is undergoing a full overhaul, focusing on preserving the good while re-editing or rewriting all other content.

Below is the latest group of updated pages.

Latest Updated pages:

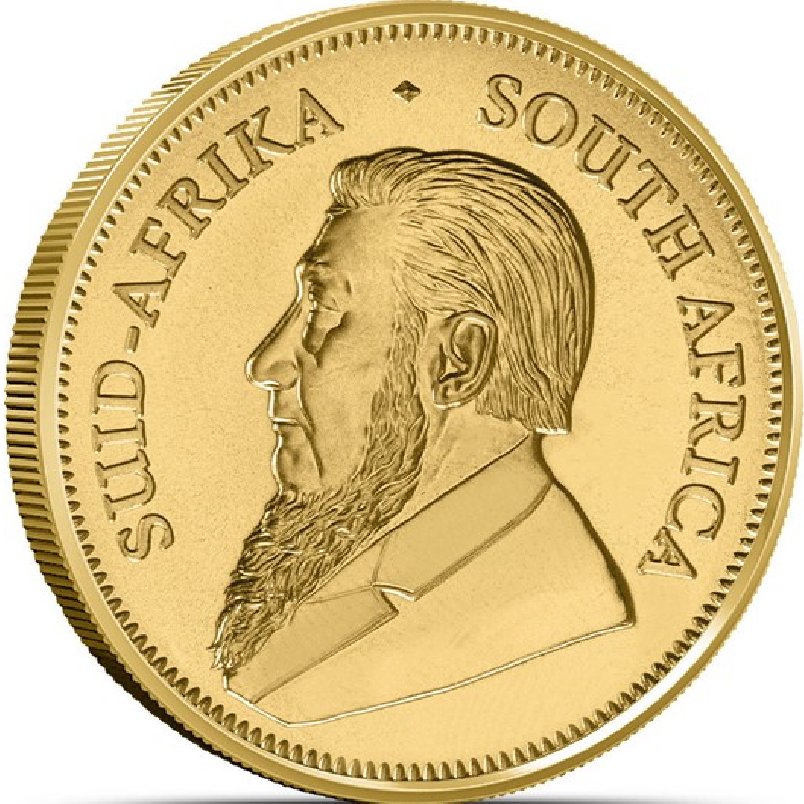

- South Africa Mint and South Africa Bullion page

- Junk Silver Buying Guide

- Gold Nanoparticle Cancer Research News #10

- Gold Nanoparticle Cancer Research News #9

- Gold Nanoparticle Cancer Research News #8

I re-edited several pages from the Gold Nanoparticle Cancer Research Blog. Many of these pages were created without proper grammar and spell-checking, so I've focused on correcting these issues.

Furthermore, the introductions for these pages have been revised, and the sentence structure has been improved where necessary.

Revamping the Free Bullion Investment Guide is far from done, there is much more to come.

My Take on the Gold & Silver Markets

Fundamental Outlook

Uncertainty is continuing to move gold and silver prices higher. The biggest areas of uncertainty in the market are still the same:

- Ukraine / Russian War

- Israel / Hamas & Hezbollah Conflict

- The Markets Over-reaction to Trumps Tariffs

- New Tariff implementation

Gold and silver prices will remain high as long as market uncertainties persist, but silver is significantly lagging behind gold. In last month's newsletter's Technical Outlook, I focused on the Gold-to-Silver Ratio and how it is over 100, which is a very positive sign to buy silver. (By the way, it is still over 100)

But the other story that the Gold to Silver Ratio is telling is that silver's price is incredibly underpriced and lagging behind gold in price and movement.

When you examine the price movement of silver in the chart below, you can see that silver's price generally rises and falls before gold; it is still doing that, it's just not mimicking gold anymore in returns. Silver's price is more volatile than gold because its industrial demand.

(Click the chart to Enlarge or click here)

The reason why (I think) gold is leading silver in today's market has everything to do with it being more in demand at the current time, for which there are several reasons why silver is lagging behind gold in price movement:

- Lack of Silver buying by the retail investor (Silver Guru - David Morgan offers a good analysis here)

- Market worries over trade tariffs are sending more buyers into gold over silver as a safe haven.

- Silver is heavily used for making solar panels, and there is a slowdown in the solar industry - First Solar (FSLR) sales are down by 20% quarter over quarter; see earnings report "here," and in this video (on the same page), the company reveals the industry is hurting without explaining why.

On the bright side, the fact that the retail investor isn't in the market means we still have time to get silver at a relatively low price according to the gold-to-silver ratio. If all this uncertainty stays in the markets, silver is due to rise higher, and in the technical outlook below, its price chart has formed a large inverse head and shoulders pattern, which is a positive sign for higher silver prices. See below.

Technical Outlook for Gold and Silver

(Silver analysis below Gold Chart)

Gold

In this first chart for Gold, I wanted to show you that Gold has broken above the Andrew's Pitchfork channel pattern, which technically is usually a bad sign for those who use this indicator.

However, gold has repeatedly bucked this trend and keeps moving higher; the gold chart below shows that a positive pattern has formed, which indicates that the price should move higher and test $3500 again. (Click the chart to enlarge or click here)

A Falling Wedge pattern (Bull Flag) has formed in Gold's price chart; it is expected to break above it and retest and perhaps break the $3500 price level. (Click the chart to enlarge or click here)

Silver

Silver has formed an Inverse Head-and-Shoulders pattern; it's a positive pattern, and its price is expected to move above and break the neckline sometime in the near future and retest and break the $35.00 resistance level. (Click the chart to enlarge or click here)

Another observation I have for Silver's price chart is in its Andrew's Pitchfork, which is a channel indicator I like to use because to draw one, its median line must anchor to a previous low (or high). Gold has broken above at least two Andrew's Pitchforks I've drawn for it since May of 2024.

Silver hasn't broken above one yet. Gold, on the other hand, has broken above the Pitchfork Channels so much that the indicator is no longer useful (at this time). Silver is due, and we'll likely see a big break to the upside when it does finally move up.

Charts provided courtesy of Tradingview.com

Note: If there happens to be a Large Broad-Market Correction or Crash in the next four weeks, gold and silver usually, and likely will again, drastically fall in price as traders scramble for liquidity and will sell anything to find it. Although the prices of silver and gold may fall in this type of market, they are also the quickest to recover after such events.

Note: All the charts and commentary in this newsletter are in no way an incentive of how you should invest or divest.

News Articles first posted on the Free-Bullion-Investment-Guide

Graphic: US Tariffs on the World (country by country) - voronoi (by Visual Capitalist)

The Royal Mint Announces Investment in Excir to Strengthen Partnership in Precious Metals Recovery - The Royal Mint

Report: Gold Demand Trends: Q1 2025 - World Gold Council

A Deep Dive into the Long-Term Bullish Case for Gold by Jesse Colombo - The Bubble Bubble

AUDIO: The New Gold Rush: Find Out What Is Behind Gold's Impressive Run in 2025 - Mining Forum

Graphic: In-Ground Gold Reserves by Country 2024 - Mining Visuals

Atlanta Fed introduces new GDP estimation model adjusted for gold trade - MINING.COM

Graphic: Mapped: Which Countries Produce the Most Silver? - voronoi (Visual Capitalist)

PNG Warns Public About False Claims of Million-Dollar Pennies and Quarters - CoinNews

(.pdf) Report: Gold Outlook to Q1 2026: Gold’s safehaven status to propel it to significant new highs - Wisdom Tree

Report: Silver Outlook to Q1 2026: Catch-up potential after the sharp correction - Wisdom Tree

We're Finally Seeing Gold's Overdue Outperformance - Daily Wealth

Report: Silver Industrial Demand Reached a Record 680.5 Moz in 2024 - The Silver Institute

Tech Bros vs. Gold Bugs - Daily Reckoning

Graphic: Copper Production Q4 2024 - Mining Visuals

Video: Gold Production 50 Years by Country (1973-2023) - Mining Visuals

Gold Keeps Setting New Record Prices. So Where Are the Investors? - U.S. Global Investors

(.pdf) Chart Report: Preview Chartbook of the In Gold We Trust Report 2025 - incrementum

Graphic: Top Gold Exporting Countries in 2024 - voronoi (Visual Capitalist)

Graphic: Top Gold Net Importers and Exporters in 2024 - voronoi

Report: Did Gold Just Peak? Looking at the Dow-Gold Ratio and 1970s Bull Market - Financial Sense

Costco's Slim Markups Turned 1-Ounce Bars Into Instant Deals - Benzinga

Graphic: Mapped: The Most Taxed States in America - voronoi

Fraud: Counterfeits Abound and eBay Doesn’t Care: Jack Young’s Fun With Fakes - CoinWeek

Graphic: The World's 10 Largest Silver Mines (2023) - Mining Visuals

Report: LBMA Precious Metals Market Report: Q1 2025 - LBMA

Gold Nanoparticle Cancer Research

A label-free method for trace detection of cancer - Healthcare-in-Europe.com

Gylden’s Gold Platform Trains T-cells to Kill Viruses - Drug Target Review

Optimizing gold nanoparticles for better medical imaging, drug delivery, and cancer therapy - PHYS.org

Gold Nanoparticles Could Restore Vision in People with AMD - Neuroscience News

Redwire Expands In-Space Drug Development Program, Launches New PIL-BOX Technology and Cancer-Detection Experiment - Stock Titan

Please Buy from our Affiliated Bullion Dealers and other Retailers

Bullion Dealers

BGASC - Bullion Dealer

Bullion Vault - Vault Storage Broker

GoldBroker.com - Precious Metals Dealer/Vault Storage

OneGold - Vault Storage Broker

SD Bullion - Bullion Dealer

SilverGoldBull - Bullion Dealer

The Royal Mint (U.K.)

Vaulted - Precious Metals Dealer/Vault Storage

Walmart - 2024 American Silver Eagles from Top Dealers

Other Retailers

Apple Apps -Apps to make your life easier

Apples of Gold - Jewelry

Gabriel & Company - Jewelry

Gunsafes.com - Large Assortment of Safes

Home Depot - Home Safes / Hardware

Rexing - Dash Cams, Night-Vision / Binoculars, Monitoring Cameras, they always have a sale

RPNB safes - Manufacturer's site

SANSI - LED Lights - Save on LED Lights straight from the Manufacturer, they always have a sale

Survival Frog - Survival Equipment

TigerKing Safes - Manufacturer's site

Tractor Supply Co. - Home Safes / Hardware

TradingView - Interactive Investment Charts

One Last Thing...

Need Help? No matter what age you are or what problems you're dealing with, the best thing you can do is to get right with God. The only way to God is through Jesus Christ, the Son of God.

Jesus said to him, “I am the way, the truth, and the life. No one comes to the Father except through Me." John 14:1-6

Truth is found through the understanding and acknowledgement that Jesus Christ (God Incarnate) shed his perfect blood and died on the cross as the perfect sacrifice to free humans from sin. Then, after he was entombed for three days, Jesus Christ was resurrected from the grave, giving those who believe in these truths eternal life in heaven with Jesus and his Father.

And Jesus came and spoke to them, saying, “All authority has been given to Me in heaven and on earth. Go therefore and make disciples of all the nations, baptizing them in the name of the Father and of the Son and of the Holy Spirit, teaching them to observe all things that I have commanded you; and lo, I am with you always, even to the end of the age.” Amen . Matthew 28:18-20

I encourage you to learn more about Jesus Christ by reading the New Testament of the Holy Bible. Talk/Pray to him like you would your best friend, and end your words with "in Jesus name, Amen" because there is power in his name.

When you believe in Jesus Christ, You'll see him move mountains in your life.

Until next month, Thank you for your time and for your support.

Take Care & God Bless,

Steven Warrenfeltz

www.free-bullion-investment-guide.com

Keep this Guide Online

& Paypal

Thank You for

Your Support

Other pages, on this Guide, that you

may like...

Free Shipping on Orders $199+

For Bullion Market News...

Visit the Homepage

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage