Politics is in Control this Week

plus

Gold, Silver, and the US Dollar

Review and Weekly Outlook

Originally Posted on 10/30/2016 @4:35pm

by Steven Warrenfeltz

Gold and Silver saw a pop in price on Friday (10/28), but as you can see in the chart below, it wasn't from the GDP report.

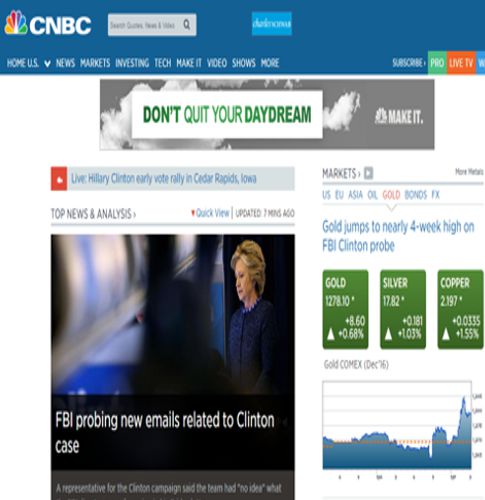

This CNBC screenshot below supports what was stated above because, next to the caption of Mrs. Clinton, the green prices of Gold, Silver, and Copper are moving higher, with the title: “Gold jumps to nearly 4-week high on FBI Clinton probe.”

Here is a better view.

The markets haven't priced in the possibility of Trump winning the Presidency, which is why Gold and Silver Popped in price on Friday.

Time will tell what will happen, and nobody will know who the winner is till the final count.

The Week Ahead

This week is the run-up to the Elections, and the Federal Reserve has a meeting on the 2nd of November.

Don't expect any fireworks out of the Federal Reserve, for now; everyone is looking to December for a rate hike, plus, they won't raise interest rates because of the election.

Furthermore, this week I expect the markets to be really nervous, with a sideways trade unless another bombshell is announced on either side of the political spectrum.

GOLD

Gold has traded sideways inside the ascending channel, in the chart below, since mid-July.

The Red vertical line (far right) on the Gold Chart below represents when the next Federal Reserve meeting takes place on November 2nd, and the Black line represents when the U.S. Elections happen on November 8th.

There is little doubt that very little will happen concerning a clear and precise price direction for the precious metals before the U.S. Presidential Elections, plus it is nearly impossible to predict what will happen until after the results of the election are in. (continued...)

Charts provided courtesy of TradingView.com

Gold's Price Resistance and

Support Levels

Gold's Resistance Level

$1310.00

$1300.00

$1280.00

Gold's Support Levels

$1250.00

$1225.00

SILVER

For the last two weeks, silver has been trading along the rising trend-line shown in the chart below.

Like gold, politics will dictate silver and the markets this week and, probably, most of the week after. But, silver will need to stay above this rising trend-line for it to have a brighter short-term future." (continued...)

Charts provided courtesy of TradingView.com

Silver's Price Resistance and

Support Levels

Silver's Resistance Level

$18.50

$18.00

$17.75

Silver's Support Level

$17.25

$17.05

$16.90

US DOLLAR

Clearly, the news released on Friday about the FBI renewing its probe into Hillary Clinton hurt the US Dollar.

Like all the charts above, politics will dictate the markets for at least until the day of the U.S. Presidential Election, so if you're in the markets, hold on because it will probably get really bumpy. (continued...)

Charts provided courtesy of TradingView.com

U.S. Dollar's Price Resistance and Support Levels

U.S. Dollar's Resistance Level

$99.00

U.S. Dollar's Support Level

$98.25

$97.50

$96.90

$96.50

God Bless, and I hope you have a Great Week!

To view prior Blog posts - Go to the Bullion Guide's Blog.

For our 2016 Blog posts see our Tumblr Archive page.

Thank You for Your Time!

Other pages, on this Guide, that you

may like...

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage