Homepage / Wise Investors: Free Market Capitalists / Jim Rogers

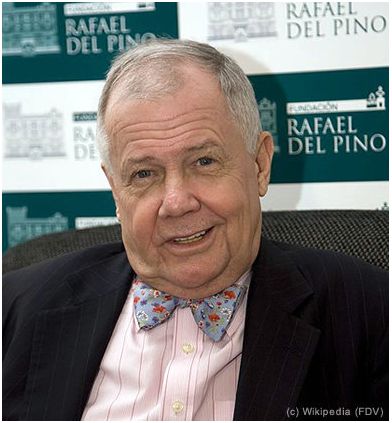

Investment Guru - Jim Rogers

Tweet

Investment Guru - Jim Rogers is an American Commodities Investor, Author, and a free market capitalist.

Jim Rogers has said that the Austrian School of economics best supports his views.

In an Interview conducted with Jim Rogers in 2009, he was asked, "Where should people put their money?"

He replied...

"Invest only in the things you know something about. The mistake most people make is that they listen to hot tips, or act on something they read in a magazine."

"Most people know a lot about something, so they should just stick to what they know and buy an investment in that area. That is how you get rich. You don't get rich investing in things you know nothing about."

Early Life

When he was five, he started a business by collecting empty soda bottles at the local baseball field.

Jim Rogers holds a bachelor's degree from Yale Univ. in History.

After graduating from Yale University in 1964, he won a scholarship to Balliol College, Oxford.

He also holds a bachelor's degree in Philosophy, Politics, and Economics from the University of Oxford.

Investments

James Beeland Rogers, Jr. was born on October 19th, 1942, in Baltimore, Md., and raised in Alabama.

In 1970, Rogers co-founded the Quantum fund with less than $1,000.00 to his name; in 10 years, the fund's portfolio gained 4,200%, while the S&P 500 gained only 42%.

In 1980, Jim Rogers retired from his position with the Quantum fund and became the chairman of Rogers Holdings and Beeland Interests, Inc.

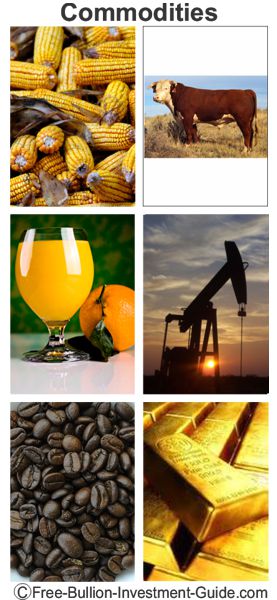

In 1998, Jim Rogers founded the Rogers International Commodity Index (RICI), and he is an outspoken advocate for agriculture investments.

In addition to the Rogers Commodity Index, Rogers is involved with two direct farmland investment funds - Agrifirma, based in Brazil, and Agcapita Farmland Investment Partnership, based in Canada.

The Rogers International Commodity Index rogersrawmaterials.com

In February 2011, Jim Rogers started a new index fund that focused on the top companies in agriculture, mining, metals, and energy sectors and the alternative energy space.

The index is called The Rogers Global Resources Equity Index.

Below is an example of an American Capitalist arguing against the 2008 Bail-out for Fannie / Freddie Mae and the big banks.

Free Shipping on Orders $199+

Jim Roger's Advice to

Future Generations

In 2010, at Oxford University’s Balliol College, he urged students to scrap career plans for Wall Street or London’s financial district and to study agriculture and mining instead.

Jim Rogers

Jim RogersHe stated,

"The power is shifting again from the financial centers to the producers of real goods. The place to be is in commodities, raw materials and natural resources..."

".....Don’t go to Harvard Business School." He also said, "If you want to make fortunes and come back and donate large sums of money to Balliol you’re not going to do it if you get an MBA."

This is a link to Jim Rogers personal web page:

www.jimrogers.com

Books by Jim Rogers

1995: Investment Biker: Around the World with Jim Rogers.

2003: Adventure Capitalist: The Ultimate Road Trip.

2004: Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market.

2007: A Bull in China: Investing Profitably in the World's Greatest Market.

2009: A Gift to My Children: A Father's Lessons For Life And Investing

2013: Street Smarts: Adventures on the Road and in the Markets

Other pages, on this Guide, that you

may like...

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage